WARNING: Your 2026 dairy contract has unlimited liability clauses. 500-cow farms face $55K in new costs. Check these three things before signing →

EXECUTIVE SUMMARY: Dairy farmers signing 2026 contracts now are discovering unlimited liability clauses that hold them responsible for allergen incidents—even those that occur at the processor. These new terms, triggered by California’s July 2026 allergen law, could cost a typical 500-cow operation between $15,000 and $55,000 annually in testing, infrastructure, and insurance. That’s up to 44% of net profit gone. With December 31 deadlines approaching, farmers face three paths: scale up to 1,500+ cows for efficiency, pivot to premium markets with $5-10/cwt premiums, or exit strategically while preserving wealth. The harsh reality is that 500-cow commodity dairies are becoming economically obsolete—caught between mega-farms operating at $3/cwt lower costs and premium producers capturing higher margins. Your decision in the next 90 days isn’t just about a contract; it’s about whether your farm exists in 2030.

You know, I’ve been talking with a lot of dairy farmers lately—folks running anywhere from 300 to 800 head—and the same topic keeps coming up over coffee.

These new contracts are landing on kitchen tables across the country right now? They’re different.

And I don’t mean different like when they tweaked the somatic cell premiums a few years back. I mean, fundamentally different.

One Wisconsin producer I know pretty well—let’s call him Tom to keep things simple—he runs about 500 Holsteins outside Eau Claire. Last Tuesday, he opens his December 2025 contract renewal expecting the usual adjustments. Maybe a change in butterfat differential or a new hauling schedule.

Instead, he finds himself staring at 15 extra pages of allergen management requirements. Language about “unlimited liability.” Clauses saying he has to defend his processor against claims he didn’t even cause.

“The efficiency gains are real—our cost per hundredweight dropped by nearly three dollars. But this wasn’t just about surviving allergen costs. We saw where the industry was heading and decided to get ahead of it.”

— A Wisconsin dairy producer who expanded from 600 to 1,800 cows last year

And here’s what’s interesting—Tom’s not alone. From the Texas Panhandle to Vermont’s Northeast Kingdom, down through the Georgia dairy belt and out to Idaho’s Magic Valley, producers are discovering their 2026 contracts contain terms nobody’s ever seen before.

Now, California’s allergen labeling law takes effect on July 1, 2026—that’s the official reason. But what I’ve found is that processors are using this regulatory change as the mechanism for something much bigger.

They’re fundamentally restructuring how risk flows through the dairy supply chain.

Let me walk you through what’s actually happening, because once you understand the pieces, the decisions you need to make become a lot clearer.

What Is California’s Allergen Law?

Starting July 1, 2026, California requires restaurant chains with 20+ locations nationwide to label major food allergens on menus. While this sounds limited to restaurants, processors are using it to justify comprehensive supply chain allergen controls—pushing liability and costs upstream to dairy farms through new contract requirements.

Why These Contract Changes Hit Different

I’ve been looking at dairy contracts for going on two decades now, and what’s landing on farm desks this quarter is genuinely unprecedented.

You probably saw the FDA’s recent data from their Reportable Food Registry—dairy products accounted for nearly 30% of all food recalls in the first quarter of 2025. That’s almost 400 recalls from our industry alone.

And when you dig into those numbers, undeclared allergens are driving a huge chunk of them, with milk proteins topping the list.

The Grocery Manufacturers Association conducted research in 2022 that showed food recalls average around $10 million in direct costs. And that’s just pulling product, investigating, notifying regulators.

Doesn’t even touch brand damage, lost sales, or legal fees. You’re looking at exposure that could bankrupt a mid-sized processor, which is why they’re scrambling to push that risk elsewhere.

What’s the target? Your farm.

What I’m hearing from agricultural attorneys who specialize in dairy contracts—and there aren’t that many of them, as you probably know—is that processors aren’t just updating compliance language.

They’re fundamentally restructuring who bears risk when something goes wrong. California’s July 1, 2026, deadline? It’s the perfect justification.

Here’s the really clever part, or concerning part, depending on where you sit. Most dairy contracts run calendar year, right? So farms need to sign their 2026 agreements right now, in Q4 2025.

By the time California’s law kicks in and everyone understands what these terms really mean, you’ll already be locked into a 12-month commitment.

Timing’s not an accident.

What Your Contract Might Look Like Now

Here’s what producers from Pennsylvania to Idaho to the Florida Panhandle—even down in Mississippi, where my cousin runs 400 head—are finding buried in their contracts:

- Testing requirements where the processor decides frequency, but farmers pay 100% of costs—we’re talking $55 to $80 per sample for standard allergen tests, based on what companies like Neogen are charging these days.

- Infrastructure modifications requiring capital investments of $50,000 to $250,000. Cornell Extension’s been helping farmers price this out, and those are real numbers.

- Insurance minimums are jumping from your typical $2 million general liability to $5-10 million specifically for allergen incidents. I’ve talked to insurance agents we work with—Nationwide, American National, some of the bigger ag insurers—and they’re all saying premiums are up 30 to 50 percent for this coverage.

- And then there’s the real kicker: unlimited indemnification clauses that make farmers liable for downstream incidents “regardless of origin.” Think about that. Even if contamination happens at the processor, you could be on the hook.

The Real Numbers for Your Operation

Let’s talk specifics for a typical 500-cow dairy producing around 10 million pounds annually—that describes a lot of operations in the Upper Midwest and down through Oklahoma and Arkansas.

I’ve been running these numbers with farm financial consultants, and here’s what the math looks like.

| Compliance Level | Annual Testing | Infrastructure | Insurance Increase | Documentation/Training | Total New Costs | Profit Impact |

| Minimal(2¢/cwt) | $1,700 | $5,000 | $4,000 | $2,500 | $15,000 | 12% |

| Mid-Level(8¢/cwt) | $7,000 | $10,000 | $8,000 | $9,500 | $34,000 | 28% |

| High (15¢/cwt) | $13,000 | $15,000 | $12,000 | $15,500 | $55,000 | 44% |

That’s a 12% hit to your bottom line if you’re running decent margins on the minimal path. Not great, but manageable for efficient operations.

Mid-level? That’s 28% of your profit gone. The difference between paying bills on time and stretching payables, as many of us know all too well.

At the high end? 44% of the net income was lost. For a lot of 500-cow operations, that’s the difference between viable and not.

The Cost Gap That’s Already There

What makes this particularly challenging is the existing cost structure gap. USDA’s Economic Research Service published their cost of production data in March 2024, and here’s the reality:

| Farm Size | Average Cost per cwt |

| 2,000+ cows | $17 |

| 100-500 cows | $20+ |

That’s more than a three-dollar disadvantage before you add a penny of allergen compliance costs.

Understanding the Bigger Picture

Here’s where things get really interesting—and by interesting, I mean concerning if you’re a mid-sized dairy like most of us.

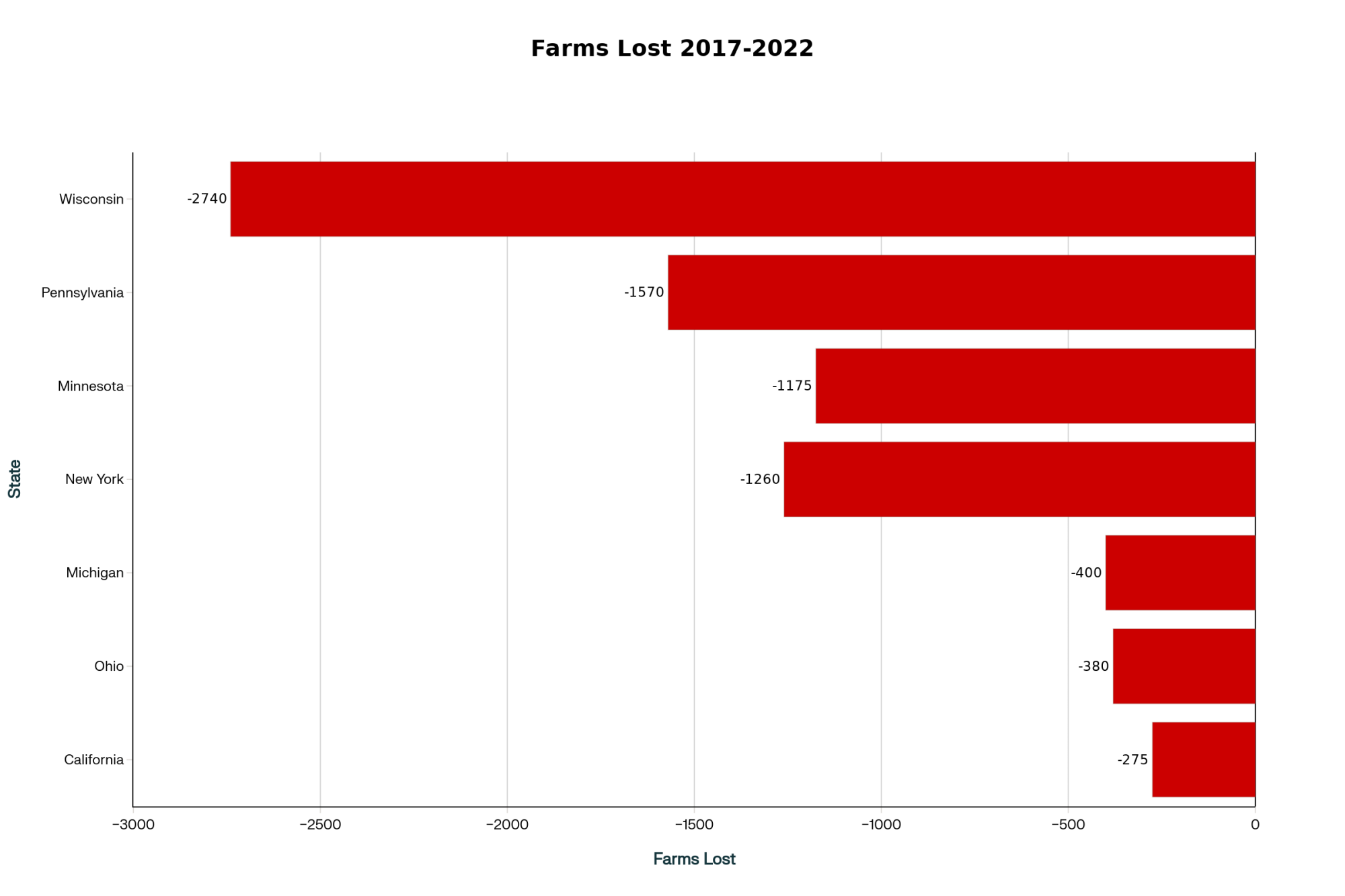

The consolidation trends were already stark before these contract changes. The 2022 Census of Agriculture, released in February 2024, shows that we lost 39% of U.S. dairy farms between 2017 and 2022.

Dropped from over 39,000 to about 24,000 operations. Yet—and here’s the kicker—milk production actually increased 5% over that same period according to the USDA’s National Agricultural Statistics Service.

Think about that for a minute. Fewer farms, more milk. The math only works one way, doesn’t it?

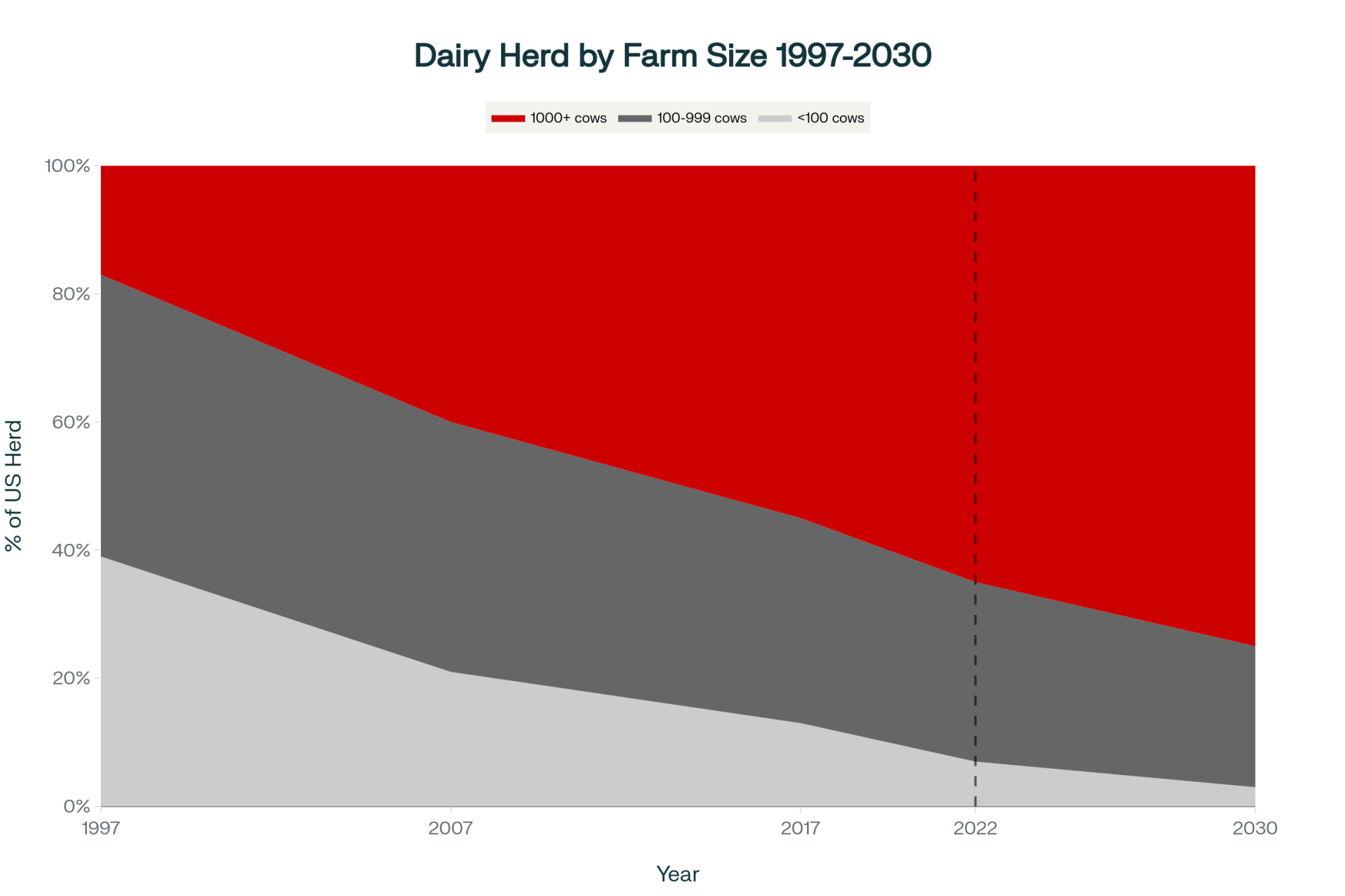

Today, according to the same Census, 65% of the U.S. dairy herd lives on farms with 1,000 or more cows. The 834 largest dairies—those with 2,500 or more head—they control 46% of production by value.

These aren’t future projections, folks. This is where we are right now.

I was talking with a senior ag lender recently—manages a portfolio north of $400 million in dairy loans—and he was remarkably candid about it.

“We’re not trying to prevent consolidation. We’re positioning our portfolio to be on the right side of it. Managing 50 medium-sized dairy loans requires far more oversight than five large ones with professional CFOs and management teams.”

— Senior agricultural lender with $400M+ dairy portfolio

The September 2025 lending data from agricultural finance institutions shows that smaller ag lenders—those under $500 million in loans—they absorbed 75% of the increase in farm lending during 2024.

Meanwhile, the big players with over a billion in ag loans? They contributed just 10% to that increase.

The sophisticated lenders they’re already pulling back from medium-sized operations. Makes you think, doesn’t it?

Three Paths Forward (And Why You Need to Choose Now)

After talking with dozens of farmers facing these decisions and running scenarios with financial advisors, I’m seeing three viable strategies emerge.

The key is picking the right one for your specific situation—not what worked for your neighbor, not what your grandfather would’ve done.

Path 1: Scale Up to Survive

Who should consider this path? Well, if you’re under 45 with kids who genuinely want to farm—and I mean really want it, not just feel obligated—this might be your route.

You need a debt-to-equity ratio under 2.0, preferably lower. You should already be in the top 25% for efficiency, meaning your cost of production is under $19 per hundredweight.

You’ve got to have the land base or be able to acquire it. And honestly? You need to actually enjoy the business side of dairy, not just working with the cows.

What’s it take? University of Wisconsin Extension’s been helping folks price out expansions, and you’re looking at $3.5 to $5 million in capital investment.

That’s an 18 to 24-month timeline just for permits and construction. You’ll be managing employees, not just family labor. And you need the stomach for significant debt and risk.

The payoff? Production costs drop two to three dollars per hundredweight at scale—USDA data’s pretty clear on this—which more than covers new allergen compliance costs.

You become the type of operation processors want to work with long-term. But it’s a big leap, no doubt about it.

Path 2: Exit Commodity, Enter Premium

What’s encouraging is that producers from North Carolina to Kansas to New Mexico are finding similar success with premium markets.

This path works if you’re within 60 miles of a decent-sized population center—100,000 people or more. You or your spouse actually has to enjoy marketing and talking to customers. Can’t stress that enough.

You’ll be working farmers markets, doing farm tours, and managing social media. As you’ve probably experienced yourself, it’s exhausting but can be rewarding.

Your location needs affluent consumers who value local food. And you’ve got to handle the three-year organic transition financially—that’s no small feat.

What’s it take? Organic certification under the USDA’s National Organic Program is a 36-month process, as you probably know.

If you’re adding processing, budget $150,000 to $300,000 for a small facility—USDA Rural Development has some grant programs that can help with this.

Plan on 15 to 20 hours per week just on marketing. It’s a completely different mindset about what you’re selling.

The payoff? Premium markets can deliver five to ten dollars per hundredweight above commodity prices—USDA tracks these premiums pretty consistently.

“We realized we couldn’t compete with mega-dairies on cost. But we could compete on story, quality, and customer connection. Our milk price went from $21 to $28 per hundredweight, and our yogurt adds another eight to ten dollars per hundredweight equivalent.”

— Vermont dairy family who transitioned to organic with on-farm processing

But more importantly, you’re building direct relationships that give you control over your price. You’re not just waiting for the monthly milk check to see what you got.

Path 3: Strategic Exit While You Can

This is the path nobody wants to talk about, but research on farm transitions suggests that strategic exits can preserve significantly more wealth than distressed sales.

Sometimes 25 to 40 percent more.

Who should consider this? If you’re over 55 without a successor who’s passionate about dairy—and I mean passionate, not just willing—this might be your reality.

If your debt-to-equity exceeds 2.5, if your cost of production is over $21 per hundredweight, if you’re emotionally exhausted from the volatility… well, it’s worth considering.

Especially if you have other interests or opportunities.

What’s it take? Good transition planning, starting 12 to 18 months out. Realistic asset valuations—don’t kid yourself about what things are worth.

Emotional readiness to close this chapter. And a clear plan for what comes next.

The payoff? Preserving capital while land values remain strong—and they won’t forever, we all know that.

Avoiding slow wealth erosion. Maybe transitioning to less-stressful agricultural enterprises, such as cash crops or custom work.

It’s not giving up; it’s making a strategic business decision.

The Supply Chain Dynamics You Need to Understand

To negotiate effectively, you need to understand what’s driving processor behavior. From their perspective, this isn’t about hurting family farms—it’s about survival in a world where one allergen incident can trigger catastrophic losses.

RaboResearch’s food industry analysis from this past summer suggests processors face an impossible situation. Their insurance companies are demanding comprehensive allergen controls.

Regulators are increasing scrutiny. Consumer lawsuits are proliferating. They’re pushing liability upstream because they genuinely don’t see another option.

What’s particularly telling is that processors actually prefer consolidation. Think about it from their shoes: Managing 200 large suppliers instead of 2,000 small ones.

Professional management teams they can work with. Sophisticated quality systems and documentation. Resources to implement new requirements properly. Lower transaction costs across the board.

This isn’t a conspiracy—it’s economics. And understanding these dynamics helps you negotiate more effectively because you know what processors actually value.

Worth noting, too, that some processors are working with their farmers through this transition. A couple of the smaller regional processors in Ohio and Pennsylvania have offered 40-60% cost-sharing arrangements with phased implementation schedules over 18 months.

They’re the exception, not the rule, but it shows there’s some recognition of the burden these changes create.

Regional Factors That Change Everything

Geography’s becoming destiny in dairy. What I’m seeing is a real divergence driven by water availability and the regulatory environment.

Water-secure regions—the Upper Midwest, Northeast, and parts of the Southeast, like northern Georgia—are seeing renewed interest from both expanding local operations and relocating Western dairies.

Dairy site selection consultants tell me they’ve never been busier. Every conversation starts with “Where can we find reliable water for the next 30 years?”

Water-stressed areas—the Southwest, parts of California—that’s a different story. University of Arizona research on aquifer depletion shows that some dairy-intensive areas are experiencing annual water-table drops of several feet. Water costs in these regions have doubled or tripled in the past decade.

That’s not sustainable, and everyone knows it. These operations face a double whammy—new allergen costs plus rising water expenses.

Negotiation Strategies That Actually Work

After watching dozens of these negotiations, here’s what’s actually effective:

- Form an informal buying group. You don’t need a formal cooperative structure—just five to ten neighbors agreeing to push for the same contract terms. When six farms representing 3,000 cows approach a processor together, they listen differently than when you come alone.

- Use professional help strategically. Yes, agricultural attorneys cost money. But spending $5,000 on contract review could save you $50,000 annually in bad terms. Frame it as the bad cop: “I’d love to sign this, but my attorney insists on liability caps…”

- Offer trades, not just demands. “I’ll implement comprehensive testing protocols if you’ll split the costs 50/50 and cap my liability at one year’s gross revenue.” Processors respond better to negotiation than ultimatums.

- Know your walkaway point. If you have alternative buyers—even if they’re 50 miles further—that knowledge changes how you negotiate. Do the math beforehand: What’s the worst deal you can accept and still stay viable?

Technology as a Survival Tool

The farms that are successfully adapting aren’t doing so through willpower alone. They’re leveraging technology to make compliance manageable.

What’s encouraging is that agricultural technology providers report dairy operations implementing digital documentation systems are seeing significant reductions in administrative burden.

Automated testing protocols are lowering sampling costs. Real-time environmental monitoring can prevent contamination incidents before they become recalls.

For example, farms using systems like DairyComp 305’s newer modules or Valley Ag Software’s compliance-tracking are finding the documentation requirements much more manageable than those trying to handle them with spreadsheets.

The upfront cost—usually $5,000 to $15,000 for implementation—pays for itself in reduced labor and avoided compliance violations. One Kansas operation told me they cut documentation time by 60% after implementing digital tracking, saving nearly $20,000 annually in labor costs alone.

Technology isn’t optional anymore. What is the difference between farms crushing under compliance costs and those managing them? Usually comes down to whether they’ve invested in the right systems.

What Dairy Looks Like in 2030

Based on everything I’m seeing, here’s my best projection for where we’re heading:

We’ll probably have 15,000 to 20,000 dairy farms by 2030, down from today’s 24,000. But—and this is important—they won’t all be mega-dairies.

I’m expecting maybe 12,000 to 15,000 large-scale commodity operations, another 3,000 to 5,000 premium or specialty farms serving local and niche markets, and 2,000 to 3,000 transitional operations finding unique market positions.

Agricultural economists analyzing dairy consolidation trends suggest we’re not witnessing the death of dairy farming. We’re seeing differentiation.

The 500-cow commodity model is becoming obsolete, yes. But opportunities are emerging for farms willing to adapt strategically.

Making Your Decision: A Practical Framework

So what should you actually do? Here’s the framework I’m suggesting to farmers facing these contracts:

Your 30-Day Action Plan

- Calculate your true cost of production—don’t guess, know it

- Review your current contract for existing allergen language

- Get insurance quotes for the new liability levels

- Talk honestly with family about succession plans

- Research premium market opportunities in your area

Key Decision Factors

- If you’re under 45 with strong succession and sub-$19 per hundredweight costs, consider scaling. The economics work if you can handle the risk.

- If you have marketing skills and you’re near population centers, explore premium markets. The margins are there for those who can sell.

- If you’re over 55 and without succession, and your costs exceed $21 per hundredweight, plan your exit. Preserving wealth beats slow erosion.

- If you’re in between? You’ve got 90 days to figure out which direction you’re heading. Drifting is the only wrong answer.

The Reality We Need to Discuss

Here’s what I think a lot of folks know but aren’t saying out loud: The 500-cow commodity dairy is structurally obsolete in the emerging market environment.

Not because farmers aren’t working hard enough. Not because they’re bad at what they do. But because the economics have shifted in ways that make that scale unviable for commodity production.

Dairy transition specialists tell me that every farmer they work with wishes they’d made their decision 2 years earlier.

Whether that’s expanding, transitioning to premium, or exiting—acting decisively preserves more wealth and creates more options than hoping things improve.

Final Thoughts

The 2026 allergen requirements are real, and they’re going to hurt. But they’re also just accelerating changes that were already underway.

The farms that recognize this—that see these contracts as a catalyst for strategic decision-making rather than just another compliance burden—are the ones that’ll still be farming successfully in 2030.

The dairy industry has weathered countless storms over the generations. This one’s different, not in its severity, but in its permanence.

The sooner we accept that and act accordingly, the better positioned we’ll be for whatever comes next.

You know, at the end of the day, it’s not about whether to sign or not sign a contract. It’s about what kind of dairy farmer you want to be—or whether you want to be one at all—in the industry that’s emerging.

And that’s a decision only you can make for your operation.

KEY TAKEAWAYS:

- Immediate action required: Review your contract for unlimited liability clauses before December 31—signing locks you into potentially business-ending terms through 2026

- Real costs revealed: $15,000 (minimal) to $55,000 (high compliance) in new annual expenses = 12-44% of typical 500-cow dairy profits gone

- Only three viable paths: Scale to 1,500+ cows for efficiency ($3/cwt savings), pivot to premium markets ($5-10/cwt premiums), or exit strategically, preserving 25-40% more wealth than distressed sales

- Negotiation leverage exists: Form buying groups with neighbors, demand 50/50 cost sharing, cap liability at one year’s revenue—processors need milk and will negotiate

- The uncomfortable truth: The 500-cow commodity dairy is structurally obsolete—not because you’re failing, but because the economics permanently shifted against mid-size operations

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Robots vs. Labor: The Hard Math on Dairy Automation ROI – This article delivers the “hard math” for the “Technology as a Survival Tool” section. It provides a clear framework for calculating the ROI on automation, helping you decide if tech investment is a viable path to lowering costs.

- The 2030 Dairy Farm: More Cows, More Tech, and a Whole New Business Model – This piece expands on the “Bigger Picture” analysis by detailing the business model of the future farm. It reveals the strategic drivers behind consolidation and the operational shifts required to remain profitable in the coming decade.

- The ‘Last Generation’ Farmer: Navigating the Emotional and Financial Hurdles of a Farm Exit – For those considering “Path 3,” this provides a tactical guide to a strategic exit. It breaks down the tough emotional and financial steps for preserving wealth and legacy, moving beyond just the numbers to the human reality of a transition.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!