3.4% milk surge, but your check’s down $1.50. Here’s why.

EXECUTIVE SUMMARY: Listen, here’s what’s really going on with your milk check: July Class III dropped to $17.32/cwt—that’s $1.50 less than June, and butter just took a 13.5¢ dive in one day. Meanwhile, we’re pumping out 3.4% more milk than last year across the top 24 states… so yeah, there’s way more milk chasing fewer buyers. China’s playing a different game now—they’re buying smart, not desperate. Europe’s keeping more product at home because their internal prices are sky-high. What does this mean for you? Simple: how you hedge your bets and protect your feed costs just became make-or-break decisions. Time to get serious about locking in those income-over-feed margins before this gets worse.

KEY TAKEAWAYS

- Watch those block prices like a hawk — when cheddar drops below $1.80, your protein payouts take a beating. Use this as your trigger for futures positions.

- Stack your protection tools — combine Dairy Revenue Protection with CME options for 6-12 months out. It’s not optional anymore in this market.

- The global game changed — U.S. milk up 3.4%, China buying selectively, Europe exporting less. These aren’t temporary blips—adjust accordingly.

- Tighten up now, not later — every percentage point you gain in feed efficiency matters more when spot markets are sliding. Small improvements = big dollars.

- Keep your banker happy — Rural Mainstreet Index is falling, covenants are tightening. Solid liquidity keeps you in the game when volatility hits.

That sinking feeling’s back. USDA locked July’s Class III price at $17.32/cwt, down $1.50 from June — a clear sign September checks are heading lower. Add a brutal week of market carnage, capped by a 13.5¢ plunge in butter, and the message for producers is stark: brace yourself.

The numbers that matter (and they’re not pretty)

On August 27, CME spot trading told a tough story: butter dropped to $2.05/lb, down 13.5 cents, and cheddar blocks slid to $1.76, down 5 cents. For farms working cheese-heavy contracts, this math is brutal. Blocks below $1.80 drag protein payouts down, and butter can only mop up so much.

The supply story that’s keeping me up nights

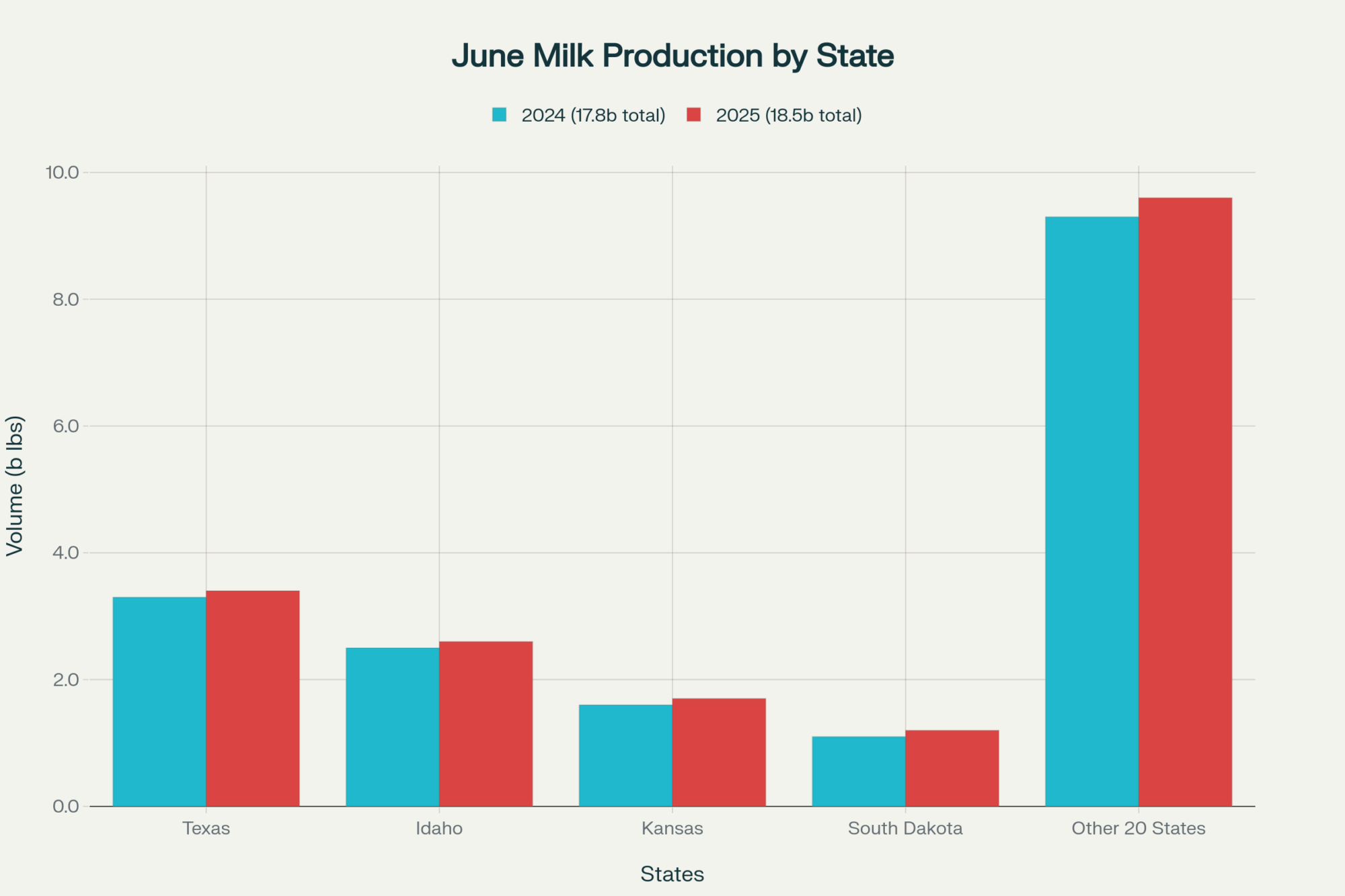

June milk production from the 24 major dairy states hit 18.5 billion pounds, up 3.4% year-over-year—the biggest jump since 2021. Dairy cow inventories rose by 146,000 head, with much of the growth concentrated in Texas, Idaho, Kansas, and South Dakota, which added 140,000 head combined. That’s a flood of milk chasing thinner buyer demand.

The global mess we can’t ignore

China used to be our safety valve, but the game has changed. Their import appetite hasn’t vanished—in fact, imports were up for five straight months to start 2025. The real story is a structural crisis in domestic production, leading to selective, strategic buying rather than panic purchases. They’re targeting specific needs, which means they’re no longer absorbing global oversupply the way they once did. USDA’s China Dairy Annual tells the story.

Europe isn’t easing the pressure. Although Brussels’ July outlook indicates that milk deliveries are holding steady, soaring internal prices have made European products less competitive on the global stage. However, butter and powder exports are forecasted to decline in 2025, resulting in more products staying close to home rather than easing global market pressure. The Brussels July Outlook has the details.

At the August 6 Global Dairy Trade auction, about 37,000 tons changed hands. Buyers acted with discipline, not panic.

Don’t bet the farm on butter

Industry analysts called the butter market “murky.” And the August 27 drop to $2.05 confirmed their concerns. Cream is abundant, churns are stable, and butter premiums just aren’t enough to prop up payouts when cheddar keeps sliding.

The banker conversation nobody wants

The Rural Mainstreet Index numbers continue to fall, reflecting growing lender caution. Covenants are tightening, and lenders are cutting slack. Hitting a $1.50 monthly drop in Class III milk and a sharp decline in butter rings loud warning bells.

While USDA’s ERS projects 2025 milk prices near $22.00/cwt, that forecast doesn’t reflect today’s mailbox realities.

What the smart money’s doing

The smart operators aren’t just relying on milk prices—they’re locking in income-over-feed margins. They’re layering Dairy Revenue Protection, LGM-Dairy, and CME options strategies to secure coverage for 6 to 12 months out.

One Wisconsin farmer said it best: “Blocks at $1.76 and butter at $2.05 don’t pencil like June. We hedged early and tightened shrink before the checks showed the damage.”

Your move

The best bet? Watch blocks stay above $1.80 and butter steady for several weeks. That’s your early sign that things might shift.

But the longer story is about patience. China’s strategic buying, Europe’s pricing challenges, and the U.S.’s milk surge signal a longer adjustment phase.

Defend your margins, trim waste, and maintain a close liquidity position.

The operations that survive this intact will be well-positioned to capitalize on the upside when things finally turn. The difference between thriving and surviving will be decided by the risk management decisions you make in the next 90 days. Make sure you’re on the right side of that divide.

Bottom line? September’s gonna be rough, but the smart money is already positioning for 2026. Don’t get caught flat-footed.

Time to make some calls and lock in those margins. Your future self will thank you.

Recovery? More likely a 2026 story than a late 2025 one.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Precision Feeding Strategies Every Dairy Farmer Needs to Know – This article provides tactical, actionable steps for improving feed efficiency. It details how to use data, forage analysis, and technology to immediately cut waste and directly combat the margin pressure discussed in the main piece.

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – For a strategic, big-picture view, this piece explains the long-term market forces at play. It expands on the “why” behind the current squeeze, offering crucial context on global supply shifts that will shape your business for years.

- Profit and Planning: 5 Key Trends Shaping Dairy Farms in 2025 – Looking toward the future, this article reveals how technology and genomics are creating a competitive divide. It offers an innovative perspective on making smart, forward-thinking investments in precision tech to build a more resilient and profitable operation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!