Your co-op newsletter: ‘RECORD EXPORTS!’ Your milk check: -$2/cwt. Your banker: ‘We need to talk.’ The disconnect has never been wider.

EXECUTIVE SUMMARY: The U.S. dairy industry’s record cheese exports are actually distress sales, with producers losing $2/cwt as milk prices sit at $16.91 against $19 production costs. Mexico—buying 29% of our exports—is spending $4.1 billion to become self-sufficient, while China’s 125% tariffs have already destroyed our powder markets. The Class III-IV price spread has exploded to $4.06/cwt, the widest since 2011, forcing all production toward cheese that’s selling below profitability. Mid-size farms (500-1,500 cows) face extinction-level losses of $400,000+ annually, with survival limited to mega-dairies with 50% or less debt or premium operations near cities. Producers have 90 days to make irreversible decisions: scale massively, find niche markets, or exit before equity evaporates. The 800,000-head heifer shortage guarantees milk production will contract 3-5% through forced exits, but recovery won’t arrive until mid-2027—and only for the operations structured to survive.

On the surface, the numbers look fantastic. We exported 119.3 million pounds of cheese in August 2025—up 28% from last year, according to the Dairy Export Council. Butter exports nearly tripled. Processing plants are announcing $11 billion in new investments.

But check your bank account. The milk checks aren’t matching the celebration. The headlines say “Record Exports,” but the market reality says “Distress Sale.”

I’ve been talking with producers from Wisconsin down to Texas, and what I’m hearing doesn’t line up with these export headlines. Understanding this disconnect could be the difference between successfully navigating the next 18 months or becoming another casualty of industry restructuring.

When Being the Cheapest Isn’t Actually Winning

Here’s what’s bothering me about these export records. Global Dairy Trade auction results from November show American butter trading at $1.57 a pound. New Zealand? They’re getting $2.57. Our cheese is moving at $1.82 while Europeans fetch $2.27 to $2.42.

That 45 to 60 cent spread on cheese isn’t a competitive advantage. It’s desperation.

Penn State Extension’s 2025 dairy outlook shows that a typical 500-cow operation in Wisconsin or Minnesota has production costs running $18 to $19 per hundredweight. But milk prices? We’re at $16.91 for Class III according to CME October data. That’s annual losses of $32,000 to $62,000 for operations that size.

These record exports everyone’s celebrating are happening because we’re willing to sell at prices that don’t cover our costs. South Korean and Japanese buyers see cheap American dairy, and they’re stocking up. Can’t blame them. But volume at a loss isn’t success.

The Time Lag Trap We’re All Stuck In

The breeding decisions you made two years ago—when milk was over $20 per hundredweight—those heifers are just entering the milking herd now.

According to USDA’s latest milk production reports, we’ve added 200,000 cows to U.S. herds over the past 18 months. Every one of those additions made sense when the decision was made. But September production jumped 4.2% year-over-year, and we’re producing 18.3 billion pounds of milk at exactly the moment when global markets are saturated.

Your operation has maybe $300,000 to $500,000 in annual fixed costs—infrastructure doesn’t get cheaper just because milk prices drop. Equipment auction data from Machinery Pete shows you’re looking at 30 to 50% discounts from what things were worth two years ago if you try to sell now.

So we keep producing. We try to spread those fixed costs over more volume. It’s rational for each of us individually, but when everyone does it, oversupply drives prices even lower.

The Mexico Situation Nobody Wants to Talk About

While we’re celebrating that Mexico takes 29% of our dairy exports according to USDA Foreign Ag Service data, they announced last July that they’re spending $4.1 billion to become 80% self-sufficient in dairy by 2030.

They’re building processing facilities in Campeche and Michoacán that’ll handle 600,000 liters a day. They’ve imported 8,000 Holstein heifers from Australia—Dairy Australia confirmed that shipment. The Mexican government is guaranteeing their producers 12 pesos per liter.

Mexico buys 51.5% of all our nonfat dry milk exports, according to Export Council trade data. If they achieve even half their plan, we’re talking about losing a billion dollars or more in annual exports. This isn’t a trade dispute that’ll blow over. They’re building the infrastructure right now.

Why Powder Is Collapsing While Cheese Keeps Moving

August export data shows cheese exports up 28%, but powder exports down 17.6%—the lowest August volume since 2019.

The October CME Spread tells the story:

- Class III (Cheese): $17.81/cwt

- Class IV (Powder/Butter): $13.75/cwt

- Spread: $4.06/cwt—widest since 2011

For a 500-cow dairy, that’s a $50,000 swing in annual income depending purely on which plant takes your milk.

China put 125% tariffs on our dairy products back in March. We used to send them 70-85% of our whey exports. That market disappeared overnight. Processors are pushing every pound they can toward cheese because at least there’s still some margin there. Powder production? They’re running the minimum.

Different Operations, Different Realities

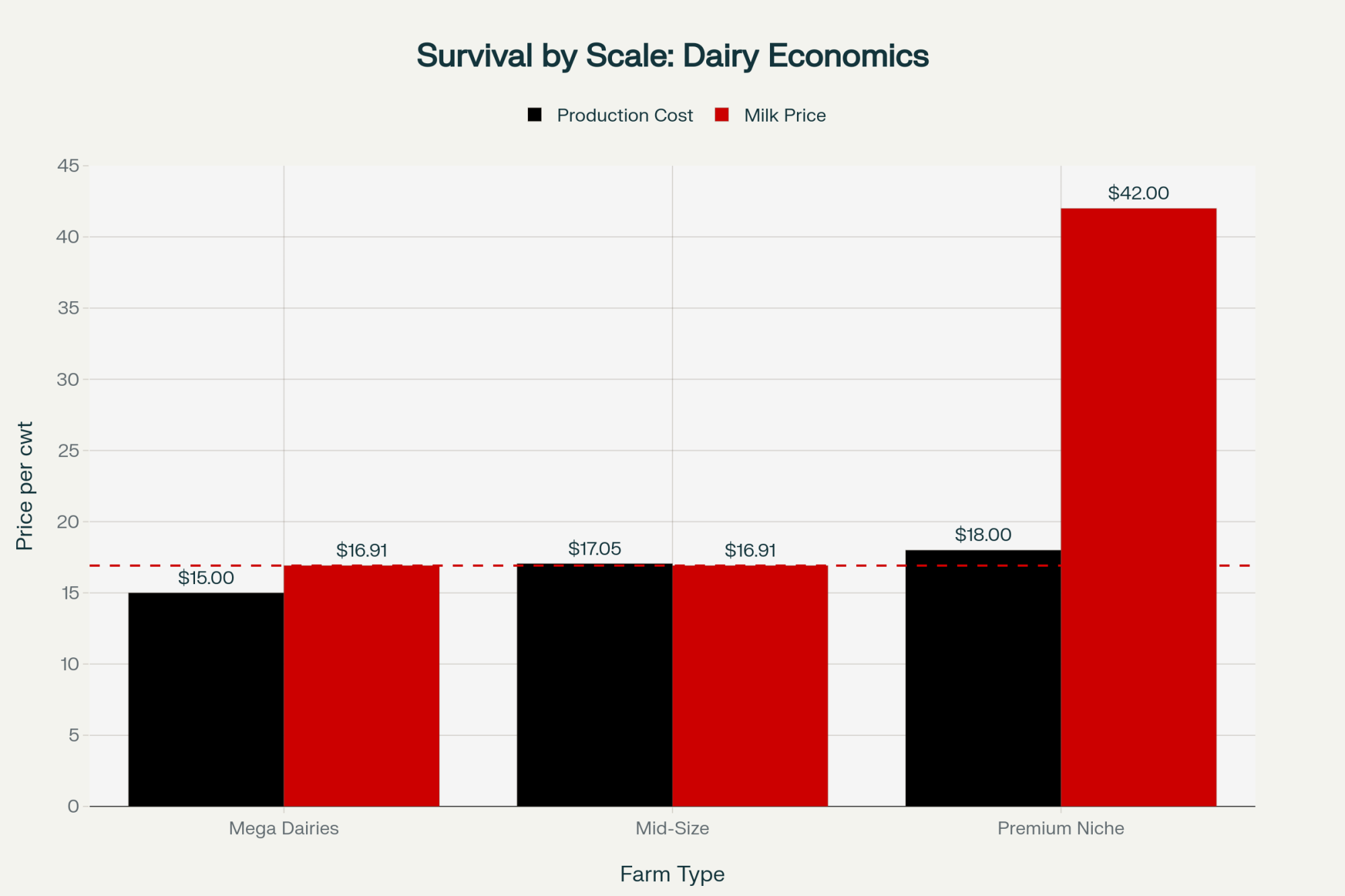

Based on the Center for Dairy Profitability at Madison and the Farm Credit System data:

Mega-dairies (3,500+ cows): Costs around $14.20 to $15.80/cwt thanks to automation and efficiency, according to Michigan State’s benchmarking study. If debt’s under 50% of equity, they can weather this storm. Some are buying out struggling neighbors at 30 to 50 cents on the dollar.

Mid-size operations (500-1,500 cows): The toughest spot. Production costs $16.30 to $17.80 based on Kansas State farm management data. With current milk prices, annual losses could exceed $400,000. Without a path to massive scale or premium markets, options are limited.

Premium niche (organic/grass-fed): Capturing $36 to $50/cwt through outfits like CROPP Cooperative are doing okay. But you need established customers near a city. Operations that went organic without premium market access are worse off than conventional farms due to higher feed costs.

Decision Time: The Next 90 Days Matter

Decision Path | Capital Required | Timeline | Equity Retained | Success Rate | Key Requirements |

|---|---|---|---|---|---|

| Exit Now (Controlled) | $0 | 90-120 days | 85-95% | 95% (preserve wealth) | Act before March 2026 |

| Scale to Mega (3500+ cows) | $8-15 million | 18-36 months | 20-40% (high debt) | 60% (if debt <50%) | Low debt + expansion capital |

| Pivot to Premium Niche | $500K-1.2M | 36 months (organic) | 70-85% | 70% (w/ city proximity) | Within 50-100mi of major city |

| Status Quo / Wait & Hope | $0 | Indefinite bleeding | 0-50% (forced exit by 2027) | 15-20% (statistically) | Hope for market recovery |

Based on Purdue’s Commercial Ag projections and USDA’s long-term outlook, you’ve got critical decisions to make in the next three to six months.

Considering expansion? Interest rates are 7.5 to 9% according to the Fed, ag credit conditions. Kansas State data shows that expanding when prices are falling rarely works. Maybe pay down debt instead.

Considering exit? Asset values today versus 18 months from now could be the difference between keeping most of your equity or losing it all. Equipment markets have declined for 25 straight months, according to Equipment Manufacturers data.

Considering organic/grass-fed? It’s a three-year conversion with negative cash flow. You need to be within 50 to 100 miles of a major city, based on consumer research. Penn State Extension says you need off-farm income during transition.

The Heifer Shortage Silver Lining

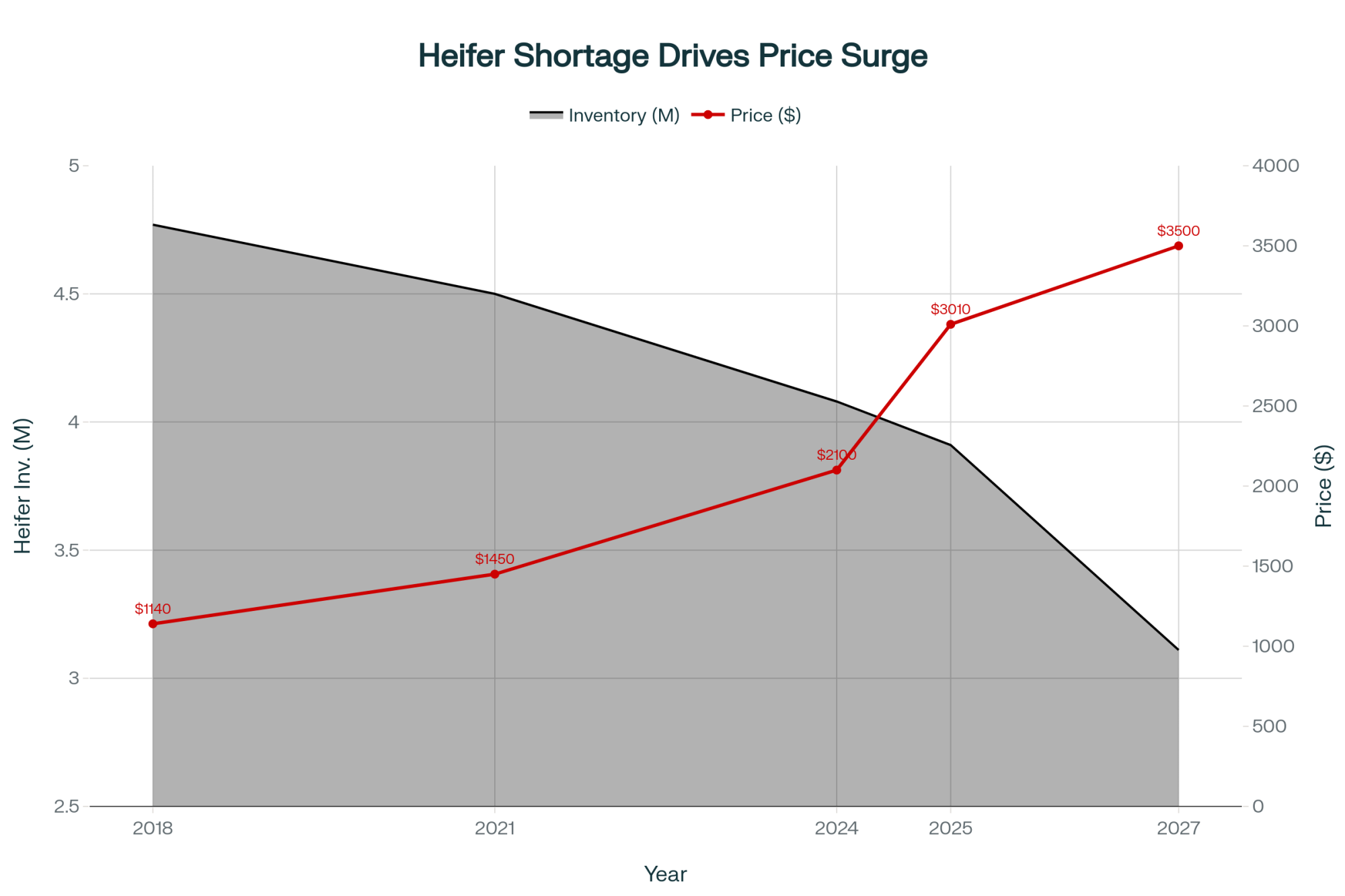

CoBank’s latest report shows we’re at 20-year lows for dairy replacement heifers. We’re short about 800,000 replacements over the next two years.

When you can get $3,500 to $4,500 for a beef-cross calf versus keeping a dairy heifer worth $800 to $1,200 in this market, the math is obvious. Progressive Dairy’s breeding survey shows most producers are making that same decision.

The dairy herd has to shrink—probably 3 to 5% by 2027, according to USDA projections. That might balance supply and demand. Rabobank and CoBank project stabilization by mid-2027, with gradual improvement into 2028.

How Geography Changes Everything

California’s Central Valley faces water costs up 40% according to UC Davis Cost Studies. Meanwhile, South Dakota State University Extension’s 2025 Feed Cost Analysis shows operations there seeing feed costs $1.50 to $2.00/cwtbelow the national average.

Texas added 50,000 cows while Wisconsin stayed flat. That’s economics playing out in real time.

What This All Means for You

Those record export numbers? They don’t mean what the headlines suggest. Moving volume at a loss is a distress sale on a national scale.

The decisions you make in the next 90 days are more important than what you do over the next year. By March 2026, many options available today won’t exist.

Mexico’s self-sufficiency plan is real. We need to plan for our biggest customer becoming a competitor. The Export Council knows it, but I’m not seeing contingency planning at the farm level.

Scale alone won’t save anyone. I’ve seen big operations with too much debt go under, and small operations with good positioning thrive. It’s about your total situation—debt levels, geographic location, market access.

The bifurcation—where you’re either huge or niche—is accelerating. If you’re in that middle range, especially 200 to 1,000 conventional cows, you need to decide which direction you’re heading.

Recovery is coming through contraction. The heifer shortage guarantees that. The question is whether you’ll be around to see it.

Looking Down the Road

By 2028, based on projections from Texas A&M and Cornell, we’ll have fewer, larger operations handling commodity production and smaller, specialized operations serving premium markets. That middle ground where many of us operated for generations is disappearing.

This isn’t random volatility. It’s industry restructuring in response to global competition, changing consumer preferences, as the Innovation Center for U.S. Dairy has tracked, and the reality of 2025 production costs.

When you see export headlines in your co-op newsletter and wonder why your milk check keeps shrinking, remember—it’s not about volume. It’s about margins. The difference between acting strategically now versus hoping things improve could be the difference between preserving or losing your family’s equity.

The herd is heading off a cliff. The record exports are just the dust they’re kicking up. Don’t follow the volume—follow the margin. The next 90 days will decide if you’re a casualty of the restructuring or one of the few left standing to see the recovery.

KEY TAKEAWAYS

- Your daily reality: At current prices, a 500-cow dairy loses $175/day ($62,000/year). The Class III-IV spread of $4.06/cwt means the same milk yields $50,000 in different income based purely on plant destination.

- The export trap: Record volumes are happening BECAUSE we’re desperate—selling cheese at $1.82/lb while New Zealand gets $2.42/lb isn’t winning, it’s liquidation.

- 90-day decision window: By March 2026, you must choose—scale to 3,500+ cows, secure premium markets at $36+/cwt, or exit, preserving 85% equity (vs 0-40% if forced out later).

- Geographic survival map: Texas/South Dakota operations save $1.50-2.00/cwt on feed. California faces +40% water costs. Location now determines viability as much as management.

- The guarantee: 800,000-heifer shortage forces 3-5% production cut by 2027, ensuring recovery for survivors—but 40-50% of current operations won’t make it.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Your 2025 Dairy Gameplan: Three Critical Areas Separating Profit from Loss – Provides actionable protocols for optimizing silage density, methionine usage, and transition cow spacing to lower production costs below the $18/cwt break-even point, directly addressing the profitability gap highlighted in the main article.

- 2800 Dairy Farms Will Close This Year—Here’s the 3-Path Survival Guide for the Rest – Analyzes the industry bifurcation into premium, scale, or exit strategies, offering a concrete decision matrix for the 7-9% of mid-size operations facing immediate closure risks due to consolidation and regulatory pressure.

- Smart Dairy Tech Isn’t Just Hype Anymore—It’s Your Competitive Survival Plan – Demonstrates how integrating IoT monitoring and automated systems can reduce feed costs by 15% and administrative labor by 40%, providing a proven pathway for family-scale operations to compete with mega-dairy efficiency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!