Five years ago, these calves paid for groceries. Today, they pay for college. Tomorrow? That’s up to us.

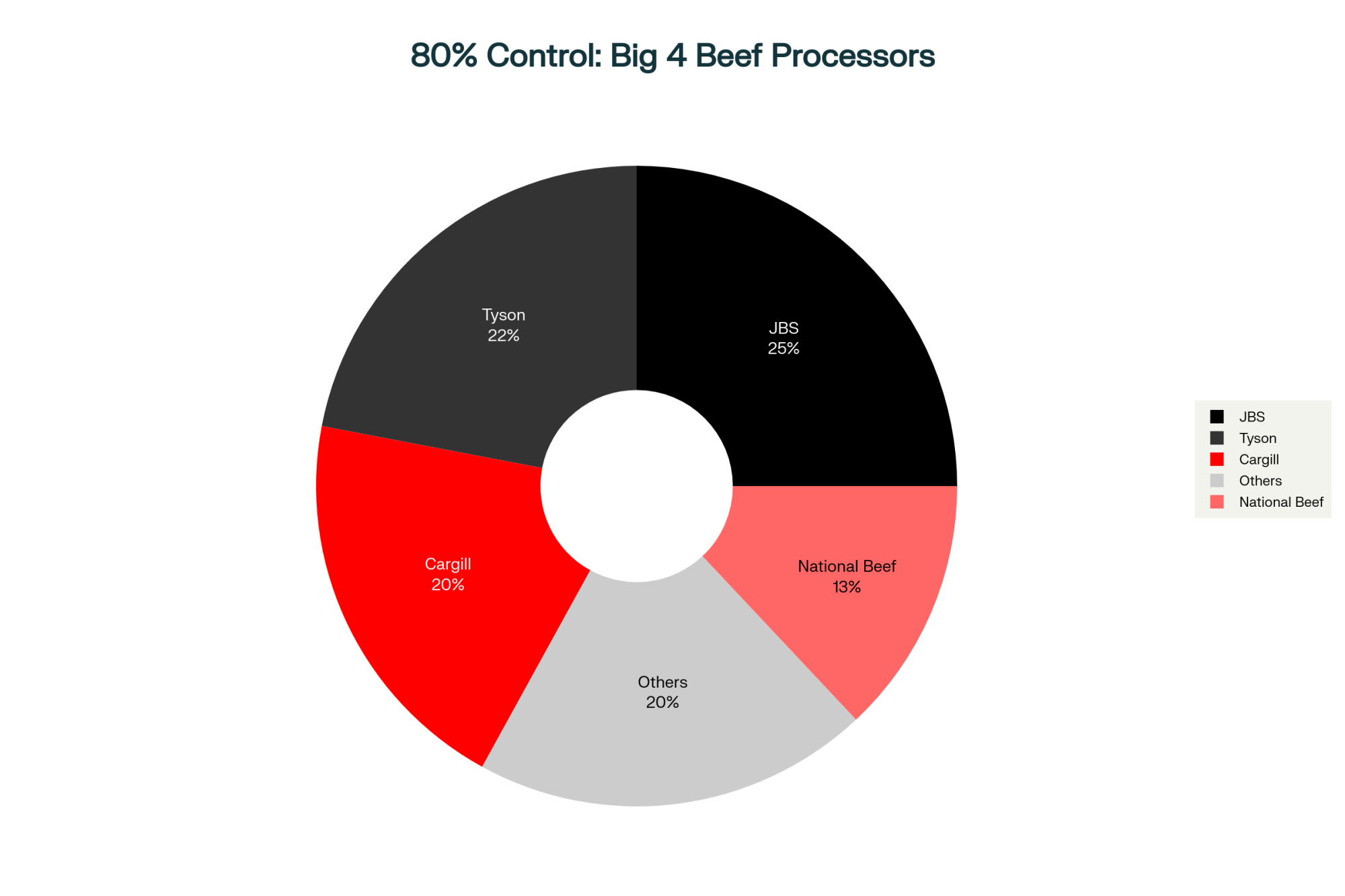

EXECUTIVE SUMMARY: Remember when dairy bull calves brought $50 and you practically paid someone to take them? Fast forward five years: those same genetics crossed with Angus now bring $1,475, generating $360,000-500,000 annually for operations like yours. But here’s what changed this week—the Trump administration announced a potential doubling of Argentine beef imports, threatening to slash your calf values by 40% and costing you $288,000 per year. Markets immediately reacted (CME futures dropped 2.4%), and producers are running scared, with calculations showing that $1,200 calves could be worth just $720 by next year. Add in foot-and-mouth disease risks from a country vaccinating 53 million cattle twice yearly, plus four packers controlling 80% of processing who can source beef globally, and you’ve got a perfect storm threatening dairy’s most successful innovation. Wisconsin operations breeding 50% to beef face maximum exposure, while even premium local markets won’t escape commodity price pressure. The bottom line: that beef-cross revenue keeping your farm profitable and your kids interested in taking over? It’s now on Washington’s negotiating table.

You know, I was talking with a Pennsylvania producer last week who showed me his auction results on his phone—$1,475 gross for his Angus-cross calves. Impressive numbers that would make anyone smile. But then he said something that’s been on my mind ever since: “Five years ago, these same calves brought maybe $275 at the sale barn. Today, they’re covering college tuition and keeping us financially stable. But with these potential Argentine beef imports? The whole economics could shift.”

Here’s what’s interesting—and honestly, what’s keeping a lot of us up at night. This October, we’re watching international trade discussions intersect with our most successful revenue diversification strategy in ways nobody really anticipated. The speed of it all is remarkable… from the October 14th White House meeting to today’s market uncertainty, we’re talking about fundamental shifts in just over a week.

When Innovation Transformed Our Operations

Looking back at how beef-on-dairy took off, it’s one of those success stories we don’t see often in agriculture. The National Association of Animal Breeders tracked this transformation—beef semen sales to dairy farms grew from about 50,000 units in 2014 to over 3.2 million recently. That’s not just growth, that’s a complete rethinking of how we approach genetics and revenue.

What I’ve found particularly encouraging is how this has played out financially. Farm Credit East’s profitability work shows cattle sales now contribute nearly 6% of total dairy farm revenue, up from 2% just three years back. For a typical 1,200-cow operation breeding 40% to beef—and many of you are probably in this range—we’re talking about $360,000 to $500,000 in additional annual profit. Real profit, after accounting for semen costs and those replacement heifers you’re not raising.

The elegance of this system, as many of us have discovered, is that your lower-genetic-merit cows—you know, those animals ranking in the bottom third for Net Merit, typically below , or falling under breed average for Dairy Wellness Profit Index—can produce beef-cross calves that bring $1,200 to $1,600 gross at auction. Meanwhile, you concentrate elite dairy genetics on your best animals. You’re actually improving herd quality while diversifying income.

Even smaller operations with 300-500 cows are seeing benefits, though the approach differs slightly. As a Vermont producer told me, “We can’t always get the volume premiums larger farms negotiate, but our local buyers appreciate the consistency of our beef-cross calves.”

How We’ve Made This Work

You probably know this already, but it’s worth reviewing what’s made this so successful. Most operations genomic test their herds and identify that bottom 30-40% based on genetic indexes—we’re usually looking at cows with Net Merit below $400 or Cheese Merit under $350, depending on your milk market. Then you use sexed dairy semen on your top performers for replacements, while breeding the rest to quality beef bulls—typically Angus, SimAngus, or Charolais.

The math is compelling and real-world, not theoretical. A Holstein bull calf might bring $50 to $150 gross at auction these days. That same cow bred to a good Angus bull? You’re looking at $800 to $1,600 gross for that calf. Even after the $30-35 semen cost, you’re ahead $700 or more per animal before considering marketing costs.

Quick Reference: Revenue Impact Scenarios

Current Market (Baseline)

- Gross auction price: $1,200/calf

- 600 calves = $720,000 gross

- Net profit after all costs: $507,000

20% Price Decline

- Gross auction price: $960/calf

- 600 calves = $576,000 gross

- Net profit: $363,000 (-$144,000)

40% Price Decline

- Gross auction price: $720/calf

- 600 calves = $432,000 gross

- Net profit: $219,000 (-$288,000)

All calculations include semen costs, foregone heifer value, and 8% marketing expenses

The Trade Development That Changed Everything

So here’s where things get complicated. On October 14th, President Trump welcomed Argentine President Milei to the White House and announced a $20 billion financial support package for Argentina. Within a week—and this is what caught many of us off guard—Agriculture Secretary Rollins confirmed on CNBC that they’re exploring expanded beef imports from Argentina.

The existing trade relationship tells an interesting story. USDA’s Foreign Agricultural Service has tracked this—Argentina exports about $801 million in beef to us, while we send them roughly $7 million. That’s a massive imbalance reflecting their various import barriers.

Currently, Argentina ships about 44,000 metric tons annually under existing agreements. Word from the National Cattlemen’s Beef Association and others is that the administration is considering doubling this. And while that’s less than 1% of total U.S. consumption, as Derrell Peel at Oklahoma State’s Extension service has noted, markets react to signals as much as actual volumes.

Looking at history, this isn’t our first experience with expanded beef imports affecting prices. Back in 2003-2004, when BSE closed Canadian beef exports temporarily, U.S. cattle prices jumped 20-30%. When trade resumed in 2005, prices adjusted downward almost as quickly.

Understanding How These Trade Deals Work

Let me walk you through the mechanics here, because it matters for your operation. Argentina can currently ship 20,000 metric tons at minimal tariffs—we’re talking pennies per kilogram. Everything above that faces 26.4% tariffs according to USDA trade data. If they expand that low-tariff quota to, say, 80,000 tons, that fundamentally changes the competitive landscape.

Here’s the key point: Lower tariffs mean Argentine beef can undercut our prices while still being profitable for them. That pricing pressure flows straight back to what feedlots pay for your calves at auction. It’s not abstract; it’s direct cause and effect.

How Markets Are Already Responding

I’ve noticed that CME futures tell the story before anything else. When the Argentine import news broke on October 19th, live cattle futures dropped over 2% in one session. CME Group data shows that translates to about $100 less per finished steer.

A trader I’ve known for years explained it simply: “Feedlots buy dairy-beef calves based on what they expect 18-22 months out. When futures signal lower prices ahead, that immediately affects what they’ll bid at today’s auction.” Makes perfect sense, doesn’t it?

I’ve been tracking sales at Pennsylvania’s Belleville market, Wisconsin’s Equity locations, and Texas auctions—beef-cross dairy calves are bringing anywhere from $800 to $1,700 gross, depending on genetics and condition. Those premium Angus crosses with good frame scores, they’re getting top dollar. But that premium exists because beef supplies sit at just 28.7 million head, according to USDA’s July inventory—the lowest since 1961.

The Disease Risk We Can’t Ignore

Secretary Rollins acknowledged during her October 22nd CNBC interview that Argentina faces the threat of foot-and-mouth disease. This deserves our attention because the implications are serious.

The World Organization for Animal Health classifies Argentina’s main regions as “FMD-free with vaccination.” They vaccinate 53 million cattle twice yearly, according to SENASA, Argentina’s animal health service, because the disease remains endemic in neighboring countries. They haven’t had an outbreak since 2006, which is good, but those vaccination programs continue because the risk persists.

We haven’t seen FMD since 1929. We don’t vaccinate because the disease simply doesn’t exist here. USDA-APHIS’s 2024 analysis suggests an outbreak could cost between $2 billion and over $200 billion, depending on how it spreads.

For dairy operations specifically? An outbreak means movement stops. No shipping calves, no culling, potential depopulation. The UK’s 2001 experience—6 million animals destroyed, £12 billion in economic damage according to their National Audit Office—happened despite their response plans.

Who Controls the Market Matters

You probably already sense this, but the concentration in beef processing affects everything. USDA’s Packers and Stockyards Division data from 2024 shows four companies—JBS, Tyson, Cargill, and National Beef—control over 80% of processing capacity.

JBS runs nine major U.S. plants while maintaining Argentine operations. Cargill’s been in Argentina since 1947 and, according to their own corporate statements, imports more products from there than anyone else. When you’ve got that flexibility, you source cattle wherever economics work best.

Brian Perkins at Kansas State’s ag econ department has observed what we all know intuitively—packers manage regardless of cattle origin. It’s producers who face the price pressure. What’s particularly interesting is that JBS announced $200 million in U.S. expansion in February 2025, despite reporting losses. Why expand when you’re losing money? Unless you expect cheaper cattle ahead…

Regional Differences Tell Different Stories

| Region | Adoption Rate | Avg Herd Size | Current Calf Value | Annual Risk 40 Drop | Exposure Level |

|---|---|---|---|---|---|

| Wisconsin | 50% | 450 | $1,285 | $116K | High |

| Minnesota | 48% | 750 | $1,300 | $176K | High |

| Idaho | 42% | 1800 | $1,250 | $378K | Very High |

| Pennsylvania | 40% | 320 | $1,475 | $61K | Medium |

| California | 38% | 5200 | $1,350 | $996K | Extreme |

| New York | 38% | 280 | $1,400 | $47K | Medium |

| Texas | 35% | 850 | $1,285 | $178K | High |

The impact varies dramatically by region, and understanding these differences is crucial.

Down in Texas and the Southwest, they’re already dealing with the screwworm situation that closed Mexican imports. That removed nearly a million feeder cattle, according to the Texas Cattle Feeders Association October report. Producers breeding heavily to beef report current gross auction premiums around $1,285 per calf. Add Argentine imports? As one told me, “It’s a one-two punch we didn’t see coming.”

Wisconsin and Minnesota really embraced beef-on-dairy. Extension specialists at UW-Madison report that most operations use beef semen, with many breeding 40-50% of their herds. A third-generation farmer near River Falls told me, “We went all-in because the economics were compelling. But we’re also more exposed if prices drop.”

Pennsylvania and New York operations often sell into local premium programs, which might provide some buffer. The Center for Dairy Excellence notes that many beef-cross calves stay regional. Still, even premium markets feel pressure when commodity prices shift.

California’s large operations—those with 5,000-plus cows—have financial depth but maximum exposure. When you’re breeding 38-40% to beef and generating $425 per cow in additional revenue, according to California Department of Food and Agriculture data, half-million-dollar swings become very real.

Out in Idaho, where operations average 1,800 cows, the infrastructure investment concerns me. As one Treasure Valley dairyman explained, “We built calf barns specifically for beef-cross programs. That’s capital we can’t easily redeploy.”

And let’s not forget the Southeast—Georgia, Florida, North Carolina operations. They’re dealing with heat-stress challenges but have found that beef-cross calves handle the climate better than pure Holsteins. Different market, same concerns about import pressure.

What Producers Are Doing Right Now

I’ve been talking with farmers across the country this week. Are you considering any of these strategies?

Many are accelerating breeding programs. If you planned 35% beef breeding and can push to 45% immediately, that might capture an extra $40,000-60,000 in gross revenue before markets shift. Yes, fewer replacements later, but with bred heifers at $2,800-3,200 according to Holstein Association USA October reports, you can buy them if needed.

Forward contracting’s getting serious attention. Some feedlots—Cactus Feeders in Texas, Five Rivers Cattle Feeding in Colorado—offer 6-12 month locks. As an Ohio producer with 900 cows told me, “I’d rather lock $1,100 gross now than risk $800 next fall.”

Others are reassessing everything. If the beef premium over dairy calves shrinks from $400 to $100, the math changes completely. An Illinois producer running 1,100 cows explained: “At $100 premium, I’m better breeding everything dairy and raising replacements.”

The Next Generation’s Decision

Here’s something not showing in projections but could reshape everything—succession planning.

A Minnesota producer I know well has an 850-cow operation. His daughter just finished her dairy science degree at the University of Minnesota, works full-time on the farm. But as he told me, “She’s looking at milk prices projected weak through 2026 by USDA, rising costs, potentially losing beef-cross revenue… and asking if this is viable long-term.”

When beef-cross programs generate $300,000-500,000 annually, that’s the difference between an operation worth inheriting and a marginal business. Remove that income, and that college graduate with options—she could make $65,000 starting at a dairy cooperative—reconsiders her future.

Christopher Wolf at Cornell’s Dyson School emphasizes we’re not just talking current economics. We’re discussing whether the next generation sees opportunity or a trap.

Practical Risk Management Today

For those reading this between milkings, here’s what needs attention:

Run scenarios at current gross prices, 20% lower, 40% lower. Know when pressure becomes critical. If 30% lower for 18 months creates problems, you need plans now.

Talk to your lender immediately. Discuss how beef-cross revenue affects debt coverage. Better to address issues using the available options.

Document your calf quality. Premium genetics and health protocols may maintain differentials even if commodity prices soften. Make sure buyers understand your value.

Consider risk tools seriously. Livestock Risk Protection insurance through USDA-RMA provides price floors. On 500-pound calves valued at $1,000, coverage might cost $40-80 per head for 6-month protection, depending on coverage level. CME futures work for operations selling 50-plus calves monthly. Some feedlots are exploring shared-risk models where price changes are split 50-50.

Connect with other producers. Through cooperatives, associations, or coffee shop conversations, collective voices matter.

Getting Your Voice Heard

Key organizations coordinating producer response include the National Cattlemen’s Beef Association at 303-694-0305, American Farm Bureau Federation at 202-406-3600, National Milk Producers Federation at 703-243-6111, and your state associations.

When calling representatives, be specific: employment numbers, local economic contribution, and exact revenue projections carry more weight than general concerns.

Where We Go from Here

Looking at this situation comprehensively, it demonstrates the complexity of modern dairy. We successfully innovated, creating revenue through genetics and smart adaptation. We invested in infrastructure, relationships, and profitable programs.

Now international trade and corporate dynamics threaten that progress. Not because we failed, but because Washington decisions could alter market fundamentals.

The Argentine discussion evolves daily. Producer organizations stay engaged, political pressure builds—especially in Nebraska and South Dakota—and the administration weighs factors. The implementation timeline remains uncertain, with some sources suggesting Q1 2026 and others suggesting it could move faster.

For those who’ve built successful beef-on-dairy programs, the immediate future requires navigating between protecting current revenue and preparing for shifts. Operations that’ll thrive maintain flexibility, strengthen relationships, and stay informed.

One thing’s certain—integrating dairy and beef through crossbreeding permanently changed resource utilization and profitability. Whatever happens with imports, that innovation won’t reverse. The question is whether American dairy farmers capture full value, or whether trade politics redirects benefits elsewhere.

As that Pennsylvania producer told me while we looked at his operation, “We’ll figure it out—we always do. But it would be nice if policy helped us succeed instead of making it harder.”

Watching the sun set over the hills here, thinking about all of you checking futures tonight, calculating scenarios, navigating another challenge… We’ll adapt, as we always have. The real $360,000 question isn’t just the money—it’s what it represents: our ability to innovate, diversify, and build sustainable operations for the next generation. That’s what’s truly at stake.

KEY TAKEAWAYS

- Your Bottom Line: That $360,000-500,000 you’re making from beef-cross? A 40% price drop means losing $144,000-288,000 annually—run your numbers at $1,200, $960, and $720 per calf

- Market Signal Already Sent: CME futures dropped 2.4% within days of announcement; feedlots adjusting bids now based on expected 2026-27 prices, not today’s market

- The Risk Nobody’s Discussing: Argentina vaccinates 53 million cattle twice yearly for foot-and-mouth disease—importing from them gambles our FMD-free status maintained since 1929

- Window Closing Fast: Forward contract locks available at $1,100 today vs. potential $800 spot prices tomorrow; LRP insurance still affordable at $40-80/head, but premiums will spike

- Your Voice Matters: Specific calls work—tell representatives your employee count, local economic impact, and exact revenue loss (generic complaints get ignored)

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beef-on-Dairy in 2025: Turning Calf Premiums into Real Profit (Without Blowing Up Your Herd) – This Tactical Guide provides an immediate checklist for producers, detailing the “60-30-10 plan” for semen use and a “60-day rule” for replacement inventory to help you avoid the $4,000 heifer shock while maximizing beef revenue before prices soften.

- Feed Quality and the Hidden Economics of Beef-on-Dairy Programs – Go beyond auction price with this Strategic Analysis that reveals the “Profit Paradox,” showing why high-cost, quality-focused programs achieve 30% grade improvements and long-term margins that significantly outperform minimum-effort approaches, protecting you when commodity prices fall.

- AI for AI: Why Your Breeding Program Might Be Stuck in the Dark Ages – This Innovation Articledemonstrates how AI-powered genomic tools can be used to manage inbreeding risk and forecast genetic potential, helping you precisely balance beef-cross volume with the need for genetically superior replacementsto secure your long-term herd health and production capacity.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!