Where should you really be milking in 2025? Hint: It’s not where you think.

EXECUTIVE SUMMARY: Here’s the deal: dairy’s economic heart is shifting to the Plains, fast. Kansas milk production jumped 18.64%, South Dakota’s rose 10.64%, and the combined investment in processing has topped $2 billion since 2020. Those numbers aren’t just stats—they mean smaller hauling costs, stronger margins, and better feed efficiency according to Kansas State’s latest research. Meanwhile, Wisconsin lost over 300 farms, but milk production’s holding steady by consolidating on bigger, more efficient farms. Globally, efficiency and cost advantages drive production shifts—and the US Plains are no exception. If you’re considering where to grow or reinvest, it’s time to examine the economics, from water reliability to mailbox prices. This isn’t about tradition—it’s about profitability. You should be watching these trends closely and adapting now.

KEY TAKEAWAYS:

- Kansas and South Dakota reported milk production gains of over 10% in 2025, driven by infrastructure investments. Producers should evaluate nearby processing plants to reduce hauling costs and boost margins in today’s volatile market.

- Feed conversion improvements in new Plains dairies give a measurable cost advantage—start tracking feed efficiency with DairyComp and compare to regional benchmarks for better ROI.

- California faces high regulatory costs (~$245/cow) but offsets some with digester and LCFS credits—producers should assess environmental programs’ ROI and explore similar revenue streams.

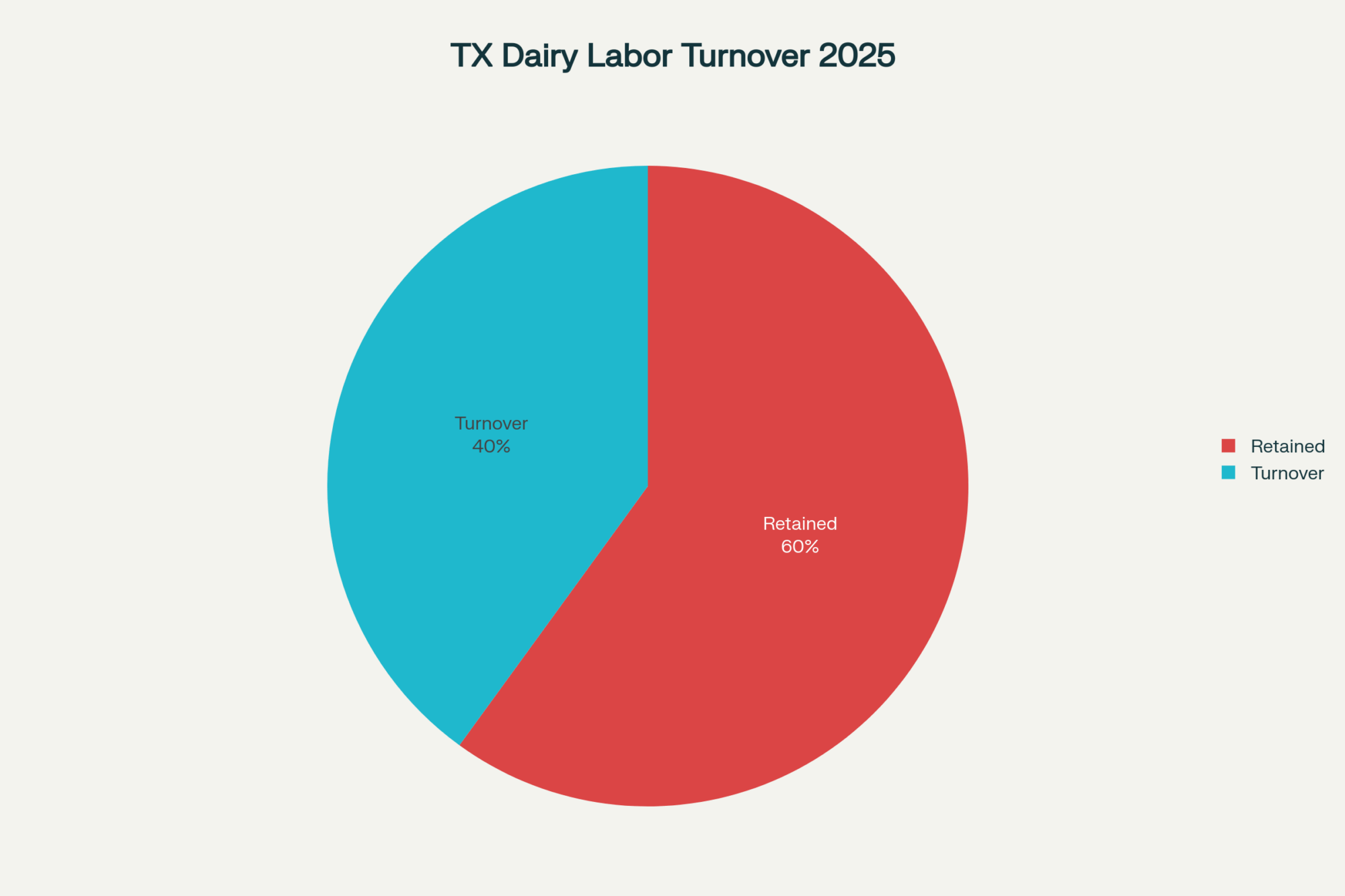

- Labor turnover exceeds 40% in parts of Texas; implementing effective retention practices can help stabilize operations, reduce costs, and improve herd performance in the 2025 tight labor market.

- Land values in key Plains expansion areas jumped 22%, so timing land purchases carefully and monitoring cropland prices are vital for strategic growth and profitability.

While traditional dairy states grapple with rising costs and regulatory pressures, a new economic reality takes hold in America’s heartland. According to August 2025 data from USDA-NASS, Kansas posted an 18.64% jump in milk production from the previous year, with South Dakota following at 10.64%. Since 2020, milk output has grown the fastest in Texas, South Dakota, and Kansas, while legacy states like Wisconsin and California have maintained their volume through consolidation, rather than by adding farms. The net effect is more milk being produced closer to new processing plants — and farther from some older ones.

The Data Driving the Shift

The numbers from Kansas are striking, with the state delivering an 18.64% increase in milk production from the previous year, followed closely by South Dakota at 10.64%. Texas continues to cement its position, producing 1.51 billion pounds in July while steadily expanding its herds.

What really stands out is how these newer Plains dairies are improving feed conversion. Agricultural economists at Kansas State University reported meaningful efficiency gains, meaning these farms get more milk from every pound of feed compared to older operations — a critical advantage when feed costs remain stubbornly high.

South Dakota’s growth is similarly well-founded. Herd numbers are up, and the state has seen substantial investment in infrastructure and feed supply, supporting sustained expansion.

Meanwhile, Wisconsin faced the closure of 313 dairy farms in 2024, highlighting the pressure on producers in traditional regions. However, production has remained resilient as dairy cows are consolidated on fewer, more efficient farms, helping maintain output and profitability.

California faces similar challenges — but with key advantages. California dairy producers benefit from proximity to major processors, higher milk solids, and revenue streams from digester-generated energy and Low Carbon Fuel Standard (LCFS) credits, which can offset some regulatory costs.

The Core Economics: Water, Labor, and Regulation

Water adds considerable complexity. Parts of the High Plains, particularly western Kansas and the Texas Panhandle, rely heavily on the Ogallala Aquifer, where water levels are declining rapidly. However, other regions, like eastern South Dakota and Nebraska, experience more stable groundwater supplies. For long-term investments, reliability and costs — including heat stress-related cooling — must factor heavily into planning.

California producers face strict water regulations, which drive up costs and incentivize innovative solutions. Regulatory costs are high, but partly offset by additional revenue from environmental credits and proximity to processing facilities.

Labor is another hurdle. Automation and efficient facility design help newer Plains dairies reduce labor per hundredweight of milk. Wisconsin and California are adapting—but the learning curves and capital needs remain significant.

Regulatory compliance costs in California are among the highest in the country — estimated at roughly $245 per cow annually, compared with $70 per cow in Plains regions. But environmental credits help some producers offset these expenses. Still, overall operational costs remain a significant factor in expansion decisions.

Where the Smart Money Is Flowing

Since 2020, investors have poured over $2 billion into dairy processing infrastructure across Kansas, Texas, and South Dakota, including expansions at the Hilmar Cheese plant in Kansas, Leprino Foods facilities in Texas and Colorado, and Valley Queen Cheese’s plant in South Dakota. These investments support and attract growing milk supplies in the region.

One 1,800-cow Plains dairy operator, speaking on the condition of anonymity, said, “The cost advantages out here allow us to reinvest and grow in ways that weren’t possible back East.”

Access to favorable financing tends to favor larger operations, though exact rates vary and are often proprietary.

Automation investments, such as milking systems, typically pay back in 18-24 months on average in these growth areas, driven by increased production and labor savings.

Proximity to processing plants is also a game-changer. The Plains benefit from facilities like Hilmar Cheese in Kansas, Leprino’s operations in Texas and Colorado, and Valley Queen in South Dakota. Herds delivering milk over shorter distances avoid the margin erosion caused by long-distance hauling.

Growth Pains: Risks to Watch

The National Weather Service highlights increasing weather variability in the Plains, posing risks to feed costs and cow comfort management.

Labor challenges persist, with turnover rates exceeding 40% at Texas dairies, according to the Texas Association of Dairymen.

Export demand appears promising, with the USDA projecting 4-6% growth for 2025; however, trade policies pose risks to maintaining this momentum.

Land prices are climbing rapidly. The Kansas City Fed reports a 22% increase in cropland values in Western Missouri over the past year, restricting the window for affordable expansion.

Disease outbreaks, animal movement restrictions, and gaps in insurance coverage for extreme weather add additional risk layers.

Why Scale Matters

Research by Cornell University confirms that dairies running more than 2,000 cows achieve significant economic advantages across geographies.

Your Strategic Takeaways

Monitor mailbox pricing and basis differences carefully, as these swings impact profitability more than volume changes. Track feed and forage costs, including sourcing silage and alfalfa locally versus transporting feed into expanding regions. Factor hauling distances and processing capacity availability into your cost analysis.

Consider potential impacts from upcoming federal milk marketing order reforms, which may alter class price relationships and influence regional payouts.

Test the sensitivity of your operation to 15% variations in feed costs, $1 modifications in milk prices, and additional cooling hours due to heat stress to refine strategic plans.

Look, I know change isn’t easy in this business. But the numbers don’t lie—and neither do your margins. Whether you’re considering expansion, exploring new technology, or simply trying to stay competitive, these shifts are happening whether we like it or not.

What do you think? Are you witnessing any of this unfold in your area?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Unseen Costs of Employee Turnover on Your Dairy – Our analysis flags the 40% turnover in Texas as a major risk. This article breaks down the hidden financial drain of that churn and provides practical strategies for improving employee retention to cut costs and stabilize your workforce.

- Brace for Impact: Why 2025’s Dairy Price Surge Masks a $780 Billion Industry’s Perfect Storm – Go beyond regional shifts and explore the global market volatility impacting your bottom line. This strategic analysis reveals how to interpret complex market signals and position your operation to withstand the economic pressures of 2025 and beyond.

- Is Your Dairy Ready for the AI Revolution? – We’ve established efficiency as a key driver for growth. This piece explores the next frontier: artificial intelligence. It demonstrates how to leverage predictive analytics for superior herd health, reproductive performance, and enhanced profitability in a competitive future.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!