- They blamed the price hike on feed producing companies and importers creating an artificial crisis

- However, price hike of raw materials for dairy feed in local and international markets is also blamed

- Disruption in import of raw materials due to lockdown is another cause

Entrepreneurs in the dairy sector are in dire straits, thanks to a sudden increase in cattle feed prices while the price of milk is falling, due to the lockdown to curb the surge in Covid-19 infections.

The prices of almost all dairy feed products in the market have shot up by Tk 100-200 per sack in the last two weeks, the dairy owners said.

They blamed the price hike of dairy feed on feed producing companies and importers creating an artificial crisis, despite having adequate stock in factories and warehouses.

However, dairy feed prices have also shot up as the price of raw materials for dairy feed has increased in local and international markets, coupled with disruption in import of raw materials due to the lockdown, businessmen said.

At present, good quality wheat husk is being sold for Tk1350 per sack (35 kg), which sold for Tk1,150 just two weeks ago. As such, the price of the product has shot up by Tk200 in two weeks, according to market visits.

Two weeks ago, medium quality wheat husk sold for Tk1,030. Increased by Tk100 per sack, currently it is being sold for Tk1130. Two weeks ago, wheat husk sold at Tk1,100 per sack (50 kg), which is now being sold for Tk1,200.

At present, a 30kg sack of lentil husk is sold for Tk820, which was Tk720 at the end of March. Earlier, a 40kg sack of Moong dal husk was sold for Tk1,100. With an increase of Tk80 per bag, it is now Tk1,180.

Soybean husk was available at Tk2,300 per sack (50 kg) but now it was Tk2,380 at the end of March. As such, its price has shot up Tk80 in two weeks. Crushed maize is sold at Tk1,050 per sack (48 kg), up by Tk100. Pea husk is sold at Tk600 per sack(18 kg). The price of Chira husk (40 kg) has shot up by Tk50 and now sells for Tk750, and dry straw (per kg) sold for Tk6, but has now increased another Tk2.

Among these products, crushed corn sold for Tk1000, Pea husk for Tk500, chira powder for Tk700 and dry straw for Tk6 in late March.

Abu Yusuf, owner of Messrs Eva Dairy Farm in Ghasiar Para, Chattogram, said that with the price of dairy feed and medicine rising day by day, it has become difficult to run the farm.

At present, the cost of milk production is around Tk63 per liter with dairy feed, medicine and labour wages. But at the wholesale level, per kg milk has to be sold at Tk54-57. Even at these prices, buyers are not available during the lockdown.

Dairy entrepreneurs said, alongside dairy feed, the prices of essential medicines for cattle has also shot up at an unusual rate.

DCP powder (bone powder) is being sold at Tk350 per packet (5 kg), which was sold for Tk300 two weeks ago. Per kg mineral powder sold for Tk280 two weeks ago. Mineral powder is now Tk320 per kg, up by Tk40 per kg. Liquid calcium is sold for Tk1,100 per packet (5 kg), up from Tk950-1,000 two weeks ago. Similarly, the price of each calcium injection has also increased by Tk40. Two weeks ago, each calcium injection sold for Tk480, which is now Tk520, they said.

Mohammad Omar Babu, general secretary of the Chattogram Dairy Farm Association, said farmers are in dire straits due to rising prices of dairy feed. Many entrepreneurs have already closed their farms due to increasing dairy feed prices year after year. Debt ridden, many of them are being forced to sell their cows.

About the price hike, Harunur Rashid, proprietor of Haji Joynal Abedin Store, dairy-poultry feed wholesaler in the Chaktai area, said manufacturers do not supply the required quantity of dairy feed in the market. Demand consequently exceeds supply of imported products in the market.

Belal Hossain, Territory Executive of ACI Feed, said the import of raw materials for poultry and dairy feed is being hampered by Covid-19 lockdowns in various countries. Not only ACI, but almost every feed manufacturer has increased prices, he added.

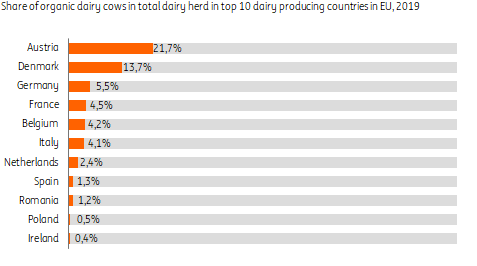

.jpg?width=544&name=Chart1A%20(3).jpg)

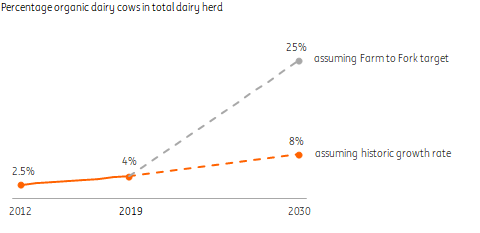

.jpg?width=544&name=Chart2A%20(3).jpg)

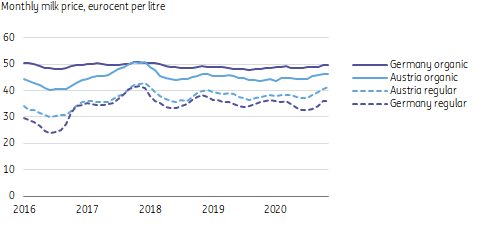

-Apr-07-2021-06-45-11-58-PM.jpg?width=554&name=Chart3%20(2)-Apr-07-2021-06-45-11-58-PM.jpg)

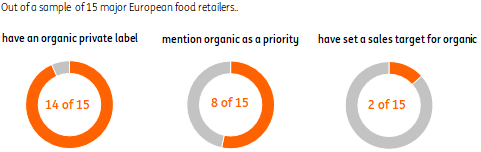

-Apr-07-2021-06-45-45-68-PM.jpg?width=554&name=Chart4%20(2)-Apr-07-2021-06-45-45-68-PM.jpg)