Nebraska farmers: 70% of your milk gets hauled out-of-state — how’s that working for your bottom line?

EXECUTIVE SUMMARY: Here’s what’s happening. Most Nebraska milk — about 70% — gets shipped out of state, and every mile those trucks roll is money out of your pocket. However, a fix is in the works: a $186 million dairy plant that’ll process 30% of that milk right here at home. We’re talking about 1.8 million pounds daily and 70 new jobs that actually matter to local communities.This isn’t just Nebraska news — it’s part of a $8+ billion wave of processing investments reshaping the dairy industry nationwide. What caught my attention? Farms maintaining somatic cell counts below 150,000 are landing premium contracts that make a real difference. The bottom line: if you’re still stuck in the “ship it far away” mindset, you’re leaving serious money on the table. Time to rethink your strategy.

KEY TAKEAWAYS:

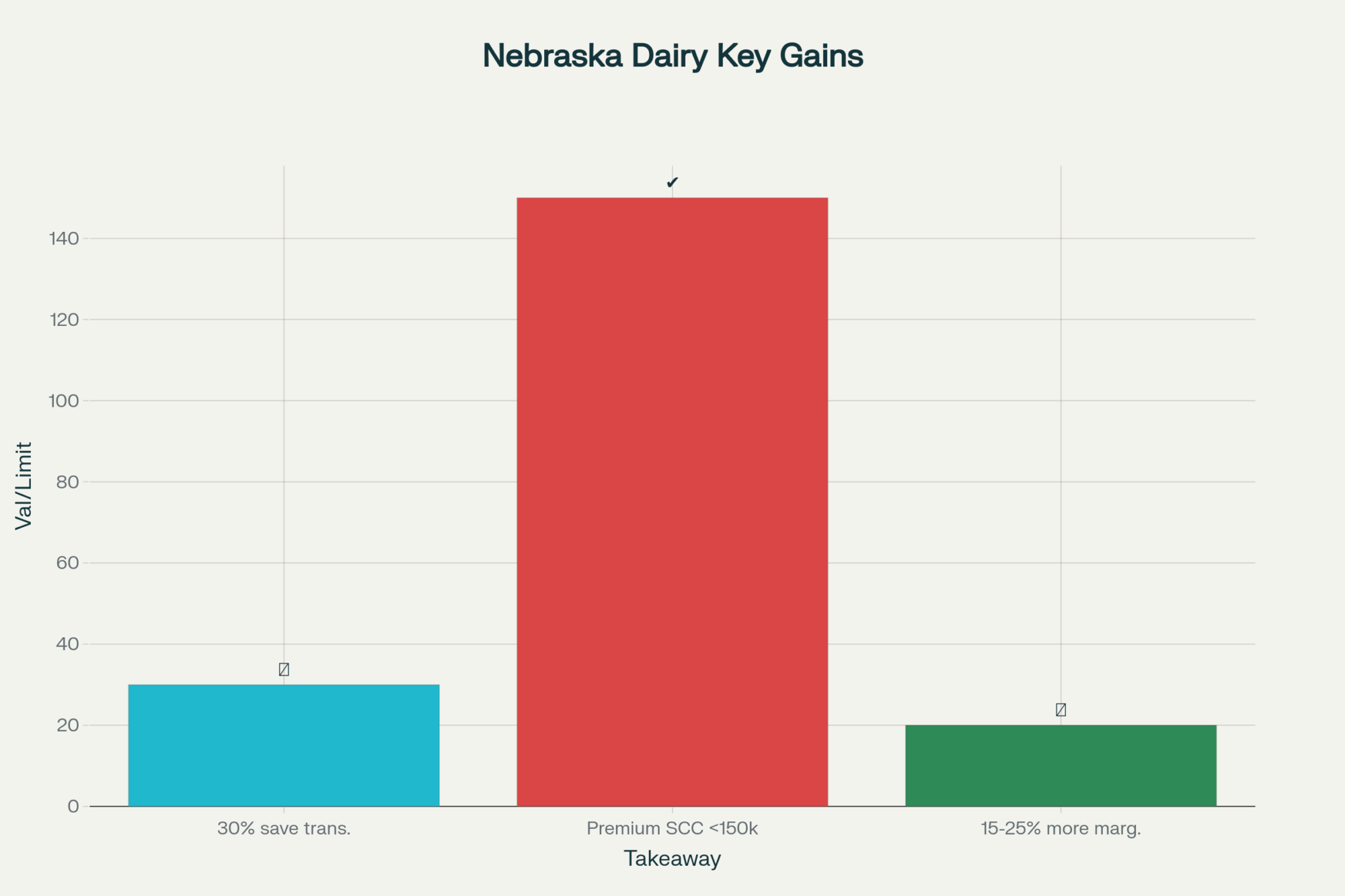

- Cut transport costs by 15-30% by processing milk closer to home — Map your distance to emerging processing hubs and explore partnerships that reduce hauling miles. With fuel volatility hitting hard in 2025, every saved mile counts.

- Boost milk premiums through disciplined SCC management below 150,000 — Tighten your herd health protocols and milking hygiene now. Premium processors are paying real money for consistent quality, not just volume.

- Capture 18-25% margin improvements through strategic vertical integration — Consider partnerships or cooperative arrangements with processors. The $ 8 billion+ industry consolidation wave means independent operators need allies.

- Leverage shelf-stable technology advantages during supply disruptions — UHT processing proved its worth during COVID when conventional milk got dumped. Position yourself near facilities offering resilient processing options.

- Focus on geographic positioning over pure production efficiency — A recent University of Wisconsin Extension analysis shows that processing proximity increasingly outweighs per-cow productivity for sustainable profitability in volatile markets.

For decades, Nebraska dairy producers have faced a stark reality: a near-total lack of local processing options, forcing most milk to be shipped far from home. But that’s changing—fast. This summer, DARI Processing, led by the experienced Tuls family, broke ground on what could genuinely be a game-changer for regional dairy economics.

We’re talking about a $186 million investment here—the first new dairy plant Nebraska has seen in over 60 years. That 60-year gap reveals just how underserved the region has been.

Here’s What Actually Happened

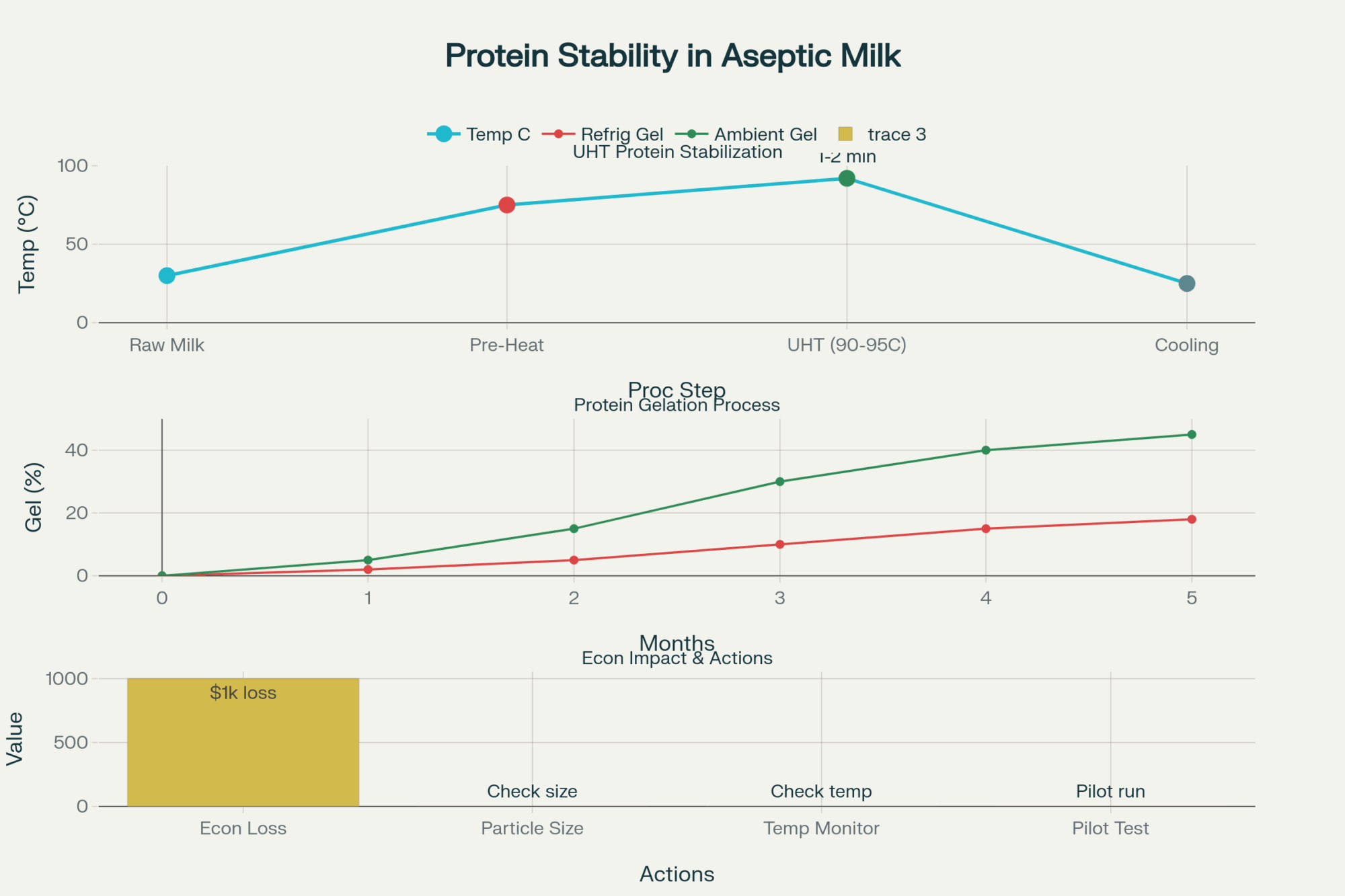

The new facility spans 236,000 square feet and is designed to process about 1.8 million pounds of milk daily. However, what makes this interesting is that they’re using Ultra-High Temperature (UHT) processing, combined with aseptic packaging technology. The strategic brilliance of this choice lies in its impact on market access: these products can remain on shelves for up to 14 months without refrigeration. That’s market access conventional fluid milk can’t touch.

The products roll out under the MooV brand: ultra-filtered, lactose-free, high-protein milk that’s already stocked in over 180 HyVee stores across the Midwest.

Governor Jim Pillen captured it perfectly at the June 18, 2025, groundbreaking ceremony: “This plant allows us to add value right here, supporting family farms and keeping economic benefits in our state.”

Key Investment Metrics:

- $103 per pound of daily processing capacity (competitive with coastal mega-facilities)

- 70 full-time jobs expected by early 2027

- 18-25% projected returns with 4-6 year payback (per UW Extension analysis)

- Public-private partnerships contributing $11.6+ million in infrastructure support

Why Your Bottom Line Should Care

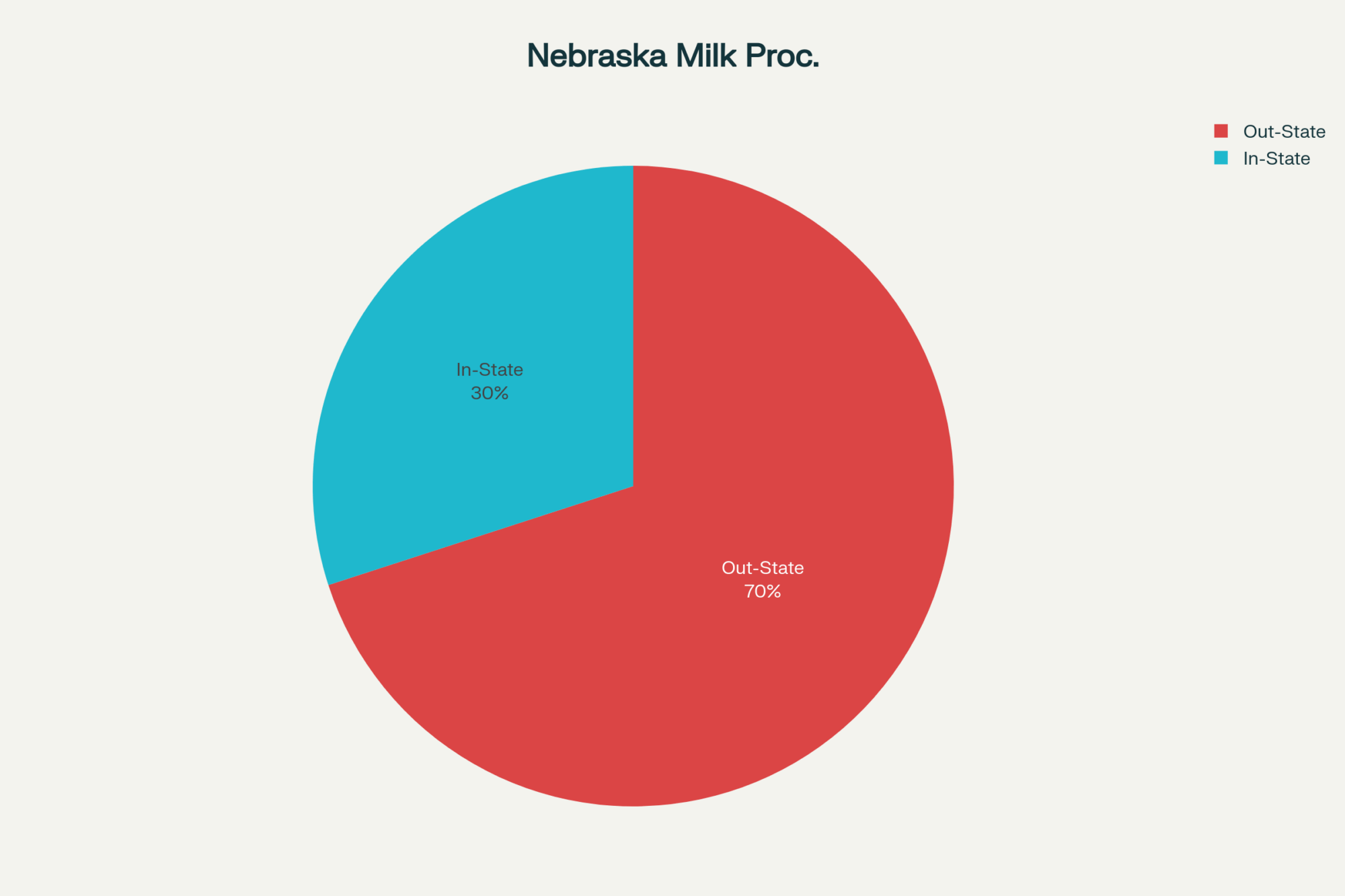

Here’s the kicker that every producer needs to understand: Nebraska currently ships about 70% of its milk out of state for processing. While exact transportation costs vary by route and season, every mile milk travels represents a direct hit to producer margins.

This plant aims to flip that dynamic entirely, retaining approximately 30% of Nebraska’s milk processing in-state. If you’re within that sweet spot of about 100 miles from Seward? You’re looking at immediate margin improvements through reduced hauling costs.

But here’s where quality becomes everything. They’re prioritizing milk with somatic cell counts below 150,000—this isn’t just about meeting standards; it’s about capturing premium pricing that rewards disciplined herd health management.

What’s fascinating is how this technology proved itself during the COVID-19 pandemic. While conventional processors were dumping millions of gallons because cold supply chains collapsed, UHT technology kept shelf-stable products flowing to consumers. That resilience isn’t just marketing talk—it’s a competitive edge when the next crisis hits.

The Supply Chain Reality Check

Here’s what gets really interesting when you dig into the numbers: Nebraska’s dairy herd has dropped from 55,000 cows in 2013 to about 49,000 today. This plant needs milk from roughly 20,000 cows to run at capacity—nearly half the state’s entire herd.

So where’s that milk coming from? The Tuls family operates about 22,000 cows across multiple operations, including Double Dutch Dairy, Butler County Dairy, and Pinnacle Dairy. They understand vertical integration—controlling both production and processing to capture margins at every level.

But scaling isn’t simple. Finding technicians skilled in aseptic processing? That’s specialized labor commanding premium wages… and they’re not exactly growing on trees around here. Additionally, expanding milk collection beyond efficient hauling distances begins to eat into the transportation savings they’re promising.

The Broader Industry Context

This investment joins a massive national wave—over $8 billion flowing into processing capacity from coast to coast. Consider Darigold’s $ 1 billion+ Pasco facility and Chobani’s $1.2 billion New York expansion. But Nebraska’s edge? Interstate 80 positioning with rail access creates distribution cost advantages that coastal mega-facilities simply can’t match for heartland markets.

Here’s the thing, though… this is more than just another processing plant. It’s part of a fundamental reshaping of how dairy value gets captured. Recent industry consolidation trends suggest that processing proximity is increasingly more important than pure production efficiency when it comes to achieving sustainable profitability.

What Smart Producers Need to Know Right Now

Critical Success Factors:

Proximity pays dividends. Supply chain volatility makes access to processing more valuable than incremental production efficiency gains. Are you positioned strategically or just efficiently?

Quality delivers real premiums. Maintaining SCC standards below 150,000 isn’t just good practice—it’s your ticket to value-added pricing structures.

Integration becomes essential. Whether through partnerships, cooperatives, or vertical arrangements, controlling more of your value chain is no longer optional.

And let’s be realistic about the challenges ahead. Tariff uncertainties, shifting consumer demand patterns, and rising input costs create a knife-edge environment where strategic positioning could make or break operations.

The Bottom Line

This facility represents more than infrastructure—it’s proof that the commodity mindset is evolving in real time. The operators who thrive won’t necessarily be those producing the most milk per cow. They’ll be those positioned strategically near value-added processing that captures premiums rather than shipping commodity products to distant processors who don’t care about your individual operation.

The question every dairy producer should be asking: What’s your strategic positioning for the next decade? Because producers who don’t start thinking beyond the commodity model might find themselves squeezed out by those who do.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlock Hidden Profits: A Producer’s Guide to Mastering Milk Quality – This tactical guide provides the on-farm protocols required to achieve the sub-150,000 SCC for premium contracts. It details practical strategies for enhancing herd health and milking hygiene to directly boost your operation’s profitability and market access.

- The Future of Dairy: Navigating Consolidation and Finding Your Niche – This strategic analysis explores the market consolidation trends discussed in the main article. It reveals how producers can identify unique market niches and leverage strategic partnerships to thrive in an industry increasingly dominated by large-scale, integrated players.

- Beyond the Barn: How Data-Driven Decisions are Revolutionizing Dairy Farming – Looking to the future, this article demonstrates how to use farm data for more than just production metrics. It covers innovative ways to leverage sensor technology and analytics to optimize herd health, improve efficiency, and secure a competitive advantage.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!