Here’s the cash flow math the dealer didn’t show you — and the one number that predicts whether your robots will pay

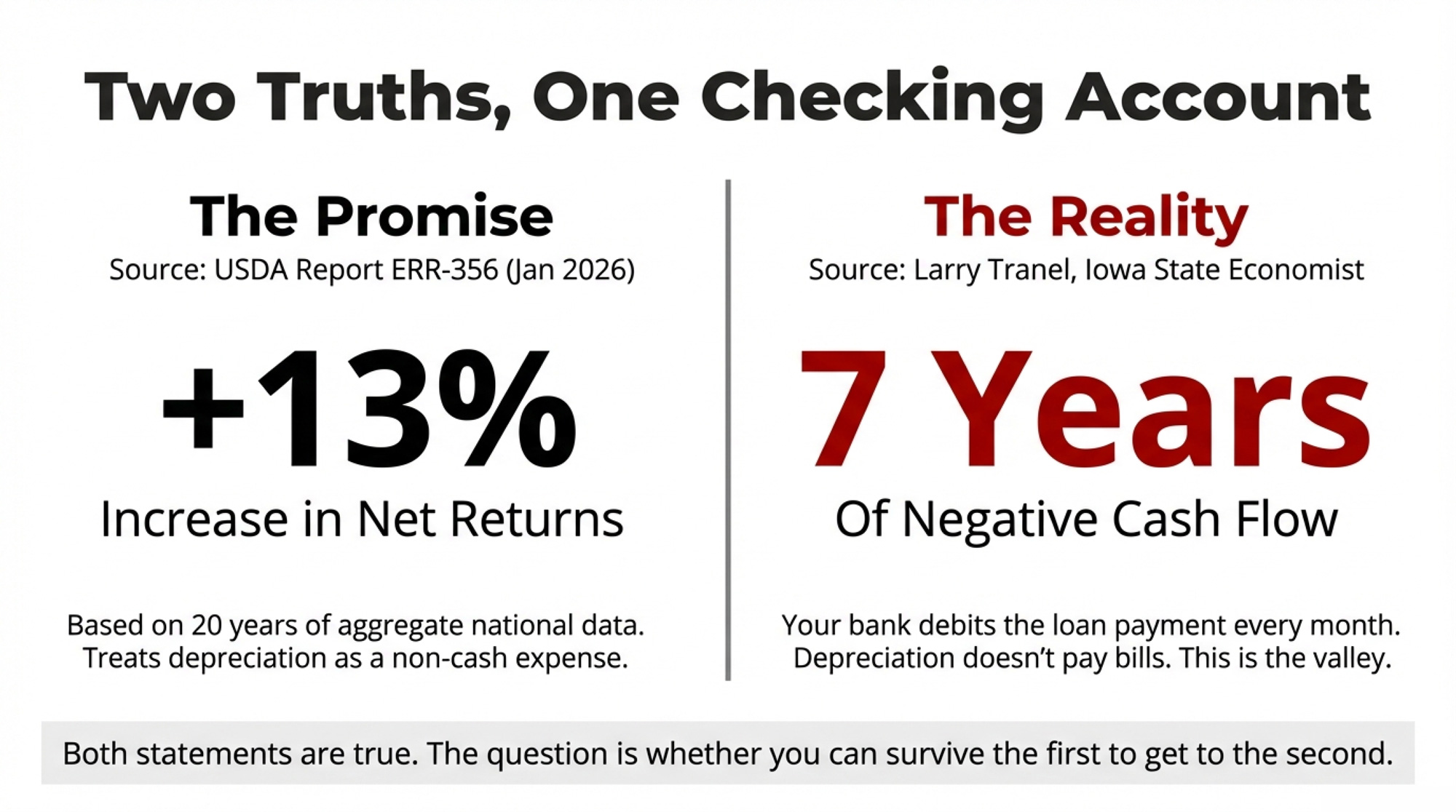

A brand-new USDA Economic Research Service report — Precision Dairy Farming, Robotic Milking, and Profitability in the United States (ERR-356, January 22, 2026) — finds that robotic milking increases U.S. dairy net returns by 13 percent on average. The researchers drew on five waves of USDA Agricultural Resource Management Survey data spanning 2000 through 2021, and they controlled for the fact that stronger managers tend to adopt first. That 13% is an adjusted treatment effect. It’s the strongest national evidence yet that AMS profitability is real.

And yet. Iowa State dairy economist Larry Tranel — the guy who’s been running AMS economics since before most dealers had a demo unit — puts it this way: “Cash flow of a robot tends to be very negative in the first seven years, then pretty positive for rest of the life of the AMS, but that is dependent on many variables, especially repair costs across the whole life of the robot.”

Both things are true. The question is whether your operation can survive seven years on the wrong side of the ledger to reach the right one.

The $8,776 Gap Your Checking Account Feels Every Year

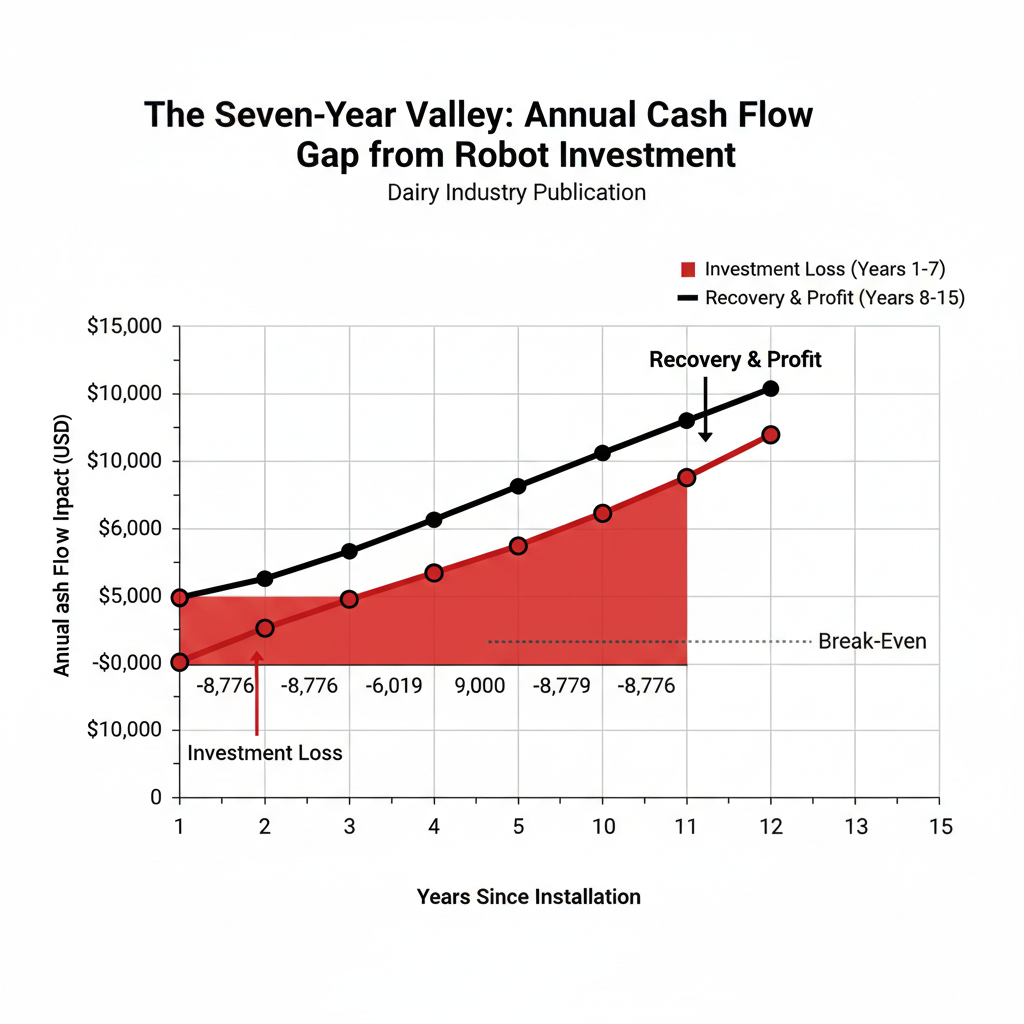

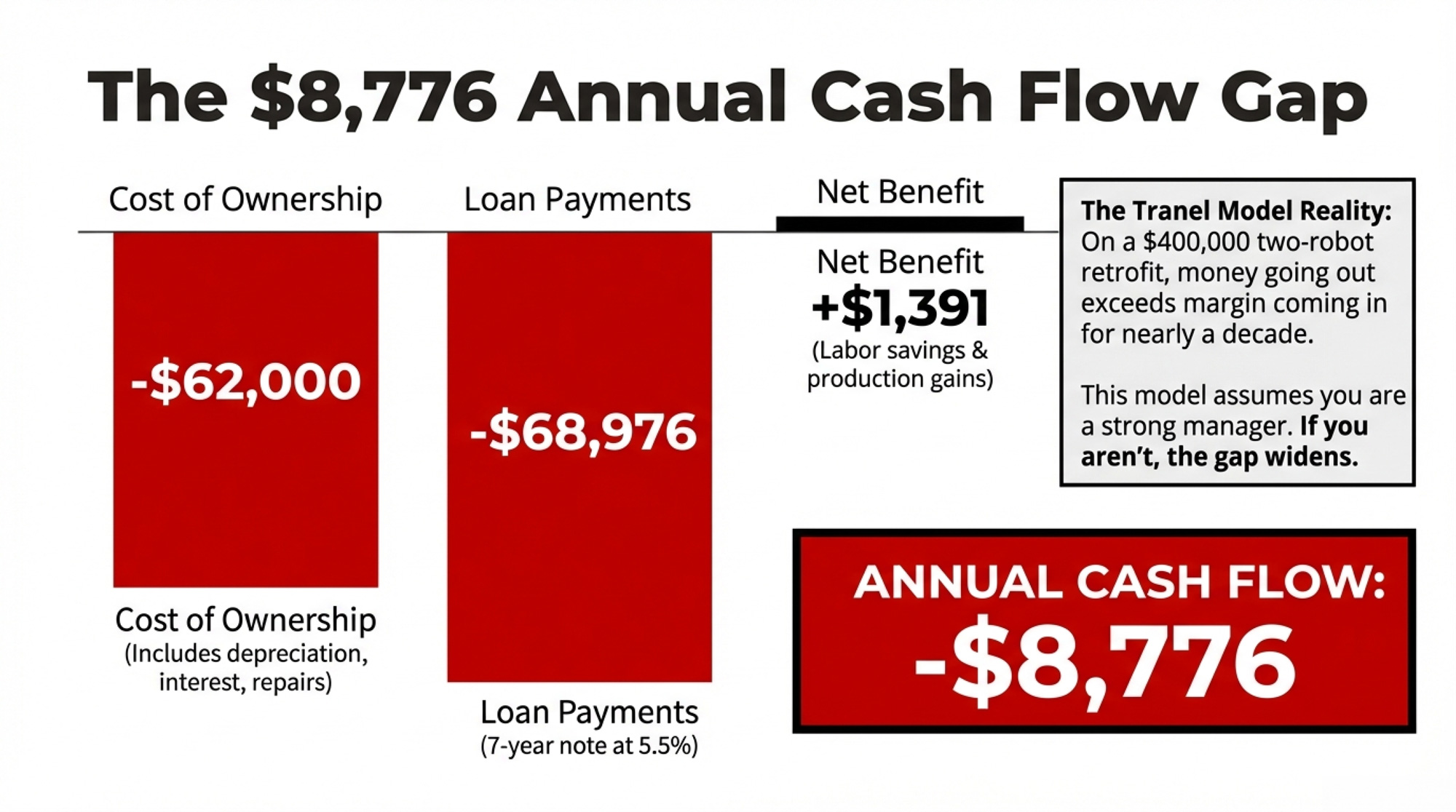

Here’s how the math works in Tranel’s partial budget model for a two-robot retrofit with a total investment of $400,000. Annual ownership costs — depreciation, interest, repairs, insurance — run roughly $62,000. Against that, the net financial benefit from labor savings, production gains, and reduced hired help comes to just $1,391 per year before you assign a single dollar to quality of life.

Now layer on the loan. A 7-year note at 5.5% means an annual payment of $68,976. The capital recovery cost for a 10-year useful life is $60,200. The gap: negative $8,776 per year in cash flow — and that’s before you account for any labor you didn’t actually eliminate.

Why does the USDA aggregate picture look so much rosier? Depreciation. In the national profitability calculation, it’s a non-cash expense spread over the equipment’s useful life. In your checking account, the loan payment is debited every month. For seven years, money going out exceeds the margin improvement coming in. That’s the valley.

Worth noting: the USDA report says only 6% of U.S. milk came from cows milked via box robots as of 2021. AMS remains the minority, meaning the profitability data reflects a population skewed toward early adopters who tend to be stronger managers to begin with.

The Production Gain That Isn’t What You Think

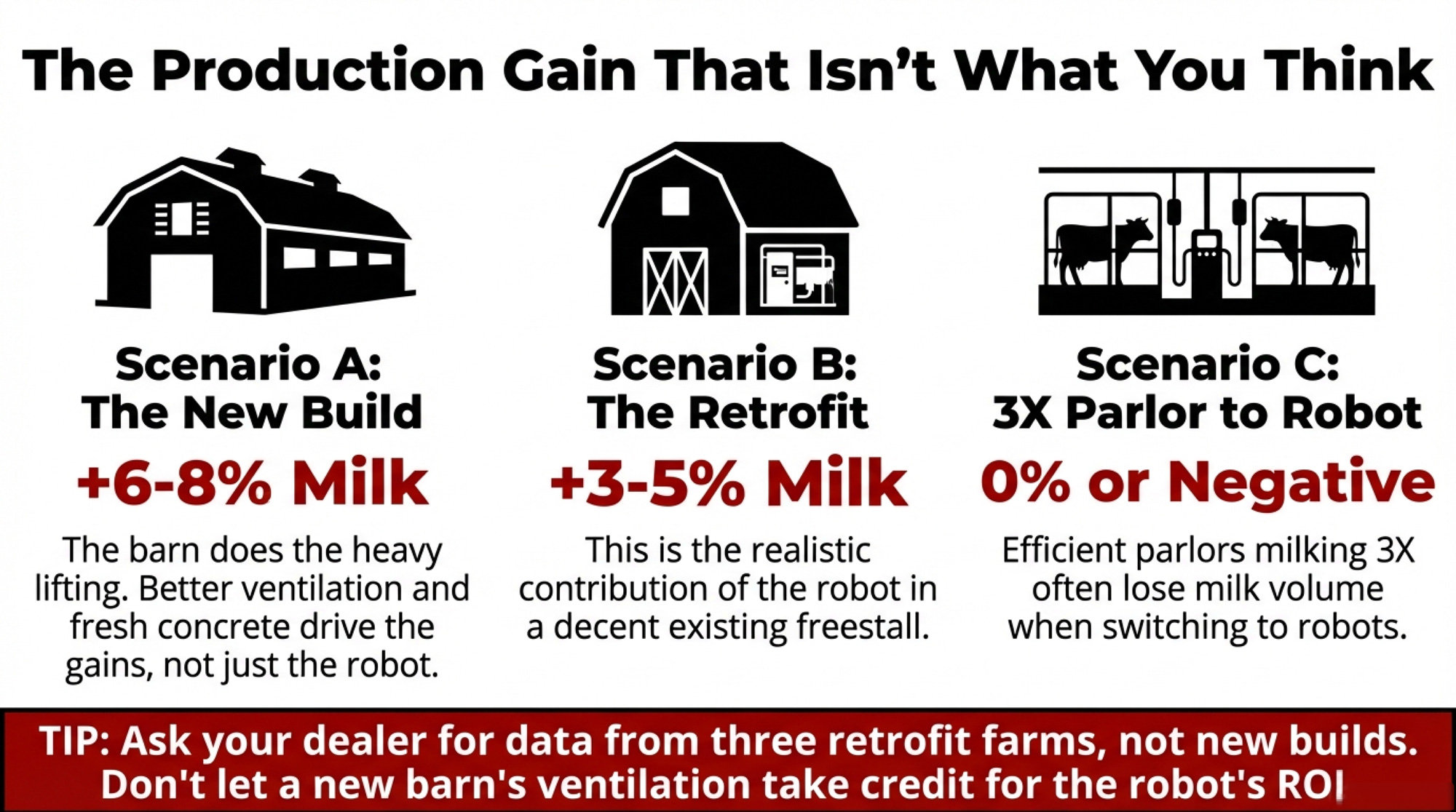

Tranel puts the typical production bump at 3 to 5 percent for herds switching from twice-daily milking. Some farms hit 10% or more. But here’s what gets glossed over at the open house: “Often, much of the increase reported on AMS is due to the new cow housing facility, not just the AMS, as new facilities often increase production 6 to 8 percent over old, worn-out facilities. This is an important point often overlooked.”

That 10% jump your neighbor reported? Maybe 3–5 points came from the robot. The rest came from the new barn. Better ventilation. Fresh concrete.

Already milking 3X in an efficient parlor? Tranel doesn’t sugarcoat it: “Producers currently milking 3X may experience a decrease in milk production.”

| Where You’re Starting | Realistic Gain |

| 2X in older tie-stall or worn-out freestall | 6–8% (new barn + robot combined) |

| 2X in decent existing freestall (retrofit) | 3–5% (robot contribution) |

| 3X in an efficient parlor | 0% or potentially negative |

Source: Tranel, Iowa State Extension (2018)

💡 The Bullvine Tip: Before you sign an AMS contract, ask the dealer for production data from three retrofit farms — not new-builds. If the big gains only show up where somebody also poured a new barn, the robot isn’t the hero. The ventilation and stall comfort are doing the heavy lifting. Purina Canada’s 2025 analysis of Canadian retrofit herds found a trending average of +3 liters/cow/day — about C$2.70/cow/day at a Canadian milk price of roughly 90 cents/liter. A useful reference point, but Canadian pricing doesn’t translate directly to U.S. operations.

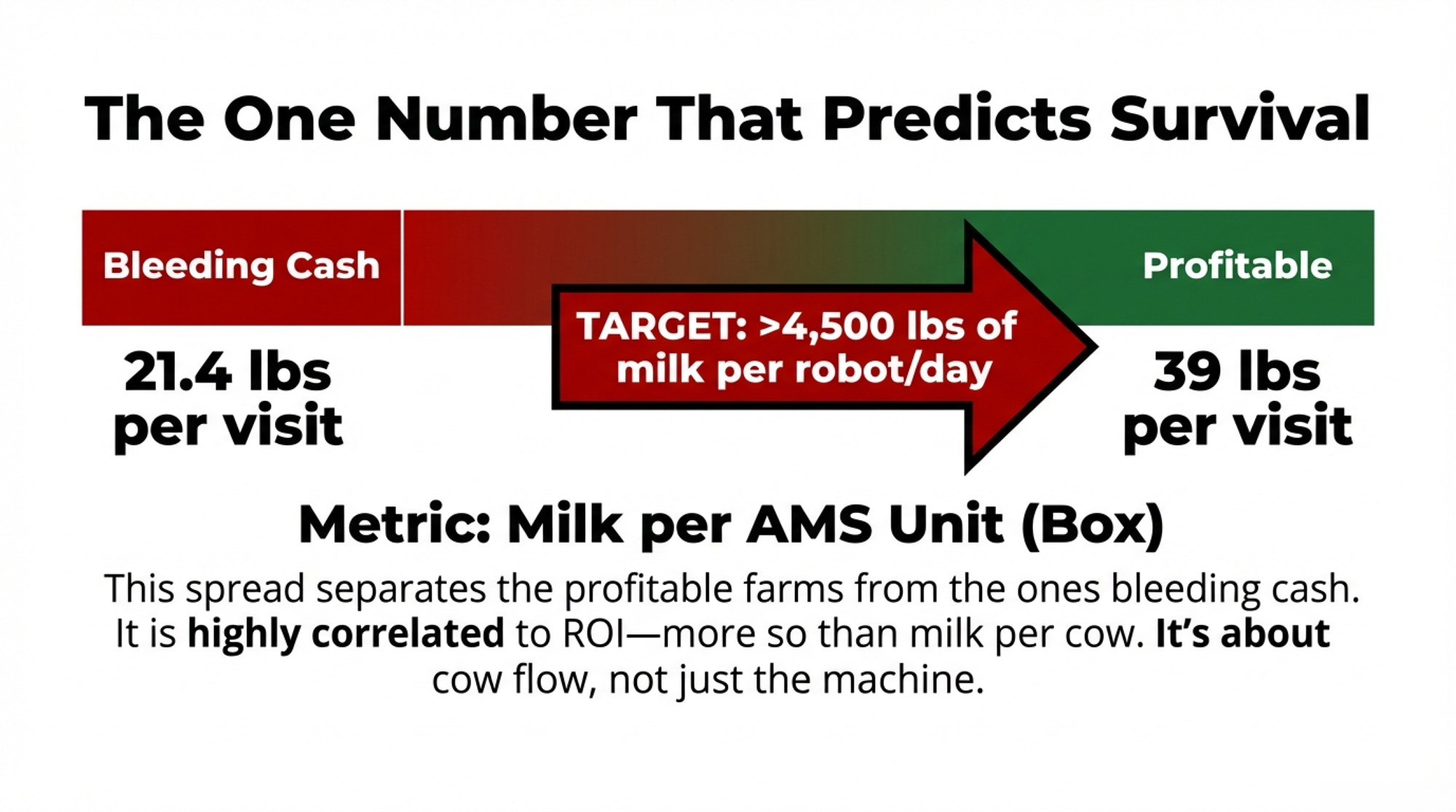

At Tranel’s benchmark of 4,500 lb of milk per robot per day, AMS milking costs run about $2.13/cwt (range: $1.77–$3.00). A well-run swing-12 parlor? Roughly $1.08/cwt. That’s a dollar-plus gap you have to close with production gains, labor savings, and management value. Every month.

| Cost Component | AMS ($/cwt) | Swing-12 Parlor ($/cwt) |

| Ownership (depreciation, interest, insurance) | $1.05 | $0.38 |

| Maintenance & Repairs | $0.54 | $0.22 |

| Labor (net after savings) | $0.34 | $0.38 |

| Throughput & Efficiency | $0.20 | $0.10 |

| Total Milking Cost | $2.13 | $1.08 |

| Gap You Must Close | +$1.05/cwt | — |

Where the Maintenance Money Goes

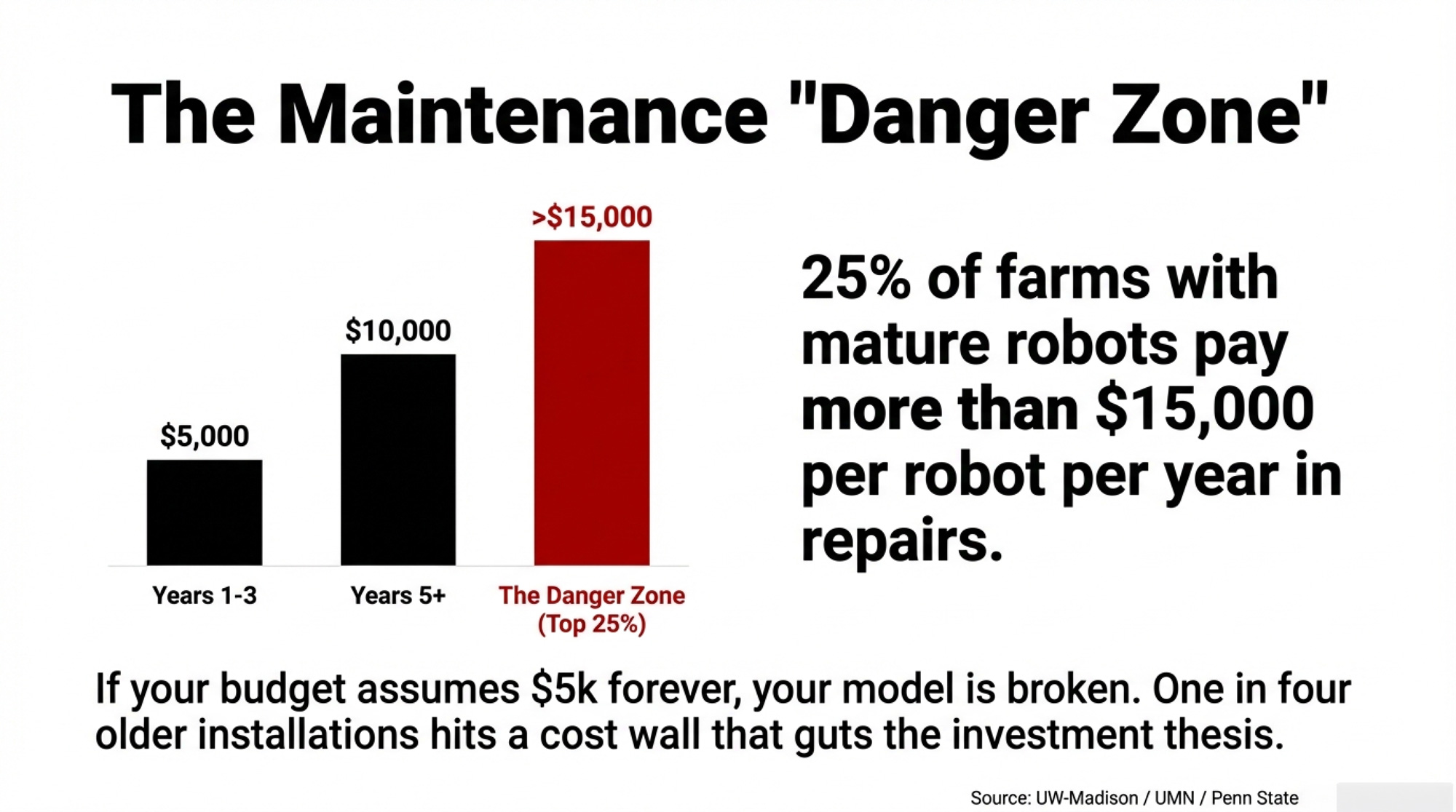

The 2019 joint survey by Extension educators at UW-Madison, the University of Minnesota, and Penn State — with more than 50 complete responses — tracked how costs change as robots age.

Early years: repairs and maintenance average around $5,000 per robot per year. As units get older, those costs climb to roughly $10,000, driven mainly by bigger repair bills while routine maintenance stays fairly steady.

But averages mask the danger zone. Among farms running robots for 5 years or more, 25% reported maintenance costs exceeding $15,000 per robot per year. A few blew past $25,000. Those producers, in their written comments, “made it clear that adaptation to AMS didn’t go well for them and that they were transitioning back to conventional milking systems or exiting the dairy sector.”

One in four older installations is hitting a cost wall that guts the investment thesis. That’s not a tail risk. That’s a quartile.

One bright spot from the same survey: 45% said dealer service had improved since they first adopted. When your robot goes down, how fast the technician arrives is the difference between a hiccup and days of lost production.

The Labor Savings Are Real. The Mental Load Is the Surprise.

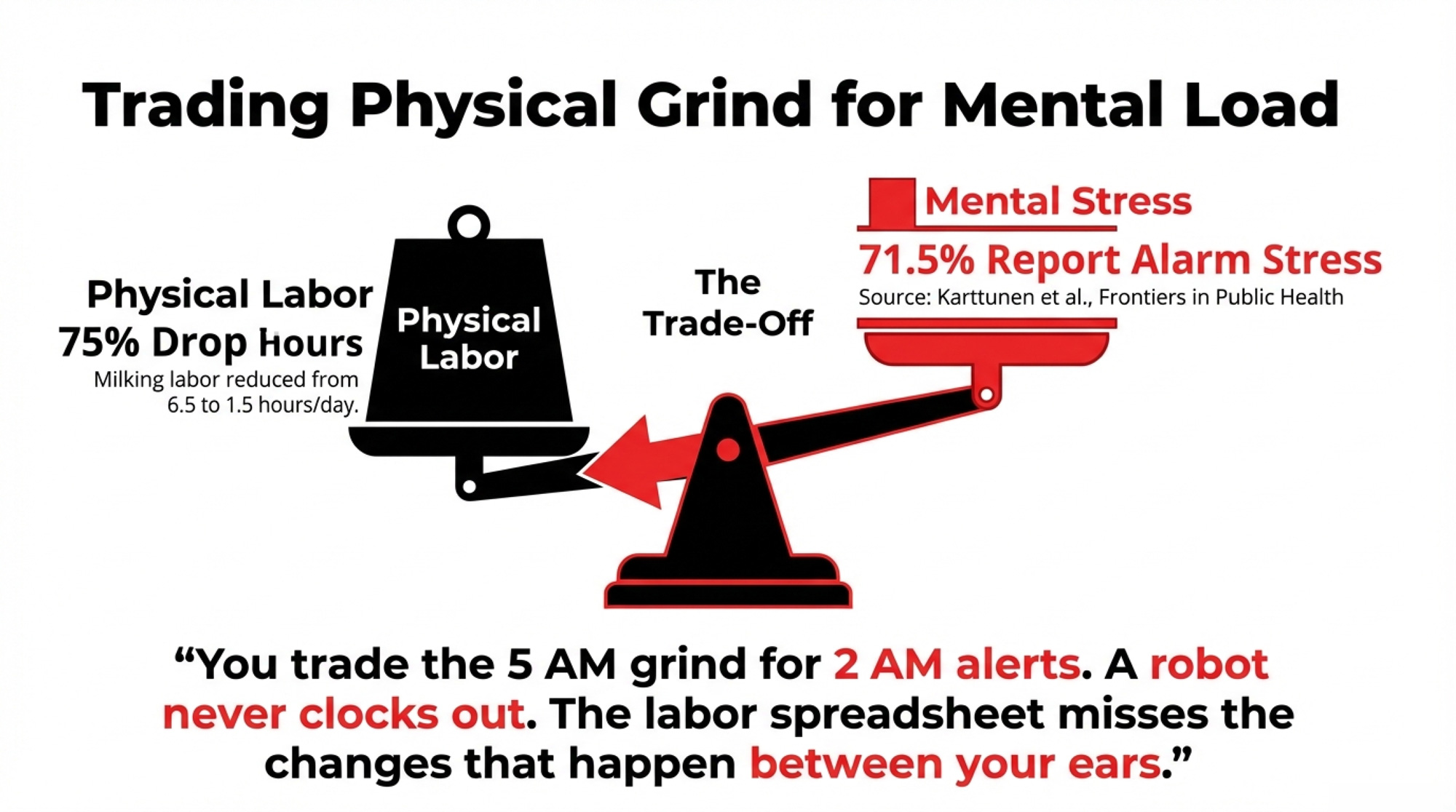

Tranel’s data show a 75% decrease in milking labor hours — from 6.5 hours/day to 1.5 on a typical two-robot farm. The UW–UMN–Penn State survey confirmed average savings of 38% per cow and 43% per hundredweight. At $15/hour, that works out to about $1.50/cwt in labor savings. Top-quartile farms saved $2.40/cwt or more.

But 8% of respondents reported no labor savings at all — mostly because maintenance demands ate the hours right back.

And the labor spreadsheet misses the changes that happen between your ears. A 2014 survey of 228 Finnish AMS farmers — published in 2016 by Karttunen, Rautiainen, and Lunner-Kolstrup in Frontiers in Public Health — found 71.5% reported mental stress from nightly AMS alarms and 51.7% experienced stress from the 24/7 standby. Overall, 93.4% mentioned at least one AMS-related issue causing mental strain.

That survey is now a dozen years old, and alarm management tech has improved. But the underlying reality hasn’t changed — a robot never clocks out. Christina Lunner Kolstrup of the Swedish University of Agricultural Sciences, a co-author on the Finnish study, put it plainly in a summary of her qualitative research reported by Dairy Global in 2021: “Previously, with conventional milking, the working day had a clear and natural ‘start’ and ‘end’, but with the AMS, there are no specific working hours. The informants claimed that they are working longer hours now than before. They are never really done after a working day, as there is always something more to be done in the dairy barn.”

One Wisconsin producer in the Extension survey nailed it: “AMS is not stress free. Physically, it is easier. Mentally stressful.” Another said: “Anyone considering robotics should understand that there is still plenty of daily work involved in milking, robots just give you more flexibility with your time.”

You trade the 5 AM and 5 PM grind for 2 AM alerts. If you run a family operation, that trade-off deserves a kitchen-table conversation before it deserves a dealer quote.

| Factor | The Financial Gain (Quantified) | The Mental Load Reality (Survey Data) |

| Milking Labor Hours | 75% reduction (6.5 hrs/day → 1.5 hrs/day) | 51.7% report stress from 24/7 standby requirement |

| Labor Cost Savings | 38–43% per cow; $1.50–$2.40/cwt | 71.5% report stress from nightly AMS alarms |

| Top-Quartile Labor Savings | $2.40/cwt or higher | Workdays no longer have clear “start” or “end” |

| Zero Labor Savings | 8% of adopters (maintenance ate the hours back) | 93.4% report at least one AMS-related mental strain |

| Physical Demand | Significantly easier (no 5 AM/5 PM milking) | “Mentally stressful… never really done after a working day” |

| Schedule Flexibility | More control over daily timing | Trade 5 AM/5 PM grind for 2 AM alerts; alarms wake you at night |

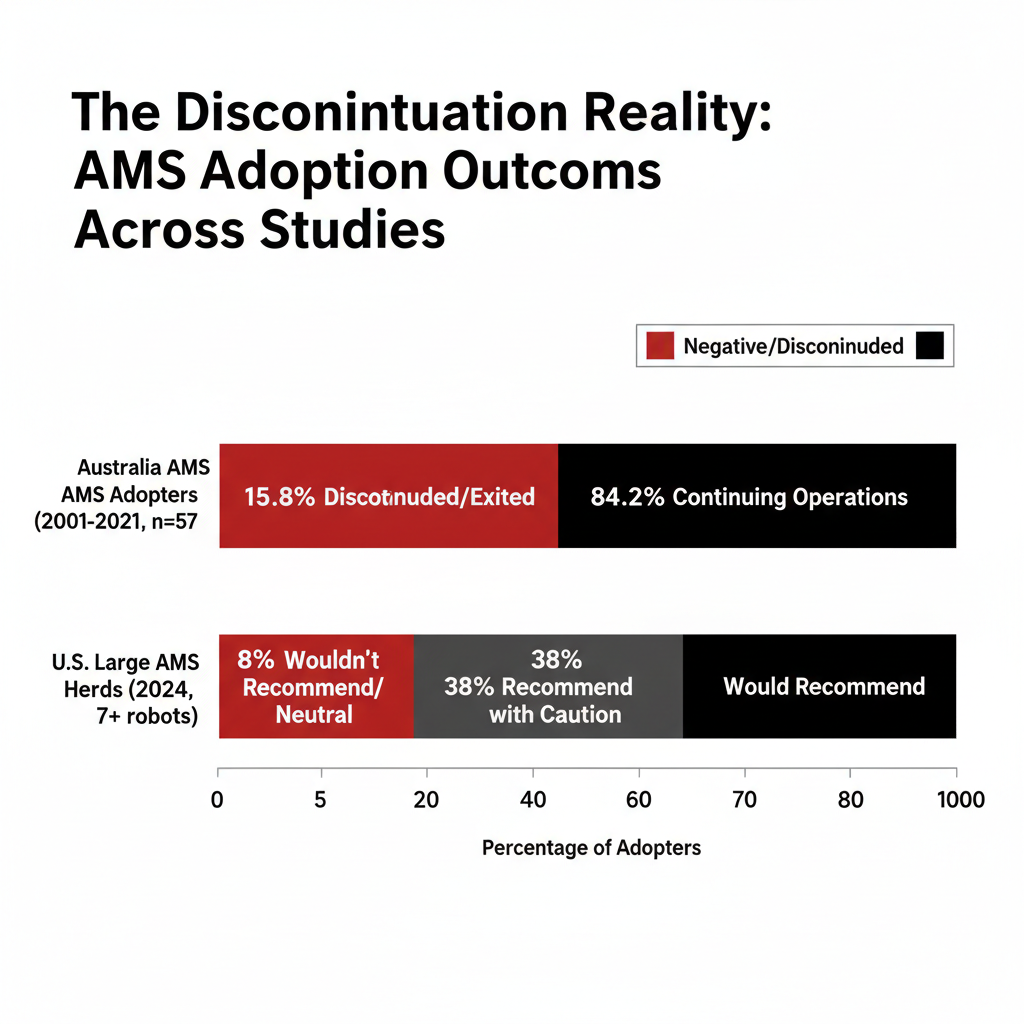

The 15.8% Who Stopped

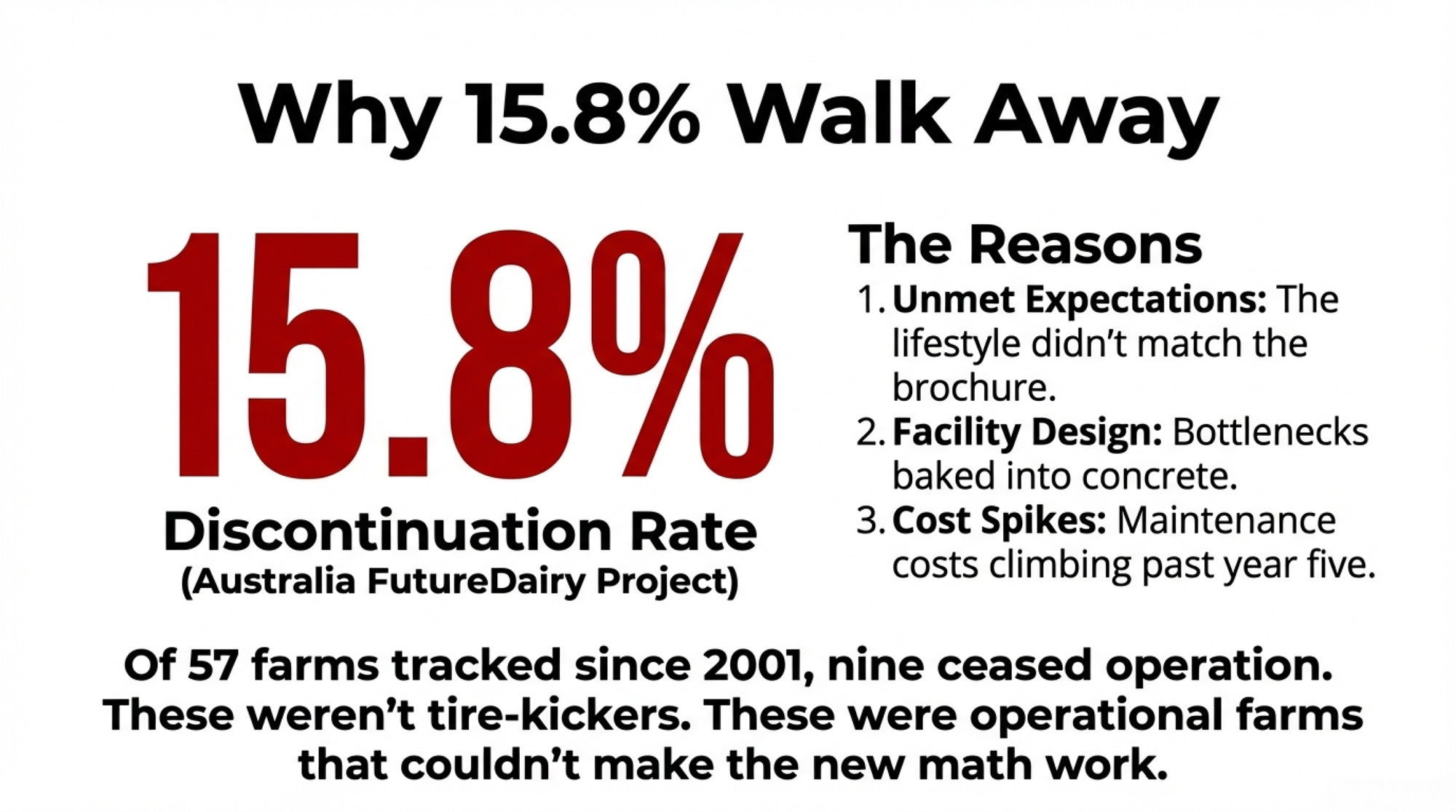

Dr. Nicolas Lyons, dairy technology leader at NSW Department of Primary Industries and a key researcher on Australia’s FutureDairy project, tracked the country’s entire AMS adoption history: “Of the 57 farms that commissioned robots since 2001, now there were only 48 operating. We had nine cease — some went back to a conventional dairy, and some left the industry entirely.”

Nine of 57. A 15.8% discontinuation rate — not among tire-kickers, but among farms that installed robots, ran them, and walked away.

Lyons didn’t dodge the reasons: “It basically comes down to things like expectations weren’t met; some couldn’t make it work; some didn’t have a good relationship with the equipment provider; and some didn’t achieve what they had hoped.”

The pattern usually starts with facility design — cow traffic bottlenecks baked into concrete you can’t move. It compounds when maintenance costs climb past year five. And it breaks open when the promised lifestyle improvement collides with the grind of 24/7 systems management.

What the Satisfied Farms Actually Said

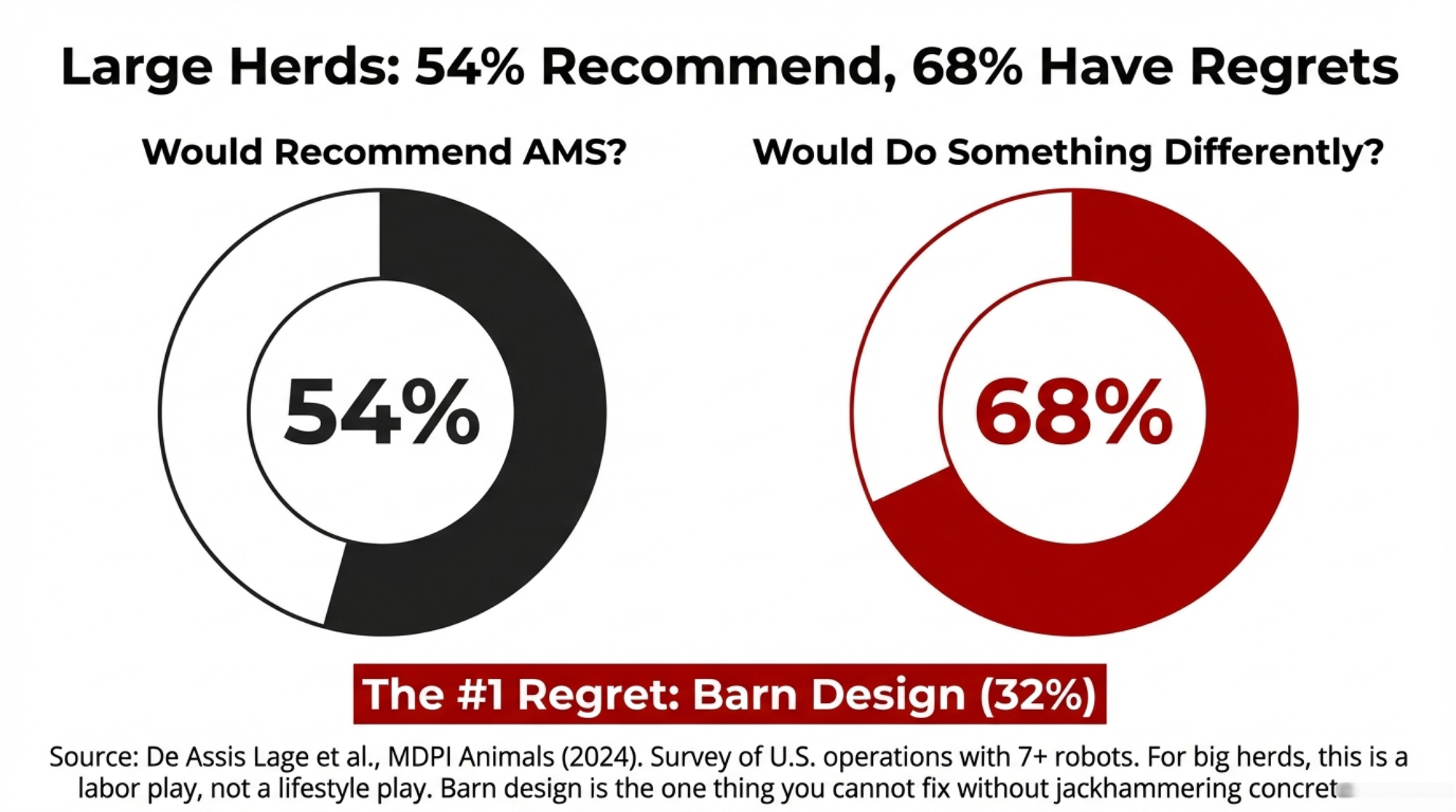

De Assis Lage and colleagues surveyed large U.S. AMS operations — farms running 7 or more milking boxes, median herd around 940 lactating cows — in a 2024 study published in MDPI Animals. The results: 54% would recommend AMS. Another 38% advised careful consideration before adopting. Just 8% were neutral or wouldn’t recommend.

That 38% isn’t a rejection. It’s producers who know it works—and exactly what it costs to get there.

Production results: 58% reported increases, and 32% saw higher fat and protein content. Top adoption motivations for these large herds: labor costs (81%), cow welfare (78%), herd performance (74%). Quality of life came in fourth at 44%. For big U.S. operations, AMS is a labor and performance investment first. The lifestyle argument carries more weight on smaller Canadian and European farms, where it consistently ranks as the top driver.

The regret data matters most: 68% would do something differently. Barn design modifications topped the list (32%), followed by improvements to cow flow (16%). Two-thirds wished they’d planned their facility better — the one thing you absolutely cannot fix without jackhammering concrete.

What Your Lender Sees

Brad Guse, Senior Vice President of Agriculture at BMO Harris Bank, frames the question the way your banker will: “Given the significant capital outlay for robotic dairy equipment, how are you going to repay the debt?”

Tranel’s model answers that bluntly. On a $400,000 investment at 7 years and 5.5%, the payment is $68,976/year. Capital recovery is $60,200/year. The cash squeeze starts on day one.

Guse warns specifically against balloon payments — you’re deferring principal at exactly the point maintenance costs start climbing.

And Tranel raises a timeline question that rarely comes up at the dealer’s table: “If you will be farming for at least another 13 to 17 years, that increases the propensity to put in robotics, but if you are only planning on farming about seven years, then it might not make sense.” Looking at 20 more years? “You need to consider needing to make a second investment of money in 15 years when the equipment wears out.”

The One Number That Predicts Your Return

Tranel is clear: milk per AMS unit is “very highly correlated” to AMS profitability — more so than milk per cow. The 2019 survey data showed robot visits ranging from 2.4 to 3.1 per cow per day, and milk per visit ranging from 21.4 to 39 lb.

That spread — 21.4 to 39 lb per visit — separates the robots that pay from the ones that bleed you dry. And the gap isn’t about the machine. It’s cow flow, feed management, lameness protocols, stall comfort, and whether you run the data like a systems manager or treat the robot as a very expensive hired hand.

What This Means for Your Operation

- Budget AMS milking at $2.00–$2.50/cwt against roughly $1.08/cwt for a good parlor. Your labor savings, production bump, and management-software value have to clear that gap. Monthly.

- Plan for maintenance to roughly double by year five — and for the real possibility you land in the top quartile at $15,000+ per robot. If your cash flow model assumes $5,000/year in perpetuity, it’s wrong.

- If you’re milking 3X in an efficient parlor, don’t model production gains from AMS. Tranel’s data says you may lose ground. Be honest about your starting point before you model the finish.

- Run Tranel’s spreadsheet — search “Iowa State Extension dairy team milking systems” for the free download. [Verify URL is current before publication.] Stress-test your numbers at $17 milk, not just $22. If the math only works at high prices, you’re making a bet, not an investment.

- Facility design is the regret you can’t undo. Visit retrofits, not just new-builds. Walk through at peak milking time. Ask every operator the same thing: “What would you do differently?”

- Know your timeline. Less than 10 years to exit? The valley may outlast your career. Twenty years out? Budget for a full equipment replacement at year 15.

- Have the family conversation about mental load before you have the dealer conversation about price. The Finnish data is clear: 71.5% of AMS farmers reported stress from nightly alarms. Alarm tech has improved since that 2014 survey, but the 24/7 nature of robot management hasn’t changed.

Key Takeaways

- The January 2026 USDA report (ERR-356) confirms that AMS boosts net returns 13% on average. But Tranel’s cash flow model shows seven years of red ink before you reach the payoff. Both are true. The difference is what you measure.

- Production gains of 3–5% are realistic for 2X herds. Much of any larger gain comes from new facilities—not from the robot itself. Ask for retrofit data before you sign.

- AMS milking costs roughly double a good parlor — $2.13/cwt vs. $1.08/cwt in Tranel’s model.

- 54% of large U.S. AMS farms recommend the technology, but 38% say do your homework first. And 68% wish they’d planned their barn differently.

- Maintenance costs nearly double as robots age. One in four older installations tops $15,000/robot/year.

- Of Australia’s 57 AMS adopters since 2001, nine stopped entirely — a 15.8% discontinuation rate driven by unmet expectations and poor dealer relationships.

The Bottom Line

The producers who recommend AMS without hesitation didn’t just buy different equipment. They became different managers — relentless about the gap between 21.4 and 39 lb per visit, obsessed with cow flow, and brutally honest about what the investment demands.

Where does your operation actually sit in that picture? Answer with a spreadsheet — not a brochure — before you pour the concrete.

Executive Summary:

USDA’s 2026 ERR-356 report says robotic milking and precision tech boost U.S. dairy net returns by about 13% on average, but Iowa State economist Larry Tranel’s cash flow work shows that a typical two-robot install often spends roughly seven years in the red before that upside appears. In his model, a $400,000 system carries about $62,000 in annual ownership costs and nearly $69,000 in loan payments, with only around $1,400 in net financial benefit — leaving an estimated $8,776/year cash flow gap in the early years. Extension surveys echo that pressure, finding that maintenance and repair costs commonly rise from about $5,000 to $10,000 per robot as units age, and that roughly one-quarter of mature AMS herds pay more than $15,000 per robot per year. On the positive side, those same data sets show 3–5% milk increases in most 2X herds that adopt robots, 38–43% labor savings, and better components in many large U.S. dairies, especially when upgrades include new barns. Mental health research from Finland and Sweden then adds a human price tag, with more than 70% of AMS farmers reporting stress from nightly alarms and describing workdays that no longer have a clear start or finish. The full article combines these numbers into a clear playbook — from cost per cwt and milk per robot box to maintenance risk and farming timeline — so you can decide, with eyes open, whether robotic milking fits your herd and your life.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Dairy Tech ROI: The Questions That Separate $50K Wins from $200K Mistakes – Gain a definitive roadmap for tech upgrades by identifying the robot profitability “sweet spot.” This breakdown exposes the infrastructure failures that sink 62% of investments and arms you with the labor-wage thresholds required for a positive return.

- More Milk, Fewer Farms, $250K at Risk: The 2026 Numbers Every Dairy Needs to Run – Secure your operation against 2026’s projected margin compression by mastering the “more milk, fewer farms” math. This strategic briefing reveals the $250,000 revenue gap facing mid-sized dairies and delivers actionable culling and hedging tactics to protect your bottom line.

- The Next Frontier: What’s Really Coming for Dairy Cattle Breeding (2025-2030) – Capture an additional $3,000 per cow in annual revenue by positioning your herd for the gene-editing revolution. This forward-looking analysis breaks down how designer milk and genomic health markers will fundamentally reshape your competitive advantage and profit potential by 2030.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!