Crop farmers: $35B bailout. Beef: $1,100 calves. You: $17.50 milk that costs $19 to make. The numbers that should anger every dairyman.

Executive Summary: Record farm income of $179.8 billion sounds great until you realize dairy’s been left behind—your neighbors got disaster checks while you’ve faced 18 months of negative margins with minimal help. The numbers are stark: mega-dairies produce $3-4/cwt cheaper, driving consolidation that’s eliminated 39% of farms since 2017. Behind every closure is a family burning through retirement savings, with 60-70% of dairy farmers now reporting serious mental health impacts. Yes, some operations thrive through creative adaptations—premium marketing in New York, specialty partnerships in Texas—but these require advantages most farms don’t have. For mid-size dairies, three paths remain: invest heavily to scale up, find niche markets, or exit strategically while equity remains. This article offers an honest assessment and practical tools to make that choice consciously rather than desperately.

You know what’s interesting? The September farm income forecast from USDA shows net farm income up 40.7% to $179.8 billion—second-highest on record. It’s all anyone’s talking about at the coffee shop. But here’s the thing: for most of us checking milk prices against feed bills this fall, that headline number feels like it’s from a different planet.

I was talking with a producer near Eau Claire last week—he’s milking about 380 Holsteins, and he’s been at it for years. While his grain-farming neighbor just deposited a disaster check for weather losses from two years back, this guy’s been navigating 18 months of tough margins with nothing but the DMC coverage he pays premiums for.

Makes you think about how these support structures really work across different commodities, doesn’t it?

Let me share what I’ve been learning from conversations around the industry—producers, economists, folks who’ve been watching these trends for decades. Maybe together we can make sense of this disconnect between ag’s overall prosperity and what’s happening in our barns.

Understanding Where That $180 Billion Really Goes

So here’s what’s fascinating when you dig into this $179.8 billion figure. About $41 billion of it? That’s government payments, not market returns.

The breakdown tells you everything:

- $35.2 billion in disaster assistance through the American Relief Act—mostly for crop losses

- $40 billion total in direct payments (we were at $10 billion just last year)

- Minimal DMC payments for dairy—margins stayed just above that $9.50 trigger

You probably know this already, but it’s worth repeating: dairy’s support structure works completely differently. We pay into programs that rarely trigger at levels that actually help. Meanwhile, crop disasters get an immediate congressional response.

Now look, I’m not saying processors have it easy either. Labor’s up about 15%, energy costs have jumped over 20%, and don’t even get me started on packaging materials—nearly 20% higher than 2020. Everyone’s feeling it somehow. But the way support flows through the system…well, that’s another story.

The Scale Reality We Can’t Ignore in 2025

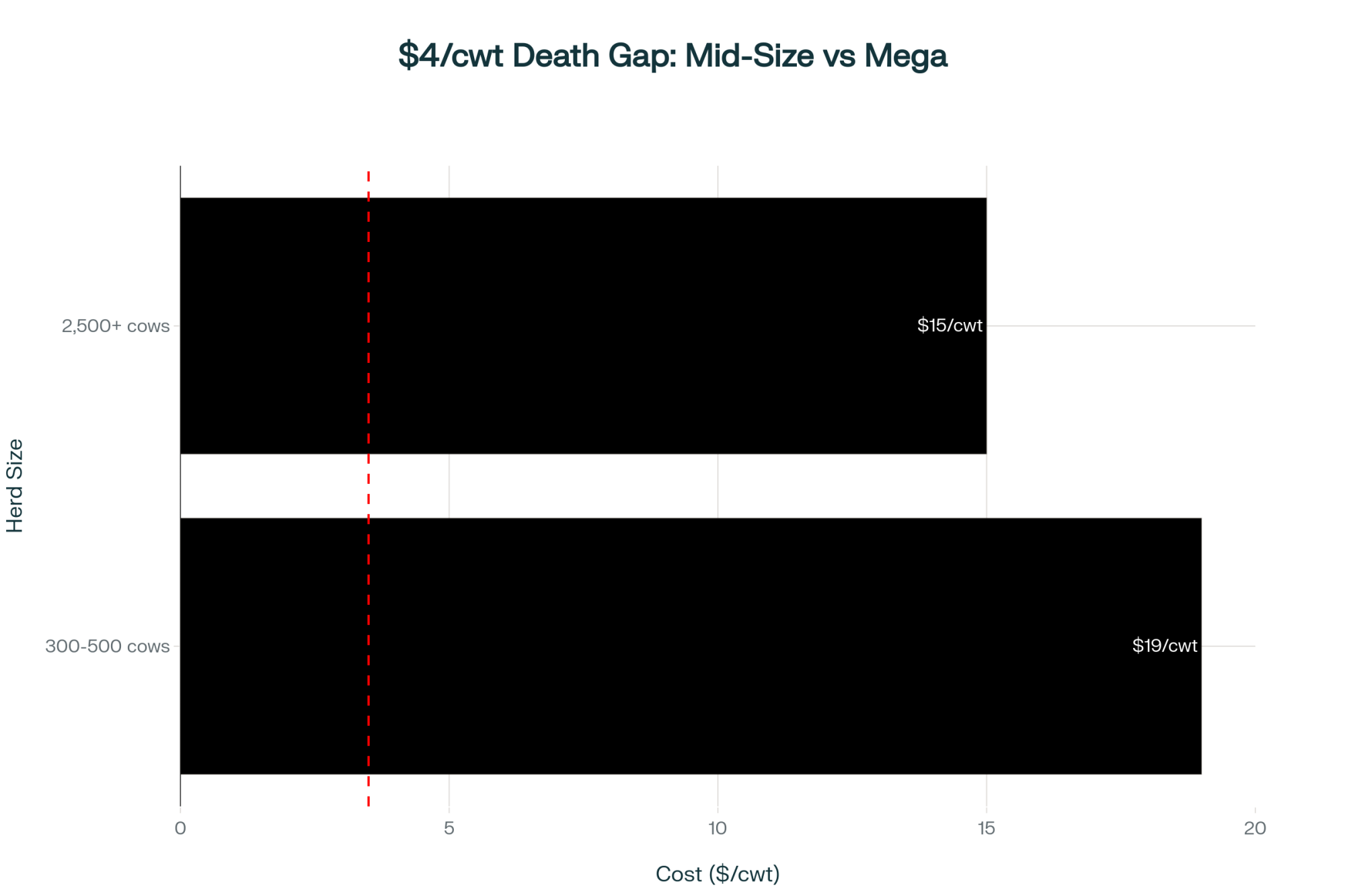

What I’ve found really compelling is the recent data from our land-grant universities on operational scale. And honestly, as much as we might not want to hear it, the numbers are clear: operations with 2,500-plus cows are producing milk for roughly $3 to $4 less per hundredweight than those of us running 300 to 500 head.

Let me break this down the way it was explained to me.

The Math Nobody Wants to Talk About

Take your typical 300-cow operation averaging 23,000 pounds:

- Fixed costs: Running about $0.90 per hundredweight (varies by region, obviously)

- Annual production: Around 6.9 million pounds

- The challenge: Can’t justify specialized equipment, stuck with truckload purchasing

Compare that to 3,000 cows:

- Fixed costs: Drop to maybe $0.45 per hundredweight

- Annual production: 75 million pounds

- The advantages: Railcar feed purchasing, specialized positions, equipment that actually makes sense

An Idaho dairyman I know—he’s running about 2,800 head—put it to me straight:

“We’re buying feed in railcar quantities for substantially less per hundredweight. The guys buying truckloads? They’re paying $1.50 to $2 more, easy. That advantage is really tough to overcome.”

But here’s what’s worth considering. Not every big operation is printing money. I spoke with a California producer managing over 5,000 cows, and his perspective was sobering:

“Everyone thinks we have it made. Truth is, we’re all walking a tightrope, just at different heights. Our debt service alone runs over a million annually. One disease outbreak, one major equipment failure—those thin margins disappear real fast.”

The Census of Agriculture data from 2022 really drives this home: we lost 39% of dairy farms between 2017 and 2022. That’s the steepest five-year decline they’ve ever recorded. And operations over 1,000 cows? They’re now producing 66% of our milk, up from 57% in 2017.

How This Plays Out Across the Country

What I find really interesting is how differently this consolidation hits different regions:

Pacific Northwest folks:

- You’re dealing with that brutal Class I utilization problem—18% versus 29% nationally

- Federal Order prices running over a dollar below the national average

- And those transportation costs to get milk to cities? Forget about it

Wisconsin and Minnesota producers:

- Over 500 farms gone in 2024 alone—mostly those 150-400 cow operations we all grew up around

- When the co-op closes, the vet leaves, the equipment dealer stops stocking parts…

- That infrastructure needs critical mass, and once it’s gone, it’s gone

Out in Idaho and Texas:

- Production’s actually growing—7% or more—even as farm numbers drop

- They’re attracting these mega-operations with the climate, the space

- New processing plants are going up to match

Northeast—and this is tough:

- Land at $4,500 an acre (if you can find it)

- Environmental compliance costs that’d make your head spin

- Infrastructure that’s 40 years older than what they’re building out West

California’s its own beast:

- Central Valley operations are expanding like crazy

- But near the cities? They’re selling to developers

- Most complex market in the country, honestly

Florida dairy—different world:

- Heat stress management costs running $100+ per cow annually

- Unique fluid milk market dynamics

- Some of the highest production costs nationally

Each region’s facing its own version of this challenge, but the underlying pressure’s the same everywhere.

The Human Side Nobody Wants to Talk About

Here’s what keeps me up at night. Recent agricultural health research suggests 60-70% of us are dealing with mental health impacts from farm stress. That’s way higher than the general population, and we need to acknowledge it.

I know a Wisconsin couple—good people, who milked registered Holsteins for nearly 30 years. Sold out this summer. They knew five years ago the math wasn’t working, but how do you walk away from something your grandfather built?

“The hardest part was watching our neighbors in grain and beef doing well while we struggled. Felt like nobody in policy circles even knew we existed.”

What makes dairy different—and we all know this:

- No breaks: Cows need milking twice a day, every day

- No sleep: Research shows we’re averaging four hours during calving season

- No let-up: Financial pressure plus operational intensity equals chronic stress

- Identity crisis: When the farm’s been in your family for generations…

By the time many folks finally make the decision, they’ve burned through the equity they’ll need for retirement. It’s heartbreaking.

But There Are Success Stories

Now, it’s not all doom and gloom. I’ve seen some really creative adaptations working.

That New York Operation Near Cooperstown

These folks transformed their 280-cow dairy:

- What they did: Switched to A2A2 genetics, found a local processor, and added agritourism

- Investment: About $450,000 over three years (yeah, it’s substantial)

- Results: They’re seeing 18% net margins, getting $32/cwt equivalent

- Key factor: They’re 45 minutes from Albany—location matters

Texas Partnership That Works

A 400-cow operation found their niche:

“It’s not revolutionary, but that $3 premium for high-butterfat milk makes the difference between losing money and modest profitability.”

- Strategy: Partnered with a local ice cream manufacturer

- Benefit: Guaranteed volume, premium for butterfat

- Lesson: Sometimes the answer’s right in your backyard

Connecticut’s Organic Journey

This one’s honest about the challenges:

“The three-year transition nearly bankrupted us. But now? It’s sustainable rather than highly profitable, and sustainable beats losing money.”

- Reality check: Needed off-farm income during transition

- Current status: Making it work, but it’s not easy money

- Truth: Location near affluent markets was crucial

Export Markets and Processing—It’s Complicated

USDA data shows we exported $8.2 billion in dairy products last year—second-highest ever. Sounds great, right? But here’s what worries me:

The vulnerabilities:

- Over 40% of our cheese goes to Mexico

- China’s substantially increased tariffs on most dairy products

- Domestic consumption’s only growing 1-2% annually

- We’re building processing capacity faster than finding markets

Recent expansions:

- Wisconsin’s new plant: 8 million pounds daily

- Valley Queen in South Dakota: Another 3 million pounds of capacity

- And there’s more coming online

The Federal Order reforms this summer increased make allowances by about $0.54 per hundredweight. Processors show the data—costs really are up. But we’re all wondering how they’re expanding if margins are so tight. Both things can be true, I guess.

Alternative Models—Let’s Be Realistic

You know, everyone asks about organic, grass-fed, on-farm processing. Here’s my honest take after watching this for years: these can work brilliantly for maybe 20-25% of producers. But you need:

The right location:

- Within 50 miles of a big city (500,000+ people)

- Household incomes above average

- Customers who value what you’re doing

The right scale:

- 80-200 cows typically

- Small enough for relationships

- Big enough for efficiency

The right mindset:

- Ready for 80+ hour weeks

- Willing to do marketing, not just milking

- Often need off-farm income initially

Burlington, Vermont? Perfect. Middle of Nebraska? Much tougher.

Technology Might Actually Help in 2025

What’s encouraging is how technology costs have come down. Genomic testing costs have dropped substantially in recent years. Activity monitoring that used to need 5,000 cows still need to be justified. Now it works at 500.

A Pennsylvania producer with 450 cows told me:

“Our conception rates improved 8%, we’re catching health issues two days earlier, and I’m actually sleeping through the night during calving. The investment was about $120,000, and we figured an 18-month payback.”

And here’s something interesting—robotic milking is finally penciling out for mid-size operations. We’re seeing 200-300 cow dairies making it work, especially where labor’s tight. About 5% of operations are exploring this now, up from almost none five years ago. It won’t overcome all the scale disadvantages, but it’s helping mid-size operations stay competitive in specific areas. That’s something, at least.

The Policy Reality in 2025

Here’s what’s uncomfortable but true: dairy doesn’t fit the disaster model Congress understands.

Recent support comparison says it all:

- Crops: $35.2 billion in disaster aid

- Commodity payments: Tripled from last year

- Conservation: Up over 10%

- Dairy: DMC that we pay for rarely helps when we need it

When crops fail due to weather, it’s visible and immediate. When will our margins compress over two years? That looks like a business problem, not a disaster. And as fewer dairy farms open each year, our political voice keeps getting quieter.

What’s Actually Working Right Now

Looking at successful operations, here’s what they’re doing:

Getting real about costs:

- Calculating true production costs, including economic depreciation

- Need about $2/cwt margin above true costs

- Most of us are below that right now

Using every tool available:

- DMC five-year commitment saves 25% on premiums

- Dairy Revenue Protection for catastrophic protection

- Strategic culling with cull prices at $140-148/cwt

One Minnesota producer shared this:

“We culled 20% strategically—generated enough cash to restructure debt and buy some breathing room.”

Having an exit strategy (even if you never use it): Financial advisors tell me farmers with exit plans actually make better daily decisions. Takes the desperation out of it.

Looking Down the Road

Based on what economists and industry folks are saying, here’s what’s likely:

Industry projections for 2025-2030 suggest:

- We’ll lose 2,000-2,800 farms annually through 2027

- Operations over 1,000 cows will hit 75% of production by 2030

- Mid-size farms are mostly gone except near cities

Policy changes?

- Farm Bill might tweak things

- But fundamental change? Unlikely

- Maybe higher DMC coverage, but same structure

Market disruptions could change everything—disease, processing problems. But you can’t plan on disasters.

So What Does This Mean for Your Farm?

Let’s get practical here.

First, know where you really stand:

- Calculate actual costs versus realistic revenue

- Penn State’s got great worksheets online for this

- If the math doesn’t work, that’s not failure—it’s information

Second, pick a lane:

- Staying in? Either differentiate clearly or scale up

- Getting out? Timing is everything for preserving equity

- Standing still? Usually means falling behind

Third, get support:

- Farm Aid: 1-800-FARM-AID for financial counseling

- Crisis line: 988 if you’re struggling

- Talk to other producers—we’re all dealing with this

Every month you operate at a loss, eats equity you’ll need later. That’s just math.

The Bottom Line

Look, this disconnect between headlines and our reality reflects changes that aren’t reversing. Consolidation, technology, global markets—these forces are bigger than any of us.

But here’s what I want to emphasize: you still have choices.

If you’re well-positioned—good location, right scale, unique advantages—this transition might create opportunities. If not, you need clear-eyed assessment and strategic planning.

Success isn’t about being the best farmer or working the hardest anymore. It’s about recognizing reality early and adapting. Sometimes that’s expanding. Sometimes it’s finding a niche. And sometimes—more often than we’d like—it’s transitioning out with dignity and security intact.

Make decisions consciously, not by default. Understand where you really stand instead of hoping for rescue. That might be the most valuable thing any of us can do right now.

We’re all trying to navigate these changes while holding onto why we got into dairy in the first place. The conversations I’ve had across the country show we’re facing similar challenges, just in different ways.

And whatever path makes sense for your operation, you’re not walking it alone. We’re all figuring this out together.

Key Takeaways:

- The economics are permanent: Mega-dairies produce $3-4/cwt cheaper—this gap will widen, not shrink, making commodity milk unviable for farms under 1,000 cows

- Your three options are clear: Scale to 1,200+ cows (requires $3-5M capital), capture premium markets (needs metro proximity), or exit strategically while equity remains

- Time is your enemy: Every month at negative margins burns $25-50K in equity—the difference between comfortable retirement and bankruptcy is acting 12-18 months sooner

- Location determines everything: Success stories share one trait—proximity to wealthy consumers or unique partnerships; without this, scaling or exiting are your only choices

- Support exists, use it: Calculate true costs with Penn State worksheets, get financial counseling at 1-800-FARM-AID, mental health support at 988—deciding consciously beats drowning slowly

Mental Health Resources: National Suicide Prevention Lifeline (988, available 24/7), Farm Aid Hotline (1-800-FARM-AID), American Farm Bureau’s Farm State of Mind resources

Financial Resources: Farm Service Agency offices, Farm Credit Services, state Farm Business Management programs, National Farm Transition Network

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong– This strategic deep-dive reveals how component-based pricing and FMMO reforms are creating new regional winners and losers, providing the crucial market context behind the main article’s economic warnings.

- Why 83% of Dairy Farms Will Disappear: How to Beat the Succession Odds Before It’s Too Late – For those considering the “strategic exit” or transition, this tactical guide provides a battle-tested roadmap for succession, helping you preserve equity and defuse the “family time bomb” before it’s too late.

- Stop Bleeding Money on AgTech: The 5-Dimension Framework That Separates Winners from $50K Failures – The main article suggests technology can help. This implementation guide shows how to calculate true ROI for robotics and data, ensuring your tech investment provides a competitive advantage, not a costly failure.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!