What would you do with an extra $20,000 this year—upgrade your parlor, or finally reward that feed guy?

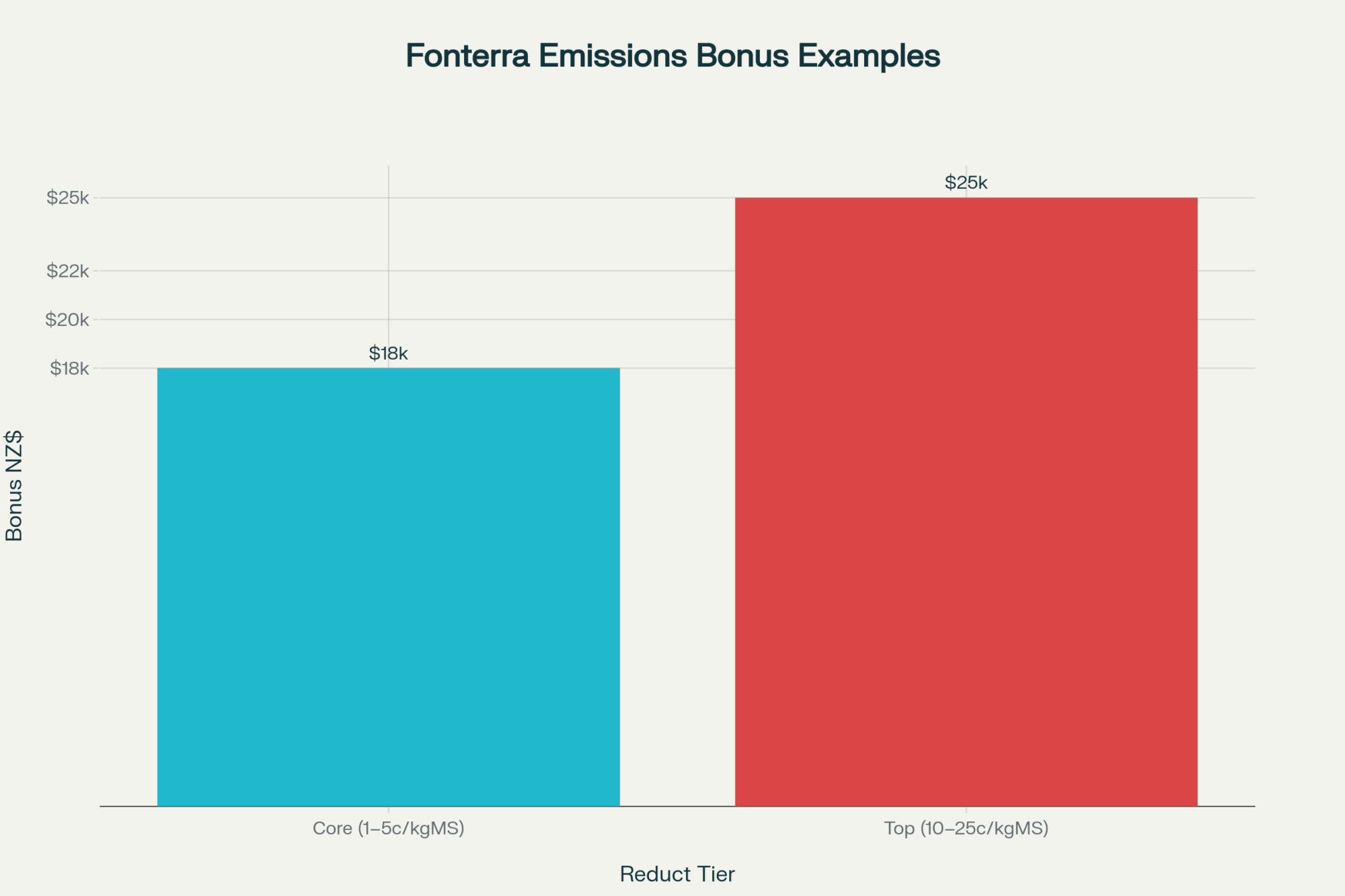

EXECUTIVE SUMMARY: Here’s the scoop—treating carbon like a side gig is over. If you’re not tracking your emissions, you’re the milk truck left at the curb. Fonterra farmers banking on those 1–5 cents per kgMS premiums are already seeing the difference: on a 400-cow herd, that’s up to $18,000 extra in your account for 2025. And the top dogs with super-low numbers? They’re grabbing as much as an extra $25k, straight up. What’s wild is that practices like better feed conversion—think shaving just 0.1 off your FCE—are now pretty much paying you twice: better cow health and cold, hard bonus money. And this isn’t just a Kiwi thing. Europe, Canada, everywhere—everyone’s talking low-carbon, genomics, real tracking. If you wanna be part of the crowd scoring export premiums, now’s the time to plug these numbers into your system. Try it. All the guys who said “nah, it’ll blow over” last year are now ringing their advisers and asking what’s next. Don’t be the last one at the table. Try this stuff before the window closes.

KEY TAKEAWAYS

- Pocket up to $25,000 more per year by qualifying for Fonterra’s low-emission bonus—start with a real-time “carbon footprinter” tool and get your emission numbers in black and white.

- Tighten your feed efficiency (aim for +0.1 FCE)—not only does it pad cash flow with extra milk yield, it lowers your emissions score for bonus eligibility in this year’s payout model.

- Ramp up genomic testing: Identify your herd’s top 30% for production and emissions traits—follow USDA and Journal of Dairy Science guidance to boost reproductive ROI right off the bat.

- Track input costs closely: Urea’s holding at $700–$800/tonne—optimize your N application, use extension calculators, and focus on maximizing every dollar’s worth in a margin-tight 2025.

- Connect with an adviser NOW: Don’t guess—ask for a region-specific break-even scenario. This year’s ROI is razor-thin, and precision will beat guesswork every time.

You’ve got options—and excuses are getting harder with every click of the carbon tracker. Globally, dairy’s changing fast. The ones cashing in? They’re not waiting for the co-op to do it for them… they’re grabbing the new margins, cow by cow and acre by acre. Give it a shot. Worst case, you end up with healthier cows and a fatter milk check.

The Thing About 2025…

Even if you’re just running cows in Manawatu or trying to keep a lid on input costs in Ontario, there’s a good chance this whole “carbon premium” talk has wound up in your inbox or shed meeting. In New Zealand, where everyone’s still tracking butterfat numbers and bulk tank averages, the biggest talk this year is: Does the new Fonterra payout really add up—and will it trickle across the global industry?

Short answer: It matters, but like everything in dairying, there are a few ‘yeah buts’ lurking behind all the marketing.

What Fonterra Is Actually Paying

Starting this June, Fonterra is paying a premium of 1–5 cents per kilogram of milk solids (kgMS)—that’s the main payout benchmark—if a farm’s Scope 1/2/3 emissions (think: barn, paddock, supply chain) land below their 2017/18 baseline. This program and its criteria were detailed in Fonterra’s official announcement and NZMP’s recognition program.

If you’re at the top—about 300–350 Fonterra suppliers for low emissions—the “up to 25c/kgMS” bonus is there for the taking. And that pool’s not coming from the government this time—it’s big food, with Mars and Nestlé directly funding the top-tier premium as part of their drive for Scope 3 supply chain targets, according to coverage from Rural News Group.

Practical Payouts and Real Margins

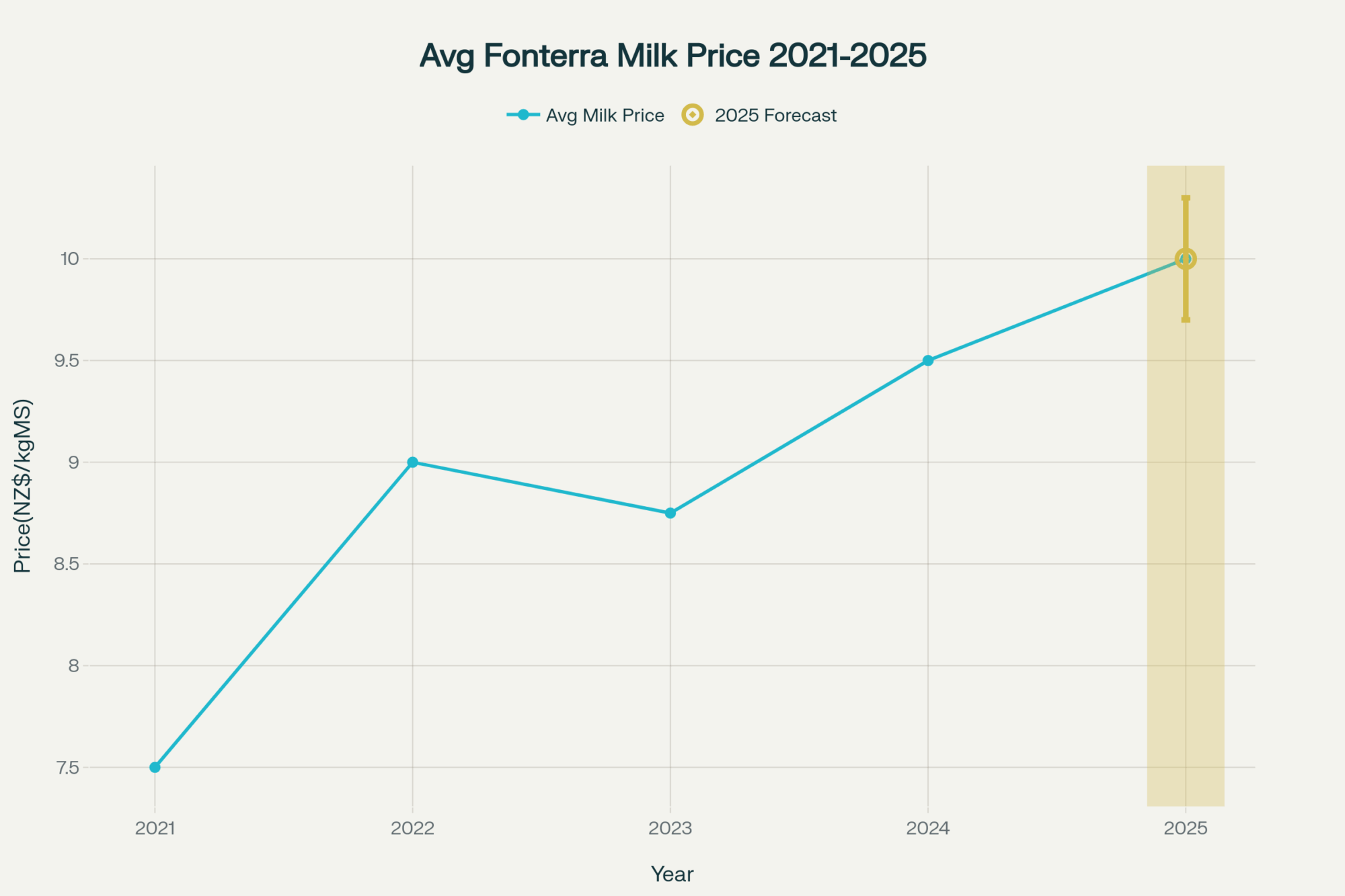

Right now, Fonterra’s payout is holding steady at $NZ9.70–$10.30/kgMS, with a forecasted range of $8.00–$11.00 for 2025/26, as outlined by RNZ, official Fonterra updates, and NZ Farm Source.

Most of us, honestly, are in the core 1–5c/kgMS bracket—that’s where the premium lands for the majority of producers. And every single cent of premium actually matters. Especially in a year when feed and fertilizer costs are keeping margins ratcheted down—anyone who went through that last dry spell in the central regions would agree. For context, urea has been hovering between $NZ700 and $800 a tonne (approximately $CAD 600–700/tonne) as of mid-2025—not the $1,200 some headlines warned of, but still a significant increase compared to most of the last decade, according to Trading Economics.

Real-World Grounding: The Net Zero Pilot

What’s happening in the paddocks? Look at Taranaki’s Net Zero Pilot Dairy Farm. These folks went deep: better breeding, targeted feed tweaks (and yes, switching minerals meant some hiccups), and, most interesting to many, a full install of the EcoPond methane system for effluent.

Over the past two years, absolute emissions dropped by 27%, and intensity decreased by another 5.5%, according to Fonterra’s project page and the update from FBTech. But—and here’s what rarely makes the PR—when they tried milking ten times per week, the unintended result was an 11–12% drop in milk solids per cow. Sometimes, even big NZ isn’t immune to trial-and-error.

Technology Performance: EcoPond

Recent field trials and manufacturer reports confirm that EcoPond delivers 90–97% methane reduction from treated effluent ponds (FBTech EcoPond coverage; EcoPond official). However, on most farms, effluent ponds account for only 5–7% of total on-farm emissions.

Carbon Footprinting: Where the Data Flows

Here’s the thing—the data flows both ways. With Fonterra’s Carbon Footprinter tool, you can see—right on your device—how your emissions stack up against your history and the co-op average. According to a February 2025 update from NZMP, over 4,000 users are already on the platform.

Ingredient teams and Scope 3 supply chain managers at Fonterra confirm that customers, such as Mars and Nestlé, now require verified certificates for every shipment. For many, these numbers are becoming as crucial as your SCC or bulk tank count.

Payback and ROI—Can It Really Work?

Here’s the real talk: the best results are being seen by those farm teams with a tradition of tight records and squeezing more out of genetics and inputs. Industry advisers estimate a five– to eight–year ROI for major upgrades, but that number varies depending on the operation’s size, region, weather, bonus tier, and the specifics of your installation deal. A lot of the three-year “got it all back” stories are best heard as encouragement—don’t treat them as a guarantee.

What About the Lower Quartile?

Fonterra has announced its intention to roll out more digital support and is considering a phased adoption for the bottom quartile producers. As of now, full details are still forthcoming, and these expectations remain plans rather than a finalized policy.

Global Perspective and Possible Canadian Ripples

What’s catching my eye is how Europe’s system spends billions on compliance and paperwork—just ask any Dutch co-op leader about their experience with the regulatory nightmare. In NZ right now, the cash is coming from brands like Mars and Nestlé, who want carbon-cutting bragging rights on global supermarket shelves. Market pull—not just compliance push. That’s a twist I never saw coming back when SCC cards were the only paperwork that mattered.

For our Canadian and U.S. crowds, the conversation has already begun. There’s clear speculation among North American dairy advisers and industry groups about how a carbon-traceable premium could show up in quota programs or processor pools, and what that would mean for Canadian supply management. Nothing official yet—but don’t be surprised if your buyers soon want verified carbon counts alongside your proAction sheets.

The Plainspoken Bottom Line

Here’s the unsweetened truth from where I’m sitting:

If you’re already running lean, tracking records, and tweaking herd and inputs—this is a real upside play.

If you’re on the fence, ask your adviser for ROI numbers specific to your setup before making a major investment commitment.

Don’t let “average” be good enough—export contracts are starting to require more than just ordinary, for carbon as much as for butterfat.

What’s especially fascinating—and trust me, I never thought I’d say this back in 2015—is how carbon, traceability, and independently certified progress are becoming as real in milk price meetings as protein, SCC, or even butterfat. Change is annoying, sometimes hard. But if carbon can add a few cents to payout while keeping NZ (and maybe Canada next) in global contracts, then—headaches and all—it’s probably worth wrestling with.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Data Overload or Profitable Decisions: The Key to Using Your Dairy Records – This article moves beyond theory, offering practical strategies for turning your existing herd and feed data into actionable insights that directly improve farm efficiency and profitability—the key to unlocking carbon premiums.

- The Great Disconnect: What Dairy Consumers Say They Want vs. What They Actually Buy – Understand the market forces driving the demand for sustainable dairy. This piece analyzes consumer behavior, helping you strategically position your operation to meet the real demands of processors and global food companies funding these new premiums.

- Feed Additives for Methane Reduction: Hype vs. Reality – Explore the science and ROI behind emerging feed additives designed to cut enteric methane. This report separates marketing hype from practical reality, giving you the data needed to evaluate future investments in emissions-reducing technology.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.