Eight hours. That’s all it takes for a labor crisis to turn into a herd crisis—and for biology to remind us who’s really in charge.

You know, picture this for a moment: It’s 4 AM on a Tuesday in Vermont, and eight workers who’ve just finished six consecutive 12-hour shifts are arrested on their one day off. Within eight hours—not days, mind you, but hours—that dairy operation faces a biological crisis that no amount of political maneuvering can solve.

Since April’s enforcement actions swept through Vermont dairy country, I’ve been having some really eye-opening conversations with producers who are grappling with a reality we’ve all understood but rarely discussed openly. What Texas A&M’s research team documented is pretty sobering—immigrant workers make up roughly half our dairy workforce while producing nearly 80% of our milk supply. But here’s what’s actually keeping folks up at night… when that workforce disappears, you’ve got maybe eight hours before the biology of dairy farming collides head-on with political reality.

The Eight-Hour Timeline Nobody Really Thought Through

During a recent industry roundtable up in Wisconsin, a producer summed it up perfectly: “You can argue politics all day long, but cows don’t care about your immigration stance—they need milking every twelve hours, period.”

What happened in Vermont illustrates this perfectly. When that farm lost eight workers in April, they didn’t just lose employees—they lost people who knew which cows kicked during fresh cow management, who could spot early mastitis symptoms before they showed up in the California Mastitis Test, who understood each animal’s quirks during the transition period. Try explaining that institutional knowledge to a temp agency. Good luck with that.

Vermont’s Agriculture Secretary has been crystal clear about the cascading effects, and it’s worth paying attention. After 24 hours without proper milking, you’re not just looking at discomfort—you’re facing potential herd-wide mastitis outbreaks. We’re talking treatment costs that can exceed replacement value, production losses that compound daily, and culling decisions nobody wants to make.

Here’s what every dairy farmer knows in their bones:

- Cows need milking twice daily—no exceptions, no delays, no excuses

- You’ve got an 8 to 12-hour window before udder health becomes a genuine crisis

- Once mastitis starts spreading, you’re playing expensive catch-up

- Animal welfare appropriately takes precedence over everything else

- Biology doesn’t pause for paperwork or politics

“Our workers maintain six-day schedules with 12-hour shifts. They rarely take holidays. The operation demands constant attention because we’re managing living systems, not manufacturing widgets.” — Wisconsin dairy producer, Marathon County

What the Economic Models Actually Tell Us

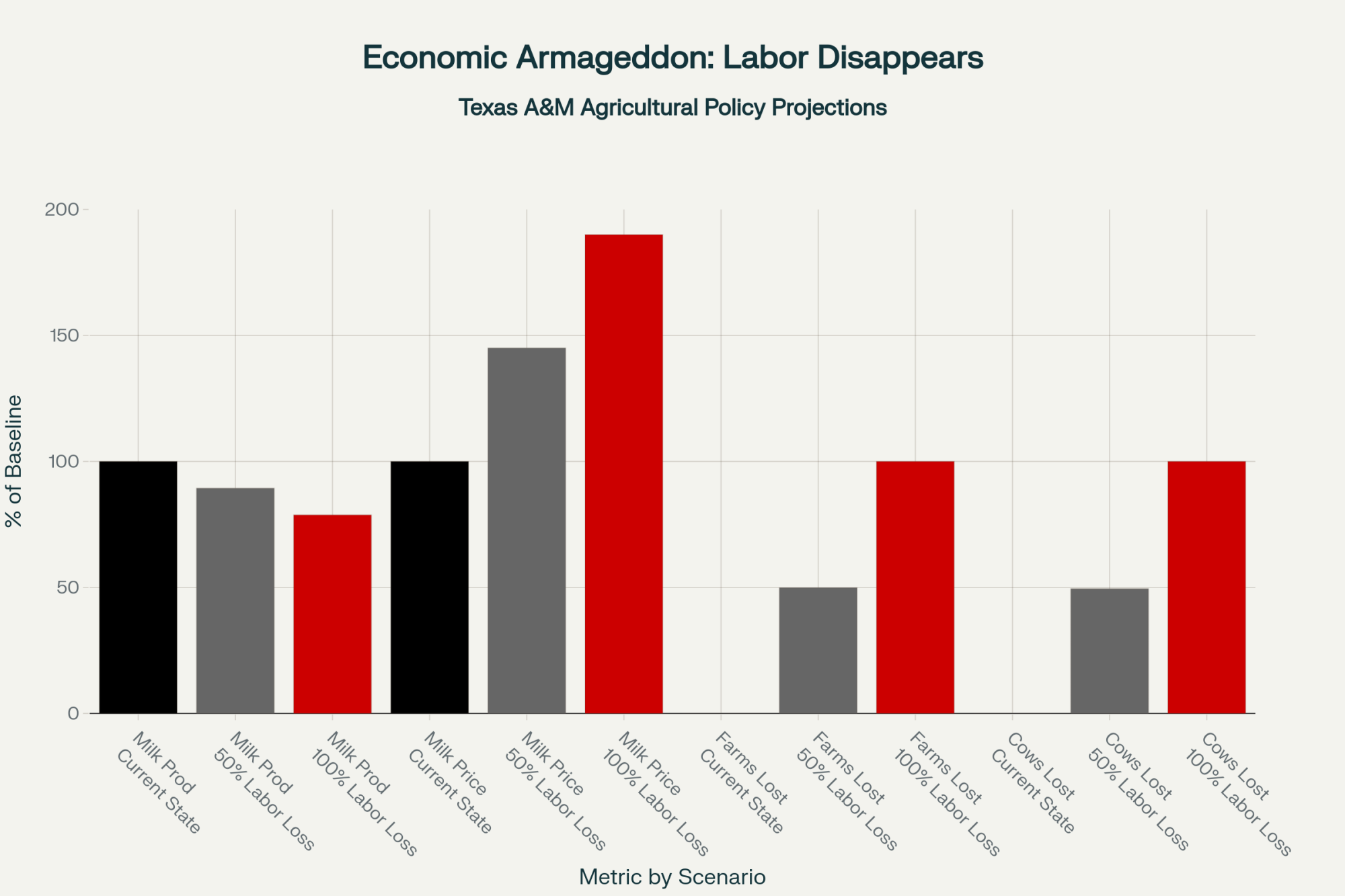

So the Texas A&M Agricultural and Food Policy Center spent years analyzing nearly 2,850 dairy operations across 14 states, and their economic modeling—updated with current market conditions—paints a sobering picture that we really need to understand.

In the complete labor loss scenario (admittedly extreme, but bear with me here), their models project we’d lose 2.1 million cows from the national herd. That’s Wisconsin and Pennsylvania’s entire dairy cow inventory, just… gone. Annual production would drop 48.4 billion pounds, effectively removing nearly a quarter of the current U.S. milk supply. About 7,000 farms would close permanently.

But here’s the number that makes everyone sit up straight: retail milk prices would jump 90%, pushing that $4 gallon to $7.60. And this isn’t wild speculation—it’s based on established supply and demand elasticity models that have proven remarkably accurate in other agricultural sectors.

Even losing half our immigrant workforce would decrease production by 24 billion pounds while increasing prices by 45%. The National Milk Producers Federation’s research confirms these workers concentrate in our most productive operations. In other words, the risk isn’t spread evenly—it’s concentrated right where it would hurt most.

KEY STATISTICS: The Labor Crisis Impact

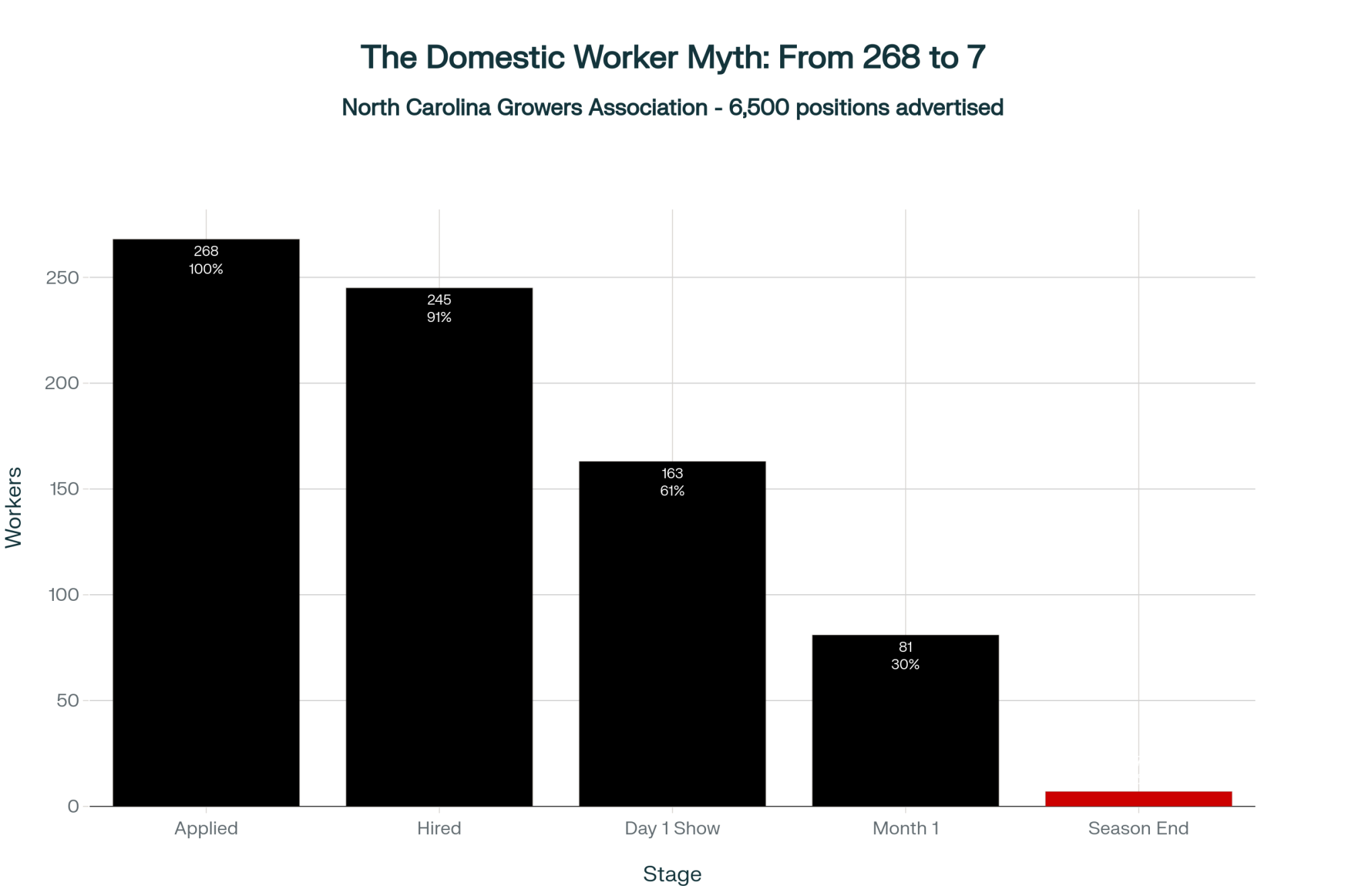

From 6,500 advertised farm positions in North Carolina:

- 268 people applied (0.05% of the unemployed population)

- 163 showed up for day one

- 7 workers remained after the season

- 90% of Mexican workers completed the season

QUICK COMPARISON: How Others Handle Dairy Labor

| Country/Region | Approach | Results |

| Canada | TFWP allows year-round agricultural workers | 60,000+ TFWs annually, stable workforce |

| Netherlands | EU worker mobility + automation investment | Lost 30% of farms in the decade, heavy consolidation |

| New Zealand | Seasonal visa programs + pasture systems | Lower labor needs but climate-dependent |

| United States | Informal immigrant labor + limited automation | 46% of production from 834 mega-dairies |

Technology: Progress and Hard Realities

Looking at automation trends, which are certainly interesting, the global milking robot market has exploded from about $2.3 billion last year to projections of $4-7 billion by 2030, according to industry analysts. Sounds promising, right?

Well, here’s what I’m actually hearing from early adopters. A Wisconsin operation near Appleton installed one of the latest automated systems last year. “We called tech support daily the first month,” the owner told me at a Professional Dairy Producers meeting. “And here’s what nobody tells you—we went from paying general workers $16-17 an hour to needing specialized techs at $24-26. That’s a massive jump in labor costs.”

University of Wisconsin research shows that these systems reduce labor time by 38-43% per cow—definitely meaningful. But that still leaves over 60% of labor needs unaddressed. And honestly, think about everything robots can’t do:

- Managing that 10-20% of cows that never figure out voluntary traffic (we all have them, don’t we?)

- Careful fresh cow training and acclimation

- Those breeding decisions that need experienced eyes

- Treatment protocols requiring real judgment

- Your entire heifer and dry cow program

A Kansas producer shared what he called an expensive lesson about retrofitting. They tried to save on construction costs by adapting their existing freestall barn. “Big mistake,” he said. “Poor cow traffic cost us 10 pounds of milk per cow daily until we redesigned everything a year later. That’s $150,000 in lost revenue we’ll never recover.”

Current installation for a 200-cow operation? You’re looking at $500,000 to $750,000 for quality systems. Michigan State Extension’s economic analysis suggests payback periods of 7 to 10 years—assuming stable milk prices. With Class III bouncing between $16 and $20 per hundredweight this year alone, according to USDA market reports, that’s quite an assumption.

The American Worker Question We Need to Face

The North Carolina Growers Association data remains the clearest picture of domestic labor reality, and it’s… well, it’s something we need to confront honestly.

From 6,500 advertised positions in a state with nearly 500,000 unemployed residents, only 268 people applied—that’s 0.05% of the unemployed population. They hired 245, but only 163 showed up for work. After one month, more than half had quit. By season’s end? Seven workers remained. Seven.

Meanwhile, 90% of Mexican workers who started and completed the season, as documented in compliance reports to the Department of Labor.

Cornell’s Agricultural Workforce Development program findings align with what we’re all seeing. It’s not just the pre-dawn starts or physical demands—it’s the combination with geographic isolation and, let’s be honest here, how society views agricultural work.

A Vermont producer told me something that really stuck—and he asked to remain anonymous, given current tensions—but he said, “Twenty years, two American applicants. Over a hundred immigrant applicants. Both Americans were gone within two weeks.”

Consolidation: The Trend We Can’t Stop

USDA’s Census of Agriculture data tells a story we all feel in our communities. Between 2017 and 2022, we lost 15,866 dairy farms while production actually increased 5%. How’s that for efficiency?

The breakdown is stark:

- Farms under 100 cows: down 42%

- Operations with 100-499 cows: dropped 34%

- Facilities with 500-999 cows: decreased 35%

- Mega-dairies over 2,500 cows: UP 17%

Those 834 largest operations now generate 46% of U.S. milk production, according to an analysis by the USDA Economic Research Service. California’s average herd size has reached 1,300 cows, according to recent state reports.

USDA research confirms that smaller operations incur production costs about $10 per hundredweight above those of larger competitors. When margins run $1-2/cwt in good times, that gap is insurmountable through efficiency alone.

What’s interesting—and I’ve been tracking this—is how this mirrors global trends. Statistics Canada documents average herd growth from 85 to 98 cows recently under their supply management system. Wageningen University research shows that the Netherlands lost 30% of its dairy farms over a decade. Different policies, same consolidation pressure.

Based on what I’m seeing, we’ll probably consolidate to 15,000-18,000 operations within five to seven years, with 60-70% of production from herds exceeding 2,500 cows. That’s just the math working itself out.

Legislative Proposals: What’s Real, What’s Not

| Policy Feature | Canada (TFWP) | United States | Impact on Dairy |

|---|---|---|---|

| Year-Round Dairy Access | ✓ Yes – Primary Agriculture Stream | ✗ No – H-2A excludes year-round | Stable, predictable workforce |

| Visa Duration | Up to 24 months | Seasonal only | Continuity for operations |

| Program Age | 50+ years operational | Fragmented, inconsistent | Proven model |

| Annual Ag Workers | 60,000+ TFWs | 77,000 (51% undocumented) | Formal employment |

| Workforce Stability | High – workers return | Low – enforcement disruption | Reduces farm risk |

| Industry Support | Strong exemptions | Bills stalled in committee | Policy supports sector |

Let me break down what’s actually on the table, because the political noise makes it hard to see clearly.

The Farm Workforce Modernization Act proposes 20,000 year-round agricultural visas annually, with dairy potentially getting 10,000. It includes Certified Agricultural Worker status for current employees, but they’d need 10 years of agricultural work before becoming eligible for permanent residency. Wage increases would be capped at 3.25% annually through 2030.

Here’s the math problem, though: 10,000 visas for an industry employing approximately 77,000 immigrant workersaddresses just 13% of current needs.

What’s particularly frustrating—and our Canadian neighbors really have this figured out better—is the stark contrast with their system. Canada’s Temporary Foreign Worker Program allows agricultural employers to hire year-round workers through multiple streams, with over 60,000 TFWs working in Canadian agriculture annually, according to the Canadian Federation of Agriculture. Their Agricultural Stream permits employment durations up to 24 months, and the program has been operating successfully for over 50 years. Meanwhile, U.S. dairy remains excluded from comparable year-round visa access, forcing reliance on undocumented workers or the limited H-2A program, which doesn’t meet dairy’s continuous operational needs.

Representative Van Orden’s Agricultural Reform Act takes a different tack. Current workers would need to leave and return, paying a minimum fee of $2,500. Anyone entering during the current administration wouldn’t qualify. Three-year renewable visas, but most current workers wouldn’t even meet the criteria.

Both proposals sit in committee as of October 2025. Don’t expect movement anytime soon. And watching Canada’s more functional system just north of us makes the dysfunction even more apparent.

Regional Adaptations: Learning from Each Other

Different regions are finding different paths forward, and there are lessons in each approach.

Wisconsin generates over $45 billion in dairy economic activity. Some counties rely predominantly on immigrant workforces. The Farm Bureau documents 137% increases in visa program costs since 2020, yet dairy still can’t access year-round coverage. Some cooperatives are exploring shared labor arrangements—complex but promising.

Vermont faces unique pressures post-enforcement. Workers hesitate to leave farms for essential services, including medical care. Producers in the region report situations where employees have delayed prenatal care for months due to enforcement fears. That’s not just an operational issue—that’s a human issue we need to address.

Idaho has maintained relative stability. The Idaho Dairymen’s Association reports that approximately 90% of its workers are foreign-born, with local relationships helping maintain continuity. “We communicate constantly with local authorities about economic realities,” their CEO explained to me.

California confronts multiple challenges despite leading national production. Water restrictions, emissions regulations, and elevated labor costs are prompting relocations. Several operations announced moves to Texas or South Dakota this year.

The Southwest corridor—Texas Panhandle, eastern New Mexico, western South Dakota—attracts new development. South Dakota added 50,000 cows recently; Texas added 75,000 over two years. They’re creating environments where dairy can operate with fewer regulatory constraints.

Practical Guidance by Operation Size

After extensive conversations with producers and lenders, here’s my take on positioning by scale:

Operations under 500 cows: Unless you’re hitting premium markets, your window’s narrowing. University of Wisconsin research suggests that premiums of $3-4/cwt are needed to match large-scale economics. Organic transition takes three years but currently provides $8-10 premiums. Direct marketing works for some, though it requires completely different skills.

Several Vermont operations under 400 cows that I know of are succeeding with grass-fed organic, getting $8/gallon at farmers markets. But that’s a lifestyle choice as much as a business model.

500-1,500 cow operations: You’re caught in the squeeze—too big for most niche markets, too small for optimal efficiency. Successful paths include expansion to 2,500+ (requiring $3-5 million per thousand cows based on recent construction), strategic partnerships, or contract production. Standing still isn’t viable when your production costs run $18-19/cwt versus $15-16 for larger competitors.

1,500-2,500 cow operations: Decision time. Expansion to 5,000+ requires $15-20 million based on recent facility costs. Consider your state’s long-term regulatory trajectory carefully. This scale attracts serious buyers if you’re considering exit—several Wisconsin operations this size achieved favorable sales this summer.

Operations exceeding 2,500 cows: You’re positioned to weather the storm, but don’t get complacent. Invest in professional HR infrastructure, documented compliance programs, and diversified labor strategies now. Automation should target genuine efficiency gains, not promised labor savings that rarely materialize fully.

THREE FUTURES: Where This Could Go

Most Probable Scenario: Continued consolidation with 10,000-13,000 farms closing over five years. Survivors will be professionally managed operations with established political relationships. Milk supply remains adequate, prices are relatively stable, but rural communities continue hollowing out.

Growing Possibility: Foreign investment accelerates as Canadian processors, European companies, and private equity acquire distressed assets. American dairy farming becomes American dairy management—owners become employees.

High-Impact Outlier: Coordinated enforcement triggers actual supply disruption. Milk hits $7-8/gallon, cheese and butter prices double. Recovery requires 5-10 years and fundamental industry restructuring.

Success Stories Worth Studying

Not everything’s challenging—let me share what’s working according to producers and extension professionals in different regions.

Central New York producers working with Cornell Extension have reportedly developed innovative training programs. They’re bringing in community college students and offering competitive salaries of around $65,000, plus benefits, for five-year commitments. Some have successfully retained American workers beyond two years this way. That’s not a complete solution, but it’s progress.

Industry groups report that operations investing heavily in quality housing—actual apartments, not dormitories—alongside automation are seeing turnover drop from 45% to 15% annually. Treating workers well, regardless of origin, generates measurable returns.

Wisconsin cooperatives are exploring rotating labor pools, enabling actual weekends off. Workers move between farms on a scheduled rotation. Complex coordination, but those trying it report maintaining workforce stability through recent challenges.

What This Means for Consumers at the Grocery Store

Here’s something we haven’t touched on yet—what happens when consumers actually face those $7-8 gallons of milk? USDA research on price elasticity suggests demand would drop 15-20% at those levels, with lower-income families hit hardest. We’d likely see major shifts to plant-based alternatives, not because people prefer them, but because dairy becomes a luxury item.

The ripple effects go beyond milk. Cheese prices doubling means pizza costs jump. Butter at $8/pound changes baking economics. School lunch programs would need emergency funding increases. It’s not just a farm crisis—it’s a food system shock.

Looking Forward with Clear Eyes

Here’s the reality we need to accept: The industry developed around workers accepting conditions that don’t align with typical American employment expectations, at compensation levels that primarily depend on international wage differentials.

April’s enforcement actions didn’t create these dependencies—they revealed vulnerabilities we’ve been managing around for decades. That eight-hour biological timeline isn’t going away. It’s the unchanging reality of dairy production.

Will technology eventually provide comprehensive solutions? Maybe, though current projections suggest 15-20-year development timelines for systems that match human adaptability. The robots coming to market now are tools, not replacements.

Will Americans suddenly embrace dairy work? The North Carolina data says no, definitively. Even at higher wages, the lifestyle requirements eliminate most potential domestic workers.

Immigration reform will likely formalize existing relationships rather than fundamentally alter workforce composition. And honestly? That might be the best realistic outcome.

Here’s what gives me cautious optimism: Consumer demand remains strong, with Americans consuming about 650 pounds of dairy products annually, according to USDA food availability data. Production will continue. The question is which operations will provide it.

The successful operations will be those that accurately assessing current realities and adapting accordingly. They’ll build strong relationships with workers, maintain professional compliance, and position strategically for whatever comes next.

Because at the end of the day—or more accurately, at 4 AM and 4 PM every single day—those cows need milking. Biology doesn’t negotiate. And until we figure out how to change that fundamental reality, we need to work with the labor force willing to meet biology’s demands.

Plan accordingly. The fundamentals of dairy production remain sound. It’s the operational environment that requires our careful navigation. And despite all the challenges, I still believe there’s a profitable future for operations that see clearly and adapt wisely.

After all, somebody’s going to produce that milk. Might as well be those of us who understand what it really takes.

Key Takeaways:

- Dairy’s reality is biological, not political—miss a milking, and biology wins. That’s the eight-hour breaking point.

- Immigrant labor sustains half the U.S. workforce and nearly 80% of milk output, proving the system’s hidden dependency.

- Automation eases routine strain but can’t replace skilled hands—robots handle less than half the work.

- Mega-operations now produce 46% of all U.S. milk, while small farms face growing costs and tough survival math.

- Long-term strength depends on modern workforce reform—year-round access like Canada’s TFWP could stabilize both herds and livelihoods.

Executive Summary:

In dairy, biology always wins. Lose your labor force for eight hours, and cows—not politics—set the agenda. Immigrant workers make up half of America’s dairy workforce and produce nearly 80% of our milk, according to Texas A&M research. When that labor disappears, production drops, animal welfare suffers, and consumers ultimately face $7 milk and $8 butter. Automation helps, but can’t replace skilled hands, while smaller farms keep closing as mega-dairies dominate production. Canada’s Temporary Foreign Worker Program shows how year-round access to labor stabilizes an entire agricultural system. For U.S. producers, acknowledging that biology doesn’t wait—and acting accordingly—is the only sustainable path forward.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Dairy’s Next Big Challenge: Attracting and Retaining Top Talent – While the main article outlines the labor crisis, this piece provides a tactical blueprint for solving it. It details actionable strategies for creating a winning work culture to improve employee retention and build a more resilient, high-performing team.

- The Dairy Industry’s New Reality: Navigating the Toughest Economic Headwinds in a Decade – This analysis unpacks the market forces driving consolidation. It moves beyond labor to explore how interest rates, high input costs, and global demand are reshaping the industry, offering strategic insights for protecting your margins against extreme economic volatility.

- Robotic Milking Systems: Are They the Silver Bullet for Dairy’s Labor Woes? – For those considering automation, this article delivers a detailed ROI analysis. It moves past the hype to reveal the true costs, efficiency gains, and management changes required, helping you decide if this multi-million dollar investment is right for your operation.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.