France’s overnight export ban is a stark warning for North American producers: Your business continuity plan is now your most valuable asset

EXECUTIVE SUMMARY: What farmers are discovering from France’s lumpy skin disease response is that government cost-cutting on disease prevention can instantly become producers’ financial catastrophe. When France chose to vaccinate just 1.2% of their 17-18 million cattle instead of pursuing the €75-100 million comprehensive approach that eliminated LSD in the Balkans, they saved upfront costs—but Irish cattle exporters absorbed €1.85-2.14 million in losses when France implemented an overnight export ban on October 18. Recent EFSA research confirms that achieving disease elimination requires 90% vaccination coverage maintained for 2-3 years, yet France’s limited approach left them vulnerable to outbreaks 500 kilometers from initial containment zones. With EU beef production at its lowest since 2014 and Mercosur imports hitting 15-year highs, disease management decisions are reshaping competitive positions across global markets. For North American producers who remember the 2003 BSE crisis that shut down $2 billion in exports from one cow, France’s situation offers a crucial lesson: building your own $2,500-per-farm biosecurity framework beats waiting for government protection when the next disease hits. The smartest operations aren’t hoping for comprehensive government response anymore—they’re investing in documented disease-free status, alternative shipping routes, and financial cushioning that turns tomorrow’s crisis into today’s competitive advantage.

I’ll tell you what’s been coming up at every producer meeting lately: “If France can shut down cattle exports overnight for disease control, what’s stopping our province or state from doing the same thing?”

It’s a fair concern, especially watching what’s happening in Europe right now. The way lumpy skin disease is being handled over there… well, it offers some real lessons for North American dairy operations—particularly around how quickly disease management can turn into trade disruption.

Two Roads Diverged in a European Field

So I’ve been tracking this situation pretty closely, and what’s really interesting is how differently countries tackled the exact same problem.

When the Balkans faced LSD between 2016 and 2018, the European Food Safety Authority documented their responsein detail. Albania, Bulgaria, and North Macedonia spent about €20.9 million combined—they vaccinated over 70% of their national herds with the homologous Neethling vaccine. You know, the type that’s shown better field effectiveness than heterologous options in European trials. And by 2018? Complete elimination. They’re disease-free today with full EU market access… roughly the equivalent of getting your interstate health papers approved permanently.

France, though… they took a different path, and the numbers tell quite a story.

According to EU Commission Decision 2025/1336 from July, French authorities have vaccinated roughly 220,000 cattle so far. Now, Institut de l’Élevage’s census puts France’s national herd at 17 to 18 million head. Quick math here—that’s about 1.2% coverage.

For perspective, that’s like vaccinating all the dairy cows in Dane County, Wisconsin, and calling the entire Midwest protected.

What’s worth noting is that EFSA’s 2019 technical guidance spells out what elimination actually requires: 90% coverage maintained for two to three years with an effective vaccine. The gap between where France is and where they’d need to be… well, it’s like the difference between managing your transition cows and managing your entire milking string.

How a Success Story Turned South

Looking at the World Organisation for Animal Health notifications from this summer forward, you can track exactly how this developed—and it’s quite something.

France detected their first LSD case on June 29 near the Alps. By late August—and Reuters covered this on August 28—things actually looked promising. Vaccination in the restricted zones had brought weekly outbreaks down from 10 in July to just 2. They’d achieved 90% coverage in those immediate 20-kilometer protection zones and 50-kilometer surveillance zones.

But here’s the thing… anyone who’s dealt with bluetongue or anaplasmosis knows the challenge with vector-borne diseases. Those biting midges? They don’t check zone boundaries before crossing.

By mid-October, French Ministry of Agriculture bulletins were reporting new outbreaks in Ain, Jura, and Occitanie. Then came the really concerning ones in Pyrenees-Orientales, just 30 kilometers from the Spanish border.

Spain had already found their first case on October 1 in Girona—their WOAH notification shows immediate culling of 123 cattle. Spanish authorities initially said they’d hold off on mass vaccination unless forced to. Nine outbreaks later, according to Catalonia’s Department of Agriculture, they reversed course completely.

When Economics Drive Health Decisions

For those of us managing operations—whether you’re milking 200 cows in Pennsylvania or running 2,000 head in California’s Central Valley—understanding how governments weigh these decisions matters more than you might think.

Based on EFSA modeling and what the Balkans actually spent, France was looking at two clear options. Scale up the Balkans’ €20.9 million program to France’s much larger herd, and you’re probably talking €75 to 100 million for nationwide vaccination. Or manage localized outbreaks for maybe €5 to 10 million annually.

They went with option two, which seemed reasonable given the initial containment success.

But when those October outbreaks hit near Spain—French surveillance maps show these were over 500 kilometers from the original Alpine cases—they had about 72 hours to make a call.

Expanding vaccination meant securing cold chain logistics for millions of doses. And according to OBP vaccine manufacturer specs, it takes about 21 days post-vaccination for solid immunity to develop. That’s three weeks of vulnerability even if you started immediately.

An export ban though? No direct government expenditure, implements in 18 hours.

Agriculture Minister Annie Genevard announced it October 17. Effective October 18. The Irish Department of Agriculture reported getting their notice Friday afternoon for Saturday morning implementation.

If you’ve ever tried to redirect a milk truck on short notice, you know what that timeline means.

| Preparedness Action | What Progressive Farms Do | What Waiting Farms Risk |

|---|---|---|

| Documentation Strategy | Duplicate records + quarterly disease-free certification from university labs | Movement delays while waiting for state clearance during restrictions |

| Logistics Resilience | Three mapped backup routes to processing plants + quarterly disruption drills | Single-route dependence = 12 days vs 12 hours to pivot during bans |

| Vaccination Readiness | Budget $3-5/head for private procurement if disease within 500km radius | Relying on government programs that may take weeks to deploy vaccines |

| Market Positioning | Document disease-free status now, write into contracts (3-7% premium potential) | Missing 3-7% premiums on $17 milk = losing $0.51-$1.19/cwt opportunity |

| Financial Cushioning | 15-30 day movement restriction cash reserves + force majeure contract clauses | Cash flow crisis during unexpected 15-30 day movement restrictions |

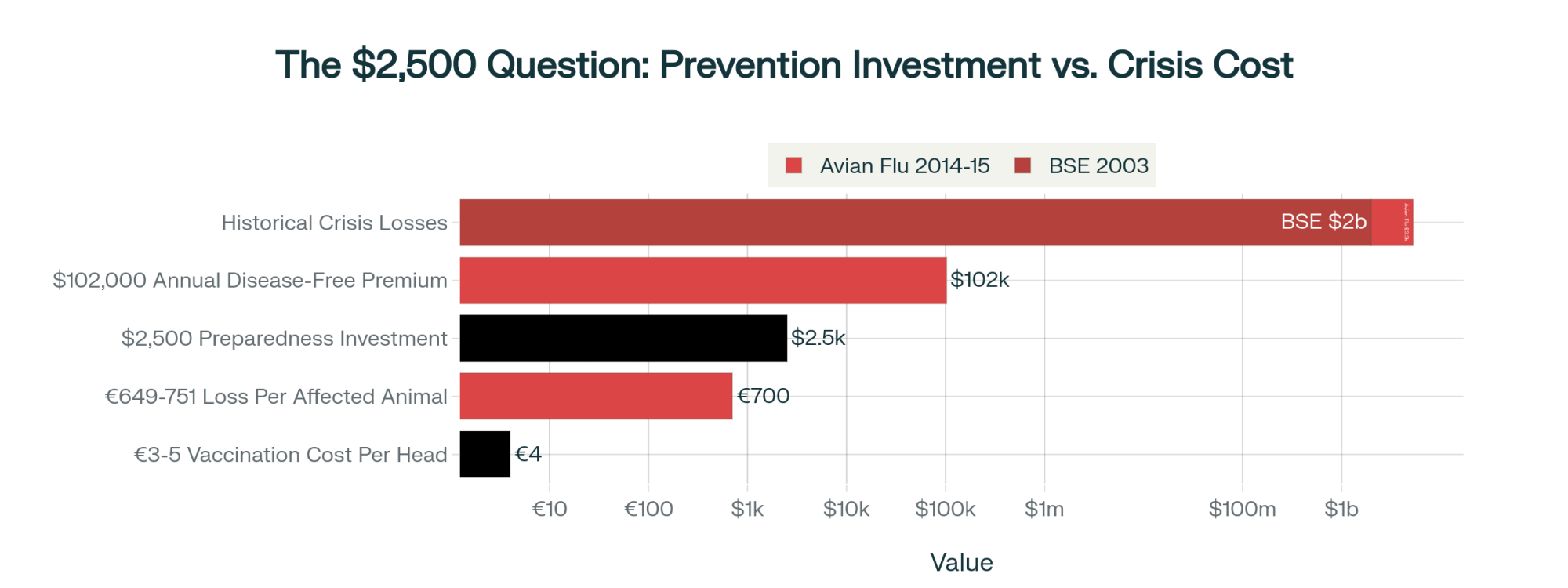

| Cost Per 500-Cow Dairy | $2,500 prevention investment | Potential losses: $649-$751 per affected animal (Ireland example) |

| Historical Loss Comparison | Avoided $2B loss (BSE 2003) and $3.3B loss (Avian Flu 2014-15) | Reactive crisis management vs. proactive competitive advantage |

Real Farms, Real Losses

What happened to Irish cattle exporters shows exactly how these decisions ripple through actual operations.

Bord Bia’s export statistics show Ireland moves about 325,000 cattle annually. Roughly 56,000 go through France to Spain, another 37,000 to Italy. We’re talking 1,800 head weekly using French transit routes—that’s equivalent to the annual calf crop from maybe 4,500 dairy cows.

When the ban hit, the Irish Farmers Association estimates about 2,850 head were either rolling down French highways, sitting at lairage facilities, or loaded on trucks ready to go.

France’s October 18 regulatory notice said Irish cattle could keep transiting—but only if they avoided protection or surveillance zones.

Sounds workable until you remember EU Regulation 1/2005 on animal transport. The law requires rest stops—every 14 hours for adult cattle, 9 hours for unweaned calves. You can’t legally drive straight through France. And those surveillance zones? They kept expanding daily, like watching a thunderstorm cell grow on radar.

The Irish Department of Agriculture’s October 17 update laid out some brutal choices. Find facilities outside surveillance zones with zero notice—good luck with that. Or turn around and head home.

Teagasc economic analysis put holding costs at €2 to 5 per head daily. Add transport costs both ways. Contract penalties for missed deliveries. And here’s the kicker—Swiss Re’s livestock insurance framework generally doesn’t cover third-party government transit bans.

The Irish Farmers Association’s preliminary calculations? Their members absorbed between €1.85 and 2.14 million in losses during that 15-day period. That’s roughly equivalent to three months of electricity costs for 500 Wisconsin freestall barns… just evaporated.

Three Approaches, Three Outcomes

Metric | Balkans Strategy | Turkey Strategy | France Strategy |

|---|---|---|---|

| Coverage | 70%+ | 93% | 1.2% |

| Investment | €20.9M total | €504M total | €5-10M |

| Duration | 2 years | 12+ years | Ongoing |

| Disease Status | ✓ DISEASE-FREE | ✗ ENDEMIC | ✗ OUTBREAKS |

| Market Access | Fully Restored | Restricted | Export Ban |

| Outcome | ✓ ELIMINATED | ✗ Still Fighting | ✗ Failed |

Looking at how different countries handled the same disease really puts things in perspective:

The Balkans: Invested €20.9 million total, achieved over 70% herd coverage, took two years, got complete elimination. Today they’ve got disease-free status and full market access. Regional authorities and market analysts have cited this as a strong return on investment—and it’s hard to argue with that.

Turkey: According to their Ministry of Agriculture reports, they’ve been fighting LSD since 2013. A 2021 study in BMC Veterinary Research documented they vaccinated 14 million cattle in 2018 alone—93% coverage. At about €3 per dose based on EU procurement data, that’s roughly €42 million annually just for vaccines. Still dealing with endemic disease twelve years later.

France: Started with €5 to 10 million for localized containment based on their 350,000-cattle target reported to the EU. When containment faced challenges, implemented an export ban that didn’t cost the government directly but shifted significant costs to trading partners.

You see the pattern developing?

The Bigger Picture Nobody’s Talking About

What makes this particularly relevant is what’s happening with global beef markets right now—and remember, this affects dairy operations too, especially with beef-on-dairy programs becoming standard practice. Plus, those of us shipping genetics internationally know how quickly disease status can shut down semen and embryo exports.

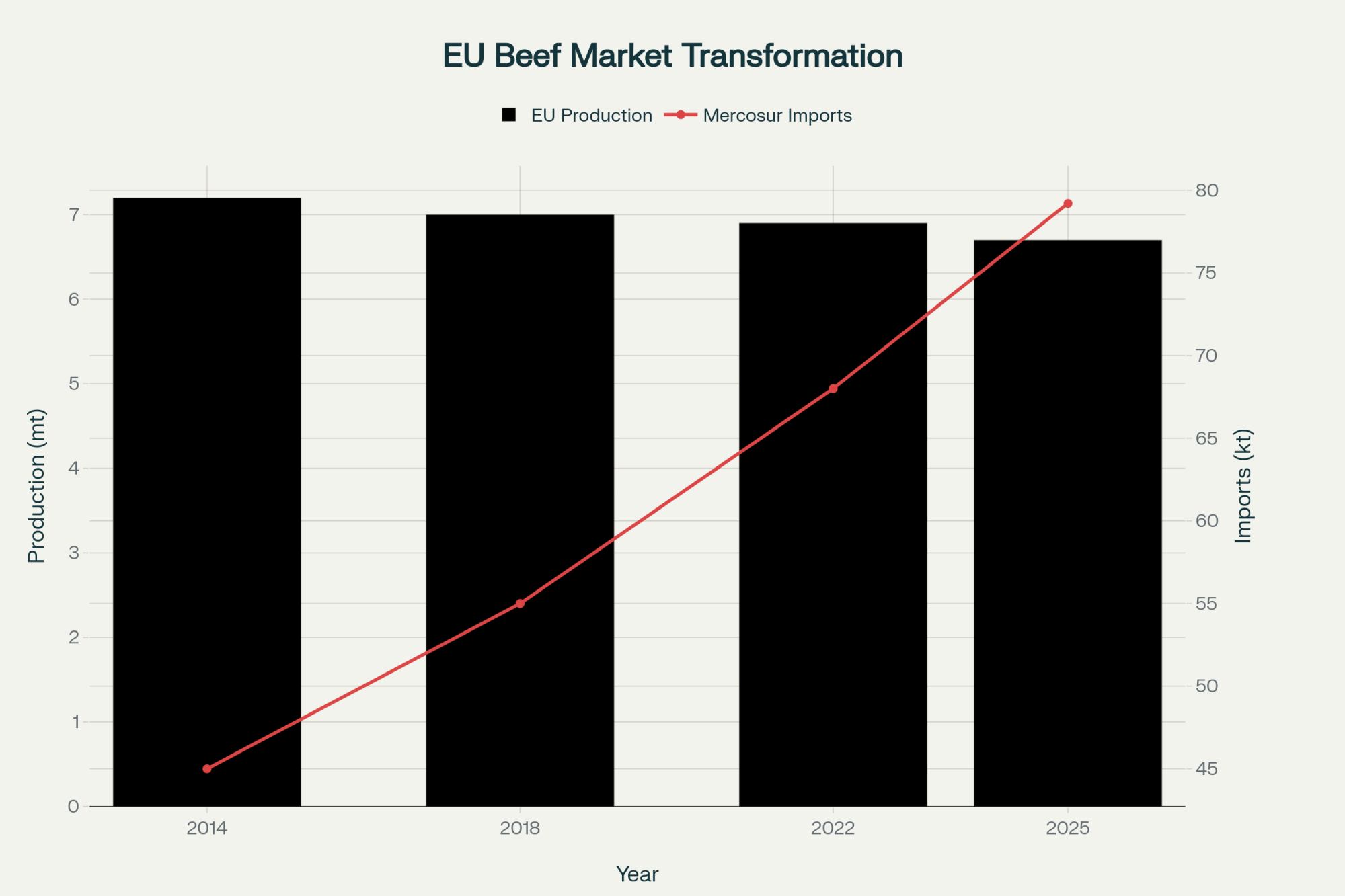

The EU Short-Term Agricultural Outlook from October 2025 shows EU beef production at 6.7 million tonnes—lowest since 2014. Projections suggest another 450,000-tonne drop by 2035. The breeding herd’s expected to shrink by 2.9 million head.

That’s like losing all the dairy cows in Wisconsin, Minnesota, and Michigan combined.

Meanwhile, European Commission trade statistics show Mercosur beef imports hit 79,211 tonnes in the first half of 2025—a 15-year high. OECD data indicates Brazilian production costs run 15 to 20% below European averages. No endemic disease management expenses. No surveillance zones. Just competitive beef flowing into EU markets.

The timing of France’s export ban coinciding with these market shifts… well, it’s worth considering how disease management decisions might influence longer-term competitive positions.

Remember what happened to our dairy exports when Mexico started developing their own production? Similar dynamics might be at play here.

Understanding the French Challenge

Now, to be fair—and this really does matter—French authorities faced genuine complexity here.

ANSES, their national animal health agency, has published extensive research on what nationwide vaccination entails. We’re talking cold chain for millions of doses, mobilizing thousands of veterinarians, coordinating farm-by-farm across diverse operations from Alpine pastures to intensive Brittany units.

It’s like trying to pregnancy-check every cow in Texas in three months.

The Balkans had smaller herds to work with. Bulgaria maintains about 550,000 cattle—roughly what you’d find in all of South Dakota. North Macedonia has around 240,000—less than a single California county. France’s 17 to 18 million? That’s a completely different scale of challenge.

North American Parallels Worth Remembering

What France is dealing with reminds me of how we handled disease outbreaks here. The 2003 BSE case instantly shut down $2 billion in beef exports—one cow in Washington state changed everything overnight. International genetics companies couldn’t ship semen or embryos for months. Then there was the 2014-2015 highly pathogenic avian influenza outbreak. State-by-state response rather than national coordination. Some states implemented aggressive containment, others waited. The result? $3.3 billion in economic losses and trade disruptions that lasted years.

The difference is, we learned from those experiences. Most states now have pre-positioned response plans, cross-state agreements, and producer compensation frameworks. France is learning those lessons in real-time.

Practical Takeaways for North American Dairies

Based on what we’re seeing in Europe—plus discussions I’ve had with extension folks from Cornell to UC Davis—here’s what progressive operations are implementing:

Documentation Strategy

Many producers are keeping duplicate health records now—official ones for regulatory compliance, private ones for business continuity. When Wisconsin briefly restricted interstate movement during the 2015 avian flu outbreak, dairies with independent lab verification kept shipping milk while others waited for state clearance.

University diagnostic labs offer quarterly disease-free certification—usually runs $300-500 based on extension service estimates. During movement restrictions, that paper becomes gold.

Logistics Resilience

The Irish experience hammers home why single-route dependence is risky. Yes, backup routes might cost 15 to 20% more in normal times. But when your primary route shuts down? That premium looks like insurance.

I know of several Midwest cooperatives that are now mapping three alternative routes to processing plants. There’s a group in Illinois that runs quarterly “disruption drills”—actually shipping milk via backup routes just to keep them viable.

Vaccination Readiness

Most extension veterinarians suggest that if disease appears within 500 kilometers—about the distance from Pittsburgh to Detroit—don’t wait for government programs. Budget $3 to 5 per head for private procurement based on current market rates.

For a 500-cow dairy, we’re talking maybe $2,500 in prevention. Compare that to losing milk premiums or facing movement restrictions. University animal health programs can often help source vaccines when commercial channels get overwhelmed.

Market Positioning

Start documenting your herd’s disease-free status now, before it matters. Several producer groups are writing this into contracts already. When neighboring states or provinces face disease challenges, processors pay for supply security.

A 2023 Preventive Veterinary Medicine study documented international premiums of 3 to 7% for verified disease-free sources. On $17 milk, that’s serious money. And for those selling genetics? Disease-free status can mean the difference between shipping internationally or not.

Network Building

The California Dairy Quality Assurance Program has been working with Nevada and Arizona on disease response frameworks. They’re sharing testing protocols, establishing communication trees, even pre-negotiating cost-sharing formulas.

Why wait for crisis to build these relationships?

Financial Cushioning

Farm Credit Services generally recommends planning for 15 to 30-day movement restrictions in your cash flow. That means credit lines for operating expenses, forward contracts with force majeure clauses, maybe even export credit insurance if you’re shipping internationally.

Usually costs 2 to 3% of revenue based on industry averages. Think of it like your liability insurance—hope you never need it, glad it’s there when you do.

What This Means for Tomorrow Morning

The European LSD situation shows how governments balance competing priorities during disease outbreaks. Public health, fiscal responsibility, political considerations—they all factor in. Understanding these dynamics helps us prepare better.

Disease-free status is increasingly functioning like other quality premiums in our markets. Just as processors pay more for low SCC milk or high components, they’re starting to differentiate based on disease risk. Smart operations aren’t waiting for government protection—they’re building their own resilience.

Sometimes the more expensive solution upfront—like the Balkans’ €20.9 million investment—proves most economical over time. Turkey’s twelve years of endemic disease management shows what happens when you try to save money on the front end. France is potentially heading down that same road.

For North American dairy producers, the lesson is clear: build your biosecurity and business continuity plans assuming minimal government support during crisis. Document everything. Diversify your routes. Maintain financial flexibility.

Most importantly, recognize that in modern agriculture, disease management and market access are inseparable.

The question isn’t whether similar situations will hit North America. Remember, we’ve been there before with BSE and avian flu. It’s whether your operation will be ready when the next one comes.

KEY TAKEAWAYS

- Implement dual documentation systems now: Progressive Midwest operations report that maintaining both official compliance records and private business continuity documentation—plus quarterly disease-free certification from university labs ($300-500)—kept milk flowing during the 2015 avian flu movement restrictions while neighbors waited weeks for state clearance

- Build your three-route logistics plan: Irish exporters lost €2 million when single-route dependence through France collapsed overnight, but cooperatives with pre-mapped alternatives pivoted in 12 hours versus 12 days—yes, backup routes cost 15-20% more normally, but that premium becomes insurance when surveillance zones expand

- Budget $3-5 per head for private vaccination readiness: Extension veterinarians from Cornell to UC Davis recommend not waiting for government programs if disease appears within 500 kilometers (Pittsburgh to Detroit distance)—for a 500-cow dairy, that’s $2,500 in prevention versus potential loss of milk premiums and movement restrictions

- Capture the 3-7% disease-free premium starting today: A 2023 Preventive Veterinary Medicine study documented these premiums in international markets, and several producer groups are already writing disease-free status into contracts—on $17 milk, that differential pays for your entire biosecurity investment

- Establish interstate/interprovincial agreements before crisis hits: The California Dairy Quality Assurance Program’s pre-negotiated frameworks with Nevada and Arizona for testing protocols, communication trees, and cost-sharing mean they’re ready while France is still learning what the Balkans proved—spending €20.9 million on elimination beats Turkey’s 12 years of endemic management at €42 million annually

Learn More:

- The Ultimate Guide to Contingency Planning for Dairy Farms: Why Paranoia is Your Best Friend – This guide provides the tactical framework for the main article’s call to action. It offers step-by-step instructions for creating robust financial, operational, and communication plans, directly addressing how to build the resilience needed to survive unexpected trade disruptions.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong– This strategic analysis provides the market context for the main article’s warnings. It dissects how policy changes, component values, and global trade volatility create financial risks and opportunities, reinforcing the urgency for producers to protect their market access.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – This piece explores the innovative technologies that underpin modern biosecurity and business continuity. It demonstrates how AI-powered health monitoring and automation can provide the data and efficiency needed to manage disease risks and maintain operational stability during a crisis.