Water bills just hit $2,200/acre-foot in CA. Your feed costs could triple overnight. Here’s what smart producers are doing now.

EXECUTIVE SUMMARY

You know that sinking feeling when you open a bill that’s way higher than expected? Well, dairy producers in California are getting that feeling every month now with water costs hitting $2,200 per acre-foot during droughts. The biggest misconception in our industry right now is that water will always be cheap and available – but SGMA regulations have already caused land values to crash 30-50% for groundwater-dependent operations, and ERA Economics forecasts $2.2 billion in losses for San Joaquin Valley dairies by 2040. Meanwhile, smart operators who’ve invested in subsurface drip irrigation are seeing 30-40% yield increases in alfalfa while using 80% less water. The divide between water-secure and water-stressed regions is creating the biggest geographic shift in dairy production since we started tracking these trends. There’s literally billions in federal funding sitting on the table right now – EQIP alone offers up to $450,000 per farm – but most producers don’t know how to stack these programs together. If you’re not planning your water strategy for 2025 right now, you’re already behind.

KEY TAKEAWAYS

- Technology ROI that actually works: Soil moisture sensors cost just $100 each but deliver $18,400 annual benefits on a 40-acre field through 20-30% water savings and 15-20% yield increases. Order them now before spring planting – the payback period is under 18 months in today’s tight forage markets.

- Free money you’re missing: Stack EQIP grants ($450K max) with state programs like California’s Dairy Plus ($1.25M) and Idaho’s $30M water fund to turn expensive irrigation upgrades into cash-flow positive investments. February 28th EQIP deadline is coming fast – get your Technical Service Provider lined up this week.

- Geographic arbitrage opportunity: Land values are crashing 30-50% in water-stressed regions while capital flows toward Great Lakes dairy operations. If you’re expanding in 2025, water security beats genetics every time for long-term profitability.

- PRF insurance as capital planning: Texas enrolled 42.8M acres in Pasture, Rangeland, Forage insurance – a 191% jump since 2011. Use drought payouts to fund irrigation upgrades; it’s essentially using insurance to pay for drought-proofing your operation.

- Carbon revenue stream: Cover crops and no-till systems generate $7.50-$100 per acre annually in carbon credits while improving water infiltration. Land O’Lakes paid $5.1M to 273 farmers in 2022 – real money hitting real accounts for practices progressive producers already implement.

You know what caught my attention at the World Dairy Expo last month? It wasn’t the latest robotic milking system or even those impressive butterfat numbers everyone was talking about. It was a conversation I overheard between two California producers near the coffee stand.

“Jim’s selling out,” one said quietly. “Twenty-three years milking 2,400 head, and his water bill just hit numbers that… well, let’s just say it made him check the decimal point twice.”

Here’s the thing that struck me about that moment – this wasn’t some struggling operation. Jim has been one of the more innovative producers in Tulare County, an early adopter of precision feeding, a solid genetics program, and the whole nine yards. However, when your water costs skyrocket to $2,200 per acre-foot during drought conditions, even the best-managed operations begin to question whether there’s a future in this business.

And honestly? This conversation is happening in dairy barns from Modesto to Twin Falls. The economics of water have shifted so dramatically that what we thought we knew about regional advantages, land values, and operational planning — well, a lot of that conventional wisdom has been turned upside down.

What the USDA Numbers Aren’t Telling You About Our Industry’s Future

Let me start with something that should make every producer sit up and pay attention. The latest USDA projections show we’re looking at 228.3 billion pounds of milk production for 2025, with all-milk prices hovering around $22.00 per hundredweight. On the surface, those aren’t terrible numbers – certainly better than what we were staring at during some of those brutal stretches in the late 2010s.

However, here’s what’s fascinating —and a little concerning. Our replacement heifer inventory has just reached 2.5 million head, which is the lowest we’ve tracked since the USDA began keeping these records in 2001.

Think about that for a second. We’re discussing the foundation of our future herds here, and those numbers are telling a story that much of the industry coverage is missing.

What strikes me about this whole situation is how everything’s converging at once. You’ve got tight replacement stock, water costs going absolutely nuts in key production regions, and – here’s something that doesn’t get enough attention – agricultural wages that USDA forecasts will exceed $53 billion industry-wide this year.

It’s like watching a perfect storm build on the horizon, except most folks are still focused on their daily milk checks and not seeing the bigger picture.

Now, I’ve been talking to producers across the border as well – my contacts in southern Alberta and the Fraser Valley are facing similar pressures. This is no longer just an American headache. The regulatory environment up there is tightening around water usage, and the cost pressures are real.

But here’s what really gets me excited about this moment… and yes, excited is the right word. The producers who recognize this shift early and adapt aggressively? They’re going to build competitive advantages that compound for decades. Those who wait and hope things will go back to “normal”? They will find themselves permanently disadvantaged.

When “Cheap” Water Became Your Most Expensive Input

The thing about California water markets is that they’ve essentially become their own commodity exchange, complete with futures trading and all the associated features. During normal precipitation years, you might get away with $50 to $200 per acre-foot from your local water district – annoying but manageable if you’re planning for it.

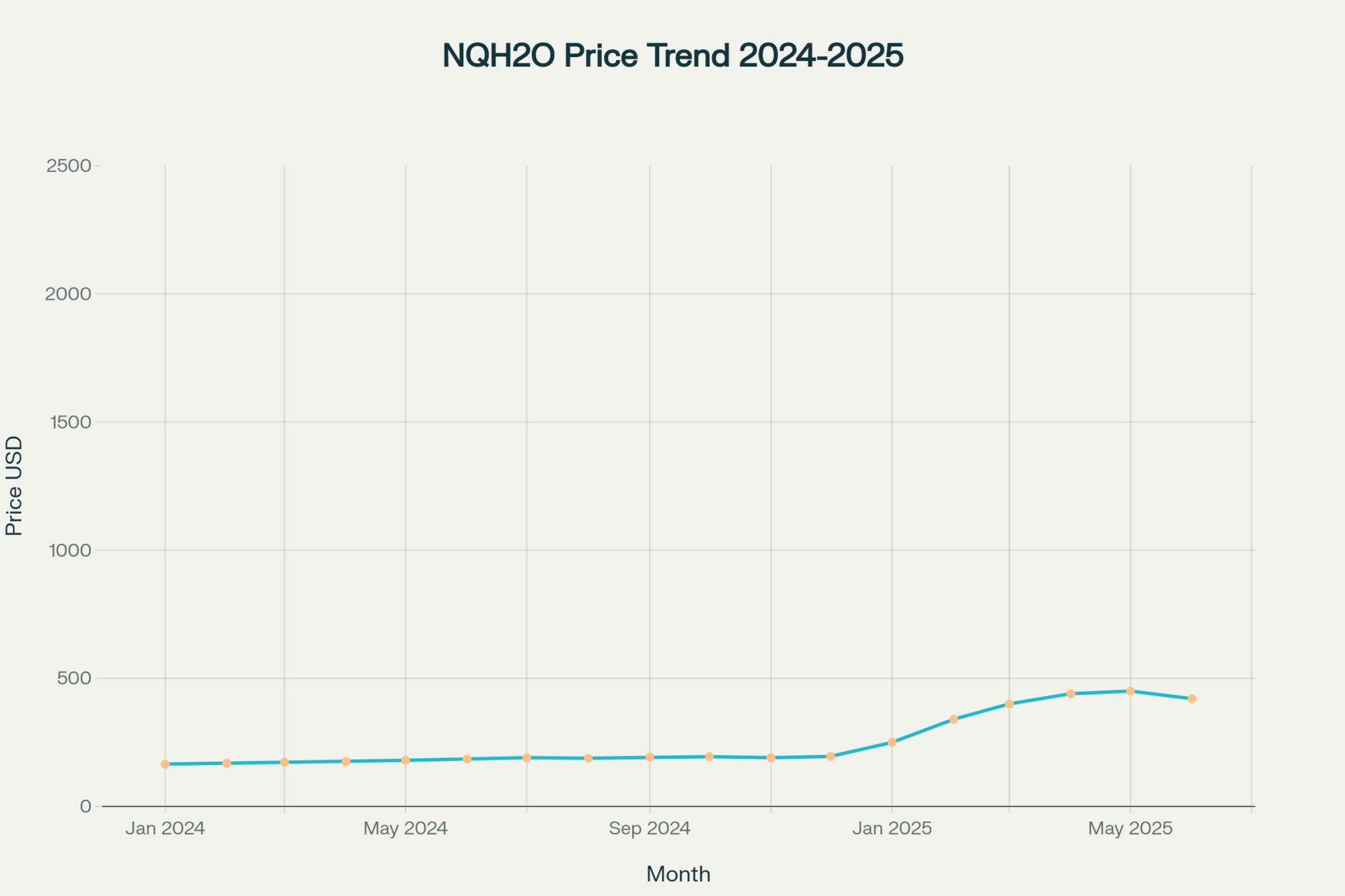

But when drought hits? The Nasdaq Veles California Water Index indicates prices that peaked near $450 per acre-foot earlier this year, subsequently settling back to around $350 by mid-year. During the really severe stretches, we’ve seen spot markets hit $2,200 per acre-foot.

Here’s where it gets really interesting, though. I was speaking with a producer near Modesto last week who shared something that doesn’t make economic sense: during the worst water cost spikes, it was actually cheaper for him to truck hay in from Nebraska than to grow it locally.

Let that sink in for a minute. The transportation costs, the logistics headaches, the quality concerns… all of that became preferable to dealing with local water costs. That’s not just a pricing anomaly – that’s a fundamental shift in how we think about regional comparative advantages.

What SGMA is Really Doing to Our Balance Sheets

Most people outside California haven’t fully grasped the impact of the Sustainable Groundwater Management Act on dairy operations in the state. And honestly, even some California producers are still treating this like it’s just another environmental regulation to navigate.

It’s not. This is economic warfare.

Let me break down what producers in the heart of California dairy country are actually facing right now. In the Tule Subbasin – we’re talking about the epicenter of the industry here – producers are looking at annual well fees of $300 per well plus $20 per acre-foot of groundwater pumped. Move over to parts of the Kaweah Subbasin, and those acreage fees jumped from $32 per acre to potentially $140 per acre.

But those fees? That’s just the appetizer.

The main course is land devaluation, so severe that it’s making agricultural lenders nervous. According to recent work from the American Society of Farm Managers and Rural Appraisers, properties that depend entirely on groundwater in critically overdrafted basins have lost 30-50% of their value in 2024 alone. Since March, almond orchards without reliable surface water have lost more than half their value.

Think about what that means for a typical dairy operation. That’s equity disappearing overnight. Your borrowing capacity gets destroyed, and suddenly you’re looking at distressed sales to operations with deeper pockets – or worse, to those “water-first” investors who are buying up agricultural land not for farming, but just for the water rights attached to it.

Sarah runs a 1,800-head operation near Hanford, and she put it perfectly when I talked to her last month: “We went from being farmers to being water speculators overnight. Except we didn’t sign up to be speculators.”

Here’s what’s really keeping me up at night about this whole situation… the ripple effects are just starting. Those higher water costs get passed through to local forage markets. ERA Economics forecasts a staggering $2.2 billion in total economic losses for the San Joaquin Valley’s dairy and beef sectors by 2040, with the majority of these losses projected to be incurred through higher feed costs.

The Regional Reality Check: Why Geography Suddenly Matters More Than Genetics

What’s happening right now is creating this stark bifurcation between the “water haves” and “water have-nots.” And it’s not just about individual farms – we’re talking about entire regions facing fundamentally different economic realities.

Take Idaho, for example. They’ve got a more structured approach through their Water Supply Bank, but even there, rental rates are jumping by over 40% – from $23 per acre-foot in 2024 to $33 per acre-foot starting this year. What’s interesting about Idaho is how it has embedded water rights into the core of its dairy regulations. You literally can’t get a permit to sell milk without demonstrating adequate water rights.

A different regulatory gate than what we see elsewhere, but it forces producers to consider water security from the outset of any expansion planning.

Now, head up to Wisconsin, and you’re dealing with a completely different set of challenges. Recent research from Marquette University shows that agricultural runoff remains the leading cause of water quality impacts on rivers and streams in the area. The regulatory framework emphasizes stewardship responsibilities rather than competing for scarce water supplies.

However, what’s fascinating about the Wisconsin situation is that the solutions they’re developing for nutrient management and manure handling could become the blueprint for other regions as regulatory pressure increases everywhere.

I was speaking with Tom, who runs an 850-head operation near Green Bay, and his biggest headaches aren’t about water costs – they’re about compliance with environmental standards for manure management and nutrient runoff. “We’ve got water,” he told me. “What we need is to prove we’re managing it responsibly.”

That’s a completely different challenge than what Sarah’s facing in California, but both are dealing with water regulations that are reshaping their cost structures and operational planning.

The Technology That’s Actually Moving the Needle (And Why Most Producers Are Still Sitting on the Sidelines)

Look, I’ve been to enough farm shows to see plenty of irrigation systems that look impressive in demonstrations but don’t deliver where it really counts – on your profit and loss statement. What we’re seeing now, though… it’s different.

Subsurface drip irrigation systems cost between $2,500 and $5,000 per acre to install. Real money, especially when you’re looking at converting 100-200 acres of forage production. And let’s be brutally honest about something – there’s a learning curve that some producers underestimate.

But the performance numbers from operations that made the switch and stuck with it? They’re compelling in ways that go beyond just water savings.

Then there is this operation near Modesto – 800 acres, which has been in the family for three generations. When I talked to the farm manager last month, he was brutally honest about their SDI experience. He told me, “The first year was rough… We had to learn how to manage the fertigation and had some clogging issues with the emitters. But by year two? Our alfalfa stands were the best we’d ever seen.”

They transitioned from flood irrigation, yielding 12-13 tons per acre, to SDI, achieving 16-17 tons per acre—a 30-40% yield increase. At current alfalfa prices (and honestly, $200 per ton is conservative in today’s tight forage markets), that extra 4-5 tons per acre generates $800 to $1,000 in additional revenue annually.

Here’s what really gets me excited about SDI… the efficiency numbers are 90-95% versus 50-60% for flood irrigation. When water costs $500 or more per acre-foot, that efficiency isn’t just nice to have – it’s the difference between staying in business and going out of business.

The payback typically runs 3-7 years, but that calculation often underestimates the full value. You’ve got reduced labor (no more moving pipe – hallelujah), lower energy costs from new, efficient pumps, and precision fertilizer application through the drip lines.

Table 1: Cost-Benefit Analysis of Precision Irrigation Technologies for Dairy Forage

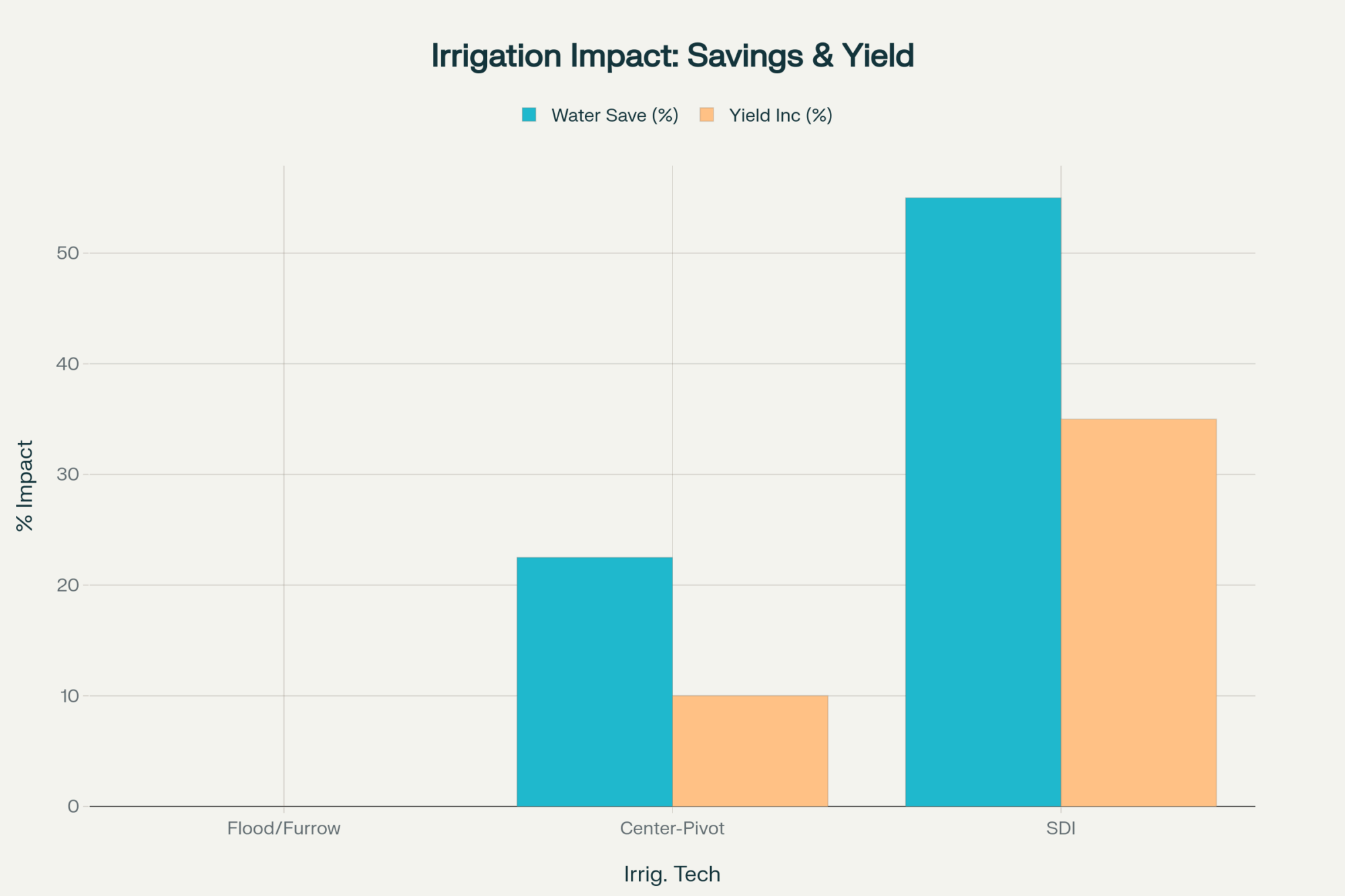

| Technology | Capital Cost per Acre | Estimated Water Savings (%) | Impact on Alfalfa Yield (%) | Key ROI Drivers | Typical Payback Period (Years) |

| Flood/Furrow | $200 – $400 | Baseline (0%) | Baseline (0%) | Low initial cost | N/A |

| Center-Pivot | $1,100 – $2,100 | 15-30% | 5-15% | Reduced labor, improved water uniformity, moderate yield increase | 5-10 |

| Subsurface Drip | $2,500 – $5,000 | 30-80% | 30-40% | Significant yield increase, reduced energy/fertilizer use, water cost savings | 3-7 |

The $100 Game-Changer Nobody’s Talking About Enough

This might surprise you, but some of the most profitable agricultural technology solutions are actually the least expensive. Basic soil moisture sensor nodes run around $100 each. Comprehensive wireless systems might cost a few thousand to cover a large operation, but the ROI is almost unbelievably good.

Studies show these sensors reduce farm water usage by 20-30% while increasing yields by 15-20%. Let me walk you through the math on a 40-acre alfalfa field because this is where the rubber meets the road…

A comprehensive monitoring system costs approximately $5,000 to install. Water savings alone – let’s say you save 1.5 acre-feet annually at $400 per acre-foot – that’s $2,400 in direct cost savings. Add yield improvement of 2 tons per acre at $200 per ton, and you’re looking at another $16,000 in revenue.

That’s $18,400 in annual benefit against a $5,000 investment. You’d be hard-pressed to find better returns in today’s market.

But here’s the thing that frustrates me… According to 2023 USDA data, only 27% of farms or ranches utilize any form of precision agriculture practices. The barriers remain the same: high upfront costs, a perceived lack of clear ROI, and the complexity of implementation.

What strikes me about this adoption gap is that we’re discussing technologies that’re proven, profitable, and readily available today. The question isn’t whether they work – it’s why more producers aren’t taking advantage of them.

Where the Real Money Is: Federal Programs That Actually Pay Out

While you’re stressing about water costs, there are literally billions in federal conservation funding sitting on the table. The challenge isn’t qualifying – it’s understanding how to stack multiple programs to turn expensive projects into cash-flow-positive investments.

The Environmental Quality Incentives Program offers up to $450,000 per Farm Bill cycle for qualifying operations. For water conservation specifically, EQIP covers irrigation system upgrades, water management plans ($3,000-$10,000 each), infrastructure improvements, and waste storage facilities.

Here’s the reality, though – EQIP is a competitive program. Really competitive. Applications are ranked based on environmental benefit per dollar invested, and not everyone receives funding. The key is working with certified Technical Service Providers who understand how to structure applications for maximum competitiveness.

Quick sidebar here – the EQIP deadline for the current cycle is February 28, 2025. If you’re considering this, don’t wait until the last minute to assemble your application.

California stepped up with their Dairy Plus Program, offering grants up to $1.25 million for operations implementing advanced manure management that delivers water benefits. Idaho responded to their 2024 Water Settlement Agreement with $30 million in targeted grants, with individual projects eligible for up to $250,000.

However, what I find really interesting about the current funding landscape is that the most successful producers aren’t just grabbing one program. They’re “stacking” multiple sources.

A typical successful project might use an EQIP grant to fund a new irrigation system partially, secure a state-level grant for a matching portion, enroll in a carbon program to generate ongoing revenue from improved soil health, and protect the resulting forage with PRF insurance. This multi-layered approach transforms a prohibitively expensive project into a financially manageable investment.

PRF Insurance: The Safety Net That Actually Works When You Need It

Pasture, Rangeland, and Forage insurance adoption has exploded in water-stressed regions, and there’s a good reason why. Texas enrolled 42.8 million acres in PRF in 2024 – a 191% increase from 2011. During recent drought periods, the program showed positive net benefits, generating significant payments exactly when producers needed them most.

PRF provides area-based coverage that automatically triggers payments when precipitation falls below historical averages. You customize coverage from 70-90% of average rainfall, selecting critical growing periods that match your operation.

I’ve seen operations use PRF payouts to fund irrigation upgrades – essentially using drought insurance to pay for drought-proofing technology. Pretty clever when you think about it.

Mike runs 650 head near Fresno, and he told me something that really stuck: “PRF isn’t just insurance for us anymore – it’s part of our capital planning. We know that if we get a payout, that money’s earmarked for water infrastructure improvements.”

Table 2: Summary of Federal and State Financial Incentives for Water Conservation

| Program Name | Administering Agency | Type | Max Funding/Benefit | Key Eligibility for Dairy | Relevant Water Conservation Practices |

| EQIP | USDA – NRCS | Cost-Share/Grant | $450,000 per Farm Bill cycle | Agricultural producers | Irrigation systems, water management plans, waste storage/separation |

| PRF Insurance | USDA – RMA | Insurance | Varies by policy | Producers of pasture, rangeland, or forage | Indemnities for below-average rainfall in selected intervals |

| CA Dairy Plus Program | California Department of Food & Agriculture (CDFA) | Grant | $1,250,000 ($750/cow) | California dairy operations | Advanced manure management with water quality co-benefits |

| ID IWRB Grants | Idaho Water Resource Board | Grant | Up to $2,000,000 (varies) | Idaho water users in specific regions | Water monitoring, infrastructure upgrades, groundwater conversion |

| WI TRM Grant | Wisconsin Department of Natural Resources (DNR) | Cost-Share/Grant | $150,000 (up to 70% cost-share) | Local governments, tribal governments | Projects to control polluted agricultural runoff |

| WI Producer-Led Grants | Wisconsin Department of Agriculture, Trade and Consumer Protection (DATCP) | Grant | $40,000 per group | Groups of 5+ farmers in a watershed | Farmer-led conservation projects, demos, and outreach |

The Carbon Credit Opportunity That Most Producers Are Missing

Here’s something that’s flying under the radar of many producers: the voluntary carbon market rewards agricultural practices that benefit water conservation through measurable carbon sequestration.

Cover crops, no-till systems, and managed rotational grazing can sequester 0.5 to 2.0 tons of CO2 equivalent per acre annually. At current market prices of $15-$ 50 per ton, this translates to $7.50-$100 per acre in annual carbon revenue.

What’s particularly noteworthy is how these practices deliver multiple benefits. By increasing soil organic matter, they improve soil structure, which in turn enhances water infiltration and increases the water-holding capacity. You’re essentially getting paid to make your operation more drought-resilient.

Land O’Lakes’ Truterra program paid out $5.1 million to 273 farmers in 2022 for verified carbon sequestration and water quality improvements. That’s real money hitting real farm accounts for practices that many progressive producers were already implementing.

The trend suggests we’re moving toward paying for verifiable outcomes rather than just practices. Early conservation programs compensated farmers simply for implementing a practice. Now, more sophisticated mechanisms tie payments to specific, data-driven results – a measured rainfall deficit or a verified ton of sequestered carbon.

This means dairy farmers who want to capitalize on future financial opportunities need to become data managers, capable of documenting and verifying their environmental performance.

What This All Means for Your Operation (And Why Waiting Isn’t an Option)

Here’s what I’m seeing from my conversations with producers across different regions… the operations that recognize this shift early and adapt aggressively will build competitive advantages that compound for decades. The ones who wait? They will find themselves permanently disadvantaged.

If you’re in the West, your priority should be securing water rights and maximizing efficiency through technology. Every drop literally counts, and the economics support major technology investments. The regulatory environment isn’t getting more lenient, and water isn’t getting cheaper.

If you’re in the Great Lakes region, focus on water quality and nutrient management. Regulatory pressure is only going to increase, but there’s a tremendous opportunity to get ahead of it through proactive stewardship. The solutions being developed in places like Wisconsin could become the template for everywhere else.

If you’re anywhere else, pay attention to both trends, as the policy approaches being tested in California and Wisconsin will likely influence federal regulations in the future.

The geographic arbitrage opportunity here is real. I’m seeing capital flows toward water-secure regions, such as the Great Lakes, while operations in water-stressed areas face increasing pressure to consolidate or sell out.

Your 90-Day Action Plan (Because the Window Is Closing)

Look, the window for proactive water management is closing fast. Here’s what you need to be doing in the next 90 days to position your operation for success…

Days 1-30: Know exactly where you stand. Document every water source, right, and cost. Model your operation’s financial performance under various drought scenarios – California operations should assume spot market pricing of $ 1,000 or more per acre-foot during severe conditions.

Get your soil tested. Not just NPK levels, but organic matter content and water-holding capacity. This baseline data will be crucial for both grant applications and operational planning.

Table 3: Comparative Water Rights Valuation in Major U.S. Dairy Regions (2024-2025)

| Region | Water Right Type | Market Mechanism | Spot/Lease Price Range per Acre-Foot | Key Regulatory Driver | 2020-2025 Price Trend |

|---|---|---|---|---|---|

| California | Appropriative | Open Market, Water Districts | $50 – $500+ (District); up to $2,200 (Spot market in drought) | SGMA, CVP/SWP Allocations | Highly Volatile, Strong Upward Pressure |

| Idaho | Appropriative | State Water Bank | $23 (2024) increasing to $33 (2025) | Prior Appropriation, ESPA Management | Stable but Increasing |

| Wisconsin | Riparian | None | N/A (Not a tradable commodity) | Clean Water Act, State Groundwater Law | N/A (Focus on compliance costs) |

Days 31-60: Start the grant application process immediately. EQIP applications for the current cycle are due February 28, 2025. Having a great project isn’t enough – you need to score higher than other applicants in your region.

Research and apply for relevant state programs simultaneously. California’s Dairy Plus Program, Idaho’s IWRB grants, Wisconsin’s TRM grants – whatever applies to your region.

Days 61-90: Order your soil moisture sensors and get them installed before the next growing season. Start conversations with drip irrigation contractors and get bids for priority acreage. Most importantly, start documenting everything. The future of agricultural funding is shifting toward paying for verifiable outcomes rather than just practices.

What would you do if your water costs doubled next year? Not might double – what if they actually did? Because for some producers, they already have.

When Water Management Becomes Your Profit Center

The most effective operations I know have stopped thinking of water management as a necessary evil. They’ve started treating it as a profit engine capable of generating multiple revenue streams from the same conservation investments.

Consumer interest in agricultural sustainability is creating opportunities for agritourism programs that can generate $30,000 to $ 50,000 annually while building brand value. Premium pricing for sustainably produced dairy products typically ranges 15-30% above commodity pricing.

I visited an operation in Lancaster County last month that’s generating an additional $45,000 annually from agritourism. However, what’s truly smart about their approach is that they’re using those farm tours to gauge consumer interest in “water-responsible” dairy products before making larger investments in specialized marketing and distribution.

The plate cooler systems that most producers think of as energy-saving equipment? They’re actually water management tools that can reduce refrigeration energy consumption by up to 60% while providing tempered drinking water for the herd. When you factor in all the benefits – energy savings, water recycling, and improved herd comfort – the ROI becomes compelling, even in regions with relatively inexpensive water.

The Uncomfortable Truth About Where This Is All Heading

What’s happening with water in dairy isn’t just another challenge to manage – it’s a fundamental shift that’s reshaping who wins and who loses in our industry.

I’ve been covering agriculture for over two decades, and I’ve seen this movie before with other input costs. Feed, energy, labor… the producers who adapt early and strategically don’t just survive the transition, they thrive during it. They use periods of disruption to gain market share from slower-moving competitors.

The technology exists. The financial tools are available. The markets are developing. What’s missing is the urgency to act while there’s still time to get ahead of the curve, rather than just react to it.

Here’s my prediction, and you can hold me to this… in five years, every successful dairy operation will have sophisticated water management systems. The question is whether you’ll be leading that transformation or scrambling to catch up with operations that have been planning for three years.

What keeps me optimistic about our industry is that dairy producers are among the most innovative and adaptable people I know. When the economy changes, they adapt to it. The challenge this time is that the pace of change is accelerating, and the stakes are higher than they’ve been in decades.

The choice is yours. But the window is closing fast.

What’s your water situation looking like in your region? Are you experiencing similar cost pressures, or is this still something you plan to address in the future? I’d love to hear what’s working – and what isn’t – because this is exactly the kind of challenge where we all benefit from sharing real-world experience.

Please leave a comment below or contact us directly. This conversation is just getting started, and honestly, the more we can learn from each other’s experiences, the better positioned we’ll all be for what’s coming next.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Hidden Secret to Boosting Milk Production: Fresh Water for Healthier Cows – Reveals practical strategies for implementing daily water quality protocols that deliver immediate 2-3 pound milk yield increases per cow, demonstrating how operational excellence complements the technology investments discussed in the main article.

- California Dairy on the Brink: Water Wars Threaten to Reshape the State’s Future – Exposes the political and economic forces driving California’s water crisis beyond SGMA regulations, providing essential context for understanding why water costs are restructuring dairy’s geographic future and investment patterns.

- Discover the Latest Innovations for Dairy Farmers: Top Products to See at World Dairy Expo 2024 – Showcases breakthrough technologies like VES-Artex’s Intelligent Soaker 2.0 that cuts water usage by 70%, offering cutting-edge solutions that extend beyond the irrigation systems covered in the main analysis.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!