Dairy’s best kept secret: The farms shrinking on purpose are the ones making money. Here’s the $165K proof.

Executive Summary: A Wisconsin dairy farmer cut 150 cows and made $165,000 MORE—proving that in today’s market, strategic shrinking beats growing. With mega-dairies producing at $13/cwt versus your $23/cwt, that $10 spread is mathematically insurmountable through volume. December 1’s new protein requirements (3.3% baseline) will either cost you $8,640 in penalties or earn you $40,000+ in premiums—depending on what you do in the next 31 days. The winning formula: cull your bottom 15% to cut costs immediately, then optimize components through amino acid supplementation for premium capture. This article delivers a tested 90-day playbook with specific actions, real costs, and realistic timelines that have already transformed dozens of operations. Your choice is simple but urgent: adapt now, pivot to alternatives, or exit while you still can.

Part One: The Squeeze Is Real—And Getting Worse

You know that feeling when you’re caught between a rock and a hard place? That’s exactly where mid-size dairy operations sit right now. And if you’re running 200 to 600 cows, you’re probably feeling it every time you look at your milk check.

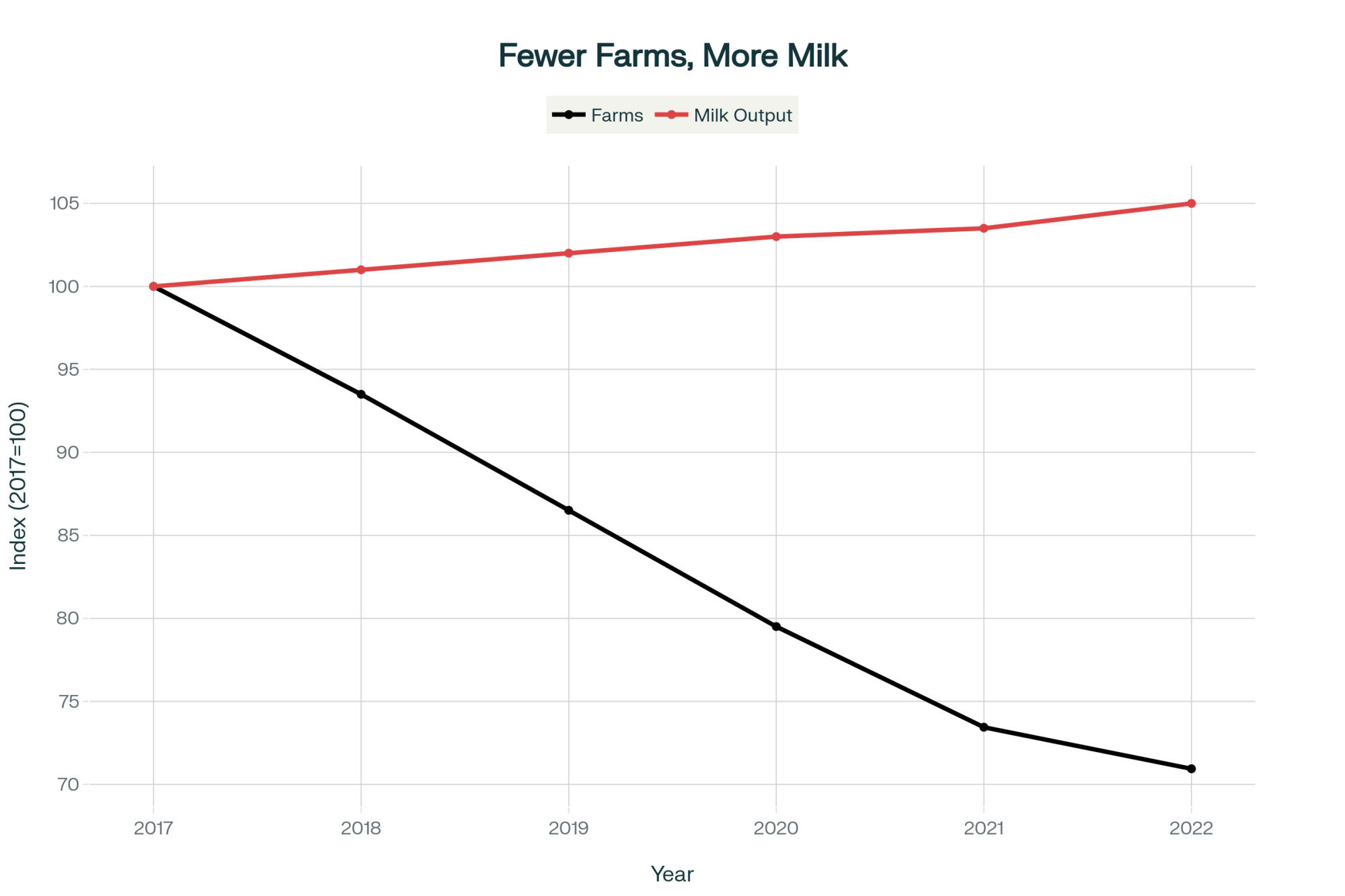

Let me paint you a picture with some hard numbers from the USDA’s latest Census of Agriculture, released in February. Between 2017 and 2022, we lost 15,866 dairy farms. During that same time? Milk production actually went UP five percent.

How’s that math work? Well, you probably know this already, but it’s worth saying—the big got bigger. Much bigger.

Year | Farms | Change | Production Index | Mega Share % |

|---|---|---|---|---|

| 2017 | 54,599 | – | 100 | 42% |

| 2018 | 51,050 | -3,549 | 101 | 43% |

| 2019 | 47,235 | -3,815 | 102 | 44% |

| 2020 | 43,410 | -3,825 | 103 | 45% |

| 2021 | 40,100 | -3,310 | 103.5 | 45.5% |

| 2022 | 38,733 | -1,367 | 105 | 46% |

The Brutal Economics of Scale

So I visited one of these mega-operations in Texas last spring. Twelve thousand cows. Robotic systems everywhere. The whole nine yards.

Here’s what’s interesting—their CFO, who came from the oil industry, actually, showed me their numbers. Thirteen dollars per hundredweight all-in production costs. Thirteen.

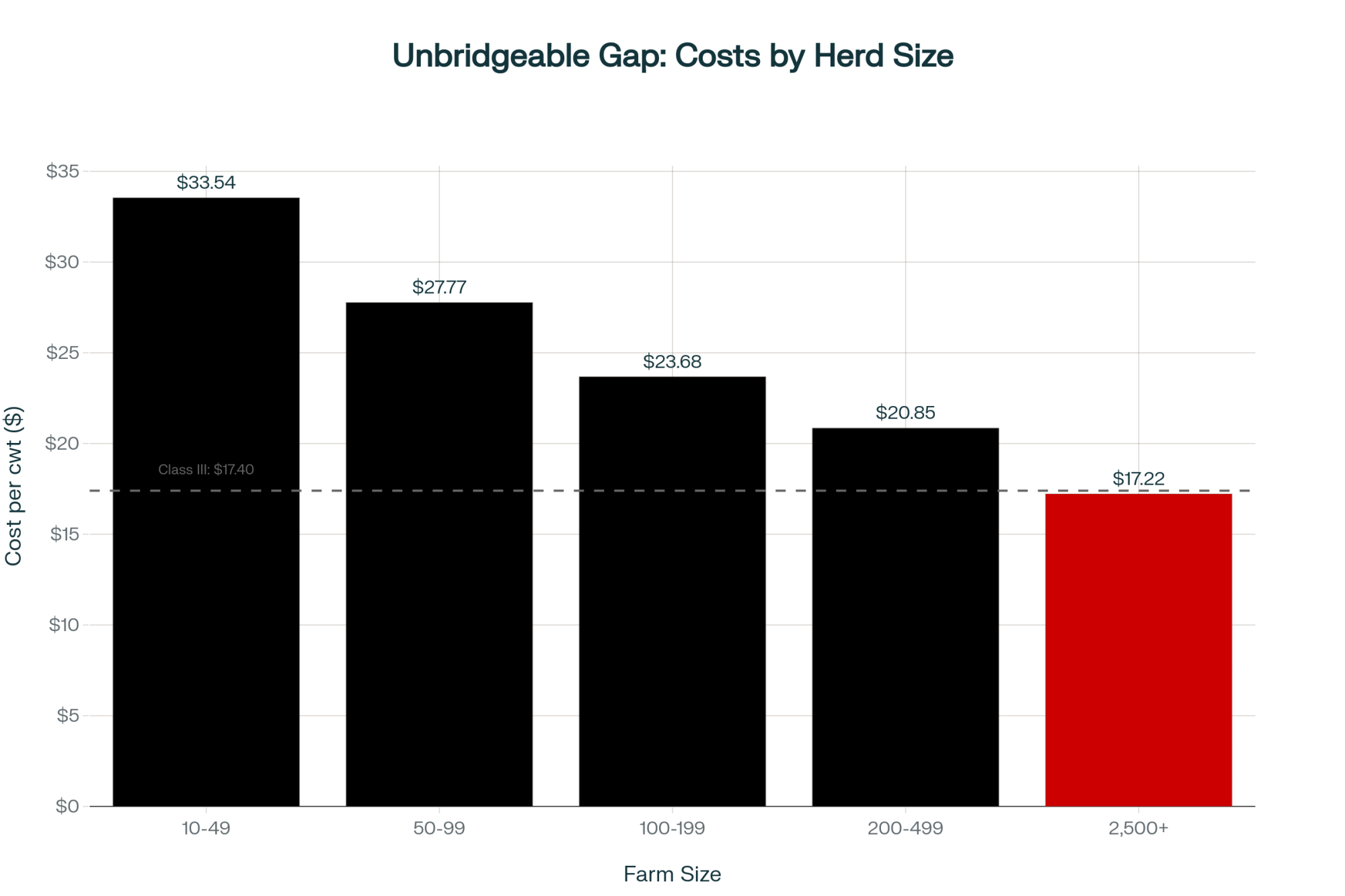

Now, I don’t know about your operation, but Cornell’s PRO-DAIRY program has been tracking costs for typical 100-200 cow herds, and they’re seeing around $23 per hundredweight. That’s… that’s a problem.

Farm Size | Cost/CWT | Status |

|---|---|---|

| 10-49 cows | $33.54 | Loss |

| 50-99 cows | $27.77 | Loss |

| 100-199 cows | $23.68 | Loss |

| 200-499 cows | $20.85 | Loss |

| 2,500+ cows | $17.22 | Profit |

At today’s Class III price—what was it this morning, $17.40 on the CME?—smaller operations are losing close to six bucks per hundredweight. Meanwhile, these mega-dairies? They’re making over four dollars.

That’s a ten-dollar spread, folks. Ten dollars!

“I realized I was trying to compete on volume with operations ten times my size. Can’t win that game. So I changed the game—focused on profit per cow, not gallons in the tank.” — Wisconsin dairy farmer who cut his herd from 1,200 to 1,050 cows

And here’s the thing that keeps me up at night—it’s not that these big operations are doing anything wrong. They’re just playing a different game entirely. Feed costs alone, they’re saving $2-3 per hundredweight through direct commodity purchases. Labor efficiency? Another couple of bucks saved. It adds up fast.

The Geographic Earthquake Nobody’s Talking About

While you’re wrestling with those economics, something else is happening that’s maybe even more important. The entire industry map? It’s being redrawn under our feet.

You’ve probably heard about the new processing capacity—Rabobank’s September report put the investment range at $8 to $11 billion. Biggest buildout since the 1990s. But here’s the kicker that nobody really wants to talk about—these plants aren’t where the milk traditionally has been.

Take Hilmar’s new Dodge City facility out in Kansas. Or Valley Queen’s expansion up in South Dakota. These aren’t small operations, folks. They need milk—lots and lots of milk.

And where’s it coming from? Well, USDA’s latest production report tells the story:

Texas added 50,000 cows this past year. Fifty thousand! Kansas jumped by 29,000 head. South Dakota gained somewhere between 18,000 and 21,000, depending on which report you look at.

Meanwhile—and this is what Mark Stephenson, Director of Dairy Policy Analysis at UW-Madison’s Center for Dairy Profitability, calls it—older plants in Wisconsin, Minnesota, parts of New York? They’re taking “strategic downtime.” That’s a polite way of saying they can’t compete for milk at current prices.

What I’m hearing from processing plant managers and dairy economists familiar with these operations is that new facilities are running at maybe 50-70% capacity right now, varying by plant, of course. They’re still ramping up, learning their systems, building those supply chains.

But when they hit full throttle—and most analysts I talk to figure that’ll be late 2026—we’re looking at an additional billion pounds of cheese-making capacity.

Just to put that in perspective… that’s about what the entire state of Vermont produces in a year.

Now, the strategies that work in Texas, with its minimal environmental regulations, aren’t the same as those that work in California, with its water restrictions. And our friends in the Southeast, dealing with heat stress, face different challenges than folks up in Vermont, where land costs are through the roof. But the pressure? That’s universal.

Part Two: December 1—The Trigger That Changes Everything

As if the squeeze wasn’t tight enough already, here comes December 1 with Federal Milk Marketing Order changes that’ll turn chronic pressure into an acute crisis for a lot of farms.

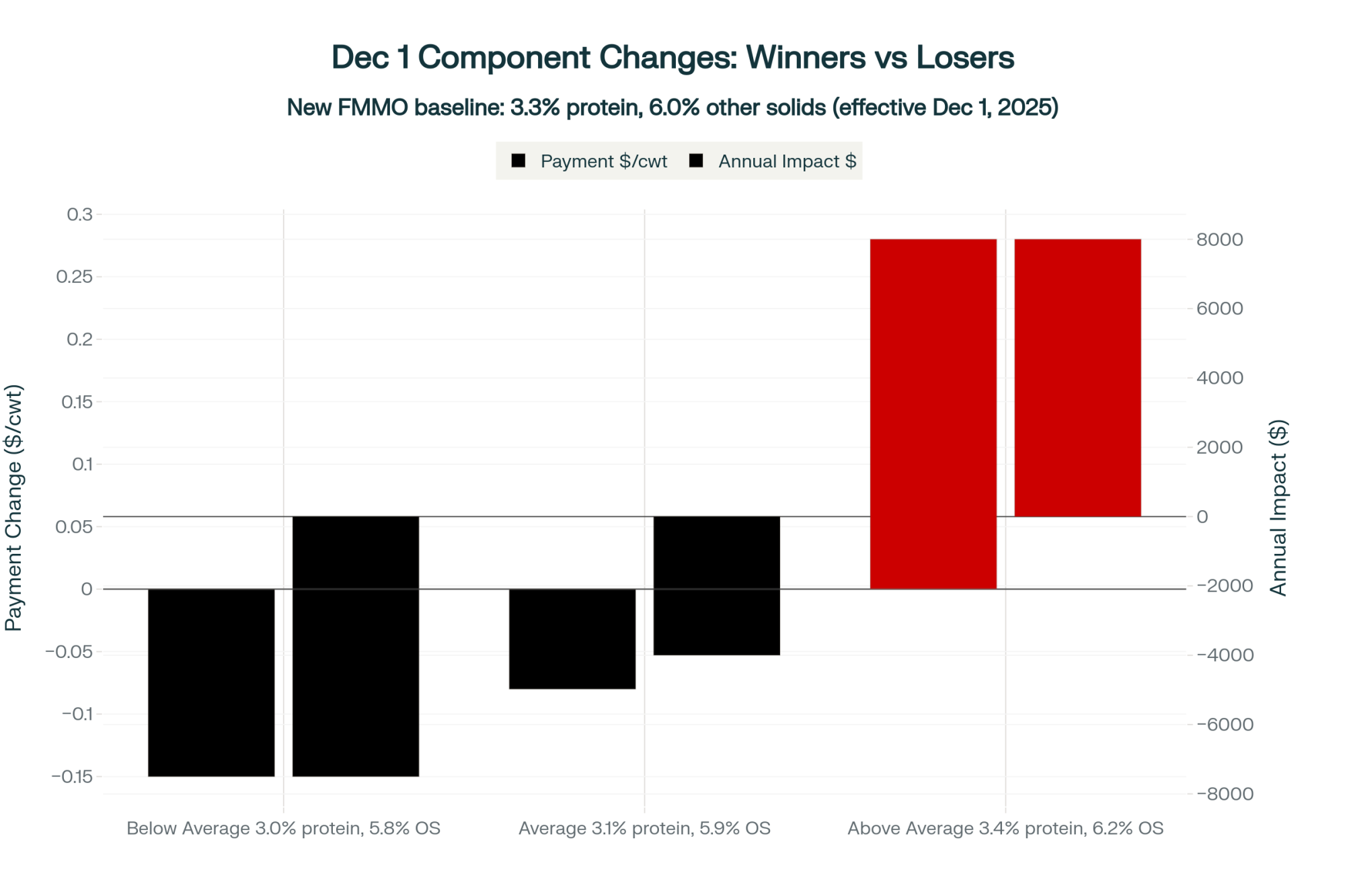

According to USDA’s final rule that came out in October—and I spent way too much time reading through all 147 pages of it—baseline protein jumps from 3.1% to 3.3% starting December 1. Other solids move from 5.9% to 6.0%.

Now, that might not sound like much when you’re sitting at the kitchen table. But let me show you what this actually means for your milk check.

The New Component Reality

A typical 200-cow operation that’s been hitting that old 3.1% protein baseline? Come December 1, they’re suddenly eight cents under water per hundredweight. Just like that—penalty instead of baseline.

On the flip side, farms hitting 3.4% protein capture about 28 cents per hundredweight in premiums under the new formulas.

Let’s do the math here—on 200 cows averaging 75 pounds daily, that’s the difference between losing money and gaining around $8,640 annually. That’s not pocket change, as many of us have learned the hard way.

Karen Phillips, who’s an Associate Professor of Dairy Science at UW-Madison, explained something fascinating at last month’s extension meeting in Marshfield. She said cheesemakers need a protein-to-fat ratio of 0.80 for optimal yield. Know what the U.S. average is right now? We’re sitting at 0.77 according to the DHIA data from January through September.

That three-hundredths difference—it doesn’t sound like much, but it forces plants to add nonfat dry milk powder to standardize their cheese vats. Cuts right into their margins. Makes them real interested in paying premiums for the right milk.

| Scenario | Protein/OS | Payment Δ | Annual Impact (200 cows) |

|---|---|---|---|

| Below Average | 3.0% / 5.8% | -$0.15/cwt | -$7,500 |

| Average | 3.1% / 5.9% | -$0.08/cwt | -$4,000 |

| Above Average | 3.4% / 6.2% | +$0.28/cwt | +$8,000 |

December 1 Component Changes at a Glance:

- Protein baseline: 3.1% → 3.3%

- Other solids: 5.9% → 6.0%

- Below baseline = penalties

- Above baseline = premiums

- 200-cow herd hitting 3.4% protein = ~$8,640 annual gain

Part Three: Why “Just Make More Milk” Is a Losing Game

Your first instinct might be to ramp up production, right? Get more cows. Push for higher yields. Try to compete on volume.

Don’t. Just… don’t.

Here’s why that strategy is basically suicide for mid-size operations.

You Can’t Out-Scale the Giants

Those 834 mega-dairies with 2,500-plus cows that USDA’s Economic Research Service tracked in their March 2025 report? They’re producing 46% of America’s milk now. Nearly half of our milk comes from fewer than 1,000 farms.

Think about that for a second.

They’ve got feed costs that run $2-3 per hundredweight lower than yours through direct commodity purchases—they’re buying trainloads, not truck loads. Labor efficiency through automation saves them another $2-2.50 based on university cost studies. Capital costs spread across massive production volumes? That’s another buck-fifty to two-fifty saved.

You can’t win that game. I mean, you literally cannot win it. So stop trying.

The Processing Capacity Trap

Michael Dykes, President and CEO at the International Dairy Foods Association—I had coffee with him at September’s Dairy Forum in Phoenix—he told me something really revealing. He said everyone in the industry was terrified there wouldn’t be enough milk for these new plants.

“I kept telling them,” he said, “farmers will respond to market signals.”

Well, respond they did. Boy, did they respond.

But here’s what nobody wants to say out loud at these industry meetings: The IDFA estimates we’ll have a billion pounds of new annual cheese capacity by the end of 2026. Meanwhile, domestic demand? It’s growing at about 1-2% annually, based on USDA consumption data from their July report.

You see the problem here? More milk into an oversupplied market just drives prices lower. You’re literally racing to the bottom.

Part Four: The Real Solution—Shrink to Grow

This brings me to something that happened last February that really opened my eyes. I was talking to this Wisconsin dairy farmer—let’s call him Tom to protect his privacy—standing in his freestall barn outside Shawano. And he tells me something that seemed absolutely crazy at the time.

He was cutting his herd from 1,200 to 1,050 cows. On purpose.

“You’re going backwards,” his neighbors told him at the co-op meeting.

Eight months later? His net income—not revenue, but actual net income—had jumped dramatically. The University of Wisconsin Extension has been documenting these kinds of strategic culling success stories in its dairy management programs, and the results are prompting many people to rethink everything.

Here’s the two-step strategy that’s actually working:

Step One: Strategic Culling (The Foundation)

Victor Cabrera, Professor in the Department of Dairy Science at UW-Madison, has data showing something really interesting—the average farm has 10-12% of cows that are net negative on profitability.

They’re eating feed. Taking up stall space. Requiring labor. Getting bred. But when you actually run the numbers? They’re not paying their way.

Culling these underperformers does two things immediately:

- Reduces your costs right away—less feed, less labor, fewer health issues

- Mechanically raises your herd’s average production and components

What Tom did with his 150-cow reduction was eliminate his worst performers. The 1,050 cows he kept? Higher average production. Better components. Lower costs per hundredweight. It’s not magic—it’s just math.

Step Two: Component Optimization (The Multiplier)

Once you’ve got a leaner, higher-potential herd, now you optimize for components through amino acid balancing.

Jim Paulson, Dairy Extension Educator at University of Minnesota Extension in St. Cloud—he’s been working with dairy nutrition for decades—he explains it really well: “Most farms overfeed crude protein while being deficient in the specific amino acids that actually drive milk protein synthesis.”

The fix? Rumen-protected methionine and lysine in the right ratio. The Journal of Dairy Science has published extensive research on this over the past couple of years, and the 3-to-1 lysine-to-methionine ratio keeps coming up as optimal.

Brian Perkins, Senior Dairy Technical Specialist with Vita Plus Corporation out of Madison—he’s worked with 47 different herds on this in 2025—told me: “Target a 0.15 to 0.20 percentage point protein increase. Budget $0.10–$0.15 per cow daily. Based on our field trials, you’ll see results in 8-12 weeks.”

On a now-optimized 200-cow herd, that’s maybe $7,000 annually for the supplements. But if it gets you to 3.3% protein or higher, you’re capturing those December 1 premiums we talked about.

I don’t have all the answers here, and finding qualified nutritionists who really understand amino acid balancing can be challenging in some regions. Your best bet is contacting your state Extension dairy team—they can usually connect you with someone who knows this stuff inside and out.

The Combined Effect

Component | Amount | Type |

|---|---|---|

| Amino Acid Supplements | -$7,000 | Cost |

| Component Premiums (3.3%+ protein) | +$40,000 | Revenue |

| Beef-on-Dairy (60% × 120 calves) | +$100,000 | Revenue |

| Cost Reduction (15% culling) | +$20,000 | Savings |

| NET PROFIT | +$153,000 | Total |

* 200-Cow Operation

Here’s where it gets really interesting:

- Culling raises your baseline—removing the bottom 15% might boost your average protein from 3.0% to 3.1% just from that alone

- Amino acid optimization adds another 0.15-0.20 percentage points on top

- Now you’re at 3.25-3.30% protein—above the new FMMO baseline

- Your costs dropped through culling

- Your revenue increased through premiums

That’s how you shrink to grow. And it’s working for operations across the country—though individual results will obviously vary based on your specific circumstances.

Part Five: Your 90-Day Survival Playbook

Phase | Days | Action Focus | Key Metric |

|---|---|---|---|

| 1 | 1-7 | Face the Truth | <$19 survive / >$21 exit |

| 2 | 8-30 | Execute Cull | 15% reduction |

| 3 | 31-45 | Fix Components | $0.10-$0.15/cow/day |

| 4 | 46-60 | Diversify Revenue | $100K+ annual |

| 5 | 61-75 | Lock Premiums | $40K-$140K/year |

| 6 | 76-90 | Hard Decision | 85-95% vs 50-65% |

Alright, so you understand the problem and the solution. But what do you actually DO? Like, starting Monday morning?

Here’s your tactical roadmap—and I mean this is what you actually need to do, not theoretical stuff:

Days 1-7: Face the Brutal Truth

Calculate your true all-in production cost. Brad Mitchell, Extension Agricultural Economist at Iowa State University, has this worksheet on their dairy team website that makes it pretty straightforward. Use it.

And here’s the part nobody wants to hear—include your own labor at $20 an hour minimum. That’s the median wage for dairy workers according to the Bureau of Labor Statistics as of October 2025. If you’re working 60-hour weeks—and who isn’t?—that’s $62,400 annually you’re not paying yourself.

Critical benchmarks to know:

- Under $19/cwt: You might survive with some adjustments

- $19-21/cwt: Major changes needed NOW

- Over $21/cwt: You need to consider all options, including… well, including exit

Days 8-30: Execute the Cull

Time to identify your bottom 10-15% performers. Look for:

- Chronic high SCC—anything over 400,000 consistently

- Repeated health issues—if she’s been treated 3+ times in 90 days

- Production under 60 pounds a day in early to mid-lactation

- Poor components—under 2.9% protein consistently

Remove them. Yeah, I know it’s hard. Your daily tank volume will drop. But your profitability will improve immediately. Trust me on this.

Days 31-45: Fix Your Components

Call your nutritionist this week. Not next month. This week.

Tell them you need amino acid balancing targeting:

- 0.15-0.20 percentage point protein increase

- Rumen-protected methionine and lysine

- That 3:1 lysine to methionine ratio we talked about

Budget $0.10 to $0.15 per cow daily. Based on what we’re seeing in the field, you’ll see results in 8-12 weeks.

For sourcing quality rumen-protected amino acids, companies like Adisseo, Evonik, and Kemin have good products—your nutritionist will have preferences based on what’s worked in your area.

Days 46-60: Diversify Revenue

If you haven’t started breeding for beef-on-dairy yet, you’re leaving serious money on the table.

Superior Livestock Auction’s video sales from October 28—I was watching them—show beef-cross dairy calves bringing around $1,400 for 400-pound steers. Straight dairy bulls? You’re lucky to get $150 at the local sale barn.

Here’s the optimal strategy:

- Top 40% of your herd: Use sexed dairy semen for replacements

- Bottom 60%: Beef semen all the way

Matt Akins, Beef Specialist at UW Extension’s Marshfield Agricultural Research Station, has calculated that this generates an extra $100,000-plus annually for a typical 200-cow herd. That’s real money.

| Metric | Traditional | Beef-on-Dairy | Difference |

|---|---|---|---|

| Per Calf Price | $150 | $1,400 | +$1,250 |

| Annual Revenue (120 calves) | $18,000 | $168,000 | +$150,000 |

| Feed Efficiency | Baseline | 8-25% better | Advantage |

| Finishing Time | Baseline | 20% faster | 5-26 fewer days |

| Carcass Grading | Lower | 15-25% Prime/Choice | Premium |

200-Cow Herd (60% bred to beef)

Now, fair warning—Les Hansen, Professor Emeritus at the University of Minnesota’s Department of Animal Science, keeps reminding everyone that beef prices won’t stay this high forever. USDA’s January 2025 cattle inventory showed we’re at a 73-year lows. When rebuilding starts—probably late 2026—these premiums will shrink. So use this 18-24 month window wisely.

Days 61-75: Lock in Component Premiums

If you can hit 3.3% protein with a 0.80 protein-to-fat ratio, those new cheese plants want your milk. They really want it.

I know of several Wisconsin operations working with processors like Grande and Foremost Farms that just locked in multi-year contracts at anywhere from 40 cents to $1.40 per hundredweight above Federal Order minimums. The exact premium depends on volume commitments, location, quality history—you know, all the usual factors.

On 200 cows, even at the low end, that’s $40,000 annually. At the high end? We’re talking $140,000.

But here’s the thing—these deals are happening NOW. By January, that window probably closes.

Days 76-90: Make the Hard Decision

Look, if you’ve done all this analysis and you still can’t hit profitable benchmarks, it’s time for the conversation nobody wants to have.

Tom Peters, Senior Farm Transition Specialist at Farm Credit Services of America—he’s tracked 127 dairy transitions across the Midwest since 2020. A planned exit over 18-24 months typically preserves 85-95% of asset value. A forced liquidation in crisis? You’re lucky to get 50-65%.

On a typical $4 million operation, that’s the difference between walking away with $3.4 million or $2 million. One sets you up for retirement. The other… doesn’t.

I know this is tough to hear. But ignoring reality doesn’t change it.

Success Stories That Prove It Works

This isn’t just theory, folks. Real farms are making this strategy work right now.

I visited an operation down in Georgia that’s similar to what folks like Sarah Martinez are doing—280 cows on pasture, focused intensively on components. She’s hitting 3.45% protein consistently and has locked in premium contracts with a regional cheese maker. Her costs run about $18.50 per hundredweight—actually profitable at current prices.

“We’re not trying to compete with the big boys on volume,” she told me. “We’re competing on quality and consistency.”

Up in Vermont, I know of operations similar to the Johnson family’s that pivoted to organic about five years ago. Yeah, the transition was brutal—they lost money for three years straight. But now? They’re capturing $35 per hundredweight through Organic Valley with production costs around $28. That’s a healthy margin in anybody’s book.

And there are plenty of mid-size operations maintaining profitability through other unique strategies—direct marketing, agritourism, value-added processing. The point is, there’s more than one path forward.

Tom in Wisconsin? His remaining 1,050 cows are now averaging strong protein levels after working on amino acid balancing. He’s breeding 65% to beef. His costs dropped to about $17.80 per hundredweight after culling those 150 underperformers. At current prices, he’s actually making money. Not a fortune, but enough.

The Digital Edge You Need

What’s encouraging is the technology available now that we didn’t have even five years ago:

Penn State’s DairyMetrics offers a free component optimization app that lets you model amino acid changes before implementing them. Wisconsin’s Dairy Management website, through UW-Madison Extension, offers calculators for everything from culling decisions to heifer inventory optimization.

Several folks I know are using FeedWatch or TMR Tracker software to dial in their rations precisely. When you’re spending $7,000 on amino acids, you want to make sure they’re actually getting into the cows, you know?

And of course, USDA’s Agricultural Marketing Service and the CME Group sites let you track real-time market prices from your phone.

The Bottom Line: Choose Your Path

Look, I’ve been covering this industry for thirty years. This isn’t just another cycle. The combination of mega-dairy economics, geographic shifts, component revaluation, and processing overcapacity—it’s creating a fundamental restructuring of how this industry works.

The whey processors figured this out already. They cut commodity production by about 30%, shifted to high-value products, and created scarcity. CME spot dry whey hit 71 cents per pound last week—a nine-month high—while cheese races toward oversupply.

As Tom told me: “I realized I was trying to compete on volume with operations ten times my size. Can’t win that game. So I changed the game—focused on profit per cow, not gallons in the tank.”

He gets it. The question is, do you?

The decisions you make in the next 90 days will determine which side of 2027 you land on. For some, that means strategic culling and component optimization. For others, it means transitioning to organic or direct marketing. And yes, for some, it means a well-planned exit that preserves wealth.

What’s not an option? Not choosing. Because not choosing is still choosing—it’s just choosing to let the market decide for you.

The clock’s ticking, folks. December 1 is 31 days away.

Time to decide: Will you shift with the market, or get shifted by it?

Key Takeaways:

- The Volume Game Is Over: With mega-dairies producing at $13/cwt versus your $23/cwt, competing on size is mathematical suicide—the $10 spread is unbridgeable

- December 1 Deadline Creates Winners and Losers: Hit 3.3% protein to capture $40,000+ in premiums, or face $8,640 in penalties—you have 31 days to pick your side

- Strategic Culling Pays Immediately: Your bottom 15% of cows are profit vampires—cutting them saves $20,000+ annually while raising your herd average instantly

- Simple Math, Big Returns: Invest $7,000 in amino acids → boost protein 0.2 points → earn $40,000+ premiums PLUS add beef-on-dairy for another $100,000 = $133,000 net gain

- Three Honest Options: Transform through the 90-day playbook (works if costs <$21/cwt), pivot to specialty markets (organic/direct), or exit strategically while assets retain 85-95% value—but decide NOW

Resources: Visit your state Extension dairy website for worksheets and calculators. Component optimization apps are available through Penn State DairyMetrics and Wisconsin Dairy Management. For amino acid suppliers, contact your nutritionist. Track markets via the USDA Agricultural Marketing Service and CME Group.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Navigating Today’s Dairy Margin Squeeze: Insights from the Field – This article reveals practical feed management strategies (5-15% cost cuts) and modern culling benchmarks, offering immediate, actionable tactics to improve efficiency and component production, directly complementing the main article’s 90-day playbook for cost control and herd optimization.

- USDA’s 2025 Dairy Outlook: Market Shifts and Strategic Opportunities for Producers – Explore how USDA forecasts impact milk production and prices, and discover strategic opportunities in component optimization, processor alignment, and export markets. This provides essential broader market context and long-term planning insights to safeguard your operation’s future profitability.

- When Butterfat Isn’t Enough: Adapting Your Dairy to New Market Realities – Delve into the role of technology and innovation in component optimization, with insights on RFID systems, automated feeding, and calculating their return on investment across various herd sizes. This article demonstrates how to leverage modern tools to achieve the profitability goals outlined in the main piece.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!