Milk prices crash 15% as trade wars erupt & new policies gut profits. Can dairy farmers survive 2025?

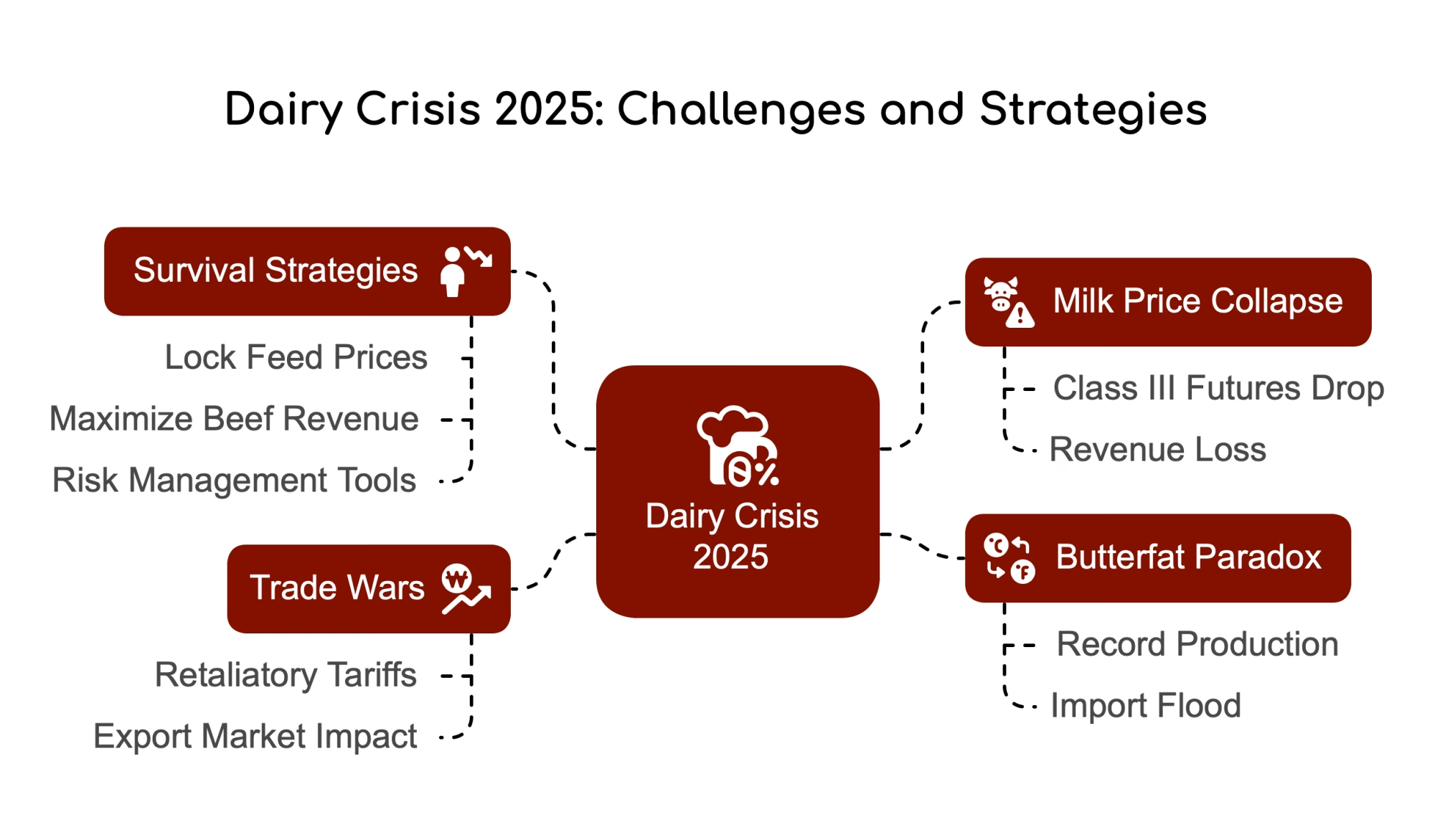

EXECUTIVE SUMMARY: US dairy faces a perfect storm in 2025: Plummeting milk prices (USDA slashes forecasts by $1.50/cwt), crippling tariffs locking exporters out of China/Mexico, and FMMO reforms reinstating $millions from producers to processors. HPAI outbreaks rage unchecked, while tight heifer supplies, and policy inertia expose farmers. Survival demands radical shifts-optimizing components over volume, aggressive risk management, and treating biosecurity as profit protection.

KEY TAKEAWAYS:

- Milk checks nosedive: 2025 prices projected at $21.10/cwt (-15% from 2024), with Class IV hit hardest (-$2.55).

- Trade wars backfired: 135% Chinese tariffs and Mexico/Canada retaliation threatened $1+/cwt price drops.

- FMMO “modernization” = wealth transfer: Higher processors make allowances slash farm payouts, favoring fluid-heavy regions.

- HPAI is the new normal: 1,000+ herds are infected, production losses are up to 15%, and no vaccine will be until 2026.

- Adapt or collapse: Component-focused feeding, blended risk strategies, and biosecurity investments separate survivors from casualties.

The 2025 dairy industry faces a perfect storm that nobody wants to discuss. Milk prices are in free fall, with USDA slashing forecasts by $1.50/cwt in just 90 days. Meanwhile, bureaucrats are ramming through FMMO “reforms” that will drain millions from producers’ pockets through bloated make allowances, all while government-imposed trade wars lock us out of our most valuable export markets. And if that wasn’t enough, HPAI continues to ravage herds nationwide, with regulators pretending they’ve got it under control. The days of $23 milk and $4 corn are dead and buried.

The data doesn’t lie, folks. After riding high on record-breaking $16/cwt margins in late 2024, dairy producers are staring at a financial cliff in 2025. Let’s cut through the spin and get to the ugly truth about what’s happening to your milk check this year.

Your Disappearing Milk Price

Remember February, when USDA economists confidently projected a 2025 all-milk price of $22.60/cwt? That number has evaporated faster than dew on a summer morning in Texas. By March, it mysteriously dropped to $21.60. The latest May forecast? A pathetic $21.10/cwt.

That’s not a rounding error – it’s a $1.50/cwt heist in just 90 days. For a 500-cow dairy producing 25,000 pounds per cow annually, we’re talking about $187,500 in vanished income. When’s the last time an “adjustment” cost you nearly $200K?

Every month this year, USDA forecasters have slashed their milk price predictions while offering zero explanation for why they got it so wrong the month before. This isn’t meteorology, where predictions naturally become more accurate over time – it’s economics, and this pattern of consistent downward revisions reveals either incompetence or a deliberate attempt to mask how bad things are getting.

Look at what’s happening to your milk check:

| Price Indicator | 2024 (Actual/Est.) | 2025 (Latest Forecast) | Change |

| All-Milk Price | $22.61/cwt | $21.10/cwt | -$1.51 |

| Class III Price | ~$19.00/cwt | $17.60/cwt | -$1.40 |

| Class IV Price | $20.75/cwt | $18.20/cwt | -$2.55 |

The spotty good news? Feed costs remain relatively stable. But don’t celebrate yet – the projected declines in milk prices will still outpace any savings on your feed bill. It’s like finding a nickel in the parlor drain the same day your milk truck jackknifes on the highway.

The Trade War Nobody’s Talking About

While economists drone on about “shifting market fundamentals,” they’re tiptoeing around the elephant in the milking parlor: we’re in an unprecedented trade war systematically dismantling decades of market development.

In March, the administration unleashed a barrage of new tariffs – 25% on nearly all imports from Mexico and Canada and escalating rates on Chinese goods. Did anyone bother to ask dairy farmers if they wanted to sacrifice their export markets on the altar of immigration politics? The predictable result? Swift and severe retaliation targeting US dairy:

- China slapped additional tariffs of 10-15% on US dairy products, pushing effective rates to an eye-watering 135%

- Mexico announced its retaliatory measures against US goods

- Canada immediately hit back with tariffs on approximately $21 billion of US products

The impact has been immediate and devastating. Nonfat dry milk/skim milk powder exports have collapsed 20% year-over-year, while lactose exports are down 14%. The critical dry whey market faces crippling tariffs of 84% to 150% in China.

Here’s what dairy economists won’t say publicly: this isn’t a typical trade dispute – it’s a full-scale market destruction that could take a decade to rebuild. When’s the last time you heard industry leaders acknowledge this reality instead of offering tepid statements about “hoping for resolution”?

The timing couldn’t be worse. New domestic cheese processing capacity is coming online just as international markets are slamming their doors in our faces. With no place for this additional production, the pressure on domestic prices will only intensify.

This is pure politics trumping economics. According to industry analysts, each posturing speech about “getting tough” on trade costs dairy farmers real money – about /cwt in Class III prices alone. That’s not theoretical – that’s your mortgage payment.

FMMO Reform: The Great Dairy Robbery

After years of debate and months of hearings, the Federal Milk Marketing Order modernization takes effect on June 1st. But before you celebrate this “achievement,” you might want to check which side of the dividing line you’re standing on – because this reform is nothing short of a massive wealth transfer.

The most crucial change is getting the least attention: substantially higher make allowances for processors. These allowances are increasing to $0.2519/lb for cheese, $0.2272/lb for butter, $0.2393/lb for NDM, and $0.2668/lb for dry whey.

Let’s call this what it is: a direct transfer of money from farmers to processors. Higher make allowances mathematically reduce the milk price paid to farmers. Period. Industry representatives frame this as “necessary adjustments reflecting higher processing costs,” but the reality is simpler: processors get guaranteed margin relief while farmers bear all the market risk.

When processors face higher costs, they get an automatic adjustment. When your diesel or labor costs skyrocket, where’s your automatic adjustment? The hypocrisy is stunning, yet industry organizations dominated by processor interests have convinced farmers to vote for their financial disadvantage.

And here’s where it gets interesting. The net impact will vary dramatically by region:

- If you’re producing milk in the Southeast, Florida, or Appalachia Orders where fluid utilization is high, congratulations – you’ll likely see a net benefit from these changes.

- But are you in the Upper Midwest, Pacific Northwest, California, or Arizona? You’re about to get fleeced. The higher make allowances will hit you hard, while your region’s manufacturing-heavy utilization will dilute the benefits of Class I changes.

This regional disparity raises a fundamental question: Should dairy policy create winners and losers based on geography rather than efficiency? Does penalizing regions that have invested billions in creating efficient manufacturing infrastructure make sense? The data suggests that the FMMO changes reward location over innovation, potentially distorting signals for long-term industry development.

HPAI: The Disease They Can’t Control

While policymakers debate prices and tariffs, dairy farmers face a more immediate threat: the relentless spread of Highly Pathogenic Avian Influenza (HPAI) in cattle. Despite more than a year of intervention efforts, this crisis is accelerating, not receding.

As of April 2025, HPAI had been confirmed in dairy cattle on over 1,009 premises across 18 states – a dramatic increase from the 16 states reported in late 2024. The states with the highest number of affected herds include California (with approximately 765 affected herds), Idaho (65), Colorado (64), Michigan (31), and Texas (27).

The most alarming finding? Scientists have identified multiple viral strains, confirming at least two spillover events from wild birds into dairy herds. This means the threat isn’t just from cattle movement – even operations with strict biosecurity remain vulnerable to environmental exposure from wild bird populations.

Why isn’t this front-page news? If a virus affecting food production had infected over 1,000 operations in any other industry, it would be deemed a national emergency. Yet HPAI has been normalized, with USDA officials repeating reassurances while case numbers climb.

The impact on affected farms is significant: reduced appetite, decreased milk production (estimated at 10-15% in clinical cases), and changes in milk consistency. While mortality rates remain relatively low, production losses can devastate farm economics.

California’s experience illustrates the scale of impact. In October 2024, the state’s milk production was down a dramatic 3.8% year-over-year, partly attributed to HPAI infections. As the virus spreads through 2025, similar production declines could emerge in other major dairy regions.

The USDA’s response, including the National Milk Testing Strategy and enhanced biosecurity recommendations, has failed to contain the spread. Let’s be honest about where we stand: regulators have shifted from containment to management after over a year. The virus is here to stay.

Breaking With Conventional Wisdom

Let’s challenge some sacred cows in the dairy industry:

1. The “Produce More” Mentality Is Dead

For decades, the standard advice during low-price periods has been to maximize production to spread fixed costs. This outdated thinking is financial suicide in today’s market. While the industry mantra has been “produce more to spread fixed costs,” the economic reality has fundamentally changed.

Instead of chasing volume, leading producers are pivoting to component optimization. With cheese prices showing relative strength compared to other products, farms focusing intensely on butterfat and protein percentages rather than raw volume are capturing premium returns despite lower overall prices.

“We’ve shifted from a volume mindset to a component value mindset,” explains one Wisconsin producer whose operation has maintained profitability despite the market downturn. “Our nutritionist now formulates rations to maximize component yield rather than total production. It’s completely changed our approach to feeding.”

Would you rather ship 80 pounds of 3.8% fat, 3.3% protein milk or 90 pounds of 3.5% fat, 3.0% protein milk? Do the math – the lower volume, higher component milk is worth significantly more in today’s market, with lower hauling costs.

2. Risk Management Isn’t Optional – It’s Essential

Too many producers still treat risk management as something only big dairies need to worry about. That mentality is financial suicide in today’s volatile market. The most successful operations have abandoned the all-or-nothing approach to risk management.

Instead of either fully contracting or staying completely exposed to the market, they’re employing blended strategies that combine:

- Targeted contracts for specific periods based on margin opportunities

- Strategic use of put options to establish price floors while maintaining upside

- Maintaining a portion of production unhedged to capture potential market improvements

Think of risk management like your breeding program – you’d never breed your entire herd to a single bull with extreme traits. You select a group of sires with complementary strengths to manage genetic risk. Your marketing approach should follow the same diversified strategy.

What Smart Producers Are Doing Differently

Faced with falling milk prices, export disasters, policy upheaval, and disease threats, smart dairy farmers aren’t waiting for conditions to improve – they’re taking decisive action now:

1. Biosecurity as a Profit Center, not a Cost

Forward-thinking operations have reconceptualized biosecurity from a regulatory burden to a profit-protection strategy. These farms aren’t just implementing basic HPAI prevention measures; they’re treating disease prevention as a core business function with dedicated staff, regular training, and rigorous protocols.

“We’ve stopped thinking about biosecurity as something we do to satisfy regulators,” notes a California producer who has kept HPAI at bay despite being surrounded by affected operations. “Now we treat it like we treat cow comfort or nutrition – as a direct driver of profitability that deserves significant time and investment.”

Consider the return on investment: spending $15,000 on enhanced bird deterrents, boot wash stations, and dedicated equipment between pens might seem excessive until you calculate the $85,000 lost milk revenue from even a moderate HPAI outbreak in your herd. The prevention math suddenly looks compelling.

2. Feed Efficiency: The New Production Frontier

With milk prices falling faster than feed costs, the margin between the two is compressing rapidly. In response, innovative producers are doubling on feed efficiency programs that reduce production costs by $0.75-1.25/cwt.

These initiatives go far beyond basic ration balancing, incorporating:

- Intensive forage quality programs that maximize digestibility

- Precision feed management systems that reduce shrink and waste

- Genomic selection specifically targeting feed conversion efficiency

“We can’t control milk prices, but we absolutely can control how efficiently our cows convert feed to milk,” explains a New York producer who has reduced feed costs by over $1/cwt in the past year. “That’s where our focus needs to be in this market.”

Every pound of feed lost to shrinkage, sorting, or spoilage is pure profit leakage. Are you treating your silage face management with the same precision you apply to your synchronization protocols? Both directly impact your bottom line.

The Bottom Line

The 2025 dairy landscape presents unprecedented challenges: systematically lower milk prices, destructive trade policies, confusing order reforms, and a persistent disease threat. The combined impact creates a perfect storm that will test even the most efficient operations.

Here’s what you need to understand:

- Official forecasts have consistently underestimated the severity of price declines – expect continued downward pressure through 2025 as export markets remain constrained and domestic production increases.

- The trade war is not a temporary disruption but a fundamental reshaping of market access that could take years to resolve – plan accordingly rather than hoping for a quick fix.

- FMMO changes taking effect mid-year will create significant regional disparities – understand exactly how they’ll impact your operation’s specific milk check calculation.

- HPAI remains uncontained and will continue to spread despite official intervention – investing in rigorous biosecurity isn’t optional but essential for financial survival.

- Component optimization, strategic risk management, biosecurity investment, and feed efficiency programs aren’t just marginal improvements but essential strategies for navigating this challenging environment.

Are you still operating with a 2023 mindset in a 2025 market? The rules have fundamentally changed. Those waiting for markets to “return to normal” will be waiting for a train never arriving. Instead of hoping for better days, take control of what you can influence: your components, your risk management, your biosecurity, and your feed efficiency.

The question isn’t whether conditions will improve – it’s whether you’ll still be in business when they do. The dairy industry has weathered difficult periods, but 2025 presents complex challenges. Success will require abandoning outdated assumptions, embracing uncomfortable realities, and implementing bold strategies that challenge conventional wisdom.

What are you changing today to ensure you’re still milking cows in 2026?

Learn more:

- USDA’s 2025 Dairy Outlook: Market Shifts and Strategic Opportunities for Producers

- Reversing HPAI’s Grip: Dairy Industry Shows Signs of Production Recovery

- USDA Slashes 2025 Milk Price Forecast By $1: What Dairy Farmers Need to Know

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!