Everyone’s celebrating 2025’s wins. Almost nobody’s asking how heifer shortage, processor overcapacity, and component changes interact—and what to do about it. The complete 2025 strategic analysis.

Walk into any dairy industry gathering in late 2025, and you’ll hear the same narrative: FMMO passed, DMC extended, $11 billion in new plants. What you won’t hear is how the heifer shortage just made half of those “wins” irrelevant for the next 30 months.

Industry associations called it progress. Most coverage treated these as separate wins.

Here’s what that narrative misses. These ten developments aren’t independent stories—they’re interconnected forces that fundamentally reshaped who’s positioned to thrive and who’s scrambling for the next five years. Some created real strategic advantages, others masked structural problems that are surfacing now, and a few are going to prove costly for producers who waited too long to respond.

What follows is what actually happened in 2025, beyond the headlines.

The Heifer Shortage: How Beef-on-Dairy Breeding Created a 27-Month Supply Constraint

Visit any Upper Midwest or California auction barn in mid-2025, and you saw the same scene playing out: replacement heifers averaging above $3,000 per head—up from around $1,140 back in April 2019, according to CoBank’s August report. Premium animals with strong genetics were commanding significantly higher prices.

And here’s the thing. This isn’t a pricing problem you hedge or a policy issue you lobby. It’s a biological constraint that binds for 24 to 30 months, and there’s no shortcut around the gestation and growth timeline.

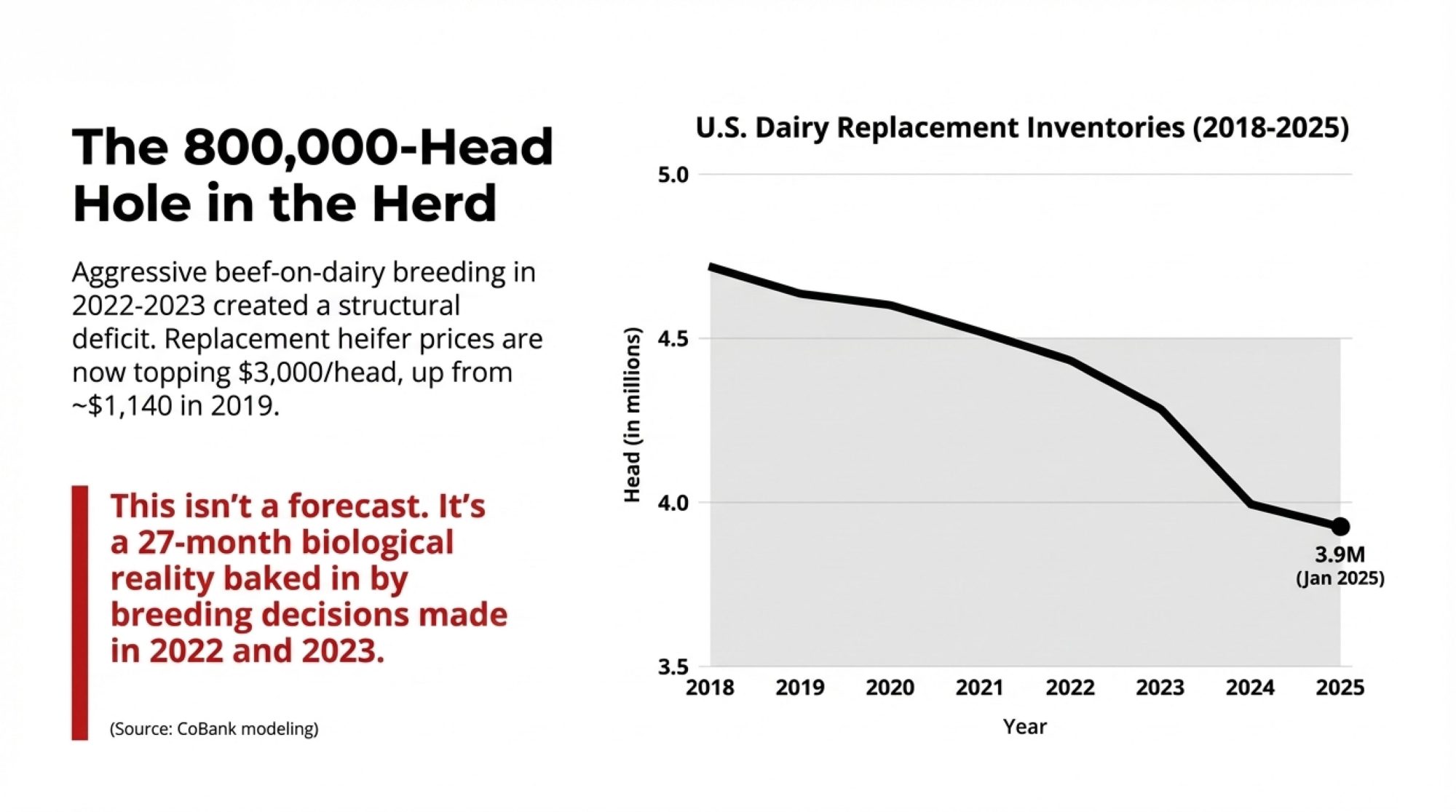

Dairy replacement inventories dropped to 3,914,300 head in January 2025, down 18% from 2018 levels, according to the USDA’s Cattle Inventory report. CoBank’s modeling shows heifer inventories will shrink by an estimated 800,000 head over the next two years before beginning to rebound in 2027. That 800,000-head deficit isn’t a projection—it’s already baked into the system based on breeding decisions made in 2022 and 2023.

The cause is straightforward, you know. Producers spent 2022-2023 breeding 60-70% of their herds to beef semen because beef-on-dairy calves brought $1,200-$1,800 while dairy bull calves fetched $50—numbers documented throughout that period in Progressive Dairy and Hoard’s Dairyman market reports. The short-term cash flow looked smart. The long-term math created a structural deficit we’re living through now.

How the Math Actually Works

Several Wisconsin producers have described similar experiences in industry discussions, with operations reporting they thought 65% beef breeding in 2022 was conservative. Looking back now, they realize those decisions created their own shortage problem.

Here’s how it plays out. An 800-cow herd with a 35% replacement rate and 85% completion needs roughly 330 heifer calves annually. Heavy beef breeding during 2022-2023 dropped that to 65-70 calves per year, creating a 260-heifer annual shortfall. Scale that behavior across the country and you get the 800,000-head hole CoBank documented in their August sector analysis.

The Timeline Won’t Speed Up

From the moment you switch back to sexed dairy semen, you’re staring at 27 months to first calving: nine months gestation plus 18-24 months to freshening. Even with perfect execution, it won’t be until mid-to-late 2028 before replacement inventories feel healthy again.

What keeps coming up in conversations—and I’ve heard this from producers across three regions now—is how quickly this creates a cascade of impacts we’re already seeing:

Culling math flips entirely. That marginal cow you would have shipped for chronic lameness or weak production now represents a different equation. Culling brings in $2,200-$2,400 at current cull cow prices, but forces a $3,000+ replacement purchase. You’re suddenly in the hole rather than keeping a marginal producer for one more lactation.

This is clearly evident in USDA livestock slaughter data. Dairy cow slaughter trailed year-ago levels for 94-98 of the past 100+ weeks through November 2025, with cumulative declines exceeding 550,000 head. Producers are keeping cows they would have shipped two years ago, which suppresses turnover and drags on herd-average production efficiency.

Expansion plans die or get completely redesigned. A planned 250-cow expansion at previous heifer pricing would cost nearly twice as much at current rates. That kind of capital increase pushes projected returns well below most lender thresholds for dairy expansion projects.

Producers who are still expanding have pivoted strategies entirely—chasing 24,000-26,000 pounds per cow through better genetics and management, buying fresh cows instead of heifers, or locking in long-term heifer contracts at fixed prices with neighboring operations or heifer growers. Each approach has tradeoffs, but they’re all designed to work around the heifer constraint rather than pretend it doesn’t exist.

Every breeding decision becomes capital allocation. You can’t afford to waste pregnancies on beef calves, but you also can’t dump expensive sexed semen on low-merit cows that deliver weak daughters. The new logic emerging across progressive herds: sexed dairy on the top 40% for genomic multipliers, conventional dairy on the middle 40% for higher conception rates, and that 50/50 gender split, limited beef on the bottom 20% to purge genetics you don’t want to propagate.

“The ones who treated it like a temporary price spike are learning that biology doesn’t negotiate.”

The operators who recognized this constraint early in 2025 rewired breeding protocols, slowed or reshaped expansion plans, and leaned into their newfound leverage with processors hunting for milk.

$11 Billion in New Stainless: When Processing Capacity Outran Milk Supply

By mid-2025, new and expanded dairy processing projects added capacity to process nearly 20 million pounds of milk per day, according to industry announcements compiled by Dairy Foods magazine.

Chobani announced a $500 million expansion in Twin Falls, Idaho, and broke ground on a $1.2 billion plant in Rome, New York, designed to process 12 million pounds of milk daily. Once at full capacity, Chobani will purchase an estimated 6 billion pounds per year. Darigold opened a $1 billion facility in Pasco, Washington, processing up to 8 million pounds daily. Hilmar Cheese launched a cutting-edge facility in Dodge City, Kansas. California Dairies and several other processors added significant capacity throughout the year.

Now, historical U.S. milk production growth has run about 1.5-2% annually, according to USDA data. Food processing facilities typically need to operate at 80-85% utilization to meet their return targets and justify capital deployment.

Biology just vetoed those growth assumptions.

Replacement heifer inventories fell to 20-year lows, with the pipeline expected to shrink further before rebounding after 2027, as CoBank’s dairy economists documented. Producers kept marginal cows longer, and national cow slaughter stayed unusually light, but per-cow efficiency gains produced a one-time volume bump rather than sustainable long-term growth.

The tension is explicit in industry commentary. “Farmers are shipping more milk components, which is most important as 80% of U.S. milk flows into manufactured dairy products,” said Corey Geiger, CoBank lead dairy economist, in their August report. “With the amount of new processing capacity coming online across the country, the ability for milk production to keep up with the demand is worth noting. Given the historically high prices for dairy replacements to enter the milking string, dairy farmers are planning two to three years out for expansions.”

In other words, these plants were built on growth assumptions just as biology capped supply, which shifts negotiating leverage toward producers who can reliably deliver milk.

What Processor Desperation Actually Looks Like

Processors don’t publicly admit supply desperation. They telegraph it through behavior patterns we’ve been tracking throughout 2025.

If a plant historically pulled milk from a 100-150 mile radius and starts recruiting 300-500 miles out, that signals supply desperation. If you’re 50 miles from that plant while they’re wooing farms 400 miles away, you’re their lowest-cost, lowest-risk volume source. That’s leverage worth understanding.

Volume bonuses, consistency premiums, multi-year price floors, richer component incentives, and co-funded capital projects signal that standard pool pricing isn’t securing enough milk. Industry sources report that some operations have negotiated arrangements, including premiums of $0.20-$0.30 per hundredweight above pool pricing, structured as multi-year agreements with processor co-financing for replacement heifers at favorable interest rates. Essentially, processors are using their cheaper cost of capital to lock in a reliable milk supply.

Plants sold as 24/7 engines running three shifts can’t hide if they’re stuck at two shifts, hiring below announced job numbers, or taking frequent maintenance downtime. If they built for 80-85% utilization and are running in the low-60s, every extra million pounds you can commit moves their return needle meaningfully.

The window for producer leverage is real but temporary. Once replacement inventories rebuild after 2027-2028 and milk supply catches up to the $11 billion of new capacity, processors drift back toward classic commodity behavior: more milk than needed, less desperation, harder-edged pricing.

Between now and then, producers who understand the supply-demand mismatch have a once-in-a-cycle opportunity to lock in better premiums, real partnership terms, and multi-year structures that still look attractive when the leverage pendulum swings back. These opportunities typically don’t announce themselves with flashing lights—they show up as unusual persistence from field reps or surprising openness to negotiation on terms that were non-starters six months ago.

FMMO Component Factor Changes: The Permanent Repricing of Standard Milk

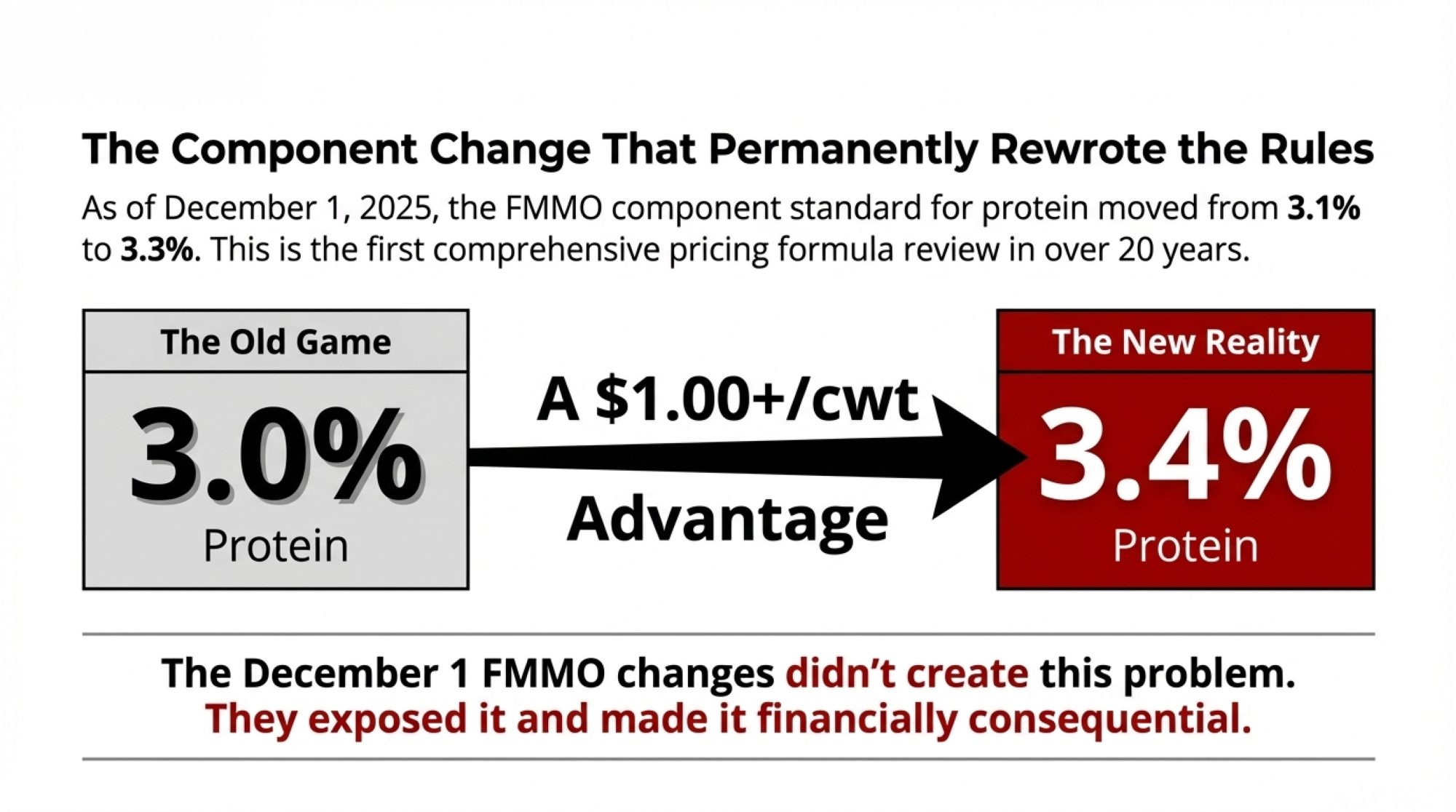

December 1, 2025, marked a fundamental shift in how milk gets valued. The component standard updates moved to 3.3% protein, 6.0% other solids, and 9.3% nonfat solids, according to the USDA’s Agricultural Marketing Service final rule published in October.

These aren’t technical adjustments—they’re a permanent repricing of what counts as standard milk.

The protein composition factor increased from 3.1% to 3.3%, the other solids factor from 5.9% to 6%, and the nonfat solids factor from 9% to 9.3%. This marked the first comprehensive pricing formula review in over 20 years after a 49-day national hearing that ran from August 2023 to January 2024, as documented in the Federal Register.

If your herd meets or exceeds these new standards, the system now better reflects the value you’re shipping. If you’re below, you’re being benchmarked against a higher bar every single month moving forward.

The spread between a low-protein herd and one at 3.4-3.5% protein can easily exceed a dollar per hundredweight once you layer in protein value and the new composition factors, according to University of Wisconsin dairy economist analyses published in early 2025.

The Trap Many Producers Haven’t Recognized Yet

There’s a common mindset you hear: “our milk has always been good enough.” And for two decades, that was largely true because the game rewarded volume. More cows, more pounds, big barns, scale economics. Components mattered, but didn’t always override sheer throughput.

Once the component bar moves up, that calculus shifts fundamentally. A neighbor at 3.4-3.5% protein and better butterfat performance can stack $1.25-$1.50 per hundredweight extra on every shipment, often running fewer cows with higher per-cow efficiency and lower overhead.

Can you fix it with genetics? You can move your herd’s component profile, but not quickly or cheaply.

Breeding your way out takes at least 4-6 years. During the spring 2025 breeding season, progressive herds significantly revised their protocols. The approach: genomic test the herd, target the top 30-40% for component-focused breeding, use sexed semen from high-component bulls, conventional dairy on the middle tier, beef or aggressive culls on the bottom.

But here’s the timeline reality. Years 1-2: you’re spending on testing and premium semen while improved daughters are still calves. Years 3-4: first wave of high-component heifers hits the parlor, herd protein inches from 3.0% toward 3.10-3.15%. Years 5-6: approaching 3.25-3.30% if you’re disciplined about culling and consistent with breeding protocols. That’s a long runway, and it requires sustained commitment and capital.

Buying your way out takes 2-3 years and substantial capital. Quality replacements with superior component genetics are trading in the same $3,000+ range currently. Replacing 50-60% of a 1,200-cow herd translates into millions in gross animal purchases, partially offset by cull revenue but still a heavy net capital outlay.

“The December 1 FMMO changes didn’t create this problem. They exposed it and made it financially consequential.”

When the math says exit. If you’re running close to 3.0% protein and 3.8% butterfat, while regional peers are closer to 3.3%+ protein and 4.1-4.2% butterfat, the widened component spread, plus your volume and cost structure, leaves you hundreds of thousands of dollars a year behind the competition.

A serious hybrid genetics improvement program might cost mid-six figures over 5-7 years between semen, genomic testing, and strategic animal purchases, with break-even landing close to a decade out. If you’re in your late 50s or early 60s with no identified successor and significant term debt, you’re grinding and investing hard for most of what’s left of your operating career just to get back to parity with more competitive herds.

The question worth asking is whether, given your age, debt structure, succession plan, and market alternatives, fixing genetics is actually the smartest strategic move or whether this is the moment to plan an orderly, strategic exit while your assets still command reasonable value. There’s no single right answer—it depends entirely on your specific situation—but it’s a question worth answering honestly.

DMC Extension Through 2031: Insurance, Life Support, or Strategic Protection?

The Dairy Margin Coverage program extension through 2031 included updated production history using 2021-2023 data, raised Tier 1 protection to 6 million pounds, and offered 25% premium discounts for long-term enrollment, according to a March USDA Farm Service Agency announcement.

Between January 2019 and December 2024, margin payments triggered in 38 months for producers who opted for $9.50 margin coverage. Total payments under DMC reached nearly $3.3 billion, with $1.2 billion paid in 2023 alone when payments triggered in 11 of 12 months, according to USDA payment data.

Three Faces of the Same Program

After watching DMC play out through six years and three very different market cycles, three distinct patterns have emerged in how farms actually use the program.

Real risk management for structurally sound operations. A 500-800 cow operation with solid components, strong efficiency, manageable leverage, and competent management enrolls Tier 1 max at top coverage levels with multi-year enrollment for the 25% discount. In a normal year, they pay low-five-figure premiums and receive modest payouts when margins briefly dip. In a disaster year like 2023—when payments reached $1.2 billion across the program—they see substantial indemnities that shore up the balance sheet or fund strategic investment in genetics, facilities, or automation.

Life support for marginal operations. Older operator, high cost structure, mediocre components, low production per cow, heavy debt service, tired facilities, no identified successor. For that operation, DMC often represents the difference between continuing to milk and being forced to liquidate. When you look at 2023’s $1.2 billion in program payments distributed across enrolled operations, you can see how meaningful those checks were for operations running on thin margins. For a marginal 300-500 cow herd, that money covered operating loan interest, minimum term-debt payments, and property taxes. Without it, a meaningful chunk of those operations likely would have hit the financial wall in 2023-2024.

Underpriced fat-tail insurance for sophisticated operators. DMC is basically a put option on the margin between the all-milk price and feed cost. USDA premiums are set using historical data and Congressional budget math, not a live options market. Premiums on Tier 1 $9.50 coverage, especially with the 25% multi-year discount, are relatively low per hundredweight compared to the extreme margins that can occur in fat-tail years. Sophisticated operators aren’t buying it for average years—they’re buying it for the one or two 2023-style years per decade where the program delivers substantial protection on Tier 1 alone.

The Program Is a Mirror

The program itself reflects your fundamentals and your strategic posture. If you’re structurally competitive, DMC is a weapon that lets you stay aggressive through margin squeezes while competitors pull back. If you’re structurally challenged, it’s buying time—either to fix fundamentals or to exit on your own terms instead of through forced liquidation.

Given DMC is now extended through 2031 with improved terms, the practical move is straightforward: use it, then be honest about why you’re using it. If you’d be profitable without DMC checks, enroll Tier 1 to the maximum and treat premiums as the cost of staying aggressive when the next 2023-style margin collapse hits. If you need DMC payments to meet loan covenants and tax obligations, admit you’re either buying time to fix structural problems or buying time to plan an orderly exit with dignity intact. Neither path is wrong—they’re just different strategic choices based on different operational realities.

Dairy Exports: Record Value Amid Structural Uncertainty

U.S. dairy exports reached $8.2 billion in 2024, the second-highest total on record, according to the U.S. Dairy Export Council’s year-end summary released in February 2025. Cheese exports to Mexico and Latin America hit records throughout the year.

At the same time, 2025 Class III futures spent chunks of the year in the mid-$15-$16 range, and make-allowance increases implemented with the FMMO changes stripped hundreds of millions in aggregate from producer milk checks, as University of Missouri agricultural economists documented in their June policy brief.

What this reveals is an uncomfortable truth: export volume can boom while your milk check tanks. U.S. and global supply were both heavy throughout 2025. The EU ran substantial output, New Zealand stayed solid, and Australia recovered. The U.S. had to move more product at lower prices just to clear processing capacity and avoid backing milk up into farm tanks.

Three Fundamentally Different Kinds of Export Growth

Understanding which type you’re looking at matters because they have very different implications for long-term sustainability.

Demand-driven growth that actually helps you. Mexico is the poster child. Big, growing population with a rising middle class. Persistent structural milk deficit—can’t self-supply because of climate constraints and limited production infrastructure. The U.S. typically supplies the bulk of Mexico’s dairy imports due to geographic proximity and the USMCA trade framework. Mexico now accounts for roughly one-third of all U.S. dairy exports, according to USDA export data. Here, exports are pulled by genuine demand. Volume increases, prices stay reasonably firm, and geography, logistics, and stable trade agreements anchor the trade relationship.

Supply-driven exports that signal trouble. The U.S. pushes more NFDM, whey, and other bulk commodities because domestic fluid consumption is flat to declining, and cheese and butter production can’t absorb everything. When China or Southeast Asia is buying, that surplus moves. When tariffs shift or political tensions rise, the same product has to be rerouted or discounted into weaker outlets. You still export it, but at prices that drag your milk check down because you’re selling into a buyer’s market, not a shortage market.

“When production growth exceeds domestic consumption growth by 2-3 percentage points, headlines calling that ‘export strength’ are basically describing an oversupply problem with better PR language.”

Political-theater exports that shift with headlines. Deal announcements and tariff suspensions that show up right before elections or major summits. The late-2025 easing of certain China tariffs and framework language on dairy market access is a good example: some relief on paper, but clearly conditioned and reversible depending on broader trade negotiations. These can bump market sentiment or create a short-term sales pop, but they’re not something you build a 10-year expansion plan around.

The Math That Tells You If Export Growth Is Actually a Warning Sign

Production growth minus domestic consumption growth equals pounds that must be exported, whether or not world demand actually grew that much.

In 2025, U.S. milk output grew about 4% year-over-year in certain months, according to USDA Milk Production reports, while overall domestic demand only crawled up around 1-2% across fluid, cheese, butter, and yogurt categories. That left a couple of percentage points of total production with nowhere to go domestically, forcing it into export channels at whatever price cleared the market.

When you see that pattern, it’s a structural red flag. And prices behave accordingly.

Interest Rate Cuts: Timing Can Make Cheap Money a Weapon

The Federal Reserve lowered the federal funds rate to 4-4.25% through a series of cuts in late 2024 and 2025, as heifer costs tripled, components were repriced, and processors desperately needed a reliable milk supply.

Cheaper money can actually be a strategic weapon right now, but only if deployed in very specific, de-risked ways that align with the structural shifts already in motion.

Where Lower Rates Create Genuine Competitive Advantage

Financing competitive genetics, not raw cow numbers. If you’re on the wrong side of the new component economics—running below 3.3% protein with mediocre butterfat—the real lever is genetics improvement, not adding headcount. A multi-year program combining sexed semen, targeted culling, strategic purchasing, and genomic testing can easily land in the mid-six to low-seven figures over 5-7 years. With borrowing rates closer to 5% than 8%, the financing cost for that genetic improvement program drops meaningfully over the life of the investment, improving returns and shortening payback.

Processor-backed capital arrangements. Processors sitting on half-empty, multi-hundred-million-dollar plants are far more sensitive to utilization than you are to adding a few extra cows. Some are already offering volume incentives, multi-year price deals, and capital assistance for heifers, genetics, or equipment for their anchor milk suppliers. Their cost of capital is often lower than yours. If they can borrow in the 4-5% range and turn that into 7-9% plant-level returns by filling processing capacity, it makes sense for them to co-finance your replacements or automation at mid-5% interest, rather than you borrowing at 7-8% independently.

Automation in a structurally tight labor market. Labor is the one input category everyone agrees is structurally constrained and getting worse. In the Northeast, where labor costs already exceed $18-20 per hour and qualified milkers are nearly impossible to find, the automation ROI math shifted even more dramatically, as USDA farm labor reports consistently document. In the Southwest, where temperatures routinely exceed 100°F and dairy-qualified labor has migrated to higher-wage construction and energy sectors, the combination of climate-related worker stress and wage competition makes automation ROI even more compelling.

Robotic milking systems, automated feeding equipment, and similar technologies typically require investments of $200,000-$700,000, depending on herd size and configuration. At 8% many of those projects were borderline on return. Knock financing down into the 5% range and combine that with another 10-20% jump in prevailing wages for qualified dairy labor, and suddenly the payback math looks dramatically different.

Where lower rates don’t save you: Generic herd expansion without locked-in buyers and replacement heifer availability is still terrible math. Cheap debt financing on top of scarce replacements and volatile milk prices is just leveraged hope wearing a lower interest rate. The fundamentals have to work first—financing just makes good fundamentals better.

Trade Wars and Tariff Volatility: Structural Markets Versus Political Theater

Trade policy volatility creates real pricing swings that require protection protocols. Late 2025 tariff adjustments on certain dairy products, including whey and NFDM, provided export relief that helped prevent an even uglier milk surplus from hitting Class III pricing. But tariff swings—from roughly 20% to triple digits and back down, as happened with certain Chinese dairy tariffs through 2024-2025—proved these are political levers subject to rapid change, not stable market foundations you build expansion plans around.

Before you bet significant capital on trade-dependent growth, here are the questions worth asking:

Are U.S. prices at a premium to global benchmarks or a discount? If CME cheese, butter, and powder prices are consistently above New Zealand GDT auction equivalents or EU spot markets, the world is pulling on U.S. product due to quality, logistics, or a genuine shortage. If the U.S. is at parity or trading at a discount, we’re the cheap barrel dumping surplus, not the prized supplier.

If tariffs doubled tomorrow, would your export market still buy U.S. product? True structural markets, like Mexico, tend to retain a substantial U.S. share even amid friction due to geography, logistics, existing relationships, and structural deficits. Tariff-fragile commodity buyers like China for whey and NFDM often shift to whoever offers the lowest landed cost after tariffs.

Is your buyer growing exports on top of a healthy domestic business, or because domestic demand can’t absorb the milk? If it’s the latter, export growth is just the pressure relief valve of an oversupply machine, and prices will reflect that reality.

The 2026 USMCA review with Canada matters considerably in the medium run because Mexico is a more stable, higher-share destination for U.S. dairy exports than politically volatile markets in Asia. That doesn’t mean ignore Asia entirely—it means understand the difference between structural and opportunistic trade relationships.

New World Screwworm: Low-Probability, High-Consequence Wildcard

Since late 2024, New World Screwworm has advanced steadily north through Mexico. The critical moment came September 21, 2025, when an eight-month-old heifer in a certified feedlot at Sabinas Hidalgo, Nuevo León—less than 70 miles from the Texas border—tested positive for New World Screwworm, according to USDA APHIS emergency notifications.

USDA and Mexican agricultural authorities ramped up sterile-fly release programs, deployed trap grids with around 8,000 traps across key southern states, and conducted sample screening, analyzing over 13,000 samples through December with no U.S. detections confirmed, according to APHIS situation reports. New sterile-fly production infrastructure came online in Texas with a dispersal facility established in Tampico, Mexico.

What Happens If NWS Is Confirmed in a U.S. Commercial Herd

What makes this worth watching closely is how fast the operational landscape changes if—and it’s still an if at this point—NWS gets confirmed in a U.S. commercial herd.

In the first 72 hours after lab confirmation, emergency notifications go out, and markets don’t wait for full epidemiology reports. Local auctions and feedlots stop accepting cattle from the suspect region immediately. Buyers step back or apply steep discounts to anything from the affected area, anticipating movement restrictions. Feeder cattle prices in the affected zone gap sharply lower.

Within a week or two: APHIS would define quarantine zones with specific geographic boundaries, restrict livestock movement out of those designated areas, and ramp up mandatory inspections and surveillance protocols. That effectively freezes cattle as collateral, snarls normal feedlot marketing flows, and triggers immediate red flags in packers’ and agricultural lenders’ risk management systems.

For integrated dairy-plus-beef-calf operations: Any beef-on-dairy calves in feedlots within or near quarantine boundaries can’t be moved as originally planned. Feed costs keep accruing daily. New calves may suddenly have nowhere to go without accepting a massive price haircut or waiting months for marketing. The same beef-on-dairy income stream that’s been a profit engine for three years can flip into a cash-flow risk almost overnight.

Practical Risk Management Moves Worth Considering

Map where your cull cows and beef-on-dairy calves typically go, and identify alternative marketing outlets genuinely outside likely quarantine radiuses if southern border states face restrictions. Producers in affected regions report developing contingency marketing plans with feedlots and buyers in neighboring states—not because they expect the worst, but because the cost of planning is minimal compared to scrambling during a crisis.

Stress-test operating cash flow assuming a 60-90 day period where beef-calf revenue is sharply reduced, delayed, or requires expensive transportation to alternative markets. Talk to lenders now about how an NWS-driven cattle movement disruption would affect loan covenants and whether pre-agreed covenant flexibility or temporary relief is possible before you need it.

Consider quietly trimming beef-on-dairy exposure slightly and modestly building dairy replacement capacity and cash reserves heading into the higher-risk spring and summer 2026 window. This isn’t about panic—it’s about building operational flexibility that serves you well regardless of whether NWS crosses the border or stays contained in Mexico.

Unlike the heifer shortage or FMMO component changes, this one doesn’t respect careful planning horizons. Once NWS crosses into established U.S. herds and gets a foothold, the first 30-60 days are about damage control and operational paralysis, not optimization and strategic positioning.

Farm Bill Extensions and Baseline Program Stability

Farm bill extensions throughout 2025 maintained operational stability through renewal of the DMC program, continuation of conservation program funding, and sustained support for Market Access Program trade promotion activities, according to Congressional appropriations language and USDA announcements.

The extensions provided operational certainty amid ongoing political gridlock on comprehensive farm policy reform, keeping baseline safety net programs intact while longer-term policy debates and structural reform discussions continue into 2026.

For producers, this means the safety net remains in place and predictable, but it also means the deeper structural challenges the industry faces—consolidation pressure, component economics, global competition, labor constraints—won’t be addressed through major policy overhauls in the near term. The strategic focus shifts to optimizing within the existing policy framework rather than waiting for Washington to solve fundamental competitive challenges through legislation. That’s not cynicism—it’s realism based on how policy actually develops in divided political environments.

HPAI Surveillance Through National Milk Testing

Ongoing surveillance of highly pathogenic avian influenza through the National Milk Testing Strategy implemented by USDA APHIS aimed to mitigate risks to dairy cattle and milk supply integrity. With most states participating in routine milk-testing protocols and a new H5N1 genotype highlighting ongoing wild-bird spillover dynamics, HPAI remains something to manage actively through biosecurity, not to center long-term strategy around.

Confirmed herd impacts through late 2025 were confined to a limited number of states—primarily California, Colorado, and Michigan—with manageable mortality rates in most affected herds, according to APHIS weekly situation reports. Maintain rigorous biosecurity protocols, including visitor controls, equipment sanitation, and active wildlife management around feed storage and water sources. But outside recognized hot-spot regions, this is operational hygiene and risk mitigation, not a fundamental competitive differentiator or strategic constraint.

The key distinction worth making: HPAI requires attention and good biosecurity practices, but it doesn’t fundamentally reshape competitive positioning the way component pricing or heifer availability does. Treat it seriously without letting it dominate strategic planning.

Whole Milk in Schools: Cultural Win, Minimal Cash Impact

The Whole Milk for Healthy Kids Act gained strong bipartisan support throughout 2025, with the Senate approving the bill and sending it to the House for consideration, according to Congressional records. The legislation would allow flavored whole milk and unflavored low-fat milk back into school nutrition programs after years of restrictions.

School milk accounts for only about 8% of total U.S. fluid milk demand, according to USDA consumption data, and one policy change won’t reverse more than a decade of structural decline in fluid consumption by itself. It’s a meaningful cultural and political win that reinforces the broader shift toward full-fat dairy products and could provide modest long-term demand support, particularly for younger consumers forming preferences. But it won’t materially move your 2026 milk check.

Pay closer attention to sustained growth areas like cottage cheese—which saw double-digit percentage growth throughout 2024-2025, according to USDA dairy products reports—and the high-protein and Greek yogurt categories, which are driving more substantial incremental volume than school milk policy shifts will deliver. Those categories matter because they’re pulling volume based on shifts in consumer demand, not policy adjustments.

The One Constraint You Cannot Afford to Get Wrong

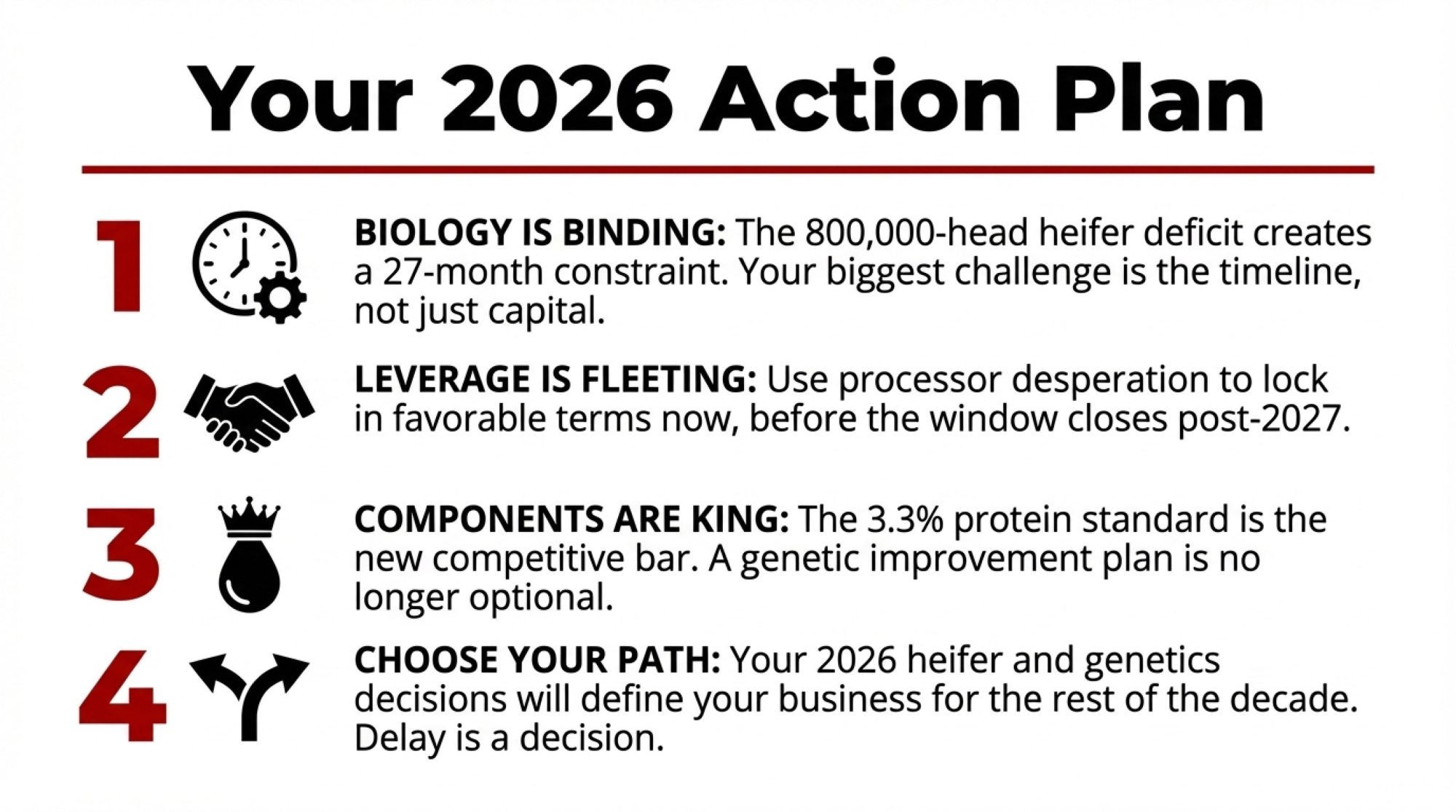

Out of everything that happened in 2025, replacement heifers represent the binding biological constraint. Every other structural force you’re dealing with—biological lag from beef-on-dairy breeding, component repricing through FMMO changes, overbuilt processing capacity, trade volatility, interest rate shifts—ultimately hits the wall of replacement heifer availability and cost.

CoBank and other agricultural lenders expect U.S. dairy heifer inventories to stay at 20-year lows and shrink further before rebounding after 2027, with the national replacement deficit measured in the hundreds of thousands of head. At current pricing levels, expansion shifts from a barn-and-bank problem to a biology-and-capital-allocation problem.

The Real Strategic Fork in the Road

Most people think the decision is breed versus buy. The actual fork is whether heifer supply normalizes—prices drop meaningfully, availability improves—by around 2027-28 as CoBank projects, or whether supply stays structurally tight and constrained well into 2029-30 if breeding behavior doesn’t shift fast enough or if beef-on-dairy economics stay attractive enough to slow the return to dairy replacements.

If scarcity lasts longer than expected and you didn’t move proactively in 2026, you’re 18-24 months behind neighbors who locked in genetics programs, secured heifer supply agreements, and negotiated processor partnership deals early. If supply unexpectedly normalizes faster and you did invest heavily in a robust internal heifer development program, you’re still positioned well: you’ve got home-grown, high-component replacements at a production cost far below whatever the new market-clearing price settles at.

Both scenarios reward proactive planning. The risk lies in waiting to see what happens.

Three Real Strategic Paths Forward

Internal rebuild: slow, capital-intensive, operationally independent. Stop counting on the open market for replacements and rebuilds; build sufficiency from within your own genetics. Slash beef-on-dairy usage to the bare minimum—reserve it only for the bottom 10-15% you’re actively purging. Use sexed dairy semen on the top tier of the herd and conventional dairy on the middle tier. Accept a few challenging years of higher rearing costs and lost beef-calf revenue while you rebuild your own replacement pipeline from the ground up.

This path takes the longest but gives you complete control and insulates you from market price volatility. Producers who began this transition in early 2025 have described the approach as an expensive insurance policy against future supply constraints. That captures it well.

Processor-financed growth: faster, relationship-dependent, shared risk. Lean directly into the capital mismatch that’s driving processor behavior. Approach your buyer with hard numbers: your current volume, component profile, and realistic growth potential over 24-36 months. In exchange for a firm multi-year volume commitment with delivery guarantees, negotiate a base price and component premium structure locked through at least 2028, cost-sharing or direct co-financing on replacement heifers, and potentially financial assistance on automation or facility upgrades that directly support the additional volume they need.

This path is faster but requires trust, transparency, and a processor genuinely desperate for a reliable milk supply. Not every processor relationship supports this approach, but for those that do, the economics can be compelling.

Hybrid approach: flexible, moderate growth trajectory. Split the difference strategically. Dial back beef-on-dairy usage significantly, but don’t eliminate it entirely—maintain maybe 15-20% beef breeding to generate some beef-calf income and purge your weakest genetics. Grow internal replacements to cover baseline needs. Use selective external heifer purchases, ideally with some processor financial assistance or partnership, to avoid herd shrinkage or to add modest 10-15% growth capacity.

Aim for controlled expansion and steady genetic improvement rather than a dramatic step-change in herd size. This balances flexibility with progress and suits operations that value optionality.

“By 2028, the difference between operationally competitive and planning an exit will trace back to a set of heifer and genetics decisions you either made deliberately in 2026, or let the market make for you by default.”

The Window for Strategic Action Is Shorter Than It Appears

Your leverage with processors is real right now, but it isn’t permanent. Processing capacity will eventually fill as replacement inventories rebuild and milk supply catches up to the $11 billion of new stainless steel that came online in 2025. Between now and late 2027 or 2028, producers who genuinely understand the mismatch—capital deployed on growth assumptions that biology is delayed by 30+ months—have a once-in-a-cycle opportunity to lock in better premiums, real partnership structures, and multi-year agreements that still look attractive when the leverage pendulum inevitably swings back toward processors.

The biology is the biology. The only variable is how you respond to it.

Key Takeaways:

- Biology dictates timing: An 800,000-head heifer deficit creates a 27-month expansion constraint through late 2027 that capital can’t override—breeding decisions made in 2022-2023 are binding today’s strategic options, regardless of farm size or financial strength

- Leverage window is narrow: $11 billion in new processing capacity collided with biology-capped milk supply, creating temporary negotiating power for reliable producers to lock better premiums, multi-year contracts, and processor-backed financing before leverage evaporates in 2027-2028

- Component standards reset competition: FMMO protein requirements rose to 3.3%, creating permanent $1+ per hundredweight advantages for high-component herds—but genetic improvement takes 4-6 years, making 2026 breeding decisions critical for competitive positioning through 2030

- Multiple strategic paths work: Three approaches suit different operational realities—internal genetic rebuilds (independent, slower), processor-financed growth (faster, relationship-dependent), or hybrid strategies—each with distinct capital requirements, timelines, and risk profiles

- Act while forces align: Ten interconnected developments—heifer shortage, processor overcapacity, component repricing, trade volatility, and more—temporarily favor proactive producers, but the strategic window closes as heifer inventories normalize after 2027 and 2026 decisions determine positioning through 2028

Executive Summary:

Ten interconnected forces reshaped dairy’s competitive landscape in 2025—from the 800,000-head heifer deficit locked in by beef-on-dairy breeding to $11 billion in processing capacity that came online just as biology capped supply growth. The collision created temporary producer leverage with desperate processors, permanent component repricing through FMMO changes to 3.3% protein, and widening performance spreads exceeding $1 per hundredweight. These forces simultaneously redefined expansion math, genetics timelines, processor negotiations, and risk management. The strategic window to capitalize on leverage, rebuild genetics, and lock multi-year terms closes after 2027 as heifer inventories recover. This year-in-review connects all ten forces, maps three pathways for different operational realities (internal rebuilds, processor-financed growth, hybrid approaches), and provides decision frameworks for the narrow action window ahead.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The $4,000 Heifer: Seven Strategies to Navigate the New Dairy Economy – Delivers seven immediate financial and operational defenses against rising replacement costs, offering specific input cost adjustments and partnership models to mitigate the 27-month biological lag described in the main analysis.

- Your 0.77 Ratio Is Wrong: The $67,500 Component Fix That Can’t Wait Until 2028 – Breaks down the math behind the new component pricing reality, demonstrating how a 0.03 shift in protein-to-fat ratios can recover over $67,000 annually for mid-sized herds under the updated FMMO standards.

- The Tech Reality Check: Why Smart Dairy Operations Are Winning While Others Struggle – Challenges standard automation sales pitches with data showing the actual 3.8-to-5-year ROI timeline, helping producers align capital investments with the new interest rate environment and labor constraints.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!