1,857 microplastic particles per kg in your premium cheese—here’s what that means for milk prices

EXECUTIVE SUMMARY: Look, I’ll be straight with you—this isn’t just a processor problem anymore. Microplastics are concentrating in cheese at levels that could impact the premiums you’re getting for high-quality milk. We’re talking about 1,857 particles per kilogram in aged cheeses, and with 80% of consumers willing to pay more for sustainably produced products, processors are scrambling to clean up their act. Here’s what really matters for your operation: plants that can’t control contamination are going to start paying less for milk, while those investing in advanced filtration are positioning themselves to pay premiums for clean product. With Class III at $18.82 per hundredweight and feed costs finally easing, this could be the quality differentiator that separates the top-tier milk contracts from the rest. The technology exists, the regulations are coming, and the early adopters are already seeing payback periods of 18-36 months. You should be asking your processor what they’re doing about this—because it’s about to affect your milk check.

KEY TAKEAWAYS

- Premium Protection Play: Processors with contamination control pay 5-8% premiums above base price—audit your current contracts and push for quality-based incentives that reward clean production practices at the farm level

- Feed System Audit: Check all plastic components in your feed handling system (TMR mixers, conveyors, storage) for wear patterns—replacing worn plastic parts now could prevent contamination that processors will start testing for by 2026

- Milk House Upgrade: Invest in stainless steel or glass-lined equipment where possible—facilities using advanced filtration report 95% contamination reduction, and those cost savings get passed back through higher milk prices

- Contract Leverage: With new EU regulations driving global standards, farms supplying export-focused processors could see 10-15% premium increases—position yourself now by documenting your contamination control measures

- Technology Partnership: Work with processors investing in real-time monitoring systems like PlasticNet—these partnerships often include guaranteed minimum prices that protect against market volatility while Class III prices stabilize

You know what’s been keeping me up at night lately? It’s not feed costs or milk prices, though those are always fun conversations. It’s the fact that we’re finding microplastics in our cheese. And I’m not talking about trace amounts that require a PhD in chemistry to detect. We’re talking about numbers that make you sit up and take notice.

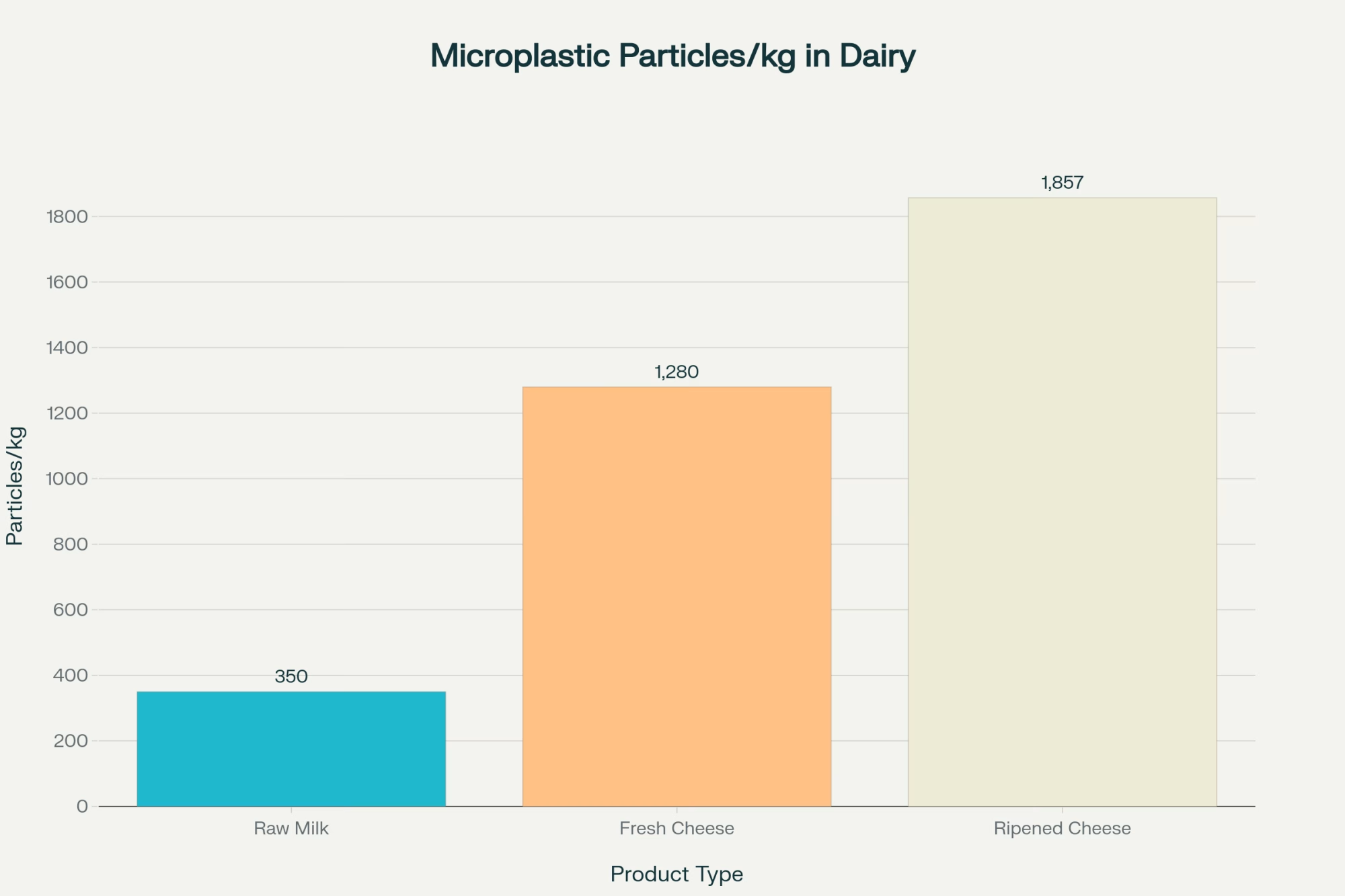

Recent research from Italy and Ireland has just released data that’s got the entire processing side of our industry buzzing: ripened cheeses are showing up with nearly 1,857 microplastic particles per kilogram. That’s not a typo—and it’s just the beginning of what we need to understand.

The thing about microplastics in dairy? They’re not just settling on surfaces like dust. Our own cheese-making processes are concentrating on them. When we drain whey—something we’ve been doing forever—you’d think those tiny plastic particles would wash away with the liquid. Instead, they’re binding with the curd solids, creating what I call a “concentration trap.” Fresh cheese hits around 1,280 particles per kilogram, while raw milk starts at about 350 particles per kilogram. What’s particularly fascinating is how this affects different products. High-butterfat items, such as aged cheddars and specialty cheeses—the ones that command premium prices—are showing the highest contamination levels. It’s like the microplastics have an affinity for the very products we’re trying to position as premium in the marketplace.

Where This Gets Real for Your Operation

Let’s talk business impact, because that’s what matters when you’re running a plant. According to recent work from PwC, approximately 80% of consumers are willing to pay more for sustainably produced goods, despite inflation impacting household budgets. That’s not just a nice-to-have statistic; it’s a market signal we can’t ignore.

I was talking to a plant manager in Wisconsin last month (can’t name names, but it’s a mid-sized operation processing about 2.8 million pounds of milk annually), and he told me something that stuck: “We spent twenty years perfecting our aging process, and now we’re discovering we might be concentrating contaminants right along with flavor compounds.”

Here’s what’s happening in our plants every day. Mechanical wear on plastic liners, seals, and films creates microscopic debris. Heat from pasteurization—especially the extended holding times we use for some specialty products—accelerates plastic degradation. Then there’s airborne contamination settling on exposed products, particularly in facilities where air filtration systems haven’t been updated in the last five years.

The FAO’s Food Safety Division has been documenting this across multiple regions, and what they’re finding aligns with reports I’m getting from colleagues in the Midwest, California’s Central Valley, and even operations in Vermont. It’s not isolated to a single region or type of facility.

The Technology Response: What’s Actually Working

Advanced Filtration Gets Real

Here’s where things get interesting—and expensive. Advanced filtration is no longer just a theory. I’ve seen plants achieve better than 95% microplastic removal using properly configured microfiltration, ultrafiltration, and reverse osmosis systems. The key phrase there is “properly configured.” You can’t just bolt on a filter and expect miracles.

A facility in New York, where I consulted last year, invested in bio-based filtration using chitosan and alginate beads. They’re seeing selective microplastic capture rates that honestly surprised me—around 87% removal for particles in the 50-150 micron range, according to research published in International Publications. The interesting part? Their product quality metrics actually improved because they were removing other contaminants simultaneously.

The Promise of Bio-Based Media

Bio-based filtration materials, such as chitosan and alginate, are gaining significant traction due to their ability to capture microplastics selectively. What’s exciting is that these materials offer a natural and sustainable approach to contamination control—something that resonates with both processors and consumers who are increasingly conscious of environmental impact.

AI Detection Changes the Game

PlasticNet and similar systems are reducing lab identification time from 4-6 hours to approximately 20 minutes, with accuracy rates exceeding 95%. Real-time monitoring during processing is becoming a reality, not just a concept from trade show demos.

But let’s be honest about the investment. Industry consensus suggests payback periods range from 18 to 36 months, depending on your scale and current contamination levels. That plant in Wisconsin? They spent six months just deciding whether to retrofit existing lines or build new ones. It’s not a decision you make over coffee.

Regulatory Reality: EU vs. US Approaches

What’s creating urgency is the regulatory landscape, and it’s developing differently on both sides of the Atlantic. The EU took the lead with Regulation 2023/2055, establishing strict limits on synthetic polymer microparticles across various industries. Phase-in periods vary by product category, but the direction is clear: intentionally added microplastics are getting banned, and contamination thresholds are getting tighter.

The US approach is more measured but equally inevitable. The FDA’s current position is that existing contamination levels don’t demonstrate health risks, but they’re quietly building enforcement frameworks. What’s telling is their recent guidance suggesting that environmental contamination—not packaging migration—is the primary source of microplastics in food. That puts the focus directly on processing environments and equipment.

For operations with international markets, the smart play is to align with EU standards now. Managing multiple compliance frameworks can become expensive quickly, and the EU requirements are likely to become the global baseline anyway.

Financial Reality: Making the Numbers Work

Class III milk prices hit $18.82 per hundredweight in June 2025—not spectacular, but stable enough to support capital investment planning. Feed costs are projected to ease with record corn crops, but here’s the thing: contamination control is becoming as fundamental as temperature control or sanitation protocols.

I’ve been tracking implementation costs across different facility sizes, and the numbers are starting to make sense. The key is understanding that this isn’t just about compliance—it’s about protecting the brand trust and product quality we’ve all worked so hard to build.

What’s Working in the Field

The most successful implementations I’ve seen share common elements. They start with comprehensive audits of plastic contact points—not just the obvious ones, but also everything from milk lines to packaging equipment. One facility discovered that its biggest contamination source was worn conveyor belt components that hadn’t been replaced in eight years.

Rather than trying to upgrade everything at once, successful operations prioritize based on contamination risk and available capital. Most start with high-risk areas, such as aging rooms, cutting equipment, and packaging lines. The key is systematic implementation, not a dramatic overhaul.

Staff training is crucial. The facilities that achieve the best results invest heavily in training their teams to identify contamination sources and properly maintain new equipment. It’s not just about installing technology; it’s about changing how we think about plastic in our operations.

Regional Variations: What I’m Seeing Across Different Markets

What’s interesting is how this challenge manifests differently across regions. California operations dealing with drought conditions are experiencing higher contamination rates, possibly due to more aggressive water recycling. Midwest facilities with older infrastructure are encountering more wear-related contamination. Northeast operations focusing on artisanal products are discovering that traditional aging methods need to be updated for modern contamination realities.

The regulatory response varies, too. Some state agencies are already requiring contamination monitoring, while others are taking a wait-and-see approach. Vermont’s Agency of Agriculture has been particularly proactive, while regulations in other states lag behind market demands.

The Bottom Line: Where We Go from Here

Look, microplastic contamination isn’t some theoretical future problem. It’s currently affecting product integrity and potentially damaging brand trust. The solutions exist, the technology works, and the business case is getting stronger every quarter.

If you haven’t already, start with a comprehensive audit of plastic contact points throughout your processing lines. You’ll probably find more than you expect. Then take a hard look at your current filtration and detection capabilities. Are they adequate for what we’re dealing with now, or are you still operating with yesterday’s standards?

Develop a phased implementation plan that strikes a balance between investment and operational realities. Prioritize the highest-risk contamination points first, and build from there. The processors who are getting ahead of this curve are positioning themselves for long-term competitive advantage.

This isn’t going away. Managing microplastics effectively is becoming as fundamental to quality assurance as managing any other contamination risk. The question isn’t whether you’ll need to address this—it’s whether you’ll lead or follow.

Your move.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Dairy Farms’ Hidden Problem: The Alarming Truth About Plastic Waste – Practical strategies for auditing feed-bag wrap, silage film and liner use; demonstrates how small tweaks in disposal and recycling cut on-farm waste bills by up to 30% while reducing contamination risk.

- Why Sustainable Packaging Is Becoming a Profit Center for Progressive Dairies – Reveals methods for turning greener packaging into premium-price contracts and export access; connects consumer trends to future milk-price bonuses so you can position ahead of 2025 market mandates.

- Smart Sensors and Bio-Based Filters: The Next Wave of Dairy Plant Innovation – Shows how cutting-edge detection tech and renewable filtration media slash microplastic loads by 90%+; outlines ROI models and early-adopter case studies to future-proof your processing partnerships.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!