What if I told you there’s tech that cuts energy costs 90% while boosting milk quality? Would you believe it… or call me crazy?

EXECUTIVE SUMMARY: Listen, I’ve seen a lot of dairy “innovations” come and go, but this UV pasteurization thing? It’s the real deal. The FDA just approved the first alternative to heat treatment in 150 years—and it’s going to make early adopters rich while everyone else scrambles to catch up. We’re talking about 60-90% energy savings (that’s $60,000+ annually for mid-sized operations) plus a shelf life that increases from 14 days to 60 days.Here’s what’s got me fired up—this tech preserves all those bioactive compounds that heat destroys, opening up premium markets that pay 25-40% more than commodity pricing. With corn still trading at around $4 per bushel and energy costs eroding everyone’s margins, processors across Europe and North America are already positioning themselves for 2027, when liquid milk applications are expected to be approved. You need to start planning now, because the early movers are going to capture advantages that’ll last for decades.

KEY TAKEAWAYS

- Slash your energy bills by 60-90% starting next year. Initial UV systems cost $10,000-15,000 for smaller operations, with 3-5 year payback periods. With today’s energy costs, the ROI calculation improves every month you wait.

- Triple your shelf life and double your distribution reach — Extending from 14 to 60 days means you can serve markets 200+ miles away profitably. Start building relationships with premium buyers in major metropolitan areas who will pay extra for minimally processed milk.

- Capture 25-40% premiums in functional food markets immediately — Sports nutrition and health-conscious consumers are already paying more for UV-treated proteins that maintain immune-boosting compounds. Contact specialty food distributors now to position your operation.

- Build competitive moats before 2027 liquid milk approval — Dual-track processing (thermal for commodity, UV for premium) lets you test markets and refine operations while competitors’ debate whether to invest. The window for pioneer advantages is closing fast.

- Hedge against commodity price volatility with value-added positioning — When milk prices tank, premium products with extended shelf life and proven health benefits maintain margins. This tech transforms you from a price-taker to a price-maker in your local market.

Look, I’ve been watching dairy tech for decades, and most of the time these “breakthrough” announcements turn out to be more marketing fluff than substance. But what happened with UV pasteurization this June? This is different. This is the kind of shift that will separate the farms still operating in 2035 from those that sell out to developers.

The FDA just approved something that… well, honestly, I wasn’t sure we’d see it happen this fast. A genuine alternative to heat pasteurization that actually works. We’re talking about UV light treatment that kills pathogens while keeping all the bioactive compounds that make milk nutritious. This isn’t just another piece of equipment you bolt onto your existing setup—this is the first fundamentally different approach to milk safety since before your great-great-grandfather was milking by hand.

What Actually Happened (And Why the Smart Money is Already Moving)

The thing about regulatory breakthroughs is they don’t happen overnight. Tamarack Biotics spent years proving their TruActive® UV light treatment could meet the FDA’s official pasteurization standards. That’s not a small investment—we’re talking about the kind of persistence that either makes companies rich or breaks them completely.

Bob Comstock, Tamarack’s CEO, put it pretty bluntly: “Safe treatment of milk hasn’t fundamentally changed in over 150 years… Our UV process actually achieves a greater level of safety than thermal pasteurization”. Bold claim, right? But here’s the thing—the data from their UC Davis trials seems to back it up.

What strikes me about this development is how perfectly it fits with what we’re seeing across the industry right now. Energy costs are crushing margins, consumers want cleaner labels, and producers are desperate for anything that gives them an edge. The timing couldn’t be better, honestly. With corn futures still bouncing around that $4 mark and energy costs making even the big Wisconsin co-ops sweat, this technology might just be the lifeline some operations need.

The FDA approval initially covers powdered dairy ingredients, including whey protein concentrate, milk protein concentrate, and lactoferrin. However, here’s where it gets interesting: they’re already expanding into other products, such as cheese, yogurt, and kefir, with liquid milk applications potentially arriving as early as 2027.

The Numbers That Should Make You Rethink Your Energy Strategy

Let’s talk real economics here, because that’s what matters when you’re trying to keep your operation profitable. The energy savings alone are compelling. UV pasteurization can cut energy consumption by 60-90% compared to traditional thermal processing.

I’ve been following what Lyras is doing up in Denmark with their “raslysation” technology—interesting name, by the way. Their systems are showing 60-80% water savings and 60-90% energy reductions. For a facility processing significant volumes, we’re talking about real money.

Here’s where it gets really interesting, though… the shelf life extension. UV treatment can extend refrigerated shelf life significantly beyond the typical 14-day window. Think about what that means for your operation. If you’re running a 1,000-head dairy in Wisconsin where energy costs are eating everyone’s lunch, or out in California where PG&E rates are… well, let’s just say they’re not farmer-friendly… suddenly you’ve got breathing room. Both operationally and financially.

For producers considering premium positioning, there’s another angle that has me excited. UV processing maintains enzymes, proteins, and immunity-supporting compounds that heat destroys. We’re referring to functional food markets that command significant premiums over commodity milk.

The Science That’s Actually Pretty Elegant

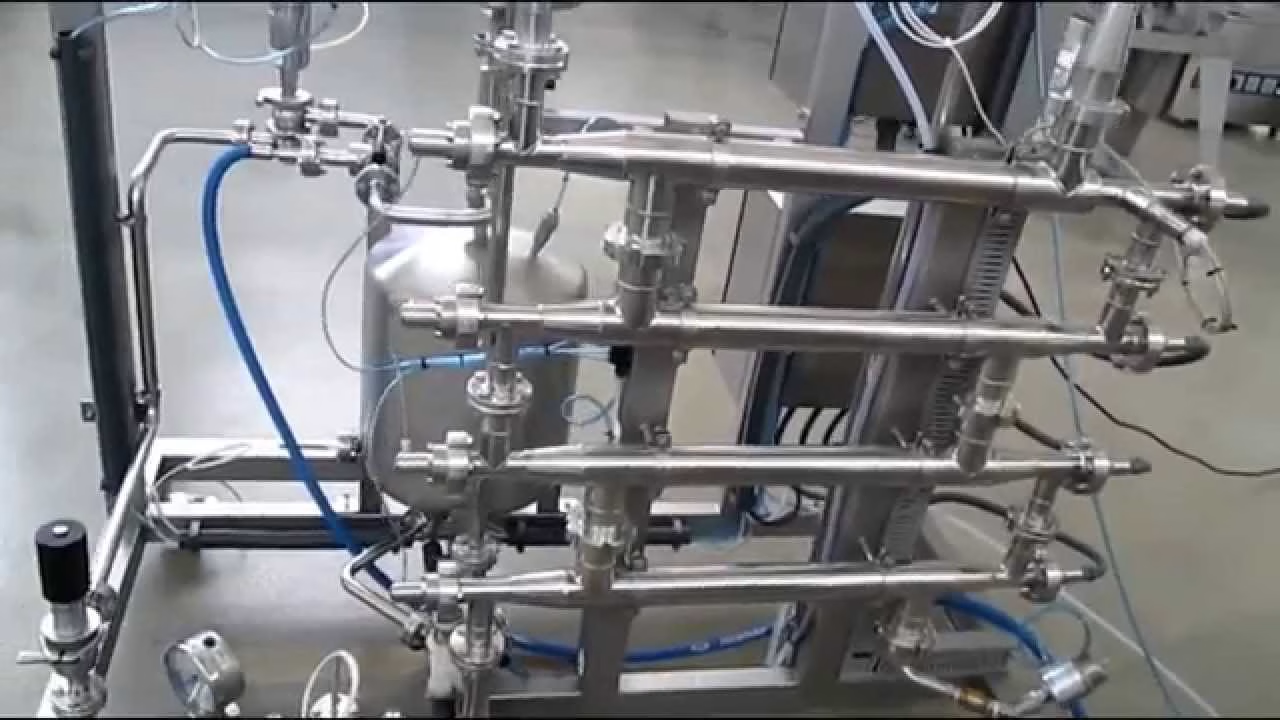

The thing about UV pasteurization is… it’s almost embarrassingly simple compared to what we’ve been doing for generations. You take milk, create a thin film, and expose it to specific wavelengths of ultraviolet light. No complex heat exchangers, no holding tubes, no thermal stress beating up your product.

What’s particularly noteworthy is how it preserves the bioactive compounds. University of California, Davis, clinical trials showed that UV-treated dairy proteins more than doubled antibody development in response to vaccines, while pasteurized products increased it by only 17%. That’s not just marketing talk—that’s a measurable improvement in immune function.

The technology works by using UV light to alter the DNA of microorganisms, preventing them from reproducing. The innovative part is getting the light to penetrate opaque liquids like milk, which normally only allows UV penetration about 0.1 millimeters deep. That’s where the engineering gets interesting.

The Implementation Reality Check

Here’s where I need to be straight with you—and this is based on conversations I’ve had with processors who are actually looking at implementing this technology. It’s not a plug-and-play solution. The infrastructure changes are real.

You need different quality control protocols, modified packaging systems, and staff training on validation procedures that are completely different from thermal methods. The learning curve is steep, and with today’s labor market… well, finding people who can master new validation procedures isn’t trivial.

What’s interesting is the psychological hurdle. Some processors are genuinely worried about consumer reaction to “non-pasteurized” labeling, even though the safety profile appears superior. There’s a peculiar disconnect where heat pasteurization feels “proven” even when the data show that UV treatment is more effective.

I talked to Jake Morrison—he runs processing for a mid-sized Wisconsin co-op—and he laid out the reality: “The payback period looks good on paper, 3-5 years depending on energy costs and whether you can capture premium pricing. But that assumes everything goes according to plan during the transition.”

Here’s what that means practically. Equipment manufacturers are still scaling up production capacity. Installation and service networks are limited. Training programs for technicians are just getting developed. If you’re going to be an early adopter, you need to plan for some growing pains.

The Decision Framework That Actually Makes Sense

What’s happening in California is different from what’s happening in Wisconsin, which is different from what’s happening in Texas. Energy costs, regulatory environments, market access—it all varies. Let me break down how different operations should approach this.

If you’re running a smaller operation (under 500 cows), The economics look different. Initial investment might make sense if you’re targeting direct-to-consumer or local premium markets. I know a couple of Vermont producers who are seriously considering UV systems specifically for their farm stores and local restaurant accounts. The math works when you’re capturing full retail margins.

Mid-size operations (500-2,000 cows): You’re in the sweet spot for dual-track implementation. Maintain thermal processing for commodity milk while building UV capacity for premium products. This is where Wisconsin and Pennsylvania producers have a real advantage—they’re close enough to population centers to capture premium pricing, yet large enough to justify the necessary infrastructure investment.

The big players (2,000+ cows): They’re thinking about this differently. UV processing becomes a strategic hedge against energy costs and a means to access premium markets that were previously unattainable. But they’re also the ones most concerned about stranded assets and regulatory risk.

The decision isn’t just about the technology—it’s about where you want to position your operation in the market five years from now.

Regional Realities You Can’t Ignore

California producers are dealing with energy costs that make UV technology attractive even without premium pricing. Plus, they’re closer to the functional food manufacturers who are willing to pay premiums for UV-treated ingredients. The regulatory environment is also more favorable for innovation.

Wisconsin producers have different math. Their energy costs aren’t as brutal, but they’ve got better access to cheese-making markets where some of the bioactive compounds preserved by UV processing could command premiums. The co-op structure also means they can pool resources for technology investments.

Texas producers? They’re looking at this through the lens of operational efficiency and export potential. The extended shelf life could be a game-changer for export markets, especially with the growing demand for American dairy products in Asia.

What’s fascinating is how the West Coast guys are approaching this differently. They’re not trying to retrofit their entire operation—they’re building parallel processing capabilities. Smart strategy, actually.

The Competitive Landscape That’s Getting Interesting

The thing about disruptive technology is that it makes established players nervous. Equipment manufacturers who’ve built entire businesses around thermal processing infrastructure are suddenly facing potential obsolescence. Some are pivoting hard into UV technology, others are doubling down on thermal efficiency improvements.

Large dairy cooperatives aren’t exactly thrilled either. When you’ve got massive investments in thermal infrastructure, UV adoption could significantly impact asset values. I had a conversation with a facilities manager at a major Midwest co-op (who asked me not to use his name), and he was pretty frank: “We’re looking at stranded assets if this technology scales as fast as some people think it will.”

However, what’s fascinating is that early adopters are already positioning themselves strategically. The regulatory landscape gives North American producers a significant advantage. European markets require additional approvals for novel foods, and other regions have their own regulatory hurdles.

This fits into a broader pattern I’ve been noticing. The dairy industry is fragmenting into two camps: innovators who are investing in new technology and market positioning, and traditionalists who are betting on operational efficiency and scale economics. UV pasteurization is becoming a dividing line.

Risk Assessment That You Actually Need to Consider

Let’s talk about what could go wrong, because that’s what smart operators think about. Equipment failure during peak production periods. Regulatory changes that affect approval status. Consumer acceptance issues. Market volatility is affecting premium pricing.

The biggest risk isn’t technical—it’s market timing. If you invest too early, you’re paying pioneer premiums. If you wait too long, you miss the competitive advantage window.

Here’s my take on risk mitigation. Start with a smaller-scale implementation. Test market response with limited product lines. Build relationships with UV equipment manufacturers who have strong service networks. And most importantly, don’t bet the farm on any single technology transition.

The smart money is building optionality. Maintaining thermal processing capability while developing UV capacity. That’s not just risk management—that’s strategic positioning.

The Timeline That Actually Matters

The rollout is going to follow a predictable pattern. Tamarack’s roadmap has liquid milk applications targeted for 2027, but the ingredient applications are happening right now. Sports nutrition companies are already incorporating UV-treated proteins into their products.

Here’s what I’m seeing from the early adopters. They’re not trying to revolutionize their entire operation overnight. They’re building parallel processing capabilities, testing market response, and refining their operations. By the time liquid milk applications get FDA approval, they’ll have years of experience with the technology.

Agricultural lenders are starting to recognize UV technology as a legitimate capital investment. The energy savings alone can justify financing in many cases, especially with current commodity price volatility and interest rate environments.

What This Really Means for Your Operation

Look, the dairy industry doesn’t change often. When it does, early movers typically establish positions that last for decades. UV pasteurization represents that kind of opportunity, but it’s not for everyone.

If you’re risk-averse, close to retirement, or struggling with cash flow, this technology probably isn’t for you right now. However, if you’re considering the next 10-15 years, if you’re seeking ways to differentiate your operation, or if you’re concerned about energy costs and interested in premium markets, then you need to start paying attention.

The question isn’t whether this technology will succeed. The question is whether you’ll be ready when it does. Based on what I’m seeing from the early adopters, the processors that move first are going to capture advantages that their competitors won’t be able to match.

The 150-year era of thermal processing is coming to an end. The only question is whether you’re going to be part of what comes next, or watch from the sidelines, wondering what happened to your competitive position.

Here’s my advice: start the conversation now. Discuss capital availability with your lender. Research equipment manufacturers and service networks. Most importantly, start thinking about how UV processing fits into your five-year business plan. Whether you adopt this technology or not, it will affect your market position.

The dairy industry is about to get a lot more interesting. Make sure you’re positioned to take advantage of it.

Disclosure: The author has no financial interest in any of the companies mentioned in this article. All information is based on publicly available sources and industry analysis.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Biosecurity Gaps in Dairy Operations – Reveals practical strategies for implementing UV-treated milk line filters and cost-effective biosecurity protocols that achieve 99.9% viral reduction while protecting your operation from disease outbreaks.

- Global Weekly Dairy Market Recap: Production Surges, Trade Tensions, and Consumer Shifts – Demonstrates how current market dynamics, including $23.05/cwt milk prices and growing functional dairy demand, create the perfect environment for premium positioning through innovative processing technologies.

- Dairy’s Bold New Frontier: How Forward-Thinking Producers Are Redefining the Industry – Explores how two-thirds of progressive dairies integrate advanced technologies with revenue diversification strategies, providing a roadmap for positioning your operation as an industry leader through innovation adoption.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!