A data center uses 2,000MW. Your dairy uses 0.5MW. When they move in, your costs jump 40%. You have 18 months to pick: Scale, pivot, or sell.

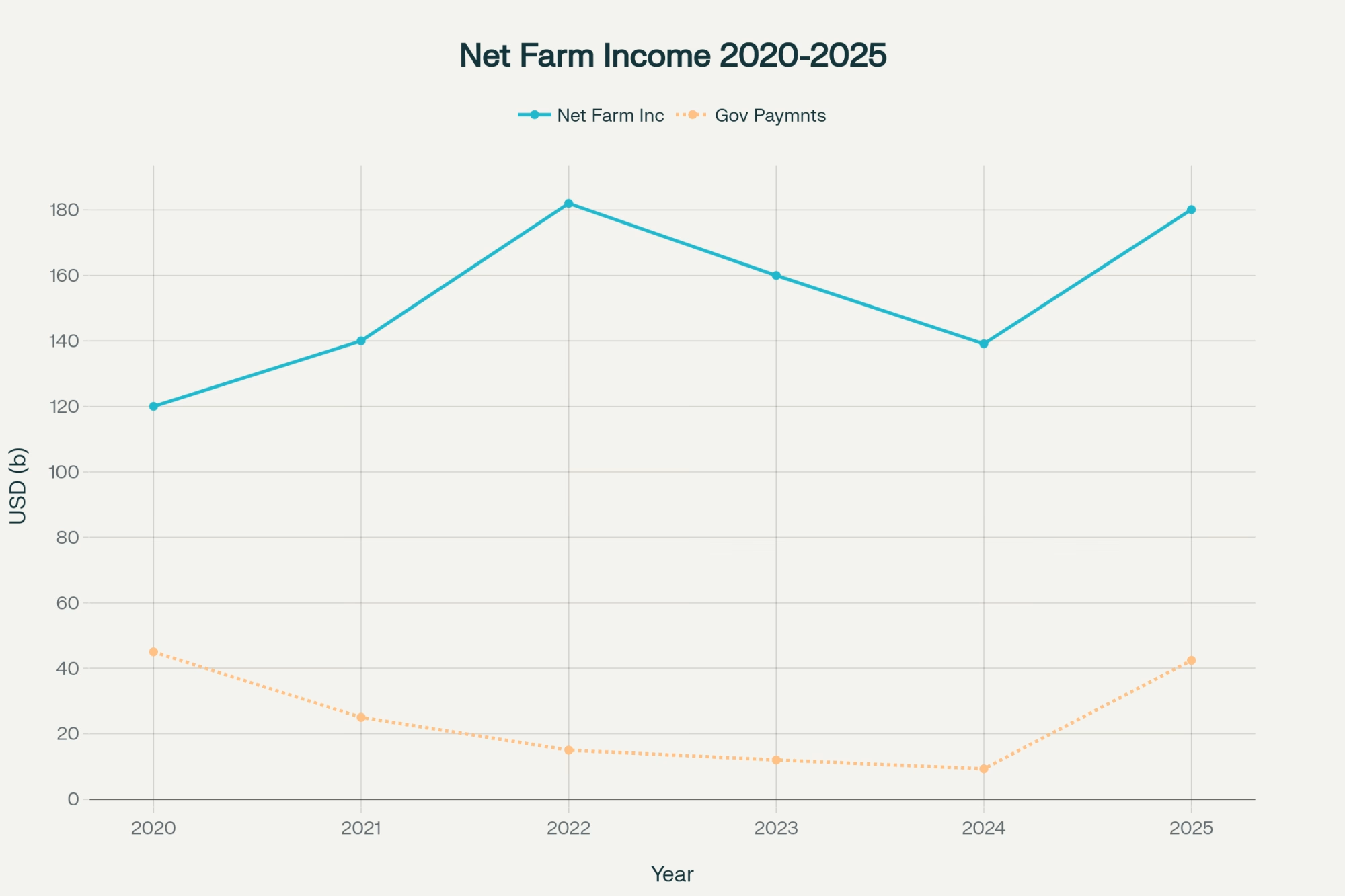

EXECUTIVE SUMMARY: Data centers consuming 2,000 megawatts—the power of 4,000 dairy farms—are reshaping rural infrastructure, with some facilities draining aquifers so fast that multi-generational wells fail within months. This collision between Big Tech and agriculture threatens mid-sized dairies with 40% power cost increases and water scarcity, yet also creates unprecedented opportunities: land values tripling, renewable energy partnerships worth $400/cow annually, and historic exit premiums. The 800-1,500 cow operations that built America’s dairy industry have 18 months to choose their path: scale beyond 2,000 cows, optimize operations while positioning for strategic exit, or sell at peak valuations that won’t last. Indiana’s proactive water protection legislation and Ohio farmers negotiating win-win land deals show that preparation beats panic. The immediate action plan is clear: document your water baseline, calculate your true costs, and decide your future before market forces decide for you.

You know, I was chatting with a producer last week who’s been milking for thirty years—rock-solid operation, three generations on the same land. His question really made me think: “Andrew, my well’s never failed. Should I be worried about these data centers moving in?”

After looking at what’s happening across the country, I had to tell him yes. Though honestly… not for the reasons either of us expected when we started talking.

A Story from Georgia That Should Matter to All of Us

So here’s what’s happening to Beverly and Jeff Morris down in Newton County, Georgia—and it’s something we all need to pay attention to. For decades, their well served them perfectly. Never a problem. Then, Meta built a data center about 1,000 feet from their property back in 2018.

Within months—and I mean months, not years—their water quality just fell apart. First, the dishwasher stopped working right. Ice maker went next. The New York Times reported this past July that they’re now hauling bottled water for basic household needs. They’ve already spent five thousand dollars trying to fix problems that started right after construction. And that twenty-five thousand they’d need for a new well? Well, that’s just not in the cards for them.

“I’m scared to drink our own water,” Beverly told those reporters.

When farm families are afraid of their own well water in 2025… I mean, that really hits home, doesn’t it?

Understanding What’s Happening to Our Power Grid

Here’s what’s interesting—and honestly, a bit concerning. Grid Strategies released its National Load Growth Report, showing that data center electricity consumption could triple from 4% of total U.S. usage today to 12% by 2028. Goldman Sachs released similar numbers in its August analysis. That’s a massive shift in just a few years.

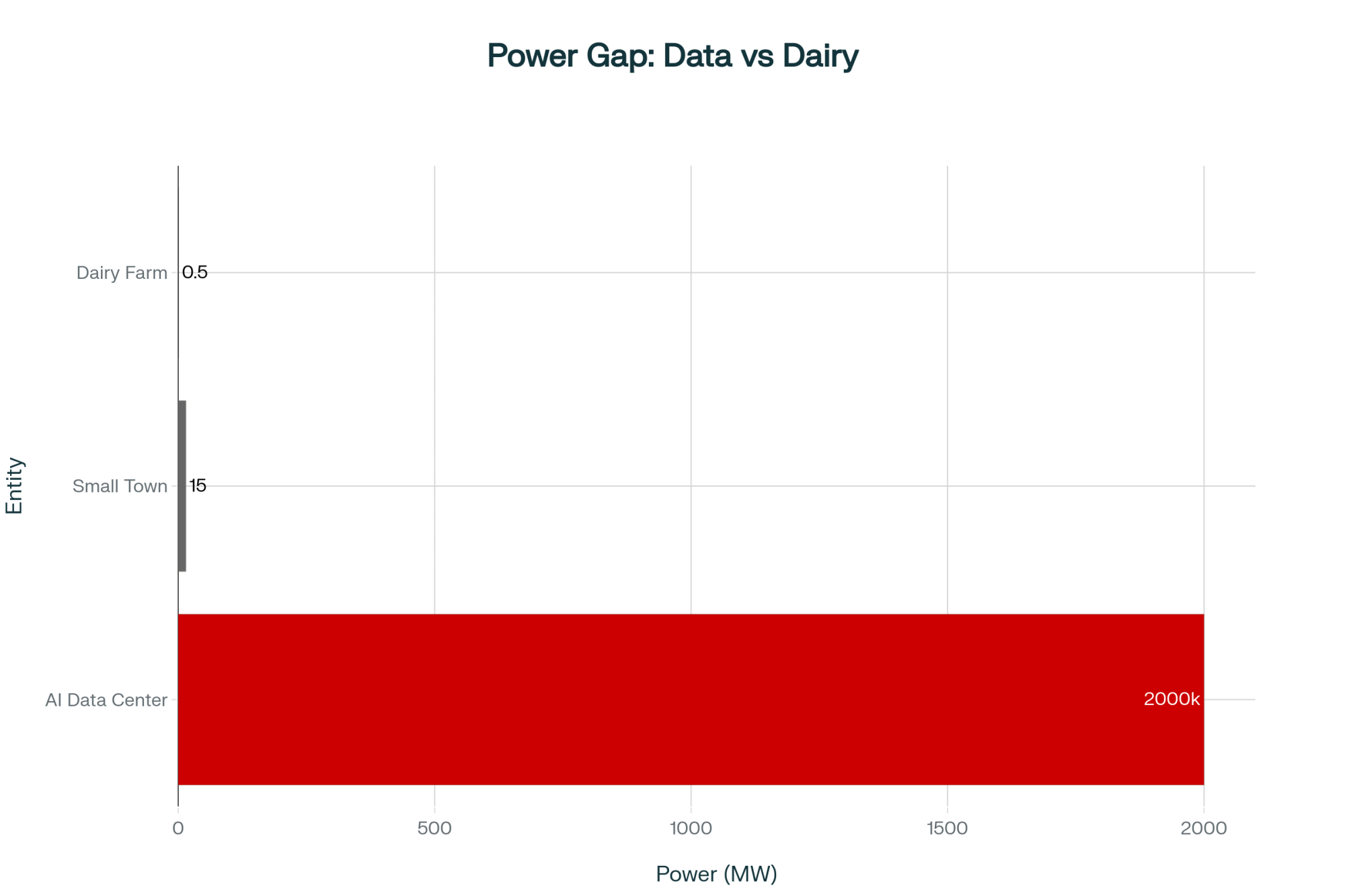

You probably know this already, but let me put it in perspective: facility planning documents from utilities like Dominion Energy show a single AI data center can demand 2,000 megawatts. Your entire dairy operation? Even with a modern parlor, all your cooling systems, feed delivery—you’re maybe peaking around 500 kilowatts on your busiest day. The scale difference is just… staggering.

Think about it this way:

- One AI data center: 2,000 MW (enough for 100,000 homes)

- Your 1,200-cow dairy: 0.5 MW

- A small town of 5,000 people: 15 MW

We’re not even in the same league here.

Rural electric cooperatives—and that’s most of us, right?—they’re really feeling this. I’ve been talking with co-op managers across the Midwest, and they’re seeing interconnection requests for hundreds of gigawatts. As one manager told us, “We built our system over decades to serve farms and rural communities. They’re asking for triple capacity in two years.”

The money side’s already hitting too. Rewiring America documented twenty-nine billion dollars in utility rate increase requests this year. And ICF International’s May report? They’re suggesting we could see increases up to 40% by 2030.

So let me break this down in terms we all understand. Say you’re running 1,200 cows in a typical freestall setup with automated milking—pretty standard operation these days. University of Wisconsin Extension research shows operations like that use between 400 and 1,145 kilowatt-hours per cow annually. Most well-managed operations average around 800.

At twelve cents per kilowatt-hour—which is what many of us are paying—you’re looking at about $115,200 a year in electricity. Jump that to fifteen or seventeen cents? That’s an extra thirty to forty thousand dollars annually. Basically, it adds twenty-five cents per hundredweight to your production costs. And there’s not a thing you can do to manage that through better feed conversion or butterfat optimization.

Water: The Challenge That Really Caught Me Off Guard

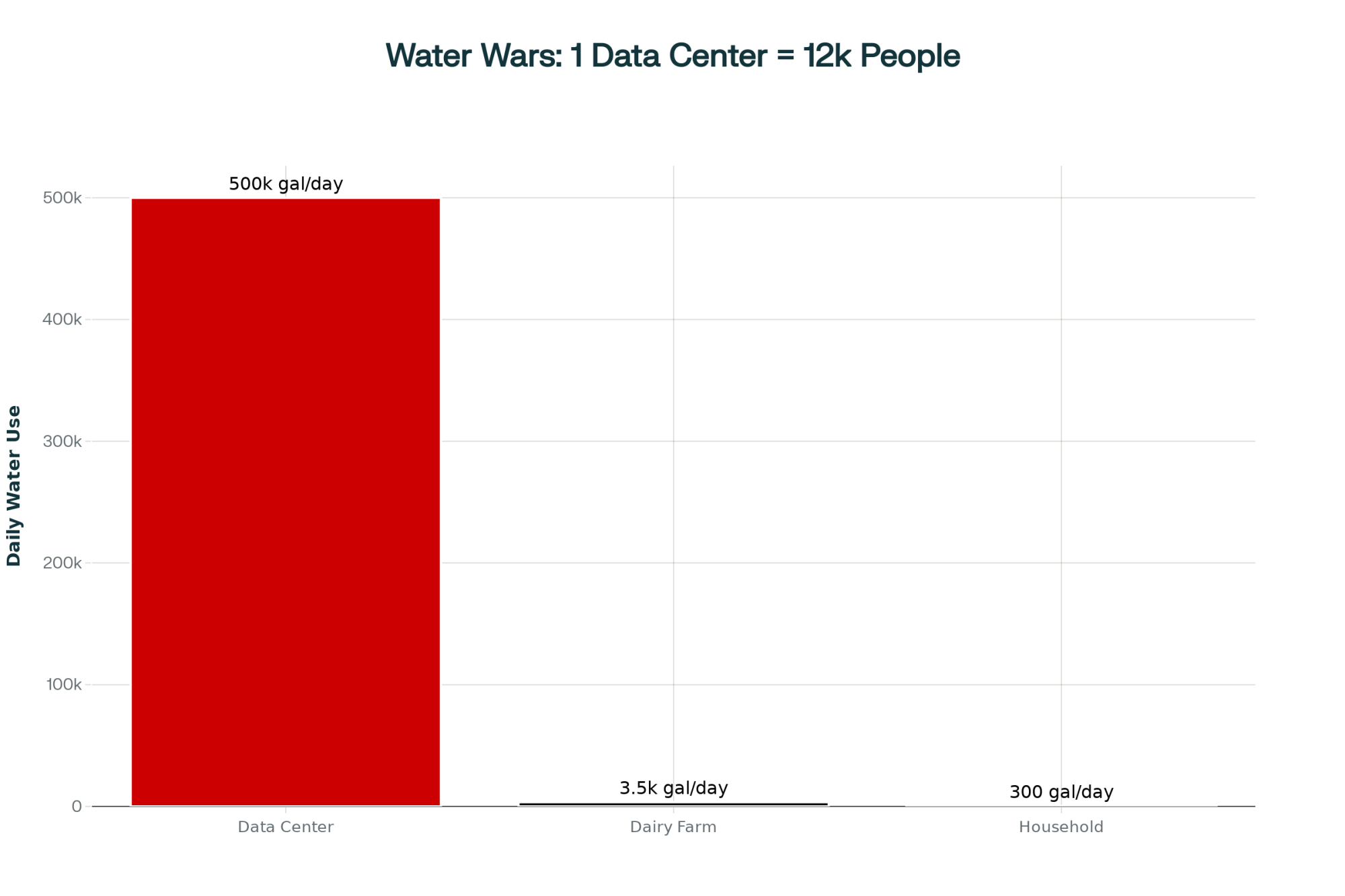

What really surprised me when I started digging into this—it’s not the electricity that’s the immediate threat. It’s water.

According to filings with Georgia’s Environmental Protection Division, Meta’s Newton County facility needs 500,000 gallons every single day. That’s 10% of the entire county’s water use for 120,000 residents. Mike Hopkins, who runs the Newton County Water and Sewage Authority, reported at a July public meeting that nine more companies have filed applications. Some want six million gallons daily. Six million! The Authority’s already projecting deficits by 2030.

Now, you might be thinking, “That’s Georgia. Different story up here in the Midwest.” But look at what’s happening in Arizona. The Attorney General’s December lawsuit documents show the Saudi-backed Fondomonte operation pumped over 31,000 acre-feet from the Ranegras Basin last year. That’s 81% of all the groundwater pulled from that aquifer.

Documentary filmmakers from The Grab captured rancher Wayne Wade describing how his well pump literally melted when water levels dropped below it. “I can’t pay for a high-powered lawyer,” Wade said. “Neither can any of my friends.”

Local churches have lost wells that served their communities for generations. Small operations are watching their water security just… evaporate. And here’s what really concerns me: this happens fast. We’re not talking gradual decline over decades, where you can plan and adapt. Wells that have been reliable for multiple generations can fail within months once industrial-scale pumping starts nearby.

Looking at where these conflicts are already emerging:

- High data center areas: Northern Virginia, Columbus, OH, Phoenix, AZ, Dallas, TX, Silicon Valley, CA

- Major dairy regions: Wisconsin, California Central Valley, New York, Pennsylvania, Idaho

- Where they overlap: That’s where we’re seeing real problems develop

This Isn’t Just an American Problem

And here’s something for our Canadian readers and international audience—this isn’t uniquely American. The Greater Toronto Area is seeing similar pressures as Microsoft and Amazon expand their data center capacity in Ontario, with facilities in Vaughan and Mississauga drawing significant power from the grid.

In Europe, it’s even more intense. The Netherlands—you know, one of the world’s most efficient dairy producers—is dealing with Microsoft’s planned facility in North Holland that will consume 20% of the nation’s renewable energy growth. Dutch dairy farmers are already operating under strict environmental regulations, and now they’re competing with tech giants for both water and power. Ireland has actually imposed a moratorium on new data center connections in Dublin because they’re projected to consume 30% of the country’s electricity by 2030.

What’s particularly interesting is that European farmers have been actively organizing responses. The Dutch agricultural union LTO Nederland has been working with energy cooperatives to secure long-term power contracts before data centers lock up capacity. That’s something we could learn from here.

Indiana Shows Us What Being Proactive Looks Like

Not every region’s waiting for a crisis to hit, though. What Indiana did offers a really solid model for the rest of us.

Randy Kron—he’s president of Indiana Farm Bureau and farms in the Wabash River watershed—saw what was coming when developers proposed pulling 100 million gallons daily for the LEAP Innovation District. Instead of waiting for problems, they made water protection their top legislative priority for 2025.

Working with State Senator Sue Glick, they passed Senate Bill 28. Governor Braun signed it in April. The law’s pretty straightforward: if an industrial user impairs your agricultural well, they have to compensate you. Either they connect you to a new water supply or drill you a deeper well. The Department of Natural Resources has three days to investigate complaints. And here’s the key part—the burden of proof is on them, not you.

As Randy explained in his public testimony: “We wanted to establish reasonable guidelines while we could think clearly, not in the middle of a crisis.”

That’s the difference between getting ahead of this thing and playing catch-up, isn’t it?

One Success Story Worth Noting

I should mention—it’s not all doom and gloom out there. I was talking with a producer from northeast Ohio recently who’s actually turned this situation to his advantage. When a data center developer approached him about purchasing 200 acres of marginal cropland, he negotiated to keep his best fields and the dairy operation intact.

The sale price? Let’s just say it funded a complete parlor renovation and new feed storage, and left enough for his daughter to return to the operation without debt pressure. Plus, the data center’s required green space buffer actually improved his pasture runoff management.

“I wasn’t looking to sell,” he told me, “but when someone offers you three times agricultural value for your worst ground, and you can keep milking? That’s not a threat—that’s an opportunity.”

Not everyone will get that lucky, of course. But it shows there can be win-win scenarios if you’re prepared to negotiate from a position of knowledge rather than desperation.

The Bigger Picture on Consolidation

Let’s be honest about something we all know—data centers aren’t creating dairy consolidation. We’ve been dealing with that for twenty years now. The 2022 USDA Census shows we’ve gone from 105,000 dairy farms in 2000 to about 22,000 today. Meanwhile, cow numbers have stayed right around 9.4 million head. Same amount of milk, way fewer farms producing it.

The economics haven’t changed either. Cornell’s Dairy Farm Business Summary from September shows that operations with 2,000-plus cows are achieving production costs of around $23 per hundredweight. Those of us with 1,000 cows? We’re looking at $26-27. In markets that routinely swing two or three dollars seasonally… well, you know what that gap means for your bottom line.

What’s different now—and this is important—is that data centers are eliminating the traditional ways mid-sized operations survived. You can’t optimize your way out of a 40% increase in power. You can’t expand when county assessor records from places like Franklin County, Ohio, show farmland jumping from $30,000 to $150,000 an acre after rezoning for data centers. And your neighbor can’t buy you out when nobody can afford these inflated prices.

Three Realistic Paths Forward—Choose Wisely

After talking with producers nationwide and working through the numbers with economists like Dr. Jason Karszes at Cornell’s PRO-DAIRY program, I’m seeing three realistic strategies for operations with 800 to 1,500 cows:

Path 1: Scale Up Now

If you’re going this route, you need at least 2,000 cows. Cornell estimates that’s eight to fifteen million in capital, depending on what you’ve already got. But here’s the thing—this only works if you have a committed successor under 40 who’s already actively managing. The International Farm Transition Network’s data shows 83.5% of dairy farms fail the generational transition. Don’t expand on hope.

You’ll also need documented water security and, if you’re thinking of digesters, proximity to natural gas pipelines. The risk? Infrastructure costs are rising faster than milk prices. You’re betting you can scale before costs eat you alive.

Path 2: Optimize and Plan Your Exit

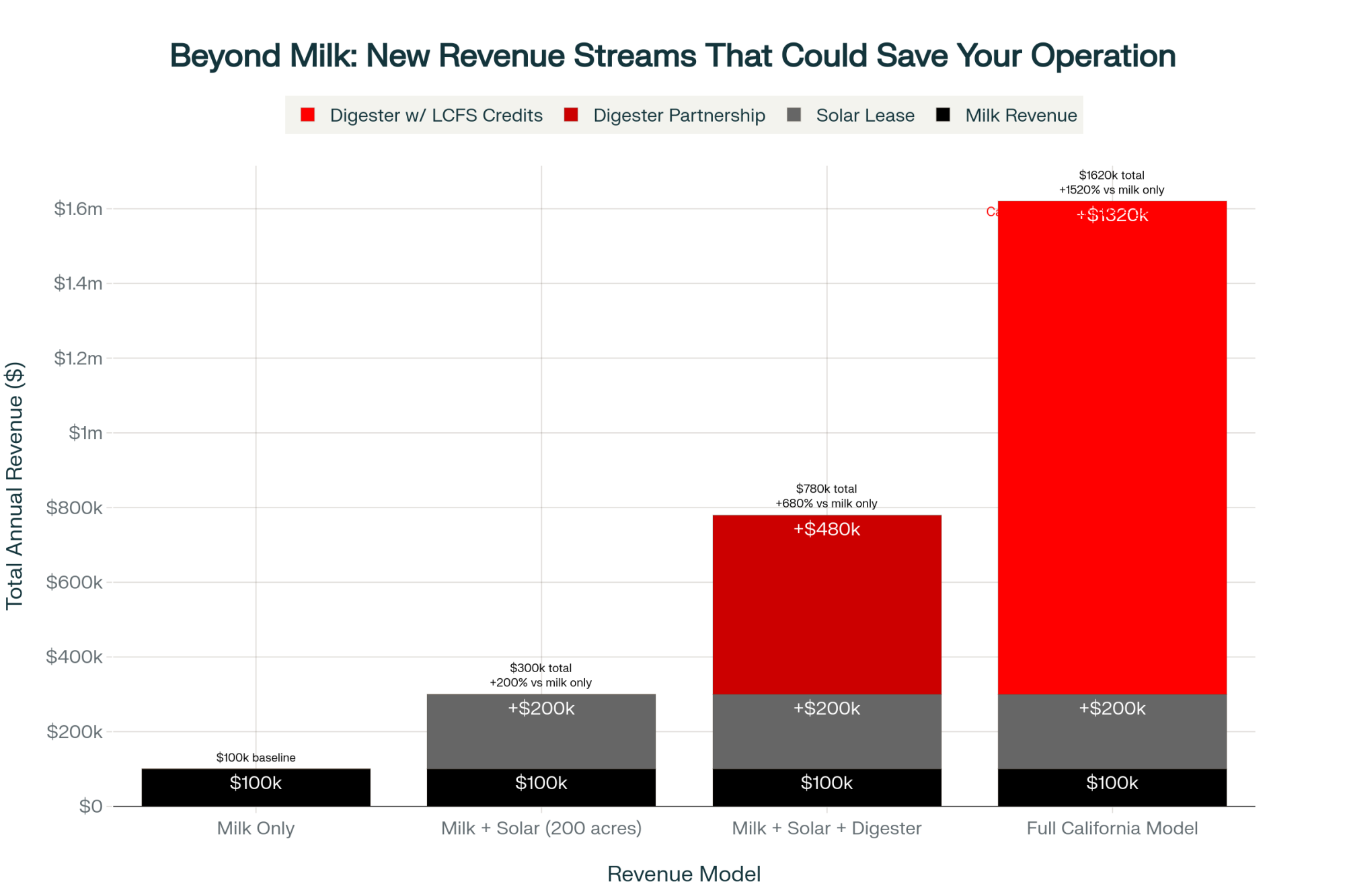

This is your five-to-ten-year strategy. Targeted investments of $500,000 to $2 million can keep you competitive medium-term—precision feeding, really dialing in component optimization, maybe adding renewable revenue.

Solar leases are now bringing $250-$1,000 per acre, according to the American Farmland Trust. Digester partnerships can add $80-400 per cow annually. In California, with those Low Carbon Fuel Standard credits, some operations are seeing up to $1,100 per cow. The key is timing your exit to the land value peak—likely 2025-2027 —before regulatory backlash hits.

Path 3: Exit While Premiums Exist

Let’s face reality—USDA data shows 71% of retiring farmers have no successor. If that’s you, the arrival of data centers might be your best opportunity. We’re seeing premiums of 40-100% over agricultural value. Davis County, Utah, farmland went from $50,000 to $400,000 per acre after rezoning. But this window won’t stay open past regulatory backlash.

| Metric | Agricultural Value | Post-Data Center Value | Change |

| Price Per Acre | $30,000 | $150,000 | +400% |

| 200-Acre Farm Total | $6,000,000 | $30,000,000 | +$24,000,000 |

| Exit Premium Window | Agricultural Use | Development Value | 18 Months |

| Your Decision | Stay & Scale | Sell at Peak | Market Decides |

And here’s the thing—you’ve got maybe 18 months to choose before the market makes the choice for you.

Understanding the Revenue Side

While we’re dealing with infrastructure pressures, some operations are finding real opportunities. But you need to distinguish genuine opportunity from sales pitches—and believe me, there are plenty of those going around.

California producers working with companies like California Bioenergy are generating substantial returns. The George DeRuyter & Sons operation in Washington state produces renewable natural gas plus multiple fertilizer products—real diversified revenue beyond just milk.

Bar 20 Dairy in Kerman reports capturing thousands of tons of CO2 annually through their digester while producing renewable electricity. As one California producer told me: “It’s like crop insurance that pays every month.”

The typical arrangement? Third-party developers cover the capital—anywhere from two to twelve million, according to industry reports. They build it, operate it, and pay you for manure. Not glamorous, but annual payments that can represent $350,000 for a 3,500-cow operation? That’s an additional 40 cents per hundredweight in margin. Nothing to sneeze at.

But here’s what nobody mentions at those sales presentations—these are 10-15 year contracts in markets that could shift dramatically. If carbon credit values crash in 2028 and you’re locked until 2040, you’re stuck. Get a lawyer who understands both ag and energy before you sign anything. Trust me on this one.

What’s Coming That Most Aren’t Seeing Yet

Your milk processor is running the same infrastructure risk calculations you are. And if they decide your watershed’s becoming high-risk, they won’t announce it. They’ll gradually shift procurement to more stable regions. By the time you notice reduced premiums or limited-volume incentives, repositioning becomes very difficult.

We’re also likely to see regulatory whiplash. Right now, everyone wants data centers for the tax revenue. But if history’s any guide—think CAFOs in the ’90s or ethanol plants in the 2000s—backlash typically emerges 3-5 years after rapid growth begins. Water conflicts and community opposition could trigger restrictions around 2027-2030, potentially leading to significant corrections in land values.

Your 30-Day Action Plan

Alright, enough analysis. Here’s what you actually do starting Monday morning:

Week 1: Document Your Water

Call your state-certified lab first thing Monday. In Wisconsin, that’s the State Laboratory of Hygiene at 608-224-6202. Pennsylvania farmers, check DEP’s certified lab list. Iowa, call the State Hygienic Laboratory at 319-335-4500. Ontario producers, contact your Ministry of Environment labs.

Comprehensive testing runs $300-500. Get everything—bacteria, minerals, heavy metals, static water level. Photograph all infrastructure with date stamps. Keep copies in three places. Without this baseline, you have zero legal protection.

Week 2: Face Your Numbers

Calculate actual production costs. Not hopes—reality. Model three scenarios: scaling to 2,000+ cows, optimizing for 5-7 years, or immediate exit. Have that succession conversation directly: “Do you want this operation?” Hesitation tells you everything.

Week 3: Work With Your Farm Bureau

Contact your county president about water protection resolutions. Draft and submit if needed—October deadlines are common. Coordinate with neighboring counties. Frame it as risk management, not emotional appeals.

Week 4: Make Your Decision

Scale, optimize, or exit based on documented succession, capital access, water security, and market position. Set concrete timelines and communicate them clearly.

Regional Differences Really Do Matter

This isn’t hitting everywhere equally, of course. Vermont and northern New York —abundant water and limited data center development? You’re facing minimal pressure so far.

But Virginia—especially Loudoun County—that’s a completely different story. The state’s Joint Legislative Audit and Review Commission found 26% of Virginia’s total electricity now goes to data centers. That’s massive.

The Pacific Northwest presents mixed conditions. Plenty of hydropower, which helps. But the Columbia River Basin’s already over-allocated. When Microsoft expanded in Quincy, Washington, irrigation districts had to fight hard to protect agricultural water rights.

The Southwest? Between existing drought and new industrial demand… it’s really tough out there. Several New Mexico producers I know are planning exits based solely on water, not even considering milk prices.

Looking Forward with Clear Eyes

You know, this transformation isn’t about whether data centers are good or bad. They’re coming regardless of what we think. When organizations with trillion-dollar valuations compete for the same resources we need… well, we all know how that usually ends up.

The smart response isn’t futile resistance. It’s intelligent positioning within what’s coming.

Our grandparents navigated equally dramatic transitions—from hand milking to automation, from small diversified farms to specialized dairy operations. They succeeded by making timely decisions based on emerging conditions, rather than waiting for perfect information that never arrives.

We need that same decisiveness now. Maybe even more so.

The timeline’s compressed. Aquifers don’t refill quickly—you know that. Electricity rates aren’t coming down anytime soon. And somewhere—probably closer than you think—another data center’s moving through the approval process right now.

Document your water. Understand your real costs. Choose your strategic direction.

Because eighteen months from now, those who acted on information will be in substantially better positions than those who waited, hoping things might somehow improve on their own.

That’s what the current data suggests. And in our business, as we all know, the data usually points us in the right direction. Even when we don’t like what it’s telling us.

For water testing contacts and Farm Bureau resolution procedures, reach out to your local county offices. For professional land valuation near data center developments, the American Society of Farm Managers and Rural Appraisers maintains a directory of qualified specialists who understand both agricultural and development values.

KEY TAKEAWAYS

- THE 18-MONTH DECISION Mid-sized dairies (800-1,500 cows) face three paths: Scale to 2,000+ cows ($8-15M), optimize operations while positioning for strategic exit (5-10 years), or sell now at historic premiums (40-100% above ag value). No decision IS a decision—the market will choose for you.

- WATER BASELINE = LEGAL LIFELINE Schedule water testing immediately ($300-500 through state labs). Multi-generational wells are failing within months of data center construction. Without a documented baseline, you have zero legal recourse when your well fails.

- YOUR POWER BILL: +40% WITH NO ESCAPE One data center uses 2,000MW (power for 4,000 dairy farms). This drives electricity costs up 40%, adding $30-40K annually to a 1,200-cow operation—equivalent to $0.25/cwt you cannot optimize away through any operational efficiency.

- OPPORTUNITIES FOR THE PREPARED Land selling at 3X agricultural value, renewable partnerships generating $400/cow annually, solar leases bringing $1,000/acre—but only for farmers who document resources, know their costs, and negotiate from knowledge, not desperation.

- PROVEN SUCCESS STRATEGIES EXIST Indiana’s proactive water protection law and Ohio farmers’ win-win land deals demonstrate that preparation beats panic. Join Farm Bureau water resolutions, coordinate with neighboring counties, and frame concerns as risk management—it works.

Learn More:

- Navigating the Highs and Lows: Strategies for Dairy Farmers in a Volatile Market – This analysis provides high-level strategies for managing risk in today’s volatile dairy markets. It offers a crucial framework for making the big-picture decisions—like scaling or exiting—that the data center boom is forcing upon the industry.

- Unlocking the Full Potential of Your Forage: The Key to Higher Milk Production and Lower Costs – This guide provides tactical methods for maximizing forage quality to directly lower feed costs. As energy expenses rise, mastering your biggest variable input is critical for protecting margins and building the financial resilience needed to navigate market shocks.

- The Robots Are Here to Stay: How Automation is Reshaping the Modern Dairy Farm – This piece explores how automation can create operational excellence and reduce labor dependency. For producers choosing to optimize rather than exit, it demonstrates how investing in technology delivers the efficiency gains necessary to compete in a high-cost environment.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!