Milk yields jumped 33 lbs per cow—what’s really driving this surge on farms like yours?

EXECUTIVE SUMMARY: Here’s what I’m seeing across the coffee shop circuit lately… milk production per cow climbed 33 pounds this year, and it’s not from throwing more animals at the problem. Smart operators are dialing in precision feeding and genomics, seeing feed efficiency gains hitting 8-12%. With corn prices sitting around $4.20 per bushel, a 500-cow operation can pocket over $1,500 monthly in feed savings alone. Globally, US dairy’s becoming the go-to partner for international buyers—they’re calling us “strategic partners” now, not just suppliers. The window’s wide open, but it won’t stay that way forever. Time to get serious about these tools before your neighbors beat you to it.

KEY TAKEAWAYS

- Boost feed conversion 8-12% by implementing precision nutrition protocols—start by tracking individual cow intake and adjusting your TMR formulations based on production groups

- Lock in $1,500+ monthly savings on a 500-cow operation by securing corn contracts under $4.50/bushel while prices remain historically low

- Increase reproductive efficiency 15-23% through automated monitoring systems—but only if you invest in proper staff training and phased rollouts

- Capture export premiums by maintaining top-tier milk quality and protecting margins with Dairy Revenue Protection enrollment (available quarterly)

- Maximize genetic potential using genomic testing to identify high-value breeding decisions—ROI typically shows within 12-18 months on commercial operations

Examining these latest milk production figures, something is happening that has genuinely fired me up about where this industry’s headed. I mean, when was the last time you saw numbers like this? The 24 major dairy states cranked out 18.5 billion pounds in June – that’s 3.4% over last year, according to the USDA’s latest data drop – but here’s what really caught my attention…

This isn’t your typical “throw more cows at the problem” story we’ve been seeing for decades.

The thing about these numbers that nobody’s talking about…

What strikes me most about this production surge is how it’s happening. We’ve got 9.469 million head nationally (146,000 more than June 2024), but these girls are averaging 2,031 pounds per cow – a solid 33-pound jump from last year.

If you’ve been in this business long enough, you know that kind of per-cow improvement doesn’t just… happen.

I was talking to Jake Morrison out in Tulare County last week – he’s running 2,400 head, and his June numbers were up 41 pounds per cow year-over-year. “Andrew,” he says, “we didn’t change our genetics overnight. This is feed efficiency and management paying off.” And he’s absolutely right.

According to recent research from Penn State and UC Davis, precision nutrition programs deliver 8-12% feed efficiency gains when implemented correctly. This isn’t some consultant’s pipe dream anymore – this is happening on commercial dairies right now, and the June numbers prove it.

The second quarter hit 58.7 billion pounds, up 2.4% year-over-year. That turnaround from a sluggish first quarter tells you everything about how quickly this industry pivots when the economics align.

What’s driving the efficiency revolution

Here’s where it gets interesting – and I’ve been tracking this across multiple regions. The smart operators aren’t just celebrating cheaper corn… they’re completely rethinking their approach to nutrition management.

Tom Vlaeminck’s group at Cornell published findings earlier this year showing that targeted amino acid supplementation can improve milk protein yield by 0.8-1.2 pounds per cow daily while actually reducing crude protein intake. When you multiply that across a 1,000-cow operation… we’re talking real money here.

A Fresno dairy has been implementing precision feeding protocols since January. “We’re seeing 6% better feed conversion on average,” they told me, “but some fresh cow groups are pushing 10-11% improvement.” Their feed costs dropped $127 per cow per month while maintaining production.

That’s the kind of efficiency that shows up in these national numbers.

Feed costs are finally working in our favor (for now)

| Herd Size | Daily Corn Consumption (lbs) | Monthly Savings at $4.20/bu | Annual Impact |

|---|---|---|---|

| 100 cows | 800 | $300 | $3,600 |

| 500 cows | 4,000 | $1,500 | $18,000 |

| 1,000 cows | 8,000 | $3,000 | $36,000 |

| 2,500 cows | 20,000 | $7,500 | $90,000 |

Based on current market calculations and the USDA’s latest WASDE projections, corn is projected at $4.20/bushel, presenting opportunities we haven’t seen since 2019. For a 500-cow herd feeding 8 pounds of corn per head daily, that price drop translates to over $1,500 monthly savings – assuming you’re smart about procurement timing.

But here’s the thing – the producers winning right now aren’t just buying cheaper grain. They’re leveraging this window to invest in systems that’ll pay dividends when feed costs inevitably climb again.

The global vacuum creates our advantage

This domestic efficiency surge is occurring while global production is stumbling, creating a unique competitive advantage. Ben Buckner from AgResource Company nailed it when he told me last month: “We can see generally no one in the world producing more milk than in the previous year. That’s the driver you need to spark fear in the marketplace.”

For the US, this means our efficiency-driven growth is meeting a world market hungry for products. Class III futures have held above $22 per hundredweight for most of the second half, and when combined with reduced feed costs, it adds up to margins we haven’t enjoyed since 2014.

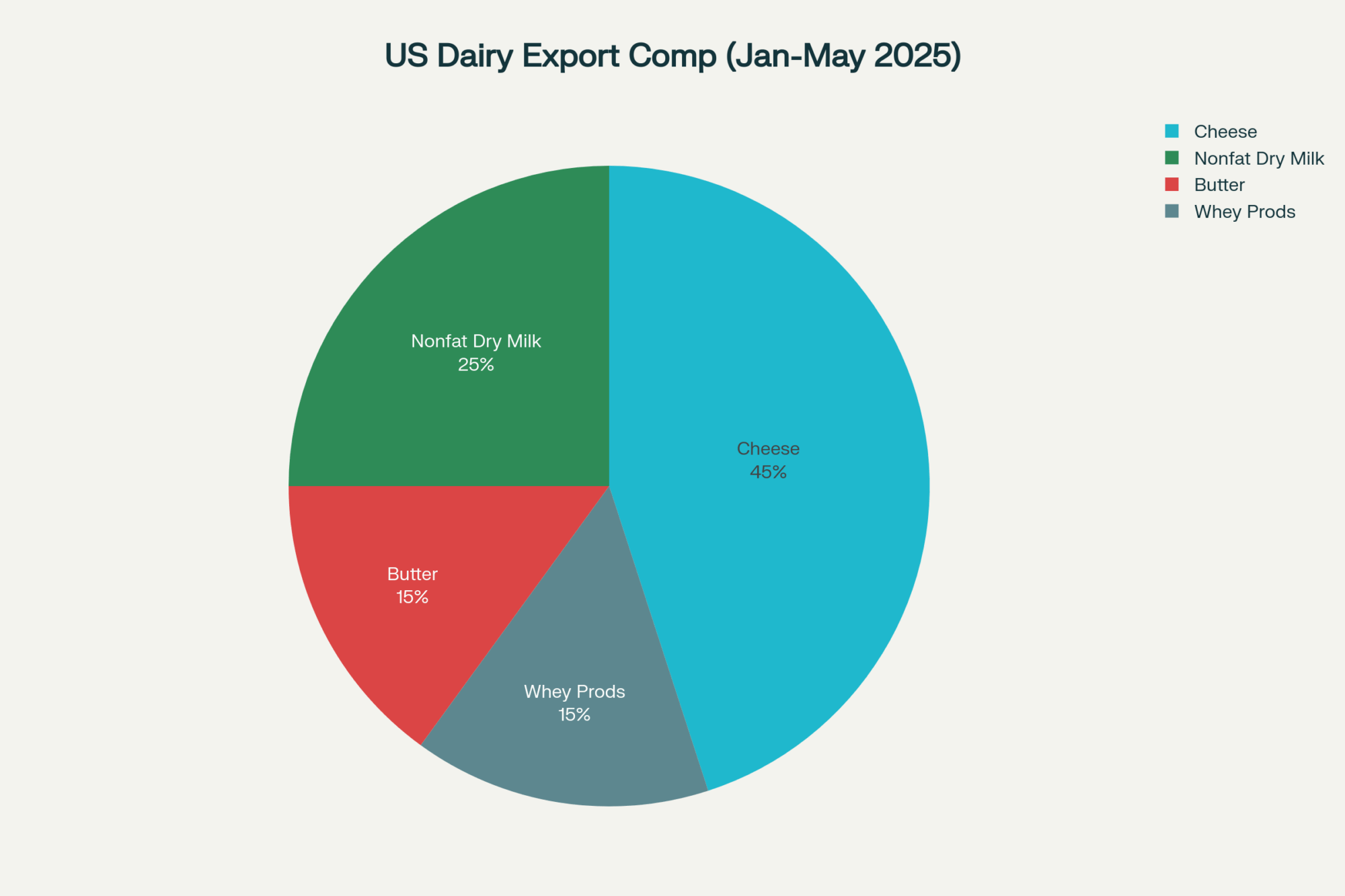

The timing couldn’t be better. US dairy exports hit $3.83 billion through May 2025 – up 13% year-over-year – with cheese exports setting monthly records. Notably, USDEC data show that our pricing competitiveness has improved dramatically against European suppliers, a trend observed across multiple export markets.

Recent case study analysis shows many farms adopting systematic precision nutrition protocols are achieving ROI within 12-18 months. That’s not theoretical – that’s documented on actual operations.

| Strategy | Implementation Timeframe | Annual Benefit per Cow | ROI Timeline |

|---|---|---|---|

| Precision Nutrition Programs | 3-6 months | $150-200 | 6-12 months |

| Genomic Testing | 6-12 months | $75-125 | 12-18 months |

| Automated Milking Systems | 12-18 months | $180-250 | 18-24 months |

| Feed Price Hedging | Immediate | $50-150 (variable) | Immediate |

| Health Monitoring Tech | 6-9 months | $100-175 | 7-14 months |

The tech revolution is finally delivering results

I’ll level with you – I’ve been skeptical of dairy tech promises for years. Too many vendors are selling dreams that don’t pencil out when you crunch the real numbers on actual farms.

But what I’m seeing now is different, and it’s got me cautiously optimistic.

What’s actually working (and what isn’t)

Recent research from the Journal of Dairy Science indicates that automated monitoring systems can improve reproductive efficiency by 15-23% when implemented correctly in conjunction with trained staff. The key phrase there is “properly implemented with trained staff,” which explains why some operations see dramatic improvements while others see minimal impact.

I spent time at Rick Peterson’s place in Minnesota last month – 950 cows, a full robotic milking system installed two years ago. “The first year was rough,” he admits. “We thought we could just flip a switch and everything would improve. Reality check – technology amplifies good management, it doesn’t replace it.”

His second year? Milk production up 18%, somatic cell count down 40%, and labor costs reduced by $23,000 annually. But that came after investing heavily in staff training and system optimization.

The regional story tells different tales

| State | Production Increase (Million lbs) | Primary Growth Driver | % Change YoY |

|---|---|---|---|

| Idaho | +135 | Robotic milking adoption | +9.7% |

| Texas | +131 | Feed management systems | +9.5% |

| California | +91 | Efficiency improvements | +2.7% |

| Kansas | +75 | Strategic expansion | +19.0% |

| South Dakota | +45 | Technology integration | +11.5% |

What’s fascinating is how technology adoption varies dramatically by region, and the June production numbers reflect these differences.

Idaho’s 135 million pound year-over-year increase comes primarily from robotic milking adoption reaching critical mass, according to local extension data. Texas added 131 million pounds through strategic feed management systems and investments in climate-controlled housing for its expanding operations.

According to industry reports, precision feeding systems can generate annual savings of $35,000 to $45,000 for a 1,000-cow operation while reducing environmental nitrogen losses by 20%. That’s not just good economics – it’s essential insurance in an increasingly regulated environment.

But here’s what nobody talks about… the payback periods for integrated monitoring platforms are averaging 7-14 months for operations that do their homework upfront. The farms that struggle? They rush into wholesale technology changes without proper planning.

Global markets are opening doors (while they last)

The international picture is creating opportunities that might not be here tomorrow, and that’s what keeps me up at night.

European production has stumbled badly this year – Bluetongue disease hit harder than expected, and their environmental regulations are constraining expansion more than most analysts predicted. Meanwhile, New Zealand continues to struggle with supply growth constraints after its environmental framework changes.

Infrastructure timing couldn’t be better

Two major cheese processing facilities launched operations early this year, adding 360 million pounds of annual capacity right as production expands. According to Ever.Ag’s analysis shows that US butter maintains a 30-35% price advantage over global competitors after adjusting for fat content.

The language from global buyers has shifted, a point Mike North from Ever.Ag drove home:

“Global buyers are referring to US dairy suppliers as ‘strategic partners.'”

However, what worries me is that this window might not remain open if global competitors recover or trade policies shift unexpectedly. The smart money is capitalizing now while the advantage exists.

Export momentum builds on efficiency gains

What’s particularly encouraging is how our efficiency improvements directly translate to increased export competitiveness. When you can produce more milk per cow with lower feed inputs, you create sustainable cost advantages that persist even when global markets tighten.

A Wisconsin operation I visited last month exports 40% of their cheese production. “Five years ago, we couldn’t compete internationally,” the owner told me. “Now, with our cost structure, we’re pricing European suppliers out of Asian markets.”

The challenges nobody wants to discuss publicly

Let’s be realistic about what’s ahead, because it’s not all sunshine and cheap corn.

The heifer crisis is real

Replacement heifer inventories sit at 47-year lows according to the USDA’s latest cattle inventory report. This fundamentally constrains traditional expansion strategies. You can optimize existing cows only so much before hitting biological limits.

Sarina Sharp from Daily Dairy Report hit something every producer I know is dealing with: “This heifer shortage means cows in the barn are older and less efficient on average than normal.”

But here’s where creative operators are adapting – extended lactation protocols, precision breeding programs, and strategic crossbreeding are maximizing genetic potential within existing herds. It’s not ideal, but it’s reality.

Weather dependency creates vulnerability

We’re essentially betting on achieving record yields for a third consecutive year with little margin for error. One major weather event could turn these favorable feed economics on their head overnight.

I was speaking with grain traders in Chicago last week – they’re concerned about subsoil moisture levels across key corn-producing regions. “We need near-perfect weather to hit these yield projections,” one told me. “Any significant deviation and corn prices jump fast.”

Technology headaches are real

Data security protocols, staff training requirements, backup system necessities… these aren’t trivial implementation challenges. The leading operations I track are implementing phased rollouts with comprehensive staff development rather than diving headfirst.

And the threat of HPAI hasn’t vanished. As of this month, USDA APHIS confirms cases in nearly 100 herds across 12 states. Smart biosecurity investments provide competitive advantages while protecting against production disruptions; however, the threat remains.

And here’s something that genuinely concerns me – domestic demand remains frustratingly flat. If export markets soften and we can’t absorb increased production domestically, we could see price pressure that quickly eliminates these efficiency gains.

What the smart operators are doing right now

The successful operations I’m tracking focus on three key areas, and they’re not waiting for perfect conditions.

Strategic feed program optimization

They’re optimizing based on total economic value rather than chasing commodity bargains. Danny Rodriguez, located in California’s Central Valley, showed me his procurement strategy – he locks in feed ingredients 6-8 months ahead by using options contracts, which protects against price spikes while maintaining flexibility.

“We’re not trying to time the market perfectly,” he explains. “We’re managing risk while capturing efficiency gains.”

Systematic technology implementation

Second, they’re implementing technology systematically with proper training rather than rushing into wholesale changes. The farms seeing real productivity increases aren’t the ones buying everything at once.

Recent work from USDA economists emphasizes that financial risk management through Dairy Revenue Protection programs is crucial, particularly given the anticipated volatility in feed prices and potential market fluctuations ahead. This isn’t the time to get caught without protection.

Building competitive moats

What’s fascinating about this June production surge is that it represents genuine, efficiency-driven growth, creating sustainable competitive advantages. The combination of strategic herd management, precision technology, and favorable input costs allows well-managed operations to capture both immediate profitability and long-term market positioning.

But here’s what you need to understand: this opportunity has an expiration date.

“This opportunity has an expiration date.”

Feed cost advantages could evaporate with weather events. Export markets may shift in response to policy changes. Technology ROI depends on proper implementation and staff buy-in.

| Technology | Setup Phase | Training Phase | Optimization Phase | Full ROI Achieved |

|---|---|---|---|---|

| Robotic Milking | 3-6 months | 6-12 months | 12-18 months | 18-24 months |

| Precision Feeding | 1-2 months | 2-4 months | 4-8 months | 6-12 months |

| Health Monitoring | 1-3 months | 3-6 months | 6-9 months | 9-15 months |

| Automated Systems | 6-12 months | 6-9 months | 9-12 months | 15-24 months |

The bottom line for your operation

For dairy operators, the path forward is becoming clearer every day. Here’s what I’d prioritize if I were still running cows:

Lock in feed advantages now through strategic procurement and hedging, not just spot buying. A December corn price under $4.50 is a gift from the market, while the USDA forecasts average farm prices at $4.20/bushel. Use options to cap upside risk while maintaining flexibility.

Invest systematically in actionable technology – monitoring systems, precision feeding, automated health detection – but implement with proper planning and training. The operations seeing documented productivity increases are the ones that treated technology adoption like any other major management change.

Optimize existing resources before expanding. With heifer inventories at 47-year lows, traditional expansion is expensive and slow. The most successful operations maximize their resources through better genetics, improved nutrition management, and strategic culling.

Protect your downside ruthlessly. DRP enrollment periods are available quarterly – don’t wait for price volatility to hit. The margins we’re seeing now won’t last forever, and the operations that survive the next downturn will be the ones that planned ahead.

The farms capitalizing on this moment combine traditional dairy expertise with modern efficiency tools and strategic market thinking. They’re not just producing more milk – they’re producing it smarter, more profitably, and more sustainably.

These June numbers represent more than just statistical success. They demonstrate how American dairy is positioning itself as the global industry leader through strategic capability rather than simple volume expansion.

The question isn’t whether this surge continues – it’s whether your operation will be positioned to capture the value while the window remains open. The producers who understand this shift and act accordingly will be the ones who remain profitable when the next market cycle arrives.

And in this business, that’s what really matters.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Cracking the Code: The 5 Management Secrets of High-Performing Herds – This article provides a tactical roadmap for turning efficiency theory into reality. It reveals the specific, data-driven management protocols that top herds use to boost health, reproductive performance, and overall profitability—the very foundation of the gains discussed above.

- Navigating the Choppy Waters: Dairy Market Outlook and Risk Management Strategies – While our analysis highlights today’s favorable margins, this piece delves deeper into market volatility. It offers advanced strategies for using tools like DRP and options to protect those hard-won profits from the inevitable price swings ahead.

- The Genomic Revolution: Are You Breeding for the Dairy Cow of the Future? – To address the heifer shortage and drive long-term efficiency, this piece explores how to leverage genomic data in your breeding program. It demonstrates methods for selecting traits that build a more resilient, efficient, and profitable herd for the next decade.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!