Mexico buys 51.5% of our milk powder exports—and they’re about to cut us off. Your feed efficiency won’t matter if you can’t sell the milk.

EXECUTIVE SUMMARY: Look, I’ve been watching this Mexico situation unfold, and it’s got me more concerned than I thought it would. We’ve gotten way too comfortable treating Mexico like a guaranteed customer when they’re actually planning to replace us completely. They’re throwing $4.1 billion at becoming self-sufficient by 2030, targeting the exact products we’ve been shipping south—especially that skim milk powder where they buy over half of everything we export. The math is brutal: we’ve got $8 billion in new processing capacity coming online while potentially losing our $2.47 billion lifeline. But here’s what most producers are missing—this isn’t just a threat, it’s the biggest partnership opportunity we’ve seen in decades if you know how to position yourself. Mexico’s got productivity gaps you could drive a milk truck through, and they’re willing to pay for the genetics and technology to close them.

KEY TAKEAWAYS

- Export diversification pays off fast – Southeast Asia and Middle East markets are growing 15-20% annually, but they take 3-5 years to develop properly. Start building those relationships in the next 12 months, or you’ll be scrambling when Mexico’s plants come online.

- Partnership beats competition every time – Mexico’s productivity gap (37 vs 9 liters per cow per day) creates immediate demand for genetics, equipment, and consulting services. Position yourself as an essential partner, not just a commodity supplier.

- Margin preparation is non-negotiable – If we lose even 25% of Mexican demand, domestic supply increases could drop milk prices 10-15%. Audit your cost structure now and make sure you can handle that scenario.

- Technology transfer opportunities are huge right now – With 97% of Mexico’s operations being small-scale, there’s massive demand for efficiency improvements. The smart money is already moving into genetics partnerships and technical services.

- Timeline matters more than you think – Mexico’s infrastructure comes online 2025-2026, same time as our $8 billion in new processing capacity. That’s not coincidence—that’s strategic planning we need to match.

You know that sinking feeling when your best customer starts talking about “going independent”? Well, that’s exactly what’s happening with Mexico right now, and honestly… most of us in the industry are sleepwalking into what could be the biggest trade disruption in decades.

Here’s what strikes me about this whole situation: Mexico isn’t just our neighbor anymore; they’re our $2.47 billion annual lifeline based on recent CoBank analysis of 2024 data. That’s not some abstract export number; that’s real money keeping operations profitable from Wisconsin to California. But now they’re saying “thanks, but we’ll handle this ourselves” with their $4.1 billion self-sufficiency campaign.

And here’s the question that keeps me awake at night: Are we so comfortable with this relationship that we’ve forgotten how quickly export markets can disappear?

What’s Happening South of the Border—And Why You Should Care

The thing about Mexico’s strategy is how systematic they’re being about it. This isn’t some politician’s campaign promise that’ll get forgotten after the election cycle. They aim to increase their production from 13.3 billion to 15 billion liters by 2030, specifically targeting the products we’ve been shipping south for years.

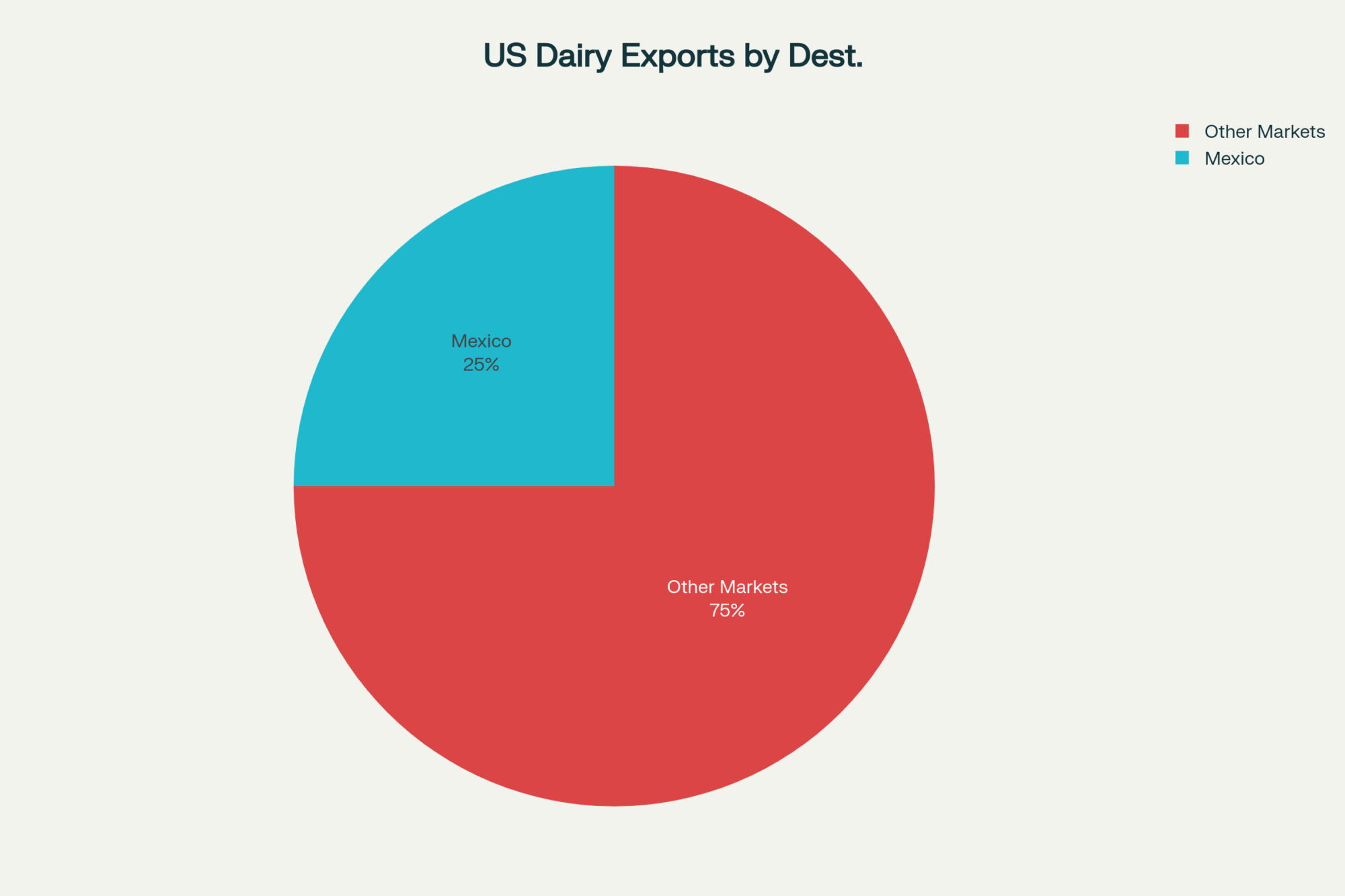

According to recent USDA data, Mexico purchases approximately 25% of all US dairy exports—making them not just our biggest customer, but our most critical one. A critical question for the industry is how we’ve allowed ourselves to become so dependent on a single market, especially when they buy more than half of all the skim milk powder we export (51.5% to be exact).

Think about that concentration risk for a minute. It’s like having one customer buy half your butterfat production… and then watching them build their own creamery.

But here’s where it gets interesting—Mexico’s offering their producers guaranteed pricing through state-owned Segalmex. The current guaranteed price is 10.60 pesos per liter, with targets moving toward 11.50 pesos per liter. That’s a significant premium over what their producers were getting just a few years back when prices averaged around 8.20 pesos.

While US producers navigate the complexities of Federal Milk Marketing Orders and risk management tools, Mexican producers are being handed pricing certainty. When was the last time our producers had that kind of guarantee?

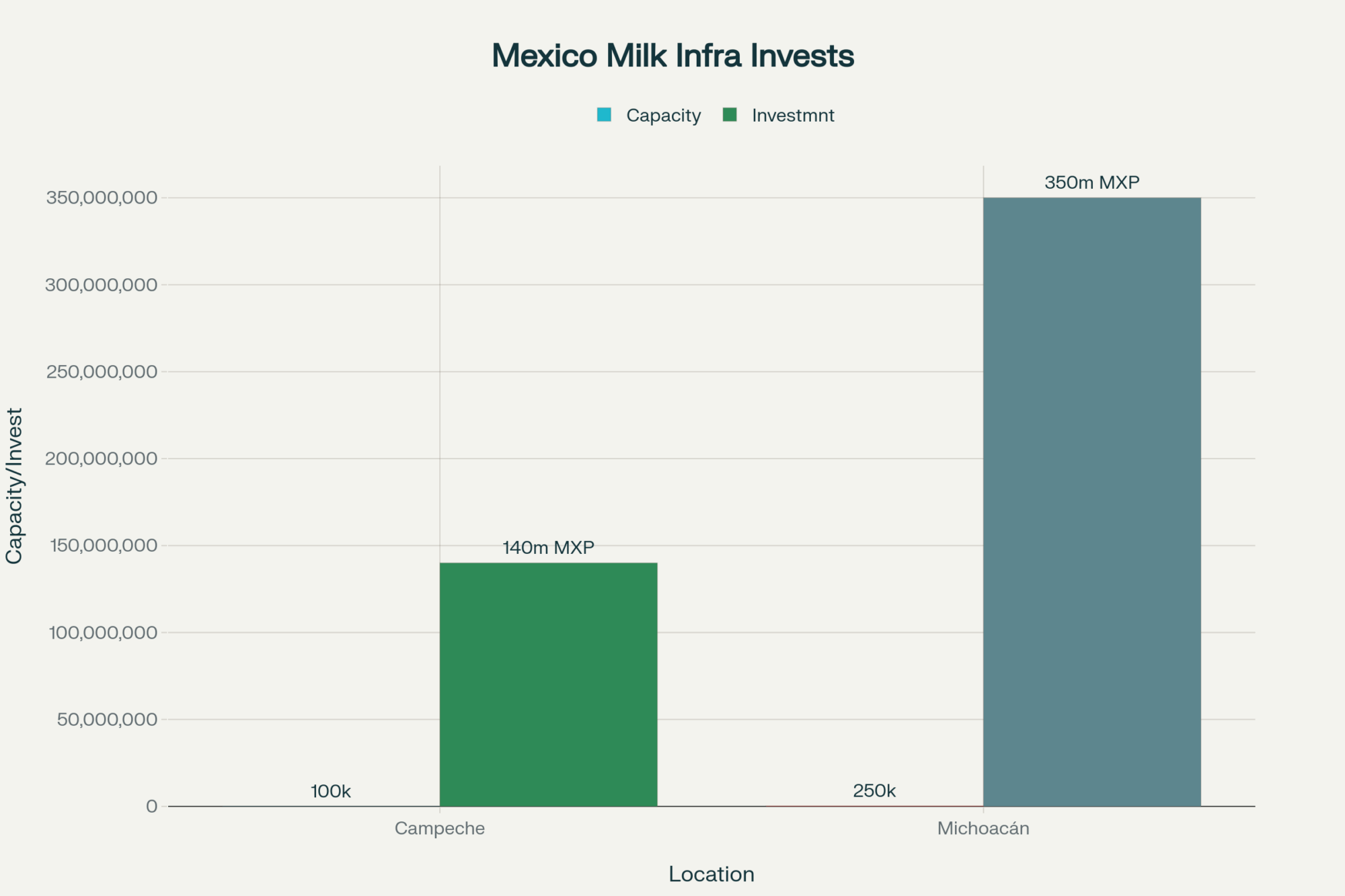

Meanwhile, they’re investing substantial funds in infrastructure. We’re discussing major investments as part of the broader $4.1 billion program, with planned processing facilities set to come online throughout 2025 and 2026. The crown jewel? A massive milk drying plant in Michoacán is explicitly designed to produce the powder they’ve been buying from us.

It’s like watching your neighbor build their own grain elevator after years of using yours.

Mexico’s Strategic and Viable Plan for Self-Sufficiency

What’s fascinating—and a bit concerning—is how well-planned and achievable this whole thing appears. They’re building infrastructure that’s calculated, not random:

The 100,000-liter daily capacity pasteurization plant in Campeche is scheduled to start operations, serving regional markets that currently rely on imports. In Michoacán, a drying facility is planned to handle 250,000 liters of water daily—that’s significant processing power aimed directly at reducing powder imports.

However, what really catches my attention is that they’re expanding milk collection infrastructure nationwide to capture previously unprocessed milk. Think about it—when you have small-scale operations scattered across a diverse geography, collection and cooling become your biggest bottlenecks.

This is where Mexico’s productivity gaps actually work in their favor, and it’s something we need to understand if we’re going to respond intelligently.

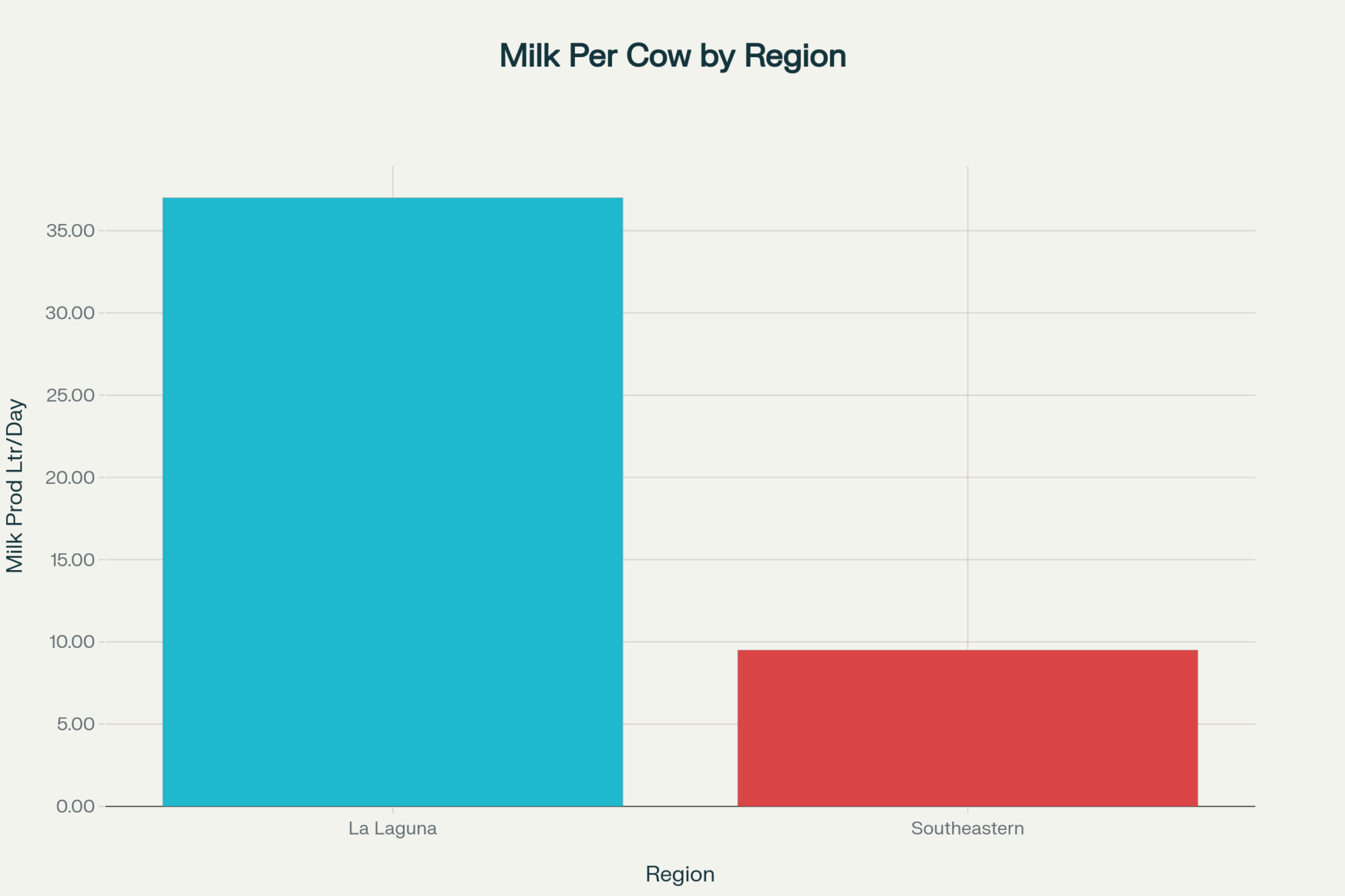

Up north in regions like La Laguna—which any of you who’ve worked in Mexican genetics know well—their modern dairies are hitting 37 liters per cow per day. Down in the southeastern states? They’re struggling to get 9-10 liters per cow. That’s not a small gap; that’s an opportunity you could drive a milk truck through.

What’s particularly noteworthy is that 97% of their dairy operations are small-scale with fewer than 100 cows each. However, when you have that much room for improvement, even modest gains can support significant production increases without proportionate cost increases.

And here’s the uncomfortable truth we need to face: If we can clearly see these productivity gaps, why haven’t we been positioning ourselves as essential partners in closing them rather than just commodity suppliers to be replaced?

Have we been so focused on shipping powder that we missed the bigger opportunity?

Why This Should Keep Every Producer Up at Night

Look, I get it. Mexico has been such a reliable market that the industry may have grown somewhat complacent. However, when you consider the level of export concentration to a single country and that country decides to erect barriers around its dairy market, the concentration risk becomes undeniable.

A recent CoBank analysis reveals that the dependency extends beyond the headline export number—Mexico doesn’t just buy our surplus; they’ve become integral to our pricing structure. Agricultural economists are projecting that if Mexican demand were to disappear, we could see milk prices drop significantly. Do you recall the China trade disputes that occurred a few years ago? This could be worse because of the volume concentration.

What’s particularly concerning is that the US has nearly $8 billion in new processing capacity coming online by 2026. Those plants were designed with export growth in mind, particularly for the Mexican market. We’re adding capacity while potentially losing our largest customer.

| US Dairy Dependence on Mexico | Current Reality |

| Total Annual Exports to Mexico | $2.47 billion (2024) |

| Share of Total US Dairy Exports | ~25% |

| Mexico’s Share of US SMP | 51.5% |

| New US Processing Capacity (by 2026) | $8 billion |

The math here is troubling. Are we building processing capacity faster than we’re securing the markets to absorb that production?

I was talking to a producer in Ohio last week who’s planning a major expansion based on projected export growth. When I asked about backup markets in case Mexico goes away, well, let’s just say that conversation got uncomfortable quickly.

Where Mexico Might Stumble (And Where We Might Find Breathing Room)

Before we panic completely, let’s discuss where Mexico’s plan could encounter some speed bumps. Those productivity gaps I mentioned? They exist for real reasons.

From what I’ve observed in similar programs in other countries, achieving meaningful productivity improvements among smallholder farmers typically takes a minimum of 5-7 years. Mexico may be optimistic about its timeline, especially when considering the potential impact of political cycles that could alter policy support. We’ve seen this movie before in other regions—Brazil attempted something similar in the early 2000s and encountered significant implementation delays.

Then there’s the water situation—and anyone who has spent time in northern Mexico knows this is a real concern. The productive regions are facing ongoing drought conditions that could limit their expansion potential. When you’re talking about expanding dairy operations in areas already stressed for water resources… that’s a genuine constraint that money alone can’t fix quickly.

Could US producers pivot to exporting high-value specialty cheeses that Mexico cannot easily replicate? Possibly, but the volume economics don’t work the same way. Specialty products command higher prices but represent a fraction of the volume that keeps our processing plants running efficiently. You can’t replace 51.5% of your powder exports with artisanal cheese sales.

However, here’s the thing that worries me—even if they don’t hit their targets perfectly, any movement toward self-sufficiency will still affect our export volumes. And we can’t afford to ignore that reality.

Are we betting our export strategy on Mexico’s plan failing, or are we preparing for the possibility that they might actually succeed?

The Hidden Opportunity in This Challenge

What’s particularly noteworthy about this whole situation is that while Mexico’s building walls around commodity products, they’re creating huge opportunities for the right kind of American companies.

Think about those productivity gaps I mentioned. Mexico has been importing high-quality dairy genetics to improve their herd performance—this tells me they’re willing to pay for superior genetics and technology, even while pushing for self-sufficiency in commodities.

Your genetic companies, equipment manufacturers, and technical service providers should view this as a massive opportunity. The infrastructure investment creates immediate demand for processing equipment, automation systems, and technical expertise, where we still hold competitive advantages.

Here’s what I’m seeing from producers who get it: they’re not just trying to maintain market share, they’re figuring out how to profit from the transformation. Because that transformation is happening whether we participate or not.

A senior executive at a leading US genetics firm recently confirmed to me that they’ve already started positioning themselves as “essential partners” in Mexico’s productivity improvements rather than just semen suppliers. Smart move.

And honestly? Diversification should’ve been happening anyway. Regional markets are showing strong growth in dairy demand, and companies that establish positions in emerging markets before they become critical will outperform those scrambling for alternatives after losing established relationships.

Here’s the question that should be driving strategy meetings: Are we going to stop thinking about this as losing a customer and start seeing it as gaining a technology partner?

What This Means for Your Operation Right Now

Look, Mexico’s dairy independence campaign isn’t just policy rhetoric—it’s economic nationalism targeting our most reliable agricultural export relationship. They’re not playing games with systematic infrastructure investment totaling billions over the next five years.

The question isn’t whether Mexico will succeed in reducing import dependence… It’s a question of whether American dairy companies will adapt quickly enough to profit from the transformation or watch it happen from the sidelines.

Here’s what you need to be thinking about—and I mean seriously considering, not just adding to your someday list:

Start diversifying your export exposure within the next 12 to 18 months. Don’t wait until Mexican demand actually disappears. Southeast Asia, the Middle East, and parts of Africa are experiencing strong growth in dairy demand. However, here’s the catch—these markets typically take 3-5 years to develop properly, which means starting from scratch.

Look for partnership opportunities before your competitors do. The infrastructure Mexico’s building creates demand for exactly what we do best—genetics, equipment, and technical services. Find ways to profit from their growth rather than just defending against their independence. Target timeline? Over the next 6-12 months, while opportunities are still available.

Get serious about margin preparation. If we lose even part of the Mexican relationship, domestic supply could increase, putting pressure on milk prices. Ensure your cost structure can withstand a 10-15% milk price decline (a worst-case scenario, but plan for it). This isn’t fear-mongering; it’s basic supply and demand mathematics.

“Are you positioning your operation to profit from change, or just hoping things stay the same?”

A veteran producer I spoke with at a recent industry meeting in Wisconsin put it perfectly: “The operations that were already thinking strategically weren’t panicked by this news. The ones that hadn’t considered export diversification? Well… they left with a lot of homework.”

The Bottom Line

The era of taking Mexican demand for granted is over. Full stop.

Mexico’s systematic approach to dairy independence—from guaranteed pricing to strategic infrastructure investment—shows they’re serious about reshaping this relationship. The successful operations will be those that can pivot from just shipping commodities to building value-added partnerships that transcend political boundaries and policy changes.

This transformation is happening whether we like it or not. The only choice is whether we profit from the change or become its casualties. And based on what I’m seeing from Mexico’s commitment and systematic approach… I’d say the window for adaptation is narrower than most people think.

What separates the operations that thrive during industry transitions from those that merely survive? The thrivers stopped defending the old model and started building the new one. They recognized that when your biggest customer starts talking about independence, that’s not a threat—it’s a wake-up call.

I’ve been watching dairy markets for over two decades, and I’ve seen this pattern before. The producers and processors who come out ahead will be those who saw this coming, adapted early, and positioned themselves to benefit from the change rather than just react to it.

Because ready or not, that change is coming faster than most of us anticipated.

The question is: will you lead that transformation, or watch it from the sidelines?

And if you’re still not convinced this is urgent… remember that $8 billion in new processing capacity is coming online. That milk has to go somewhere. Better make sure you know where that somewhere is going to be.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Top 7 Cents-Per-Cow Per Day Savers That Will Transform Your Dairy’s Bottom Line – This piece delivers seven actionable strategies for trimming daily operational costs. It provides a tactical playbook for building the financial resilience needed to thrive even if domestic milk prices face downward pressure from shifting export dynamics.

- Navigating the New Dairy World Order: Where Will the Next Billion Consumers Come From? – This strategic analysis looks beyond the immediate threat to identify the next high-growth global dairy markets. It provides a crucial roadmap for diversification, helping you position your operation to capture future demand in emerging economies.

- Beyond the Bull: How Genomic Selection is Reshaping Dairy Profitability – This piece explores how to leverage genomic selection to accelerate genetic gain and herd profitability. It reveals methods for creating a more efficient, resilient herd, positioning your operation to be a high-value genetics partner rather than a replaceable commodity supplier.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!