Argentina now ships dairy products to over 80 countries, despite labor costs ranging from $ 4 to $8 per hour. We’re paying $20-25/hr. Something’s gotta give.

EXECUTIVE SUMMARY: You know that feeling when you realize everyone else figured out something you missed? That’s what’s happening with South American dairy right now. While we’re fighting $25/hour labor and massive cooling bills, Argentina’s running 150-200 cow herds at $4-8/hour labor costs, and Chile’s hitting record production with GPS-guided grazing. The numbers don’t lie—their feed costs about 50% of what we pay, land rent is $200-400/hectare versus our $1,000-2,000, and they’re shipping to 80+ countries because their cost structure allows them to compete anywhere. Uruguay exports 65% of its milk, despite being smaller than most countries, demonstrating that efficiency often outweighs size. After Argentina’s production dropped 22% early this year, they’re bouncing back through exports, while we’re still fighting the same old cost pressures. Here’s the thing—their tech adoption is smart, not expensive, and it’s working with their natural advantages instead of against them. Maybe it’s time we stopped thinking bigger is always better and started thinking smarter.

KEY TAKEAWAYS

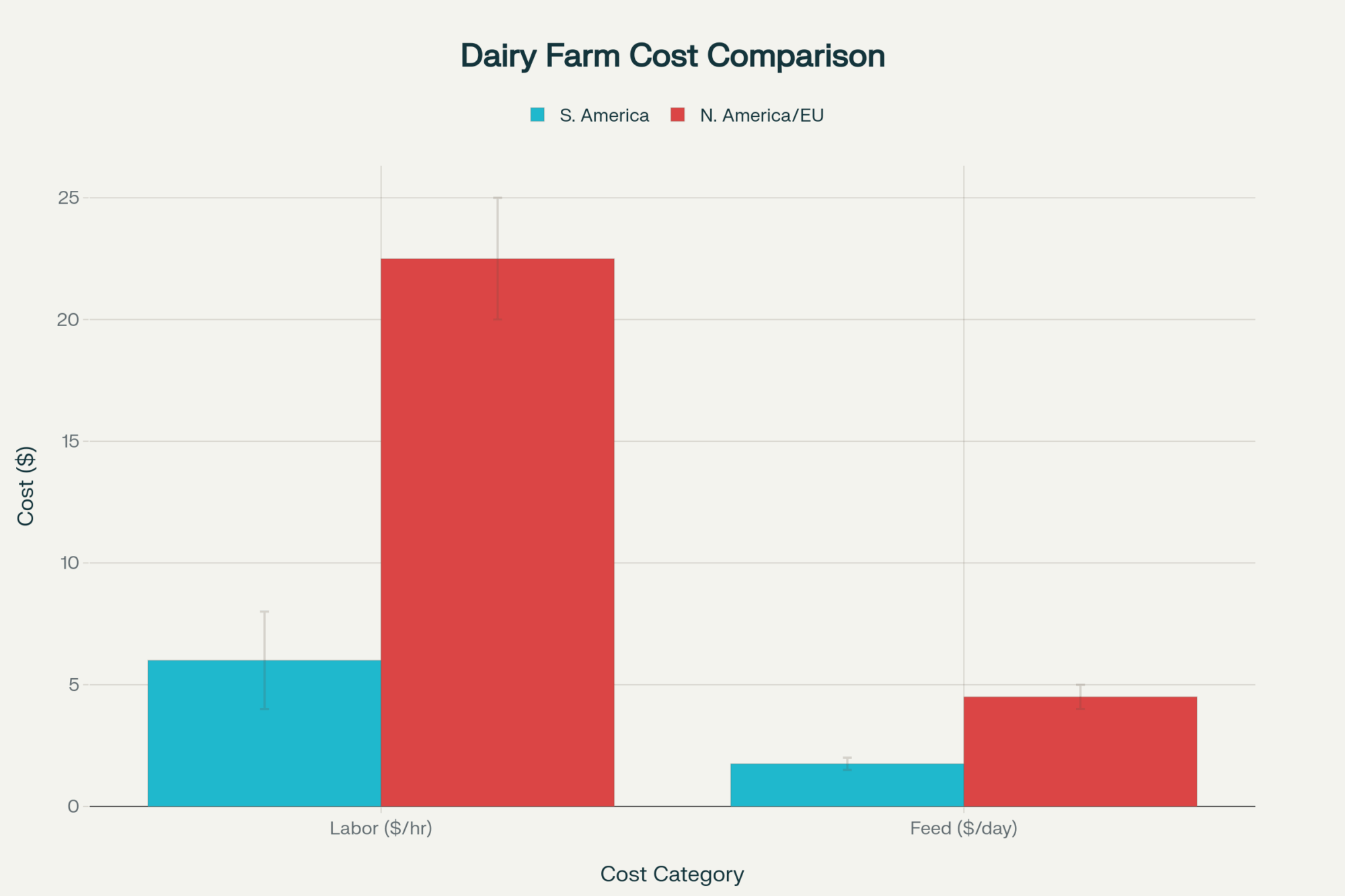

- Labor advantage that changes everything: Argentine dairy workers cost $4-8/hour while ours run $20-25/hour—that’s a $30,000+ annual savings per worker that goes straight to your bottom line. Start benchmarking your labor costs per cow against these numbers.

- Feed costs are cut in half through pasture optimization: South American operations spend $1.50-$2.00 per day per cow on feed, versus our $4-$5 per day average—GPS-guided rotational grazing and extended seasons make the difference. Calculate what a 40-50% feed cost reduction would mean for your operation.

- Technology that fits your system, not fights it: Automated gates and pasture sensors are paying back in 12-18 months without forcing system overhauls—Chilean producers are proving precision ag works for grass-based operations. Evaluate tech investments that enhance your natural advantages instead of replacing them.

- Export diversification fosters market stability: Argentina reached 80+ countries in 2023, whereas we’re often limited to 2-3 buyers—their cost structure provides pricing flexibility that we can’t match. Start monitoring global milk flows through USDA FAS reports to understand your competitive position.

- Climate advantages worth $100-300/cow/year: Natural cooling eliminates massive infrastructure costs while 7-8 month grazing seasons reduce purchased feed dependence—these aren’t temporary benefits, they’re permanent structural advantages. Assess your climate-related costs and identify where efficiency improvements could be beneficial.

I just wrapped up a call with a buddy who tracks global milk flows for a living. “Argentina’s now shipping dairy to over 80 countries,” he told me. “And their growth isn’t slowing.”

That caught me off guard. While we’re busy watching Wisconsin weather and New Zealand production reports, something massive is happening down south.

Argentina: From Crisis to Competition

Out in the Pampas—Argentina’s dairy heartland—most operations run 150-200 cows, rotating paddocks every 28-35 days. Those cows are producing 20-24 liters of milk daily during peak lactation.

The real story? Cost structure. Land and labor run a fraction of what we pay up north.

The turnaround has been dramatic. Following severe droughts and economic pressures, which led to a nearly 22% decline in milk production from January to February 2024 compared to the same period in the previous year, the industry is relying on exports for recovery.

A key catalyst was the removal of export tariffs (retenciones) on dairy products. This policy, initially implemented by the previous government, was made permanent by President Javier Milei’s administration in late 2023, signaling a major shift toward promoting exports.

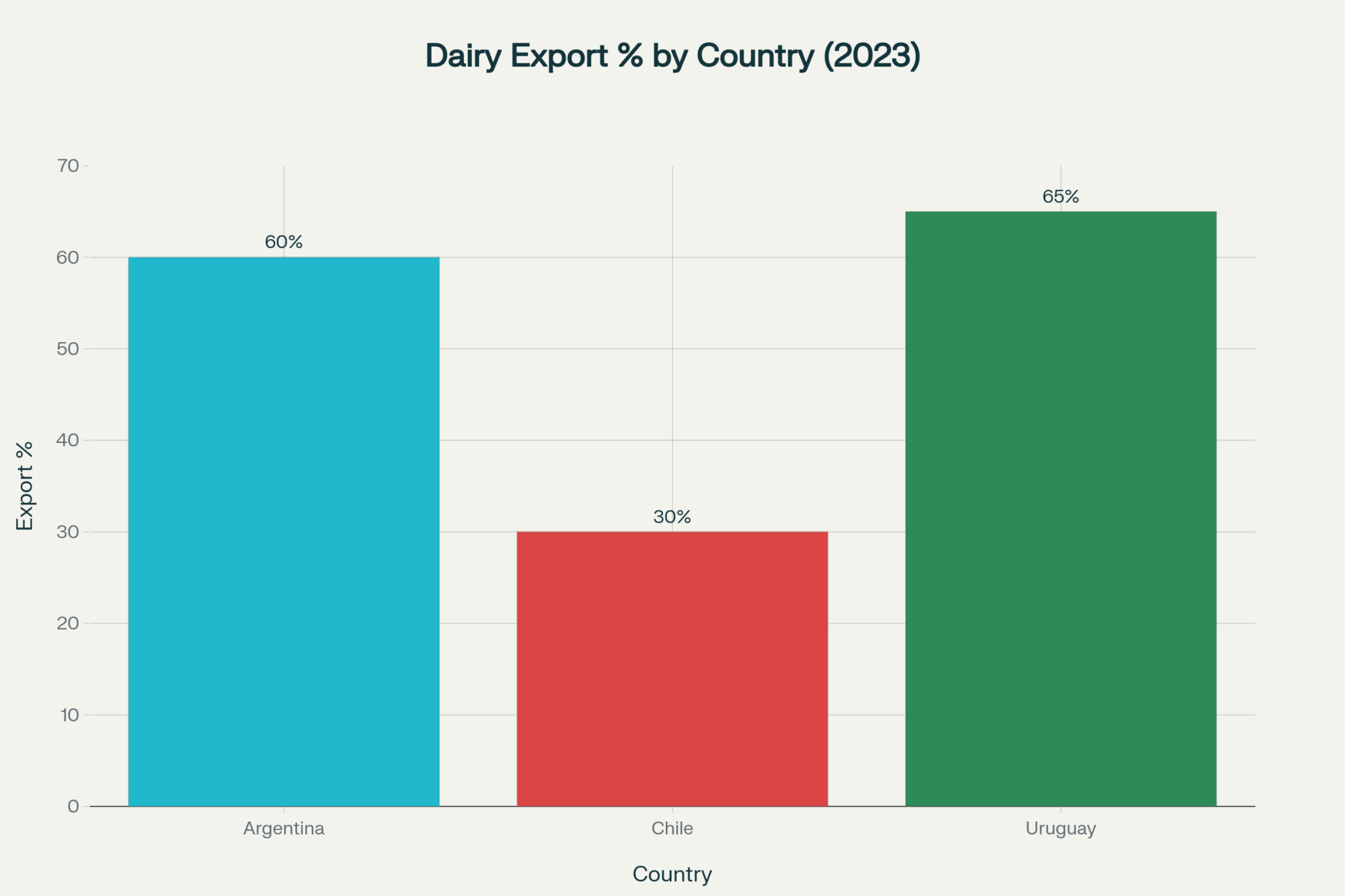

According to export data monitored by OCLA, around 60% of dairy products, mainly milk powders, were destined for export in 2023—not the entire milk volume.

Juan Diaz of El Rosario Farm near Santa Fe notes, “Opening up export routes has transformed our cash flow and outlook.”

Chile: Where Precision Meets Pasture

Chile’s dairy production is concentrated in Los Ríos and Los Lagos, contributing 83.6% of the national milk output. Average farm sizes range between 120 and 150 head.

Despite periodic droughts, these regions produced approximately 2.23 billion liters of milk in 2023.

Dairy tech advisors in the Temuco region observe that the most competitive producers are those blending technology—including GPS-guided pasture management and automated water systems—with a deep respect for their pasture-based heritage.

Uruguay: Small But Mighty Dairy Exporter

Uruguay, home to less than 4 million people, exports about 65% of its dairy production. Herd sizes commonly range from 120 to 160 cows.

Export volumes increased by roughly 10% in 2023, despite price volatility.

A producer near Montevideo, Lucia, points out, “Our steady climate and reliable supply are major drivers behind buyer loyalty.”

South America’s Unbeatable Cost Structure

USDA data highlights a stark contrast: Labor costs in Argentina average $4-$8 per hour, while in the US, they average $20-$25. Likewise, feed costs for pasture-based systems are typically half the price of those for confinement systems.

| Cost Category | Pasture-Based (S. America) | Confinement (US/EU) |

| Labor Cost | $4-$8/hr | $20-$25/hr |

| Feed Cost | $1.50-$2.00/day per cow | $4.00-$5.00/day |

| Land Rent | $200-$400/ha | $1,000-$2,000/ha |

| Cooling Costs | Minimal | $100-$300/year/cow |

These savings add up fast, helping producers maintain stronger margins.

Tech That Works with Your System

Technology is no longer confined to large-scale dairy operations. Automated gates, pasture sensors, and robotic milkers are well-suited for pasture-focused operations.

Ana Gómez, a veterinary technician and farm manager in Uruguay, said, “We installed automated waterers last season. It helped reduce labor without changing how we run our farm.”

Shift in Global Markets

Argentina expanded exports to over 80 countries in 2023, diversifying product lines and markets.

Chile’s growing domestic production is actively displacing imports worth millions annually.

Uruguay reported a 10% growth in dairy exports in 2023, expanding reach into Africa and Asia.

Watch the Risks

While Argentina’s 2023 tariff reforms under President Milei have boosted exports, currency swings and political volatility remain concerns.

Infrastructure issues, including inadequate transportation and cold storage systems, also hinder growth and market access.

What You Can Do Next

- Understand your full cost structure, especially feed, labor, and climate-related costs.

- Monitor global market flow and emerging buyer preferences.

- Evaluate technology that complements your production system, not forces it.

- Plan for currency, political, and environmental risks.

The global dairy market is shifting, and South America’s rise demands your attention.

The fundamentals of global dairy are shifting under our feet. South America’s structural advantages in cost and climate aren’t a temporary trend—they represent a new competitive reality. Smart operators aren’t just watching this change; they’re analyzing their own operations against it. The question isn’t if this will affect your business, but how you’ll prepare for it.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Why 70-Hour Weeks Are Killing Your Dairy Profits – This article provides tactical strategies to optimize labor efficiency. It uses data to prove that working smarter, not harder, is the key to profitability, directly complementing the main article’s focus on South America’s labor cost advantage.

- Global Dairy Market in 2025: Production Shifts, Demand Fluctuations, and Trade Dynamics – For a strategic, big-picture view, this piece details the economic forces and production trends shaping global trade. It contextualizes the South American surge within the broader market, revealing opportunities and threats for North American producers.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – This forward-looking article explores the innovative tools available to compete. It demonstrates how to leverage precision technology, from sensors to feeding systems, to boost efficiency and close the competitive gap with lower-cost regions.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.