Milk yield jumped 3.4% but cheese hit $1.85—are you maximizing component value

EXECUTIVE SUMMARY: You’ve probably noticed something’s different out there. The old milk pricing playbook just got tossed out the window. Latest USDA numbers show we’re cranking out 3.4% more milk—cows hitting 2,045 pounds monthly—but here’s where it gets interesting. Cheddar blocks jumped to $1.85/lb while butter dropped 4.3% in the same week. That’s not a typo… it’s the new reality. Cheese exports smashed records at 52,191 metric tons (up 34%), and butterfat exports doubled. Meanwhile, feed costs are finally giving us a break with corn near $4.05/bushel, potentially boosting margins by $12/cwt. Bottom line? If you’re not targeting component-specific marketing and genomic selection for feed efficiency, you’re leaving serious money on the table.

KEY TAKEAWAYS

- Genomic testing isn’t optional anymore—select for higher PTA fat and protein to ride the cheese wave. With cheddar up 3.93% recently, every percentage point of butterfat matters. Start reviewing your bull lineup today.

- Hedge smart, not hard—lock in 25-30% of fall milk using Class III futures at current $17.50/cwt levels. The cheese market’s on fire, and you want in on this action before it cools.

- Feed costs are your friend right now—corn futures sitting pretty at $4.05/bushel with soybean meal declining. Forward contract now to bank those savings worth up to $12/cwt through 2025.

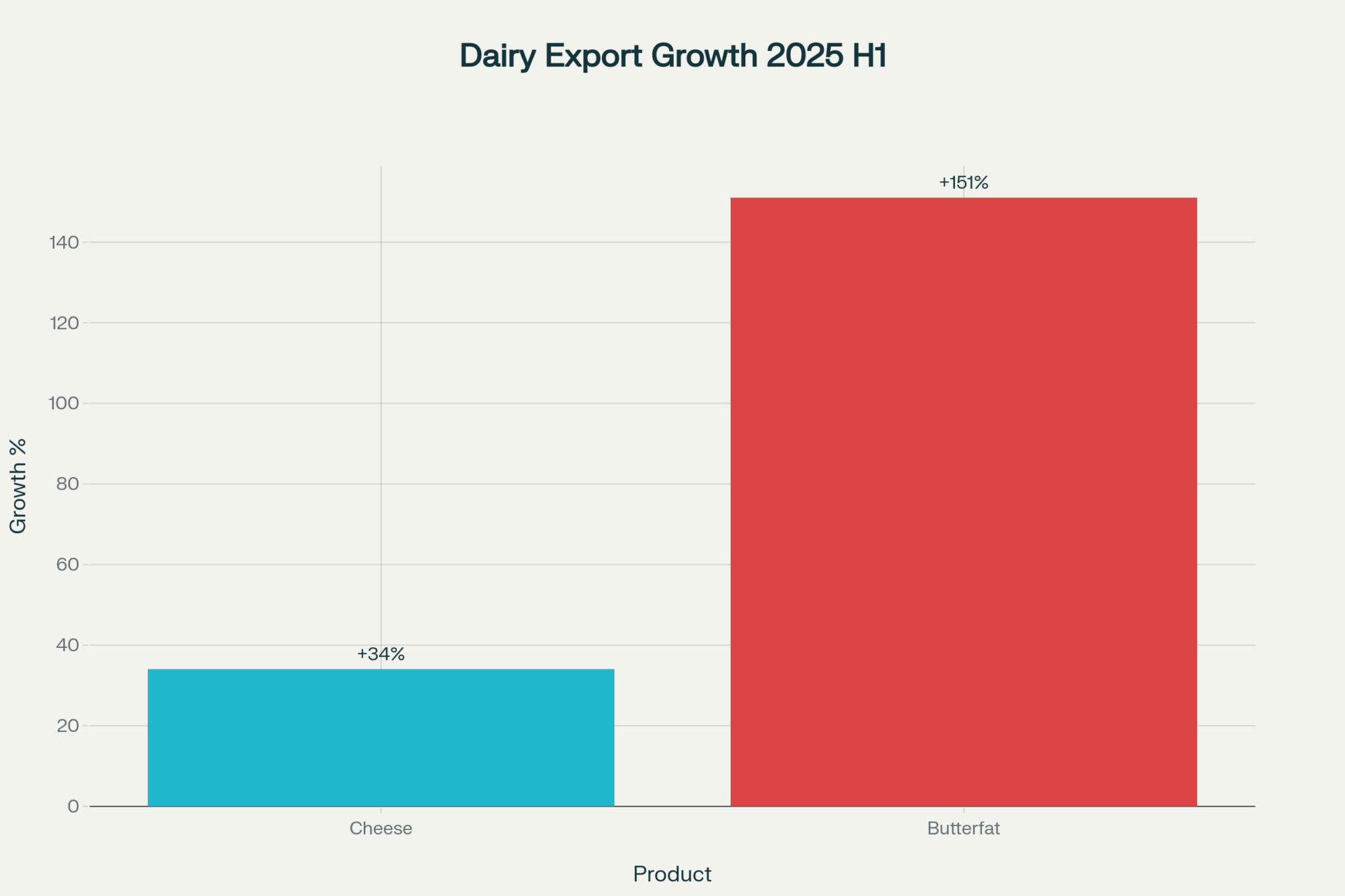

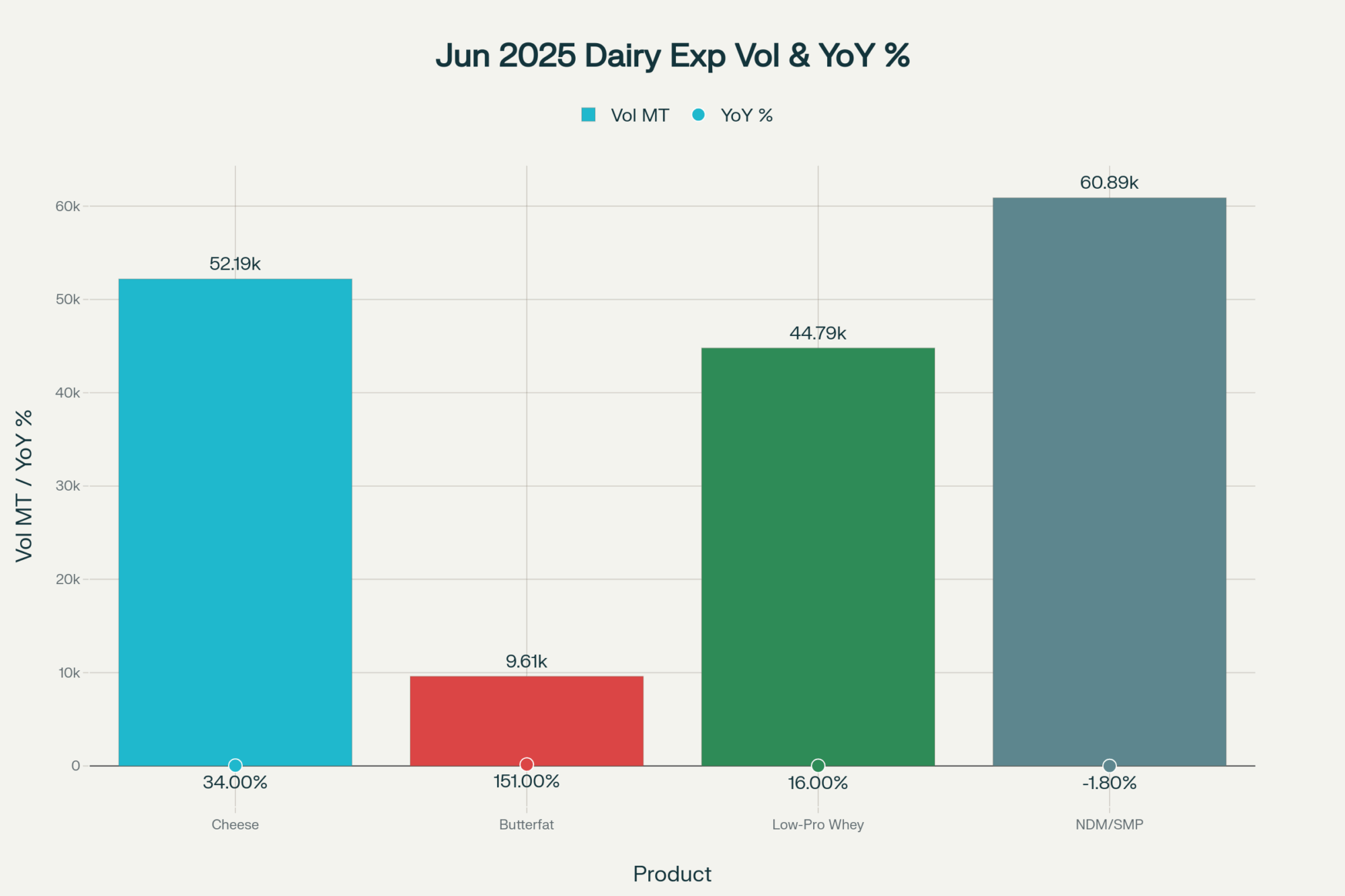

- Export dependency is real—cheese exports up 34%, butterfat 151%. Your milk check depends on keeping foreign buyers happy, so watch those trade numbers like a hawk.

- Geography matters more than ever—Plains states like Kansas are crushing it with 19% growth while Washington’s down 9.4%. Know your region’s trajectory and plan accordingly.

Look, I’ll cut to the chase here — this week’s numbers aren’t just another set of monthly reports. We’re watching the dairy market rewrite its own rulebook in real-time, and if you’re still pricing milk like it’s 2020, you’re about to get a very expensive education.

The thing is, most producers I talk to are still thinking in terms of the old Class III versus Class IV relationship… but that relationship just died. And what’s replacing it? Well, that’s what’s keeping me up at night.

The Numbers That Don’t Make Sense (Until They Do)

So here’s what happened in June — and trust me, this matters more than you think. Milk production jumped 3.4% to hit 18.5 billion pounds across the 24 major dairy states. More cows, better per-cow productivity (we’re talking a 2,045-pound monthly average), and yet…

Cheese prices are climbing like they’re rocket-powered while butter is sliding down a greased hill. Makes no sense, right?

Well, here’s where it gets interesting. I was chatting with some folks out in Wisconsin last week — spots that were trading at discounts to Class III just fourteen days ago are now commanding premiums. That’s not seasonal fluctuation, folks. That’s demand that’s so tight it’s changing the fundamental economics of spot milk pricing.

What strikes me about this is how quickly processors are adapting. When you’ve got CME cheddar blocks jumping to $1.85/lb while butter drops to $2.36/lb in the same week… that tells you something fundamental has shifted in how the market values different components of our milk.

The Export Dependency That Should Concern You

Here’s what really caught my attention in the latest numbers: cheese exports hit 52,191 metric tons in June. That’s not just strong — that’s a 34% jump over last year and an all-time monthly record.

But here’s the kicker… we’re now exporting close to 9% of our total cheese production. A decade ago? That number was around 5%.

The butterfat story is even more dramatic. Exports surged 151% year-to-date, and we’re trading at massive discounts to European benchmarks — sometimes 40% gaps.

[Insert chart here: Bar chart showing 34% growth in cheese exports and 151% growth in butterfat exports for first half 2025 vs 2024]

I keep asking myself: what happens if those international buyers suddenly decide they don’t need our cheese? Because right now, with domestic demand basically flat, those export markets are literally the only thing standing between current prices and a complete collapse.

Think about that for a minute. When did we become so reliant on selling our milk overseas?

Geographic Reality Check: The Great Dairy Migration

What’s happening regionally is just as important as the overall numbers, and honestly, it’s accelerating faster than I expected. Kansas posted 19% year-over-year growth. South Dakota hit 11.5%. Idaho came in at 9.7%. Meanwhile, Washington dropped 9.4% and Oregon fell 1.9%.

This isn’t random market forces — it’s strategic capital allocation happening in real-time. The Plains and Mountain West offer modern processing infrastructure, lower regulatory burdens, and what economists call a “processing-production feedback loop.”

And for traditional dairy regions? When you’ve got operations running on infrastructure built in the 1980s competing against facilities designed for today’s efficiency standards… well, the economics get pretty brutal pretty fast.

I’ve been to some of these new facilities, and the difference is staggering. We’re talking about processing capacity that can handle today’s milk volumes with half the labor and twice the efficiency.

The Policy Curveball That Blindsided Everyone

Here’s something that caught even the sharpest market watchers off guard: those Federal Milk Marketing Order reforms that kicked in during June.

Let me walk you through what actually changed, because this matters more than most people realize. The pricing formula for Class I (fluid milk) now uses the “higher-of” Class III or Class IV skim milk prices. Previously, Class IV often led because it typically carried a premium.

Now that premium has evaporated. So when Class III is at $17.37 and Class IV drops to $17.20, suddenly Class III is setting your fluid milk floor instead.

What’s particularly noteworthy is how this demonstrates that in dairy, there’s always another variable lurking in the background. Just when you think you understand the pricing structure, policy changes interact with market dynamics in ways nobody anticipated.

Risk management professionals across cooperatives are telling me they’re having to rewrite their entire hedging models because the old relationships just don’t work anymore.

Feed Markets: Finally Some Good News

The feed situation is actually offering genuine relief, which honestly couldn’t come at a better time. December corn futures are trading around $4.05/bushel, well below recent peaks. Soybean meal has backed off toward $285/ton for December delivery.

Current margin calculations show income-over-feed-cost averaging $8.50/cwt, with some projections suggesting annual averages could reach $12.99/cwt. Those are levels that historically support herd expansion and reinvestment — which explains some of the production growth we’re seeing.

But here’s the uncomfortable truth… improved margins from lower feed costs might actually make our export dependency problem worse by encouraging even more production. It’s like we’re trapped in this cycle where good news becomes bad news.

What This Means for Your Operation Starting Monday

Look, the reality is that traditional All-Milk price hedging strategies just became obsolete overnight. You need to understand your specific component exposure because this market bifurcation isn’t going away.

If your milk flows primarily to cheese plants, you’re sitting in the sweet spot right now. Class III futures for fall delivery are holding above $17.00/cwt, and the export momentum shows no signs of slowing. I’d seriously consider locking in 25-30% of fall production using current futures contracts.

For operations in butter/powder regions… this environment demands way more defensive positioning. Butter inventories continue building despite record exports, which suggests prices may need to fall further before finding sustainable support.

The feed cost outlook presents clear opportunities. Forward contracting corn and soybean meal at current levels could lock in these improved margin opportunities for months ahead.

Bottom Line: Five Things You Must Do This Week

- Component-specific risk management is mandatory. Generic All-Milk hedging strategies won’t cut it anymore. You need to understand exactly where your milk goes and price accordingly.

- Export performance has become your most important leading indicator. Monthly trade data deserves more attention than production reports. If you’re not tracking these numbers, you’re flying blind.

- Feed cost advantages create strategic opportunities for forward contracting that could lock in improved margins through volatile periods. Don’t let this window close because you’re overthinking it.

- Geographic production shifts are accelerating. If you’re in a declining region, you need to think seriously about your long-term positioning. The data is clear about where this is heading.

- Market dependency on exports creates vulnerability that requires constant monitoring of global competitive positioning. This isn’t set-it-and-forget-it territory anymore.

The Hard Truth About What Comes Next

What keeps industry veterans like me awake at night? Our entire price structure now balances on export competitiveness. Domestic demand simply can’t absorb current production levels at profitable prices.

The cheese complex demonstrates this perfectly. Those record export volumes are literally the only thing preventing inventory accumulation and price collapse. Remove that export demand, and the math gets ugly real fast.

This development is fascinating from a market structure perspective, but it’s also concerning. We’ve never been this dependent on global buyers for price stability. The U.S. dairy industry has essentially become an export-driven business without most producers fully realizing it.

The producers who understand their specific component exposure, adapt risk management accordingly, and capitalize on feed cost advantages will navigate this successfully. Those clinging to traditional approaches? They’re going to learn some expensive lessons about how markets evolve.

This is the new reality every dairy operation needs to plan for. The sooner you adapt, the better positioned you’ll be for whatever comes next — because if there’s one thing I’m certain about, it’s that this market evolution is just getting started.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlock Hidden Dairy Profits Through Lifetime Efficiency: How Modern Genetics and Strategic Nutrition Can Cut Feed Costs by $251 Per Cow – This article provides a tactical implementation guide for the main report’s advice, showing how to leverage genomic selection and precision nutrition to increase component value and cut feed costs, delivering a clear return on investment.

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – For a strategic perspective, this piece dives deeper into the global market forces mentioned in the report. It analyzes how production shifts in the EU and U.S. influence the export dependency and pricing dynamics your operation faces.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Looking to the future, this article explores the innovative technologies that enable the strategies discussed in the main report. It details how tools like smart calf sensors and advanced health monitoring can build a more resilient and profitable operation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!