Kansas farms crushing 19% milk growth while butter stocks crash 10M lbs—the component revolution is separating winners from losers

EXECUTIVE SUMMARY: The dairy industry’s obsession with milk volume over components is leaving serious money on the table while smart producers capitalize on the biggest shift in decades. Despite total U.S. milk production climbing just 3.3%, calculated milk solids surged 1.65% through 2025, with butterfat tests hitting 4.36%—nearly 9 basis points above last year. Kansas farmers are absolutely crushing it with 19% growth while butter inventories dropped from 364.6 to 354.4 million pounds in just one month, creating supply tightness that’s driving premiums higher. Meanwhile, genomic testing is delivering $70 additional value per cow annually, and feed efficiency improvements can save $470 per cow per year on well-managed operations. Global trade tensions—especially China’s dairy import challenges and potential Mexico tariffs—are reshuffling traditional export patterns, creating both risks and opportunities for forward-thinking producers. The bottom line? Producers who pivot from volume thinking to component optimization, leverage genomic selection, and implement strategic risk management are positioning themselves to capture the premiums while their competitors chase outdated metrics.

KEY TAKEAWAYS

- Component Focus Delivers Immediate Returns: Recent data shows butterfat production jumped 5.3% and protein climbed 4.9% year-over-year, with component-rich milk commanding premium pricing in tightening markets—implement targeted nutrition programs focusing on 16:0 fatty acid supplementation and amino acid optimization to boost component tests within 4-6 weeks.

- Genomic Testing ROI Pays Off Fast: Genomic selection delivers $70 additional value per cow annually compared to traditional breeding methods, with 65-70% breeding value reliability versus just 20-25% from parent averages—test heifer calves early to identify low-genetic-merit animals before investing $1,400-$2,000 in feed costs per head.

- Feed Efficiency Gains Cut Major Costs: Improvements in herd feed efficiency from 1.55 to 1.75 equate to savings of $470 per cow per year, contributing about $1.2 million to a 2,500-cow dairy’s bottom line—focus on precision nutrition, waste reduction, and intake optimization to achieve 5-15% efficiency gains that directly impact your largest variable cost.

- Strategic Culling Captures High Beef Values: With cull cow prices at $145+/cwt and beef-on-dairy crossbreds commanding $900 for day-old calves, strategic herd management decisions can generate significant cash flow—evaluate bottom-performing animals using income-over-feed-cost metrics and leverage current high prices for immediate capital injection.

- Risk Management Is Non-Negotiable: Class III futures pricing milk at $17.21/cwt through Q3 with feed costs rising and trade uncertainties mounting—lock in 60-70% of winter feed needs now at favorable corn ($4.19/bushel) and implement Dairy Revenue Protection coverage to protect against margin compression in volatile markets.

The week ending July 28th delivered some market signals that honestly have me scratching my head – and I think a lot of producers are feeling the same way.

Two Completely Different Stories Playing Out

Here’s what’s got me thinking about where this industry is headed. While European traders seemed to take a collective breather – moving relatively modest volumes across butter and skim milk powder – Asian markets were going absolutely crazy. I mean, when you’re seeing Singapore exchange activity that massive (we’re talking serious tonnage here), something fundamental is shifting.

The price action tells you everything you need to know. European butter futures drifted lower – nothing dramatic, maybe 0.3% or so – while skim milk powder dropped a bit more. But over in Singapore? Traders were bidding up whole milk powder by nearly 2% and butter climbed close to that same level.

That’s not random market noise, folks. That’s Asian demand meeting supply constraints, and it’s a pattern I’m seeing more of when I talk to guys in the export business.

Production Numbers That Make You Think We’re in a New Era

Get ready for this – and I had to double-check these numbers because they seemed almost too good to be true. New Zealand just posted a 14.5% jump in milk collections compared to last June, according to USDA’s latest international production data. After everything they’ve been through – drought, regulations, you name it – Kiwi farmers are back with milk solids production up nearly 18%.

I was talking to a consultant who works down there, and he says the combination of better weather and that opening milk price signal at $10.00 per kgMS has farmers really motivated again. When you’ve got good feed under your feet and prices that work, producers respond quickly.

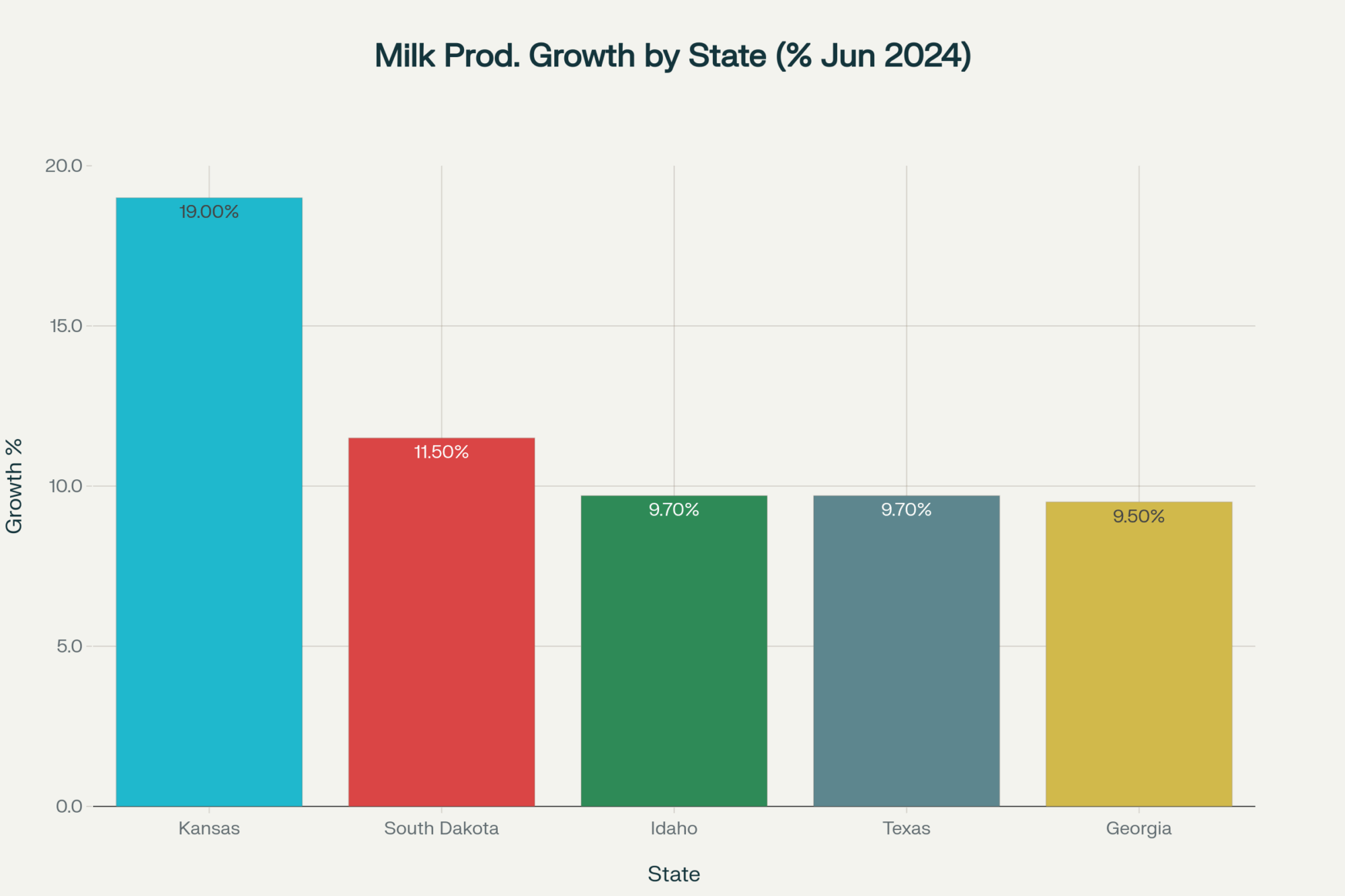

But here’s the number that really caught my attention: USDA’s monthly milk production report shows U.S. output surged 3.3% year-over-year in June – the biggest annual increase since May 2021. Kansas farmers are absolutely crushing it with 19% growth. South Dakota’s up 11.5%, Idaho’s climbing 9.7%.

When you see numbers like that, you know there’s serious infrastructure investment paying off.

What’s fascinating is how regional this is becoming. I know guys in Colorado who are struggling to find homes for extra milk because there’s no new processing capacity, while Kansas producers are basically printing money with all that new cheese-making ability coming online.

The component story might be even more important, though. American dairy farmers aren’t just making more milk – they’re making richer milk. Recent USDA data shows butterfat production jumped 5.3%, protein climbed 4.9%, and nonfat solids rose 3.8%.

Dr. Mike Hutjens at Illinois always said the real money is in components when margins get tight, and boy, is he being proven right.

The Heifer Problem Nobody Wants to Talk About

Here’s something that should keep every dairy producer awake at night – and I’m seeing this pattern everywhere I travel. The latest cattle inventory data suggests U.S. dairy farmers are culling significantly fewer cows than historical averages. We’re looking at the lowest cull rates since 2008, and we all remember how that expansion story ended… not well.

Why? Simple math – there just aren’t enough replacement heifers. USDA’s July 1 inventory shows dairy heifer numbers essentially flat, but that’s only after they made some pretty significant revisions to their 2023 estimates. Translation: we’re running short on the next generation, so farmers are keeping older cows longer.

I was at a producer meeting in Wisconsin last month, and a guy who’s been milking for 30 years said something that stuck with me: “I’ve got cows in fourth lactation that I’d normally ship, but I can’t replace them.” That’s happening everywhere, and it’s not sustainable.

Butter Markets Flash Some Serious Warning Signals

CME spot butter took a beating this week, dropping to around $2.465 per pound– testing two-month lows. But here’s where it gets interesting. USDA’s Cold Storage report showed butter inventories actually dropped to 354 million pounds from May to June, which is faster than the typical seasonal drawdown.

What really caught my eye, though, is what’s happening with exports. Industry sources suggest U.S. butter has been showing improved competitiveness in global markets recently. When you’re among the cheapest butter globally and quality is solid, international buyers notice. A trader I know in California says they’re moving more butter overseas than they have in years.

China’s Whey Situation – and What It Means for Everyone

The trade war casualties keep piling up, and this one hits close to home for a lot of Midwest producers. From what industry observers are seeing, Chinese whey imports took a significant hit in June after those mid-May tariffs kicked in.

CME spot whey powder dropped to around 54¢ per pound, and that’s real money out of producer pockets. A guy I know who’s been in the whey business for 20 years told me, “When your biggest customer goes shopping elsewhere, you feel it immediately.”

That’s exactly what’s happening, and it’s a tough lesson in supply chain diversification that maybe we should have learned earlier.

Futures Markets Price in the New Reality

August Class III milk futures fell 56¢ to $17.21 per cwt** this week. The market’s basically telling us to expect $17 milk through Q3, with maybe a modest recovery to just north of $18 in Q4.

Look, these aren’t disaster prices – especially with corn futures at $4.19 and soybean meal at $281.70 per short ton. But they’re a far cry from where we were earlier this year, and margins are definitely tighter.

Class IV settled around $18.95 for nearby contracts, with the back months in the low $19s. A nutrition consultant I work with says these price levels still work for well-managed operations, but there’s not much room for error.

What Argentina’s Telling Us About Global Dynamics

Here’s something that doesn’t get enough attention – Argentina’s dairy sector showed strong recovery during early 2025, with production up 12.4% in the January-May period according to recent industry reports. After the economic chaos they went through last year, that recovery is pretty remarkable.

What’s particularly noteworthy is how quickly producers there responded to better margins. When milk prices moved up and feed costs stabilized, production followed. It’s a reminder that dairy farmers everywhere react to the same economic signals – they just need them to work in their favor.

Bottom Line: What This Means for Your Operation

Here’s what I’m taking away from all this, and what I think matters most for producers making decisions right now:

The heifer shortage is real and it’s going to bite us. If you’re thinking about expansion, replacement heifer costs are only going higher. The guys who locked in bred heifers six months ago are looking pretty smart right now.

Feed cost advantages won’t last forever. With corn at $4.19 and soy meal under $282, this is the time to lock in Q4 and early 2026 feed needs. Every nutritionist I talk to says the same thing – book 60-70% of your winter needs now.

Regional differences are getting bigger. If you’re in an area with new processing capacity, you’re sitting pretty. If you’re not… well, basis is going to be a problem. Transportation costs are already up 12% year-over-year in some regions.

Risk management isn’t optional anymore. With Class III futures pricing in the $17 range through fall, spending a buck or two per cwt on Dairy Revenue Protection beats taking a $3-4 hit on unprotected milk. Do the math on 75 pounds per cow per day – it adds up fast.

Components are where the money is. Every tenth of a percent improvement in milk fat is worth about 30¢ per cwt when margins are this tight. Nutrition programs that boost butterfat are paying for themselves quickly.

The thing that strikes me most about all this is how quickly the landscape is changing. We’ve got production surging in some regions while others struggle with infrastructure constraints. Trade tensions are reshuffling traditional patterns in real time. And underneath it all, we’re running short on the next generation of milk cows.

The producers who adapt fastest to these new realities – who lock in feed costs, manage risk properly, and focus on components – those are the ones who’ll come out ahead. Because if there’s one thing this industry has taught us over the years, it’s that change is the only constant. And right now, we’re seeing more change than most of us have dealt with in a long time.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- DAIRY PRODUCER’S GUIDE To Getting More From Your Feed – The main report highlights shrinking margins and the value of components. This guide provides practical strategies to maximize feed efficiency, helping you boost butterfat and protein production to immediately improve your milk check.

- The Ultimate Guide to Dairy Sire Selection – With the heifer shortage becoming a critical issue, this article offers a long-term strategic solution. Learn how to refine your breeding program to create more profitable, resilient, and efficient cows from the ground up.

- Unlocking Dairy Profits: The Untapped Potential of Automation – The market report notes that new infrastructure is creating regional winners. This piece explores how to leverage automation and technology on your own farm to gain a competitive edge and drive profitability when traditional margins are tight.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!