What if waiting on methane additives means losing $100K+ to your neighbors?

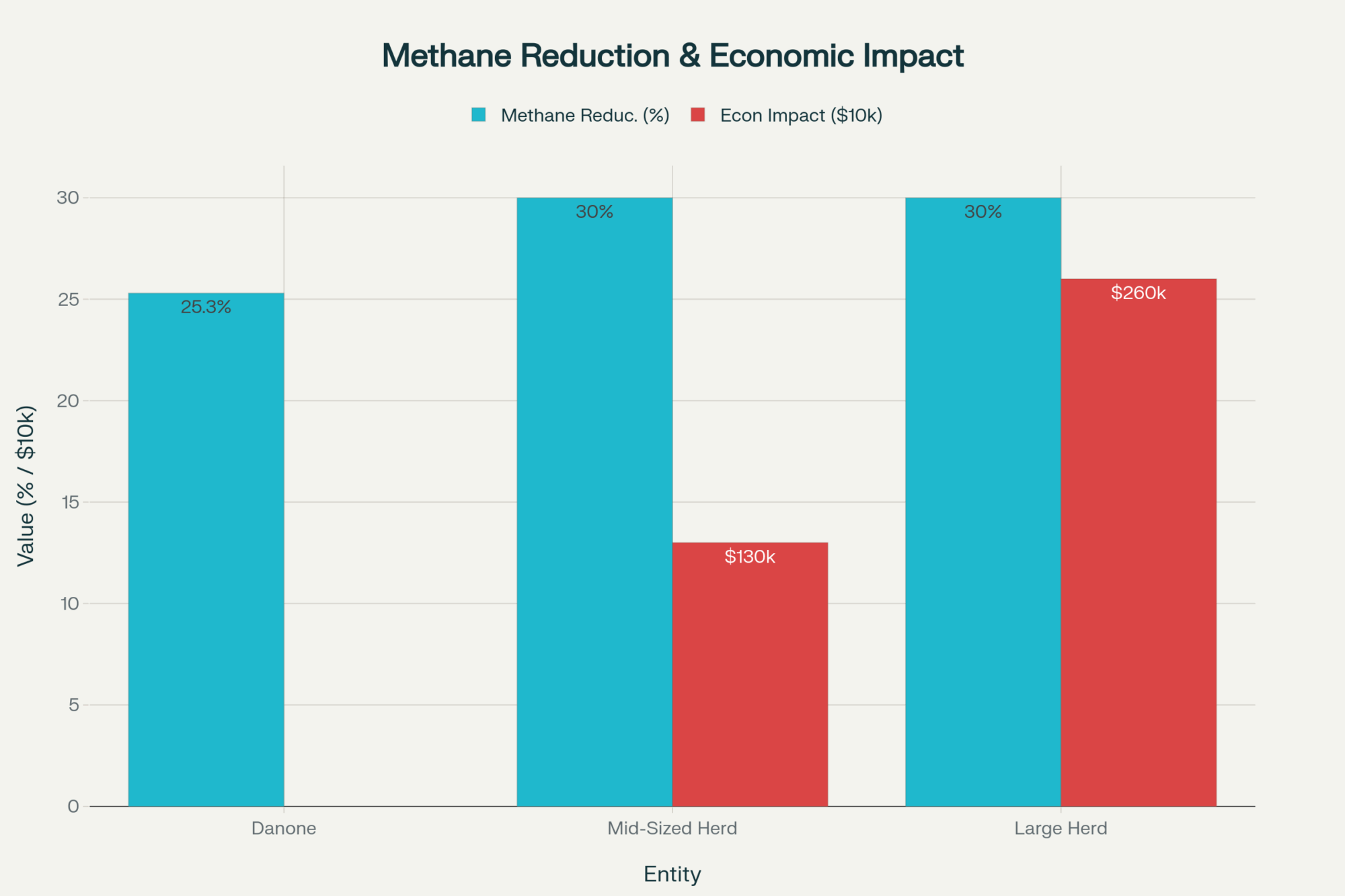

EXECUTIVE SUMMARY: Here’s what we’ve uncovered, and it’s gonna challenge everything you think you know about methane reduction: These feed additives aren’t just an environmental feel-good story—they’re a legitimate profit play.Sure, you’re looking at 30-50 cents per cow daily in costs, but early data suggests returns could hit 70 cents per cow per day. Do the math on a 500-cow herd… that’s potentially $130,000 in additional annual revenue (though we’ll be straight with you—these are preliminary estimates that’ll vary by operation). Meanwhile, global giants like Danone are already 25% of the way to their 30% methane reduction targets by 2030, signaling this isn’t going away.But here’s the kicker we don’t hear enough about—the premium pricing window likely shuts between 2027 and 2030. Miss it, and you’re back to commodity pricing while your neighbors collect the bonuses. The science shows cow responses vary wildly based on genetics and feed management, so this isn’t plug-and-play. But producers who test their herds, work with sharp nutritionists, and pilot smart protocols? They’re positioning for advantages that could last years. Time to stop debating and start testing—because your competition sure isn’t waiting.

KEY TAKEAWAYS

- Cut methane 30% without sacrificing production – FDA-approved additives maintain milk yield and butterfat while meeting regulatory targets (MDPI, 2024). Your move: Schedule a sit-down with your nutritionist this month to evaluate your herd’s suitability.

- Potential returns of 70 cents per cow daily translate to roughly $130K annually on 500 cows, though results vary by genetics and management (Industry analysis, 2025). Smart approach: Pilot with 50-100 of your best cows before committing the whole herd.

- Documentation is everything for carbon credits – rigorous baseline measurements and continuous monitoring are mandatory, no shortcuts (US DOE, 2025). Get ahead: Connect with your local extension office now for compliance guidance tailored to your region.

- Feed management makes or breaks success – unbalanced rations can kill your ROI before you start (Cornell Cooperative Extension, 2025). Critical step: Work with feed advisors who understand additive interactions, not just someone pushing products.

- Regional regulations are all over the map – California’s SB 1383 mandates differ drastically from Wisconsin’s cooperative approach and New York’s Climate Act timelines. Bottom line: Know your state’s rules because 2025 regulatory reality varies wildly depending on where you milk.

You know what’s been bugging me lately? There’s this massive shift happening with methane feed additives in dairy, and half the producers I talk to at the local co-op are still treating it like some far-off science experiment. Meanwhile, the smart operators—they’re already positioning themselves while the rest of us debate whether it’s worth the hassle.

Here’s the thing, though… if you’re not moving on this soon, you won’t just miss out on the opportunity. You might end up helping pay for your neighbor’s success.

Let’s Talk Real Numbers (Because That’s What Actually Matters)

The FDA finally gave Bovaer the green light back in May—that’s 3-nitrooxypropanol for those keeping score—and the results coming out of peer-reviewed research are pretty solid. Multiple studies, including recent work published by MDPI, show these additives consistently knock down methane emissions by about 30%, and here’s the kicker: your butterfat numbers and milk volume stay put (MDPI, 2024).

But it ain’t cheap. We’re talking 30 to 50 cents per cow, every single day, according to FDA documentation and manufacturer pricing (FDA, 2024). Now, if you’re milking 500 head, that’s $54,750 to $91,250 annually just in additive costs. Real money.

The economic projections—and I want to be straight with you here—suggest you might see returns around 70 cents daily per cow. That’s potentially $127,750 in additional revenue for that same 500-cow operation. But these are preliminary estimates based on economic modeling, and your actual results will depend on everything from your cows’ genetics to your feed management and local market conditions (Industry economic analysis, 2025).

What strikes me about this whole thing is how the big players are already positioning themselves. Danone’s not messing around—they committed to slash methane by 30% by 2030, and according to their latest sustainability report, they’re already at 25.3% (Danone, 2023). DSM-Firmenich is ramping up production like crazy, getting ready for what they see as inevitable demand.

The Window’s Closing Faster Than You Think

Here’s what’s keeping me up at night: the premium pricing window for methane-reduced milk isn’t going to stay open forever. Market analysts are pointing to somewhere between 2027 and 2030 as when this opportunity likely diminishes, depending on how fast adoption rates climb and regulations kick in. But that’s an estimate—regulatory changes and market forces could shift this timeline significantly (Market analysis, 2025).

Miss that window, and you’re back to commodity pricing while the early movers keep their premium contracts. Supply chains are already tightening—I’m hearing from feed dealers that those who got in early secured better pricing and delivery slots.

Why Aren’t More Producers Jumping In?

The honest answer? It’s complicated, and that scares people.

The breakthrough research from UC Davis really opened my eyes on this—individual cow responses to these additives vary like crazy, mostly because of rumen microbiome differences and genetics. You might have half your herd responding great while the other half barely budges (UC Davis Veterinary Research, 2025). That’s a tough pill to swallow when you’re looking at the daily costs.

And let’s be real about the feed side of this equation. If your ration’s heavy on grain or you’ve got mineral imbalances, you might as well flush that additive money down the drain. The nutritional management piece is absolutely critical, according to Cornell’s extension work (Cornell Cooperative Extension, 2025).

Storage is another headache most people don’t think about. These aren’t your standard mineral tubs—heat, humidity, and light exposure will kill the potency faster than you’d believe. The feed industry safety standards are pretty clear on this (Feed Industry Standards, 2025).

The Compliance Game Nobody Talks About

Want to get into carbon credits? Better get comfortable with paperwork. Serious paperwork.

We’re talking verified baseline measurements, continuous monitoring, third-party audits—the whole nine yards, according to US Department of Energy requirements (DOE, 2025). Miss a detail, skip a report, and you’re out. No exceptions.

The monitoring equipment that actually meets verification standards? You’re looking at $35,000 to $50,000 just to get started properly. Not the cheap stuff some companies are pushing.

Consumer Reactions Are All Over the Map

This is fascinating to watch unfold. When Arla announced their Bovaer trials in the UK, consumers went absolutely nuclear—boycotts, milk dumping, viral videos, the whole social media meltdown. The BBC covered it extensively back in December (BBC News, 2024).

But here’s what’s interesting… at the exact same time, Danone was quietly expanding their premium programs across continental Europe for the same technology. No backlash, just steady premium payments.

The difference? Marketing and messaging. Research shows that framing methane reduction as “natural farm efficiency” rather than “chemical intervention” makes all the difference in consumer acceptance (Marketing Research, 2024).

The Split-Herd Strategy Some Are Testing

Some of the bigger operations—we’re talking 1,000+ cows—are getting clever with a dual-herd approach. They feed additives to their top producers and market that milk separately to premium buyers, while the rest of the herd stays on conventional feed for local markets.

Now, industry modeling suggests that infrastructure investments of $170,000 to $275,000 are required for proper segregation systems, with potential annual returns of $15,000 to $25,000. However, these are preliminary figures from an economic analysis, and actual results may vary considerably by operation (Dairy Systems Analysis, 2025).

This development is fascinating because it’s creating a two-tier milk market that most producers are not even aware of yet.

Small Operations Aren’t Left Out

Don’t think you need to be huge to play this game. A lot of state cooperatives are setting up group purchasing programs for feed additives, plus they handle the compliance documentation, according to cooperative reports (State Cooperative Programs, 2025).

Minnesota’s got a particularly good program running—smaller producers can get group pricing and shared technical support without the big upfront commitments.

Your Regional Reality Check

The regulatory landscape is… well, it’s a patchwork, frankly.

California’s SB 1383 means business—mandatory methane reductions with some serious incentive money behind it (California Air Resources Board, 2025). If you’re in the Central Valley, this isn’t optional anymore.

Wisconsin’s taking a softer approach, but the cooperative support is growing fast, according to their Department of Agriculture updates (Wisconsin DATCP, 2025). The DFA facilities there are starting to offer preferred pricing for verified low-emission milk.

New York’s Climate Leadership Act is picking up steam, and the North Country producers I know are starting to feel the pressure (NY Department of Environmental Conservation, 2025).

What This Means for Your Next Move

Look, I get it. Change is hard, especially when you’re dealing with your livelihood. But here’s my take after watching this unfold…

Start with microbiome testing on your herd. Find out which cows are most likely to respond before you commit serious money.

Work with a nutritionist who actually understands this stuff—not just someone pushing products.

Pilot with 50-100 of your best cows. Test the waters before you dive in completely.

Get your documentation systems right from day one. Don’t try to retrofit later.

And for crying out loud, keep an eye on what’s happening in your state. These regulations are moving faster than most people realize.

The Bottom Line Truth

This industry transformation is happening whether we participate or not. The early adopters are positioning themselves for advantages that could last for years. The late adopters… well, they might find themselves at a permanent disadvantage.

Your decision timeline isn’t measured in years anymore. It’s months. The competition is already making their moves.

The question is: what’s yours going to be?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Carbon Credit Goldmine: How Forward-Thinking Dairy Producers Are Turning Methane Reduction into Cash Flow – This strategic article reveals the detailed economics of turning methane into a revenue stream. It provides a crucial breakdown of carbon credit valuation, market dynamics, and a cost-benefit analysis of both feed additives and anaerobic digesters, helping producers calculate their potential ROI.

- Reducing Methane Emissions from Dairy Cows: Practical Strategies for Mitigating Rumen Methane Production – A valuable tactical guide that goes beyond additives, offering actionable advice on optimizing feed composition and forage management. This piece provides a hands-on checklist and research-backed methods for immediate methane reductions, serving as a practical follow-up to the main article.

- California’s $522 Million Secret: How Smart Dairy Farmers Turned Methane into Money While Saving the Planet – This case study showcases a proven, profitable sustainability model from the largest dairy state. It demonstrates how innovative practices like digesters and advanced manure management have created a new revenue stream, providing a powerful real-world example of what’s possible for dairy operations of all sizes.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!