Everyone’s waiting for feed prices to drop more. Meanwhile, the sharp operators are already banking margin while others hesitate.

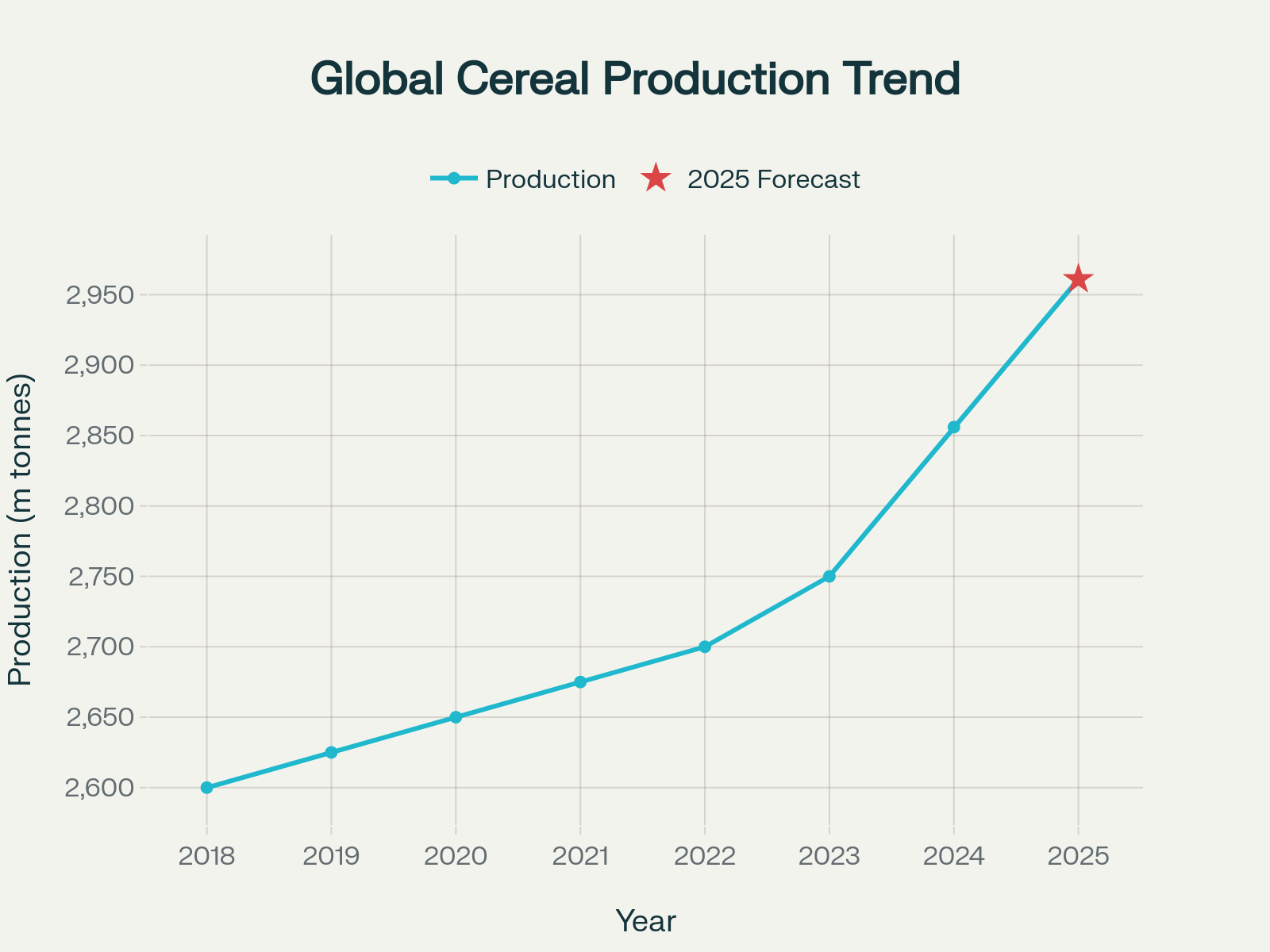

EXECUTIVE SUMMARY: Look, we’ve been tracking this feed market setup for months, and what we’re seeing now isn’t your typical seasonal pattern. The conventional wisdom says wait for grain prices to drop more, but we’re telling progressive producers to lock in contracts now while the margin window is wide open. Here’s the reality: global cereal production hit 2.961 billion tonnes (up 3.5% from 2024), yet food prices remain 6.9% higher than last year—creating a rare divergence that smart operators can exploit. With feed representing 53% of production costs and every /ton price drop worth per cow annually, a 1,000-cow operation could bank ,000 just by timing procurement right. China’s shrinking dairy herd and EU production declines are supporting milk prices while abundant grain keeps feed costs favorable—a combination we haven’t seen since 2014. The scientific data from the University of Illinois and USDA reports confirm this window typically lasts 18-24 months before market forces rebalance. We’re watching butterfat premiums hit $2.84/lb versus protein at $1.87/lb, making genetic strategy as critical as feed procurement strategy right now.

KEY TAKEAWAYS

- Lock 50-70% of your feed needs before November – Historical basis patterns show freight costs climb after harvest crunch, eating into the $95/cow annual savings you could bank from current corn pricing (University of Illinois data confirms producers acting within 90 days outperform those who wait)

- Shift breeding emphasis to butterfat genetics immediately – Federal Milk Marketing Order data shows fat commanding $0.97/lb premium over protein in August 2025, turning genetic decisions into direct profit drivers when feed costs are dropping

- Implement precision feeding systems now while cash flow supports capital investment – Penn State research documents 5-7% efficiency improvements worth $285-400 per cow annually on current feed costs, with payback accelerated by favorable margin conditions

- Diversify feed suppliers to bypass consolidation premiums – Industry consolidation means fewer players control grain handling, keeping basis spreads artificially wide and costing producers money that direct relationships can recover

- Review risk management coverage before margins compress – Current Dairy Margin Coverage and LGM-Dairy programs can lock in protection during this favorable window, with USDA data showing this market convergence typically lasts 18-24 months maximum

Listen, I’ve been around this business long enough to recognize when the stars align for a real opportunity. What are we seeing this fall with feed costs and milk prices? It’s the kind of setup that comes maybe once every eight to ten years.

The thing is, half the producers I run into at the elevator or co-op meetings are still waiting, thinking prices might drop another nickel. But here’s what I’ve learned over the years—timing beats perfection every time.

The Numbers That Should Get Your Attention

The FAO dropped their September cereal report, and the production numbers are eye-opening. Global cereal output is forecast at 2.961 billion tonnes—that’s a solid 3.5% jump from last year when we already had decent supplies[FAO Cereal Supply and Demand Brief, September 2025].

But here’s what’s really interesting: despite all this grain floating around, the FAO Food Price Index sat at 130.1 points in August, running 6.9% higher than last August[FAO Food Price Index, September 2025]. That tells me grain supplies are abundant, but prices aren’t dropping like you’d expect.

What does this mean for those of us milking cows? Simple math: feed costs represent about 53% of our total production expenses according to University of Illinois data[University of Illinois Farm Business Management, 2024]. When grain prices ease but milk stays firm, margins expand.

Real Farm Economics

Let me break down what this looks like on an actual operation. A typical Holstein consumes around 52 pounds of dry matter daily—pretty standard for high-producing cows in our region[Penn State Extension, 2023]. That works out to about 9.5 tons annually per cow.

Here’s the calculation: every per ton drop in feed price saves roughly per cow annually. For a 1,000-cow operation, that’s $95,000 straight to your bottom line.

The Illinois team projects feed costs at $11.96 per hundredweight for 2025, down from recent highs[University of Illinois Economic Review, December 2024]. But protein costs aren’t following the same pattern—something to keep in mind when you’re planning procurement.

Global Forces Working in Our Favor

What’s driving this opportunity? Several trends are lining up that don’t happen often.

China’s dairy herd keeps shrinking, according to USDA Foreign Agricultural Service reports[USDA-FAS China Dairy Report, May 2025]. They’re not the reliable powder buyer they were for the past decade.

EU milk production is declining—149.4 million metric tons in 2025, down from 149.6 million metric tons in 2024[USDA GAIN EU Dairy Report, February 2025]. Environmental regulations and poor profitability are squeezing their producers harder than we’ve seen in years.

Meanwhile, New Zealand’s pivoting toward higher-value products instead of bulk powder[USDA New Zealand Dairy Report, 2025]. Smart move for them, but it’s tightening global supplies.

Component Premiums You Can’t Ignore

Here’s where it gets interesting for breeding programs: Federal Milk Marketing Order data shows butterfat commanding $2.84 per pound versus protein at $1.87 in August[USDA Agricultural Marketing Service, August 2025].

That’s a premium worth chasing. With feed costs dropping, now’s the time to emphasize fat genetics in your breeding decisions.

Regional Picture from the Trenches

The crop reports tell a compelling story. Iowa’s corn is rated 84% good to excellent—58% good, 26% excellent—with 9% already mature according to USDA data[Iowa Crop Progress Report, September 2, 2025]. Some areas are dealing with southern rust, but overall conditions support strong yields.

Wisconsin cooperatives are reporting competitive December corn pricing, though specific quotes vary by location and timing. The key is locking in favorable basis levels before harvest logistics tighten freight costs.

Here’s what I’ve learned from watching basis patterns over the years: get your contracts done before November. Once we hit harvest crunch time, transportation costs start eating into any price relief you might have banked earlier.

The Consolidation Reality

Here’s something that deserves more attention: grain handling has consolidated dramatically over the past decade. When fewer players control more capacity, basis spreads tend to stay wider than they should.

That consolidation premium is real money walking away from livestock operations. Some of the sharper producers I know are diversifying suppliers or exploring direct relationships to bypass inflated handling fees.

Your September Strategy

Based on what’s working for operations that understand market cycles:

Feed Procurement:

- Lock in 50-70% of corn needs through Q1 2026

- Secure protein positions when opportunities arise

- Diversify suppliers to avoid basis manipulation

Genetic Focus:

- Emphasize butterfat genetics for current premiums

- Genomic test all replacement heifers

- Strategic breeding targeting milk composition

System Efficiency:

- Audit feed waste—5% waste reduction is found money

- Evaluate TMR mixing consistency

- Consider precision feeding investments

Risk Management:

- Review Dairy Margin Coverage levels

- Assess Livestock Gross Margin-Dairy options

- Project cash flow through 2026

Why Acting Now Beats Waiting

Here’s the reality about market windows: they don’t announce when they’re closing. Research consistently shows that operations making strategic decisions during favorable periods outperform those who wait for perfect conditions.

Record grain production is easing feed costs—it is.

Global supply constraints are supporting milk prices—they are.

Component premiums are rewarding focused genetics—they definitely are.

This convergence typically lasts 18-24 months before market forces rebalance. The operations are now strategically positioned to bank margins that will carry them through whatever comes next.

The Bottom Line

Every day you spend debating whether to act is an opportunity cost. Markets don’t wait for perfect information, and neither should you.

The fundamentals are aligned. The window is open. The question isn’t whether this opportunity exists—it’s whether you’re going to walk through it while it’s available.

What’s stopping you from locking in these margins this week?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Precision Feeding Strategies Every Dairy Farmer Needs to Know – This article provides a tactical deep-dive into the “how” of precision feeding. It reveals practical methods for diet formulation, TMR mixing, and data analysis, helping you capture the 5-7% efficiency gains mentioned in the main piece.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – For a strategic market view, this piece explores the long-term economic shifts, including the critical move toward component pricing. It validates the main article’s focus on butterfat and shows how FMMO reforms will create regional winners and losers.

- ICE Raids Resume: Why Dairy’s $48 Billion Labor Crisis Exposes Our Innovation Failure – Looking toward the future, this article makes a powerful case for technology adoption. It details the accelerated ROI on automation and AI-powered herd management, connecting the main article’s call for capital investment to operational stability and a long-term competitive advantage.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!