Feed dropped 23% but 68% of farms report worse margins—labor up 30%, equipment up 25%, co-op fees eating $1-3/cwt

EXECUTIVE SUMMARY: Here’s what’s keeping dairy producers up at night: despite feed costs dropping roughly 23% from recent peaks, land-grant university analyses show the majority of operations are experiencing their tightest margins in years. The disconnect stems from the feed’s shrinking role in total costs—now just 35-40% of expenses, compared to the historic 50%, according to extension economists at Cornell, Wisconsin, and Penn State. Labor costs have increased by approximately 30% since 2021, with wages commonly exceeding $20 per hour. Meanwhile, equipment financing has essentially doubled, and cooperative assessments are now taking $1-3 per hundredweight, a figure that didn’t exist five years ago. What farmers are discovering is that the traditional safety nets, including the Dairy Margin Coverage program, often miss these non-feed pressures entirely—the formula still assumes an economic structure from decades past. Looking ahead, operations that adapt through strategic diversification—whether that’s beef-on-dairy genetics capturing premiums of $800-$ 1,000, targeted technology investments, or collaborative marketing approaches—are finding paths forward despite the pressure. The key is understanding that waiting for old economic relationships to reassert themselves is no longer a viable strategy; successful operations are already rewriting their playbooks for this new reality.

What’s been puzzling everyone at the co-op meetings lately? Feed prices have come off their highs—grain markets have softened quite a bit, and protein sources are more reasonable than they’ve been in a while. But here’s the thing that doesn’t add up… many producers I talk with are actually seeing tighter margins now than when feed was more expensive.

I’ve been chewing on this for a while, talking with folks from different regions, and what’s becoming clear is that something fundamental has shifted in how dairy economics work. Land-grant university analyses from Wisconsin, Cornell, and Penn State in recent months all point to the same thing—the traditional relationships between feed costs and margins have broken down. Check your state extension’s dairy enterprise analysis tools for tracking these costs, because understanding what’s happening might help us all figure out how to navigate what’s ahead.

The Broken Feed-Margin Relationship

For generations, we all operated on this principle: when feed costs drop, margins improve. Simple as that, right? However, that relationship appears to have deteriorated, and it’s affecting everyone, from small grazing operations in the Southeast to mega-dairies in Idaho and the Pacific Northwest.

A producer from central Wisconsin put it to me this way recently: “Twenty years ago, if someone told me I’d have cheaper feed but worse margins, I’d have thought they were crazy.” And yet… here we are.

What’s striking is the disconnect between the USDA Dairy Margin Coverage program’s calculations and the actual cash flow pain producers are experiencing. The DMC formula—based on corn, soybean meal, and alfalfa prices compared to the all-milk price—often shows acceptable margins. Meanwhile, extension economists note the DMC margin can diverge significantly from on-farm cash flow when non-feed costs rise, which is exactly what we’re seeing now.

Multiple land-grant analyses indicate that the feed’s share of total costs has declined from the historic 50% range to the mid-30s to low-40s in many systems. When your biggest historic cost shrinks that much, relief from lower feed prices just doesn’t move the needle like it used to.

Quick Cost Reality Check:

- Labor: Up approximately 30% since 2021

- Equipment: Up 20-25% since 2021

- Interest rates: Doubled from 2021 lows

- Co-op assessments: $1-3/cwt (new for many)

The Hidden Costs Eating Away at Margins

Labor: A New Competitive Landscape

We’re no longer just competing with other farms for labor. Amazon warehouses, manufacturing plants, and retail operations are all in the game, offering comparable pay and easier schedules.

USDA farm labor surveys in 2025 show wage rates across all dairy regions commonly approaching or exceeding $20 per hour—and that’s if you can find people. Extension field reports describe elevated turnover rates that significantly impact training and productivity. Every time someone new comes on board, there’s that learning curve… equipment doesn’t get maintained quite right, routines change, cows get stressed. It all adds up.

The stress isn’t just financial either. I know many operators who are working 80-hour weeks because they can’t find reliable help, and that takes a toll on their families, health, and ability to think strategically about the future. A producer in Washington state mentioned to me that he has started exploring different shift schedules, trying to make the job more appealing to individuals who prefer non-traditional dairy hours.

Equipment: Sticker Shock and Hard Decisions

Industry indices indicate notable increases in dairy equipment costs since 2021, with significant jumps in certain areas. At the same time, the Federal Reserve’s data shows prime rates have more than doubled from their 2021 lows. Current dealer quotes and recent lender reports suggest financing rates that would’ve been unthinkable just a few years ago.

Now, rebuilding or limping equipment along often beats financing new gear for many smaller farms. It’s not ideal, but when you’re looking at those payment schedules… well, you make do. I’ve seen some creative solutions out there—neighbors sharing equipment more often than they used to, people becoming really skilled at creating YouTube repair videos, and even some groups buying used equipment together to spread the risk.

Cooperative Fees: The Bite Gets Bigger

Several large cooperatives implemented capital retains or assessments between roughly $1 and $3 per hundredweight in 2024-2025, according to producer notices and regional reports. These weren’t a monthly concern five years ago. Now, they can turn a breakeven month into a loss, and there’s not much individual producers can do about it.

What’s interesting here is the timing—these assessments are coming when producers are least able to absorb them. But from the co-op perspective, they need to modernize facilities to stay competitive with private processors. It’s a tough situation all around.

Component Pricing: The Traditional Math is Failing

Component pricing under Federal Orders pays for pounds of butterfat, protein, and other solids, not just milk volume. Butterfat value especially has jumped. According to the USDA’s October 2025 component price announcement, butterfat reached $3.21 per pound, representing nearly 60% of the total Class III value, up from around 47% just five years ago.

But here’s the tricky part that extension specialists keep explaining at meetings: because of the pricing formulas, higher butterfat prices often correspond with lower protein values. It’s not a simple win. As dairy economists note, high-component milk takes years of genetic and nutritional investment—and the price swings for one component can erode gains in another.

Jersey herds typically test higher for butterfat and protein than Holsteins, which helps in this pricing environment. But transitioning your genetics? That’s expensive and takes time. The folks doing well with components started that journey years ago. A producer in Georgia recently told me he wishes he’d started crossbreeding five years earlier—now he’s playing catch-up while margins are tight.

Processors’ Confidence vs. Producers’ Reality

It seems almost every month brings news of new or expanded processing plants. The International Dairy Foods Association has documented over $11 billion in announced capacity investments since January 2023.

Why so much expansion when farms are hurting? Industry experts at Cornell and other universities explain that modern cheese plants need 2.5 to 3.5 million pounds of milk per day to run efficiently. Mega-dairies can supply that volume directly, and processors prefer dealing with fewer, larger suppliers for consistency and logistics.

So capital keeps flowing into processing, but on the farm side, it’s a different world—shrinking margins, steeper costs, and big questions about who gets to supply milk to these facilities in five years. The discussions surrounding the upcoming Farm Bill negotiations suggest that these structural issues are finally getting attention, but meaningful change takes time.

When Safety Nets Don’t Catch You

Dairy Margin Coverage insurance was designed as a lifeline. However, with feed now accounting for a smaller share of costs, labor, energy, and fees are climbing, making it frequently miss the mark.

DMC margins remained above the $9.50 trigger throughout much of late 2025, according to Farm Service Agency data, while many farms reported cash flow strain. Key expenses, such as labor, energy, and new co-op assessments, are not included in the formula. It’s like having insurance that covers your roof but not your foundation—helpful, but not when the real problem’s underground.

What Producers Are Trying

Beef Genetics—A New Revenue Stream

Beef-on-dairy crosses remain a bright spot for many. USDA market reports from various auction centers show beef-cross calves bringing $800 to $1,000 premiums over straight Holstein bulls. Extension specialists at Wisconsin and other universities commonly recommend keeping it to 25-30% of breedings to avoid running short on replacements—especially with quality replacement heifers now approaching $3,000 each according to market reports.

I’ve noticed operations in the Mountain West have been particularly successful with this strategy, partnering with local beef producers who value the consistency of dairy-beef crosses for their feeding programs. One Colorado operation told me they’ve built relationships with three different feedlots, ensuring steady demand for their crosses.

Direct Marketing—Potential and Pitfalls

Direct-to-consumer sales are gaining traction in areas such as Vermont and other regions near population centers. But feasibility studies suggest startup costs can easily run into the hundreds of thousands. Margins can be impressive for those who make it work, but it’s no small risk, and many who try it find that selling isn’t their passion.

One thing that’s working for some smaller operations is collaboration—several farms working together on processing and marketing, sharing the investment and the workload. It doesn’t eliminate the challenges, but it spreads them around. I know of a group in Oregon—five farms, none with more than 200 cows—who invested in a bottling line together and now supply three school districts, as well as a handful of stores.

Technology—Promise and Payback

Peer-reviewed studies and land-grant extension trials report labor savings and modest production gains with robotic milking, depending on management and herd size. However, with robots costing well into six figures per unit, according to current dealer quotes, payback periods stretch out considerably. Michigan State’s dairy financial tools and similar extension models often show payback periods of 8-12 years under current margins.

The operations that make these technologies work tend to be larger, with better access to capital and sometimes special arrangements with processors that provide pricing stability, which most of us can’t access. However, I’ve also seen smaller operations make strategic tech investments work—focusing on one area, such as feed management or reproduction, rather than trying to automate everything at once.

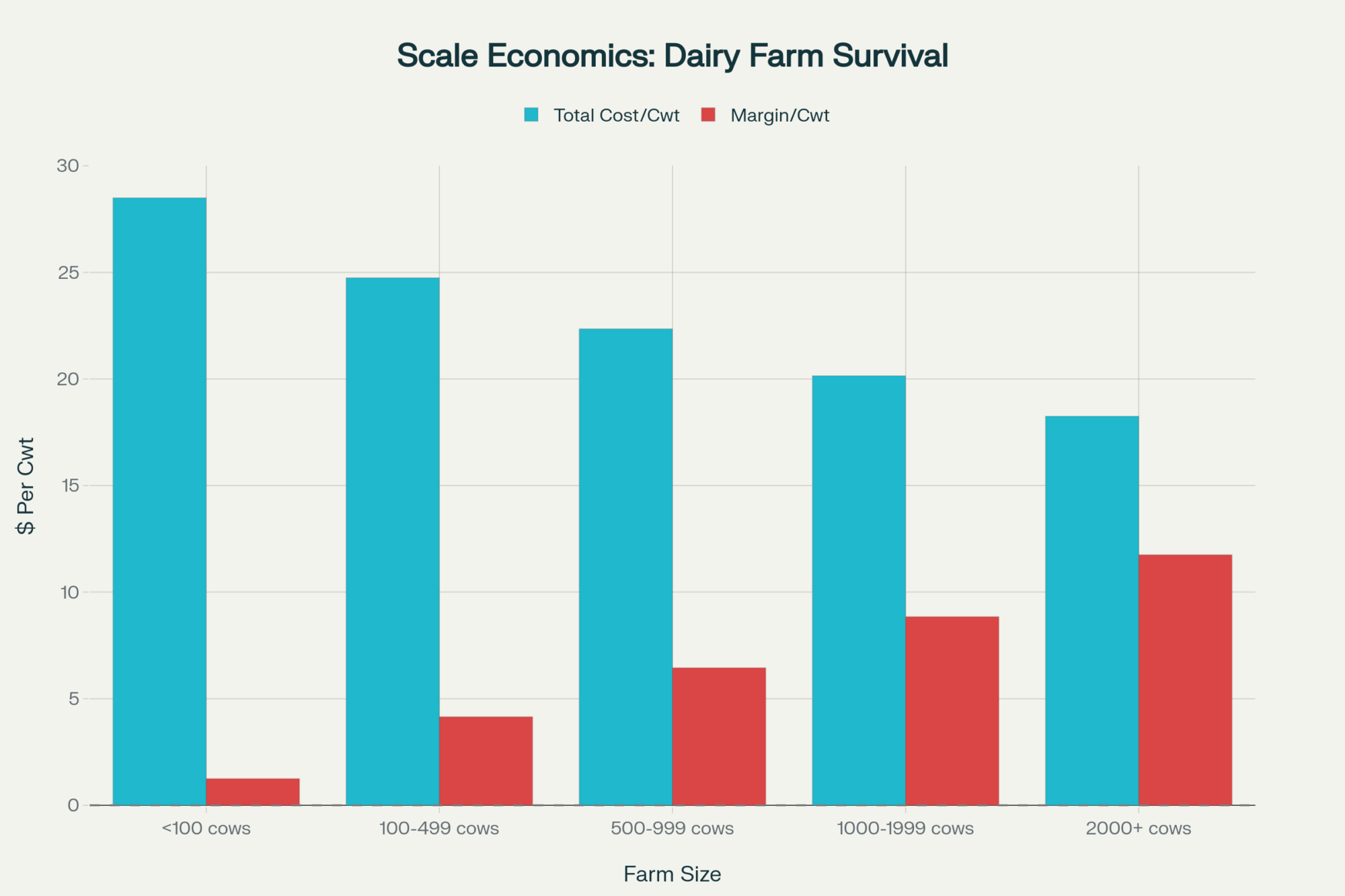

The Realities of Scale

Here’s something we need to acknowledge, even if we don’t like it. The USDA’s Agricultural Resource Management Survey consistently shows multi-dollar-per-hundredweight cost advantages for herds with over 2,000 cows relative to those with fewer than 500. It’s not about who’s working harder—it’s economies of scale, volume discounts, and spreading overhead.

That doesn’t mean small and mid-sized farms can’t survive; some do through niche marketing, ultra-efficient operations, or creative partnerships. However, the economics become increasingly challenging each year, and agility and specialization are more crucial than ever.

Looking Forward

For many, 2025 feels like a tipping point. Agricultural economists at land-grant universities and the USDA anticipate further consolidation alongside rising total milk output in their long-term outlooks. Perhaps your best fit is ramping up efficiency, diving into specialty markets, partnering up, or, for some, exiting while retaining equity.

Mid-sized farms—say 300 to 1,000 cows—you’re in a particularly tough spot. Often too big for niche markets but not big enough for maximum efficiency. The path forward isn’t always clear. Some are exploring renewable energy opportunities, others are diversifying with agritourism, and yes, some are planning their exit.

Larger operations have their own unique challenges, including workforce management, environmental compliance, and community relations. Success increasingly requires professional management approaches that extend far beyond simply knowing how to produce milk.

Key Takeaways for Your Operation

- Don’t trust old formulas: Lower feed costs alone won’t deliver profit—track all expenses, especially labor, equipment, and fees, using tools from your extension service or lender.

- Diversify strategically: Explore genetics, marketing, and tech that fit your herd size and mindset—but go slow and seek input from others who’ve tried it before making major investments.

- Stay proactive: Communicate regularly with your co-op, lender, and local extension agent to ensure a smooth process. Prepare business scenarios for best, worst, and base case situations, and plan changes deliberately, not reactively.

The Bottom Line

What we’re experiencing goes beyond feed and milk prices. The whole structure of dairy farming is shifting. That paradox—cheaper feed and tighter margins—is only one symptom of an industry in transition.

There’s no silver bullet. What works for a mega-dairy out West won’t always work on 300 acres in Wisconsin. What makes sense for 3,000 cows in Texas might be completely wrong for 150 cows in Vermont or a grazing operation in Missouri.

The key is understanding these dynamics, knowing the numbers for your own barn, and making changes that fit your future—not chasing the past. Because from everything the data shows and everything we’re experiencing… the old rules aren’t coming back.

But here’s what I’ve learned after all these conversations: dairy farming’s never been easy, but resilience runs deep in this community. We adapt, we help each other, and—whatever the industry throws at us—there’s always another way to move forward. It might look different than what we expected. It might mean some tough decisions. But we’re still here, still producing food, still figuring it out together.

And that’s worth something, even when the margins don’t show it.

KEY TAKEAWAYS

- Track the real cost drivers: With feed now just 35-40% of total expenses (down from 50%), monitor labor costs (up ~30%), equipment financing (rates doubled since 2021), and co-op assessments ($1-3/cwt) using your extension service’s dairy enterprise analysis tools—these hidden costs are what’s actually driving your margins.

- Diversify revenue strategically: Beef-on-dairy crosses are bringing $800-1,000 premiums per calf at auction, but keep it to 25-30% of breedings to maintain replacements—especially with quality heifers now approaching $3,000 each according to market reports.

- Right-size technology investments: Michigan State’s financial models show 8-12 year payback periods for robots under current margins, so focus on targeted improvements (feed management or reproduction systems) that match your herd size and capital access rather than wholesale automation.

- Collaborate for market access: Small operations in Oregon, Vermont, and other regions are successfully sharing processing facilities and marketing costs—five 200-cow farms together can achieve economies that none could manage alone, particularly for direct-to-consumer sales, capturing those premium margins.

- Prepare for structural change: USDA data shows that operations with over 2,000 cows achieve multi-dollar per hundredweight cost advantages. Therefore, mid-sized farms (300-1,000 cows) need clear strategies—whether that involves efficiency improvements, niche market development, strategic partnerships, or planned transitions while maintaining strong equity.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beef-on-Dairy: Real Talk on Turning Calves into Serious Profit – Reveals the specific economic tactics for beef-on-dairy, showing how to maximize the $800-$1,000 calf premiums. Learn the genetic sweet spot—breeding only the bottom 60% to beef—to manage replacement rates while generating a vital new revenue stream against tight cash flow.

- Feed Costs Are Down, But Profits Aren’t Up: The Hidden Math Reshaping Dairy Economics – This deep-dive reveals how to optimize your milk check by focusing on component premiums. Discover the significant financial benefits of increasing butterfat quality by just 0.2 points, offering a crucial strategy for maximizing returns when volume alone fails to yield a profit.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – Provides clear ROI timelines and cost-cutting methods for targeted technology adoption. Learn how precision feeding systems deliver the fastest payback (2–4 years) by cutting feed waste 15–25%, offering an immediate buffer against rising labor and equipment costs.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!