What if the beef-on-dairy strategy that made sense at $2,200 heifers is now costing you $280K yearly?

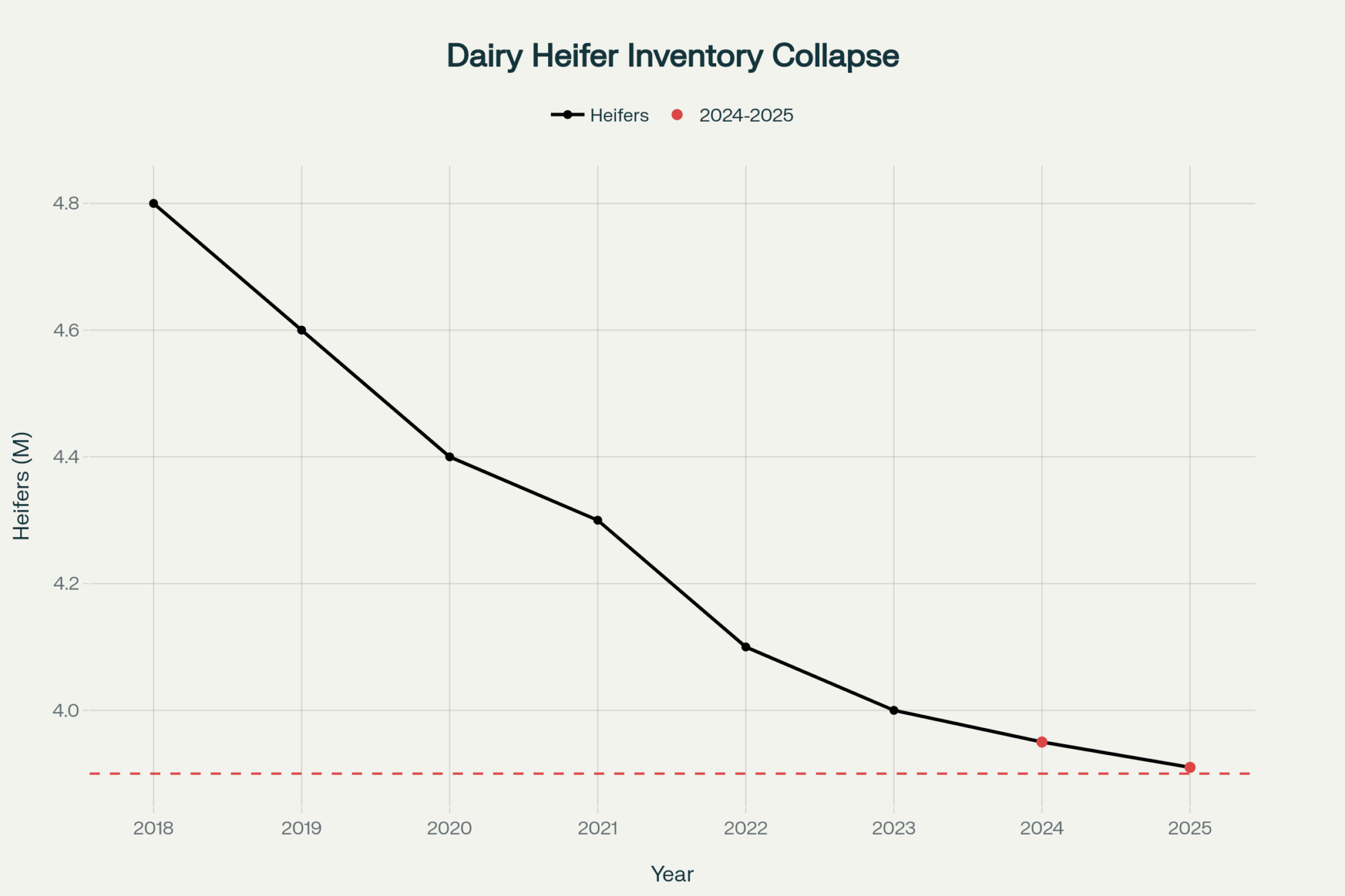

EXECUTIVE SUMMARY: What farmers are discovering about today’s replacement market fundamentally challenges the beef-on-dairy strategies that seemed bulletproof just two years ago. With springer heifers commanding $3,800 to $4,000 across most regions — a 73% jump from 2023’s $2,200 average — while actual beef-cross premiums hover around $20-30 after all costs, the economics have completely inverted. Research from Penn State’s dairy team and Wisconsin’s Center for Dairy Profitability confirms what producers are experiencing firsthand: operations that shifted to aggressive 65% beef breeding are now facing an additional $200,000 to $280,000 annually in replacement costs. Here’s what this means for your operation — the traditional 70/30 dairy-to-beef ratio is making a comeback, but with strategic twists like genomic testing every animal and tiered breeding programs that maximize both genetic progress and cash flow. Forward-thinking producers are already locking in 2026-2027 heifer contracts at today’s prices, essentially buying insurance against further market volatility. The path forward isn’t about abandoning beef-on-dairy entirely… it’s about finding the sweet spot where replacement security meets revenue opportunity, and that calculation looks different for every farm.

Let me share what’s been on my mind lately. You know something’s fundamentally different when processing plants appear to have capacity while replacement heifers are commanding historically high prices across the country. It’s not following the patterns we’ve come to expect, is it? And if you’re trying to figure out when to ship cull cows or whether that beef-on-dairy program is actually paying for itself… well, these dynamics matter more than most of us initially realized.

What’s particularly noteworthy is how these patterns are playing out differently across regions. Industry reports suggest California’s vertically integrated systems are seeing different market signals than what’s emerging in Wisconsin’s co-op model or the grazing-based operations down South. This builds on what we’ve been observing since spring 2024 — a fundamental shift in how breeding strategies and replacement economics interact.

As we head into winter feeding season, these decisions become even more critical.

What Current Market Observations Are Telling Us

So here’s what’s interesting about the conditions we’re seeing. The beef processing industry generally runs facilities at high utilization rates when everything’s functioning properly — that’s basic industrial economics. In normal times, we’d expect to see something around 95% capacity utilization. But recent industry observations suggest we’re nowhere near that level.

Kevin Grier, that Canadian economist who’s been tracking North American beef markets for decades through his Market Analysis and Consulting firm, has been documenting this fascinating disconnect between available processing capacity and actual cattle throughput. Why is this significant? The economics suggest patterns that go beyond simple supply and demand.

Producers across Wisconsin and other dairy states are reporting similar experiences — cattle ready to ship, processing capacity theoretically available, yet prices that don’t reflect what we’d expect from those conditions. The math doesn’t seem to add up.

This pattern — and this is what’s really caught the attention of many observers — isn’t isolated to one region. Whether you’re looking at traditional dairy states like Wisconsin and New York with their smaller family operations, the larger feedlot-integrated systems in Texas and New Mexico, or even California with its unique market dynamics… similar patterns keep emerging. Dr. Derrell Peel from Oklahoma State’s agricultural economics department, one of the respected voices in livestock market analysis, suggests in his recent Extension publications that these patterns indicate something beyond typical market cycles.

The Beef-on-Dairy Reality Check

Remember those genetic company presentations from 2022 and 2023? The promise of significant premiums for beef-cross calves seemed like a genuine opportunity to diversify revenue streams. And conceptually, it made perfect sense — capture premium markets, reduce exposure to volatile dairy calf prices, improve cash flow.

But here’s where reality has diverged from projection. Industry reports and producer feedback across multiple states suggest that actual returns often fall significantly short of initial projections. After accounting for transportation costs (and with diesel prices where they’ve been), shrink at sale barns, and various marketing fees, many operations are finding net premiums considerably lower than anticipated.

What Extension services across Pennsylvania, Wisconsin, Minnesota and other states have been observing reveals that real-world returns can differ dramatically from those PowerPoint projections we all saw. Penn State’s dairy team, Wisconsin’s Center for Dairy Profitability, and Minnesota’s Extension dairy program all report similar findings — the gap between projected and actual returns is substantial.

I’ve noticed operations that are making beef-on-dairy work really well tend to have specific advantages — direct marketing relationships with particular buyers, consistent quality that commands loyalty, or local markets that value certain attributes. Success often comes down to matching your operation’s strengths with specific market opportunities.

And then there’s the replacement heifer situation…

Multiple market sources, including reports from the National Association of Animal Breeders and various regional heifer grower associations, confirm what producers across the country are experiencing — springer heifer prices have reached levels that fundamentally alter breeding economics. Custom heifer growers in traditional dairy regions report being booked solid through mid-2026, with waiting lists growing.

Consider what this means for a typical 500-cow operation that shifted from a traditional 70-30 breeding strategy (70% dairy, 30% beef) to a more aggressive 35-65 approach. You’re potentially purchasing significantly more replacements at these elevated prices. The financial implications can run into hundreds of thousands of dollars annually in additional replacement costs. One Wisconsin producer recently calculated his operation’s additional replacement cost at nearly $280,000 annually — enough to make anyone reconsider their breeding strategy.

Understanding the Replacement Market Dynamics

So what’s driving these unprecedented heifer prices? It’s really a convergence of factors, and while market data is still developing on some aspects, the pattern is becoming clearer.

There’s the supply situation — when the industry collectively shifted breeding strategies over a relatively short period, it created replacement availability challenges. Dr. Jeffrey Bewley at Holstein Association USA, who analyzes breeding data extensively, points out in his industry presentations that different breeding strategies have compounding effects over time. Research published in the Journal of Dairy Science consistently shows beef semen generally has lower conception rates than conventional dairy semen — often running 8-12 percentage points lower depending on management and season — and those differences accumulate in ways that weren’t immediately obvious.

Then consider milk price dynamics. When Class III futures trade at relatively attractive levels, as they have periodically through 2025, producers naturally want to maintain or expand cow numbers. But when replacement availability is constrained… well, basic economics takes over.

What’s particularly interesting is the regional variation we’re observing. Larger operations in the West sometimes have different market dynamics than smaller farms in traditional dairy areas. California’s integrated systems might negotiate directly with heifer growers, while Midwest operations often compete on the open market. They might have scale advantages in negotiating, but they’re also competing with each other for limited replacements.

Industry economists, including those at agricultural lenders like CoBank and Farm Credit who track these markets closely in their quarterly dairy outlooks, suggest these inventory dynamics aren’t likely to shift dramatically in the near term. This appears to be more structural than cyclical — a distinction that matters for long-term planning.

Strategies Emerging Across the Industry

What’s encouraging is observing how different operations are adapting. There are some genuinely innovative approaches emerging across various regions.

Many operations are restructuring their breeding programs entirely. Some are using genomic testing more strategically — and the economics are interesting here. With genomic tests running around $35-45 per animal through major breed associations, operations are testing their entire herd to make targeted breeding decisions. Bottom-tier genetics might receive beef semen, solid performers get conventional dairy semen, and top genetics receive sexed semen (which typically runs $15-30 premium per unit over conventional). Yes, it costs more upfront, but it helps maintain that replacement pipeline while still capturing some beef revenue.

This development suggests producers are thinking more strategically about genetic progress and cash flow simultaneously. It’s not just about maximizing one or the other anymore.

What’s also emerging is renewed interest in contract heifer growing arrangements. Some operations are securing replacements eighteen to twenty-four months in advance. The prices might include a premium for certainty — think of it like buying insurance — but as many producers note, you can plan around known costs. It’s the unknowns that create problems.

The Contract Market Many Don’t Consider

Here’s something worth noting — custom heifer growers, particularly in traditional dairy regions like eastern Wisconsin, Minnesota, and upstate New York, are often interested in longer-term commitments. These arrangements typically involve predetermined pricing and delivery schedules over multiple years.

Both parties can benefit from these arrangements. Growers get predictable cash flow (which lenders appreciate when it comes to operating loans), and dairy operations get cost certainty. The challenge, naturally, is that many producers hope for price improvements. But what if prices don’t drop? Or what if they actually increase? That’s the risk-reward calculation each operation needs to make.

New Processing Capacity — Context Matters

You’ve probably heard about new processing facilities being developed. Recent industry reports, including those from Rabobank’s North American beef quarterly and CattleFax market updates, indicate several major projects underway, each with different capacity targets and business models.

What distinguishes many of these new operations is their structure. Unlike traditional commodity plants that buy on the spot market, many feature integrated supply chains or specific retail partnerships. Their procurement models often involve contracting cattle well in advance with specific quality parameters — think Certified Angus Beef specifications or natural program requirements.

The question worth considering is why new capacity is being built when existing facilities aren’t maximizing utilization. Various theories exist among market analysts, but it suggests these new plants might be operating under fundamentally different business assumptions than traditional facilities. Are they positioning for future supply? Creating regional competition? Building branded programs? The answer probably varies by project.

Global Factors Adding Complexity

International beef markets increasingly influence our domestic situation. USDA’s Foreign Agricultural Service October 2025 Livestock and Poultry report tracks significant production shifts in countries like Brazil and Australia. When Brazilian exports increase substantially (up 15% year-over-year according to their latest data) or Australia recovers from drought-induced liquidation, it affects global beef flows.

Major processors operate internationally, and their strategies reflect global opportunities. Companies like JBS, Tyson, and Cargill balance operations across continents. When operations in different regions show varying profitability patterns, it influences domestic investment and operational decisions.

For U.S. dairy producers, these international factors contribute to price volatility in ways that weren’t as pronounced even five years ago. Global beef trade essentially influences domestic price ceilings — when imported product can fill demand at certain price points, our cull cow values face pressure.

Canadian producers, despite their different regulatory framework providing some buffer through supply management, are experiencing similar dynamics with beef-on-dairy economics. The fundamentals transcend borders, as recent reports from the Canadian Cattlemen’s Association indicate.

Practical Considerations for Current Conditions

After observing various operational approaches this season, here are some considerations worth discussing:

It’s crucial to track actual returns versus projections. Many land-grant universities have developed tools for this purpose — Wisconsin’s Center for Dairy Profitability has spreadsheets, Penn State offers decision tools, Cornell’s PRO-DAIRY program provides calculators. These resources can reveal important gaps between expectations and reality. Success metrics vary, but operations reporting improved cash flow often see 15-20% better performance when they track actual versus projected returns closely.

When calculating replacement costs, remember it extends beyond purchase price. There’s financing (and with interest rates where they are, that matters), transportation (fuel costs add up quickly), and that transition period when fresh heifers adjust to your system — different water, new TMR, group dynamics. University research, including work from Michigan State and Cornell, suggests these additional costs can add 10-15% to the sticker price.

If you’re committed to a particular breeding strategy, explore risk management tools. The Livestock Risk Protection for Dairy (LRP-Dairy) program offers price floor protection. Forward contracting through organizations like DFA or your local co-op might provide stability. Various hedging products exist through the CME — they all have costs, certainly, but weigh those against the risks you’re managing.

The optimal breeding strategy varies by operation. Your conception rates (which vary seasonally and by management), voluntary culling patterns, facilities (tie-stall versus freestall versus robotic), available labor — they all factor in. What works for a 2,000-cow operation with its own feed mill won’t necessarily translate to a 200-cow grazing operation. And that’s okay — diversity has always been one of dairy’s strengths.

Market timing has become increasingly complex. Those traditional seasonal patterns we relied on for decades — shipping cull cows before grass cattle hit the market, buying replacements in spring — they’re less predictable now. Price swings within monthly periods can be substantial. Local and regional market intelligence has become more valuable than ever.

Maintaining Perspective in Uncertain Times

Markets evolve — sometimes gradually, sometimes surprisingly quickly. What functions in one region might not translate to another. What makes sense for a large, integrated operation might not pencil out for a traditional family farm. And that’s the diversity that’s always characterized our industry.

Before implementing significant changes, consultation with your advisory team becomes crucial. Your nutritionist sees things from the feed efficiency and production angle. Your veterinarian considers herd health and reproduction implications. Your lender evaluates cash flow and debt service coverage. Each perspective contributes to better decision-making.

And let’s acknowledge — some operations are finding genuine success with various strategies. Direct marketing relationships with specific buyers who value consistency. Genetic programs that command buyer loyalty. Local markets that pay premiums for specific attributes. These successes remind us that opportunities exist even in challenging markets. Success often comes down to matching your operation’s strengths with market opportunities.

Looking Forward Together

This market environment certainly isn’t what any of us anticipated back in 2023 when beef-on-dairy really took off. The interaction between processing capacity, replacement availability, and breeding economics has created unprecedented challenges.

But what’s encouraging is how producers are adapting. Whether through adjusted breeding strategies, innovative contracting arrangements, or collaborative marketing efforts (like the producer groups forming in several states to pool beef-cross calves for better marketing leverage), paths forward exist. The dairy industry has weathered significant challenges over the decades — the 1980s farm crisis, the 2009 collapse, the 2020 pandemic disruptions. This situation, while unique in certain aspects, represents another test of our collective resilience.

The fundamentals remain constant: understand your actual costs (not what you hope they are or what someone projected they’d be), know your markets (both what you’re selling into and buying from), and base decisions on real data rather than projections. Every farm faces unique circumstances — facilities, labor availability, local markets, financial position. But understanding broader patterns helps inform better individual decisions.

We really are navigating this together. The conversations at co-op meetings, information shared at winter dairy conferences, neighbor-to-neighbor discussions over fence lines or at the feed store — that’s how our industry has always moved forward. Whether you’re milking 50 cows or 5,000, whether you’re in Vermont or California, we all face these markets together.

These are certainly interesting times. But with solid information, realistic planning, and thoughtful adaptation, operations will find their way through. That’s what we do, isn’t it? We observe, we adapt, we support each other, and we keep moving forward.

Always have. Always will.

KEY TAKEAWAYS:

- Contract heifer growing arrangements can reduce replacement uncertainty by 100% while typically costing 20-25% less than panic buying on spot markets — Wisconsin and Minnesota growers report strong interest in 18-24 month contracts at $2,800-$3,200 delivered, providing both parties predictable cash flow

- Strategic genomic testing at $35-45 per animal enables precision breeding that maintains genetic progress while capturing beef revenue — bottom 20% get beef semen, middle 50% conventional dairy, top 30% sexed semen, optimizing both cash flow and herd improvement

- Regional market variations create opportunities smart operators are exploiting — California’s integrated systems negotiate direct contracts while Midwest co-ops pool beef-cross calves for 15-20% better premiums than individual marketing

- Risk management tools like LRP-Dairy provide price floor protection that costs $15-25 per head but prevents catastrophic losses when replacement markets spike or cull values crash — essentially disaster insurance for volatile times

- The optimal breeding ratio depends on your conception rates, culling patterns, and local markets — 60/40 might work with excellent reproduction, but operations with challenges find 70/30 provides essential cushion against today’s $3,800 replacement reality

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Top Strategies for Successful Dairy Cattle Breeding: Expert Tips and Insights – This tactical guide reveals how to implement genomic selection, embryo transfer, and sexed semen to strategically improve your herd’s genetics, providing actionable steps to build a more profitable and resilient breeding program that complements the main article’s focus.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – This article provides a strategic market overview, with specific data on the “component revolution” and new processing capacity. It helps progressive producers understand the changing economic landscape and shows how to position their farms for profitability beyond traditional volume-based thinking.

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – Discover how investing in robotic milking systems can solve the labor crisis and provide a significant ROI. This piece offers a deep dive into how technology can create efficiencies and reduce long-term costs, complementing the main article’s discussion of strategic adaptation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!