African dairy farms are generating $ 500,000+ annually from smart sustainability—while boosting milk yields. Missing out?

EXECUTIVE SUMMARY: Look, I just spent time digging into what’s happening in African dairy, and honestly? These guys are making sustainability pay like nothing I’ve seen before. We’re talking real money here—operations saving $500,000+ annually on energy costs while earning $11.55 per carbon credit. Fan Milk cut their CO2 by 2,513 tons and banked half a million in energy savings. Nestlé’s sequestering 6,000 tons of carbon per farm while recycling millions of gallons of water. The kicker? Milk production’s actually going up 34% in these systems. With feed costs and energy prices hammering everyone in 2025, these African producers found the sweet spot where good farming meets great business. Time to pay attention.

KEY TAKEAWAYS:

- Solar ROI that actually works: 1MW installations paying back in 3-4 years while cutting energy costs 40-60% during peak hours—audit your energy bills and run the numbers

- Carbon credits aren’t just hype: Verified programs paying $10-15 per ton of CO2 sequestered through better soil management—call your extension agent about soil carbon programs

- Biogas systems are hitting 96% emission reductions while producing organic fertilizer worth thousands—evaluate your manure management for biogas potential this quarter

- AI-driven feed efficiency cuts costs 5% through precision nutrition and herd monitoring—invest in data collection tools before feed prices spike again

- Energy independence = market resilience: Solar and biogas protecting against volatile energy costs that crushed margins in 2024—diversify your energy sources now

The African dairy sector is undergoing a transformation that few expected to arrive this quickly: smart decarbonization that’s paying off in real, measurable ways.

“Implementing solar-powered systems hasn’t just cut our costs,” explains Samuel Mwangi, a third-generation dairy farmer from Kenya’s central highlands. “It’s given us resilience against grid failures—something we couldn’t afford before when a single outage could spoil an entire day’s production.”

Where the Big Money’s Going

Across Kenya, Rwanda, Tanzania, and Uganda, the DaIMA programme has mobilized nearly $358 million to reshape how millions of farmers produce milk—a coordinated effort that’s proving profitability and sustainability aren’t mutually exclusive. What strikes me about this initiative is how it has adapted to regional differences… some areas with better grid infrastructure can focus on efficiency improvements, while others need to prioritize energy independence first.

Take Nestlé’s work in South Africa, where they plan to scale regenerative practices across 96 farms by mid-2024. At their flagship Skimmelkrans Farm, they’re sequestering about 6,000 tonnes of carbon annually while recycling 14.5 million liters of water—impressive numbers when you consider the Western Cape’s ongoing water challenges.

Meanwhile, in Ghana, Fan Milk completely overhauled its energy approach with biomass boilers, which cut CO2 emissions by roughly 2,513 tonnes per year while saving more than half a million dollars in energy costs. That’s the kind of win-win that gets CFOs excited.

Zimbabwe’s Dairibord Holdings wasn’t sitting on the sidelines either—they dropped $2 million on a 1MW solar plant at their Chipinge dairy facility, which is slated to come online in 2025 to power their entire production line.

The Carbon Credit Reality Check

Here’s where it gets interesting for smaller operations. AgriCarbon’s pilot project has issued over 182,909 verified carbon credits from 29 South African farms, paying farmers an average of $11.55 per credit—a competitive rate in the global voluntary market.

“The carbon payments aren’t making anyone rich,” admits Johann van der Merwe, whose family farm near Stellenbosch participates in the program, “but they’re covering the cost of soil testing and some of the regenerative practices we wanted to try anyway. It’s like getting paid to improve your land.”

“Sustainability isn’t a buzzword anymore—it’s a legitimate business strategy that’s reshaping profit margins across the continent.”

The Technical Reality

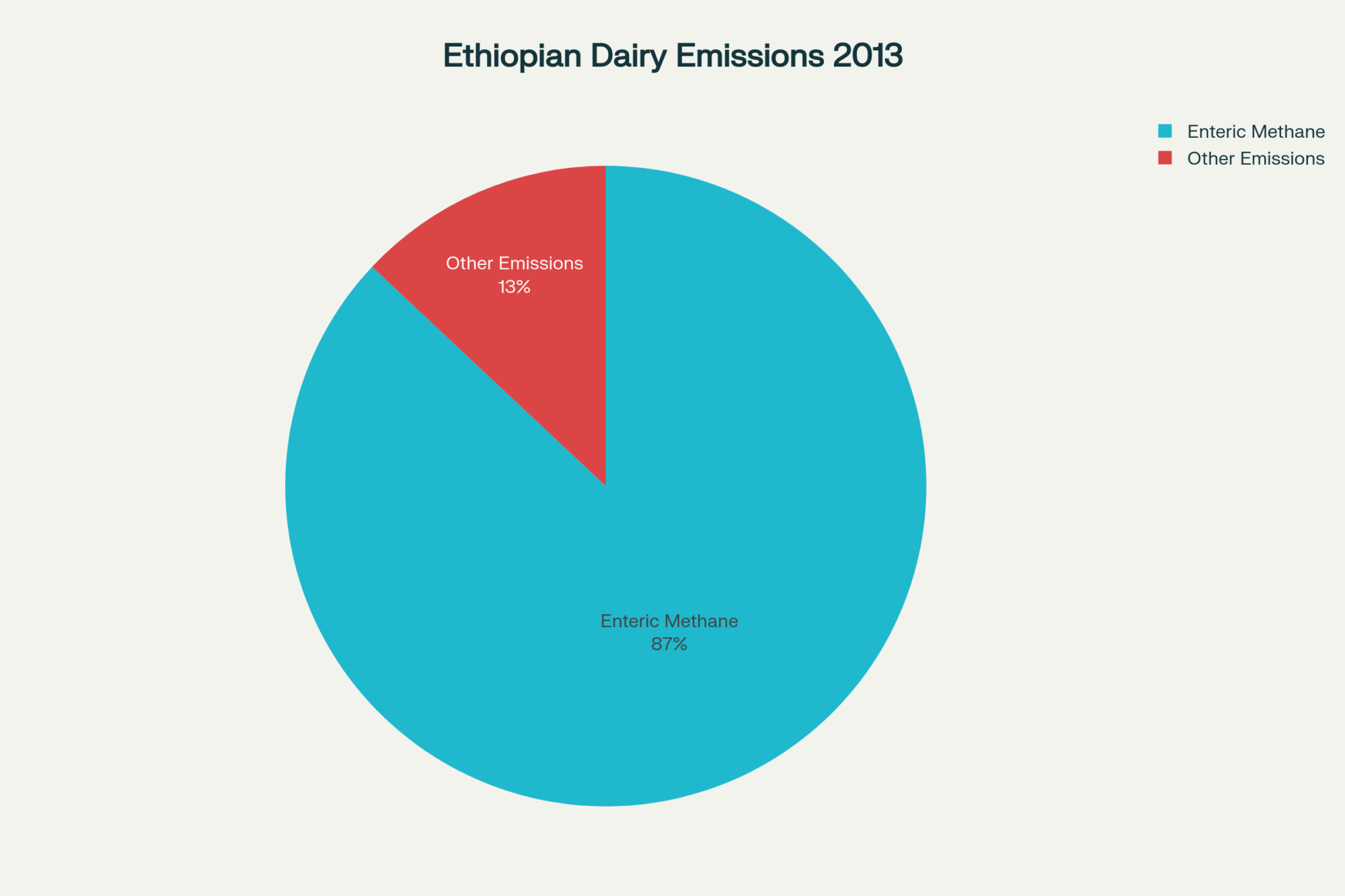

The science behind all this is pretty compelling. Ethiopian dairy, which FAO data shows released approximately 116 million tonnes of CO2 equivalent in 2013—mostly enteric methane, with which we are all familiar—has managed to reduce emission intensity to approximately 24.5 kg CO2 equivalent per kilogram of fat- and protein-corrected milk through improved feeding and management practices.

What’s particularly fascinating is how biogas systems capture 85-90% of methane emissions, effectively reducing total farm emissions by up to 96% compared to untreated waste. The digestate becomes valuable organic fertilizer—it’s circular economics at work.

The Operational Challenges Nobody Talks About

But let’s be honest about the challenges, because they’re real. South African dairy farmers continue to struggle with load shedding, which forces them to rely on expensive diesel generators. I’ve seen operations where fuel costs alone can eat up 15-20% of gross margins during heavy outage periods.

Zimbabwe presents different headaches—rising administrative and compliance costs that are pushing some smaller producers toward the exit. The paperwork burden alone can cost operations $5,000-$ 10,000 annually in administrative overhead.

And solar? It’s fantastic when the sun shines, but cloudy days reduce generation by 20-30%, which means you’re likely to consider battery storage or backup generators that add significant upfront capital costs.

The Technology Leap

One genuinely exciting development: AI adoption in African dairies is accelerating efficiency gains at a rate faster than anyone predicted. Farms are using machine learning for everything from predicting heat cycles to optimizing feed rations based on real-time milk composition data.

Different Paths for Different Operations

| Technology | Farm Size | Initial Investment | Payback Period | Annual Savings |

|---|---|---|---|---|

| Carbon Credits | <500 cows | Low | 1-2 years | $10K-$50K |

| Solar Systems | 500-2000 cows | $1M-$3M | 3-5 years | $200K-$500K |

| Biogas Systems | >2000 cows | $2M-$5M | 4-7 years | $300K-$1M+ |

What I find most practical about this whole movement is how scalable it is:

Small-scale operations (under 500 cows) can start with carbon credit programs—lower capital requirements, faster payback, and you’re building soil health while generating revenue.

Mid-sized dairies should consider solar installations closely, especially in areas where grid reliability is uncertain. The energy independence alone justifies the investment in many regions.

Large commercial operations can maximize returns through integrated biogas systems that simultaneously manage waste, generate energy, and produce fertilizer.

What This Means for Global Competition

But this isn’t just an African story. These processors are building competitive advantages that will matter in global trade. As carbon border adjustments and sustainability certifications become standard requirements for premium markets, the early movers are positioning themselves perfectly.

The DaIMA programme projects avoiding 2.1 million tonnes of GHG emissions over 20 years while increasing milk production by 34%. That’s not just environmental improvement—that’s operational efficiency that translates directly to cost advantages.

The Bottom Line for Everyone

Whether you’re milking cows in Wisconsin or the Western Cape, watching this African transformation offers real lessons. The early adopters—the ones implementing these integrated approaches now—aren’t just preparing for future regulations. They’re building more resilient, profitable operations that can weather volatility in energy costs, input prices, and climate variability.

“The farms that adapt quickly to these innovations will be the ones still thriving in 20 years,” reflects David Kiprotich, whose family has been dairy farming in Kenya for three generations. “We’re not just changing how we produce milk—we’re changing what it means to be profitable in agriculture.”

The pace of change is accelerating, and the financial benefits are becoming undeniable. For dairy professionals worldwide, ignoring this shift means risking competitive disadvantage in an industry that’s increasingly rewarding environmental performance alongside production efficiency.

This isn’t about being green for green’s sake—it’s about being smart for profit’s sake. Currently, some of the most innovative developments in dairy are taking place in Africa.

“Decarbonization has shifted from cost center to competitive advantage. The question isn’t whether to adapt—it’s how quickly you can learn from the pioneers.”

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Corporate Giants Are Hijacking Dairy Sustainability (And Your Farm’s Future Depends on Getting Aboard) – Explore the strategic market forces driving the sustainability push from corporate buyers. This analysis details how to align your operation with new supply chain demands, ensuring your farm remains a preferred supplier in a green-focused global market.

- Unlocking Carbon Credits in Agriculture: What You Need to Know – This article breaks down the practical steps for entering the carbon market. It reveals methods for quantifying your farm’s sequestration potential and provides key questions to ask before signing any contract, helping you turn soil health into a bankable asset.

- 3,000-Cow Dairy Goes Solar With 719-kW Tracking System – See the real-world ROI of a large-scale solar installation on a U.S. dairy. This case study demonstrates how to evaluate system specs and energy output against capital costs, providing a tangible blueprint for achieving grid independence and long-term savings.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!