The $3 billion bailout hit producers’ accounts—but the real story is how farmers are turning that relief into resilience and re‑engineering the future of dairy.

Executive Summary: The USDA’s $3 billion dairy bailout bought farmers time—just not transformation. Since 2018, over $60 billion in federal “emergency” funding has kept America’s milk moving, but it’s also made rescue money feel routine. What’s interesting is how differently producers are responding. In Wisconsin, smaller family herds keep shuttering, while Idaho’s integrated systems keep growing. Yet across regions, many farms are proving that strength now comes from management, not money—from tracking butterfat performance to securing feed partnerships and using Dairy Revenue Protection as standard operating procedure. The article reveals a quiet shift happening in dairy: the producers thriving today aren’t waiting for Washington—they’re building resilience from the inside out.

When the USDA released $3 billion in previously frozen dairy aid earlier this fall, a lot of barns felt the same quiet relief. That check helped cover feed, tide over payroll, or pay for the next load of seed. But here’s what’s interesting—what used to be considered “emergency relief” has quietly become routine.

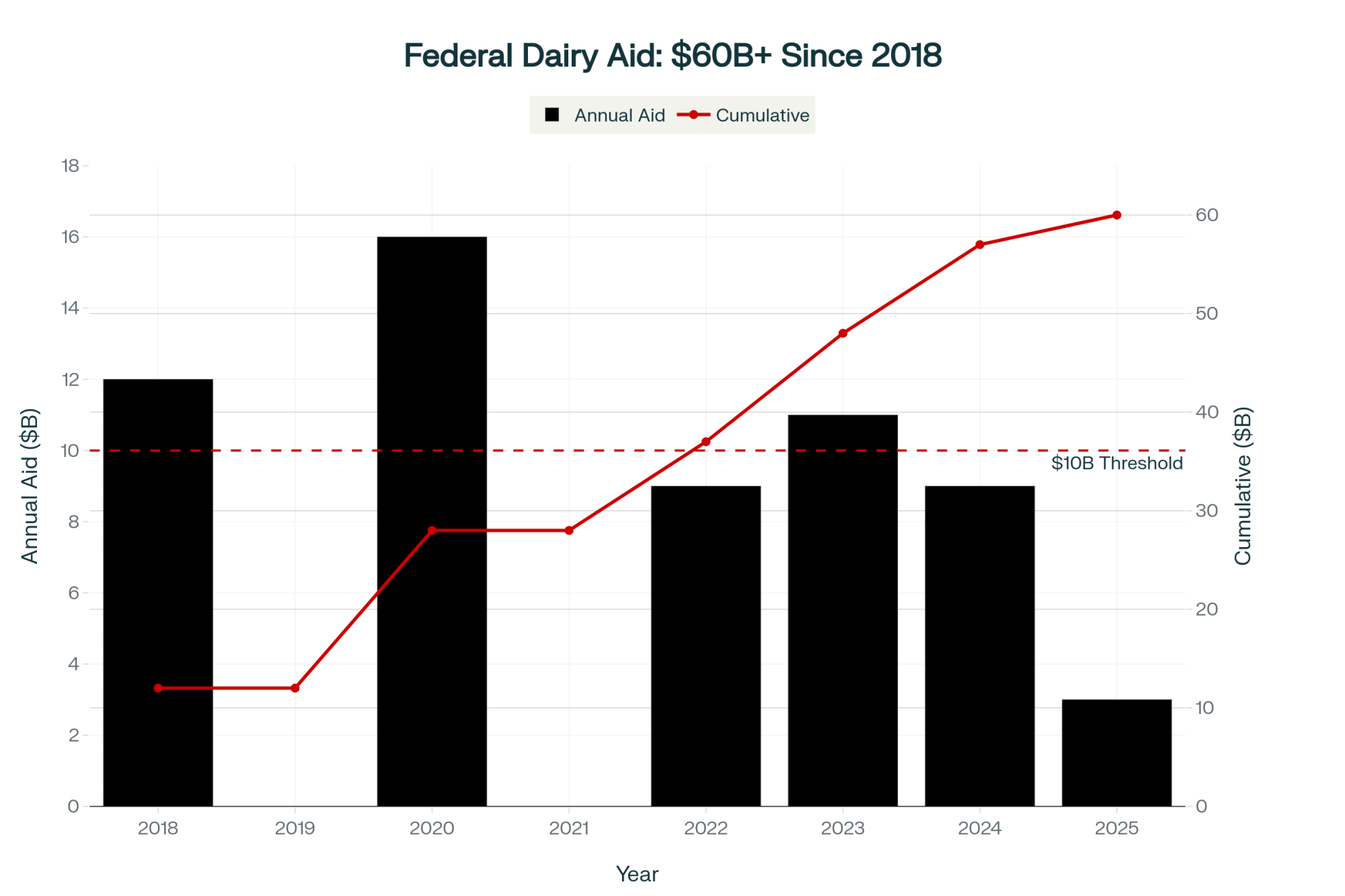

Since 2018, the government’s Commodity Credit Corporation has distributed over $60 billion in ad‑hoc support to U.S. farmers, according to USDA and Congressional Research Service data. That includes the trade‑war relief payments, COVID‑era CFAP funds, weather‑related disaster programs, and now, this latest round of support. Each program had different names and triggers, yet all share one thing: they’ve made emergency relief feel ordinary.

Looking at this trend, it’s clear that the system doesn’t just respond to volatility—it depends on it.

From Safety Net to Part of the System

University of Illinois economist Jonathan Coppess put it plainly during a 2025 policy forum: “Every time we call these payments extraordinary, we prove how ordinary they’ve become.”

He’s right. The CCC now spends more than $10 billion each year keeping farm sectors whole when prices collapse. The money buys time—valuable time—for dairy families to stay solvent when margins evaporate. But I’ve noticed something else: those interventions slow the kind of market corrections that might otherwise drive innovation.

In other words, the aid keeps everyone in motion—but it also keeps everyone in the same spot.

Geography Still Shapes Success

| Metric | Wisconsin (Traditional) | Idaho (Integrated) | Impact |

|---|---|---|---|

| Herd Trend 2024 | 400+ closures | 4.2% growth | Consolidation accelerating |

| Primary Model | Small-mid family farms | Vertically integrated | Structure determines survival |

| Processor Relationship | Co-op (variable deductions) | Direct long-term contracts | Security vs. volatility |

| Co-op Deductions | $1-3 per cwt | Minimal/contracted | Margin erosion for traditional |

| Feed Strategy | Mixed/spot market | Integrated supply chains | Cost predictability advantage |

| 2025 Production Trajectory | Declining | Expanding | Geographic winners emerging |

Here’s a sobering contrast.

In Wisconsin, USDA NASS reports for 2025 show that over 400 milk license holders closed in 2024, the vast majority small or mid‑sized herds. Co‑op deductions for hauling, marketing, and retained equity often run from $1 to $3 per hundredweight, depending on the service region. Add that to feed pressure, and margins vanish quickly when Class III milk averages around $16 per hundredweight.

Meanwhile, Idaho saw 4.2 percent production growth, driven by vertically integrated systems and processor partnerships (Idaho Dairymen’s Association Annual Report 2025). Many herds there ship directly to long‑term contracts with Glanbia Foods or Idaho Milk Products. As CEO , Rick Naerebout says, “Security here comes from being part of someone’s plan.”

That’s becoming the modern split in U.S. dairy. It’s not only about scale—it’s about supply security.

Export Growth Without Equal Payoff

U.S. dairy exports have tripled since 2000, making America the world’s third‑largest dairy exporter, trailing only the EU and New Zealand (USDA Livestock, Dairy and Poultry Outlook, August 2025). It’s an incredible achievement. The challenge is that the extra volume hasn’t meant better milk checks.

The European Commission’s Agri‑Food Trade Report (2025) confirms that EU processors still benefit from export‑enhancing subsidies. And USDA ERS data shows that while New Zealand’s grass‑based systems remain the most cost‑efficient in the world, Americans must rely on grain‑fed cows and higher‑input models.

In 2025’s Q3, Class III prices averaged $16.05 /cwt, while breakevens in most regions sat near $18–$20 /cwt(CME Markets and USDA ERS cost‑of‑production reports). Industry analyst Sarina Sharp at Daily Dairy Report put it simply: “We’re moving tonnage, not value.”

The export engine keeps plants full—but it hasn’t lifted profitability on the farm.

When DMC Numbers Don’t Match Reality

By federal calculations, dairies are doing fine.

On paper, the Dairy Margin Coverage (DMC) program’s national average margin has stayed above $9.50 for 25 consecutive months (USDA FSA DMC Bulletins, 2025). But back home, budgets tell a different story. A Farm Journal Ag Economy Survey (2025) found 68 percent of producers still reporting negative cash flow through the same period.

The difference is in the math. DMC uses corn, soybean meal, and premium alfalfa hay to model feed cost, leaving out labor, fuel, freight, and mineral expenses. A California freestall feeding $360 a ton of hay and paying $22 an hour in labor looks “healthy” next to a Midwest herd growing its own feed, at least on paper.

As one Wisconsin producer told me, “DMC says I’m comfortable. My milk check says otherwise.”

Where Resilience Is Actually Happening

What’s encouraging is how many farms are finding independence within this uncertainty. Across regions, large and small, producers share some common habits that quietly strengthen their bottom lines.

- Holding processor relationships close. Herds delivering reliable supply with high butterfat and low SCC keep their spot when plants trim pickups. Consistency is its own insurance policy.

- Milking components over volume. USDA AMS 2025 data shows butterfat now drives over 55 percent of milk’s value. Just a 0.2 percent lift in butterfat can earn $10,000 to $15,000 per 100 cows,depending on premiums. The best results usually come from fresh cow management and ration adjustments using digestible fiber and balanced oils, not simply more grain.

- Locking in feed and forage partnerships. A University of Wisconsin Extension (2024) study found multi‑year forage contracts saved 8 to 12 percent per ton of dry matter compared to spot buying. Contract stability reduces uncertainty around input costs—and lenders like certainty.

- Treating insurance like a feed input. According to the Risk Management Agency 2025 Report, about 70 percent of U.S. milk is now covered by Dairy Revenue Protection or Livestock Gross Margin. Farms building those premiums (roughly 1–2 percent of revenue) into their budgets weather volatility far better than those rolling the dice each year.

- Diversifying strategically. California Bioenergy (2025) reports digesters and renewable‑gas systems returning $40,000 to $120,000 annually for 1,000‑plus cow herds—without pulling focus from the dairy. Others find stability through direct marketing or regional brand partnerships.

- Measuring profitability monthly. Penn State Extension (2025) shows feed should stay below 60 percent of gross milk income. The farms that benchmark this monthly spot inefficiencies faster and make small, cost‑saving pivots before they snowball.

- Planning exits on their own terms. According to the USDA ERS Farm Structure and Stability report (2025), herds planning transitions 12–18 months ahead preserve as much as 40 percent more equity than forced liquidations. Some call that quitting; others call it smart continuity.

Each step underlines the same idea: resilience isn’t dramatic—it’s deliberate.

What the Bailouts Really Buy

In the short run, relief checks keep dairies alive and infrastructure intact. They pay feed bills and save lenders a lot of sleepless nights. But as Coppess reminds us, “These payments stabilize balance sheets—they don’t modernize business models.”

Bailouts treat symptoms, not sources. Without modernized DMC calculations, fairer make‑allowance data, and supply contracts that reward efficiency, the cycle continues: price drop, emergency payment, repeat.

The Bottom Line

Here’s what the 2025 bailout really offers: time.

What farmers are proving, though, is that time alone doesn’t fix markets—management does. Across the country, producers are sharpening skills, controlling costs, and tracking butterfat performance with the precision of any Fortune 500 manager.

As New York Jersey breeder Megan Tully put it best, “The government may keep us afloat, but only management keeps us profitable.”

And there it is. Resilience in dairy right now isn’t a talking point—it’s a mindset. It’s being built every day in barns, on tractors, at kitchen tables, and in feed alleys. One cow, one ration, one decision at a time.

Key Takeaways:

- Emergency aid has become standard practice. Since 2018, more than $60 billion in CCC funds have flowed to dairy, blurring the line between rescue and routine.

- Farm outcomes now depend on geography and leverage. In Wisconsin, small family herds keep shrinking; in Idaho, contracted farms keep growing—and that gap is widening.

- Official margins hide on‑farm reality. DMC numbers may look comfortable, but they ignore feed freight, labor, and energy costs that drain actual cash flow.

- Producers are creating their own safety nets. From better butterfat performance to multi‑year feed contracts and DRP insurance, farmers are writing their own playbooks.

- Resilience is being rebuilt one decision at a time. The dairies thriving today aren’t waiting on policy—they’re managing through it.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Profit-Driven Persistence: How Dairy Farmers Overcome Challenges to Boost Production – Explores how producers are strategically managing herd growth, breeding, and resource allocation to maintain profitability despite volatility. This article provides actionable tactics for optimizing herd expansion and balancing short-term cash flow with long-term stability.

- Dairy Outlook December 2024: Navigating Price Shifts and Production Trends in a Competitive Market – Delivers timely market insights into Class III and IV price forecasts, butter and cheese trends, and expectations for 2025. Farmers can use these forecasts to shape budget plans, marketing decisions, and contract strategies for the year ahead.

- Revolutionizing Dairy Farming: How AI, Robotics, and Blockchain Are Shaping the Future of Agriculture in 2025 – Reveals how precision technologies—from AI-enabled milkers to blockchain traceability—are redefining farm efficiency and sustainability. An essential read for producers exploring automation and digital tools to reduce labor and unlock new value streams.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.