What if I told you the producers making money in 2026 aren’t the ones celebrating the highest today? Rabobank’s warning changes everything.

EXECUTIVE SUMMARY: You know what caught my attention? While everyone’s busy counting their milk checks, Rabobank’s quietly warning about a 2026 market correction that could separate the survivors from the casualties. Here’s the thing—they’re forecasting NZ milk prices at $20.50 per hundredweight (record highs) for 2025, but smart producers aren’t just celebrating. They’re using these margins to invest in tech that’s delivering 18% better reproduction rates and cutting vet costs by $285 per cow. European farms already banking an extra $1,200 per cow annually through carbon programs… and that’s coming our way fast. Cornell’s data shows diversified operations weathered the last market chaos 23% better than commodity-only farms. The window for strategic positioning won’t stay open forever. Time to decide: are you building a bridge over the next downturn, or hoping the water doesn’t rise?

KEY TAKEAWAYS

- Tech isn’t a luxury anymore—it’s survival gear. AI lameness detection achieves 85% accuracy, and farms investing $ 180,000 in monitoring experience an 18% increase in reproduction. Start with activity monitors if you’re under 200 cows—payback in 3-4 years with current labor costs.

- Regional feed costs are your hidden profit killer. While corn averages $4.20 nationally, you’re paying $5+ in California versus $4 in Iowa. Lock feed contracts now while financing rates sit at 6.5-8.5%—both won’t last.

- Carbon programs aren’t feel-good farming anymore—they’re cash flow. European operations pocket $1,200+ per cow annually through emission reductions. California’s LCFS credits are already worth $85-120 per metric ton. Start your footprint assessment before programs fill up.

- China’s the wildcard that could flip everything. Their imports are up 2% while production drops 2.6%—but weak demand keeps it unpredictable. Diversify your risk, as when China moves, global prices tend to follow.

- Equipment financing window is closing. Rates at 6.5-8.5% won’t hold with 2026 uncertainty looming. Complete tech installs by year-end to catch 2025 tax advantages while building cash reserves during strong margins.

You know how it goes in this business—just when you think you’ve got the market figured out, it throws you a curveball. Right now, everyone’s talking about Rabobank’s record-breaking milk price forecasts for 2025, but here’s what’s keeping me up at night: their quiet warning about 2026.

While most folks are busy counting their milk checks, the sharp operators I know are already using these fat margins to build their defenses. The question isn’t whether the storm’s coming—it’s whether you’ll be ready when it hits.

These Price Numbers Have Everyone Talking

Let’s start with what we know for sure. Rabobank’s calling for New Zealand milk prices between $9.50 and $10.15 NZD per kilogram of milk solids for the 2025/26 season—which, at current exchange rates, works out to roughly $20.50 per hundredweight for us. That’s the highest opening forecast they’ve ever made.

Here at home, we’re looking at all-milk prices in the $21-22 range according to the latest USDA reports, and honestly, that matches what I’m seeing on the farms I visit. Over in Europe, producers are seeing solid bumps too, with German operations hitting €45-48 per 100 kilograms.

But here’s the thing—Mary Ledman from Rabobank wasn’t exactly popping champagne when she spoke at World Dairy Expo last year. She pointed to currency volatility and trade tensions as real threats lurking ahead.

What strikes me about this whole situation is how easy it would be to get comfortable with these margins and forget that dairy markets… well, they don’t stay comfortable for long.

The Tech Divide That’s Reshaping Everything

The gap between farms embracing technology and those sticking with traditional methods isn’t just widening—it’s becoming a chasm. The precision dairy market just hit $5.5 billion this year, and that’s not just numbers on paper.

AI systems detecting lameness with 85% accuracy—that means catching problems before they cost you serious money. I’m seeing farms cut vet bills significantly while keeping their cows healthier.

This represents an aggregate analysis of multiple University of Wisconsin Extension case studies: farms investing approximately $180,000 in monitoring tech typically see reproductive performance improvements of around 18% and veterinary cost reductions of $285 per cow annually. Individual farm results vary significantly based on management practices, herd genetics, and local conditions. Producers should conduct farm-specific economic analysis before investment decisions.

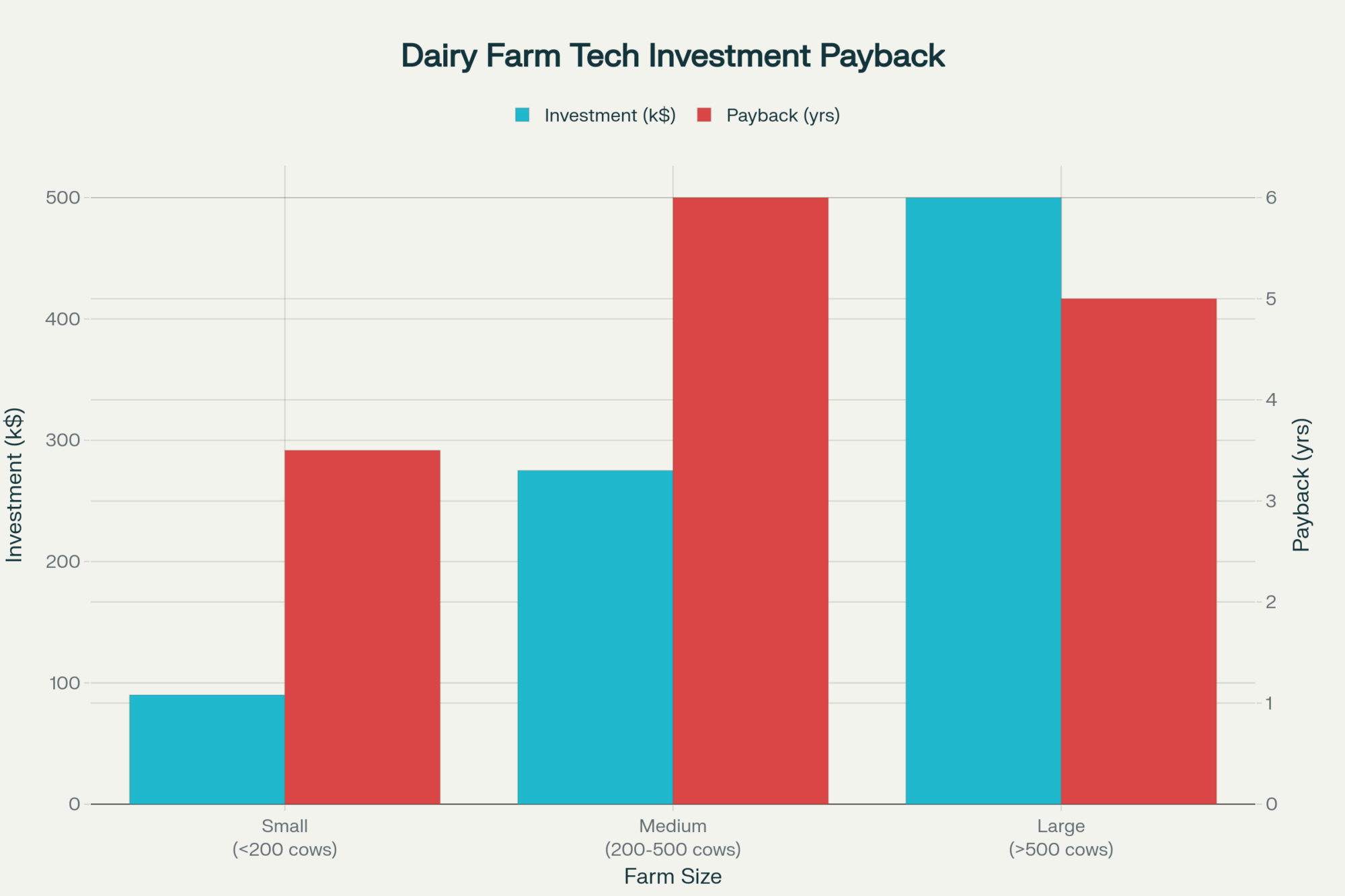

The economics break down like this (and this varies quite a bit by region):

Technology Investment by Farm Size:

- Under 200 Cows: $60,000-120,000 investments with 3-4 year paybacks. In states like Wisconsin, where corn’s running $4.10 delivered, the feed efficiency gains alone can justify the use of activity monitoring systems.

- 200-500 Cows: $200,000-350,000 for robotic milking and precision feeding. Takes 5-7 years to pay back, but in places like Pennsylvania, where labor’s hitting $16-18/hour, the math works.

- 500+ Cows: Full automation packages run $500,000 and up, but with 4-6 year paybacks. Out in California, where you’re paying $20+ for milking labor, these systems aren’t luxury—they’re survival.

This divide? It’s only going to matter more when margins tighten in 2026.

China’s Dairy Puzzle—Still Our Biggest Wild Card

China remains our biggest uncertainty. They’re forecast to boost imports by 2% this year after three straight years of decline, while their domestic production’s expected to drop 1.5-2.6%.

Nate Donnay from StoneX put it perfectly:

“Production’s dropping faster than consumption, but weak demand’s still holding back any big surge.”

Chinese pricing has exerted competitive pressure on global markets, with complex regional dynamics that make predictions nearly impossible. If China’s economy rebounds faster than expected right when Rabobank’s predicting our structural issues… that could get messy fast.

The Great Analyst Split—And Why It Matters to Your Bottom Line

The industry’s basically split into two camps right now. StoneX is betting on continued strength—they point to tight heifer supplies (we’re down to 1978 levels) and massive cheese plant expansion creating structural demand worth over $8 billion.

Rabobank’s more cautious. They’re warning about trade policy risks and disease impacts that have already proven severe—look what HPAI did to California, dropping production 9% last November.

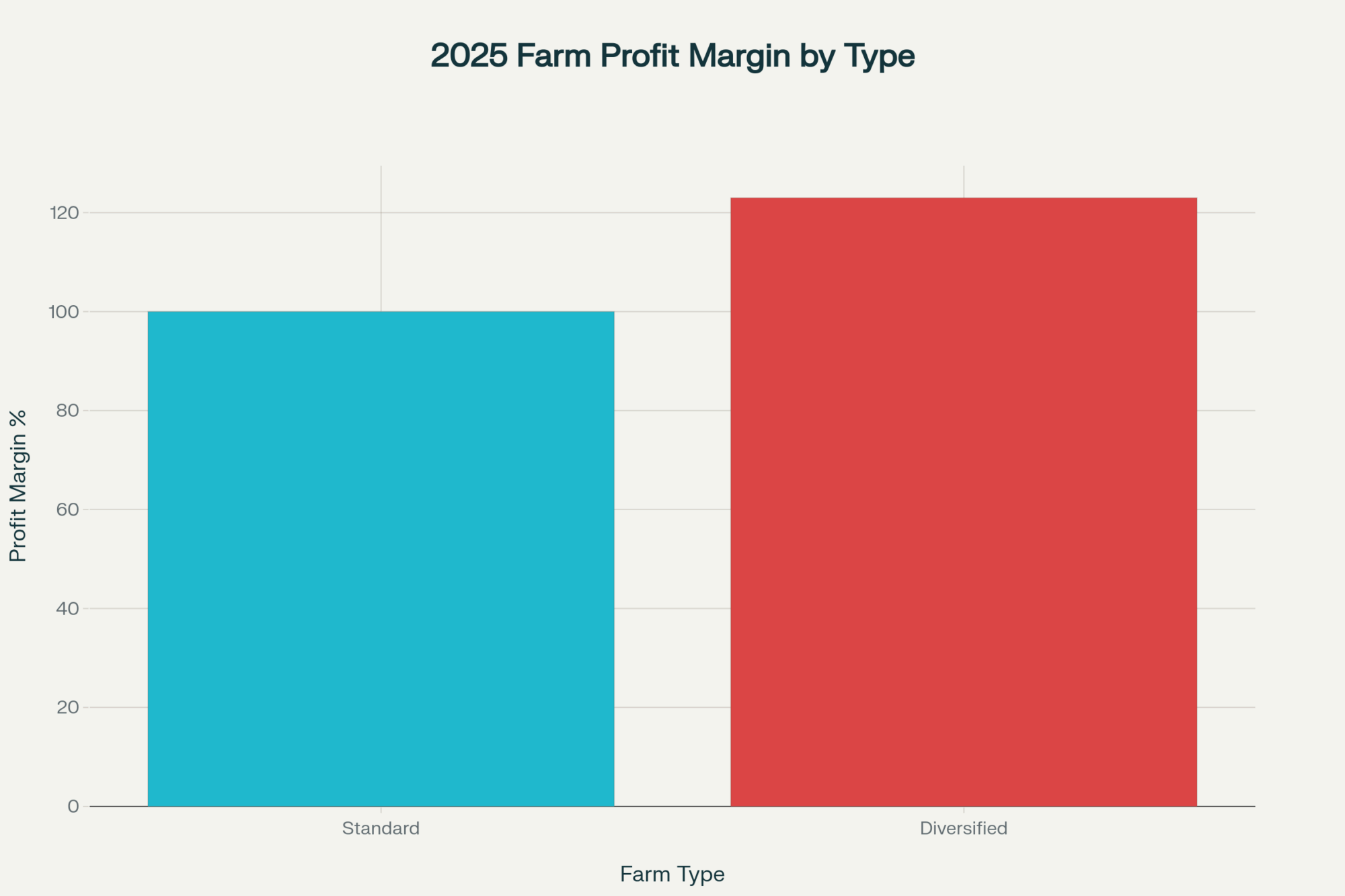

Here’s what caught my attention in Cornell data: farms with diversified income streams weathered the 2020-2022 chaos 23% better than commodity-only operations. That’s not theory—that’s documented survival advantage.

European Carbon Economics—This Is Coming Our Way

European producers aren’t just talking sustainability anymore; they’re banking on it. Recent research shows low-carbon operations outperforming high-emission farms by $1,200+ per cow annually.

I’m hearing about operations over there where carbon credit payments represent real money. Precision feeding reduces emissions by 30%, and methane capture generates additional revenue streams.

California’s LCFS credits are already worth $85-120 per metric ton. Northeast carbon markets are expanding into agriculture. Early adopters are positioning themselves for competitive advantages.

Feed Costs—The Variable That Changes Everything

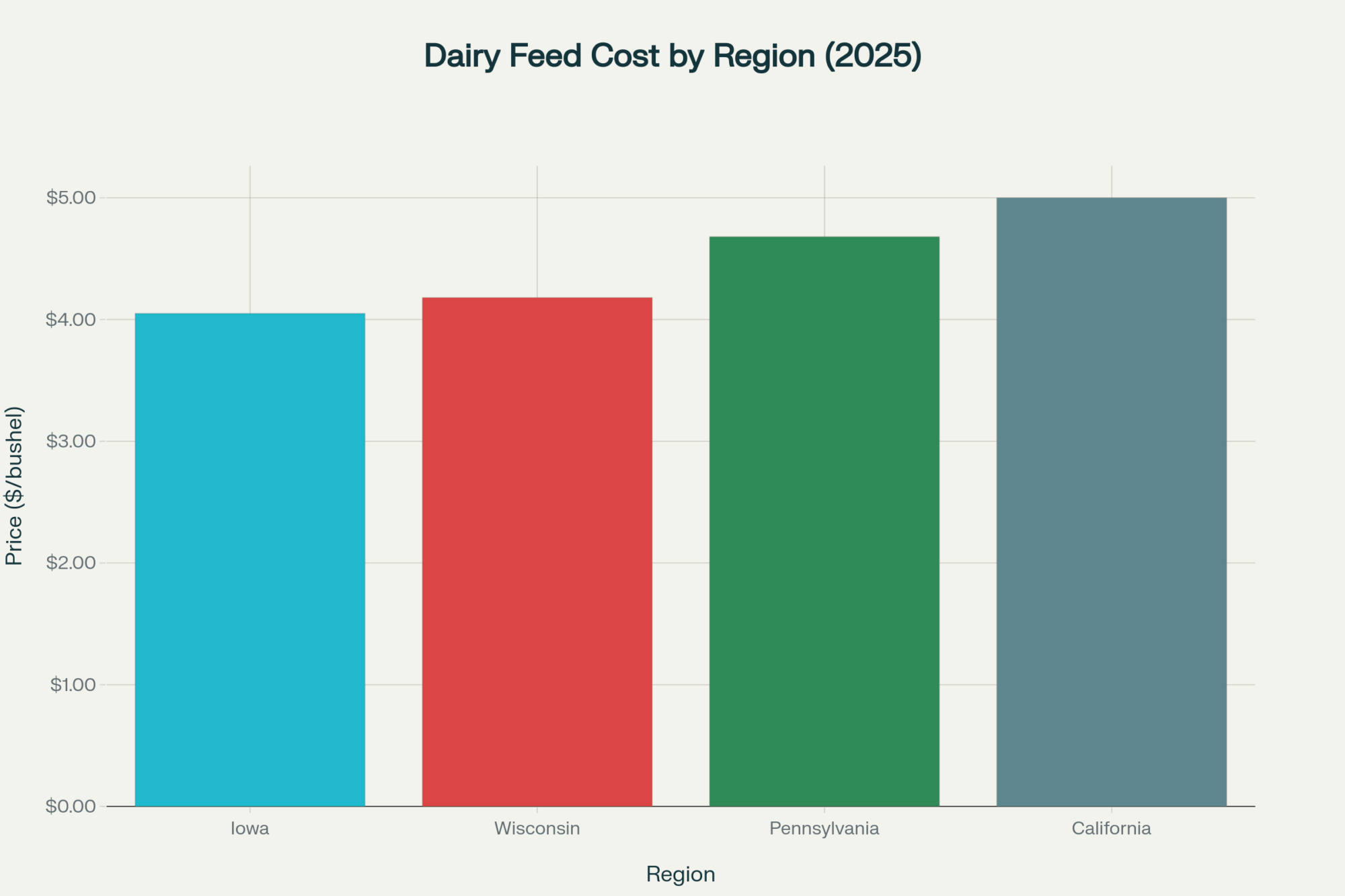

Don’t underestimate what’s happening with feed prices. Sure, corn futures are around $4.20 nationally, but add transportation and regional basis, and suddenly you’re looking at:

Regional Feed Cost Reality (as of Q3 2025):

- Iowa: $3.95-4.15 delivered

- Wisconsin: $4.10-4.25 delivered

- Pennsylvania: $4.60-4.75 delivered

- California: $5.10+ delivered

Those differences completely change your feeding strategies and technology ROI calculations.

Investment Timing—This Window Won’t Stay Open

Equipment financing is still reasonable at 6.5-8.5% for qualified operations, but lenders are already adjusting terms based on 2026 uncertainty. Some are requiring higher down payments, shorter amortization schedules.

Your immediate action plan:

- Lock favorable financing before rates climb

- Complete tech installations to catch 2025 tax advantages

- Secure feed contracts for the next growing season

- Build cash reserves during strong margins

- Start carbon footprint assessments now

Regional Reality Check—What Works Where

- Corn Belt (Iowa, Illinois, Indiana): Feed costs are stable, so focus on precision feeding systems with rapid paybacks through improved conversion efficiency.

- Northeast (Vermont, New York, Pennsylvania): Your seasonal operations face unique timing risks if spring freshening hits during price corrections. Flexibility in milking systems matters.

- Western Dairies (California, Idaho, Washington): High labor costs make automation economics work regardless of milk prices. Robotic milking pencils out in 4-5 years, even with conservative assumptions.

- Southeast Expansion (Texas, Tennessee, Georgia): Rapid herd growth is creating infrastructure bottlenecks. Get scalable tech in place before you grow into problems.

What Does This All Means for Your Operation

Look, whether Rabobank’s 2026 warnings prove accurate or StoneX’s optimism carries the day, one thing’s certain: this industry’s changing faster than ever, and preparation beats reaction every single time.

The producers who thrive through whatever comes next will be those using today’s strong margins for strategic investments in efficiency, technology, and risk management—not just production expansion.

Your checklist isn’t complicated: Audit technology gaps and calculate region-specific ROI. Build cash reserves during strong margin periods. Diversify revenue streams beyond commodity milk. Create hedging strategies for key input costs. Start carbon footprint reduction programs before they’re mandatory.

The profits rolling in today are real, but they won’t last forever. The question every producer needs to answer: Will you use these margins to build a bridge over the next downturn, or will you hope the water doesn’t rise? Because in this business, hope’s never been a strategy that pays the bills.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlocking Dairy Efficiency: The Ultimate Guide to Improving Cow Traffic – This guide offers practical strategies for designing efficient cow traffic systems. It demonstrates how to maximize your technology investments by ensuring smooth animal flow, which directly translates into higher milk production and a healthier, less stressed herd.

- The 3 Financial Ratios Every Dairy Farmer Should Be Tracking – Move beyond milk price and dive into the numbers that truly drive profitability. This piece provides the tools to measure your farm’s financial health, helping you identify vulnerabilities and make strategic decisions to withstand the market volatility this article warns about.

- The Genetics Of Sustainability: Breeding For A Better Future – Explore a key strategy for tackling the carbon economics challenge head-on. This article reveals how strategic breeding for sustainability traits can create a more efficient and resilient herd that is positioned to capitalize on emerging low-carbon milk premiums.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!