5% component-adjusted growth while markets tanked? Something’s broken in how we’re thinking about milk production.

EXECUTIVE SUMMARY: You know that feeling when good news hits like bad news? That’s exactly what happened with June’s milk production report. We hit 19.23 billion pounds nationally—up 3.3% year-over-year—but markets sold off hard anyway. The real story isn’t the volume; it’s that component-adjusted production surged 5% while geographic production is completely reshuffling. Kansas jumped 19.1% thanks to new processing capacity while Wisconsin barely moved at 0.3%. Meanwhile, butterfat climbed to 4.18% and protein hit 3.25%—those improvements alone are worth serious money per hundredweight. European competitors are struggling with environmental constraints, creating export opportunities, but domestic demand challenges aren’t going away. Here’s the thing: if you’re still thinking volume-first instead of components-plus-location strategy, you’re already behind where this industry’s heading.

KEY TAKEAWAYS

- Component premiums are the new profit center – With butterfat up 2% and protein up 1.5% year-over-year, focus on genetics and nutrition programs that boost components rather than just volume. That 5% component-adjusted growth versus 3.3% base growth represents real dollars on every milk check.

- Geography is destiny in 2025 – Plains states with new processing capacity are seeing explosive growth (Kansas +19.1%, Texas +9.5%) while traditional regions stagnate. If you’re planning expansion, secure processing agreements first—capacity constraints are creating 18-24 month margin pressure cycles.

- Feed cost advantages won’t last forever – Current milk-to-feed ratios around 1.8 are workable, but smart producers are locking grain prices now. Weather, trade issues, or energy costs could flip the equation overnight, so build flexibility into your feed program.

- Export opportunities exist but don’t count on them – U.S. cheese exports are strong while Europe struggles with environmental limits, but building your whole strategy around international demand is risky. Domestic foodservice demand remains weak, so diversify revenue streams through beef-on-dairy programs.

- Strategic thinking beats volume obsession – Cornell analysis suggests 75-85% probability of continued margin pressure through early 2026. Winners will be operations that read market signals, optimize for components over volume, and adapt quickly when conditions change.

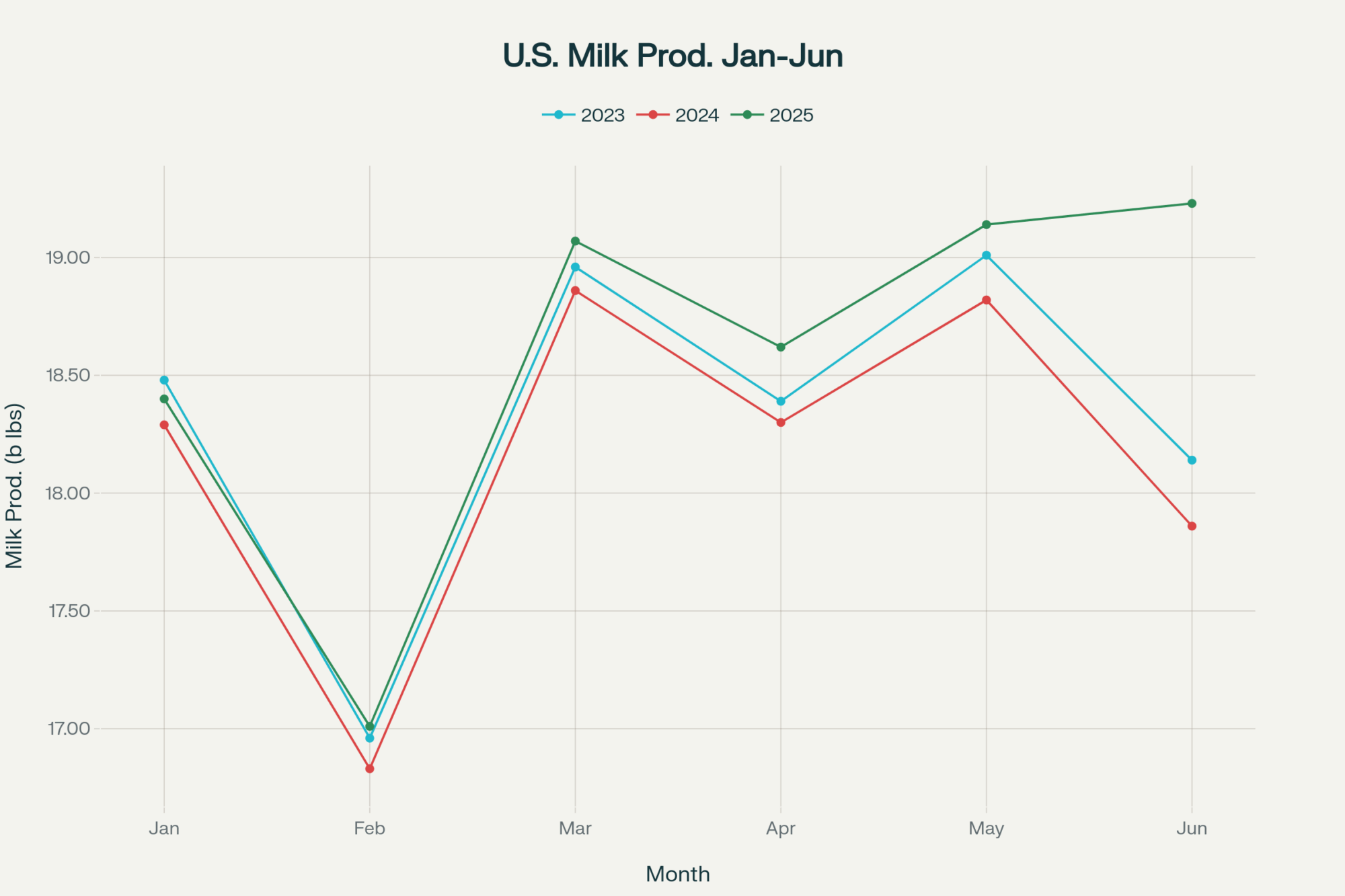

You know that pit-in-your-stomach feeling when production reports should make you smile, but instead your phone starts buzzing with panicked calls from concerned producers? That’s exactly where we landed when June’s milk numbers dropped. The raw data—19.23 billion pounds nationally, up a whopping 3.3% from last year—should’ve had us popping champagne. Instead, markets sold off sharply, and honestly, that disconnect is telling us everything we need to know about where this industry’s headed.

When Crushing Expectations Becomes the Market’s Nightmare

What strikes me about June’s numbers is how they caught absolutely everyone off guard. According to the latest StoneX analysis¹, the report was “bearish compared to expectations”—and that’s coming from analysts who eat, sleep, and breathe these numbers.

We didn’t just meet projections… we obliterated them. Most folks were penciling in maybe 2% growth, but here we are staring at production that jumped 3.3% year-over-year. What really gets my attention, though, is how the component story amplifies everything. Our butterfat content increased to 4.18% (up from 4.10% last year), while protein levels rose to 3.25%(up from 3.20%). When you factor in those improvements—and this is crucial for understanding the real market impact—we’re looking at component-adjusted production that surged 5% year-over-year.

Five percent! The last time we saw growth like that? May 2021, right when everything was still bouncing back from pandemic disruptions.

What really caught my attention was the 2,031 pounds per head in June, up 1.7% from the previous year. Now, before anyone gets too carried away, remember that we’re comparing this to a brutal June 2024 when H5N1 absolutely hammered production numbers across key regions. The StoneX folks note we were “lapping over a 1.7% drop last year due to bird flu,” so there’s definitely some recovery built into that figure.

However, here’s the thing that should make everyone pause—we’ve added 114,000 head since December (that’s equivalent to adding several good-sized dairies every month), and we’re still seeing these kinds of individual animal improvements. Mark Stephenson from Wisconsin’s dairy markets program has been tracking these patterns for decades, and as he pointed out in his recent university brief, “when you see both scale and efficiency gains happening together, producers are clearly responding to sustained positive signals… but markets don’t always interpret additional supply as welcome news.”

The Geographic Revolution That’s Rewriting Our Industry Map

What’s happening regionally is what really gets my blood pumping about this data. Producers are “culling fewer dairy cows” because margins have been workable, but that’s just scratching the surface.

Look at these Plains states numbers and tell me we’re not watching a fundamental restructuring:

- Texas: jumped 9.5% to 1.503 billion pounds

- Kansas: posted a jaw-dropping 19.1% increase to 400 million pounds

- South Dakota: surged 11.5% to 255 million pounds

Meanwhile, traditional regions are struggling:

- Washington: dropped 9.3% to 475 million pounds

- California: managed only 2.7% growth despite adding cows

- Wisconsin: barely budged at 0.3%

That Kansas number isn’t some statistical fluke. That’s the new Hilmar cheese facility in Dodge City pulling milk like a powerful magnet. I was talking to a producer near there recently—he’s been shipping to that region for about eighteen months now—and he said the local milk market dynamics have completely changed. Premium pickups, shorter hauls, predictable demand… it’s exactly what every operation wants.

Here’s the thing, though, and this is where it gets uncomfortable for those of us in traditional dairy country. Industry investment exceeding $10 billion is flowing toward areas where operations can actually pencil out profitably. Smart money follows processing capacity, and that capacity is definitely heading south and west.

Brian Gould from UW-Madison doesn’t mince words about this trend; he pointed out that “we’re witnessing the most significant geographic restructuring of U.S. dairy production since the 1970s, but this time it’s being driven by regulatory environment and processing economics, not just feed costs.” That’s a sobering assessment from someone who’s tracked these patterns longer than most of us have been in the business.

The Market Reality Nobody Wants to Face

Now, here’s where the story gets really uncomfortable —and why those market reactions weren’t just traders having a rough day. Despite these impressive production numbers, we face some fundamental demand challenges that are unlikely to be resolved anytime soon.

Restaurant traffic still hasn’t bounced back to where we need it. When you consider that over half of America’s food dollars get spent outside the home, weak foodservice demand creates problems that more milk simply can’t solve. Major restaurant chains have been reporting declining traffic in recent quarters, and that ripple effect is felt in cheese demand faster than most people realize.

The Processing Bottleneck That’s Coming for All of Us

What really concerns me—and I’m hearing this from plant managers across multiple regions—is that some facilities are already approaching capacity limits, while others are having to implement milk dumping protocols when volumes exceed what they can handle. We’re seeing this with current production levels, not the higher volumes everyone’s projecting for the rest of .

Recent analysis from Cornell’s Program on Dairy Markets and Policy suggests this kind of regional capacity mismatch typically pressures milk prices for 18 to 24 months until infrastructure catches up or production adjusts. When analysis from sources like Cornell suggests a 75-85% probability of continued margin pressure through early 2026 based on current supply trajectories, that timeline isn’t exactly encouraging news if you’re planning expansions.

Feed Costs Keep Things Manageable… For Now

The one bright spot that’s keeping margins workable? Feed costs haven’t gone completely sideways on us. We’re seeing corn futures trading in the low-four-dollar range, and while protein feeds aren’t cheap, they’re not breaking operations either. That’s maintaining milk-to-feed ratios around 1.8, which most producers can work with.

I was just talking to a guy running 850 cows in central Wisconsin who locked corn back in May when planting conditions looked sketchy. Smart move. He’s feeling pretty good about that decision while watching grain markets bounce around this summer.

But here’s what worries me… feed cost advantages can disappear faster than a fresh cow’s peak production drops off. Weather patterns, trade disruptions, energy costs—any of these could flip the equation pretty quickly.

What This Actually Means for Your Bottom Line

Looking ahead—and this is where three decades in this business starts showing—I don’t think this greater than 3% growth rate continues much longer. The StoneX analysis confirms what most agricultural economists are projecting: we’ll moderate toward 2% growth as we face tougher year-ago comparisons and seasonal heat stress hits those expanding Plains herds.

If you’re operating in traditional dairy regions, Focus on efficiency gains over cow numbers. This geographic shift is real, and trying to counter it by simply adding more animals might not be the most effective approach. The data shows Wisconsin barely growing while Kansas explodes—that should tell you something about where competitive advantages lie.

If you’re in one of those growth regions, Be strategic about it. Just because you can expand doesn’t mean you should do so without first locking in processing agreements. When forward-looking models show a 60-70% probability of regional capacity mismatches continuing through 2026, securing those relationships becomes critical.

Regardless of where you are, Start taking component premiums seriously if you haven’t already. Those butterfat and protein numbers aren’t just statistics on your milk check—they’re becoming the difference between profit and loss. When component-adjusted production is growing at 5% while base volume grows at 3.3%, that spread represents significant financial gains.

What’s interesting about the export picture is that U.S. cheese exports have been hitting strong levels recently while European production struggles with environmental constraints. When your competitors can’t produce, opportunities definitely emerge. But counting on exports to bail us out of domestic oversupply? That’s a risky way to build a business model.

It’s essential to remember that export markets can shift more rapidly than domestic production can adjust. Building a business model that depends entirely on international demand is like farming without crop insurance—it might work until it doesn’t.

The Bottom Line: Strategic Thinking Beats Volume Every Time

If you’re making production decisions for the next 18 months, here’s what I’m telling producers: forget about filling every stall or pushing every cow to maximum output. The operations I see thriving aren’t just focused on making more milk—they’re making smarter milk.

Key strategic moves that separate successful operations:

- Prioritize components over volume (those 2% butterfat and 1.5% protein gains matter more than total pounds)

- Secure solid processing relationships before expanding (capacity constraints are real)

- Diversify revenue streams (beef-on-dairy programs have become essential, not optional)

- Build financial flexibility to weather market volatility (18-24 month margin pressure cycles are becoming the norm)

What I’ve learned over the years is that producers who understand market signals, position themselves strategically, and build operations that can adapt when conditions change—and they always do—those are the ones that remain standing when the dust settles.

This June report confirms that we have the technical ability to produce milk like never before. The real question facing our industry is whether we’ve got the wisdom to produce it profitably in a market that’s sending us some pretty clear signals about supply, demand, and where we’re headed.

Honestly? I think that’s the conversation we should be having, rather than just celebrating production records. Because right now, with component-adjusted production up 5% and markets selling off anyway, the story being told is one we might not want to hear… but we’d better start listening.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlocking Component Gold: Are You Feeding for Fat and Protein, or Just Volume? – This tactical guide moves beyond why you need higher components to how you achieve them. It offers practical feeding and management strategies for immediately boosting butterfat and protein, directly impacting your milk check and profitability.

- The Dairy Industry’s New Math: Are You Ready For The Change? – With the main article forecasting margin pressure and geographic shifts, this piece provides the strategic financial playbook you need. It details the key performance indicators (KPIs) that top herds use to build resilience and weather market volatility.

- Beef on Dairy: A Trend That’s Here to Stay – The main article flags beef-on-dairy as essential. This piece breaks down the economics of this strategy, revealing how to leverage terminal genetics and market knowledge to transform your calf program from a cost center into a significant revenue stream.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!