Milk powder just dropped 4.3% at GDT. While others panic, smart farmers see opportunity.

EXECUTIVE SUMMARY: Listen, I get it… seeing that 4.3% drop in the Global Dairy Trade Index stings. Whole milk powder fell to $3,809 per tonne, skim dropped even harder. But here’s what separates the survivors from the strugglers: while everyone’s panicking about oversupply, smart operators are positioning for the rebound. Doug down in New Zealand? He’s banking carbon credits from tree planting that cover his entire fertilizer bill some years. Wisconsin guys running 1.27 million cows at 2,230 pounds each are learning that a tiny 0.2% butterfat drop costs thousands per check. Argentina’s flooding markets with 4.5% more milk, China’s cutting imports… but the operators who adapt fastest always come out ahead. Stop chasing flashy genetics without proof and start building resilience. That’s your ticket to staying profitable when everyone else is just trying to survive.

KEY TAKEAWAYS

- Watch the GDT like a hawk — that 4.3% drop signals buying opportunities for feed, equipment, and genetics while competitors retreat

- Proven genetics beat hype every time — focus on bulls with daughters tested across market cycles, especially those hitting 150+ PTA on feed efficiency

- Heat stress is costing you thousands — Wisconsin data shows even small butterfat drops during hot weather can wreck a milk check; invest in resilient genetics now

- Diversify your income streams — Doug Storey’s carbon credits from native trees sometimes cover his whole fertilizer bill; real money, not tree-hugger nonsense

- Scale your strategy — 50-cow operations should chase udder health to cut vet bills; 2,000-cow dairies need feed efficiency specialists to slash TMR costs

I’ll be straight with you—the September 2nd Global Dairy Trade auction played out pretty much like the pessimists predicted. The GDT Price Index dropped 4.3%, with whole milk powder sliding 5.3% to $3,809 per tonne and skim powder taking an even bigger hit at 5.8% down to $2,620. Over 150 bidders fought over 41,465 tonnes, but buyers clearly weren’t feeling generous.

This wasn’t panic selling—it was reality setting in. Global dairy’s still drowning in oversupply, and demand just isn’t keeping pace.

The Numbers Behind the Drop

Here’s what’s driving this market pressure:

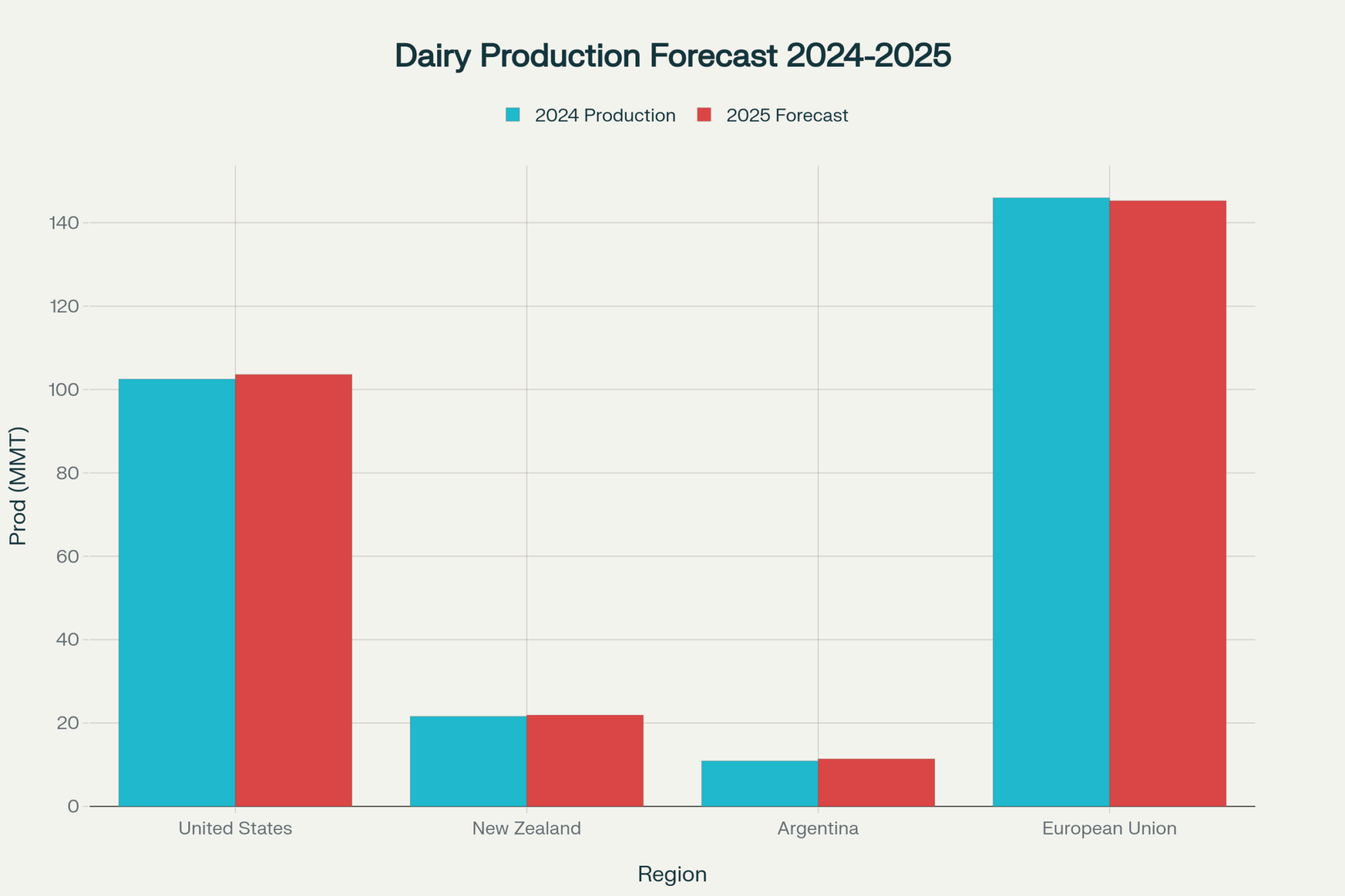

| Region | 2024 Production (Million Metric Tonnes) | 2025 Forecast (MMT) | What’s Really Happening |

| United States | 102.5 | 103.6 | Export pressure keeps building |

| New Zealand | 21.6 | 21.9 | Environmental costs eating margins |

| Argentina | 10.9 | 11.4 | Production surge weighing on prices |

| European Union | 146.0 | 145.3 | Supply tightens but premiums squeezed |

Meanwhile, China’s been quietly building up domestic production to cover roughly 85% of their own needs, up dramatically from 70% in 2018. When your biggest customer starts making their own product, you’ve got a problem.

How Smart Operators Hedge Their Bets

Out in Te Awamutu, Doug Storey’s showing how smart operators hedge their bets. He’s planted over 25,000 native trees—kahikatea, tōtara, rimu—creating ecological corridors that generate carbon credits. “Some years those credits cover our entire fertilizer bill,” Doug told me. “It’s real money, not just tree-hugger stuff.”

That’s the kind of diversification that matters when milk prices get ugly.

Up in Wisconsin, they’re milking smarter, not bigger. The state’s 1.27 million cows are averaging 2,230 pounds per head, but operators aren’t expanding herds—they’re pushing every animal to perform. Problem is, when corn hits $6.50 and heat waves test cow resilience, even a two-tenths drop in butterfat across the herd can cost thousands on a single milk check.

Brexit’s Still Messin’ with Things

UK dairy numbers tell their own story. Farm counts dropped 2.6% last year, but average herd sizes grew to around 165 cows as survivors consolidated and shifted focus toward domestic markets rather than EU exports. When you can’t ship across the Channel like before, you better make sure your genetics fit local demand, not some German powder specification.

Australia’s Drought Reality

Down under, drought’s forcing a complete rethink of genetic priorities. Heat tolerance and feed efficiency aren’t nice-to-have traits anymore—they’re survival requirements when temperatures hit 40°C and feed costs double overnight.

Why Global Markets Hit Your Bottom Line

I hear the skepticism: “Why should some auction in Auckland affect my milk check?” Here’s the uncomfortable truth—research shows about 85% correlation between GDT price movements and what hits your bank account within 90 days.

Thanks to arbitrage pressure, processors have to align domestic prices with global benchmarks. Those waves from halfway around the world always find their way to your farmgate, whether your local plant admits it or not.

Your Genetic Playbook for a Choppy Market

When markets get this choppy, quit chasing flashy genomic young sires without proven daughters. You need insurance, not lottery tickets.

Focus on bulls whose daughters have weathered multiple economic cycles. Think proven lines like O-Man or Shottle—daughters that were profitable when milk was $15 and when it was $25. That predictability is gold when markets swing hard.

Currency matters too. When the Canadian dollar weakens against the USD, that imported semen just got 5% more expensive overnight. Smart operators hedge currency exposure because every penny counts.

The Adaptation Game

Here’s the bottom line—you can’t predict where markets are headed, but you can prepare for multiple scenarios.

Adaptation looks different depending on your operation. Running a 50-cow dairy in Vermont? Your best bet might be genetics focused on udder health to slash vet bills. Managing a 2,000-cow operation in California? That money’s probably better spent on feed efficiency specialists to cut TMR costs.

The operations thriving aren’t the ones trying to predict market directions—they’re the ones adapting fastest when reality proves predictions wrong. Revenue diversification through environmental programs, genetic selection for volatile conditions, flexible processing arrangements—that stuff matters more than crystal ball gazing.

2025’s the year where resilience separates the survivors from the strugglers. The dairy world’s changing fast, and the operators who adjust quickest will be standing tall when the dust settles.

Stay sharp, stay flexible, and don’t just survive—thrive.

Ready to turn market volatility into profit? The full analysis breaks down exactly how forward-thinking farmers are positioning for 2025’s challenges. Because in this business, adaptation beats prediction every single time.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beat The Heat: 7 Strategies To Maximize Summer Performance And Minimize Heat Stress – This article provides seven tactical strategies for mitigating heat stress. It delivers actionable methods for maintaining butterfat and production, directly addressing the operational efficiency challenges and financial losses highlighted in the Wisconsin example.

- Navigating The Waves Of Dairy Market Volatility: A Producer’s Guide To Risk Management – This strategic guide expands on market volatility by detailing concrete risk management tools. It reveals how to use futures, options, and insurance programs to build a financial buffer and protect your farm’s bottom line from GDT price swings.

- The New Profit Driver On The Dairy Farm: Sustainability – Building on the carbon credit example, this piece explores how sustainability is becoming a key profit center. It shows how to leverage environmental initiatives and new genetic indexes to unlock new revenue streams and boost your herd’s future value.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!