Everyone’s celebrating today’s cheese rally. We dug deeper – here’s what the trading floor isn’t telling you.

EXECUTIVE SUMMARY: We’ve been tracking something interesting in today’s CME session that most market reports are missing completely. Sure, cheese blocks rallied 0.75¢ and Class III futures exploded 73¢ higher – but here’s what caught our attention: butter got absolutely hammered (down 4¢) while NDM continues pricing us out of global markets at a 6-14¢ premium over competitors.This isn’t just mixed signals… it’s revealing a fundamental shift in how the dairy complex is splitting apart. With milk production up 3.4% in major states and cow inventories at 2021 highs, we’re looking at an abundant supply hitting selective demand. The cheese plants still need your milk, but export markets? That’s where the real profit erosion is happening.What’s fascinating is how trading volume backed up today’s moves – heavy selling in butter (14 transactions) versus light buying in cheese (just two trades). Our analysis of the futures curve suggests this cheese rally might have more staying power than previous head fakes, especially with seasonal demand patterns shifting toward holiday production.Here’s the bottom line: the market is telling us to focus on domestic cheese demand while export competitiveness continues to deteriorate. Smart producers are using today’s Class III jump to lock in October-November pricing around $17.50+. Don’t wait for perfect signals – they don’t exist in dairy markets.

KEY TAKEAWAYS

- Lock in 25-30% of remaining 2025 production NOW – Today’s 73¢ Class III surge creates pricing opportunity at $17.50+ levels, but futures volume was light, suggesting limited upside momentum. Use Dairy Revenue Protection or forward contracts while this window exists.

- Export markets are broken for powder, focus domestic – U.S. NDM running 6-14¢/lb premium over European and New Zealand competitors means export profits are gone. Redirect marketing strategy toward domestic cheese demand, where we still have a competitive advantage.

- Feed cost relief is real but temporary – Corn at $3.99/bu and soybean meal at $281/ton improve milk-to-feed ratios, but harvest pressure won’t last forever. Contract for 6 months of feed-forward while basis relationships favor buyers.

- Production efficiency beats volume expansion – With 18.5 billion pounds produced in major states (up 3.4% YoY) and cow numbers at 2021 highs, margins come from per-cow productivity, not herd growth. Focus rations on components, cull bottom quartile performers.

- California’s model shows the future – Down 3% in cow numbers but ahead on per-cow production proves efficiency wins over scale. Their forced optimization from HPAI and regulations demonstrates profit potential through targeted culling and technology adoption.

Well, that was quite a session today. After getting hammered for two weeks straight, we finally saw some life in the cheese block market – up 0.75¢ to close at $1.6725/lb. Not exactly cause for celebration, but when you’ve been watching your projected milk checks shrink daily, you’ll take any green you can get.

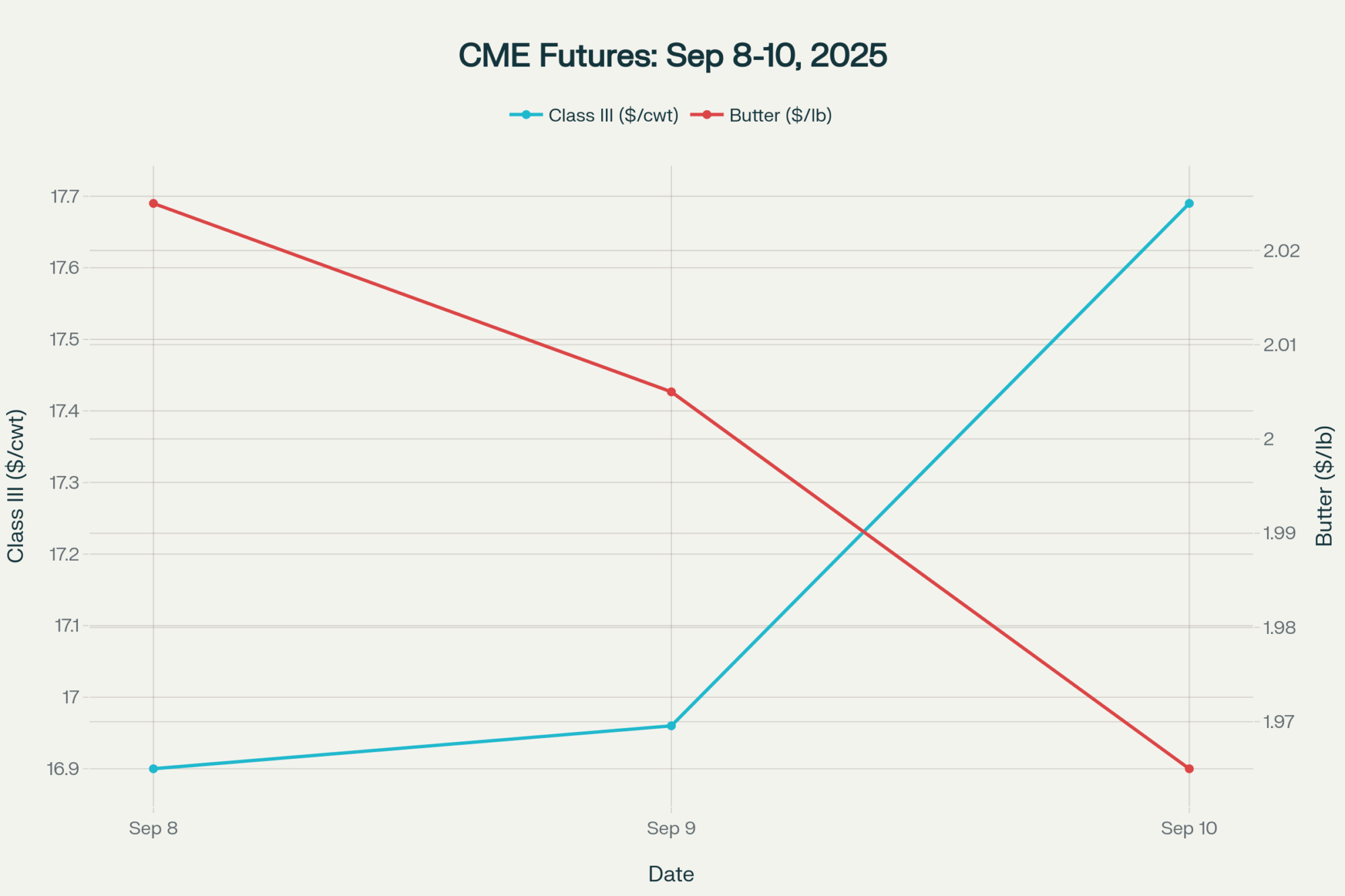

The real story was in the futures pit. Class III September contracts jumped 73¢ to settle at $17.69/cwt, according to CME data. That’s the kind of move that gets your attention, especially when you’re trying to figure out what September’s milk check might look like.

But here’s where it gets complicated – and you know how dairy markets love to be complicated. While cheese gave us hope, butter got absolutely crushed, dropping 4¢ to $1.9650/lb. NDM wasn’t much better, falling 1.25¢ to $1.1875/lb.

So we’re sitting here with one foot on the gas pedal and one on the brake. Classic dairy market stuff.

Today’s Numbers – The Real Story

Let me break down what actually moved today and what it means for those of us shipping milk:

Cheese Blocks: $1.6725/lb (+0.75¢) Finally, some buying interest. This happened mostly in the last hour – probably some short covering, but buying is buying. The cheese plants still need our milk to make product, and this price action suggests they’re willing to pay for it.

Cheese Barrels: .6750/lb (-0.50¢)

Here’s what’s interesting – barrels are trading at a slight premium to blocks. That’s not normal, and it usually means processors aren’t sure which format they prefer right now. Could signal some uncertainty in the cheese complex.

Butter: $1.9650/lb (-4.00¢) This hurt. A 4¢ drop in one day tells you inventories are building, and demand just isn’t there. Class IV outlook took a hit with this move.

NDM Grade A: $1.1875/lb (-1.25¢) Export competitiveness continues to erode. We’re pricing ourselves out of international markets, which puts more pressure on domestic demand.

The trading volume backed up the price moves. Butter saw 14 transactions on a down day – that’s heavy volume, suggesting real selling pressure. Cheese blocks managed just two trades despite the rally, which makes you wonder if this bounce has staying power.

Where We Stand Globally

This is where things get uncomfortable for us as U.S. producers. Our NDM is currently trading well above that of international competitors, making it challenging to move the product overseas.

According to recent Global Dairy Trade data and international price comparisons, U.S. nonfat dry milk prices are running 6 to 14 cents per pound higher than European skim milk powder and New Zealand equivalents. When you’re the high-cost supplier in a commodity market, that’s never a good spot to be in.

The European situation isn’t helping either. Ireland’s having a strong production year despite overall EU output being slightly down. Their processors are remaining aggressive on pricing, especially in Southeast Asian markets where we used to have a stronger foothold.

Mexico remains our strongest export partner – CoBank and USDA data show Mexico purchasing about 4.5% of total U.S. milk production through various dairy products. However, even there, we’re seeing increased competition from European suppliers, who are getting creative with freight arrangements.

Feed Costs – Finally Some Relief

Here’s one bright spot in all this. Corn futures settled near $3.99/bushel today, and soybean meal is around $281/ton, according to AMS grain reports. That’s manageable compared to where we were earlier this year.

The milk-to-feed price ratio is still below where you’d want it for comfort, but it’s trending in the right direction. Every dollar saved on feed costs goes straight to your bottom line when milk prices are under pressure like this.

Regional differences are still significant, though. Upper Midwest operations are experiencing some harvest logistics issues that are driving up corn basis. Western producers are still managing through higher hay costs from this summer’s drought conditions.

Production Reality Check

The latest USDA data from July shows milk production in the 24 major dairy states totaled 18.5 billion pounds, up 3.4% from June 2024. That’s a lot of additional milk looking for a home.

Dairy cow inventories have increased by approximately 114,000 to 159,000 head as of mid-2025, representing the highest population since 2021, according to USDA and CoBank reports. Texas and South Dakota continue leading the expansion, while some traditional dairy regions are holding steady or declining slightly.

The processing capacity situation is actually pretty healthy. Most plants are running at 90-95% utilization – busy enough to be efficient, but not so maxed out that quality suffers or maintenance gets deferred.

California’s Unique Situation

California deserves special mention because what happens there affects everyone. The state’s cow numbers are down about 3% from peak levels, but per-cow production is running ahead of historical norms, according to ERA Economics and California Department of Food & Agriculture data.

The surviving operations out there tend to be the most efficient ones. HPAI essentially forced the industry to cull the bottom quartile performers, leaving behind the higher-producing herds.

Water costs remain a significant factor in the Central Valley. Regulatory pressures around methane reduction are actually driving some interesting technological adoption that’s improving efficiency, even if the initial compliance costs were substantial.

The challenge for California operations is that their higher cost structure makes them vulnerable when milk prices drop. They need stronger milk prices than Midwest operations to maintain similar margins.

What the Fundamentals Are Telling Us

Domestic demand patterns are holding up reasonably well. Cheese consumption stays pretty steady, which explains why the cheese complex is performing better than butter and powder. But retail inventory builds are becoming more noticeable, which puts pressure on spot prices.

Export markets face multiple headwinds – a stronger dollar, competitive international pricing, and logistics challenges. Southeast Asian markets show growth potential, but the U.S. market share is under pressure from New Zealand and European suppliers.

The supply side story is straightforward – we’ve got abundant milk, processing capacity is adequate, and this shifts negotiating power toward the processors. That’s not great news for milk prices in the near term.

Risk Management Considerations

Current market conditions demand a strategic approach to pricing. Today’s cheese rally created an opportunity to lock in some October-November production around $17.50+ levels.

Dairy Revenue Protection enrollment is running higher than last year – producers learned from previous market cycles about the importance of having some price floor protection. The program changes have tightened some premium subsidies, but it remains a valuable risk management tool.

For production decisions, the focus has shifted toward efficiency over volume. With margins under pressure, maximizing milk components and minimizing costs per hundredweight makes more sense than just pushing for maximum volume.

Regional Variations Matter

Upper Midwest operations are seeing relatively stable basis relationships compared to national averages. Cheese plant utilization is running around 94% capacity, which is healthy for the region.

Several major cooperatives are implementing seasonal pricing programs to help smooth cash flow volatility for members. If you’re not already enrolled in something like that, it’s worth investigating.

The Northeast continues dealing with higher labor costs and regulatory pressures, but fluid milk markets provide some pricing stability that other regions don’t enjoy.

Southwest expansion continues, particularly in Texas, where feed costs are manageable, labor is available, and processing capacity is growing to match increased production.

Looking Ahead

The next few weeks will be critical for determining whether today’s cheese rally has staying power. Weekly cold storage data on Friday could provide more insight into inventory levels.

Seasonally, we’re entering the period where milk production typically peaks while demand patterns shift toward holiday products. The question is whether processing capacity can handle the seasonal surge without additional price pressure.

Current price levels sit in the lower third of the past three years’ range. While that suggests potential upside, it also reflects fundamental challenges that won’t disappear overnight.

For your immediate decisions, focus on what you can control – production efficiency, cost management, and smart risk management. The volatility isn’t going away anytime soon.

Bottom Line

Today’s mixed session captured where the dairy industry sits right now – domestic demand holding up reasonably well, but international competitiveness is under serious pressure.

The cheese rally was encouraging, and that 73¢ jump in Class III futures suggests the market thinks we may have found a floor around these levels. But the weakness in butter and powder reminds us that fundamental challenges remain.

Stay disciplined with risk management, focus on efficiency over volume, and remember – we’ve weathered tougher markets than this before. The key is making smart decisions with the information we have and not getting caught up in the daily volatility.

This industry has a way of humbling you just when you think you’ve got it figured out. Today offered a small ray of hope, but the real work happens in the barn and the feed alley, not on the trading floor.

Learn More:

- Tips from the Sports Pros to Improve Your Dairy Herd’s Efficiency – This article provides a tactical, on-farm perspective on how to achieve the production efficiency gains mentioned in the market report. It offers practical strategies for optimizing herd health, nutrition, and management, helping producers improve per-cow productivity and profitability in a challenging market.

- Dairy Profit Squeeze 2025: Why Your Margins Are About to Collapse (And What to Do About It) – Go deeper into the strategic market forces driving the issues highlighted in the report. This piece offers a hard-hitting look at the long-term implications of China’s tariffs, export challenges, and regional disadvantages, providing a crucial context for why a domestic focus is essential.

- Future-Proof Your Dairy Farm: Tackling the Top 3 Challenges of 2050 – Look beyond the daily market swings and explore the innovative solutions that will define the dairy industry’s future. This article reveals how technological advancements in methane reduction, animal welfare, and data-driven management are not just future trends but actionable strategies for long-term sustainability and success.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!