Your co-op says fall flush is normal. We found why 2025 is different – and it’s costing you $0.50/cwt

EXECUTIVE SUMMARY: We’ve been digging into today’s CME chaos, and here’s what’s really happening while everyone else is focused on the obvious cheese drop. The 3¢ whey surge isn’t random – it’s revealing where protein demand is actually flowing in 2025, and most producers are completely missing this shift.Your September milk check just took a $0.30-0.50/cwt hit, but that milk-to-feed ratio sitting at 1.65 is the real killer – anything below 2.0 means you’re in survival mode, not profit mode. Meanwhile, we’re sitting on butter that’s $0.95/lb cheaper than European competition globally, yet most operations aren’t structured to capture export premiums.The fall flush started early this year because processors are too comfortable with their inventory levels. What’s different from previous years? The financial pressure is forcing producers into culling decisions that might actually moderate the typical production surge – and that creates opportunity for operations positioned correctly.Bottom line: this isn’t your typical September softness, it’s a fundamental repositioning that separates the survivors from the thrivers.

KEY TAKEAWAYS

- Lock your feed costs NOW before soybean meal climbs higher – today’s $3.40/ton jump to $288.60 is a warning shot, and with that 1.65 milk-to-feed ratio, every dollar in feed cost hits your margin directly (call your feed supplier this week for Q4 contracts)

- Your butter is export gold at $2.00/lb – we’re underselling European competition by nearly a dollar per pound globally, but only operations with port access logistics can capture this premium (talk to your co-op about export programs immediately)

- Whey’s 5% surge signals protein demand shift – while everyone panics about cheese, whey protein demand is exploding in 2025, making high-component milk more valuable than ever (focus on butterfat and protein optimization in your ration)

- DRP coverage at $17.50/cwt for Q1 2026 still makes sense – with Class III futures tracking $16.96 and downside risk increasing, protecting above $17.50 covers your cost of production plus margin (don’t wait for premiums to climb higher)

- Fall flush dynamics started early and aggressive – processors aren’t chasing milk like usual, meaning premium structures will stay weak through October unless you’re positioned with the right co-op contracts (review your marketing agreements now)

Here’s what caught my attention today – while most of the dairy complex was getting hammered, dry whey decided to party like it’s 1999, jumping 3¢/lb in a market where everything else was bleeding red ink. The thing about days like this is they tell you exactly where the real demand is hiding.

Your September milk check just took a hit, no sugarcoating it. We’re looking at probably $0.30-0.50/cwt coming off what you were expecting just last week. But here’s what’s interesting – this isn’t some random market noise. This is processors telling us they’re comfortable, maybe too comfortable, with their inventory positions as we head into fall flush territory.

What Actually Happened Today

The story starts early this morning when the blocks opened weakly and never recovered. What strikes me about today’s action is how broad-based the selling was – this wasn’t just one product having a bad day.

| Product | Price | Today’s Move | What This Means for Your Operation |

| Cheese Blocks | $1.6650/lb | -3.00¢ | Ouch. This is your Class III taking a direct hit. Processors aren’t chasing milk |

| Cheese Barrels | $1.6800/lb | -2.00¢ | Barrels over blocks again – weird market signal right there |

| Butter | $2.0050/lb | -2.00¢ | Just above the psychological $2.00 level. Class IV is feeling the pressure |

| NDM | $1.2000/lb | -2.00¢ | Making us the high-cost powder supplier globally – not good |

| Dry Whey | $0.6000/lb | +3.00¢ | The lone soldier standing. Protein demand is real |

The thing about cheese blocks dropping 3¢ in one session… that’s the biggest single-day move we’ve seen since late July. Meanwhile, barrels holding up better create this inverted spread that frankly has traders scratching their heads. When the market can’t decide which product should be worth more, you know uncertainty is creeping in.

Trading Floor Reality Check

Here’s where it gets interesting from a mechanics standpoint. We had zero barrel trades today – none. The price fell 2¢ without a single load changing hands. That tells you buyers just walked away from the market entirely at those levels.

On the flip side, dry whey had five active bids and zero offers at the close. Sellers didn’t want to part with the product, and buyers were begging for more. That’s why it popped 5% in one session while everything else was getting crushed.

The volume story is telling too – 11 butter loads and 12 NDM loads. This wasn’t some quiet drift lower on thin trading. There was real conviction behind the selling, which makes me more concerned about the sustainability of current price levels.

The Global Chess Match (And We’re Not Winning Everywhere)

This is where things get really interesting, and frankly, a bit concerning for some of our export programs.

Butter – We’re the Global Bargain Bin: Our CME butter at $2.0050/lb makes European butter at roughly $2.95/lb look like highway robbery. New Zealand’s sitting at around $3.14/lb. If we can get our butter to the ports – and that’s always the question with logistics these days – it should move internationally. The freight situation out of the West Coast has improved, but we’re still dealing with container availability issues that can turn a great export opportunity into a logistics nightmare.

Powder – Houston, We Have a Problem: Here’s where I get worried. Our NDM at $1.20/lb is pricing us out of the global market. European SMP is trading around $1.06/lb, New Zealand’s at $1.18/lb. That 6-14¢ premium we’re carrying is massive in commodity terms. I’ve been talking to export traders, and they’re basically shut out of new business except for some specialty applications.

What’s particularly troubling is the South American situation that’s not getting enough attention. Argentina and Uruguay have been quietly building their powder capacity, and they’re starting to compete directly with us in key markets like Southeast Asia and North Africa. Their cost structure, especially with favorable exchange rates, is putting additional pressure on global pricing.

The Asian Demand Picture: Speaking of Southeast Asia… the demand patterns we’re seeing out of Vietnam, Thailand, and Indonesia are shifting. These markets are becoming increasingly price-sensitive, opting to shop globally rather than remaining loyal to traditional suppliers. China’s still playing games with import timing – they’ll go months without buying, then suddenly need massive quantities. Makes planning impossible for our exporters.

Feed Costs and the Margin Squeeze

The math on feed costs is getting ugly, and today’s action made it worse. Soybean meal jumped hard – up $3.40/ton to $288.60 for December – while corn eased slightly to $4.1950/bu.

Here’s the calculation that’s keeping me up at night: with Class III futures at $16.96/cwt and current feed values, we’re looking at a milk-to-feed ratio of about 1.65. Anything below 2.0 means you’re in survival mode, not profit mode.

What’s particularly challenging is the regional variation in feed costs. Talking to producers in the Northwest, they’re dealing with drought-related hay costs that are astronomical. Meanwhile, parts of Wisconsin are seeing decent local corn prices, but their basis to futures is still wide due to transportation bottlenecks.

The currency angle isn’t helping either. The strong dollar makes our exports less competitive, but it also makes imported feed ingredients more affordable. It’s a mixed blessing that currently feels more of a curse than a blessing.

Production Patterns and Seasonal Reality

The fall flush is happening right on schedule, maybe even a bit early in some regions. I’m hearing from Wisconsin and Minnesota that milk is flowing freely – heat stress is gone, cows are comfortable, and production is ramping up just as it should this time of year.

But here’s what’s different this year compared to recent falls: the financial pressure on producers is more intense. With these tight margins, some operators are making hard decisions about culling and herd management that might actually moderate the typical fall production surge. It’s early to call this a trend, but it’s worth watching.

California’s telling a slightly different story. Central Valley producers are seeing more normal seasonal patterns, but they’re also dealing with feed cost pressures that are keeping some milk in the fluid market rather than going to manufacturing. The Class 4b premium for fluid milk is looking pretty attractive compared to manufacturing returns right now.

What’s Really Moving These Markets

Domestic Side of Things: Retailers finished their back-to-school cheese promotions and frankly don’t seem eager to reload aggressively. Food service demand always hits a lull in September – it’s as predictable as sunrise. The surprising thing is how comfortable processors seem with their inventory positions. Usually by now we’d see some restocking ahead of Q4 holiday demand, but that’s not happening yet.

Export Markets – The Full Story: Mexico remains our most reliable customer, but even they’re starting to shop around when our premiums get too wide. I’m hearing reports of Mexican buyers testing European suppliers for powder programs, which should be a wake-up call for our pricing.

The Middle East and North Africa markets are evolving rapidly. These regions are growing their import needs, but they’re also becoming more sophisticated buyers. They’ll take advantage of global price differentials in ways they didn’t five years ago.

Currency Impact Deep Dive: The dollar’s strength is a double-edged sword that’s currently cutting us more than helping. Yes, it makes feed imports cheaper, but it’s pricing us out of competitive export situations. A 5% move in the dollar can easily swing export profitability from positive to negative, and that’s exactly what we’re seeing in some markets.

Futures and Forecasting (With Some Healthy Skepticism)

The futures market’s reaction to today’s weakness was muted, which suggests that traders believe this might be overdone. September Class III settled at $16.96/cwt, up slightly, while Class IV dropped to $16.92/cwt.

Now, about those USDA forecasts everyone quotes religiously… their latest work suggests Class III averaging $17.25 for Q4 2025. Here’s the thing, though – their methodology tends to smooth out the kind of volatility we’re seeing right now. They use models that assume rational market behavior, but markets aren’t always rational, especially when seasonal patterns collide with global trade disruptions.

The confidence intervals on these forecasts are wider than USDA typically admits. I’d put real money on Q4 Class III being anywhere from $16.50 to $18.00/cwt, depending on how export demand develops and whether this fall flush is as pronounced as expected.

Hedging Reality Check: With this volatility, Dairy Revenue Protection (DRP) premiums are climbing. What cost you $0.25/cwt to ensure last month might run $0.45/cwt today. But given the downside risk we’re seeing, those premiums might be worth it for Q1 2026 coverage.

Put options on Class III futures are getting expensive, too, but they’re still cheaper than the potential losses if this downtrend continues. I’m particularly interested in the $17.00 puts for December and January contracts.

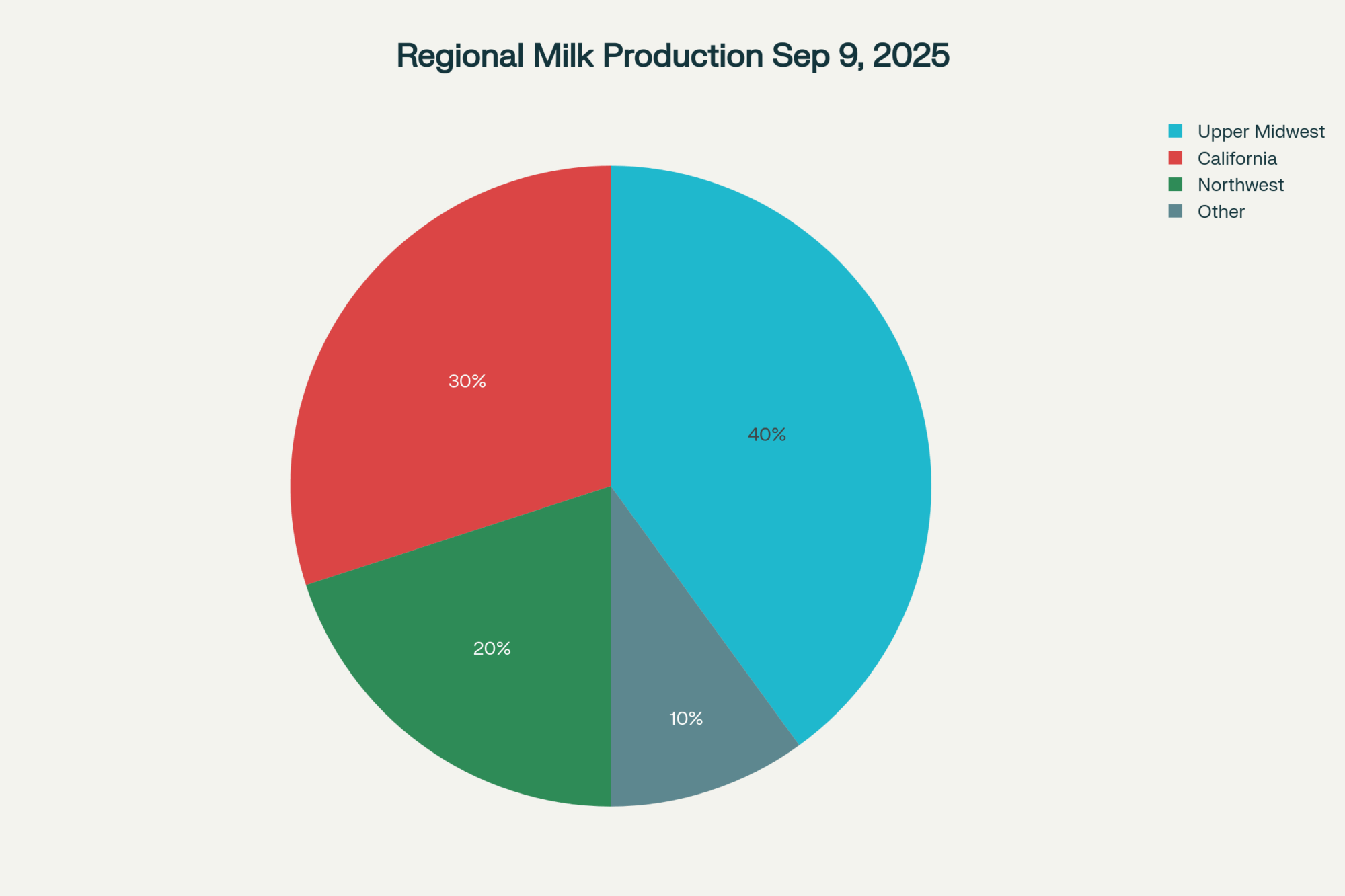

Regional Market Deep Dive: Upper Midwest Dynamics

Let’s talk about what’s happening in America’s dairyland, because it’s telling a broader story about supply and demand dynamics.

Wisconsin and Minnesota are experiencing what I’d call a “comfortable flush” – production is up, components are good, and there’s no shortage of milk for processors. But here’s the catch: local basis levels are weaker than usual because co-ops and processors don’t feel pressure to bid aggressively for supply.

Feed costs tell a mixed story across the region. Local corn basis is reasonable in areas with good crops, but transportation to deficit areas is keeping overall feed costs elevated. Hay prices are all over the map – some areas with decent alfalfa crops are seeing reasonable prices, while drought-affected regions are paying premium rates for imported feed.

The exciting development is how some producers are adjusting breeding and culling decisions based on margin pressure. Instead of the traditional fall breeding programs, some operations are being more selective, which could moderate the typical spring freshening surge.

Currency and Competitive Positioning

This doesn’t get talked about enough, but exchange rate movements are having a huge impact on global dairy competitiveness. The dollar has been strong against the currencies of most major dairy-producing countries, which makes our exports more expensive and their imports to our markets cheaper.

Here’s a concrete example: when the dollar strengthens 5% against the Euro, European butter becomes roughly 10¢/lb more competitive in Asian markets than it was before the currency move. Multiply that across multiple products and markets, and you’re talking about significant trade flow shifts.

The Brazilian real and Argentine peso have been particularly volatile, creating both opportunities and challenges for South American dairy exporters competing with us in key markets.

What Producers Need to Do Right Now

Look, I’m not going to sugarcoat this – the margin picture is challenging, and today’s price action made it worse. Here’s what needs to happen:

Feed Management (This Week): Get quotes on your next 90 days of feed needs. Today’s soybean meal surge is a warning sign that costs could rise further. Some nutritionists are recommending adjustments to rationing to reduce meal dependency where possible, without compromising production.

Price Risk (This Month): Your September milk check is tracking in the $16.90-17.00 range based on today’s action. If you haven’t locked in some Q4 and Q1 2026 protection, now’s the time to get serious about it. DRP coverage at $17.50/cwt for Q1 2026 still makes sense, even with higher premiums.

Cash Flow Planning (Immediate): With milk-to-feed ratios this tight, cash flow timing becomes critical. Know exactly when your milk checks arrive and plan feed purchases accordingly. Some producers are finding success with split deliveries to smooth out cash flow timing.

Production Decisions (Next 60 Days): This might not be the year for aggressive expansion plans. Focus on maximizing efficiency from your current operation rather than adding capacity in a tight margin environment.

Industry Intel You Need to Know

Processing Capacity News: Saputo’s expansion at their Turlock facility is ahead of schedule, adding whey protein concentrate capacity that should support stronger whey pricing in the long term. This is actually bullish for Class III calculations, since whey is carrying more weight in the formula.

Regulatory Developments: USDA’s Milk Production report drops September 19, and early indications suggest August production was up 1.8% year-over-year nationally. That’s in line with seasonal expectations, but doesn’t help the supply-demand balance in the short term.

Technology Trends: More operations are investing in precision feeding systems to optimize ration costs. With margins this tight, the technology that seemed nice-to-have last year is becoming essential for survival.

Putting Today in Historical Context

Today’s 3¢ drop in cheese blocks was the largest single-day decline we’ve seen in six weeks. But here’s the thing – we’re still trading 8-10¢/lb above the spring lows, so this isn’t exactly crisis territory yet.

What concerns me more is the character of the decline. This wasn’t some external shock or weather event driving prices lower. This was a fundamental repositioning as market participants adjusted to harsh realities and global competitive pressures.

September typically brings seasonal price pressure – that’s nothing new. What’s different this year is how quickly processors seem willing to step back from aggressive milk procurement. Usually, we see more of a gradual transition into fall patterns.

The technical picture on the charts is also becoming concerning. Cheese blocks broke below what had been solid support around $1.70/lb, and the next meaningful support level doesn’t appear until the $1.60-1.65 range.

Bottom Line Reality Check:

This market is telling us that fall flush dynamics are asserting themselves earlier and more aggressively than usual. The global competitive situation for some products is challenging, particularly powder, while others like butter remain attractively priced for export.

Your operation needs to be prepared for a potentially prolonged period of tight margins. This isn’t necessarily a crisis, but it’s definitely not a time for complacency. The producers who manage feed costs aggressively and protect downside price risk are going to be the ones still standing when margins improve.

The good news? Milk demand fundamentals remain solid, and we’re still the most efficient dairy production system in the world. This too shall pass… but it might take a while.

Market conditions as of 4:00 PM CDT, September 9, 2025. As always, consult with your risk management team before making marketing decisions – this market is moving fast enough to make yesterday’s strategy obsolete by tomorrow’s close.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Feed Window That’s Got Everyone Talking – And Why Some Producers Are Already Cashing In – This piece provides tactical advice on feed procurement, revealing practical strategies for locking in feed costs and implementing precision feeding to capitalize on the exact margin opportunities discussed in the main report.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – For a strategic, big-picture view, this article analyzes the component revolution (butterfat and protein) and upcoming policy changes, helping you position your operation for long-term profitability beyond today’s spot market chaos.

- Tech Reality Check: The Farm Technologies That Delivered ROI in 2024 (And Those That Failed) – Looking to the future, this report offers a critical review of which on-farm technologies, like robotic milkers, actually deliver a return on investment, providing an essential guide for making smart capital decisions in a tight-margin environment.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!