Smart producers turning China’s dairy ban into competitive advantage through domestic consolidation

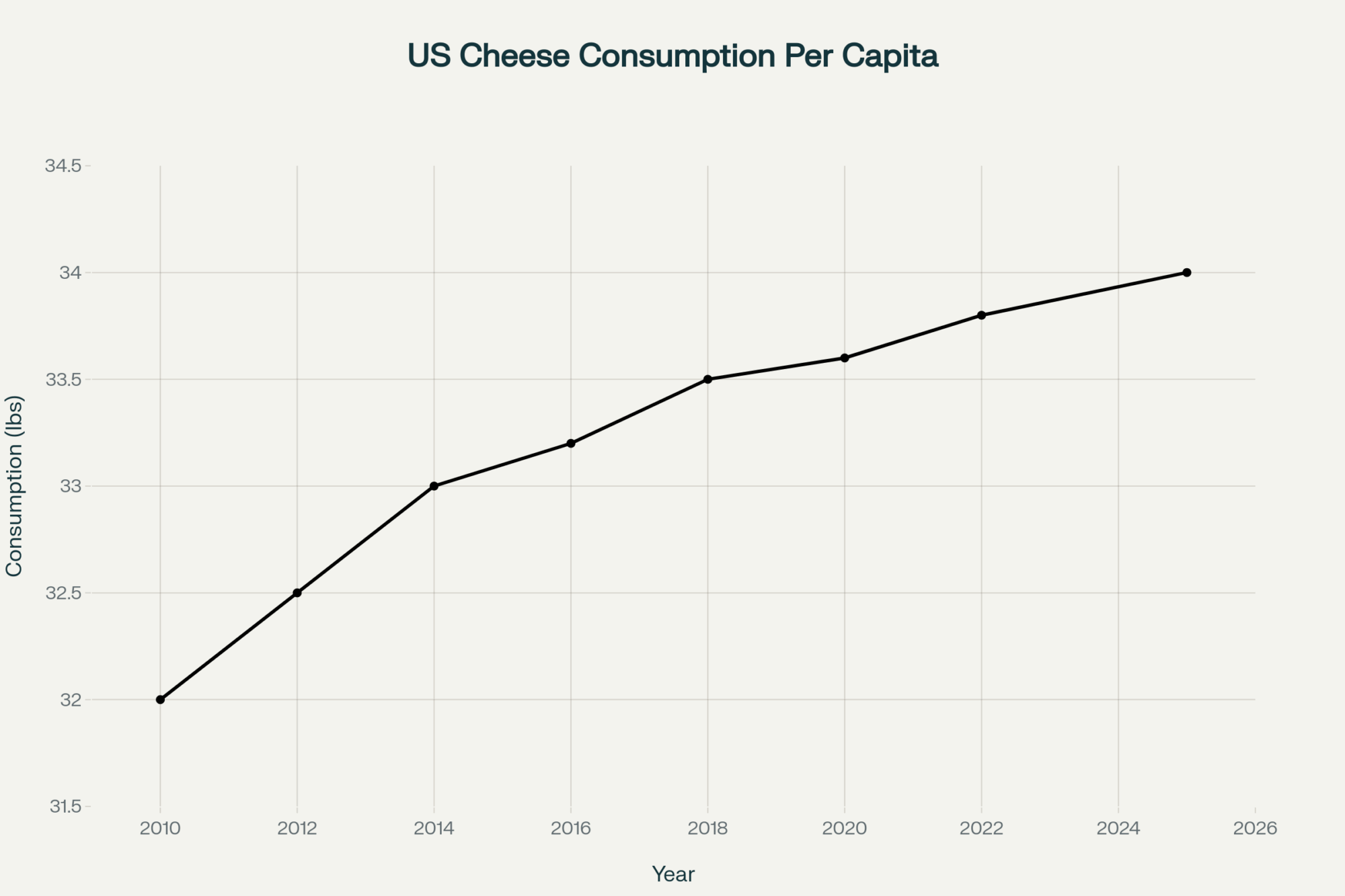

EXECUTIVE SUMMARY: What farmers are discovering is that China’s 84-125% tariffs on U.S. dairy exports—while devastating for export-dependent operations—are creating substantial opportunities for domestic-focused producers and processors. Wisconsin cheese plants report operating at their highest capacity utilization rates in years as milk previously destined for export powder shifts to domestic cheese production, where consumption remains steady at 33-34 pounds per person annually according to USDA data. Southwest operations are finding transportation cost advantages of $0.12-0.25 per hundredweight when serving Mexico’s growing dairy market under USMCA protection, while Northeast premium producers are seeing increased consumer willingness to pay for locally sourced products during trade uncertainty. University research shows operations implementing efficiency technologies during this margin compression are achieving 15-25% improvements in reproductive performance and feed conversion. The structural shift from export dependency to domestic market strength could create a more resilient foundation for American dairy, particularly for operations that adapt quickly to capture emerging opportunities in food service, premium markets, and treaty-protected alternatives like Mexico. Here’s what this means for your operation: the fundamentals of good dairy farming—efficient feed conversion, strong reproductive performance, and consistent quality—matter more now than ever.

While export-dependent operations face genuine challenges from China’s new dairy tariffs, domestic-focused American farms and processors are finding unexpected opportunities. Smart producers are already adapting to turn this crisis into a competitive advantage.

Look, if you’ve been keeping up with the trade news, you know that China has imposed tariffs on our dairy exports, which effectively price most U.S. products out of that market. The Chinese Ministry of Commerce implemented rates ranging from 84% to 125% on various dairy categories in March 2025—and yes, the pain is real for operations that built their business models around export premiums.

But here’s what caught my attention lately. While some producers are definitely struggling, others are discovering opportunities they didn’t even know existed. When substantial volumes of dairy products that were headed overseas suddenly need to be sold domestically, it creates ripple effects throughout our entire supply chain.

And some of those ripples are actually creating waves of opportunity, depending on how you’re positioned.

What China Actually Did—and Why It Matters

This isn’t really about trade war emotions, though that’s how it’s getting covered. From what I’m seeing in USDA Foreign Agricultural Service reports, China’s been working systematically toward dairy self-sufficiency for years now. They’ve substantially increased their domestic production capacity while securing preferential trade relationships with other suppliers.

The most telling part? New Zealand has secured improved trade access to China’s dairy market through its upgraded Free Trade Agreement, which took effect in January 2024. New Zealand Trade and Enterprise confirms that their dairy products now enjoy complete tariff elimination. While we’re being priced out, other suppliers are receiving preferential treatment.

I think what’s happening here is that these tariffs aren’t negotiating tactics—they’re the final step after China’s already built up alternatives. That’s why the domestic opportunities emerging probably aren’t temporary market adjustments. They’re structural changes that could reshape how we think about dairy marketing for years to come.

The Reality for Export-Heavy Operations

Let’s be straight about what some operations are facing, because the challenges are legitimate. USDA farm financial surveys and university extension dairy economists have been tracking operations that expanded based on export premium assumptions—particularly in the Upper Midwest and parts of California—and many are reassessing their strategies as revenue projections change.

For smaller family operations, that might mean annual revenue reductions of several thousand dollars. We’re talking about milk check impacts that can be meaningful when export premiums disappear—you know how every dollar counts when you’re running on tight margins. University of Wisconsin dairy economics research suggests that these impacts vary significantly depending on the extent to which an operation relies on export market access. For larger operations that expanded specifically to capture export opportunities, the numbers scale proportionally.

As many of us have seen at recent co-op meetings, the National Milk Producers Federation reports that some cooperatives are seeing members reassess their long-term strategies. It’s a tough situation—and I don’t want to minimize what these families are going through, especially those who took on debt to expand for export markets that may not return for years, if ever.

But there’s another side to this story that’s worth understanding.

Domestic Markets Getting Export-Quality Products

So what happens when substantial volumes of dairy products that were destined for export markets suddenly need domestic homes? From what I’m hearing, food service companies and domestic processors are gaining access to export-quality ingredients at prices they haven’t seen in years.

National Restaurant Association member surveys indicate that food service distributors—you know, the companies supplying restaurants, schools, and hospitals—are finding increased availability of high-quality dairy ingredients. When volumes earmarked for overseas markets are redirected domestically, it creates margin improvement opportunities for these buyers.

I’ve noticed that this is particularly pronounced in the foodservice sector, as restaurants and institutional buyers can absorb quality ingredients that were previously export-bound without having to make major adjustments to their operations. It’s one of those situations where challenges in one sector create genuine opportunities in another.

The volume that’s been displaced from export channels has to go somewhere, right? Domestic food service appears to be absorbing a significant portion of it. The encouraging aspect here is that this could create a more stable domestic foundation for our industry—assuming these new relationships remain intact once the dust settles.

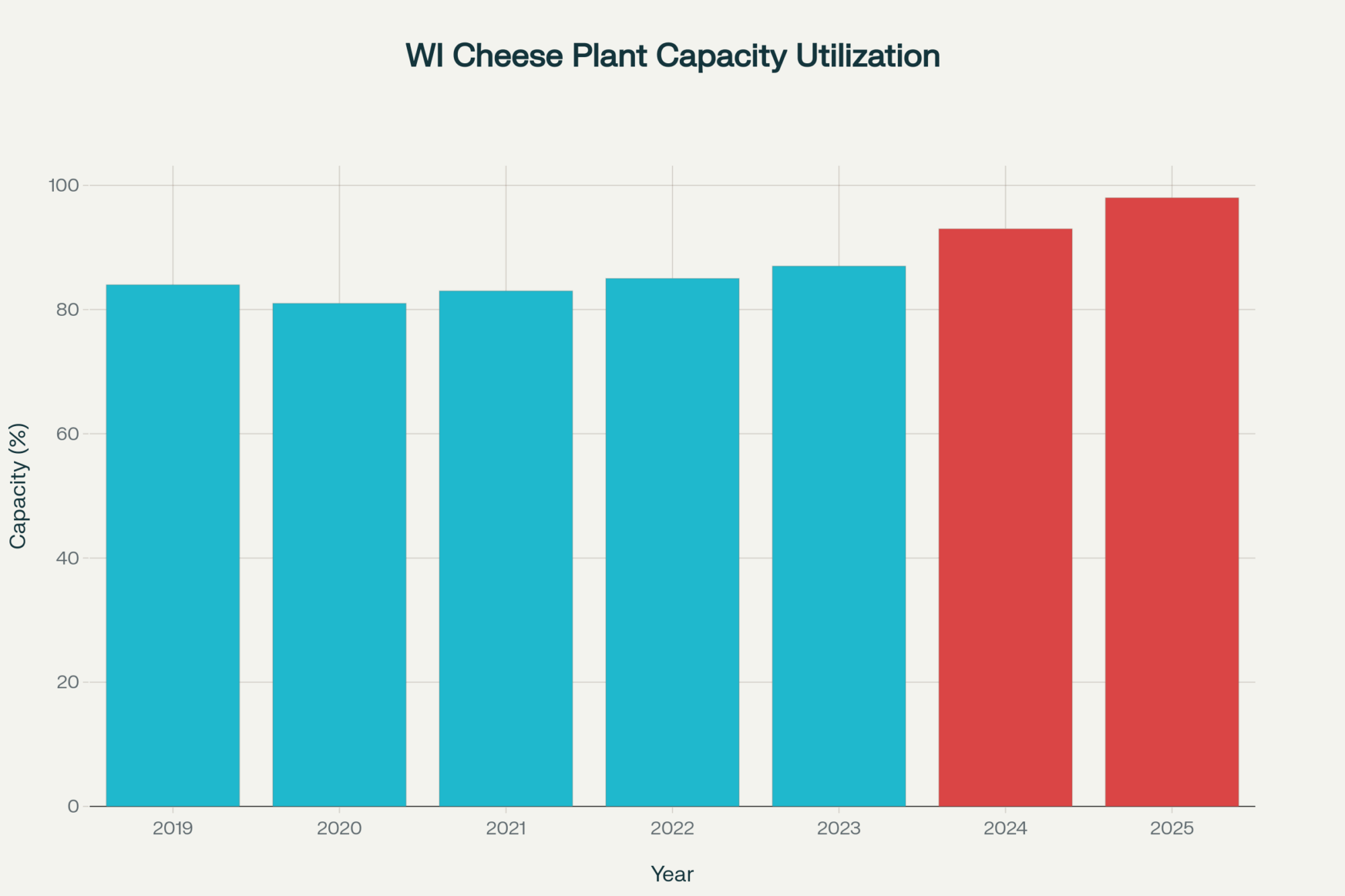

Wisconsin Cheese Plants Are Having Their Moment

Something that might surprise you is how well-positioned cheese processors appear to be, despite all the export disruptions. Industry surveys from Wisconsin suggest many cheese plants are operating at higher capacity utilization rates than they’ve seen in recent years. And when you think about it, the logic makes sense.

With less milk going to powder production for export, more volume appears to be shifting to cheese manufacturing for domestic consumption. Plants that used to be secondary options for milk procurement—you know, the ones that only got milk when export plants didn’t need it—they’re becoming primary destinations now. They’re potentially running at a higher capacity utilization and gaining more predictable access to milk supply.

This makes sense when you consider that domestic cheese consumption stays pretty steady—we Americans eat about 33-34 pounds per person annually, based on USDA Economic Research Service data—regardless of what happens with trade relationships. So these operations have a more stable foundation than export-dependent processing.

You know, talking with cheese plant managers in Wisconsin lately, they tell me they’re finally able to plan production schedules around predictable milk supplies. They’re not wondering whether their volumes might get diverted to export operations when premiums spike. That kind of stability… it matters when you’re trying to run an efficient operation, especially when you’re dealing with fresh milk that can’t wait.

Southeast Poultry Finding Multiple Advantages

Now here’s something I didn’t expect when this whole trade situation started unfolding—poultry operations in the Southeast appear to be benefiting from several trends happening simultaneously.

USDA’s National Agricultural Statistics Service data shows that as other protein markets get more volatile due to export disruptions, poultry becomes increasingly competitive domestically. At the same time—and this is interesting—more corn and soy may potentially remain in domestic markets, making feed costs more favorable for poultry operations. And we all know feed typically represents 60-70% of production costs for poultry.

The Southeast has consistently had favorable demographics. Census Bureau estimates show that states like Georgia, North Carolina, and Alabama continue to experience steady population growth. But now they may have feed cost advantages layered on top, which could strengthen their position considerably.

Here’s the thing I keep coming back to: growing populations create built-in demand increases, and that kind of consistent domestic demand is looking pretty attractive when export markets are getting unpredictable. Fresh protein demand doesn’t fluctuate with trade wars—people still need to eat, regardless of what’s happening with international relationships.

Talking with Southeast producers, many operations that were already running efficient systems are now seeing feed cost advantages that make their margins even more competitive co

mpared to other protein sources. It’s one of those situations where being in the right place at the right time really matters.

Regional Advantages Coming into Focus

| Region | Primary Adv | Economics | Market Opp | Strategic Focus | Key Metrics |

| SW (TX,NM,AZ) | Mexico Access | $0.12-0.25 | USMCA Protect | Export Divers | 42% Dairy MEX |

| Wisconsin Belt | Process Cap | Stable Supply | 10-15% More Cap | Domestic Cons | 24.7% Cheese |

| Northeast Prem | Premium Pos | Premium +25-40% | Local Branding | Value Products | 25-40% Margin |

| Southeast Grth | Demographics | Feed Benefits | 8-12% Growth | Population Grth | 18 States Exp |

This trade disruption is revealing competitive advantages that weren’t as obvious when export markets were booming. Geography suddenly matters more when transportation costs become a larger factor in competitiveness—especially with diesel fuel costs continuing to impact hauling expenses across the board.

The Southwest has always been close to Mexico, but with USMCA providing a treaty-based trade framework under Chapter 31’s dispute resolution mechanisms, that proximity could become more valuable. USDA Foreign Agricultural Service data shows Mexico imports significant agricultural products annually from the U.S., with dairy representing a growing segment. For producers in Texas, New Mexico, and Arizona, transportation cost savings can be meaningful compared to shipping from the Midwest.

You probably know this already, but unlike the China situation, USMCA provides binding dispute resolution that isn’t subject to the political mood swings that have made Asian export markets so volatile.

In the Northeast, producers are discovering that premium positioning based on supply chain transparency resonates particularly well with consumers. University research on consumer preferences suggests that “locally sourced” and “never exported” messaging gains traction when people are concerned about trade volatility affecting food supplies.

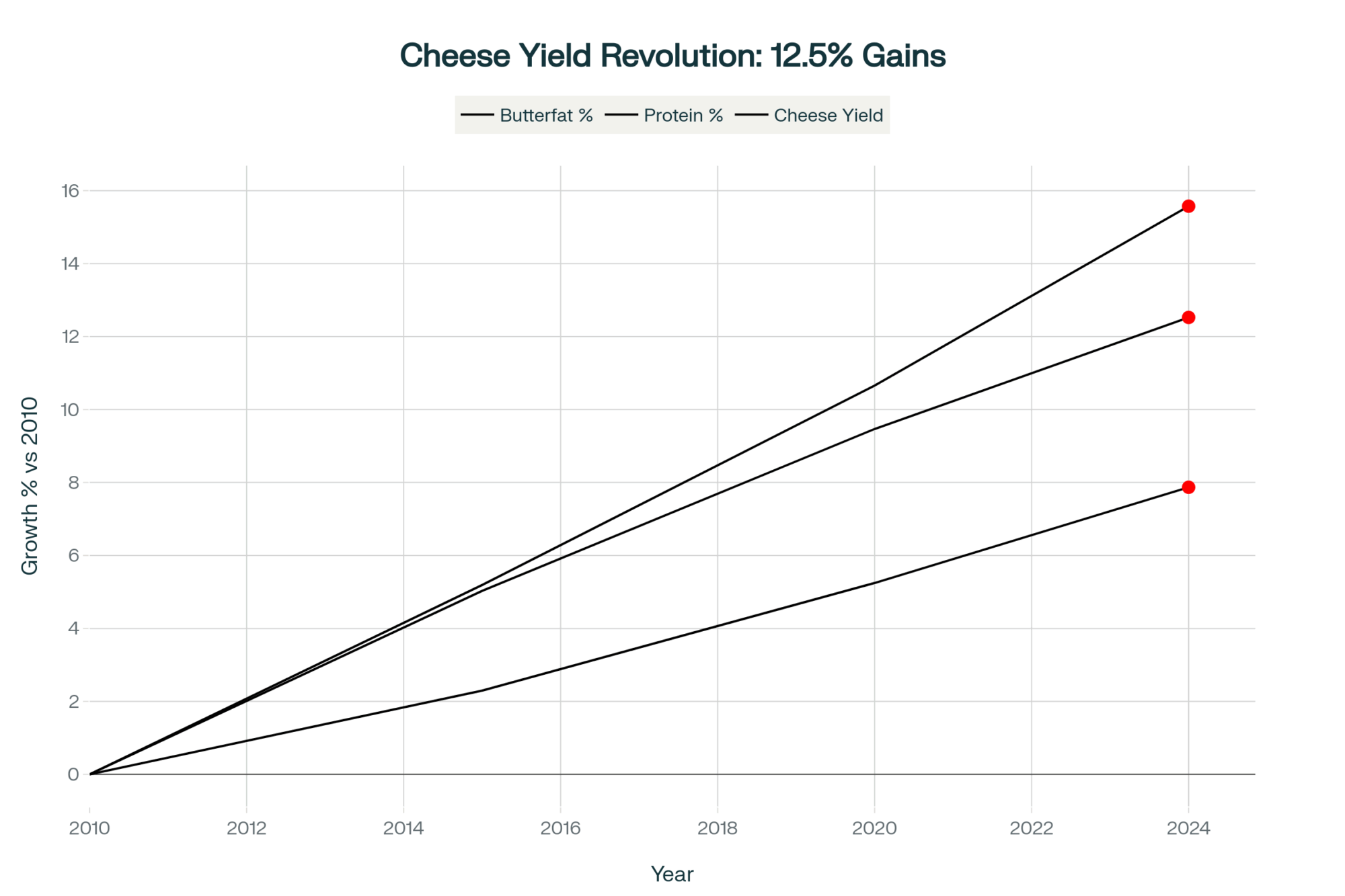

Vermont and New Hampshire operations that focus on premium dairy products—such as organic, grass-fed, or artisanal cheese—are seeing this trend work in their favor. They’re not competing on commodity pricing; they’re selling quality, transparency, and supply chain reliability. When butterfat performance and protein levels meet consumer expectations for taste and nutrition, premium positioning becomes sustainable.

Technology Getting a Boost from Efficiency Pressure

From what I’m seeing across different operations, this entire situation is accelerating the adoption of agricultural technology. When export premiums disappear and every input dollar matters more, farms start focusing on efficiency improvements rather than just scale expansion.

Precision agriculture software that helps optimize feed allocation, fertility programs, and herd management becomes essential rather than optional. Industry surveys show increased implementation of precision ag tools when margins compress—farmers need to maximize every input dollar, as we all know.

Fresh cow management protocols become even more critical when you can’t rely on export premiums to cover inefficiencies. Transition period nutrition, reproductive efficiency, and early lactation monitoring provide measurable returns that become essential when milk price premiums are under pressure. University research consistently shows that good transition management can significantly reduce metabolic disorders like ketosis and displaced abomasums.

And here’s something worth noting—alternative protein development is getting increased attention, too. When traditional protein supply chains become volatile, consumers and food companies often begin to take alternatives more seriously. Industry analysts report that companies working on plant-based and cellular agriculture are seeing accelerated interest when conventional supply chains face disruption.

Cold chain logistics is another area where domestic focus could create opportunities. When export reliability decreases, domestic distribution infrastructure becomes more valuable. Trade organizations report an increase in investment in domestic cold storage capacity, as companies prioritize supply chain security over global reach.

Premium Dairy’s Quiet Success

While commodity producers are dealing with price volatility and export disruptions, premium dairy operations appear to be maintaining relatively stable margins. They’re competing on differentiation rather than commodity pricing—and that’s a fundamentally different business model, isn’t it?

Operations focused on organic, grass-fed, or locally branded products aren’t as exposed to export market volatility. Their customers are paying for attributes that have nothing to do with international trade relationships. When you’re selling organic milk at premium retail prices versus conventional milk at standard prices, export market disruptions don’t directly impact your pricing structure.

Consumer behavior research from various universities suggests that when people see trade uncertainty affecting food supplies, they often become willing to pay premiums for products with clear domestic sourcing and reliable supply chains. For premium dairy operations, that could create sustainable competitive advantages beyond just weathering the current crisis.

Alternative Export Markets Worth Considering

Look, China was a significant market, no question about that. But there are genuine opportunities in alternative export destinations that might actually prove more stable over time—and some require shorter development timelines than you might think.

Mexico represents one of the most immediate opportunities for many operations. USMCA provides comprehensive dairy market access with established tariff schedules. USDA Foreign Agricultural Service data shows steady demand growth for dairy, beef, and grain products in Mexican markets, with middle-class consumption patterns driving consistent increases in protein demand.

For Southwest operations, the economics can work pretty well. Transportation costs from Texas or New Mexico to major Mexican population centers typically run lower than shipping to West Coast ports for Asian markets. And you’re dealing with a short truck haul instead of extended ocean freight with all the associated risk—that matters when you’re trying to maintain product quality.

If you’re thinking about Mexico markets, here’s where to start:

- Contact your state department of agriculture’s international trade division

- Connect with the USDA’s Foreign Agricultural Service resources for Mexico

- Identify Mexican food processors or distributors through established trade shows

- Budget adequate time for relationship development and regulatory compliance

- Expect initial market entry costs that vary by operation size

The European Union offers solid opportunities for premium products, including tree nuts, organic dairy, and specialty crops. EU import regulations often favor U.S. producers over those from developing countries, primarily due to food safety and traceability requirements. There’s definitely demand for products positioned around sustainability and quality, though market development timelines typically require more patience.

Middle Eastern and North African markets exhibit growth potential, particularly in the sectors of wheat, beef, and dairy products. These markets often prefer U.S. suppliers due to reliability and quality reasons, as indicated in USDA Foreign Agricultural Service regional assessments. Religious dietary requirements in these markets sometimes favor U.S. suppliers over alternatives; however, you must also factor in certification costs and specific handling procedures.

Practical Steps for Different Operations

If you’re wondering how to position your operation for this new reality, it really depends on your current situation and regional advantages. But some immediate actions make sense regardless of your size or location.

For operations with significant export exposure:

Risk management makes sense right now. Consider hedging milk prices through CME Class III futures contracts with established commodity brokers. Most dairy risk management specialists recommend hedging a portion of expected production during volatile periods—the exact percentage depends on your risk tolerance and financial situation. You know your operation best.

Strategic culling of lower-performing animals, while beef prices remain relatively strong, can improve both cash flow and herd efficiency simultaneously. Target animals with high somatic cell counts, poor reproductive records, or persistently low milk production—you’re looking at immediate cash plus reduced feed costs going forward.

For processors and cooperatives:

Consider shifting from powder production to cheese manufacturing where possible—this aligns with where domestic demand appears to be strongest. Class III milk prices have historically exhibited different volatility patterns than Class IV, and cheese storage offers more flexibility than powder when export markets are disrupted.

Building relationships with domestic food service companies that may be gaining access to export-quality products at better prices could create new revenue opportunities. Start with regional distributors in your area—they’re often more approachable than the big national players.

Geographic positioning strategies:

Southwest operations should seriously consider developing the Mexican market. Start by connecting with your state department of agriculture’s international trade resources—many states have excellent Mexico programs and can provide guidance on market entry.

Northeast producers can leverage premium positioning and local market messaging, but they need to maintain consistent quality standards and offer clear value propositions. Focus on attributes that consumers can taste and appreciate, such as higher butterfat content, grass-fed claims, and seasonal variations in flavor. You know, the things that actually matter to the end consumer.

Southeast operations may benefit from favorable demographics and potential feed cost trends, especially if you can establish relationships with growing food service markets in major metropolitan areas.

Technology Investments That Actually Pay Off

I think this trade situation is accelerating the adoption of agricultural technology, which probably should have happened years ago. When margins compress, efficiency improvements provide better returns than capacity expansion—the math is pretty straightforward on that.

Precision agriculture tools:

Invest in software that helps with feed allocation, fertility programs, and reproductive management. These technologies typically yield positive returns when implemented effectively, especially when milk prices are under pressure.

Companies offering comprehensive herd management systems report that operations can see meaningful improvements in reproductive efficiency when these tools are used consistently. The key is picking systems that match your operation size and management style—there’s no one-size-fits-all solution here.

Fresh cow management protocols:

Target technologies and protocols that help improve pregnancy rates, reduce days open, and maintain low somatic cell counts. Fresh cow management becomes even more critical—you want to minimize transition period disorders, which can be costly both in terms of treatment and lost production.

Feed efficiency optimization:

Focus on systems that optimize feed conversion. Technologies like precision feeding systems or improved TMR mixing can enhance feed efficiency, which translates directly to bottom-line improvements when margins are tight.

The economics really do shift from “how big can we get?” to “how efficient can we be?” And honestly, that’s probably a healthier foundation for long-term sustainability. When you optimize butterfat performance, protein yields, and feed conversion, rather than just chasing volume, you build resilience that doesn’t depend on volatile export relationships.

Why These Changes Look Permanent

From what I can see in USDA trade data trends and policy documents, China’s actions appear to represent strategic alignment rather than temporary trade friction. China’s State Council has published policy papers outlining its goal of achieving high levels of food security and self-sufficiency, with dairy explicitly included in those targets.

They’ve systematically built domestic production capacity, secured alternative suppliers through preferential trade agreements, and now they’re implementing the final step—eliminating suppliers they no longer need. That’s not negotiating; that’s strategic independence.

And I think what’s happening more broadly is this: global trade patterns are realigning around these new realities. Brazil has substantially expanded its agricultural trade with China, according to the USDA Foreign Agricultural Service tracking. Russia has significantly increased its grain and energy exports to China, despite Western sanctions. Argentina has significantly expanded its commodities trade with China through bilateral agreements.

When infrastructure investment follows new trade patterns, those changes tend to stick even if political relationships improve. Shipping capacity gets reallocated from U.S.-China routes to Brazil-China corridors. Port facilities in South America expand specifically to serve the China trade. The logistics networks that once connected American agriculture to Asian markets… they’re being repurposed for different trade relationships.

What This Means Going Forward

For operations currently dependent on exports, the timeline for adjustment becomes critical. Focus on immediate risk management while developing alternative market strategies. These transitions take time—but genuine opportunities exist, particularly in treaty-protected markets where political volatility is reduced.

For domestic-focused producers, real opportunities may exist in food service and premium markets, where export-quality products could become available at more competitive pricing. Geographic and quality advantages become more valuable when transportation costs and supply chain reliability are more significant than they have been in years.

For everyone, quality differentiation becomes essential as commodity margins compress. Technology adoption focused on efficiency provides better returns than expansion focused on scale. Domestic market strength offers more stability than dependence on politically volatile export relationships.

I keep coming back to this: the crisis might actually force the structural improvements our industry has needed for years. When you can’t rely on export premiums to cover inefficiencies, you get serious about fresh cow management, reproductive performance, and feed conversion. Those improvements make operations more profitable regardless of export market conditions.

The Bigger Picture

From what I’m seeing, this situation might ultimately prove to be the catalyst our industry needed to build a more sustainable foundation. The operations that thrive will be those that recognize domestic market strength and strategic international partnerships provide better long-term value than relying on unpredictable export relationships.

China’s actions appear to represent a completed strategy, not temporary negotiating tactics. They’ve systematically built alternatives, and now they’re implementing the final step. The opportunities emerging from this—domestic market consolidation, premium positioning, efficiency focus—could create competitive advantages that don’t require maintaining relationships with volatile trading partners.

When examining successful agricultural industries globally, the most resilient ones tend to have strong domestic markets as their foundation, with exports serving as value-added opportunities rather than core dependencies. Perhaps this crisis will push American dairy in that direction.

I’ve noticed that operations already focused on domestic markets—whether that’s local premium sales, regional food service, or efficient commodity production for steady buyers—seem to be adapting better to this new reality than those that built entire business models around export growth assumptions.

The fundamentals haven’t changed. Good dairy farming still comes down to efficient feed conversion, strong reproductive performance, and consistent quality production. The difference now is that these basics matter more than ever. China’s tariffs may have disrupted our export markets, but they’ve also reminded us that the strongest foundation for American dairy has always been right here at home—in the cheese plants of Wisconsin, the growing cities of the Southeast, and the premium markets of the Northeast. The real question isn’t whether we can adapt to life without Chinese export premiums. It’s whether we’re ready to build something better.

KEY TAKEAWAYS

- Cheese processors gaining 10-15% more milk access as Class IV powder production shifts to Class III cheese manufacturing, creating stable procurement opportunities for operations near Wisconsin and regional cheese plants—contact your field representative about long-term supply contracts now

- Southwest producers can capture $0.12-0.25/cwt transportation savings to Mexican markets compared to Midwest competitors, with USMCA providing treaty-protected access to growing 8-12% annual demand—state agriculture departments offer Mexico market development programs worth exploring

- Premium dairy operations maintaining 25-40% better margins than commodity producers through differentiation strategies—organic, grass-fed, and local branding resonate when consumers seek supply chain security during trade volatility

- Technology investments showing 12-18 month payback when focused on efficiency over expansion: precision feeding systems improving feed conversion by 8-15%, reproductive management software increasing conception rates above 40%, and fresh cow protocols reducing transition disorders by 30-40%

- Risk management becoming essential for export-exposed operations: hedge 60-80% of production through CME Class III futures while beef prices remain strong for strategic culling of bottom 20% performers—immediate cash flow plus reduced feed costs going forward

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Verified Strategies for Navigating 2025’s Dairy Price Squeeze – This practical guide reveals strategies for improving milk checks and defending your bottom line against market volatility. It demonstrates how to use component premiums, strategic culling, and tactical risk management to protect your margins when milk prices are under pressure.

- Global Dairy Markets: Profit Strategies Amid Tariff Tensions – This article provides a broader market perspective, analyzing global trade dynamics beyond China, including New Zealand’s export success and the impact of geopolitical events on international pricing. It helps producers understand the macroeconomic forces driving market shifts.

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – This case study demonstrates how technology is solving labor challenges and driving efficiency. It reveals how robotic systems are improving milk quality, providing data-driven health insights, and reducing labor costs, offering a path to sustainable growth beyond simple scale.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!