The following article was written by Marian Macdonald and published on her The Milk Maid Marion Blog

Thank you. The most heartening thing about the Australian dairy crisis is the support ordinary Australians have shown for farmers. The remarkable graph above proves what we’ve all seen on supermarket shelves. Real people taking real action.

This graph showing the split between home brand and brand name milk sales comes from Dairy Australia analyst John Droppert, who has answered a handful of questions from Milk Maid Marian with some very telling numbers. Thank you, John! I have added quotes from John in italics. Because they were so fulsome, I have selected some highlights for you.

Is supermarket milk really important to dairy farmers?

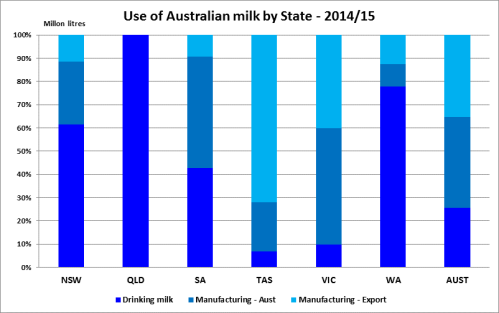

To answer this question I asked Dairy Australia how much of the milk that leaves the farm gate ends up in cartons on supermarket shelves. Well, (with apologies to Lara Bingle) that depends on where the bloody hell you are. In Queensland, just about every drop goes to the supermarket. Here in Victoria, about a tenth of our milk ends up in the fridge and another half is turned into other foods like cheese, yoghurt and butter plus ingredients for everything from toothpaste to glue.

So, yes, what happens in the supermarket matters – critically for farmers in Queensland, NSW and WA. It also can’t be ignored in dairy farming powerhouse, Victoria, especially in the light of cheese prices now targeted by Coles to follow milk down, down, down.

The value of milk has fallen

Aussies are drinking less fresh white milk, despite the supermarket discounts

JD: “…it appears that after an initial lift in demand from consumers in response to discounted milk, consumers have become accustomed to paying the reduced price for fresh white milk, and consumption patterns have since reverted back to pre-discounting levels. Therefore, the implementation of this discount pricing strategy has ultimately failed to lead to a sustainable lift in per capita consumption of fresh white milk.”

Using a table of numbers supplied by John, I’ve created a chart showing the decline below:

Why processors want to supply milk to supermarkets

That graph of falling consumption matched with falling retail prices doesn’t look good but could it be part of a bigger deal? DA’s John Droppert notes that:

“DA’s understanding has been that dairy processors, when faced with adverse conditions in one segment of their market, will naturally look to make decisions in other segments of their business to offset those impacts.”

“With the understanding that processor profit margins were compromised by the consumer shift to private label milk after the $1/litre policy, DA was of the view that the change in market dynamic was likely to have encouraged processors to seek alternate revenue streams – particularly UHT and flavoured milk. It is our understanding that processors consider returns for branded and private label milk across their portfolio of milk (both white and flavoured), while factoring in any efficiency benefits generated by additional private label milk throughput.

“Per capita consumption for both flavoured milk and UHT milk has achieved consistent growth over the last 25 years. DA believes that this has been supported by increased investment by processors in advertising to encourage consumers to purchase more flavoured milk to offset profitability challenges in other parts of the total milk category. We are currently in the process of trying to secure a time series of data showing advertising spend across the liquid milk category in order to verify this claim.”

Again using data in a table supplied by DA, I created the graph below. And wow, look at UHT (in grey) and and flavoured milk (orange)! Those babies might be a small part of the equation but they’re doing the heavy lifting, propping up total consumption.

At the time MG announced it would supply home brand milk for Coles, getting other Devondale products on the shelves – particularly cheese – was certainly considered a triumph for the co-op.

Is the profitability of fresh milk for processors known?

JD: “DA is not privy to retailer or processor profit margins for any manufactured product. There is a widely held belief that processor margins are better for branded product, compared to private label equivalents.”

“DA also understands that there may be an advantage for processors in attaining additional supermarket shelf space for their company branded products in both milk and other dairy categories by supplying private label milk (i.e. a non-financial return). The upcoming ACCC dairy market study is likely to bring some of this information to light, and allow some of these questions to be more definitively addressed”.

Does DA have a position on whether supermarket discounting is a positive or negative for dairy farmers? Why/why not?

JD: “From a DA (services body) perspective, we look at this in terms of impacts along the supply chain back to farmers; the peak bodies (ADF and ADPF) take this analysis into account in projecting an industry position through ADIC. As far as impacts go, there are two levels to look at: the emotional aspects, and the data.”

“Taking the emotional side of the issue into account first, there is no doubt that the discounting of fresh white milk has devalued the perception of product value in the eyes of farmers. To see milk selling for less than the price of something like bottled water has an impact on farmer sentiment that the economic data doesn’t capture. It suggests to farmers that all the hard work, capital investment, and management skill that goes into producing the product is not properly valued, by those selling it, or the wider community buying it.

“From a data perspective, this is a complex issue, and a proper evaluation relies heavily on assumptions in place of open access to hard data relating to profit margins which in most cases is commercial in confidence information held by the processors and retailers. However, DA is concerned that the analysis published in the recent S&O was deliberately misinterpreted to infer that the $1/litre discounting of private label fresh milk has had a positive impact on dairy industry profitability.

“Data available to DA relating to sales volumes and values does not allow us to derive definitive evidence relating to the impacts on dairy supply chain profitability. But based on the assumptions noted above (notably around margins) and in our broader fresh milk market analysis, DA believes it is incorrect to suggest that the introduction of $1/litre private label milk has not had a detrimental impact on the dairy supply chain. DA recognises that there is a significant opportunity to improve upon the coverage and robustness of analysis in this space, and believes that the upcoming ACCC investigation will provide a means to obtain the data required to do this.

“What DA can demonstrate though is that per capita consumption of fresh white milk has not increased as a result of the $1 litre pricing policy introduced in 2011.”

Source: Milk Maid Marian