Current dairy markets are hinting at potential gradual increase in milk price into 2019. Global trade volatility continues to hinder widespread optimism.

Current dairy markets are hinting at potential gradual increase in milk price into 2019. Global trade volatility continues to hinder widespread optimism.

The dairy sector, particularly Pennsylvania, has had a few weeks of some optimism along with continued concern. With the tentative agreement on a new North American Trade relationship with Canada and Mexico, the U.S. dairy industry may be poised to strengthen our export markets. While the agreement must still be approved by Congress, there is optimism that this agreement will pass, and eventually the U.S. dairy markets will reap the benefits. Nearby futures prices have not yet responded to this potential boost to exports because the provisions of the trade agreement will not take effect for at least 6 months. A price bump, due to this trade agreement, will probably be noticed in the fall of 2019.

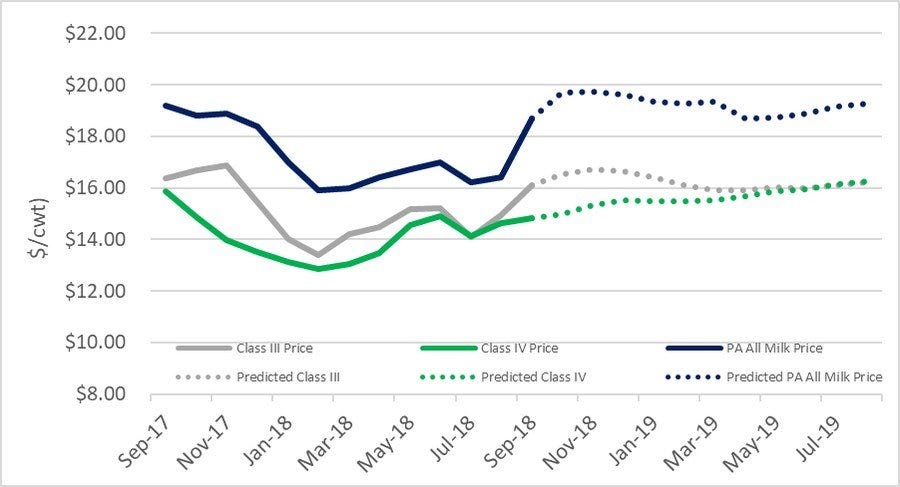

Class III futures prices for the first 6 months of 2019 are up over a dollar compared to the first 6-month Class III prices of 2018. This is good news, especially considering the general oversupply of dairy markets. However, even with the nice boost in Class III prices, most farm gate prices are still below the cost of production in Pennsylvania.

The Penn State Dairy Extension Team’s cash flow work with dairy producers shows that the average farm gate price for January-June 2018 was $15.10/cwt. However, the range of farm gate prices was nearly $4.00/cwt (High of $17.00/cwt, low of $13.10/cwt). That variation in price occurred due to milk components, the type of markets to which the milk was shipped (mostly fluid, or mostly Class III and IV) and the level of extra location adjustment and marketing adjustment taken by the cooperative to which the milk was shipped.

Unfortunately, this has been a particularly challenging growing season, especially in saturated Pennsylvania. Starting with the miniscule harvest windows for small grain forages, forages have been tough to get harvested at optimal quality and dry matter. This has caused some quality and supply issues in the hay markets, causing statewide greater price fluctuations. The end of the season harvests for corn silage and grains are also proving challenging not only to get into fields to harvest, but quality issues are becoming an increasing concern. Though there are some drops in feed prices nationally, as seen in Table 1, Pennsylvania’s feed costs are currently not decreasing at the same pace. Hopefully this is a temporary fluctuation and not a long-term trend.

Income over Feed Cost, Margin, and All Milk Price Trends

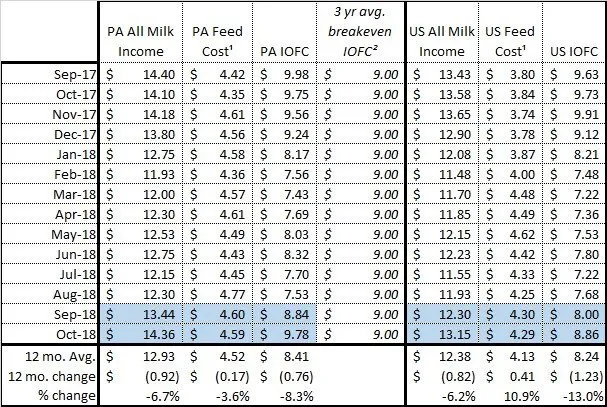

Table 1: 12 month Pennsylvania and U.S. All Milk Income, Feed Cost, Income over Feed Cost ($/milk cow/day)

¹Based on corn, alfalfa hay, and soybean meal equivalents to produce 75 lbs. of milk (Bailey & Ishler, 2007)

²The 3 year average actual IOFC breakeven in Pennsylvania from 2014-2016 was $9.00 ± $1.67 ($/milk cow/day) (Beck, Ishler, Goodling, 2018).

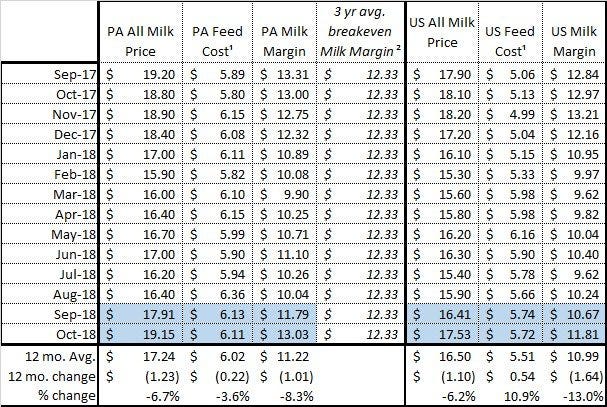

Table 2: 12 month Pennsylvania and U.S. All Milk Price, Feed Cost, Milk Margin ($/cwt for lactating cows)

¹Based on corn, alfalfa hay, and soybean meal equivalents to produce 75 lbs. of milk (Bailey & Ishler, 2007)

²The 3 year average actual Milk Margin breakeven in Pennsylvania from 2015-2017 was $12.33 ± $2.29 ($/cwt) (Beck, Ishler, Goodling, 2018).

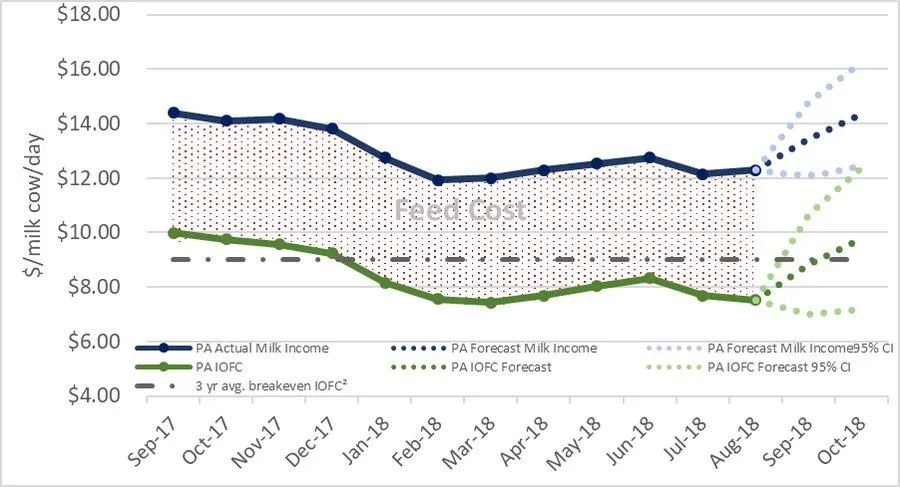

Figure 1: 12 month Pennsylvania Milk Income and Income over Feed Cost ($/milk cow/day)

²The 3 year average actual IOFC breakeven in Pennsylvania from 2015-2017 was $9.00 ± $1.67 ($/milk cow/day) (Beck, Ishler, Goodling, 2018).

Figure 3: 24 month Actual and Predicted* Class III, Class IV, and Pennsylvania All Milk Price ($/cwt)

*Predicted values based on Class III and Class IV futures regression (Gould, 2018).

Table 3: 24 month Actual and Predicted* Class III, Class IV, and Pennsylvania All Milk Price ($/cwt)

| Month | Class III Price | Class IV Price | PA All Milk Price |

|---|---|---|---|

| Sep-17 | $16.36 | $15.86 | $19.20 |

| Oct-17 | $16.69 | $14.85 | $18.80 |

| Nov-17 | $16.88 | $13.99 | $18.90 |

| Dec-17 | $15.44 | $13.51 | $18.40 |

| Jan-18 | $14.00 | $13.13 | $17.00 |

| Feb-18 | $13.40 | $12.87 | $15.90 |

| Mar-18 | $14.22 | $13.04 | $16.00 |

| Apr-18 | $14.47 | $13.48 | $16.40 |

| May-18 | $15.18 | $14.57 | $16.70 |

| Jun-18 | $15.21 | $14.91 | $17.00 |

| Jul-18 | $14.10 | $14.14 | $16.20 |

| Aug-18 | $14.95 | $14.63 | $16.40 |

| Sep-18 | $16.09 | $14.81 | $18.70 |

| Oct-18 | $16.52 | $14.97 | $19.68 |

| Nov-18 | $16.71 | $15.33 | $19.72 |

| Dec-18 | $16.63 | $15.51 | $19.60 |

| Jan-19 | $16.42 | $15.49 | $19.33 |

| Feb-19 | $16.09 | $15.48 | $19.26 |

| Mar-19 | $15.90 | $15.53 | $19.33 |

| Apr-19 | $15.92 | $15.67 | $18.70 |

| May-19 | $16.01 | $15.86 | $18.74 |

| Jun-19 | $16.00 | $15.95 | $18.88 |

| Jul-19 | $16.11 | $16.13 | $19.15 |

| Aug-19 | $16.21 | $16.24 | $19.26 |

*Italicized predicted values based on Class III and Class IV futures regression (Beck, Ishler, and Goodling 2018; Gould, 2018).

To look at feed costs and estimated income over feed costs at varying production levels by zip code, check out the Penn State Extension Dairy Team’s DairyCents or DairyCents Pro apps today.

Data sources for price data

All Milk Price: Pennsylvania and U.S. All Milk Price (USDA National Ag Statistics Service, 2018)

Current Class III and Class IV Price (USDA Ag Marketing Services, 2018)

Predicted Class III, Class IV Price (Gould, 2018)

Alfalfa Hay: Pennsylvania and U.S. monthly Alfalfa Hay Price (USDA National Ag Statistics Service, 2018)

Corn Grain: Pennsylvania and U.S. monthly Corn Grain Price (USDA National Ag Statistics Service, 2018)

Soybean Meal: Feed Price List (Ishler, 2018) and average of Decatur, Illinois Rail and Truck Soybean Meal, High Protein prices, National Feedstuffs (USDA Ag Marketing Services, 2018)

References

Bailey, K. and V. Ishler. “ Dairy Risk-Management Education: Tracking Milk Prices and Feed Costs ”. Penn State Extension. Accessed 9/20/2017.

Beck, T.J., Ishler, V.A., & Goodling, R. C. 2018. “Dairy Enterprise Crops to Cow to Cash Project,” the Pennsylvania State University. Unpublished raw data.

Dairy Records Management Systems. “DairyMetrics Online Data Report system”. Accessed 9/14/2017.

Gould, B. 2018. “Mailbox Price Forecaster”. Dairy Marketing Tools website. University of Wisconsin-Madison. Accessed 10/8/2018.

Ishler, V. “ DairyCents Mobile App ”. Penn State Extension. #App-1010.

Ishler, V. “ DairyCents Pro Mobile App ”. Penn State Extension. #App-1009.

Ishler, V. “Feed Price List”. Personal Communication. Accessed 10/8/2018.

Microsoft 2016. “Forecast.ets function”, Office Help Website .

USDA National Ag Statistics Service, 2018. Agricultural Prices, Quick Stats version 2.0. Accessed 10/8/2018.

USDA Ag Marketing Serivces, 2018. Milk Marketing Order Statistics. Accessed 10/8/2018.

USDA Ag Marketing Services. 2018. “National Feedstuffs: Soybean Meal, High Protein”. Summary of USDA AMS Grain Reports. Accessed 10/8/2018.

Source: extension.psu.edu