Trump’s tariff gamble: Dairy sees trade war leverage while grain fears collapse. Will new tariffs crack EU cheese barriers or spark Chinese retaliation?

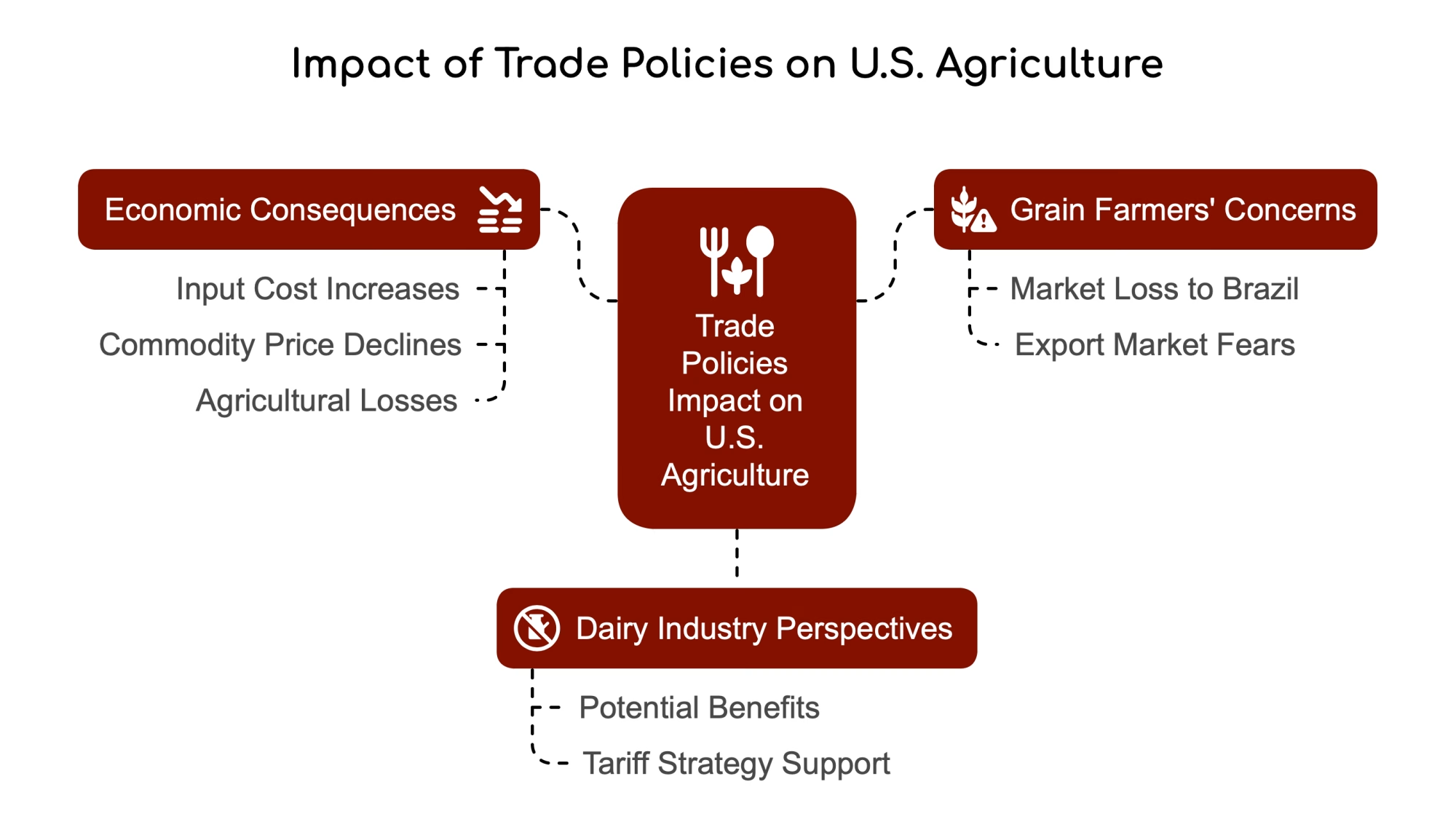

EXECUTIVE SUMMARY: President Trump’s new tariffs on major trade partners have divided agriculture, with dairy leaders cautiously supporting the measures as potential leverage against long-standing EU cheese restrictions (blocking $168M in exports) and Canada’s quota system (where U.S. exports fill less than 30% of allowed volumes). However, grain producers warn of permanent market loss to Brazil, citing 2018’s $25B trade war damage. The tariffs target EU GIs, India’s lactose taxes, and China’s retaliatory risks, with dairy advocating for swift negotiations to dismantle barriers. While the strategy could pressure reforms, farmers face uncertainty as implementation begins today.

KEY TAKEAWAYS:

- Canada’s dairy paradox: 200%+ tariffs exist but apply only if exports exceed quotas—a scenario that’s never occurred due to systemic barriers.

- EU’s $168M cheese blockade: Geographical Indications block U.S. products from using names like “feta,” costing millions annually.

- China gamble: 34% tariffs risk retaliation in America’s third-largest dairy export market ($584M), already down 12% YoY.

- Sector divide: Dairy backs tariffs as negotiation tools; grain growers fear irreversible market loss, per Purdue’s Ag Barometer.

- TRQ reality: Complex tariff-rate quotas govern global dairy trade, with most countries failing to fill allocated volumes.

As President Trump’s newly announced tariffs are set to take effect tomorrow, dairy industry leaders are expressing cautious optimism that these measures could help address longstanding trade barriers that have hindered U.S. dairy exports. The tariff plan, which includes both a baseline 10% duty on all imports and higher targeted rates for specific countries, is being viewed by some dairy representatives as a potential lever to create more equitable trade conditions.

Breaking Down Trump’s Bold Tariff Strategy for Dairy Markets

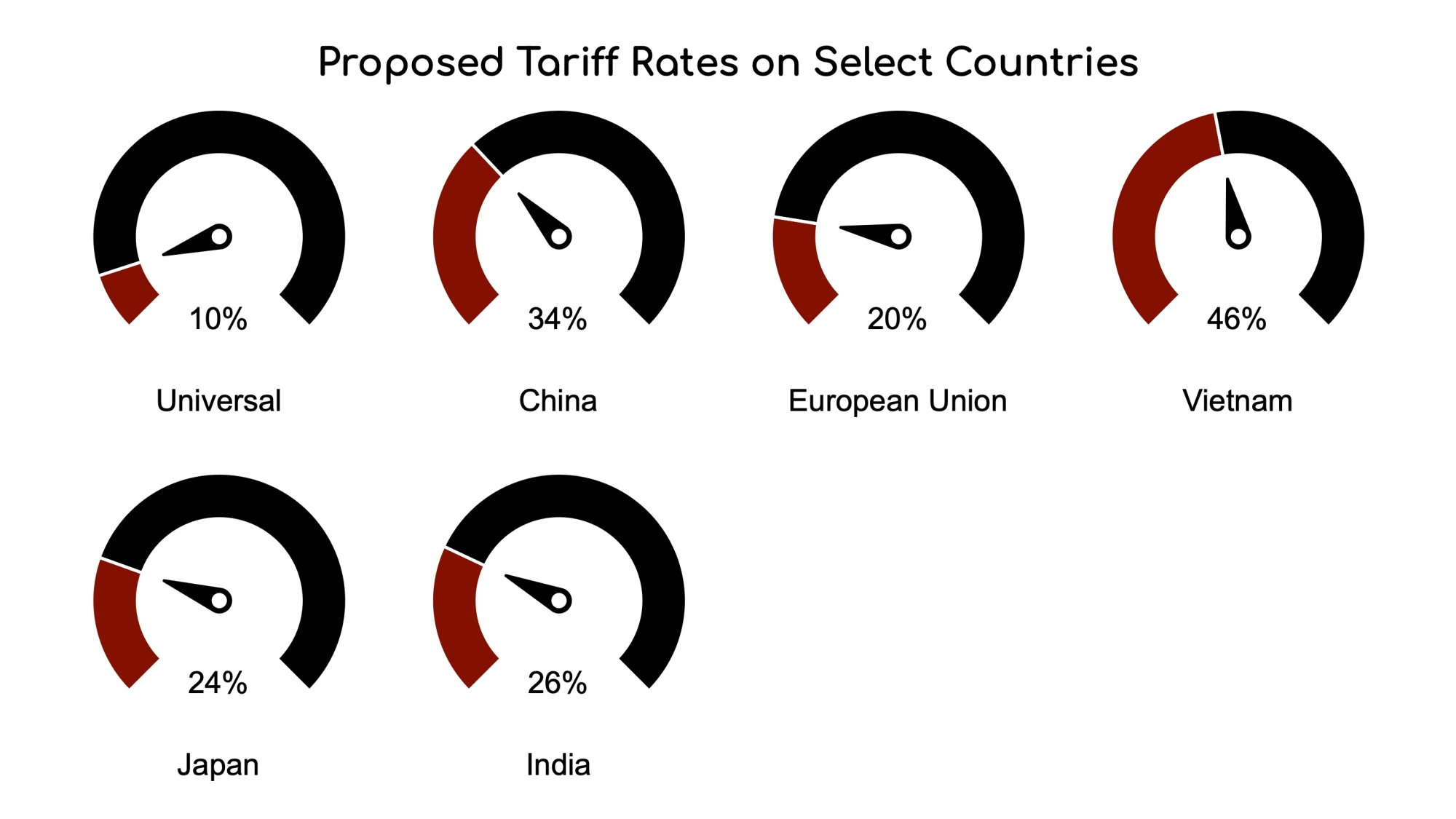

President Donald Trump unveiled his tariff plan during a “Make America Wealthy Again” event at the White House Rose Garden, announcing a universal 10% tariff on all imports beginning April 5, 2025, with additional targeted tariffs on countries with which the U.S. has significant trade deficits starting April 9. The higher rates include 34% for China, 20% for the European Union, and targeted percentages for countries including Vietnam (46%), Japan (24%), and India (26%).

Unlike some agricultural sectors expressing concern, dairy industry leaders offered measured support for the administration’s approach. Gregg Doud, President and CEO of the National Milk Producers Federation (NMPF) framed the tariffs as potentially beneficial for U.S. dairy producers.

“Tariffs can be a useful tool for negotiating fairer terms of trade,” Doud stated. “We are glad to see the administration focusing on long-time barriers to trade that the European Union and India have imposed on our exports.”

Krysta Harden, President and CEO of the U.S. Dairy Export Council (USDEC), echoed this sentiment, emphasizing that a “firm hand and decisive approach” is particularly needed with the European Union and India “to correct their distortive trade policies and mistreatment of American agriculture.”

The USMCA Paradox: How Canada Blocks U.S. Milk Despite “Zero” Tariffs

President Trump has specifically highlighted Canadian dairy policies as problematic, claiming Canada imposes tariffs of 250-270% on U.S. dairy products. While these high rates do exist on paper, the reality is more complex and often misrepresented.

These triple-digit tariffs would only apply if U.S. exports exceeded predetermined quota thresholds established under the United States-Mexico-Canada Agreement (USMCA), which Trump himself negotiated during his first term. Below these quotas, American dairy sales to Canada face zero tariffs.

The critical fact often overlooked is that U.S. dairy exports have never come close to reaching these quota limits. For dairy products subject to a quota year tariff, the average fill rate as of March 2025 was only 21.24%. In practice, this means “these tariffs are not actually paid by anyone,” according to agricultural economists.

“We’ve never hit 50% of our tariff-free milk quota. Canada’s system is designed to look open while keeping U.S. products out.”

Becky Rasdall Vargas, IDFA Senior VP of Trade Policy

| Dairy Product | TRQ Year Basis | 2024 Fill Rate | March 2025 Fill Rate |

| Cheese & Curd | Calendar | 18% | 14% |

| Skim Milk Powder | Quota (Aug-Jul) | 32% | 23% |

| Fluid Milk | Calendar | 29% | 19% |

| Butter | Quota (Aug-Jul) | 41% | 27% |

The real issue, according to U.S. dairy representatives, lies in Canada’s implementation of the quota system. Becky Rasdall Vargas, senior vice president of trade and workforce policy at the IDFA, argues that “Canada imposes unfair barriers that make it increasingly difficult for U.S. products to enter the Canadian market”.

“Our complaint is we’re not able to get anywhere near the quota cap, even though we have buyers who tell us they would like to bring in our product,” Rasdall Vargas explained.

USMCA Promised Big Gains for Dairy—But Delivery Falls Short

The USMCA established significant growth in market access for U.S. dairy exports to Canada, with TRQ volumes scheduled to increase substantially over the agreement’s implementation period.

| Product Category | Year 1 TRQ | Year 6 TRQ | Year 19 TRQ | Growth Mechanism |

| Cheese | 10,416 MT | 15,624 MT | 17,860 MT | +25% Y3, +20% Y6, +1% annually |

| Skim Milk Powder | 5,000 MT | 7,500 MT | 8,575 MT | +50% Y2, +1% annually |

| Fluid Milk | 7,000 MT | 10,500 MT | 12,005 MT | +33% Y3, +1% annually |

| Butter | 3,000 MT | 4,500 MT | 5,145 MT | +50% Y2, +1% annually |

Under CUSMA (the Canadian term for USMCA), butter TRQs increased by 25% in the 2023/24 dairy year. With an 81.3% fill rate, this year’s rate is lower than last year’s at 97%, indicating some challenges in fully utilizing the expanded market access.

$168 Million Lost: How EU Cheese Rules Block American Exports

The relatively moderate 20% tariff on European Union goods reflects a strategic approach to a complex trade relationship. According to Doud, this rate is “a bargain for the EU considering the highly restrictive tariff and nontariff barriers the EU imposes on our dairy exporters.”

One of the most contentious issues between U.S. and EU dairy trade involves Geographical Indications (GIs), which the EU uses to protect regional food names. These designations prevent U.S. cheesemakers from labeling their products as “feta” or “gorgonzola” when exporting to EU markets, as these terms are reserved for regionally produced cheeses.

The EU’s GI restrictions effectively “erase American products from store shelves overseas,” as Krysta Harden of USDEC has noted, blocking $168 million in potential U.S. cheese exports in 2024 alone.

“If Europe retaliates against the United States, we encourage the administration to respond strongly by raising tariffs on European cheeses and butter,” Doud stated, signaling the industry’s support for a tough stance on this issue.

China’s $584 Million Dairy Market at Risk: Will Retaliation Follow?

The highest targeted tariff rate—34% on Chinese goods—raises significant questions for U.S. dairy exports to what has become America’s third-largest dairy export market, worth $584 million in 2024. U.S. dairy exports to China declined by 12% year-over-year in 2024, reaching their lowest level since 2020, a trend that could be exacerbated by new trade tensions.

China has previously imposed retaliatory tariffs on U.S. dairy imports in response to earlier Trump-era tariffs, with dairy products facing a 10% duty. During the 2018 trade war, these retaliatory measures cost dairy farmers $1.5 billion in lost revenue. With the new 34% U.S. tariff set to take effect April 9, there is concern about potential escalation.

“China will take necessary measures to firmly safeguard its legitimate interests against these WTO-violating tariffs.”

Guo Jiakun, Chinese Foreign Ministry Spokesperson

Chinese officials have already signaled their opposition to the new tariffs. Foreign Ministry Spokesperson Guo Jiakun stated that the measures “seriously violate WTO rules” and promised that “China will resolutely take countermeasures to safeguard its legitimate interests”.

The Trade Barrier Paradox: U.S. Import Quotas Remain Unfilled Too

While much attention focuses on barriers to U.S. exports, it’s worth noting that many countries face challenges accessing the U.S. market as well. Current data shows varying utilization rates for dairy TRQs established under U.S. free trade agreements:

| Trade Partner | TRQ Type | 2024 Utilization | Key Barrier |

| Canada | Cheese | 1% | Quota allocation complexity |

| EU | Butter | 44% | GI restrictions |

| Mexico | SMP | 8% | Section 232 tariffs |

This data from the USDA Dairy Import Circular shows that trade barriers can flow in both directions, with complex quota systems sometimes limiting the effectiveness of market access provisions.

“We’re Handing China to Brazil”: Grain Farmers Fear Permanent Market Loss

While dairy industry representatives see potential benefits in Trump’s tariff strategy, grain producers have expressed significant concerns. Chase Dewitz, who operates a large farming operation in North Dakota, worries about permanent market loss.

“We’re handing China to Brazil,” warns Dewitz, reflecting grain growers’ fears of losing export markets. “I think there’s going to be some pain here for a while, and the biggest thing is these export markets.”

These concerns are reflected in broader industry sentiment, with 43% of farmers citing shifting trade policy as their primary concern in the Purdue University-CME Group Ag Economy Barometer for March.

During the 2018 trade war with China, U.S. agriculture experienced more than $25 billion in losses. The United States has yet to fully recover its former market share of soybean exports to China, the world’s largest buyer of the commodity.

“Tariffs tear us apart—raising input costs while crushing commodity prices. This isn’t trade policy; it’s economic vivisection.”

Vance Ehmke, Kansas Farmer (6th Generation)

“These tariffs are just absolutely bad news,” said Vance Ehmke from the western Kansas farm his ancestors homesteaded in 1885. “They cause the prices for everything that we buy to go up, and the price for everything that we sell to go down. I mean, it is being economically drawn and quartered”.

Tariff Rate Quotas Explained: Why the “Milk Tank” Analogy Matters

Think of Tariff Rate Quotas (TRQs) like a milk tank—fill it tax-free, but overflow costs steeply. Both the U.S. and Canada use this system for dairy products, allowing a certain number of imports at low or zero tariffs, with significantly higher rates applied to imports exceeding these quotas.

For example, while U.S. dairy exports to Canada face potential tariffs of 241-298.5% if they exceed quota limits, these exports have never reached even 50% of their tariff-free allocation. Similarly, Canadian butter exported to the U.S. faces no tariffs under quota thresholds but would be subject to over-quota tariffs of about 24-39%.

Understanding these mechanisms is crucial for dairy producers navigating international markets and evaluating the potential impact of Trump’s new tariff strategy.

Will Your Dairy Operation Benefit or Suffer Under New Tariffs?

As the April 5 implementation date approaches tomorrow, dairy producers should consider how these tariffs might affect their specific operations. Would a 34% tariff on Chinese imports benefit your bottom line? Or would retaliatory bans on milk powder erase your profits?

The contrasting reactions between dairy and grain sectors highlight the diverse impacts trade policies can have across different agricultural commodities. While dairy organizations see an opportunity to leverage tariffs for negotiations with problematic partners like the EU, India, and Canada, they also emphasize the importance of quickly resolving tensions with constructive trading partners.

“Through productive negotiations, this administration can help achieve a level playing field for U.S. dairy producers by tackling the numerous tariff and nontariff trade barriers that bog down our exports,” Doud stated.

Tariffs as Leverage: Strategic Tool or Economic Self-Harm?

As the dairy industry navigates the complex landscape of international trade, the response to Trump’s tariff announcement reflects a strategic calculation: potential short-term disruption weighed against the possibility of addressing persistent barriers to U.S. dairy exports.

“Every farmer says trade needs fixing—until it affects their bottom line. Well, buckle up: this storm will hit us all.”

James Mintert, Purdue Ag Economist

“Broad and prolonged tariffs on our top trading partners and growing markets will risk undermining our investments, raising costs for American businesses and consumers, and creating uncertainty for American dairy farmers and rural communities,” warns Becky Rasdall Vargas of the IDFA.

The dairy sector appears poised to support targeted use of tariffs while advocating for swift negotiations to expand export opportunities and eliminate both tariff and non-tariff barriers that have limited U.S. dairy’s global competitiveness. As implementation begins tomorrow, the industry will be watching closely to see whether these tariffs serve as effective negotiating tools or trigger costly trade conflicts.

Learn more:

- Trump’s Liberation Day Tariffs: A $8.2B Gamble for Dairy Farmers – Examines how retaliatory tariffs threaten $8.2 billion in U.S. dairy exports and strategies for farmers to navigate market disruptions.

- TRUMP’S 250% DAIRY TARIFF THREAT: What’s Really at Stake for Your Farm – Reveals the truth behind U.S.-Canada dairy trade disputes, including the fact that U.S. exporters are filling only 42% of their tariff-free quotas.

- Weekly Dairy Market Report: Tariffs Cast Shadow Over U.S. Dairy Industry Outlook – Provides market analysis of how the 25% tariffs on Canadian and Mexican imports are reshaping dairy prices and export opportunities.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!