Oct 12: Australian dairy defeats wealth tax. Nov 2025: OECD targets North America. The playbook that wins? Right here.

EXECUTIVE SUMMARY: Australian dairy farmers just showed you exactly how to beat the wealth tax that’s coming for your farm. When their government tried forcing farmers to pay taxes on unrealized gains—$30,000 cash for paper profits they hadn’t sold—farmers didn’t just protest and hope. They invested $250,000 in professional campaign infrastructure, united 3,500 farms with 13,000 small businesses, and utilized the Treasury’s own data to demonstrate that the policy would harm family operations. After two years of strategic pressure, they achieved complete victory on October 12, 2025. With the OECD coordinating similar taxes globally and U.S. estate tax exemptions dropping from $14 million to $7 million in 2026, you may have only 18 months to build a similar defense. The blueprint’s right here—the question is whether you’ll use it before it’s too late.

As we head into winter, it’s worth taking a look back at what Australian farmers accomplished over the past few weeks. You know how it is when you’re knee-deep in managing feed costs—which, depending on where you are and what quality you’re buying, can run anywhere from $350 to well over $450 per ton according to recent USDA reports—and trying to keep butterfat levels steady through these weather swings. The last thing on your mind is tracking tax policy from the other side of the world.

But here’s what’s interesting: Australian dairy farmers just forced their government to completely reverse a wealth tax that would’ve made farm succession planning nearly impossible. They achieved this victory on October 12, with Treasurer Jim Chalmers standing there repeating how “the prime minister and I agreed” on the changes—political speak for “I got overruled and I’m not happy about it.”

What I’ve found really compelling about this whole situation is how their approach could work just as well here in Wisconsin, or Ontario, or California. Because let’s be honest… the challenges we’re all facing with succession planning aren’t that different. And with discussions about eliminating the stepped-up basis heating up in Washington, the timing couldn’t be more relevant.

Understanding the Fight Down Under

So here’s the deal. In 2024, the Australian Treasury proposed a measure they considered reasonable: increasing taxes on retirement accounts (known as superannuation funds) from 15% to 30% for those exceeding $3 million Australian dollars. They sold it as only affecting the wealthiest 0.5% of people. Sounds familiar, right?

But as many of us have learned the hard way, the devil’s always hiding in those details. This tax would’ve hit unrealized gains. Think about that for a minute… If your farmland goes up in value—just on paper, nothing sold—you’d owe taxes on that increase even though you’ve got zero extra cash in your pocket.

Let me paint you a picture. Say you’ve got 500 acres in your retirement structure worth about $3.8 million. Urban sprawl has increased nearby property values by 10% this year. Under what they proposed, you’d suddenly owe around $30,000 in taxes on that $300,000 paper gain. The National Farmers’ Federation ran these exact numbers in their modeling, and it’s sobering stuff.

Where’s that cash coming from when you’re already managing tight margins? You and I both know the answer—you’d have to sell something. Equipment. Land. Maybe part of that herd you’ve spent years building.

KEY AUSTRALIAN VICTORY STATISTICS:

- 3,500 farm retirement funds are immediately affected

- 14,000 additional farms at risk through appreciation

- 6.7% of affected funds lacked liquidity to pay without asset sales

- 2-year sustained campaign from proposal to reversal

What’s particularly concerning is what Ben Bennett from Australian Dairy Farmers pointed out after the reversal—this would’ve forced farmers to liquidate productive assets just to pay taxes on gains they hadn’t realized. The University of Adelaide’s agricultural economists collaborated with the SMSF Association, utilizing Tax Office data, and confirmed the numbers above.

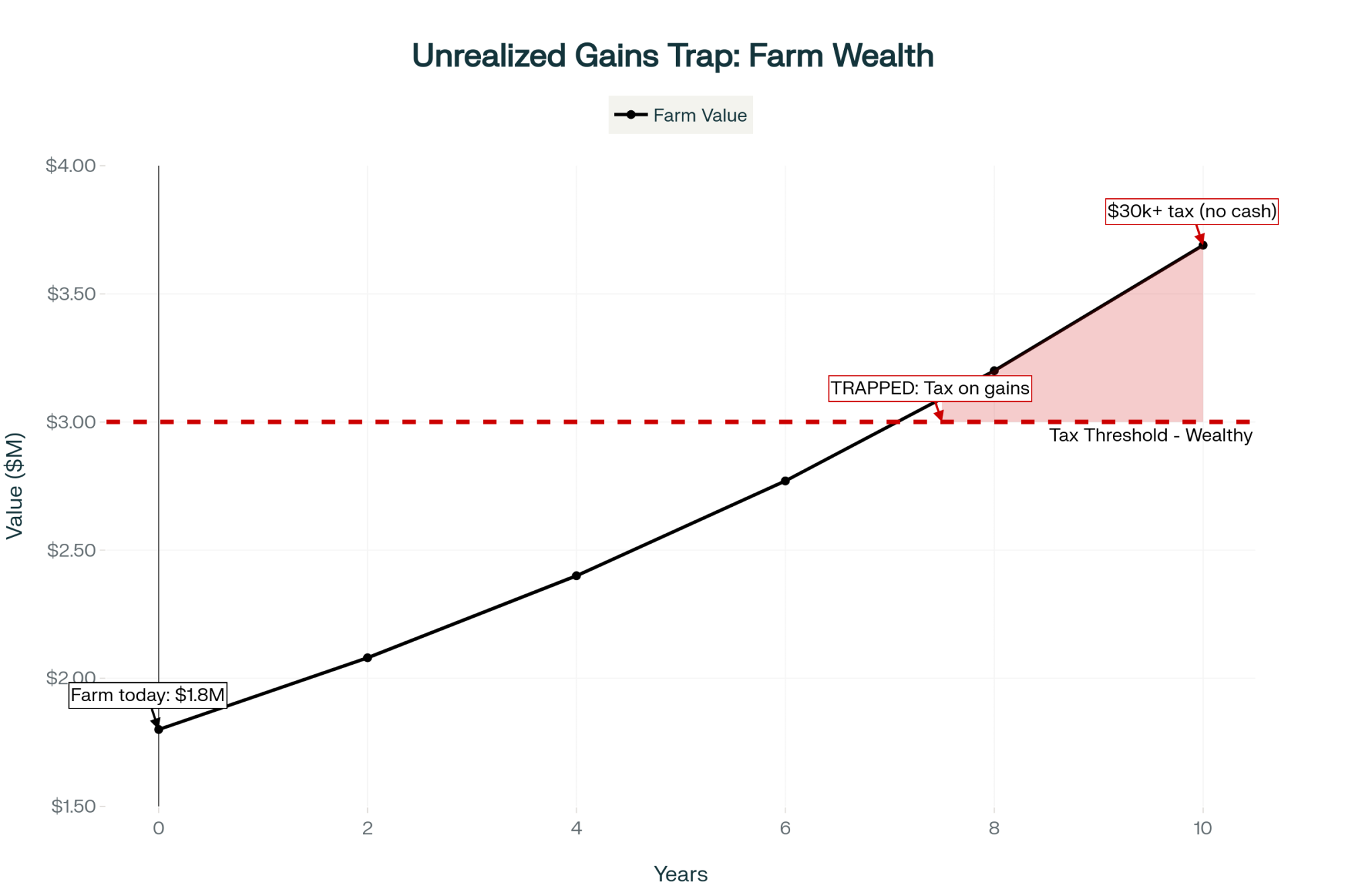

And here’s where it gets really sneaky… the threshold wasn’t indexed to inflation. Rural Bank’s farmland reports—carefully tracked by them—show that agricultural land has been appreciating at a rate of 7 to 8% annually over the past couple of decades. With those numbers, a farm worth $1.8 million today would cross the $3 million threshold in about a decade, simply through normal market movement. That’s not farmers getting wealthy. That’s a trap being set.

Now, I should mention that from the Treasury’s perspective, they were seeking revenue to fund other programs and viewed large retirement accounts as under-taxed wealth. But the fundamental problem was they didn’t understand—or didn’t care—about the difference between liquid financial assets and productive agricultural land. Whether you’re running a sole proprietorship or an incorporated business, the impact would’ve been devastating.

How They Built a Winning Strategy

What Australian farmers did differently from what we typically see is worth paying attention to. You know the usual playbook—angry press releases, tractors at the capitol, emotional testimony. Gets headlines for a week, then everyone goes back to milking, and the government just proceeds anyway.

The Aussies took a completely different path, and honestly, it’s brilliant.

Taking Time to Build the Case

First thing they did? Nothing public for 48 hours. I know that sounds counterintuitive—your gut says fight back immediately. But they used that time to build something more powerful than outrage.

During those two days, the National Farmers’ Federation got university economists from places like the University of Adelaide analyzing the real impacts. They pulled Australian Taxation Office data showing that there were approximately 610,000 self-managed super funds in the country. They identified specific technical problems—unrealized gains taxation and no inflation indexing—rather than simply calling it unfair.

When they finally went public, they didn’t lead with emotion. They presented hard data from their work with ASF Audits and university researchers: “Initial analysis shows 3,500 agricultural funds immediately affected, with 17,000 at risk based on historical appreciation.”

The difference that makes… it’s huge. One approach gets dismissed as farmers complaining about everything. The other forces the government to respond to specific numbers, they can’t just wave them away.

Coalition Building That Changed Everything

Within a week—and this is where it gets really smart—they’d expanded way beyond farming. They brought in small business groups representing hundreds of thousands of operations, family business associations covering most Australian enterprises, and retirement fund administrators speaking for all fund holders nationally.

Now you might be thinking, why does this matter when we’re dealing with fresh cow management and keeping somatic cell counts in check? Here’s why: suddenly, it wasn’t just farmers fighting. The SMSF Association’s analysis revealed that 13,000 small businesses with commercial property were facing the same problem.

Think about the politics there… When it’s just us complaining, politicians can write that off as rural districts they might not need anyway. But when the plumber in suburban Sydney and the restaurant owner in Brisbane are facing the same issue? That changes everything.

Matthew Addison from the Council of Small Business Organizations said it perfectly after they won—the government had to listen to the concerns of the entire small business community about taxing unrealized gains.

Leveraging Government’s Own Data

What really impressed me was how they used the government’s own data against them. Instead of presenting estimates Treasury could dismiss as biased, they worked with independent firms like ASF Audits, which handles compliance for thousands of funds, to analyze actual tax records and project impacts nationally.

They had university validation, independent auditor confirmation, and Class Limited—a major fund administrator—all reaching the same conclusions using government baseline data. The class found that approximately 6.7% of the affected funds lacked sufficient liquid assets to cover their expenses without selling property.

When you’ve got that many independent sources saying the same thing using government numbers, Treasury can’t dismiss it as “industry special pleading.”

Sustaining Pressure Without Burning Out

You know how these fights usually go. Strong start, lots of energy… but after a few months, everyone needs to get back to farming. The volunteers burn out, donations dry up, and the government just waits you out. As many of us have seen with previous battles, that’s where things fall apart.

The Australians addressed this issue with a professional campaign infrastructure.

Professional Staff Made All the Difference

The National Farmers’ Federation employs full-time people whose actual job is managing these multi-year campaigns. Not lobbyists having lunch with legislators. Not policy people writing papers. Campaign managers who wake up thinking about coalition coordination and maintaining pressure. You can see this in their “United Advocacy, Stronger Outcomes” roadmap and their annual reports.

When this tax got proposed, they didn’t scramble to figure out who’d run things. They activated what was already in place—committees with real authority to make decisions, budgets already approved through membership dues, and professional staff who kept things moving even when farmers were deep in calving season or dealing with heat stress affecting production.

Strategic Escalation at Key Moments

The campaign ran nearly two years, but here’s what’s smart—they didn’t try to maintain crisis-level intensity the whole time. NFF President David Jochinke discussed this in various forums, noting that they escalated strategically. Senate hearings in November 2024. Budget prep in early 2025. Right before the May 2025 federal election, when politicians get nervous.

Between those peaks, professional staff kept things coordinated, allowing farmers to focus on their operations. It’s like managing your breeding program—you don’t check every cow daily, but you never completely drop the protocol either.

The Admission That Changed Everything

Here’s the turning point: During Senate Economics Committee hearings, sustained pressure forced Treasury officials to admit something devastating. They hadn’t actually modeled how many agricultural businesses would be affected. The transcripts are public—they literally admitted they proposed this massive change without analyzing who’d be hurt.

Once that information was released and the farm coalition filled the gap with detailed evidence from groups like GrainGrowers and the University of Adelaide, the policy became politically toxic. How do you defend something when your own Treasury admits they didn’t study the impact?

Why This Matters for North American Dairy

So why should you care about Australian tax battles when you’re dealing with milk prices, managing components, trying to keep things running in this economy?

Because what’s happening isn’t random. Look at the pattern:

Canada attempted to increase capital gains inclusion from 50% to 66.7% on farms in April 2024. After massive pushback led by the Canadian Federation of Agriculture, they reversed it in March 2025. The UK has just eliminated agricultural property relief in its October Budget—protests by the National Farmers Union are still ongoing. Here in the US, we’re looking at estate tax exemptions potentially dropping from approximately $14 million to around $7 million when the Tax Cuts and Jobs Act provisions expire in 2026, according to projections from the Congressional Budget Office. And that’s before we even consider current congressional discussions about eliminating the stepped-up basis for inherited assets.

What I’ve found looking into this is these aren’t coincidental. The OECD has been publishing reports since 2020, calling agricultural land “undertaxed.” The G20 finance ministers met in Brazil last November to discuss coordinated wealth taxation. Agricultural land is explicitly on their radar.

Building Our Defense Now

| Organization | Annual Budget | Recommended (10-15%) | vs Australian Benchmark |

| Nat’l Milk Producers | $13M | $1.3M-$2.0M | 5-8x Australian |

| Midwest Dairy | $25M | $2.5M-$3.8M | 10-15x Australian |

| Dairy Farmers Canada | $9M CAD | $900K-$1.4M | 3.6-5.6x Australian |

| TOTAL | $47M+ | $4.7M-$7.2M | 19-29x winning benchmark |

What struck me about the Australian win is that they had everything in place before the crisis hit. Their committees, professional staff, coalition relationships—all ready to go.

Most North American dairy organizations… we’re not there yet. Consider the National Milk Producers Federation, which has a $13 million budget, as shown in its Form 990s, or Dairy Farmers of Canada, with a budget of approximately $9 million Canadian. They certainly have government relations personnel. But campaign managers who can sustain multi-year fights? That’s rare.

Building this capability means:

Professional staff whose job is coordinating campaigns, not just maintaining relationships. That’s about $150,000 annually for someone with real experience.

Committees that can actually make decisions without waiting for quarterly board meetings. When the Treasury announces something on Friday afternoon—and they love Friday afternoons—you need to respond on Monday morning.

Real partnerships already in place with groups like the National Federation of Independent Business and their 600,000 members, and the Farm Bureau with 6 million member families.

Current data ready to go. Operations by congressional district using USDA Census numbers. Estate values from Federal Reserve ag finance reports.

The Critical First 72 Hours

If Treasury announced an unrealized gains tax tomorrow morning—and given revenue pressures, it could happen—what happens in the next 72 hours would largely determine whether you win or lose.

Here’s what works: Don’t issue emotional statements right away. Secure your resources—the Australians spent approximately $250,000 in their first 90 days—and hire independent economists to analyze the impacts. Gather baseline data from USDA, reach out to coalition partners with actual phone calls, and draft messaging about specific policy flaws. Hold a real coordination meeting with assigned responsibilities, then release preliminary data by congressional district.

Practical Steps for Today

Whether you’re milking 50 cows in Vermont or running 5,000 head in New Mexico dry lots, there are things worth doing now.

For Your Own Operation

Document your succession structure now. What’s your operation worth according to your lender’s recent appraisal? What’s your tax exposure under different scenarios? How much actual liquidity do you have—real cash you can access, not equity in cattle or equipment?

When challenges come—and based on OECD coordination, they will—specific numbers carry weight. Being able to say “according to our CPA, we face $247,000 in tax liability with $31,000 in liquid assets, forcing sale of productive acreage” makes it real for policymakers.

For Our Organizations

The gap between Australian success and typical North American outcomes isn’t passion—it’s infrastructure. Professional campaign management differs from government relations.

Yes, that means real investment. Considering groups like Midwest Dairy, with a $25 million budget, we’re talking about 10-15% of the budget going towards this capability. Sounds like a lot until you consider the asset values at risk across our industry.

Working Together Internationally

What’s happening globally through OECD frameworks and G20 coordination requires similar coordination in response. When Australian farmers can cite Canadian reversals and we can reference Australian successes, it shows these aren’t isolated issues but recognized challenges with proven solutions.

The Bottom Line

Here’s what Australian dairy farmers proved: You can defeat even Treasury-backed proposals with the right approach. Not through protests that make the news once. Not through emotional appeals. However, through professional campaigns that utilize the government’s own data to highlight problems, while building coalitions that make the political cost too high.

The principle they defended—that productive agricultural assets shouldn’t be taxed until actually sold—that’s fundamental to farm succession everywhere. When governments tax unrealized appreciation, they’re not just extracting revenue. They’re forcing the liquidation of productive capacity that feeds nations.

Given the developments through international coordination, revenue pressures, and ongoing discussions, we can expect similar proposals within 18 months in North America.

Australian farmers invested in capability before their crisis. When Division 296 emerged, they activated existing systems rather than scrambling to do so. The result protected thousands of family operations from devastating tax changes.

That’s the lesson—not that Australian farmers are tougher, but that they invested in organizational capability to win before they needed it. They made that choice when things were calm, not in panic mode.

The blueprint exists, and it’s been proven effective. Whether North American dairy follows that model or continues with traditional approaches will likely determine how we navigate the succession planning challenges ahead. And looking at what’s developing globally through OECD and G20 frameworks… our clock’s already ticking.

What I’ve found is that those who prepare systematically tend to succeed. Those who react emotionally usually struggle. The Australians just showed us which path leads to victory. Now it’s up to us to decide which way we’re going.

KEY TAKEAWAYS

- Build before the battle: Australian farmers had professional campaign infrastructure ready BEFORE the tax hit—scrambling after Treasury announces means you’ve already lost

- $250K beats $30K tax bills: Investing in professional campaign management (1% of major dairy org budgets) protected 17,000 farms from forced asset sales

- Government data is your weapon: Proving 6.7% of farms lacked liquidity using Treasury’s own numbers worked; emotional “save family farms” appeals failed

- Small businesses are your secret army: 13,000 affected plumbers and restaurant owners made suburban politicians care about a “rural” issue

- 18 months until impact: With U.S. estate exemptions dropping 50% in 2026 and OECD coordinating globally, your window to build defense is closing fast

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Navigating the Crossroads: A Dairy Farmer’s Guide to Succession Planning – While the main article details the political threat to your farm’s future, this guide provides the tactical framework for protecting it. It reveals actionable steps for structuring your operation to shield assets and ensure a smooth, tax-efficient transition.

- The Tightrope of 2025: Balancing Dairy Profitability in a Volatile Market – To understand why a new wealth tax would be devastating, you need to know the numbers. This analysis details the current economic pressures on margins, reinforcing the urgency of the Australian fight by showing just how little room there is for error.

- Digital Due Diligence: Using AgTech for Accurate Farm Asset Valuation – The Australian fight was won with data. This article demonstrates how to use modern technology to get a precise, defensible valuation of your assets—the exact data you’ll need to model tax impacts and build a powerful, evidence-based political defense.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!