The $3 drop from January’s $20.34 to today’s $17.59 milk price costs a 500-cow dairy $1,800 daily

EXECUTIVE SUMMARY: What farmers are discovering right now is a fundamental disconnect between milk prices and production costs that goes beyond normal market cycles—the September Class III price of $17.59 represents a $3 drop from January’s highs, costing typical Midwest operations roughly $135 per cow monthly. Recent USDA data confirm that we’ve lost 15,532 dairy farms (nearly 40%) between 2017 and 2022, yet milk production increased by 8%. As a result, the largest 3% of operations now produce over half of our milk supply. Cornell and Penn State research shows that successful adaptations are emerging: direct marketing captures $2-4 premiums per gallon, precision feeding delivers 8-12% efficiency gains with sub-two-year paybacks, and strategic breed shifts to Jerseys improve component economics. The $5-8 billion in processor investments signals continued consolidation ahead, but innovative mid-sized operations are finding profitable niches through differentiation, technology adoption, and regional market advantages. Here’s what this means for your operation: understanding these structural shifts—not waiting for prices to “return to normal”—becomes essential for making informed decisions about expansion, technology investments, or alternative marketing strategies that align with your farm’s specific strengths and local opportunities.

You know how it is at 4:30 AM—there’s something about that quiet time in the parlor that gets you thinking. Recently, I’ve been giving a lot of thought to where we stand with milk prices and what it means for all of us trying to make a living in the dairy industry.

I’ve spent the past few weeks reviewing the latest market data and, more importantly, speaking with producers from Wisconsin to Pennsylvania, California, and even the Southeastern United States. What’s emerging is… well, it’s complicated. However, it’s worth understanding because it affects each of us differently.

Where Prices Stand Right Now

So here’s where we are. The USDA announced in early October that September’s Class III came in at $17.59 per hundredweight—that’s up thirty-five cents from August. Now, if you’re like me, you probably remember those January and February prices this year—$20.34 and $20.18, according to the Federal Milk Marketing Order announcements. That three-dollar difference? You’re feeling it in your milk check, I guarantee it.

The disconnect between costs and prices becomes even clearer when you look at this historically. The Bureau of Labor Statistics’ inflation calculators indicate that if milk prices had kept pace with general inflation since the 1970s, we’d be looking at significantly higher prices today. The gap represents something deeper happening in our industry.

At a co-op meeting last month, I heard a producer from central Wisconsin say it perfectly: “My dad used to be able to predict milk prices within reason based on feed costs and what was happening in the general economy. That relationship? It’s just gone now.” And you know what? He’s absolutely right.

As we head into the winter feeding season—with concerns about feed inventory on everyone’s mind after the variable growing conditions this past summer—that disconnect between costs and prices feels even more pronounced. Many of us are already planning for the spring flush, wondering whether to push production or hold back, given the potential direction of prices.

Quick Reference: Key Numbers to Know

- Current Class III: $17.59/cwt (September 2025)

- Make Allowances (June 1, 2025): Cheese $0.2504/lb, Butter $0.2257/lb

- Farms Lost (2017-2022): 15,532 operations (39.5% decline)

- Typical Robot Cost: $180,000-250,000

- Organic Premium Range: $35-40/cwt

- Beef-on-Dairy Premium: $200-400/calf

The Processing Side of Things

What many of us are realizing is how dramatically the processing landscape has shifted. Remember when you had four or five plants competing for your milk? According to USDA Agricultural Marketing Service data, most regions now have just one or two buyers. That’s a dramatic shift in negotiating power.

Those Federal Milk Marketing Order changes that took effect on June 1—the make allowances increased as documented in the Federal Register. Cheese to $0.2504 per pound, butter to $0.2257. Now, these might sound like small adjustments, but multiply them across your production… For those Upper Midwest operations shipping anywhere from 35,000 to 45,000 pounds daily—which is pretty typical for a 400 to 500-cow herd with decent production—that’s real money coming right out of the milk check.

The regional differences are striking, too. Northeast producers often have access to those fluid markets—though university extension reports from Cornell show the premiums aren’t what they used to be, averaging just $2-3 above manufacturing milk. Meanwhile, those of us in the Midwest are primarily dealing with fluctuating milk prices.

| Region | Average Herd Size | Fluid Market Access | Heat Stress Costs | Processing Options | Direct Marketing Potential | Labor Availability | Feed Cost Advantage |

| Upper Midwest | 400-500 cows | Limited | $0 | 1-2 buyers | Moderate | Challenging | Corn/soy belt |

| Northeast | 200-300 cows | Good ($2-3 premium) | $25-35/cow | 3-4 buyers | High ($2-4/gal premium) | Very challenging | Higher costs |

| California | 1,300+ cows | Manufacturing focus | $35-50/cow | Multiple co-ops | Low | Moderate | Variable |

| Southeast | 300-400 cows | Some fluid access | $50-75/cow | 2-3 buyers | Growing | Challenging | Heat stress offset |

California’s situation is unique, too. They’ve been in the Federal Order system since November 2018, but with average herd sizes over 1,300 head according to California Department of Food and Agriculture data, they’re operating at a completely different scale. And down in the Southeast? Those folks are dealing with heat stress management costs that can range from $50 to $ 75 per cow annually, according to University of Georgia research, which eats into any fluid premiums they might capture.

Looking at processor investments, we’re seeing announcements totaling $5-8 billion in new facilities coming online by 2026, based on industry reports and construction permits. For example, Dairy Farmers of America alone announced over $1 billion in processing expansions this year. They’re clearly betting on continued consolidation.

| Farm Size Category | 2017 Farms | 2022 Farms | Change (%) | Milk Production Share 2022 | Survival Strategy |

| Under 100 cows | 23170 | 14129 | -39% | 7% | Niche marketing/Exit |

| 100-499 cows | 11000 | 7326 | -33% | 17% | Efficiency/Technology |

| 500-999 cows | 2054 | 1434 | -30% | 16% | Scale up or specialize |

| 1,000-2,499 cows | 1365 | 1179 | -14% | 31% | Continued expansion |

| 2,500+ cows | 714 | 834 | +17% | 29% | Market dominance |

Learning From Our Neighbors North

It’s worth examining what’s happening in Canada with their supply management system. Statistics Canada reports show that their dairy farms maintain more predictable margins, with average net farm income significantly higher than that of comparable U.S. operations. Their farms tend to have debt-to-asset ratios of around 20%, according to Farm Credit Canada, compared to the 35-40% range reported by the USDA Economic Research Service for U.S. dairy operations.

They pay more for milk in Canada, no question—retail prices run about 30% higher according to comparative price studies. However, they have been chosen by a society that expects farms to be profitable enough to survive and pass on to future generations. We’ve made different choices here, and… well, we’re living with the consequences of those choices.

I was talking with a producer at the Pennsylvania Farm Show who said, “We keep looking for the perfect system, but maybe it’s about finding what works for each operation within the system we’ve got.” That really resonates with me.

What Producers Are Doing to Adapt

Despite all these challenges, I’m seeing some really creative adaptations out there. And it’s worth sharing because even if something doesn’t work for your operation, it might spark an idea that does.

Direct marketing is one path that’s gaining traction, especially for farms near population centers. Penn State Extension’s research shows that operations successfully transitioning to direct marketing can capture margins of $2 to $ 4 per gallon above commodity prices. I am aware of a typical mid-sized operation in Pennsylvania—approximately 300 cows—that invested around $800,000 in a bottled milk processing facility a few years ago. They’re now capturing significantly better margins on about a third of their production and expect to hit payback within four to five years. The capital requirements are substantial—USDA’s Value-Added Producer Grant program data shows typical processing facility investments range from $500,000 to $2 million. But those who make it work? They’re capturing margins that completely change the equation.

The organic market has gotten more complex. USDA Agricultural Marketing Service Organic Dairy Market News reports indicate that premiums are currently running $35-40 per hundredweight, but as more producers convert, those premiums are being squeezed. And we’ve seen major processors like Horizon Organic dropping dozens of farms when they have oversupply, so it’s not the guaranteed path it might have looked like a few years back.

Speaking of different approaches, I’ve noticed Jerseys making more economic sense for some operations lately. With butterfat premiums where they are and lower feed requirements per pound of components, a neighbor switched half his herd and says it’s working out better than expected.

The Technology Conversation

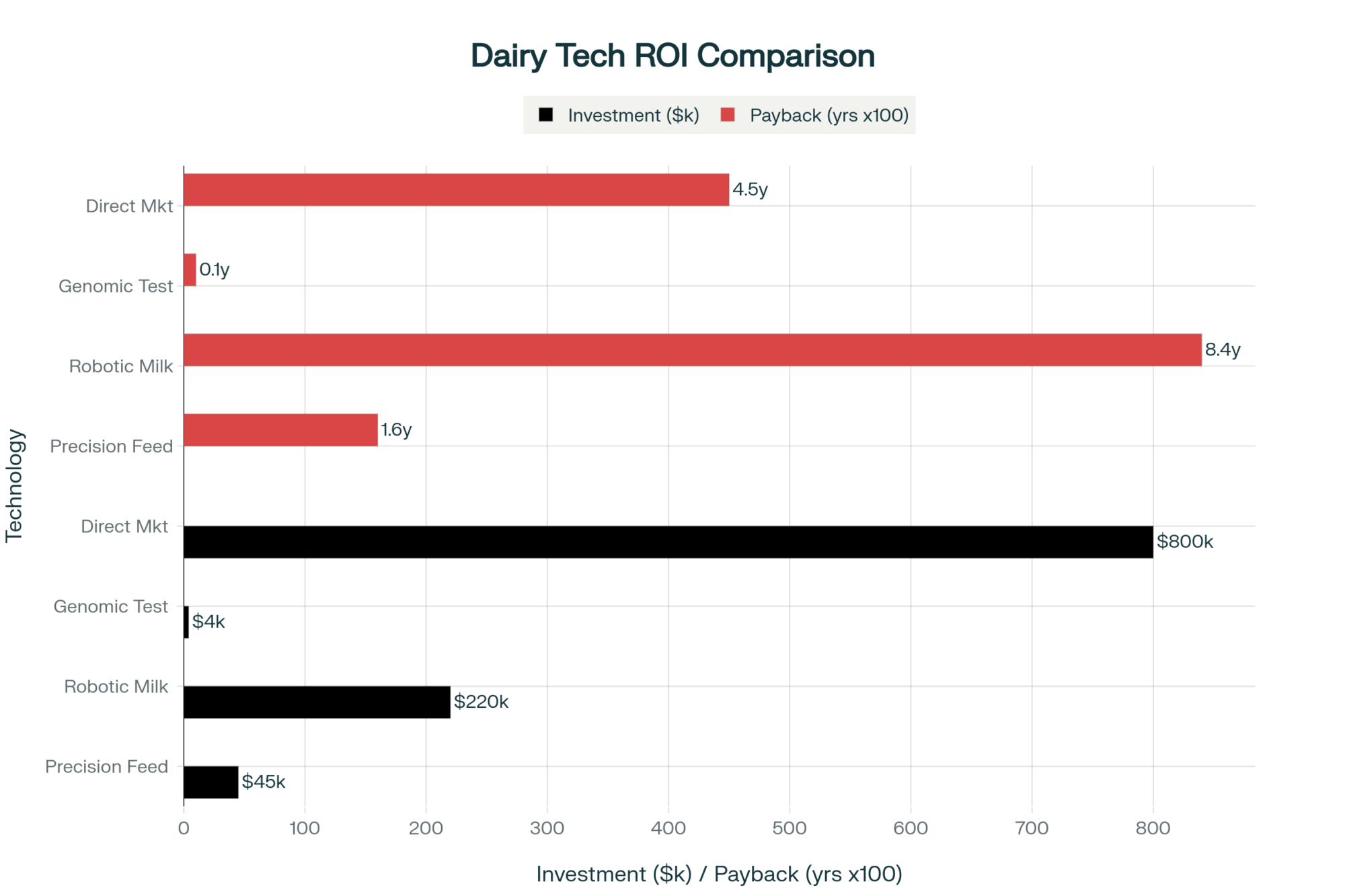

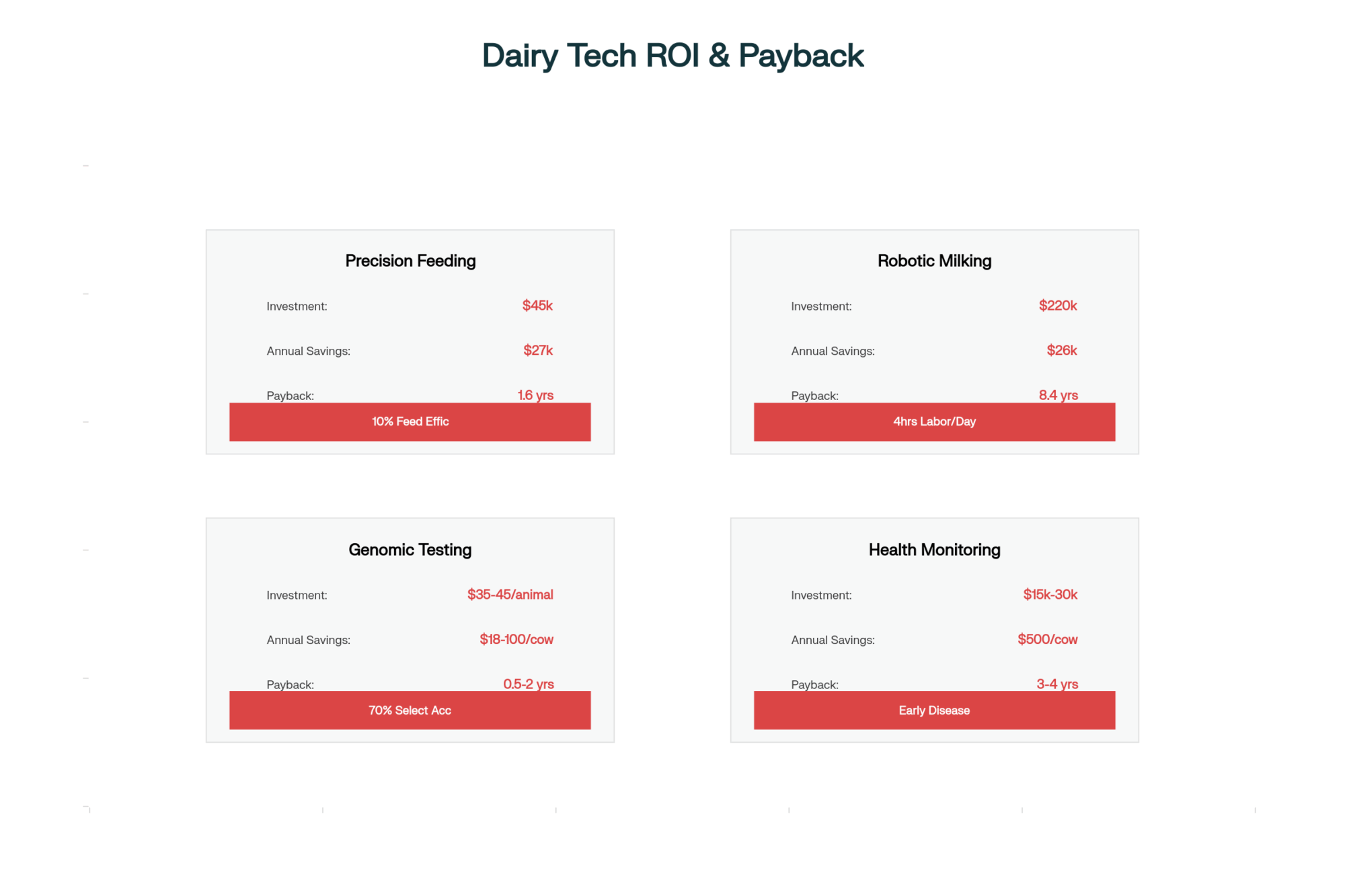

| Technology | Initial Investment | Annual Savings/Revenue | Payback Period | Key Success Factor | Risk Level |

| Precision Feeding (120 cows) | $45,000 | $27,360 | 1.6 years | 10% feed efficiency gain | Low |

| Robotic Milker (120 cows) | $220,000 | $26,280 | 8.4 years | Consistent protocols + labor shortage | Medium-High |

| Genomic Testing (per animal) | $35-45 | $18-100/cow | 0.5-2 years | 70% selection accuracy | Very Low |

| Health Monitoring (120 cows) | $20,000 | $500/cow | 2-4 years | Early disease detection | Low |

| Direct Marketing Setup | $800,000 | $2-4/gal premium | 4-5 years | Near population centers | High |

Here’s a discussion I’m having everywhere I go: should you invest in technology when margins are this tight?

Penn State Extension’s dairy team has done excellent work showing that precision feeding systems can deliver real returns—typically 8-12% improvement in feed efficiency. Cornell’s Dairy Farm Business Summaries indicate that feed costs typically range between $8 and $11 per hundredweight of milk produced, making significant efficiency gains.

Let me give you a concrete example: A 120-cow operation investing $45,000 in precision feeding, saving 10% on feed at $9.50/cwt, producing 24,000 pounds per cow annually—that’s about $27,360 in annual savings. You’re looking at less than two years payback if everything goes right.

Robotic milkers? That’s even more complex. University of Wisconsin research shows labor savings of three to four hours daily per robot, which, at $15-$ 20 per hour, adds up. Take that same 120-cow operation: one robot at $220,000, saving 4 hours daily at $18/hour equals $26,280 annual labor savings. Before any production increases or milk quality improvements, you’re looking at 8+ years for payback. Most extension analyses indicate that total payback periods typically range from 5 to 8 years when factoring in all costs.

A producer from Michigan, whom I met at World Dairy Expo, put it well: “Technology is a tool, not a solution. It works when it fits your operation, your finances, and your management style.”

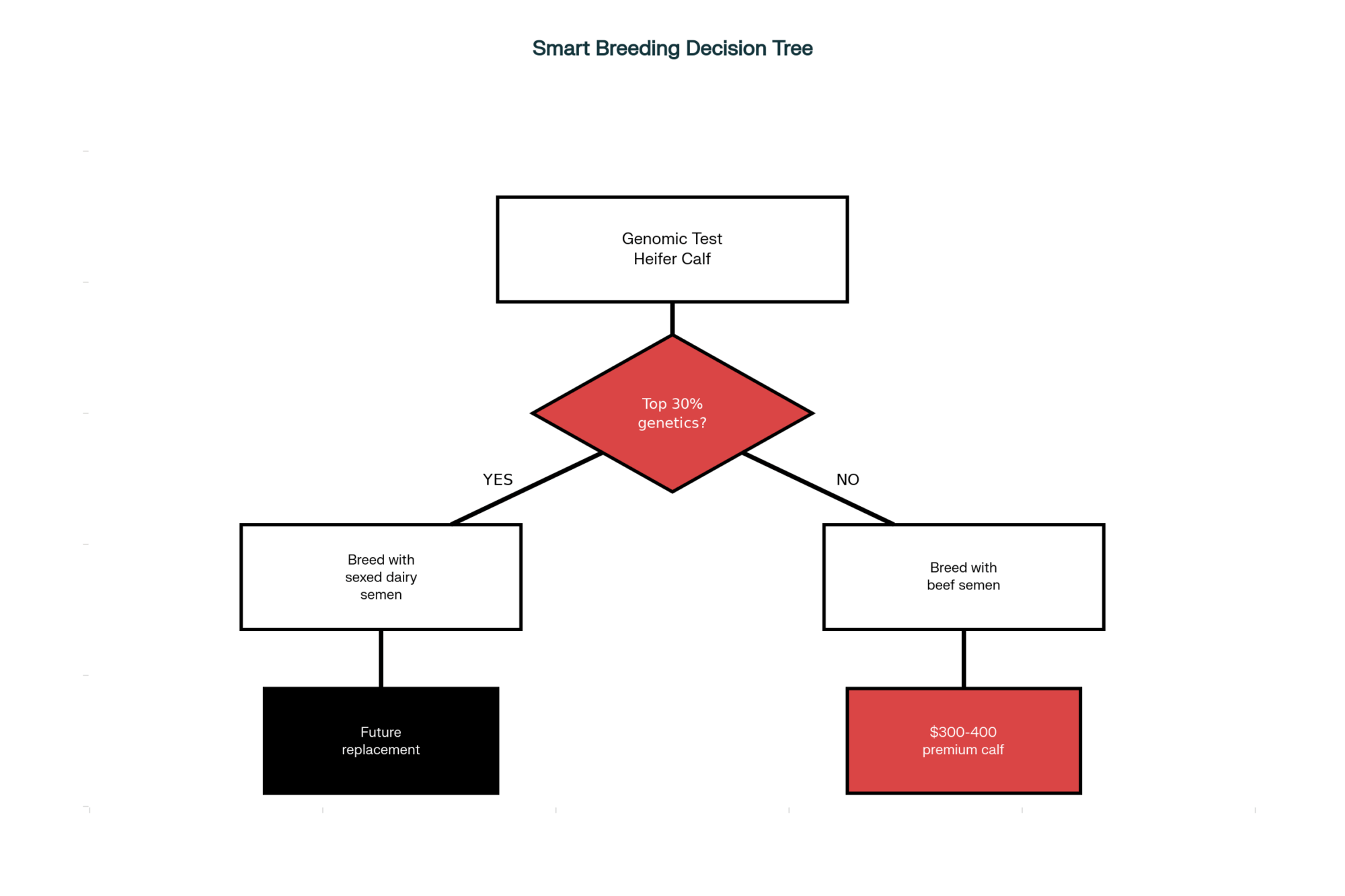

And speaking of management, the heifer side of things is getting interesting too. With replacement heifer values where they are and beef-on-dairy premiums running $200-$ 400 per calf, according to recent market reports, more operations are rethinking their entire replacement strategy. Add in genomic testing at $35-45 per animal (companies like Zoetis CLARIFIDE or STgenetics), and you can really target which heifers to keep. Do you raise every heifer, or do you breed your best cows for replacements and use beef semen on the rest? It’s a conversation worth having.

Where We’re Heading

The 2022 Census of Agriculture numbers were eye-opening. We went from 40,002 dairy farms in 2017 to just 24,470 in 2022. That’s… that’s nearly 40% of our dairy farms gone in just five years. But here’s what’s really telling: USDA National Agricultural Statistics Service data shows milk production actually went up 8% during that same period.

The larger operations are picking up that production and then some. Economic Research Service analysis shows that the largest 3% of dairy farms now produce over 50% of our milk. The economics increasingly favor these bigger dairies, and you can see processors positioning themselves for a future with fewer, larger suppliers in their capital investment patterns.

The mid-sized dairies—those 200 to 500-cow operations that are too big for niche marketing but don’t have the scale of the really large operations—they’re in a particularly tough spot, according to most agricultural economists. But I’m still seeing innovative mid-sized farms finding ways through differentiation, efficiency improvements, or strategic partnerships.

Geography matters more than ever now. A 200-cow dairy near Madison or Burlington might actually have opportunities that a 1,000-cow operation in northern Minnesota doesn’t have. It’s all about understanding and leveraging what advantages you do have.

Making Sense of Your Own Situation

Every operation is different—your debt structure, your family situation, where you’re located, what you’re good at managing. There’s no one-size-fits-all answer here, but there are some things worth thinking about as we head into the winter planning season.

If you’ve got kids who genuinely want to farm, that changes your whole calculation compared to someone whose kids are happily working in town. And that’s okay—there’s no judgment there. It’s just about being honest about what makes sense for your family.

Your financial structure significantly determines your flexibility. Cornell’s Dairy Farm Business Summaries consistently show operations with debt-to-asset ratios under 30% have significantly more options during tough times. As that ratio climbs above 40%, your options narrow pretty quickly. Every month of losses eats into that equity cushion you’ve built up over the years.

Location and market access create opportunities or constraints that you can’t ignore. Being within 50 miles of a city with over 100,000 people, having multiple processing options, and understanding your local food economy —all of these factors go into what strategies might work for you.

Looking Forward with Clear Eyes

Despite all these challenges, I’m actually encouraged by a lot of what I see. The innovation, the willingness to try new approaches while building on proven management practices, is a testament to the resilience in this industry that shouldn’t be underestimated.

I was at a young farmer meeting in Ohio where someone made a comment that really stuck: “We can’t control milk prices or feed costs, but we can control how we respond. That’s where our opportunity is.”

As we approach the spring flush, with all the management decisions that entail, such as breeding, culling, and production planning, the mindset of controlling what we can control becomes even more crucial. How we handle transition cows, fresh cow management, and even which bulls we’re using… these decisions matter more when margins are tight.

The industry’s going to keep evolving—global markets, consumer preferences, technology advances, policy changes—it’s all part of the mix. But farmers have always adapted. We’ve always found ways to make it work, even when “making it work” means making tough decisions about the future.

The Bottom Line

The economic pressures we’re facing—they’re real and they’re structural. Understanding them without sugar-coating but also without doom and gloom helps us make better decisions.

For some operations, expansion to capture scale economies makes sense. Others might find their path in differentiation or adding value to their product. And yes, for some, transitioning out of dairy might be the right decision for their family. Each choice reflects individual circumstances and priorities.

What matters is making informed decisions based on a realistic assessment of the situation. The dairy farmers I respect most look at their situation honestly, thoroughly explore options, and make decisions aligned with their family’s long-term well-being.

Whatever path you choose, make it with clear eyes about what’s happening in our industry. The decisions we make today—whether about technology, herd expansion, replacement strategies, or succession planning—shape not just our own operations but also the future of dairy farming.

The conversation continues, and your voice and experience are part of it. That’s what makes this industry worth being part of, even in these challenging times.

As my old neighbor used to say, “Dairy farming isn’t just about making milk—it’s about making decisions.” And right now, those decisions matter more than ever.

KEY TAKEAWAYS:

- Technology ROI varies dramatically by operation: Precision feeding systems ($45,000 investment) can deliver $27,360 annual savings on a 120-cow farm through 10% feed efficiency gains, achieving payback in under two years—while robotic milkers require 5-8 years for full ROI when factoring production increases and quality premiums

- Geographic advantage matters more than size: Operations within 50 miles of cities over 100,000 people can capture direct marketing premiums of $2-4/gallon, making a 200-cow dairy near Madison potentially more profitable than a 1,000-cow operation in remote Minnesota

- Debt structure determines flexibility: Cornell’s Farm Business Summaries show operations with debt-to-asset ratios under 30% maintain multiple adaptation options, while those above 40% face rapidly narrowing choices—making equity preservation as important as operational efficiency

- Heifer strategies are shifting fundamentally: With beef-on-dairy premiums at $200-400 per calf and genomic testing at $35-45 per animal, breeding only the top 30% of cows for replacements while using beef semen on the rest can add $15,000-30,000 annually to a 100-cow operation’s bottom line

- Regional processing dynamics create different realities: Southeast operations face $50-75 per cow in annual cooling costs that offset fluid premiums, while Upper Midwest farms shipping to single buyers lose negotiating power but benefit from lower operating costs—understanding your regional context shapes which strategies actually work

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The $3,800 Heifer Problem: How Smart Dairies Are Adapting When Beef Premiums Don’t Cover Replacement Costs – This article provides an in-depth, tactical analysis of today’s complex heifer market. It offers producers specific strategies to balance beef-on-dairy breeding, cow longevity, and genomic testing to reduce costly replacement needs and improve herd profitability in a challenging market.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – This strategic deep-dive reveals how component economics are replacing volume thinking and why the next wave of processing investments creates regional winners and losers. It helps producers understand the big-picture forces that are shaping prices and explains why traditional market analysis is failing.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – This article provides a comprehensive look at the ROI of modern technology, going beyond robotics to show how AI-powered health monitoring and precision feeding can deliver significant feed cost savings and production boosts, with clear payback timelines for farms of any size.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!