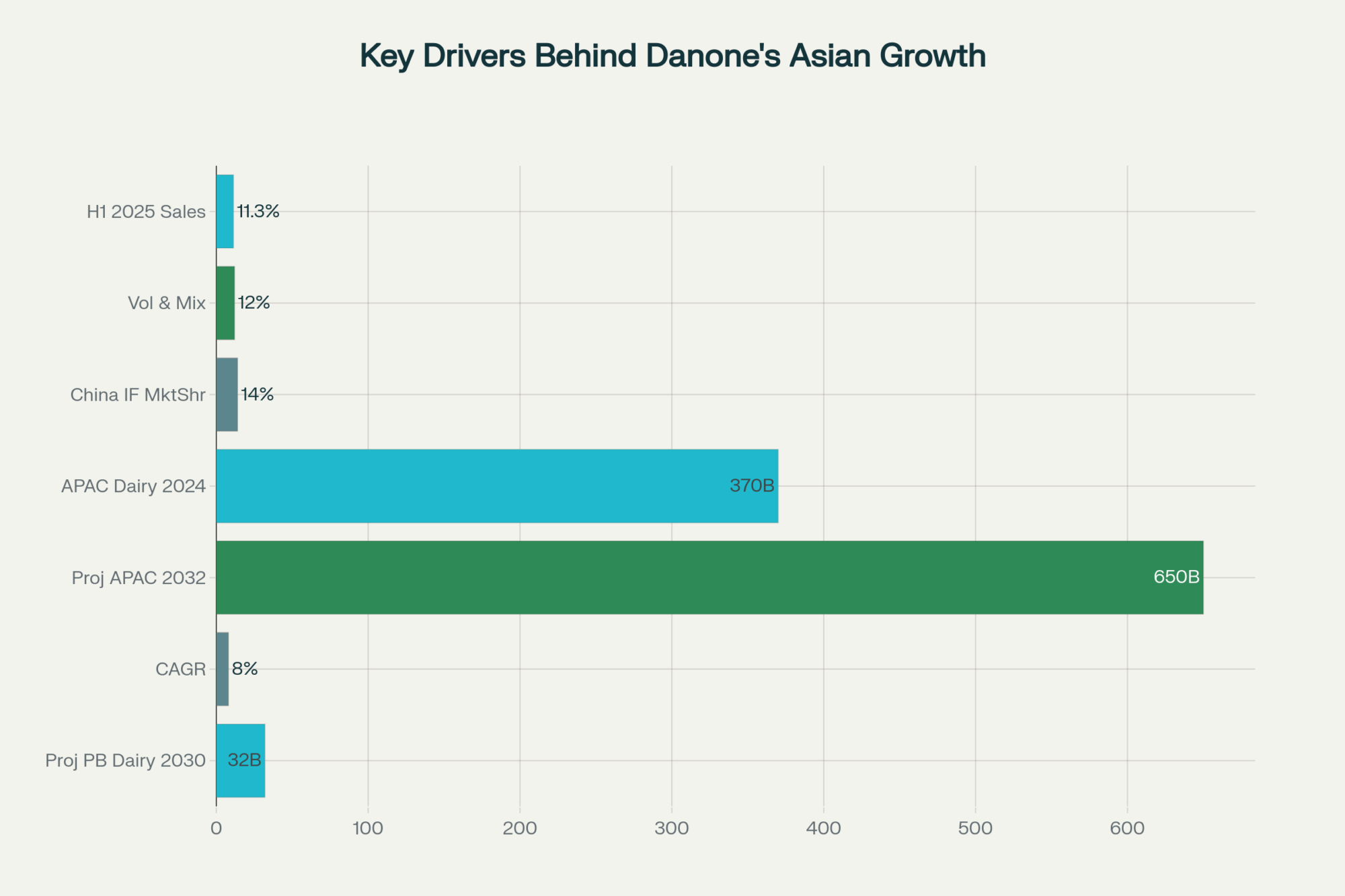

11.3% milk sales jump in Asia? Here’s what Danone’s feed efficiency gains mean for your genomic testing strategy.

Executive Summary: Listen, here’s what caught my attention about Danone’s H1 2025 numbers—they didn’t just post an 11.3% sales jump in Asia by accident. These guys combined smarter genomic selection with precision feed management and it’s paying off big time. Their volume/mix grew 12% while feed conversion ran 15% better than local averages, which any of us managing tight margins knows is gold. Plus, they’re commanding a 14% share in China’s infant formula market where consumers willingly pay dollar-plus premiums for enhanced nutrition. The Asia-Pacific dairy sector’s growing from $370 billion to $650 billion by 2032—that’s an 8% annual clip that’s not slowing down. What really gets me is they’re proving that genomic testing combined with feed efficiency isn’t just academic theory—it’s driving real ROI on commercial operations. Start looking at your genomic evaluation data differently and fine-tune those rations, because this approach is reshaping dairy profitability worldwide.

Key Takeaways

- Boost milk production 10-12% through targeted genomic selection—Focus on feed efficiency traits and health genetics that actually translate to pounds in the tank, not just fancy breeding papers.

- Cut feed costs up to 15% with precision feeding protocols—Match your ration to genetic potential and environmental conditions instead of using one-size-fits-all approaches that waste money.

- Capture premium pricing through component quality improvements—Target genomic markers linked to butterfat and protein production; those extra cents per hundredweight add up fast when you’re shipping volume.

- Leverage on-farm technology for real-time monitoring—Start small with sensors that track feed intake and health metrics, then scale as you see the payback in reduced veterinary costs and improved conception rates.

- Position for the premium nutrition wave hitting 2025—Asian markets are proving consumers will pay significantly more for functional dairy products, and similar trends are emerging stateside among health-conscious buyers.

The French dairy giant just cracked something big in Asia, and the strategies they’re using could reshape how we approach premium positioning and feed efficiency

Danone’s surge in Asia isn’t just a stat on a spreadsheet—it’s a game-changer sending ripples through global dairy markets.

In their H1 2025 results, Danone reported a solid 11.3% surge in sales across Asia, which is quite impressive and is grabbing attention worldwide. What strikes me is how they’ve combined smarter feed efficiency with savvy premium positioning, playing those cards so well that it’s shifting the industry’s playbook.

Let’s break that down.

The Numbers That Got Everyone’s Attention

Volume and mix sales grew by nearly 12%, while feed conversion is reportedly running about 15% better than local averages. I recently spoke with a few producers in Victoria—individuals who understand that feed optimization can make or break the bottom line, especially during challenging times. The regions driving growth include China and North Asia, with sales in those areas increasing by 12-13%. Danone’s specialized nutrition segment, including premium infant formulas, jumped an eye-opening 12.9%.

And here’s the kicker: they hold a commanding 14% of China’s infant formula market, as confirmed by NielsenIQ and Euromonitor reports.

Now, that’s significant.

Why This Market is Worth Your Attention

Why? Because the Asia-Pacific dairy market clocked in at about $370 billion last year, and it’s on pace to nearly double, reaching $650 billion by 2032, growing at a rate of roughly 8% annually, backed by IMARC and DataBridge insights. While Asia consumes half the world’s milk, its per capita intake still lags behind Western levels, leaving plenty of room for growth. And here’s a nugget to mull over: according to dairy market research from industry economists, consumers in these markets are dropping upwards of a dollar extra per serving for premium, protein-boosted dairy options. That’s a significant margin that savvy operators are chasing.

The Tech Side That’s Actually Working

On the tech side, Danone’s putting serious money behind it—investing €16 million in precision fermentation facilities slated for launch this year, aimed at creating plant-based proteins like casein and whey analogs. Meanwhile, on the ground in places like Victoria, farms fine-tuning feeding protocols and monitoring are clocking yield gains of over 10%.

And it’s not just tech—probiotic inclusion is reshaping the narrative of gut health. Meta-analyses and clinical studies published in the Journal of Dairy Science have confirmed that the inclusion of probiotics in dairy products offers measurable digestive health benefits, which can translate into enhanced product valuation, particularly in markets with high lactose sensitivity rates.

The Regulatory Reality Check

Of course, the regulatory maze is a challenge. China’s new infant formula standards have eliminated approximately 60% of smaller players, with compliance costs reaching nearly $250,000 per product, setting the bar high. The winners gain valuable exclusivity periods—a real market moat.

What This Means for Your Operation: Looking forward, Danone’s strategic reinvestment in R&D accounts for approximately 4-5% of revenue, with a laser-focused approach on protein innovation—a move that has helped their protein portfolio grow from modest beginnings to over € 1 billion recently.

Here’s what forward-thinking producers should consider:

- R&D Investment Strategy: Target 4-5% of revenue toward protein enhancement and functional ingredients

- Technology Adoption: Precision feeding and monitoring systems showing 10%+ yield improvements

- Premium Positioning: Functional dairy products commanding significant premiums per serving

- Regulatory Navigation: Understanding compliance requirements before entering premium segments

Don’t overlook the plant-based wave either—the sector’s forecasted to hit $32 billion by 2030, growing at a solid 13% annual clip, according to reports from Grand View and IMARC.

Navigating the Risks

Sure, the path isn’t without hurdles: currency hedging and trade disputes can cause significant cost fluctuations, with market volatility analyses showing potential swings up to 18% in supply chain costs. We all know that quality mishaps can wreak havoc as well. However, here’s the rub—according to market research on dairy premiumization trends, first movers often secure premiums 15-20% above the pack during market establishment phases.

Where This Leaves Us

So, what’s the takeaway?

Danone’s recent trajectory proves that to win, you need to nail operational efficiency, pair it with innovation, and master the regulatory play. That’s the new dairy blueprint—whether you’re eyeing Asian markets directly or applying premium positioning strategies closer to home.

The question in the room remains: are you set to dive in or watch from the sidelines? Because the moment is here, but the window won’t stay open forever.

That’s my take. What’s yours? Drop me a line in the comments below—I’d love to hear how you’re thinking about these global trends and what they mean for your operation.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Dairy Feed Efficiency Frontier: Pushing Your Margins – This piece moves from strategy to execution, offering practical methods for optimizing your TMR and forage quality. It provides a clear roadmap for lowering feed costs while maximizing the component yield that drives your milk check.

- Beyond the Bulk Price: Finding Profit in a Volatile Dairy Market – While the main article focuses on Danone’s premium play, this analysis broadens the lens. It uncovers key economic trends and identifies diverse strategies that progressive producers are using to navigate global volatility and unlock new, high-margin revenue streams.

- Genomics is Not a Crystal Ball… It’s a Roadmap – For those intrigued by the role of genetics in driving efficiency, this article breaks down how to leverage genomic data effectively. It demonstrates how to translate test results into a strategic breeding plan that delivers measurable return on investment.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!