$220 million in settlements since 2013 – and that’s just DFA. Your cooperative might be costing you more than you think.

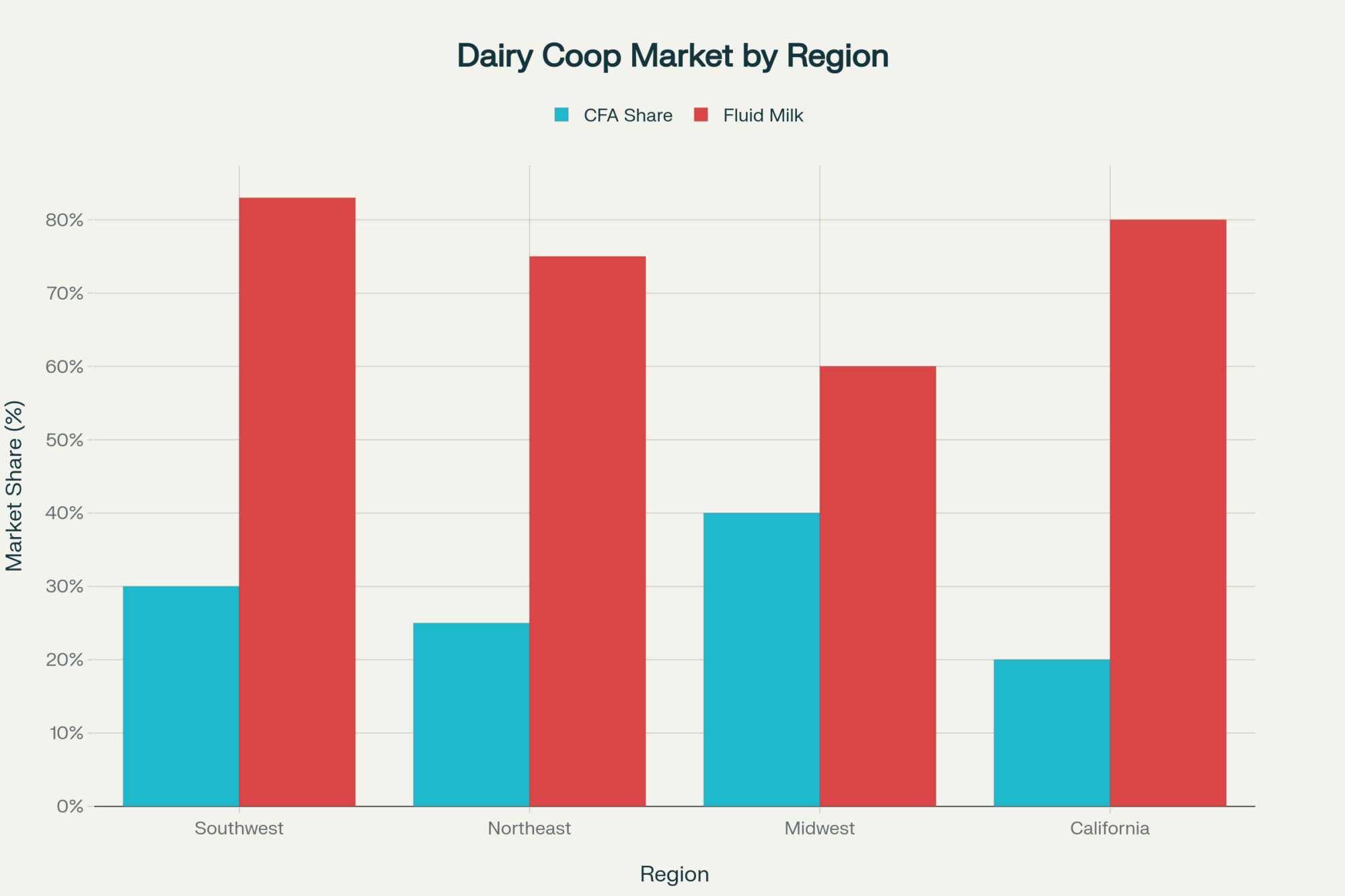

EXECUTIVE SUMMARY: Look, here’s what really gets me about this whole thing: DFA and Select Milk just paid $34.4 million because they allegedly worked together to suppress milk prices instead of competing for our business. We’re talking about a decade-long scheme affecting over $3.5 billion in production across five states. And this isn’t DFA’s first rodeo – they’ve now paid out over $220 million in antitrust settlements since 2013. The kicker? Those new FMMO reforms that kicked in this June are cutting another 85-90 cents per hundredweight from our checks while potentially making it easier for this kind of coordination to happen. With DFA controlling 30% of raw milk marketing and the top three companies holding 83% of fluid milk sales, we’ve got a concentration problem that’s only getting worse. Bottom line: if you’re not questioning your cooperative relationship and documenting everything, you’re leaving money on the table and missing the bigger picture.

KEY TAKEAWAYS:

- Document suspicious pricing patterns – if your cooperative and a “competitor” announce identical price changes within 24-48 hours, that’s worth noting and could be worth money later

- Question your cooperative’s conflicts of interest – if they’re setting your milk price AND profiting from processing margins, demand transparency at annual meetings and board minutes

- Explore alternative marketing channels – consider splitting production or direct processor contracts; one producer saw his main cooperative become more attentive after marketing just 30% elsewhere

- Know your legal rights under Capper-Volstead – most producers don’t understand their antitrust protections; it’s worth a conversation with an ag attorney

- Understand the transportation trap – with hauling costs over 75 cents per hundredweight beyond 150 miles, geographic concentration gives cooperatives more power to control pricing

What should keep you awake at night: the organizations supposedly fighting for better milk prices just paid $34.4 million because they were allegedly doing the exact opposite. When Dairy Farmers of America and Select Milk Producers write checks this large, it marks the third time DFA has been caught with its hand in the cookie jar since 2013. Think about that for a second – we’re talking about over $220 million in antitrust settlements from an organization that’s supposed to be working for farmers. At what point do we stop calling these “isolated incidents” and start recognizing a pattern?

Look, I’ve been watching this industry long enough to know when something stinks worse than a lagoon in July. This latest settlement isn’t really about the money, though DFA’s $24.5 million and Select Milk’s $9.9 million payout, as documented in Reuters’ July coverage, is certainly substantial.

How the Alleged Price-Fixing Scheme Actually Worked

The thing about this settlement is how systematic it all was. Court documents filed in the U.S. District Court for the District of New Mexico show that coordinated pricing strategies were implemented across New Mexico, Texas, Arizona, Oklahoma, and Kansas from January 2015 through June 2025 – a decade of alleged market manipulation affecting over $3.5 billion in annual dairy production.

Here’s what’s particularly troubling… instead of competing for your milk, these cooperatives allegedly worked together to keep prices artificially low. Dr. Michael Boehlje of Purdue University has written extensively about how cooperatives, once they achieve regional dominance, can effectively set procurement prices rather than compete for them – and this settlement seems to validate exactly that principle.

I’ve been speaking with producers in the settlement region, and what strikes me is the consistent reporting of similar patterns across their operations – neighbors shipping to supposedly competing cooperatives receiving identical pricing adjustments within days of each other. “Almost like they’re talking,” one told me. Turns out they might have been.

| Year | Settlement Amount | Region Affected | Key Details |

|---|---|---|---|

| 2013 | $140 million | Southeast US | Largest single settlement, class action involving multiple states |

| 2015 | $50 million | Northeast US | Regional cooperative pricing coordination allegations |

| 2025 | $34.4 million | Southwest US | Current settlement with DFA ($24.5M) and Select Milk ($9.9M) |

| Total | $224.4 million | Multiple regions | Demonstrates ongoing legal challenges over 12 years |

What really gets me is how this manipulation allegedly worked within the Federal Milk Marketing Order system. You know those FMMO mechanisms documented by USDA’s Agricultural Marketing Service that we’ve all been told protect fair pricing? When you have dominant cooperatives gaming the system, those protections can actually facilitate price manipulation rather than prevent it.

And here’s the kicker – those FMMO reforms that kicked in this June. The reforms implemented on June 1, 2025, increased make allowances, which are the estimated costs processors face in turning milk into cheese, butter, and other products. These increases effectively reduce the minimum prices guaranteed to producers under the milk pricing system, leading to lower net milk checks by $ 0.85 to $0.90 per hundredweight, according to an American Farm Bureau Federation analysis published by Brownfield Ag News.

Because make allowances are part of the pricing formula used by cooperatives and processors, those with processing operations can potentially exploit these changes to coordinate pricing behavior within the regulatory framework. This means regulatory reforms intended to improve market function might inadvertently provide opportunities for the very coordinated conduct antitrust laws aim to prevent.

The Market Structure Challenge Nobody Wants to Discuss

| Market Segment | Top Player Share | Top 3 Share | Competitive Status |

|---|---|---|---|

| Raw Milk Marketing | DFA: 30% | ~65% | Highly Concentrated |

| Fluid Milk Sales | DFA: 39.1% | 83% | Extremely Concentrated |

| Processing Capacity | Varies by region | 39-41% | Moderately Concentrated |

I’ve been tracking dairy consolidation for years, but the numbers from Farm Action’s 2024 agricultural concentration analysis still shock me. DFA now controls roughly 30% of all raw milk marketing in this country. In fluid milk sales? The top three companies – led by DFA at 39.1% – control 83% of the market.

This isn’t normal market evolution, folks. This is a systematic concentration that creates what economists call “coordinated effects,” where companies don’t need explicit agreements because parallel behavior yields the same results.

Geographic concentration makes it even worse. In the settlement region, average hauling costs exceed 75 cents per hundredweight beyond 150 miles, according to transportation cost analyses from New Mexico State University. That means even if you wanted to switch cooperatives or find alternative buyers, the transportation economics trap you with whoever controls your local market.

I’ve spoken to producers in West Texas who have no choice but to sell to the dominant cooperative – and now we understand why those cooperatives might not have been competing for their business. Meanwhile, in Vermont, you still have smaller regionals actually bidding against each other for milk. The difference? Market structure, pure and simple.

Here’s the thing, though – while we’re focusing on the risks of concentrated market power, it’s important to acknowledge that many cooperatives, even large ones, provide valuable services to their members. These include milk marketing expertise, risk management programs, and access to processing facilities that small producers might struggle to reach on their own. Not all cooperative actions are allegedly self-serving.

However, recognizing these benefits doesn’t mean turning a blind eye to concerns regarding transparency, governance, and negotiation power that affect producers. It’s about balancing cooperative advantages with addressing real market pressure points.

Innovation is another casualty of this market structure. Without competitive pressure, cooperatives have little incentive to improve services or offer value-added programs. I’ve seen cooperatives in competitive markets offering everything from feed purchasing programs to veterinary services. In concentrated markets? Good luck getting your field rep to return calls.

This Isn’t Just About DFA – It’s About Power

Here’s what really gets me… this isn’t happening in isolation. The Department of Justice’s February 2025 lawsuit against Agri Stats targeted the company for facilitating information exchanges among agricultural processors. The federal court approved JBS’s $83.5 million cattle settlement in March 2025. McDonald’s is suing the “Big Four” meatpackers for alleged price fixing.

We’re seeing systematic enforcement across agriculture because the consolidation problem has reached crisis levels. And dairy? We might be the worst example of all.

Agricultural law experts consistently point out that this settlement pattern suggests a coordinated enforcement strategy targeting systematic information sharing among agricultural cooperatives. Federal prosecutors are building case law that limits how cooperatives can share competitive intelligence.

The legal precedent here is huge. The Capper-Volstead Act provides cooperatives with limited antitrust exemptions, but these protections explicitly exclude price-fixing conspiracies. What this settlement establishes is that federal prosecutors now have both the tools and willingness to go after agricultural cooperatives that allegedly abuse market power.

Industry professionals tell me they’re starting to ask uncomfortable questions at cooperative annual meetings. Questions about pricing transparency, board representation, and why premium structures seem to favor the largest operations. The responses? Often, it’s just “that information is confidential.”

That’s when you know something’s wrong.

The Real-World Impact: What This Settlement Means for Your Farm

The financial impact of this particular settlement amounts to approximately 30-50 cents per hundredweight over the affected decade. Not life-changing money, but when you’re dealing with feed costs running in the high $200s to low $300s per ton range for protein-rich dairy rations (based on current USDA Economic Research Service livestock outlook reports) and credit lines running 7-8% (according to USDA Farm Service Agency’s July 2025 rate announcements), every cent matters.

However, what really matters is documentation. Antitrust enforcement increasingly relies on electronic communication evidence. If you’re experiencing pricing patterns that seem coordinated, if you’re receiving identical offers from supposedly competing buyers, or if your cooperative is sharing information about your operation with competitors, document everything.

Recent analysis indicates that traditional cooperative governance structures are breaking down as large operations gain disproportionate influence. The old “one farmer, one vote” system doesn’t work when mega-dairies can effectively control cooperative decision-making.

I’ve seen this firsthand in several western cooperatives – where operations shipping thousands of loads annually essentially dictate policy for hundreds of smaller producers who might ship 50 loads per year. Do you think they receive the same treatment? Same pricing discussions? Same board representation proportionally?

Not a chance.

So what are your options? Start evaluating alternative marketing arrangements – and I mean seriously evaluate them, not just grumble at coffee shop meetings. Consider direct processor contracts, but be prepared for the added complexity. Consider regional cooperatives that maintain competitive bidding environments.

The Uncomfortable Truth About “Farmer-Owned”

Look, here’s what the industry doesn’t want to admit – market concentration has reached the point where even farmer-owned organizations can allegedly harm farmers. When cooperatives gain sufficient market power, they cease competing for your milk and instead coordinate to control it.

This settlement proves legal remedies exist, but they require substantial evidence and years of litigation. The real question is whether we will continue to pretend that this is about isolated bad actors or start acknowledging that our current system creates structural incentives for anti-competitive behavior.

Current Class III futures are trading around $18-19 per hundredweight for August delivery, according to CME market data, and every dollar of that pricing reflects market structure problems we’ve been ignoring for too long. The next generation of producers isn’t just worried about volatile milk prices. They’re concerned about whether competitive markets even exist anymore.

This is particularly troubling because of how it affects the next generation. What’s especially troubling is how this impacts the next generation; I’ve heard of operations where the grandfather had relationships with multiple buyers, allowing him to negotiate favorable terms by playing them against each other. Now? There’s essentially one buyer for a 200-mile radius, and it’s take it or leave it.

“It’s not the same business my grandpa knew,” is something you hear a lot these days. “Sometimes I wonder if there’s a place for operations like ours anymore.”

That’s the real cost of concentration – not just the money, but the hope.

Your Action Plan: How to Protect Your Operation

Here’s your action plan – and I’m not talking about some consultant’s PowerPoint presentation. This is real-world stuff you can do tomorrow:

Document everything suspicious. Screenshots of emails, notes from phone calls, patterns in pricing announcements. If your cooperative announces price changes and a “competitor” follows within 24-48 hours with identical adjustments, that’s worth noting.

Understand your cooperative’s conflicts. If they’re setting your milk price and profiting from processing margins, you need to understand how those incentives align —or don’t. Ask uncomfortable questions at annual meetings. Demand transparency in board minutes.

Explore your alternatives. This might mean splitting your production, marketing some milk directly, or joining smaller regional cooperatives that still actually compete. One producer I know started marketing 30% of his milk through a different channel – suddenly, his main cooperative became a lot more attentive.

Know your legal rights. Most producers are unaware of the protections they actually have under antitrust law and the Capper-Volstead exemptions. It’s worth consulting with an agricultural attorney who understands cooperative law.

The dairy industry is at a crossroads. We can continue to pretend that farmer-owned always means farmer-first, or we can demand transparency and accountability. Federal enforcers are finally paying attention to agricultural market concentration.

The question is: will you be part of the change or just a victim of it?

After $220 million in settlements, it’s clear someone needs to stop being polite and start asking the hard questions about who’s really running the show in our markets.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – This strategic analysis provides a broader market context by detailing global production trends and consumer preferences for 2025. It helps producers understand the long-term economic forces shaping milk prices and reveals how to align their operations with shifting market dynamics for sustainable growth.

- Dairy Cooperative Marketing Is Broken – Here’s How the Indy 500 Fiasco Proves It – Dive into the tactical failures of cooperative marketing that prioritize “industry presence” over member profitability. This article provides practical strategies for evaluating your co-op’s marketing budget and demanding programs that generate measurable returns, ensuring your co-op is investing in your farm’s success.

- The Future of Dairy Farming: Embracing Automation, AI, and Sustainability in 2025 – While the main article focuses on market structure, this piece offers a forward-looking perspective on how to leverage technology. It explores how innovations in automation, AI, and whole-life monitoring can increase efficiency, reduce costs, and improve herd health, creating a more resilient operation against market volatility.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!