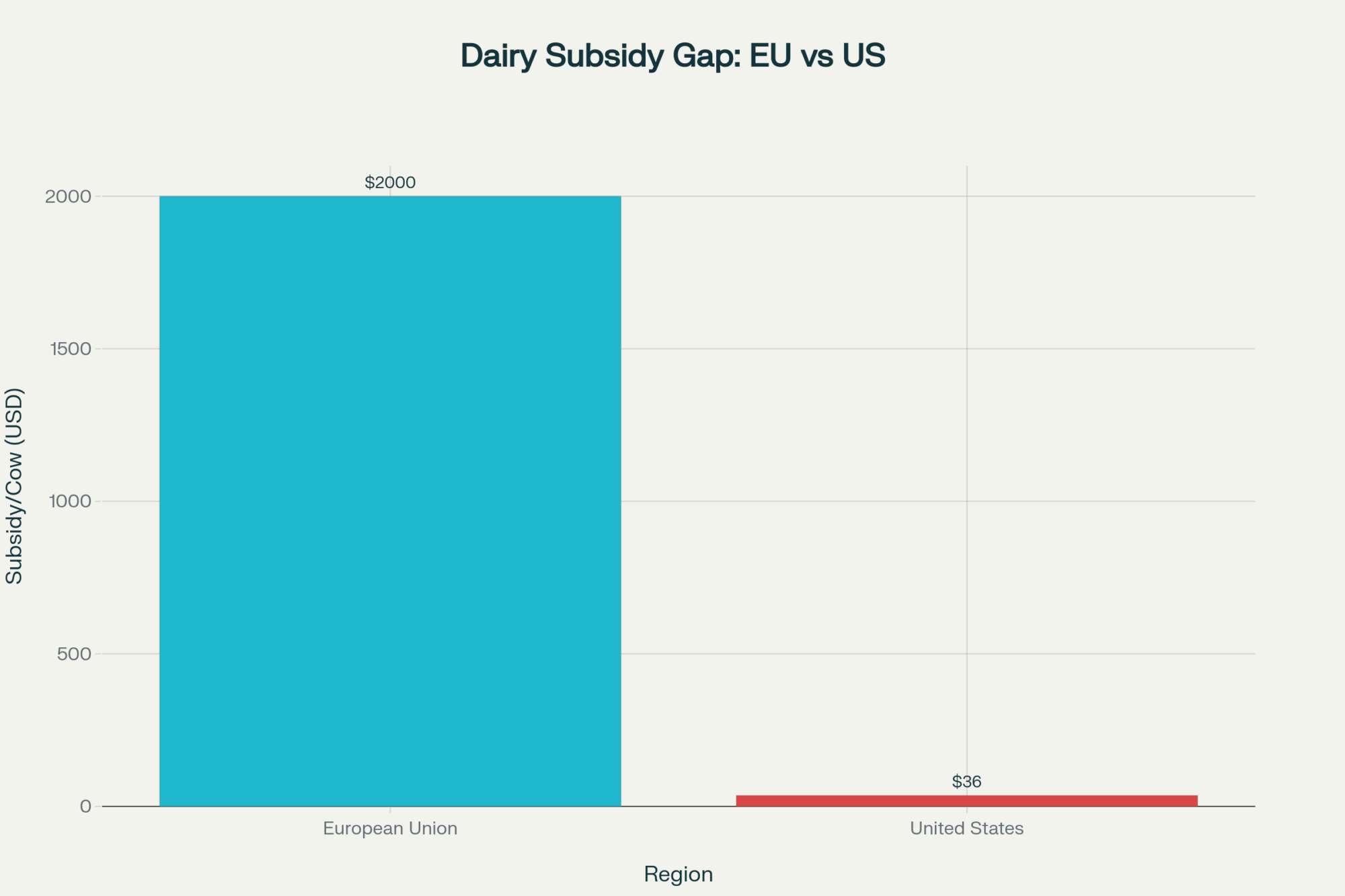

€1,800 vs $36 per cow—guess which country’s getting the better deal? Here’s what this subsidy gap means for your milk check.

EXECUTIVE SUMMARY: Look, here’s something that’ll make you spit out your morning coffee: New Zealand dairy farmers get zero subsidies and still dominate global powder markets, while European producers rake in €1,800 per cow annually—that’s roughly $240,000 per average farm! Meanwhile, we’re getting about $36 per cow through Dairy Margin Coverage, and that’s insurance you pay into, not free money. The kicker? Our average herd size hit 377 cows in 2024, up from 357 just five years back, giving us scale advantages those smaller European operations don’t have. China just cut dairy imports 12% as their domestic production ramps up, tightening the global squeeze. Bottom line—your survival depends on efficiency, not handouts. Smart producers are already tracking carbon footprints, investing in precision tech, and building premium brands. Don’t wait for the market to separate the wheat from the chaff.

KEY TAKEAWAYS:

- The Subsidy Reality Check: European farms get 50x more government support per cow than we do—use that DMC insurance smartly and focus on what you can control: feed efficiency and margin management (OECD, USDA data).

- Size Does Matter: U.S. herds averaging 377 cows now means better economies of scale—time to seriously look at robotic milking or precision feeding systems that boost your per-cow productivity by 15-20% (Progressive Publishing, Penn State Extension).

- Carbon = Cash: New Zealand’s carbon footprint runs 46% below Europe’s, proving sustainability isn’t just feel-good nonsense—it opens premium market doors and better pricing power (AgResearch study).

- Global Game Changer: China’s 12% import drop means less competition for their market, but also signals you better diversify your customer base and product mix fast (AHDB reports).

- Cash Flow Is King: Without that steady subsidy cushion, managing seasonal swings—spring freshening costs, summer feed spikes, fall breeding expenses—becomes make-or-break territory (USDA Economic Research Service).

I was talking with a Holstein producer the other day—runs about 280 cows up near Marshfield, Wisconsin. He shook his head and said what a lot of us are thinking: “How do those Kiwi farmers keep flooding our powder market with zero government help? Meanwhile, European cheeses sit on store shelves priced so low that it makes you wonder how any of us stay in business.”

That conversation’s been sticking with me because it hits on something we all feel but don’t always put into words.

The Subsidy Gap: What the Numbers Actually Show

Here’s the reality: New Zealand dairy farmers get zero direct subsidies—haven’t since their industry went through that radical deregulation back in the 1980s. Across the Atlantic, European producers collect about €1,800 per cow annually through the EU’s Common Agricultural Policy, which works out to roughly €243,000 per farm when you figure their average herd runs around 132 cows (OECD Agricultural Policy Monitoring, 2024).

Here in the States, farms average 377 cows now—up from about 357 just five years ago—and our main support comes through the Dairy Margin Coverage program. But here’s the thing: DMC isn’t welfare. It’s insurance you pay into, and it only pays out when the margin between your milk price and feed costs drops below specific triggers (USDA Economic Research Service, 2024; Government Accountability Office, 2025).

Working the math, that’s about $36 per cow annually. Not exactly what you’d call substantial compared to Europe’s numbers. According to Wisconsin Extension’s producer surveys, import competition consistently ranks as a top concern among Midwest dairy operators, with many citing the challenge of competing against subsidized products.

| Program | How It Works | Benefits | Reality Check |

| Dairy Margin Coverage (DMC) | Producer-paid insurance; margin-triggered payouts | Protects during tight margin periods | Payments only when market conditions trigger |

| EU Common Agricultural Policy (CAP) | Direct payments per cow | Steady income and rural community support | Can distort markets and create dependency |

How This Plays Out Across Regions

Down in Pennsylvania, smaller operations—mostly under 100 cows—have been carving out success with artisan cheeses and specialty yogurts. It’s not about volume but about quality and storytelling that command premium prices. Individual farms like Manning Farm Dairy’s on-farm ice cream operation show how specialty positioning can work.

Wisconsin’s nearly 6,000 dairies, predominantly Holstein herds averaging 142 cows, form America’s cheese heartland. But they’re battling subsidized European imports daily. As one processor buyer put it: “When European gouda hits my dock at ‘X’ price, that sets my baseline for negotiating with local producers. Nobody likes it long-term, but the math is the math.”

Out West, California’s mega-dairies double down on technology—robotic milking, precision feeding, real-time analytics—to maintain profitability under tough environmental regulations.

The New Zealand Efficiency Model

Meanwhile, New Zealand’s Canterbury farmers have achieved efficiency through the use of sophisticated rotational grazing and precision irrigation systems. AgResearch’s peer-reviewed research shows that their carbon footprint clocks in at about 0.74 kg CO₂-equivalent per kg of fat-and-protein-corrected milk, compared to Europe’s 1.37 kg—nearly 50% better (AgResearch, 2024). In today’s sustainability-focused markets, that’s a real competitive advantage.

Trade Dynamics Are Evolving

U.S. dairy organizations continue advocating for improved European market access through ongoing trade discussions, though EU geographical indication protections for names like “Parmesan” remain significant barriers. The National Milk Producers Federation calls this “abuse of the GI system to maintain trade barriers.”

More importantly, Chinese dairy imports dropped roughly 12% in 2024 as domestic production expanded (AHDB, 2024). Industry observers note that Chinese buyers are increasingly valuing pricing transparency and sustainability documentation—a trend worth watching closely.

This shift means what’s in your tank and your genetics program matter more than ever.

Breed Strategy in a Post-Subsidy World

Holstein operations, which dominate the Midwest, excel at volume but depend on high-energy feeding systems and face greater commodity price volatility. Jersey operations, more common in the Northeast and South, produce milk with higher butterfat (4.8%) and protein (3.9%) content, often commanding premium prices while showing better heat tolerance (Holstein USA, 2025; American Jersey Cattle Association, 2025).

Why Cash Flow Management Is Critical

Here’s what European producers don’t have to worry about: seasonal cash flow swings. Spring freshening drives peak feed demands. Summer heat stress reduces intake while requiring energy-dense rations. Fall breeding involves upfront costs that won’t show returns until next lactation.

European dairies have steady CAP payments buffering these swings. We manage without them—which means cash flow planning becomes absolutely critical.

The Government Accountability Office notes DMC participation actually declined from 69% of eligible farms in 2019 to 63% in 2024, suggesting growing producer confidence in market-driven management rather than government support.

What’s Coming: Efficiency Over Entitlements

Current trends point toward fundamental change. European subsidy programs face unprecedented budget pressure from defense spending, reconstruction costs, and competing priorities. Success won’t come from hoping subsidies return—it comes from building competitive advantages that work regardless of politics.

This transition isn’t a threat; it’s clarification. For producers prepared to compete on efficiency and quality, it’s an opportunity. Your competitive edge depends on three things: how efficiently you produce milk, how effectively you differentiate your product, and how quickly you adapt to market signals.

The tide of government support is receding, revealing who has been building on solid operational foundations versus who has been relying on artificial supports.

Don’t wait for the market to expose weaknesses. The playbook is already written by those who’ve been swimming on their own merit for decades.

Position yourself accordingly.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Know Your Cost of Production: The Key to Dairy Profitability – This article breaks down the essential steps to calculate your true cost of production. It provides a practical framework for identifying financial leaks and making data-driven decisions that directly improve margin management and overall farm profitability.

- Navigating the Tides: A Deep Dive into Global Dairy Market Trends – This piece explores the key economic drivers shaping global supply and demand. Understanding these long-term trends allows you to anticipate market shifts, manage risk more effectively, and make strategic decisions about growth and market positioning.

- Genomics: The Unseen Herd Hand That’s Reshaping Dairy Profitability – This deep dive demonstrates how to leverage genomic data to make smarter breeding decisions. It reveals practical strategies for accelerating genetic progress in health, efficiency, and production traits, offering a clear path to building a more profitable, resilient herd.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!