Butter’s up 65% globally while smart farmers bank extra $180/cow from feed efficiency. Your milk check just got a component makeover.

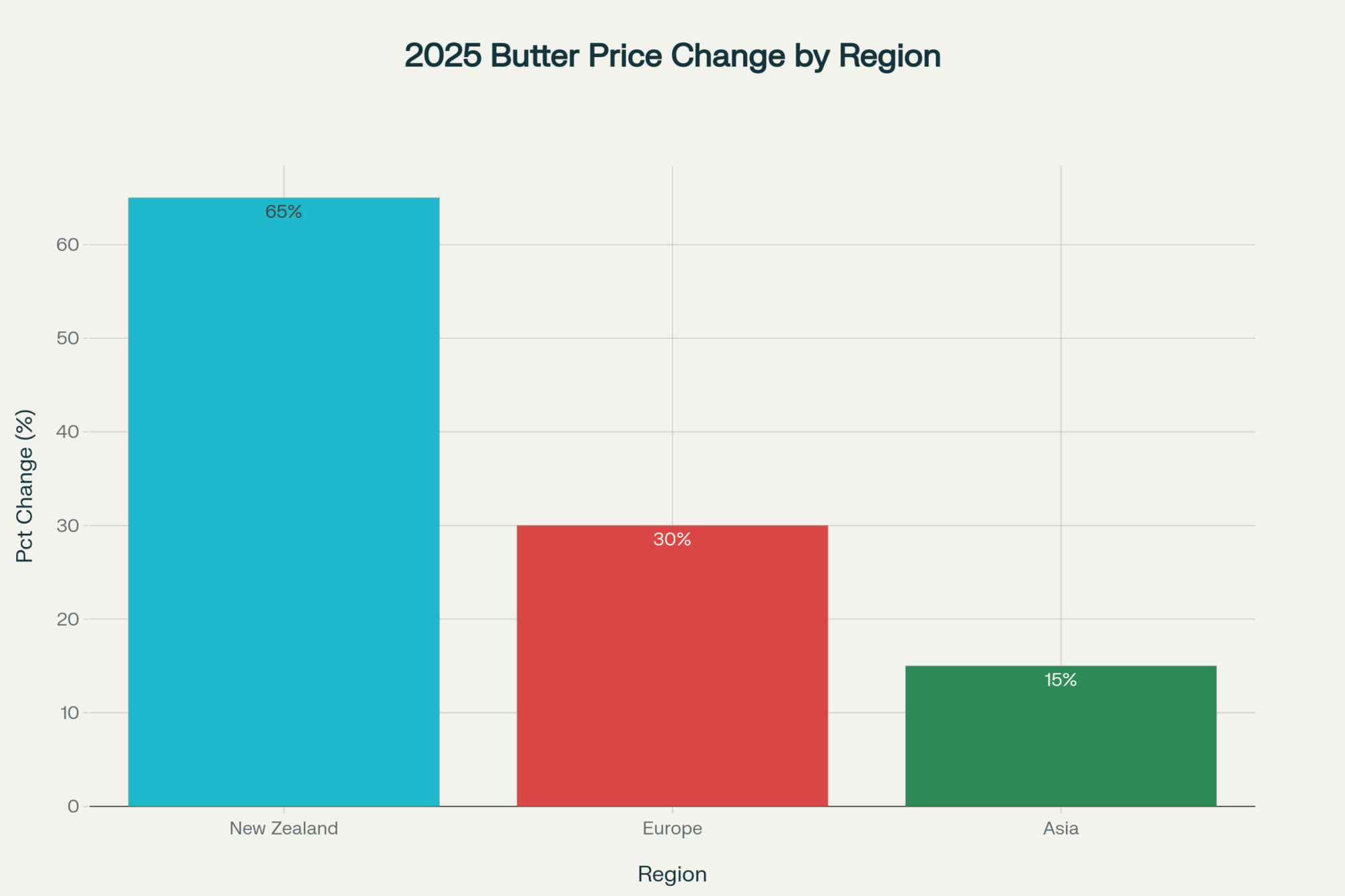

EXECUTIVE SUMMARY: Look, I’ve been tracking these butter price explosions across global markets, and here’s what’s really happening… Most producers are still thinking volume-first when component premiums now make up the majority of their milk checks. The numbers don’t lie – New Zealand butter jumped 65% in twelve months, and that’s creating serious money for farms optimizing butterfat production. Feed conversion tech is delivering $180 per cow annually while precision feeding systems show 8-12% improvements with payback periods hitting just 18-24 months for larger operations. European processors are shifting toward cheese over butter, tightening fat supplies even more. Asian buyers are paying premiums we haven’t seen before, and environmental regs aren’t going anywhere. You need to get your component strategy locked down now – this isn’t just another price cycle, it’s a fundamental shift in how dairy economics work.

KEY TAKEAWAYS

- Precision Feeding ROI Just Got Real: 8-12% feed conversion improvements with documented $180 annual savings per cow – start by auditing your current feed efficiency with your nutritionist and identify cows underperforming on components, not just volume

- Component Payments Dominate Your Check: Butterfat premiums now drive majority of milk income as processors prioritize cheese over butter production – review your breeding program immediately to emphasize fat/protein genetics over pure volume traits

- Technology Payback Accelerated: Energy efficiency grants covering substantial installation costs while precision systems hit 18-24 month ROI on herds over 300 cows – evaluate automated feeding systems now before your neighbors lock up the best contractors

- Global Fat Shortage Creates Premium Opportunities: Asian demand surge plus EU production declines mean butterfat-optimized operations capture extra margins while volume-focused farms subsidize competitors – implement component tracking systems to position for sustained premiums through 2025

- Market Arbitrage Rewards Regional Positioning: Upper Midwest seeing moderating feed costs while maintaining fat premiums, creating double-win scenarios – hedge feed costs immediately while optimizing for components to maximize the current margin window

Here’s what caught the industry’s attention: The dramatic jump in butter prices across global markets this year wasn’t just sticker shock for consumers—it was a signal of a fundamental shift in dairy economics that’s delivering substantial returns to dairy operations worldwide.

The Situation: A Global Fat Crisis Creates Unexpected Opportunities

Everyone’s talking about these massive butter price increases. Politicians are grilling dairy executives, consumers are frustrated… but here’s what most people are missing. This isn’t corporate greed – it’s a genuine global milk-fat shortage creating unprecedented market dynamics that smart producers are capitalizing on.

What strikes me about recent market patterns is how tight these fat supplies really are. According to Stats NZ data, butter prices in New Zealand surged 65% in the 12 months leading to April 2025, with average prices reaching NZ$8.60 per 500g block by June. That’s not just a local phenomenon – European butter inventories have hit some of their lowest levels in decades, while Asian import demand continues growing despite higher prices.

Recent analysis from industry sources confirms what we’re seeing across processing plants – processors are fundamentally shifting milk allocation toward cheese production, where margins stay more predictable. Less cream heading to the churn means tighter fat supplies across global markets… and that’s creating some serious opportunities for producers who understand component optimization.

The Core Drivers: Why This Shortage Isn’t Going Away

Processing Economics: Cheese Wins Over Butter

The thing about modern processing economics is that they consistently favor cheese and protein powders over butter production. According to dairy ingredient supplier Maxum Foods and the latest USDA Dairy World Markets report, EU butter production is forecast to decline by more than 1% in 2024, driven by a limited milk supply and a shift in demand from cream products to cheese.

What’s interesting is how this trend has accelerated. Processors I’ve spoken with across different regions are all saying the same thing – the stability and predictability of cheese margins make more business sense than the volatility we’re seeing in butter markets.

Regulatory Pressure: Environmental Caps Hit High-Fat Breeds Hard

Environmental regulations are capping herd sizes across major dairy regions, and this is particularly affecting high-fat breeds. Think about Jersey operations in California dealing with methane regulations, or European dairy operations managing nitrogen caps that directly limit cow numbers. These regulatory constraints particularly impact the breeds that historically supplied premium butterfat content.

Here’s the thing, though – these aren’t temporary policy shifts. This regulatory environment is the new normal, which means structural changes to the fat supply that are unlikely to go away anytime soon.

Shifting Global Demand: Asia’s Appetite for Fat

Asian markets are aggressively competing for available butterfat supplies, representing a structural change rather than a temporary market fluctuation. The surge in Asian demand coincides with declining global trade volumes, creating what industry economists are calling a perfect storm for elevated prices.

This development is fascinating because it’s not just about volume – it’s about quality preferences and willingness to pay premiums that we haven’t seen before in these markets.

The Producer’s Opportunity: Capitalizing on Component Premiums

Feed Optimization & Nutrition: Where the Real Money Is

Research from various university extension programs shows most operations haven’t fully optimized their feed allocation for butterfat production. What’s particularly noteworthy is how current market analysis reveals butterfat’s increasing dominance in milk payment calculations across major dairy regions – in many areas, component premiums now make up the majority of producer payouts.

Industry data suggest that feed conversion optimization can deliver $180 per cow annually when operations focus on both volume and component quality, although implementation typically requires a substantial upfront investment and an 8-12 month learning curve.

The challenge? Most producers I know are still thinking in terms of volume first, and components second. That’s backwards in today’s market environment.

Technology & Efficiency Investments: Precision Pays Off

| Investment Type | Initial Cost Range | Payback Period | 3-Year ROI | 5-Year ROI |

|---|---|---|---|---|

| Precision Feeding Systems | $85,000-$120,000 | 18-24 months | 180% | 320% |

| Energy Efficiency Upgrades | $25,000-$50,000 | 12-18 months | 220% | 380% |

| Automated Milking (per robot) | $200,000-$250,000 | 36-48 months | 140% | 240% |

| Component Genetics Program | $5,000-$15,000 | 24-36 months | 160% | 280% |

What’s becoming clear from equipment manufacturer data is that precision feeding systems are documenting 8-12% improvements in feed conversion across participating operations. Researchers from the University of Idaho and multiple universities are developing AI-powered precision feeding systems designed to optimize rations for individual dairy cows, leveraging robotic milking data and cloud-based modeling to reduce feed waste and improve production efficiency.

The technology is getting impressive – we’re talking about systems that can adjust rations for individual cows based on production stage, body condition, and component goals. Payback periods typically range from 18 to 24 months for larger herds in current market conditions.

Energy efficiency is also becoming a significant opportunity. Various government programs offer substantial grants for diesel-to-electric conversions, although the application process can be daunting for smaller operations. Industry reports suggest that successful implementations can generate substantial annual energy savings, and there is also the added benefit of protection against future carbon policies.

Financial & Risk Management: Getting Sophisticated

Component hedging requires sophisticated capabilities, but it’s offering significant protection for producers who can access it. Futures markets offer strategies that protect against fat premiums while maintaining protein exposure, although successful implementation requires an understanding of basis relationships and maintaining substantial margin deposits.

Industry finance specialists consistently warn that operations focusing exclusively on fat production face exposure if protein markets strengthen unexpectedly or feed costs spike beyond current projections. Diversification remains critical – even in today’s fat-favorable environment.

The Reality Check & Outlook: What the Numbers Actually Show

Current market projections from USDA sources indicate that butter prices will remain elevated, well above historical averages. European agricultural outlook data suggest a continued elevation in butter prices extending into 2026, although specific projections remain vulnerable to production increases or shifts in demand.

Dairy management specialists widely advise producers to capture current fat premiums while maintaining operational flexibility to adapt to changing market conditions. The fundamental message from university extension programs is to bank the windfall but avoid restructuring entire operations around permanent fat premiums.

Market analysts consistently warn that while structural changes – such as environmental regulations, processing economics, and shifting global demand patterns – drive current conditions, commodity cycles remain cyclical by nature. Smart money is treating this as an opportunity to build better systems, not a permanent new reality.

Regional Market Variations Create Different Opportunities

| Region | Key Advantages | Primary Challenges | Opportunity Rating |

|---|---|---|---|

| Upper Midwest (US) | – Moderating feed costs – Strong butterfat premiums – Established infrastructure | – Competition for premium markets – Weather volatility | High |

| California (US) | – Large scale operations – Advanced technology adoption | – Labor costs – Production constraints – Regulatory pressure | Medium |

| European Union | – Highest butterfat premiums – Strong export demand | – Elevated feed costs – Environmental compliance costs – Tightening regulations | Medium-High |

| Asia-Pacific | – Growing import demand – Premium pricing acceptance | – Supply constraints – Quality requirements – Distance to markets | High |

The thing about dairy markets is they’re intensely local even when they’re global. I’ve been tracking how this plays out across different regions, and the variations are significant.

North American Advantages: Upper Midwest producers are benefiting from moderating feed costs while butterfat premiums hold strong. Recent commodity reports indicate that corn and soy meal prices are trending lower, creating favorable conditions for component optimization. However, California operations face distinct challenges, including labor costs and ongoing production constraints, stemming from various factors affecting the region.

Global Arbitrage Opportunities: The spread between different national markets continues to create unprecedented export opportunities. These differentials could narrow quickly if production patterns change, but right now they’re creating profit opportunities for positioned producers.

European Market Dynamics: Recent reports from major European sources highlight the complex challenges EU producers face. Feed costs are elevated, environmental compliance costs are rising, and the regulatory environment continues to tighten. Yet, butterfat premiums remain stronger than North American levels because of how tight EU supplies have become, with cheese production prioritized over butter, resulting in a 0.6% increase in cheese output while butter production declines by 1%.

The Bottom Line: Building Resilient Operations for Long-Term Success

Here’s what this whole global fat shortage really means for dairy producers: we’re witnessing a structural shift in dairy markets that rewards component optimization and sophisticated management over traditional volume approaches. This isn’t just about riding a price cycle – it’s about understanding that the fundamental changes driving these markets represent permanent shifts in how dairy economics work.

Current market conditions create immediate opportunities for operations optimizing fat production through precision feeding and genetic selection. Feed optimization technology, which shows 8-12% feed conversion improvements, combined with energy efficiency programs offering substantial cost coverage, creates compelling ROI scenarios that weren’t viable just a few years ago. However, successful producers won’t restructure entire business models around permanent fat premiums – markets change, and flexibility matters more than ever.

Market sophistication separates competitive leaders from followers. Understanding component markets, managing feed cost volatility, and implementing risk management strategies are competitive necessities rather than luxuries in today’s dairy economy. The producers who understand component optimization, market dynamics, and financial risk management are building sustainable advantages that’ll serve them well beyond current market conditions.

The technology and management systems matter. Precision feeding systems deliver documented improvements, automated systems reduce labor while increasing efficiency, and risk management tools protect against volatility – these are no longer just helpful, but essential for competing in markets that reward efficiency over raw volume.

The butter boom won’t last forever – commodity cycles never do. However, this global fat shortage has created a window of opportunity where butterfat optimization delivers immediate returns while building long-term operational advantages. The producers who succeed in the long term won’t just catch this price wave – they’ll use this opportunity to build more resilient, efficient, and profitable operations that thrive regardless of future market dynamics.

What really gets me excited about this situation? It’s seeing producers who invest in understanding their operations, markets, and risk exposure consistently outperform those who focus solely on producing more milk. That’s the difference between riding market waves and building businesses that thrive regardless of what comes next in global dairy markets.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Secret to High Butterfat Starts with the Rumen – This piece drills down into the “how” of feed optimization. It reveals practical strategies for enhancing rumen function to directly increase butterfat percentage, providing the on-farm tactics needed to capitalize on the market trends discussed in the main article.

- Dairy Farming For Profit, Not Production – This article provides the strategic framework behind the main article’s advice. It demonstrates how to shift your entire operational mindset from chasing production volume to maximizing overall profitability, building a business model that thrives in any market cycle.

- Genomics: The Shortcut To The Top – Go beyond feed and technology with this deep dive into genetic strategy. It explores how to leverage genomics for faster genetic gains, creating a herd inherently designed for high component production and long-term profitability in a component-driven market.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!