US cheese exports jumped 34% while domestic demand tanked – your milk check depends on Asia more than you think.

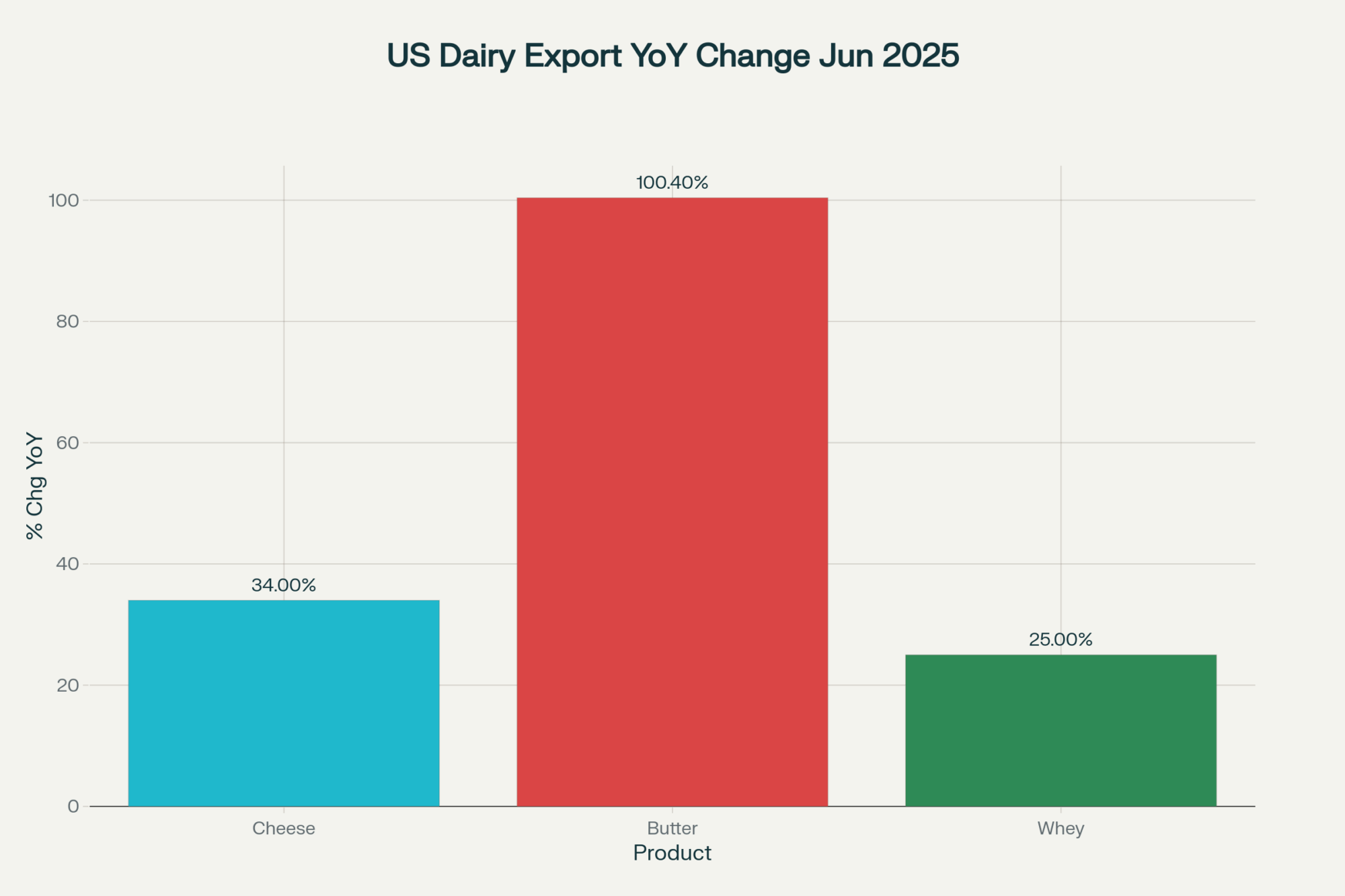

EXECUTIVE SUMMARY: Here’s what every dairy producer needs to understand right now… exports have become our industry’s lifeline, not just a nice bonus. Cheese exports hit 52,191 MT in June – that’s 34% higher than last year – while domestic consumption actually dropped 0.4%. However, butter exports doubled, with a 100.4% growth, which is the primary reason we’re not seeing $2.00/lb prices despite record 185 million pound production months. The math is simple: without export demand absorbing 9% of cheese production (up from 5% a decade ago), your milk price would be in the tank. Chinese buyers alone drove whey up 25% year-over-year after tariffs dropped from 125% to 10%. Bottom line – if you’re not tracking export numbers as closely as your somatic cell count, you’re missing the biggest driver of your milk check.

KEY TAKEAWAYS

- Export demand = price stability: Cheese at $1.85/lb is only sustainable because 34% more product is shipped overseas this year. Start following GDT auction results monthly – they’re predicting your milk price 60-90 days out.

- Butter margins depend on global buyers: With 185 million pounds produced in June (+10.4% y/y), domestic demand can’t absorb the volume. Track the CME export basis to time your forward contracting – it’s fluctuating by $0.10/lb based on shipping schedules.

- Quality premiums matter more now: Solarec’s Belgian WMP commanded $4,745 while standard grades hit $4,012. Invest in your protein and component testing – export buyers pay for consistency, and that’s where margin expansion lives in 2025.

- Feed cost advantage won’t last: Favorable corn/soybean outlook supports current margins, but export dependency means currency swings affect your bottom line. Lock in feed costs now while crop conditions support sub-$4.00 corn – export volatility is coming.

This past week in the dairy markets was a head-scratcher, highlighting just how interconnected the business has become. We’re seeing cheese and whey absolutely flying off the shelves due to export demand, while butter’s getting hammered despite record production numbers. It’s like watching two completely different movies at the same time.

Exports have become the industry’s essential pressure-release valve. Without them, we’d be drowning in product faster than you can say “oversupply.”

Futures Tell the Story – But Not Always the One You Expect

EEX saw significant trading activity last week with butter leading the way in volume, but here’s the kicker – butter futures actually slipped 0.2% to €6,995 on that Aug25-Mar26 strip. Meanwhile, whey just exploded +6.5% to €967. That performance in the whey market is the canary in the coal mine.

Over on SGX, things took an interesting turn in a different way. WMP futures managed a modest +0.2% gain to $3,882, but SMP took another beating at -1.0% to $2,841. The Asian markets are being pretty selective about what they want right now… and it shows.

GDT Auction TE385 threw us another curveball – the overall index climbed +0.7% to $4,249, with WMP leading at +2.1% to $4,012. However, what caught my attention was Solarec’s Belgian WMP, which commanded $4,745 – that’s premium pricing, if I’ve ever seen it. There’s definitely some quality differentiation happening in these markets.

European Quotations: Butter Losing Steam, Whey Finding Its Voice

The latest EU quotations delivered some eye-opening numbers. Butter lost ground, slipping about €16 to around €7,100 per tonne – still running €136 ahead year-over-year, but the momentum’s clearly shifting.

Here’s what should grab your attention: Whey jumped €20 (+2.5%) to €807 and is now sitting €162 (+25.1%) above last year. That 25% year-over-year gain isn’t a coincidence – it’s Chinese demand meeting reduced tariffs head-on, and US suppliers are capitalizing.

Production Stories: Ireland Soars, Others Struggle

Ireland’s absolutely crushing it with June milk collections hitting 1.08 billion litres (+4.9% y/y). Their year-to-date numbers are even more impressive: 4.65 billion litres (+7.0% y/y). The extended grazing period and cooperative weather have been pure gold for Irish producers.

Spain’s singing a different tune – production trends suggest they’re down from last year, which isn’t surprising given the weather challenges they’ve faced. When you’ve got Ireland flying and continental Europe struggling, you know Mother Nature’s picking favorites.

The US continues to steamroll ahead, with June milk production up and year-over-year growth at around +3.3%. That’s not just good – that’s production dominance on full display.

The Export Explosion: Records Tumbling Everywhere

Hold onto your hats, because US dairy exports in June were spectacular. Milk equivalent exports surged +14.4% year-over-year, driven by competitive pricing and that temporary truce in the China trade war.

Cheese exports hit an absolute moonshot – 52,191 MT in June, smashing previous records. That’s a 34% increase over last June, with Mexico, South Korea, and Japan leading the buying frenzy. What’s fascinating is how this export growth is fundamentally reshaping our domestic market dynamics.

Butter exports doubled, surging by 100.4% year-over-year. The US has transitioned from a dairy butter importer to a net exporter in 2025, and honestly, that shift is reshaping global trade flows in ways we’re still figuring out.

But here’s the trade war twist that everyone’s talking about: that whey surge of +33% to China in June happened because tariffs dropped from 125% to just 10% in mid-May. When trade barriers fall, buying surges – and US whey suppliers were ready.

CME Spot Action: Tale of Two Markets

CME cheese markets delivered exactly what export fundamentals suggested, with blocks averaging $1.8115/lb (up 13.25¢ for the week) and Friday’s close hitting $1.8500. That’s a two-month high backed by solid export demand.

Butter tells the opposite story – Friday’s close at $2.3550/lb was down 6.10¢ for the week, marking the lowest level since late May. When you’re producing 185 million pounds in June (a record) and domestic consumption isn’t growing much, even strong exports can’t keep prices elevated.

Dry whey’s riding that China wave at $0.5800/lb, up 2.50¢ for the week. Those Chinese buyers who got burned by tariff whiplash earlier this year? They’re making up for lost time.

Analysis: Why Export Dependency is the Whole Story

Here’s what every dairy producer needs to understand: US cheese exports now account for nearly 9% of total production, up from just 5% a decade ago. That’s not just growth – that’s fundamental market restructuring.

The numbers tell the story:

- Cheese production hit 1.20 billion pounds in June (+4.2% y/y)

- Domestic demand remains challenging amid persistent inflation and shifting consumer preferences

- Without exports, we’d be drowning in inventory

That domestic demand weakness? From what I’m seeing across the industry, it’s likely a combination of persistent inflation squeezing household budgets, some shifting toward plant-based alternatives, and food service recovery still not matching retail strength. The fundamentals just aren’t there domestically like they used to be.

Butter is following the same playbook. June production was up 10.4% year-over-year to a record 185 million pounds, but domestic consumption patterns haven’t shifted to absorb that kind of increase. An export surge of 100% or more is literally the only thing preventing a price collapse.

Feed Markets: Good News for Cost Structure

Corn and soybean futures continue to reflect optimistic crop expectations, with strong condition scores pointing toward potentially record yields. When the weather that delivers record US milk production is also the same pattern supporting massive feed crop potential, dairy producers win twice – more milk per cow and favorable feed costs.

Market Outlook: The Export Question

The central question for the rest of 2025: Can export growth keep pace with production increases?

The optimistic case points to:

- Record cheese exports showing no signs of slowing

- China’s tariff reduction opens whey and lactose opportunities

- Competitive US pricing versus European alternatives

- Favorable feed cost environment supporting producer margins

The concerns center on:

- Tepid domestic demand across multiple categories

- Massive production increases potentially outpacing consumption growth

- Trade policy uncertainty as we head toward election season

- Global economic headwinds, including slowing growth in key Asian economies and potential currency volatility, could reduce import appetite

Bottom Line: We’re Living in an Export-Driven World

This isn’t your grandfather’s dairy market anymore. We’ve transitioned from a domestically-focused industry to one where export performance literally determines price direction.

Cheese at $1.85/lb isn’t sustainable without continued export growth. Record butter production means nothing if domestic demand stays flat. Whey at $0.58/lb only works if Chinese buyers continue to come back for more.

The fact is… dairy’s future is unquestionably global, and producers who understand these export dynamics will be the ones to thrive when market volatility hits. Those who don’t risk being left behind by this fundamental shift – and in today’s market environment, that’s not a position any operation can afford.

Watch those export numbers like your operation depends on it – because it absolutely does.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlocking Dairy Profits: The Top 5 Areas to Focus on for a Stronger Bottom Line – This piece provides practical strategies for managing input costs and improving herd efficiency. It shifts focus from macro market trends to tactical changes you can implement immediately to protect your margins, regardless of global price swings.

- Beyond the Bulk Tank: Diversifying Your Dairy Revenue Streams – While the recap focuses on commodity exports, this strategic guide details how to build resilience by exploring value-added opportunities. It demonstrates how direct marketing, on-farm processing, and agritourism can create more stable, high-margin income sources.

- The Genomic Revolution: How Advanced Genetics Are Building the Dairy Cow of Tomorrow – This article looks beyond current production numbers to the technology driving them. It reveals methods for leveraging genomic data to breed for superior health, feed efficiency, and sustainability, future-proofing your herd’s performance and profitability.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!