Indonesia’s million-cow plan is rewriting global dairy trade—are we paying attention?

EXECUTIVE SUMMARY: Here’s what we discovered: Indonesia’s quiet revolution is slashing global dairy imports by up to 20%, with plans to import a million dairy cows by 2029—enough to flip the script on old export markets. Their fresh milk production hit 672,000 metric tons in 2023 despite recent disease setbacks, signaling rapid recovery with big implications for exporters worldwide. This shift is backed by strict local sourcing mandates in massive school nutrition programs serving over 80 million kids daily. Together with moves in Malaysia and Vietnam, it signals a tectonic shift in regional dairy supply chains. The data tells a different story than corporate PR: export premiums are at risk, margins are tightening, and family farms face real pressure. Progressive dairy producers need to rethink market assumptions, adjust genetics for heat tolerance, and diversify buyers now or risk being left behind. The time for complacency is over.

KEY TAKEAWAYS:

- Indonesian policies could reduce dairy imports by up to 20%, impacting export revenues by hundreds of millions.

- The importation of 1 million dairy cows by 2029 aims to boost domestic milk production, thereby pressuring foreign suppliers rapidly.

- Local sourcing mandates in school nutrition programs create a massive, guaranteed demand that is inaccessible to imports.

- Progressive producers should invest in heat-tolerant genetics, expand buyer diversification, and strengthen coop alliances.

- 2025 market realities necessitate strategic agility to maintain profitability amid shifting global dairy trade dynamics.

You ever sit down over coffee with the guys on the farm and wondered if Asia really is this endless dairy goldmine we’ve been sold? I’ve been chewing on this myself, and Indonesia’s quietly changing the game in a way that’s hard to ignore.

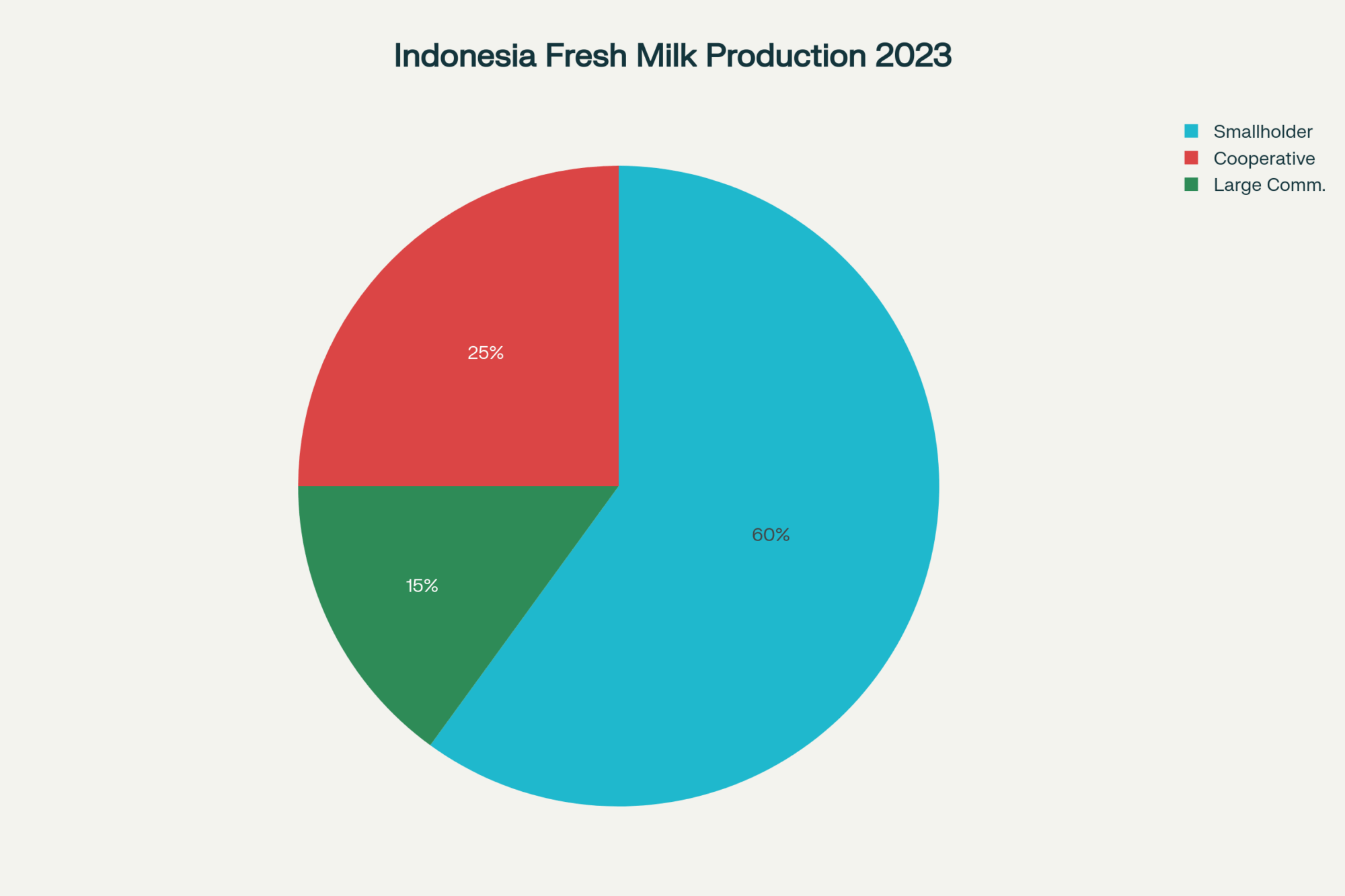

See, Indonesia pushed its fresh milk production up to about 672,000 metric tons last year, bouncing back fairly quickly after a heavy hit from that foot-and-mouth outbreak took out a good chunk of their herd (USDA GAIN Report ID2024-0038, 2023). But listen—their dairy imports dropped by 10 to 20 percent in 2023, not for lack of demand, but because the government cracked down hard on those import licenses and started backing their own dairy farmers (USDA GAIN Report ID2023-0033, DairyNews 2023).

When a Million Cows Change Everything

Now, here’s the kicker—these folks are planning to import a million dairy cows by 2029. Not just any cows, but mainly pregnant heifers ready to calve fast and get milk flowing (Reuters, September 2025; Indonesian Ministry of Agriculture).

These cows are mixed breeds—Holsteins crossed with Zebu—which those of us dealing with hotter summers can appreciate. They’re heat-tough and push out milk levels that small family farms see averaging 9 to 10 liters a day, while the bigger operations can hit 25 liters and up (USDA GAIN Reports; GKSI Cooperative Data).

The School Milk Shell Game

The government’s Free Nutritious Meals program is massive—serving over 80 million kids daily. And here’s the catch that should worry every export manager: every drop of milk for those kids has to come from local dairies. No imported powder slipping into those cartons (Indonesian Government releases; UN Nutrition Program, 2025).

That’s not just guaranteed demand. That’s a wall around billions of liters that used to flow from places like New Zealand and Australia.

The Ripple Effect Hits Home

Malaysia’s following suit, aiming to be 100% dairy self-sufficient by 2030, and they’ve got operations already positioning to cover demand (Malaysian Ministry of Agriculture, 2024). Vietnam’s boosting processing capacity like a barn raising, while the Philippines—reliant on nearly 99% imports—is working hard with Australian research backing to flip the script.

So here’s the deal—Indonesia’s moves have already hit export revenues hard. New Zealand and Australia have faced significant losses in the Indonesian market, and the U.S. has seen a decline of about 20 percent in exports to Southeast Asia recently (The Bullvine, USDA trade data, 2025).

Back home, you’re feeling this squeeze too. The processor plants from Ontario to Wisconsin and the Dakotas aren’t running full tilt anymore. And it’s the smaller operators who get hit first when export premiums shrink and contracts dry up.

Red Flags for Smart Operators

Now, if you hear about new dairy plants investing hundreds of millions across Asia, or government cattle import pushes targeting hundreds of thousands of head—that’s not just expansion. That’s systematic market capture.

Those Holstein-Zebu crosses that handle the heat? They’re no longer just a tropical curiosity. With climate change pushing temperatures up everywhere, those genetics are heading north whether we’re ready or not.

What This Means for Your Operation

The thing is, processing plants that built their growth plans around export markets are finding out those markets aren’t expanding—they’re shrinking. Family operations depending on export premiums to service debt are feeling the pinch first.

When your local co-op starts talking about “diversifying markets” or your processor mentions “adjusting contracts,” that’s code for export revenues getting squeezed.

The Bottom Line for Independent Producers

So here’s what I’m telling folks at every coffee shop and fence line: Get your genetics sorted—heat tolerance isn’t optional anymore. Spread your risk—don’t hang everything on one buyer if you can help it. Get tight with your co-op and understand their export exposure, because their pain becomes your pain real quick.

Most important? Stop believing fairy tales about endless growth markets. Start planning for a world where those markets supply themselves.

The Hard Truth About Market Shifts

The dairy industry you grew up in—where rich countries shipped to poor countries—is changing faster than a summer storm. Indonesia has demonstrated that developing nations can reduce their import dependency through coordinated policy and investment.

The question isn’t whether this transformation continues. The question is whether your operation adapts fast enough to survive what’s coming next.

That’s the straight story—no industry spin, no comfortable lies. Just the facts you need before your next equipment purchase, before your next expansion decision, before you bet your farm’s future on yesterday’s assumptions about tomorrow’s markets.

The dairy world we know? It’s changing fast. If you’re not ready to roll with it, you might get left chasing yesterday’s milk check.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Heat Crisis Forces European Dairy into Unprecedented Tailspin – This article moves beyond genetics to provide practical strategies for managing heat stress, revealing how a combination of technology, nutrition, and infrastructure can protect milk production and profitability when temperatures soar, safeguarding your operation from the same fate.

- The $2.2 Billion Feed Story, Nobody’s Telling You About Southeast Asia’s Dairy Revolution – While the main article focuses on milk imports, this piece exposes the massive, related opportunity in the feed market. It provides a strategic look at how proactive producers can capitalize on growing demand and compete with global suppliers.

- The Future of Dairy Farming: Embracing Automation, AI, and Sustainability in 2025 – The central article warns about market shifts; this one shows how to adapt. It explains how to use emerging technologies like whole-life monitoring and AI to reduce risk, enhance herd health, and increase operational efficiency for future resilience.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!