80% of your milk yield gains may be hiding in your feed efficiency — have you checked lately?

EXECUTIVE SUMMARY: Here’s the deal: feed efficiency is quietly slashing inputs and boosting profits, but most aren’t tuning in. Farms dialing feed efficiency up by just 3% can see milk yields jump by over 600 liters per cow—a real game changer. Meanwhile, genomic testing continues to separate the top producers, driving genetics that pack protein premiums of up to $4.00 per cwt, according to research from the University of Wisconsin. Global demand for high-protein dairy products is driving up prices, but butterfat and traditional milk volumes are no longer covering the costs as they once did. With feed costs shaky despite record corn crops, you need strategies that lock in gains here and now. If you haven’t looked at your feed efficiency or taken genomic insights seriously, you’re leaving money on the table. Trust me, start now if you want to keep your milk check growing in 2025 and beyond.

KEY TAKEAWAYS:

- Boost feed efficiency by at least 3%: test your herd’s conversion ratios this week and adjust rations using your nutritionist’s advice to save feed costs and add $14+ per cow monthly.

- Start genomic testing or refine your lineup: identify cows with protein traits boosting milk checks by up to $4.00/cwt, focusing breeding decisions on these genetics.

- Lock feed prices now: with corn futures near $4, secure feed contracts before prices jump, safeguarding your margins amid supply uncertainties.

- Embrace component-focused management: shift from volume to protein emphasis, respond to market demand, and protect revenue against fluctuations in butterfat prices.

- Engage proactive risk management: consider Dairy Revenue Protection at 95% coverage this quarter to shield income in volatile market conditions.

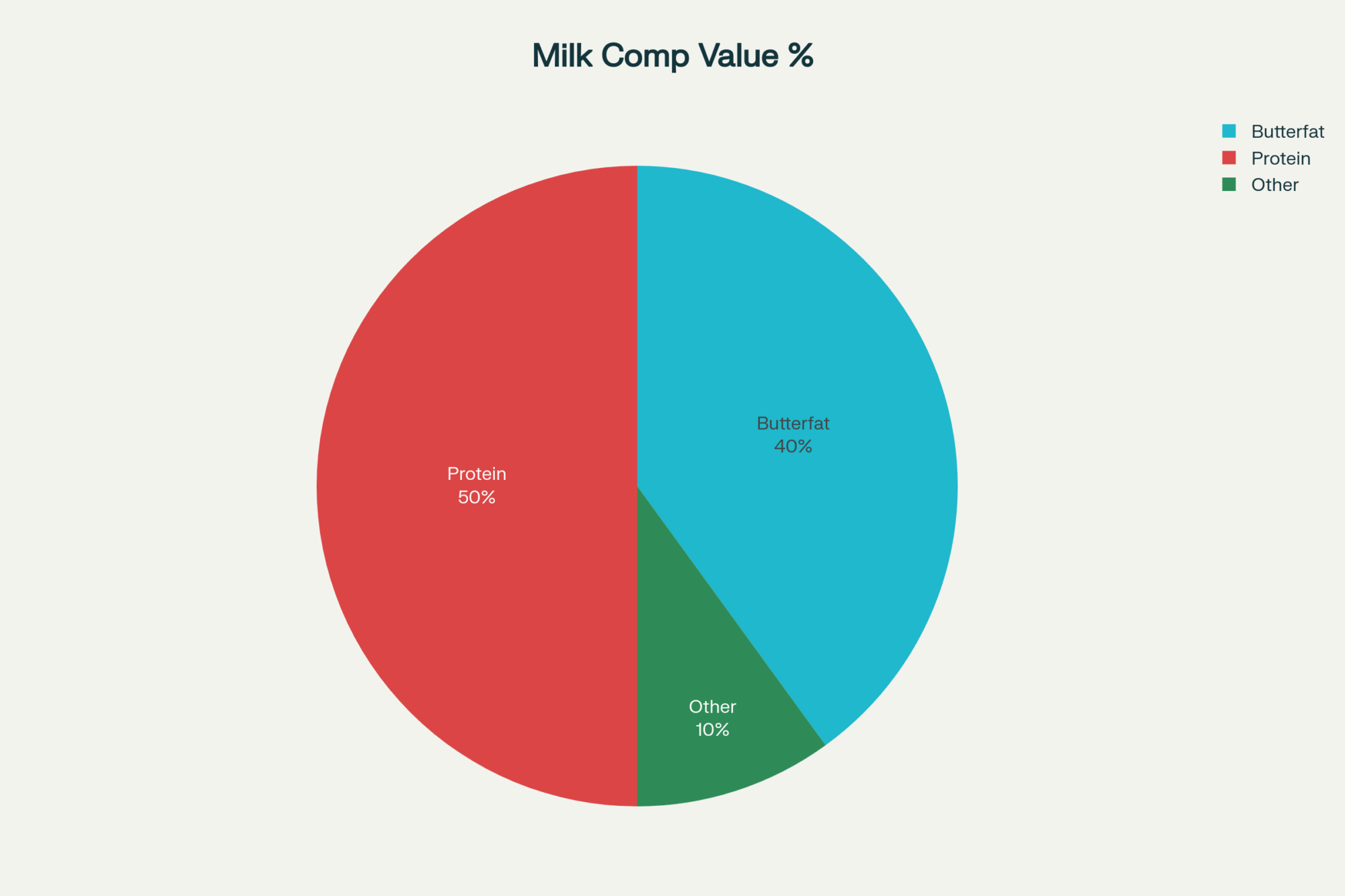

The thing about dairy markets lately? They’re split—protein prices are climbing while butterfat is taking a serious hit. This isn’t just your typical summer shift; with the USDA forecasting a record corn crop and demand pulling dairy components in opposite directions, producers are stuck navigating some tight margins.

When Ice Cream Season Ends, Trouble Begins

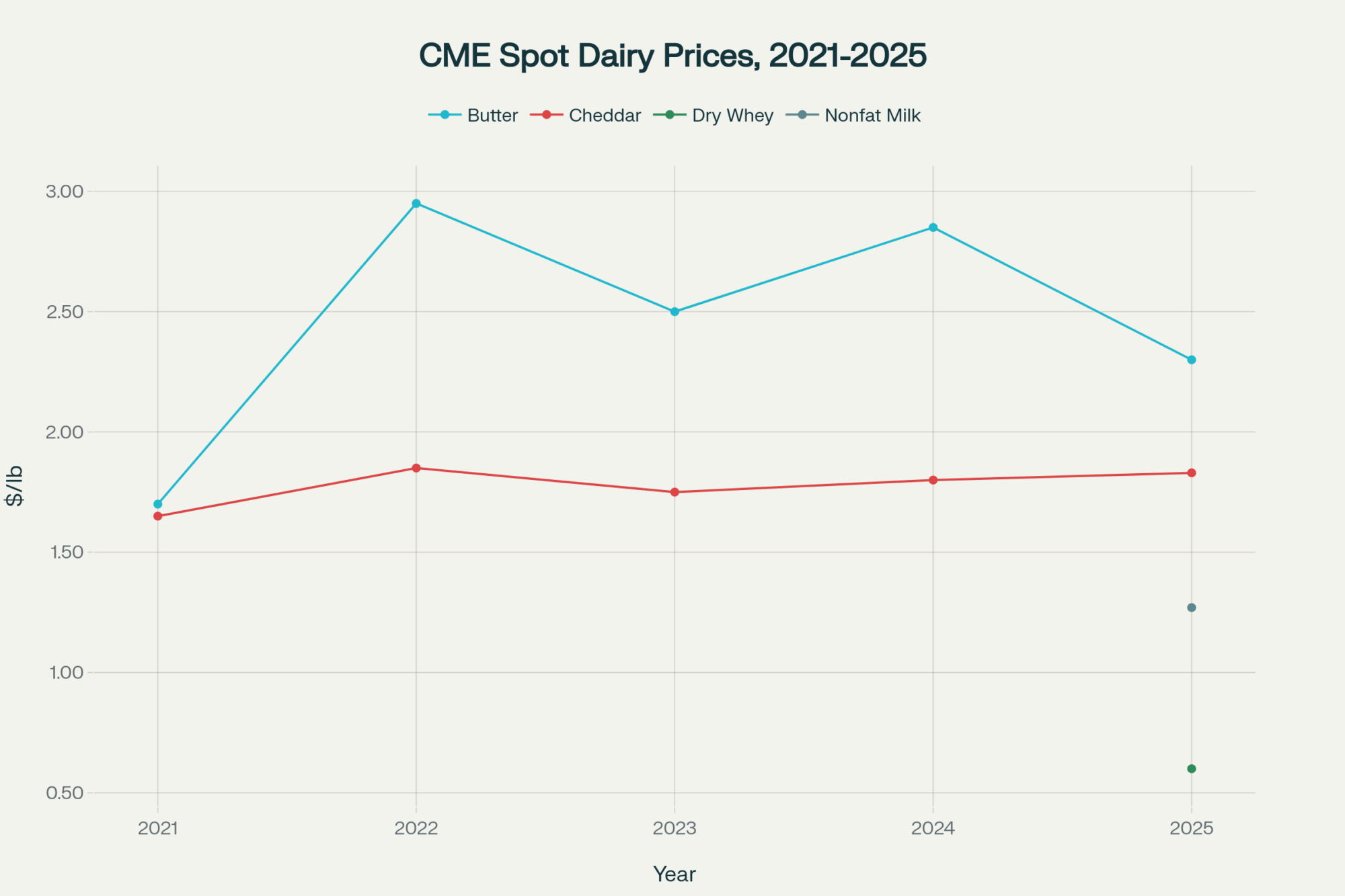

Take butterfat, for example. As of the week ending August 15, 2025, CME spot butter prices dropped 4 cents to $2.30 per pound, hitting the lowest summer point we’ve seen in years, according to CME Group data. What’s interesting is how ice cream makers, who generally consume most of the cream, are stepping back after the peak season. That extra cream floods the market, dropping cream multiples well below what we’d expect historically.

Analysts monitoring USDA Cold Storage data predict that the August and September reports will confirm a significant buildup in butter inventories. If that holds, we could be staring down a prolonged butter price slump into the holiday baking season and beyond.

Here’s what’s concerning, though — September Class III futures dropped 48 cents to $18.39 per hundredweight, with fourth-quarter contracts dancing dangerously close to that $18 floor that makes everyone nervous.

Where the Real Money Lives Now

Compare that with dry whey prices, which hit a six-month high of nearly 60 cents a pound last week. Despite China’s export challenges due to trade tensions, domestic demand remains strong, especially for high-protein ingredients. Dr. Mark Stephenson, director of dairy policy analysis at the University of Wisconsin-Madison, notes that protein has become the primary driver of milk prices lately.

Producers who’ve dialed in genetics and nutrition to push milk protein between 3.2% and 3.4% are definitely seeing dividends. This isn’t just about tweaking rations anymore—it’s about fundamentally rethinking what drives your bottom line.

Why Cheap Feed Won’t Save You

However, here’s the catch: cheap feed is no longer a free pass to profitability. The USDA’s August 12, 2025, WASDE report showed a corn yield forecast of 188.8 bushels per acre and 97.3 million planted acres—a monster crop that’s suppressing feed costs. Still, milk futures hovering near $18 per hundredweight signal that producers face vulnerability.

A small rise in corn or soybean meal prices could tighten margins. Penn State Extension recommends aiming for a milk-to-feed ratio of 1.4 to 1.5 now to break even—a steep drop from the 2.5 to 3.0 breakeven ratio many producers used to count on.

Building a Resilient Operation

Here’s where it gets interesting on the farm. The national dairy herd grew year-over-year by roughly 146,000 head to 9.5 million, while weekly cull rates remain steady around 0.54%. This isn’t panic selling, but a calculated approach that focuses on efficiency and milk components, rather than just herd size. It ties directly into why protein is king right now.

What strikes me is how this connects to component management. Smart producers aren’t just growing herds—they’re building better herds. Those focusing on genetics that boost protein percentages are essentially future-proofing their operations against exactly the kind of market split we’re seeing now.

Technology also plays a key role. A 2023 report from the Agricultural Technology Research Institute found that automated feeding systems can improve feed efficiency by up to 12%. That’s a real margin-saver when you need to hit that 1.4-to-1.5 feed conversion ratio. However, it’s also a significant investment—costing $2,500 to $4,000 per cow—with payback periods ranging from 5 to 7 years, especially with tighter credit. Smart producers are weighing that carefully against current cash flow realities.

And don’t forget about locking in inputs. December corn futures near $4.00 per bushel as of mid-August offer a chance to secure feed costs before weather or geopolitical shifts push prices upward again. That window won’t stay open forever.

Risk Management Isn’t Optional (And Most Still Aren’t Doing It)

I can’t stress risk management enough. Dairy Revenue Protection premiums vary from 15 to 35 cents per hundredweight at 95% coverage, depending on your region. Industry observations suggest uptake remains limited in many key dairy areas—too many producers are waiting too long.

If you haven’t talked to your crop insurance agent about DRP for Q4 2025 yet, now’s the time. Don’t be the producer who waits until margins are already gone.

Your Monday Morning Action Plan

So what now? Here’s what needs to happen this week:

- Lock those feed costs for the next six months while corn holds support

- Get serious about DRP coverage before the sales deadline hits

- Manage feed efficiency tightly — aim for that 1.4-to-1.5 ratio, measure it, don’t guess it

- Focus on improving milk protein percentages — that’s where the money is

This protein demand trend is no fad. It’s real, and it’s going to shape milk checks for the foreseeable future. Those dialing in genetics and nutrition to boost component percentages will be miles ahead of operations still chasing volume.

I expect the coming months to be a dividing line between those who plan and hedge and those who just hope prices will bounce back. In today’s dairy world, hope simply won’t pay the bills.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlocking Feed Efficiency: The Key to Dairy Profitability – This guide dives into the practical strategies for measuring and improving feed conversion. It reveals actionable methods for ration balancing and management that directly translate to lower input costs and the higher margins discussed in our main analysis.

- Navigating Market Volatility with Dairy Revenue Protection (Dairy-RP) – Go beyond the basics of DRP with this strategic breakdown. It demonstrates how to effectively use this risk management tool to protect revenue floors, providing financial stability and peace of mind in today’s unpredictable component-driven market.

- The Genomic Revolution: How DNA-Based Selection is Transforming Dairy Breeding – Understand the science and strategy behind genomic selection. This article explores how to leverage DNA insights to accelerate genetic progress for high-value traits like protein, helping you build the profitable and resilient herd needed for the future.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!