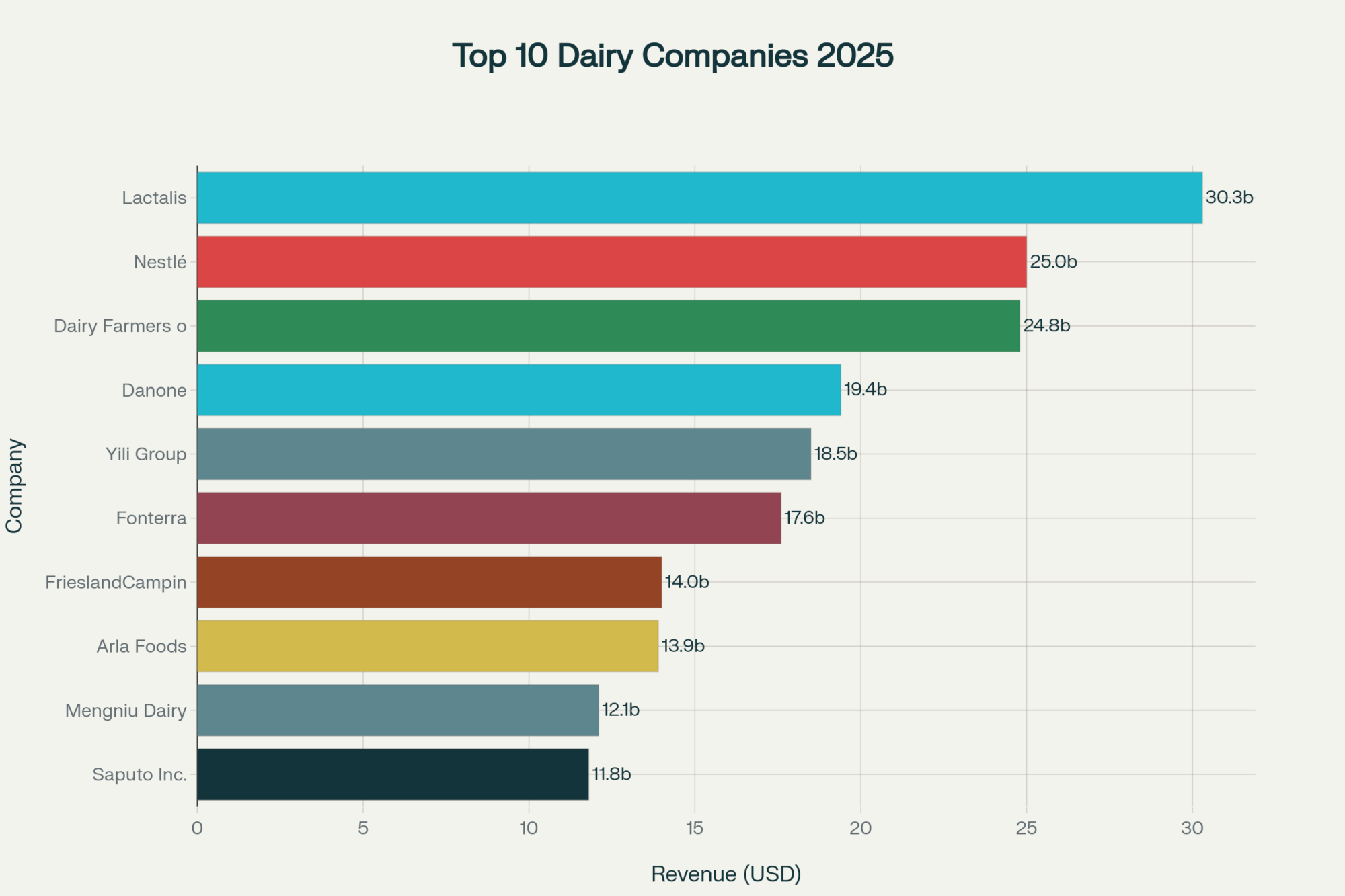

Lactalis just hit $30B while everyone else crawled at 0.6% growth—here’s what they know that you don’t about dairy’s new reality.

EXECUTIVE SUMMARY: You know that feeling when you see numbers that just don’t add up? Lactalis blasted past €30 billion while the rest of us limped along at 0.6% growth—and it’s not because they got lucky. The dairy industry’s splitting into winners who adapt fast and everyone else watching from the sidelines. Texas producers added 50,000 cows and jumped 10.6% in milk production, while Wisconsin barely moved the needle at 0.1%. Meanwhile, China’s flipping the script on exports—powder down 9%, whey up 52%—and farmers using beef-on-dairy genetics are padding their bottom line when milk prices stay tight. The University of Wisconsin’s AI systems are reducing feed waste by 15%, with paybacks occurring within eight months. Here’s the deal: if you’re not adjusting your strategy for 2025’s reality, you’re betting against data that’s already proven what works.

KEY TAKEAWAYS

- AI isn’t hype anymore—it’s profit. University of Wisconsin farms are trimming 15% off feed waste and improving calving intervals by 18%, with some seeing full ROI in under 8 months. Start with smart cameras for health monitoring—they catch issues days before you’d spot them visually.

- Geographic arbitrage is real money. Texas producers are capitalizing on cheaper feed, lighter regs, and better weather to scale fast while traditional dairy regions struggle. If you can’t move, focus on efficiency gains that compete with their cost advantages.

- China’s buying habits changed everything for exports. Whey products shot up 52% while powder dropped 9%—processors who adapt to this shift win, those stuck on old models lose. Review your processor’s export portfolio and pursue whey-focused contracts.

- Beef-on-dairy genetics aren’t just diversification—they’re insurance. Midwest farmers utilizing crossbreeding strategies are generating revenue streams that help buffer tight milk margins. Plan for 18-24 month timelines and proper calf facilities, but the math works when milk prices stay squeezed.

- Consolidation’s forcing tough choices on governance. The Arla-DMK merger, bundling 12,200 farmers, shows where co-ops are heading—get vocal about transparency and member benefits now, or risk losing your voice in future decisions that affect your operation’s profitability.

You ever get that moment when a number just stops you in your tracks? That’s the feeling I had seeing the latest Rabobank numbers. Lactalis, the French dairy powerhouse, busted through the $30 billion mark, topping over €30.3 billion last year. Meanwhile, the rest of the industry barely moved, limping along at 0.6% growth, down from the solid 8.1% we saw the year before.

Let me tell you how this feels on the ground: those easy money days? They’re gone. Now, it’s about steadying your footing, watching every dime, and squeezing every bit of efficiency out of those fresh cows.

Europe’s Dairy Landscape Is Shifting Like Never Before

Across the Atlantic, things are shaking. Arla and DMK are locking arms, forming a €19 billion cooperative and bundling up over 12,200 farmers under one roof. This isn’t just some PR fluff—this is survival talk in the face of rising costs and tighter rules.

What really hits home is what Kjartan Poulsen, head of the European Milk Board, has to say. He warns that in these mega-mergers, regular farmers risk losing their voice. And if you’ve been in a co-op meeting, you know that voice is critical.

Farmers I know around Europe share that gut feeling—we want the strength of numbers, but not at the cost of losing control around the feed bunk or voting floor.

Midwest Holds the Line, Texas Shows Muscle

Back here in the U.S., Wisconsin barely saw a bump: milk production inched up 0.1% last April, but that’s preliminary USDA data, and charts could shift. Still, farmers like David Trimner at Miltrim Farms are keeping it real, using beef-on-dairy crosses to help balance the ledger.

David straight-up told me, “Beef markets have been a lifeline,” but quickly reminded me it’s not easy managing two types of herds with different needs.

Now, Texas? That’s a whole different story. They posted a 10.6% jump last April with about 50,000 new cows landing on the ground. What’s luring all these farmers? Cheaper feed, a lighter regulatory leash, and weather that lets them ramp up fast without the headaches the corn belt throws at us.

This shift’s not just a footnote—it’s shaking up feed markets and forcing a rethink of processing infrastructure for years to come.

Asia’s Dairy Boom Is No Fad

India’s Amul cooperative is poised to reach $12 billion in revenue by 2026, driven by a booming middle class that is aware of its butterfat content.

China’s market is trickier, though. Imports showed consistent growth through early 2025, with trade experts noting five consecutive months of increases. But taste buds have changed there—whole milk powder’s down 9%, while whey products are up a staggering 52%.

If you’re sending dairy products to China, you’d better be ready to mix up your portfolio.

On-Farm Tech: It’s Not Magic, But It Works

There’s chatter about AI turning profits sky-high, but trust me, the reality’s a bit cooler.

The University of Wisconsin Dairy Brain Project demonstrates measurable improvements in feed efficiency and reproductive performance, with some operations achieving payback in under eight months by identifying issues earlier and adjusting feeds accordingly.

Smart cameras are also becoming must-haves, spotting cows getting sick before you’d know just by looking.

And this tech’s spreading. California dairies using automated feed monitoring report about 12% feed savings (shout out to UC Davis), and New York farms using Cornell’s health tracking catch mastitis earlier.

Sustainability Goals Aren’t Just Talk—But It’s Complex

Eight dairy giants have pledged net-zero emissions by 2050, and the numbers show the progress—U.S. farms cut water use by 30% and land use by 21% per gallon since 2008.

Michigan’s got a growing biogas scene. Projects like Red Arrow Dairy turn manure from about 6,000 cows into energy—processing 200,000 gallons daily.

But this stuff isn’t pie in the sky. Environmental groups are wary, warning about water pollution and calling some digesters “pay-to-pollute” setups.

The takeaway? These projects require substantial budgets and long paybacks (7-12 years), making them best suited for large farms. Smaller outfits are better at focusing on manure management, cover crops, and nutrient recycling.

What Separates the Winners from the Rest?

From where I stand, here’s what’s really moving the needle:

Farmers using beef-on-dairy genetics for extra cash flow… but knowing it’s a long game, and you need the right facilities.

Investing smartly in tech with clear returns—feed efficiency monitors, reproduction tools, health tracking that pays back within 24 months.

Farmers are pushing for transparency and good governance in cooperatives, especially following mergers.

Diversifying markets in specialty products or direct sales, but understanding these channels requires real work and separate expertise.

The industry’s dividing fast—those who scale with savvy, and those left in the dust.

What’s Your Next Move?

Line up the right partners for tech, market access, and regulations. Plan efficiency investments that pay back inside 12 to 18 months. Keep nimble—margins aren’t getting any softer.

Focus on what you can control: feed efficiency, animal health, market timing, and operational excellence. The fundamentals haven’t changed, but the margin for error definitely has.

So, What’s the Bottom Line?

Consolidation’s here. Are you riding that wave or getting swept away?

Winners know their cows, manage feed closely, time their markets like pros, and keep their operations tight—backed by data, not wishful thinking.

This transformation is real and happening on farms like yours. Move fast. Partner smart. And keep your eye on what actually grows your milk check.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Ultimate Guide to Beef on Dairy: A Playbook for Higher Profits – This article provides a tactical playbook for implementing a successful beef-on-dairy program. It reveals methods for sire selection, calf management, and market timing to maximize revenue, turning a diversification strategy into a significant profit center for your operation.

- Beyond the Milk Check: Advanced Risk Management Strategies for Today’s Dairy Producer – Shift from defense to offense with this strategic guide to financial risk management. It demonstrates how to leverage tools like Dairy Revenue Protection (DRP) and futures markets to build a resilient business model that withstands the market volatility described above.

- Genomics 3.0: How the Next Wave of Genetic Selection Will Redefine Your Herd – Look beyond today’s challenges with this deep dive into next-generation genomics. It uncovers how to select for new traits like feed efficiency and climate resilience, offering a long-term strategy for building a herd that thrives in dairy’s new reality.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!