New insights reveal how strategic policy and tech adoption fuel Argentina’s dairy boom and what it means globally.

EXECUTIVE SUMMARY: Argentina’s dairy sector saw a remarkable 11% increase in milk production in 2025, even as herd size fell by 2.5%, highlighting a substantial boost in per-cow productivity. Milk quality metrics improved concurrently, with butterfat rising to 3.88% and protein to 3.49%, enhancing revenue per litre. This transformation is driven by deliberate policy reforms, including the permanent removal of export duties and the introduction of innovative credit mechanisms, combined with advanced genetics and precision feeding technologies. Globally, similar consolidation trends are unfolding, with timing and socio-political factors shaping outcomes, while increased self-sufficiency in key markets, such as China, intensifies competitive dynamics. Looking ahead, dairy’s competitive edge is shifting toward product innovation — biotechnological advances like lactoferrin-enriched milk and fermentation-derived proteins promise to redefine market value. For producers, the message is clear: embrace efficiency gains today and prepare for rapid innovation tomorrow to stay competitive.

KEY TAKEAWAYS:

- Producers can achieve up to 14% in per-cow production gains through improved genetics and enhanced management, backed by Argentine data.

- Removing export duties and stabilizing financing helped make sustainable growth possible.

- Technologies like rumination monitoring and precision feeding deliver 5–7% yield improvements with a fast payback.

- Global markets face oversupply risk as more regions implement consolidation and efficiency strategies.

- Innovation in milk components and alternative proteins is becoming a key competitive differentiator.

You know, I keep hearing from producers across Ecuador when I was there recently, about something that’s really catching everyone’s attention. Argentina’s dairy sector just reported an 11% jump in milk production this year, even though they actually trimmed their cow numbers by about 2.5%. That kind of math—it doesn’t happen by accident in our business.

What’s really fascinating here is that this isn’t just about good weather or market timing. Argentina has engineered a comprehensive transformation that has dairy operations worldwide taking note, and for good reason.

The Numbers That Tell the Story

According to the latest data from Argentina’s SENASA, the country’s herd has decreased to approximately 1.48 million cows, spread across roughly 8,995 farms. However, milk production per cow has increased by nearly 14%. That’s efficiency that commands attention.

But here’s what’s interesting—it’s not just volume. According to the official reports, butterfat content has crept up to 3.88%, protein to 3.49%. Small percentage gains, sure, but when you’re working with millions of liters, those decimals turn into serious revenue.

Industry discussions with operators in Buenos Aires province reveal how Holstein-Montbeliarde crossbreeding programs are hitting that sweet spot—good milk volume, strong butterfat performance, and cows that excel in local grazing conditions. These crosses are maintaining production levels above 9,000 kg per mature cow with solid component percentages.

What’s encouraging is how Argentina’s Dairy Chain Observatory has documented 18 consecutive months of positive producer margins through 2025. That’s sustained profitability that lets farmers make strategic decisions rather than survival moves.

Policy Engineering That Actually Works

Now here’s where Argentina got really smart. Back in August 2024, they permanently eliminated export duties on dairy products through Decree 697/2024—not as a temporary measure, but as a strategic policy. Combined with currency adjustments that created a 15-20% export competitiveness advantage, according to OCLA data, they essentially provided a launching pad for efficient producers.

The financial innovation impressed many of us in the industry most. BICE credit lines that price loan payments in milk liters rather than pesos eliminated currency risk during expansion. I’ve seen government programs before, but rarely with this level of coordination between trade policy, monetary policy, and agricultural credit.

What’s particularly noteworthy is how these policies are layered together—each one reinforcing the others to create momentum that’s hard to stop.

Consolidation Mathematics in Real Time

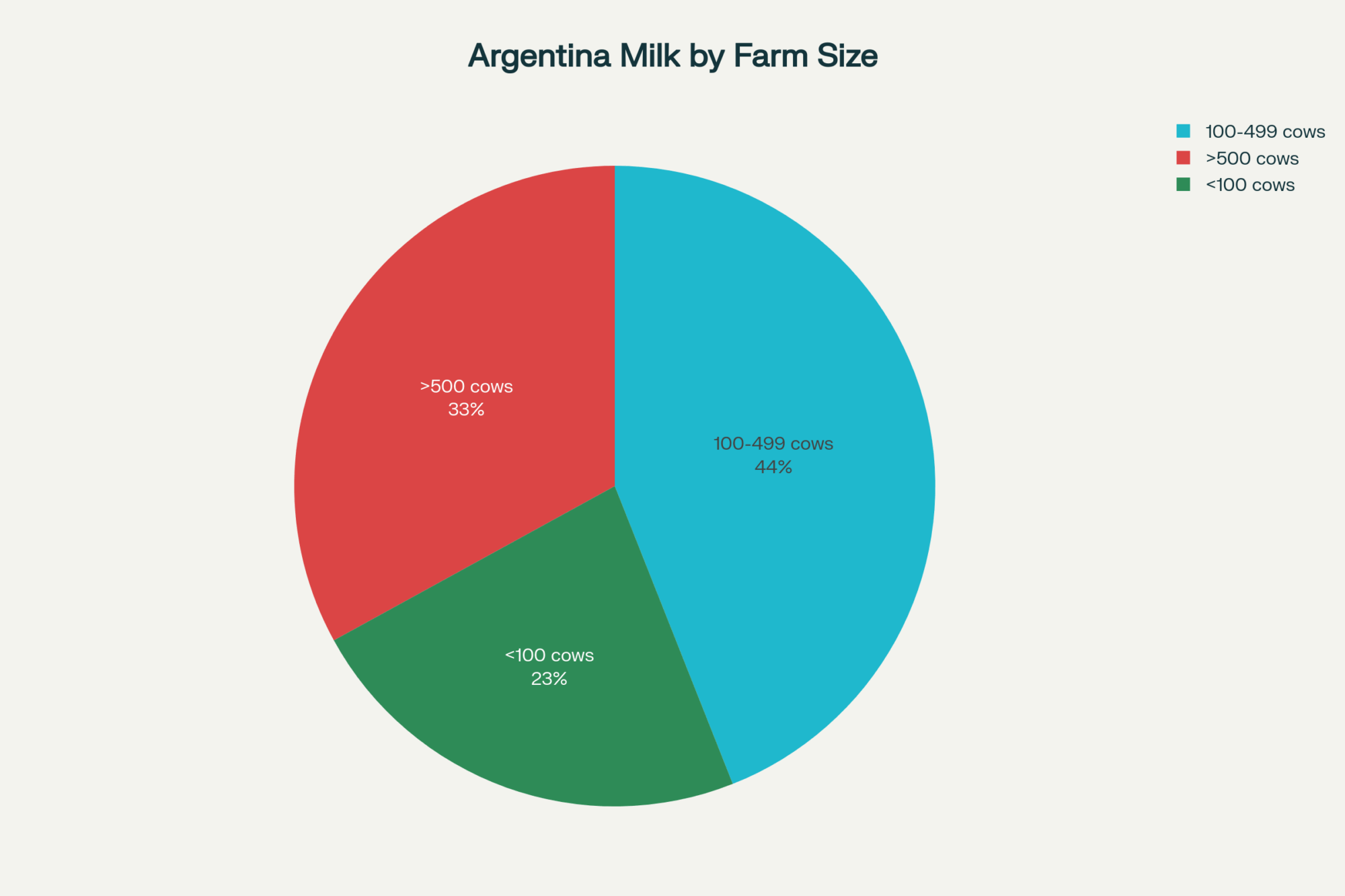

This development suggests something profound about the relationship between scale and efficiency. From 30,000 farms in 1988 to 8,995 operations today—that’s systematic consolidation, not gradual market evolution. And here’s what catches your eye: farms with 500+ cows represent just 6.7% of operations but control 28.8% of cattle and produce 33.3% of total milk.

I’ve noticed that when you concentrate the same feed resources among fewer, genetically superior cows, the productivity gains compound quickly. Argentina didn’t reduce total feed production when cow numbers dropped—they just concentrated better nutrition among better performers.

The technology adoption is where things get really interesting. Rumination monitoring systems with proven accuracy above 90% according to University of La Plata validation studies, are now commonplace. On the feeding side, precision systems are delivering yield boosts around 5-7%, with growers seeing payback within 18-24 months for herds over 300 cows.

Why This Model Won’t Work Everywhere

Of course, every region’s different, and that’s important to understand.

Poland provides what many industry analysts consider the clearest replication attempt. According to the Polish Chamber of Milk, dairy sector profitability collapsed from 79% of companies profitable in 2022 to just 49.5% in 2023. That economic pressure enabled rapid consolidation—DMK Deutsches Milchkontor acquired Mlekoma Dairy, while Mlekovita expanded to manage 26 plants across Central and Eastern Europe.

But contrast that with New Zealand, where Fonterra already controls 84% of market share through farmer cooperatives formed in 2001. Or Denmark, where cooperative structures represent thousands of farmer-members who own the processing infrastructure. These regions completed their consolidation decades ago.

The timing challenge is real, too. China has shifted from 70% to 85% dairy self-sufficiency in just five years, according to USDA Foreign Agricultural Service reports and Rabobank analysis. Europe’s production constraints are easing. When multiple regions attempt Argentina-style transformations simultaneously, export markets get saturated fast.

Beyond Efficiency: The Next Competitive Frontier

So what happens when efficiency becomes table stakes? This is where the conversation gets really interesting, and where I think we’re heading as an industry.

Biological innovation is already emerging in some fascinating ways. Research from UC-Davis shows lactoferrin applications expanding beyond infant nutrition into consumer products with room-temperature stability breakthroughs. Imagine cows genetically modified to produce milk with enhanced lactoferrin content commanding 30-50% price premiums over commodity milk.

Consumer experience architecture is equally important. Small-scale operations across New England report serious success with artisan dairy products sold directly to health-conscious consumers. Scale isn’t everything when you can create value through story and quality.

And here’s what many of us are watching closely—sustainability becomes the primary differentiator. Journal of Dairy Science research confirms that carbon footprint reduction through genetics creates permanent advantages competitors can’t replicate through management changes alone.

Strategic Assessment for Your Operation

Looking at current trends, here’s how many producers I talk with are evaluating their positions:

Operations Under 200 Cows: Technology investment should target basic efficiency systems with 24-month ROI targets. Focus on direct-consumer strategies and specialty products. Local sourcing stories for premium positioning are working well in many markets.

Operations 200-800 Cows: Precision feeding and rumination monitoring become essential—the data suggests these technologies are paying back consistently. Sustainability positioning for B2B advantages is increasingly important.

Operations Over 800 Cows: Value chain integration and processing capability development become critical. Biotechnology partnerships for product differentiation are where the smart money seems to be moving.

Many Wisconsin operations are finding that cooperative relationships for technology sharing help smaller farms access precision systems they couldn’t justify individually.

What the Global Data Really Shows

Based on OECD-FAO projections through 2034, global dairy demand will grow 1.5% annually, but transformation regions could add production capacity equivalent to 2.3+ million efficient cows by 2028. That’s a supply-demand imbalance that changes everything.

Rabobank’s 2025 Global Dairy Report signals major competitive shifts as multiple regions achieve efficiency simultaneously. The mathematical reality becomes concerning when you calculate concurrent transformation impacts—it suggests we’re heading toward systematic oversupply conditions by 2027-2028.

The Strategic Reality Check

I’ve been talking with producers across different regions about these developments, and what’s clear is that the next 24 months will determine which operations successfully navigate this transition. The uncomfortable truth? We’re watching multiple regions build the same competitive advantage just as demand growth moderates.

Early indications suggest that operations focusing purely on efficiency improvements may find themselves competing against other efficient operations rather than displacing inefficient incumbents. While the data’s still developing, current trends point toward a fundamental recalibration of global dairy competitive dynamics.

Looking Forward

Drawing on insights from industry economists, cooperative leaders, and producers who have implemented these strategies, Argentina’s transformation demonstrates that systematic change is possible when the conditions are aligned. However, it also reveals the limitations of an efficiency-focused strategy when it is widely adopted.

As we head into fall breeding decisions and 2026 planning, the question isn’t whether Argentina’s model works—it’s whether there’s still time to implement elements that make sense for your operation before competitive advantages become commoditized.

Because here’s what I’m seeing across the industry: The future belongs to operations that master efficiency quickly, then pivot immediately toward innovation and value creation before efficiency becomes just the price of admission to an increasingly competitive game.

Whether we’re talking at the next field day or grabbing coffee at World Dairy Expo, I’d love to hear how you’re thinking about these trends. What lessons from the Pampas make sense for your operation? And more importantly—what’s your next strategic move?

The dairy industry is evolving faster than many of us expected, and those who stay curious and adaptable are going to be the ones who thrive in whatever comes next.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Your 2025 Dairy Gameplan: Three Critical Areas Separating Profit from Loss – This tactical guide reveals three high-impact, low-cost strategies for immediate implementation on your farm. It provides actionable steps for optimizing silage, utilizing methionine, and perfecting transition cow management to unlock significant productivity and profitability gains.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – This article offers a crucial strategic and economic perspective on the global dairy market. It demonstrates why the focus is shifting from volume to high-value components and how understanding this trend is essential for positioning your operation for long-term success amidst market volatility.

- Revolutionizing Dairy Herding: How a $100M AI Investment Signals the End of Traditional Cattle Management – This piece provides a forward-looking, innovative perspective on technology adoption. It showcases a case study on virtual herding technology, highlighting how emerging solutions can drastically reduce labor costs and improve pasture management, offering a glimpse into the future of efficiency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!